- Revenue of €12.0 million in 2024 Q3, stable compared to 2023

Q3

- Declining revenue in the Group’s historical core business

areas

- Dynamic growth in the “Industry” business area thanks to

investments made by the Group in the Biopress site, acquired in

April 2023

Regulatory News:

Groupe Berkem, a leading player in bio-based chemistry

(ISIN code: FR00140069V2 – Ticker: ALKEM), announces its revenue as

of September 30, 2024, and provides an update on its recent

activity.

2024 THIRD-QUARTER REVENUE

As of September 30, 2024, Groupe Berkem’s revenue for the first

nine months of 2024 reached €40.4 million, against €39.9 million

over the same period in 2023, i.e. an increase of +1.2%.

Repartition of revenue per business

area for 2024 third-quarter

In € thousands

30/09/2024

30/09/2023

% Change

Construction & Materials

5,396

5,420

-0.4%

Hygiene & Protection

2,161

2,397

-9.9%

Health, Beauty & Nutrition

3,580

3,716

-3.7%

Industry

893

406

+119.7%

Central/Shared

-

46

-100.0%

TOTAL 3rd Quarter

12,029

11,986

+0.4%

TOTAL first nine months

40,423

39,943

+1.2%

The “Construction & Materials” and “Hygiene and

Protection” business areas recorded a declining of their

activity compared to 2023 Q3 of -0.4% and -9.9% respectively,

reflecting the persistently sluggish market conditions for the

construction sector in France and abroad. The “Health, Beauty

& Nutrition” business area showed a -3.7% decrease of the

activity compared to the same period in 2023. Finally, the

“Industry” business area continues its trajectory of

development by posting a +119.7% growth compared to 2023 Q3, driven

by investments realized by the Group on the site of Biopress

company, acquired in April 2023.

HIGHLIGHTS OF THE FIRST NINE MONTHS OF 2024

External growth operation

February 2024: Acquisition of

Naturex Iberian Partners, industrial site of Givaudan in Valence

(Spain) specialized in plant extraction and marine products for

players in the food, nutrition (nutraceuticals) and cosmetics

markets. With this acquisition, Groupe Berkem significantly

increases its production capacity in plant extraction for the

“Health, Beauty & Nutrition” business area.

Activity

January 2024: Extension of the

H2OLIXIR range of 100% natural floral waters, with the launch

of two brand new 97.5% organic floral waters and intended for

players of cosmetic industry: lavender water and thyme water.

May 2024: Presentation of

BiombalanceTM and Pineol® Premium, two active ingredients

provided from the new range of the Group for Nutraceuticals

market.

Simplified tender offer project

As announced in the press releases issued on July 18, 2024, and

July 31, 2024, Kenerzeo1 intends to irrevocably offer to all of the

Company's shareholders the opportunity to acquire all of their

Groupe Berkem shares at a price of €3.10 per share through a

simplified tender offer.

On September 27, 2024, Kenerzeo filed with the Autorité des

marchés financiers a simplified tender offer project (the

“Offer”) for the shares of Groupe Berkem, together with a

Draft Information Document relating to the Offer project. Groupe

Berkem drew up and filed a Draft Response Document on October 21,

2024. The Draft Response Document includes the favorable opinion of

the Board of Directors dated October 18, 2024, as well as the

report of the independent expert. At the date of the Draft Response

Document, Kenerzeo held 80.55% of the Group's share capital and

80.54% of its theoretical voting rights.

Kenerzeo intends to apply to the AMF, as soon as the Offer

closes or within three months of the closing of the Offer, for the

implementation of a squeeze-out procedure to benefit from the

transfer of the shares not tendered to the Offer, should they

represent less than 10% of the Company's share capital.

It should be noted that the Offer project, the Draft Information

Document and the Draft Response Document remain subject to review

by the Autorité des marchés financiers.

The Draft Information Document is available on the AMF and

Groupe Berkem websites, and may be obtained free of charge from the

headquarters of Groupe Berkem (20 Rue Jean Duvert - 33290

Blanquefort) and from Banque Delubac & Cie (10, rue Roquépine -

75008 Paris). The Draft Response Document is available on the AMF

and Groupe Berkem websites, and may be obtained free of charge from

the headquarters of Groupe Berkem (20 Rue Jean Duvert - 33290

Blanquefort).

Outlook As a reminder, Groupe Berkem reconsidered its

Business Plan as well as its financial forecasts as part of the

simplified tender offer to which the Group is subjected. The Group

now expects to achieve revenue of at least €70 million by 2025, and

an EBITDA2 margin of at least 16% by 2027. In view of the numerous

investments to be made at its new production site in Valencia,

Spain, and the ever-changing economic and geopolitical context,

Groupe Berkem is not currently considering making any new

acquisition in the short to medium term.

Availability of the 2024 Half-Year financial report

The 2024 Half-Year financial report was submitted today to the

Autorité des marchés financiers and is available on the Company's

investor website.

ABOUT GROUPE BERKEM

Founded in 1993 by Olivier Fahy, Chairman and Chief Executive

Officer, Groupe Berkem is a leading force in the bio-based

chemicals market. Its mission is to advance the environmental

transition of companies producing the chemicals used in everyday

life (Construction & Materials, Health, Beauty & Nutrition,

Hygiene & Protection, and Industry). By harnessing its

expertise in both plant extraction and innovative formulations,

Groupe Berkem has developed bio-based boosters—unique high-quality

bio-based solutions augmenting the performance of synthetic

molecules. Groupe Berkem achieved revenue of €51.9 million in 2023.

The Group has almost 200 employees working at its head office

(Blanquefort, Gironde) and 5 production facilities in Gardonne

(Dordogne), La Teste-de-Buch (Gironde), Chartres

(Eure-et-Loir),Tonneins (Lot-et-Garonne) and Valence (Spain).

Groupe Berkem has been listed on Euronext Growth Paris since

December 2021 (ISIN code: FR00140069V2 - ALKEM).

www.groupeberkem.com

___________________________________ 1 Subsidiary owned at 91.45%

by Kenercy, itself managed by Olivier FAHY, Chairman and CEO of

Groupe Berkem. 2 Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA), corresponds to the operating cash flow

generated by the Group, taking into account other operating income

and other operating expenses, but excluding depreciation and

amortization and the Group's financing policy.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024253409/en/

Groupe Berkem Olivier Fahy,

Chairman and CEO Anthony Labrugnas, Chief Financial Officer

Phone: +33 (0)5 64 31 06 60 investisseurs@berkem.com

NewCap Investor Relations

Mathilde Bohin / Nicolas Fossiez

Phone: +33 (0)1 44 71 94 94 berkem@newcap.eu

NewCap Media Relations

Nicolas Merigeau

Phone: +33 (0)1 44 71 94 94 berkem@newcap.eu

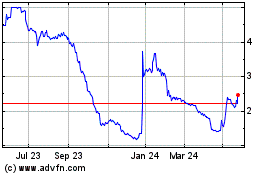

Groupe Berkem (EU:ALKEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

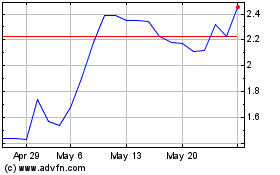

Groupe Berkem (EU:ALKEM)

Historical Stock Chart

From Jan 2024 to Jan 2025