- Number of BIOCERA-VET kits sold increased by 19% compared to

the 1st half of 2023, and by 72% in the 2nd quarter of 2024

compared to 2nd quarter 2023

- Net sales increase by 12.1%1 compared to the 1st half of

2023

- Net operating loss reduced by 23% compared to the 1st half

of 2023 with operating charges reduced by 13%

- Cash position of €0.7 million on June 30, 2024, giving

financial visibility up to November 2024

- Suspension of the ViscoVet clinical trial and associated

expenses pending its anticipated results

- The Company continues assessing several refinancing

options

- The Board of Directors will reconvene on September 26th,

2024 to assess the situation of the Company’s net assets value and

will put in place any required measures, in accordance with the

processes provided for by Belgian legislation

Regulatory News:

TheraVet (ISIN: BE0974387194 - ticker: ALVET), a pioneering

company in the management of osteoarticular diseases in pets, today

announces its financial results ended June 30, 2024, and the

publication of its half-year financial report.

Recent operational highlights

- Commercial launch of BIOCERA-VET® Equine, a BIOCERA-VET®

version specifically adapted for equine dental and orthopaedic

surgeries in March 2024;

- Commercial launch in additional important European markets:

Germany & Italy;

- Early termination of recruitment in the pivotal multicentric

European study assessing VISCO-VET in canine osteoarthritis and

associated expenses waiting for results ;

- Available cash of €0.7 million on June 30, 2024, covering

operational activities until November 2024.

2024 half-year financial results

Financial information as of June 30, 2024

All amounts are in € (Belgian GAAP)

(1)

30.06.2024

6 months

31.12.2023

12 months

30.06.2023

6 months

Revenue

56,058

117,839

55,266

Of which net sales of finished

goods, excluding credit notes related to sales in the previous

reporting period1

58,169

n.c.

51,886

Other operating income

434,195

1,148,747

606,172

Variation of stocks of finished

goods and work and contracts in progress

(4,409)

(8,817)

(8,746)

Produced fixed assets

394,356

960,216

554,887

Operating Grants

3,800

76,813

2,606

Other operating income

40,448

120,535

57,424

Total Operating products

490,253

1,266,585

661,438

Operating charges

(1,075,352)

(2,377,685)

(1,233,841)

Goods for resale, raw materials,

and consumables

(48,829)

(74,588)

(39,839)

R&D Expenses

(90,100)

(370,139)

(206,318)

Expenses related to the listed

company

(81,779)

(121,067)

(54,437)

Marketing and commercial

expenses

(86,705)

(186,617)

(73,297)

General & administrative

expenses

(442,747)

(847,623)

(414,643)

Staff

(322,358)

(770,425)

(441,626)

Other operating charges

(2,833)

(7,226)

(3,681)

Gross Operating result

(585,099)

(1,111,100)

(572,403)

Amortization & Depreciation

(379,161)

(1,064,009)

(686,722)

Net Operating result

(964,260)

(2,175,109)

(1,259,125)

Financial result

115,560

558,635

353,968

Result before taxes

(848,700)

(1,616,474)

(905,157)

Income taxes

45,766

Net result

(848,700)

(1,570,708)

(905,157)

Net Cash & Cash equivalents at the

end of the period

713,562

1,147,082

1,753,562

(1) The accounts presented at 30.06.2024 and 30.06.2023 have not

been reviewed by the Statutory Auditors

In the first half of 2024, TheraVet generated revenue of

€56,058. When excluding credit notes related to revenue generated

during the first half of 2023, net sales of finished goods

increased by 12.1% compared to the first half of 20231.

In the first half of 2024, commercial expansion continued with

the launch of the BIOCERA-VET® range in Germany and Italy,

important markets in Europe, for which distribution has been

entrusted to Alcyon Italia, the leading distributor of innovative

orthopaedic products in Italy.

As announced in the 2023 annual report, given the delay in

setting up operations and in distributing BIOCERA-VET® in the

United States, the distribution agreement with InVictos LLC has

been terminated, and advanced discussions are underway to enable

its rapid replacement. This lack of distribution support partly

explains the lower-than-expected contribution of the United States

to the Company's sales in the first half of 2024.

TheraVet also changed its distributor in Spain to enable to work

with a more established player with a larger commercial coverage in

Spain, the Canary Islands and the Balearic Islands.

The two sales channels (direct and indirect) resulted in the

sale of 300 kits, compared with 252 in the first half of 2023, an

increase of 19%. The second quarter was more dynamic, with a growth

of 72% compared with the second quarter of 2023 and of 4% in the

number of kits sold as compared to the first quarter of 2024.

The first sales of BIOCERA-VET Equine were recorded during the

period. The BIOCERA-VET Bone Surgery range still accounts for most

sales, i.e. 90%, and is 33% up on the first half of 2023. The

BIOCERA-VET® Osteosarcoma range showed a decline of 44% compared

with the first half of 2023, despite a recovery in sales during the

second quarter of 2024.

The Company also generated €394,356 of “capitalized production”

because of the activation of development expenses related to the

BIOCERA-VET® and VISCO-VET® programs during the first half of 2024,

representing a decrease of €160,531 as compared to the first half

of 2023.

The inventory of finished products and work in progress, valued

at €4,409 as of December 31, 2023, decreased by €4,409 during the

first half of 2024.

1 Clarification note: during the first half of 2024, TheraVet

issued credit notes related to sales made during the first half of

2023. These credit notes relate to product returns by a

distributor. These credit notes are included into the revenues of

the first half of 2024, thereby leading to a biased view of actual

net sales during the first half of 2024. When applying the value of

these credit notes to the revenues of the first half of 2023,

actual net product sales in the first half of 2024 have increased

by 12.1% compared to the first half of 2023.

Other operating income of €40,448 as of June 30, 2024, compared

to the amount of €57,424 as of June 30, 2023, represents a decrease

of €16,976 because of the decrease in payroll and the public

financial contributions received in this context.

The decrease in “Operating charges" reflects the continued focus

on increasing the Company’s operational efficiencies:

- COGS have increased by €8,990, to

rebuild inventories built up at the end of 2022 tand largely

consumed during 2023 following the continued expansion of the

BIOCERA-VET® products in several countries; - R&D

expenses of €90,100 as of June 30, 2024, decreased by €116,218

compared to the first half of 2023. This reduction is explained by

the particularly important R&D activities performed in 2023

compared to H1 2024; - Listed company expenses are amounting

to €81,779, which represents an increase of €27,342 compared to the

first half of 2023 and resulting from the stock market

communication activities and the Company’s search for new financing

sources during H1 2024; - Marketing & Sales expenses

amount to €86,705, representing an increase of €13,408 as compared

to first half of 2023, explained by the commercial launch of the

equine product range; - G&A expenses represent €442,747

an increase by €28,104 compared to the first half of 2023. This

limited increase results from the inflation’s impact on the

Company’s administrative expenses, despite the ongoing focus on

optimizing the Company’s structural expenses since 2023; - Staff

expenses reached €322,358 by June 30, 2024, compared to

€441,626 as of June 30, 2023. This decrease of €119,268 is

explained by an increase in organizational and process efficiencies

in the second half of 2023 and the first half of 2024.

Finally, the amortization of development expenses related to the

BIOCERA-VET® Bone Surgery and VISCO-VET® programs represents

€379,160 as of June 30, 2024, and resulted in an operating loss of

€964,260 compared to €1,259,125 as of 30 June 2023 and a reduced

net loss of €848,700 million compared to €905 157 as of June 30,

2023.

Post-closing event as of June 30, 2024

Ms Sabrina Ena, COO of the Company, has left the Company in

August 2024 to take on a new role as CEO of the EU Biotech School

in Gosselies (Belgium). The Company wishes her great success in

this new challenge.

On August 29, 2024, the Company has increased its capital by

€19,028.10 following the issuance of 190,281 new shares, related to

the conversion of 42 convertible obligations issued as part of its

equity line put in place with IRIS Capital. Following this capital

increase, the Company’s new capital is valued at €341,241.70.

On September 11, 2024, the Company decided to put on hold all

operating expenses related to its ViscoVet clinial trial to limit

their impact on the Company’s current cash position, as delivery of

the results is not expected until December 2024.

Next key milestones of the next 2024 half-year

The Company is currently concentrating all its efforts on

refinancing and/or any alternative solution.

The Board of Directors will reconvene on September 26th, 2024 to

review and act as needed on the Company’s net assets value, in

accordance with the processes provided for by Belgian

legislation.

2024 Half-year report

The 2024 half-year financial report ending June 30, 2024, will

be published September 12, 2024, and will be available on the

Company’s website (www.theravet-finances.com).

Going Concern

At the end of the reporting period, the Company's equity

remained above the share capital.

The current accounting loss is due to the fixed costs of running

the Company, and to the development costs of the VISCO-VET® and

BIOCERA-VET® projects, which are not covered by a grant. Cash flow

has been sufficient to cover these costs.

Based on the current scope of its activities and best estimates

of annual cash consumption, revenue and grants, as well as the

absence of any significant impact of the political situation on its

activities, the Company estimates that its cash and cash

equivalents as of June 30, 2024, should be sufficient to finance

its operations until November 2024. These circumstances indicate

the existence of a material uncertainty that may cast significant

doubt on the Company's ability to continue as a going concern.

The Company is currently considering several options for raising

additional funds, whether through equity financing, collaboration,

or a strategic tie-up with another player in the animal healthcare

market. Based on its operating budgets, the management believes

that the Company will be able to meet its financial obligations for

the 2 months following the date of these financial statements.

In addition, the Board of Directors has formally noted on

September 11, 2024 that the value of the Company’s net assets on

June 30, 2024 stands at €(116 345), if all non-amortized R&D

assets are excluded from its valuation, meaning a value below the

threshold of 50% of its share capital (which is valued at €322 394

on June 30, 2024). The Board of Directors will reconvene on

September 26th, 2024 to review this situation and take any relevant

measures, in line with the processes provided for by Belgian

legislation.

Financial calendar for 2025

Full-year financial results: April 22, 2025 Ordinary

General Assembly: June 05, 2025 Half-year business

update: July 8, 2025 Half-year financial results:

September 11, 2025

About TheraVet SA TheraVet is a veterinary biotechnology

company specialising in osteoarticular treatments for companion

animals. The Company develops targeted, safe and effective

treatments to improve the quality of life of pets suffering from

joint and bone diseases. For pet owners, the health of their pets

is a major concern and TheraVet’s mission is to address the need

for innovative and curative treatments. TheraVet works closely with

international opinion leaders in order to provide a more effective

response to ever-growing needs in the field of veterinary medicine.

TheraVet is listed on Euronext Growth® Paris and Brussels, has its

head office in Belgium (Gosselies) with a US subsidiary. For more

information, visit the TheraVet website or follow us on LinkedIn /

Facebook / Twitter

Forward-looking statements

This release may contain forward-looking statements.

Forward-looking statements may include statements regarding the

Company's plans, objectives, goals, strategies, future events, the

safety and clinical activity of TheraVet’s pipelines and financial

condition, results of operation and business outlook. By their

nature, forward-looking statements involve inherent risks and

uncertainties, both general and specific, and there are risks that

predictions, forecasts, projections, and other forward-looking

statements will not be achieved. These risks, uncertainties and

other factors include, among others, those listed and fully

described in the “Risk Factors” section in the Annual Report.

TheraVet expressly disclaims any obligation to update any such

forward-looking statements in this document to reflect any change

in its expectations with regard thereto or any change in events,

conditions, or circumstances on which any such statement is based,

unless required by law or regulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911853430/en/

TheraVet Chief Executive Officer Enrico Bastianelli

investors@thera.vet Tel: +32 (0) 71 96 00 43

NewCap Investor Relations and Financial Communications

Théo Martin / Nicolas Fossiez theravet@newcap.eu Tel: +33 (0)1 44

71 94 94

Press Relations Arthur Rouillé theravet@newcap.eu Tel: +33 (0)1

44 71 00 15

NewCap Belgique Press Relations Laure-Eve Monfort

lemonfort@newcap.fr Tel: + 32 (0) 489 57 76 52

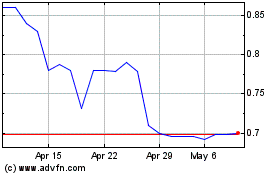

EGEIRO Pharma (EU:ALVET)

Historical Stock Chart

From Jan 2025 to Feb 2025

EGEIRO Pharma (EU:ALVET)

Historical Stock Chart

From Feb 2024 to Feb 2025