Amundi Annual Shareholder Meeting 2022

19 May 2022 - 1:34AM

Amundi Annual Shareholder Meeting 2022

Press release

Paris, 18 May 2022

Amundi Annual General

Meeting

Vote on all resolutions with an average

approval rate of 97.8%

Say on Climate approved by

more than 97% of voters Dividend set at

€4.10 per share

General meeting and

dividend

Amundi’s Annual General Meeting of Shareholders

was held on Wednesday 18 May 2022 in the presence of its

shareholders. With a quorum of 86.9%, the Meeting approved all the

resolutions submitted by the Board of Directors, with an average

approval rate of 97.8%. The detailed results of the votes of the

General Meeting are available on the website

https://about.amundi.com/

As announced on 9 February 2022, Amundi’s

financial strength allows it to pursue its dividend policy,

i.e. a payout rate of 65% of net income, Group share. The

dividend for the financial year 2021 has been set at €4.10 per

share, representing a yield of 7.3%1. The ex-dividend date is set

at 23 May 2022 and the dividend will be paid from 25 May 2022.

Say on Climate

At the Annual General Meeting, Amundi submitted

its climate strategy to the shareholders’ advisory vote, making it

the first asset manager to put forward a Say on Climate resolution.

The resolution was voted by 97.7% of shareholders, which

demonstrates their strong support. Making a success of the energy

transition requires aligning the key players on short-, medium- and

long-term strategies: governments, which must define public,

industrial and fiscal policies as well as coherent regulations;

companies, which must design the necessary technology solutions and

make plans for the transition; and the financial system, which must

support companies by allocating them the necessary capital. Amundi

is well aware of the challenges and resources to be deployed to

ensure the success of the energy transition and believes that

shareholders should be fully informed of how companies intend to

contribute to this collective effort. As a shareholder, it

therefore encourages the companies in which it invests to submit

their climate strategy to an advisory vote at their General

Meeting. Furthermore, as a listed company, Amundi considers that it

also has a responsibility to be transparent about its own climate

strategy to its shareholders.In addition to the need for a

scientific approach and the search for social and economic progress

that guarantees the acceptability of the energy transition,

Amundi’s climate strategy is based on the conviction that rather

than excluding or divesting, it needs to support investee companies

on their transition path. As part of the climate strategy submitted

to its shareholders’ advisory vote at the Annual General Meeting,

Amundi has indicated that its voting policy with regard to “Say on

Climate” of investee companies in the most emissions-intensive

sectors will take into account the credibility of their

decarbonisation strategy, as well as the drive for energy

independence and competitiveness in all the countries in which

Amundi invests, and the social impacts that this entails.

***

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players2, offers its 100 million

clients - retail, institutional and corporate - a complete range of

savings and investment solutions in active and passive management,

in traditional or real assets.

With its six international investment hubs3,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,300 employees in 35 countries. A subsidiary of the

Crédit Agricole group and listed on the stock exchange, Amundi

currently manages more than €2.0 trillion of assets4.

Amundi, a trusted partner, working every

day in the interest of its clients and society

www.amundi.com

Press contact:

Nathalie Boschat

Tel. +33 1 76 37 54 96

nathalie.boschat@amundi.com

Investor contacts:

Anthony Mellor

Tel. +33 1 76 32 17 16

anthony.mellor@amundi.com

Thomas Lapeyre

Tel. +33 1 76 33 70 54

thomas.lapeyre@amundi.com

1 Compared with 16 May 2022 closing price2

Source: IPE “Top 500 Asset Managers” published in June 2021, based

on assets under management as at 31/12/20203 Boston, Dublin,

London, Milan, Paris and Tokyo4 Amundi data including Lyxor as at

31/03/2022

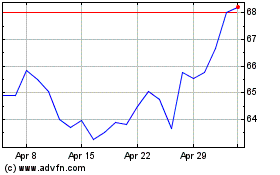

Amundi (EU:AMUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amundi (EU:AMUN)

Historical Stock Chart

From Apr 2023 to Apr 2024