Arcadis Trading Update Q1 2022

Continued strong

organic revenue and

record backlog

- Strong order intake

inclusive of projects in energy transition, environmental

restoration and new mobility, underpinning the strategy

- Continued client

demand for sustainable solutions and advisory, resulting in net

revenue of €688 million and organic net revenue growth of

5.6%1)

- Record backlog at

€2.3 billion. Organic year-on-year backlog growth of 7.6%1)

- Operating EBITA

margin improved to 9.4% (Q1’21: 9.2%)

- Net Working Capital

of 12.9% (Q1’21: 15.3%) and DSO of 70 days (Q1’21: 78 days)

Amsterdam, 4 May

2022 –

Arcadis (EURONEXT: ARCAD), the leading global Design &

Consultancy organization for natural and built assets,

sees a continued growing client demand

across its Global Business Areas

(GBAs), resulting in an

organic net revenue growth of

5.6%,

and an organic

backlog growth of

7.6%.

Operating EBITA margin

increased to

9.4% (last year:

9.2%), driven by

improved performance across all

GBAs.

Peter Oosterveer, CEO Arcadis

said: “The impact of the crisis in Ukraine is

undoubtedly being felt all around the world. We are shocked and

appalled by the senseless violence and suffering, and while Arcadis

does not have any employees, offices, or live projects in either

Ukraine, Russia or Belarus, we are supporting humanitarian efforts

through donations and volunteering initiatives. With the war now

into its third month, we call on all parties to do their utmost to

bring the crisis to a peaceful end.

During the quarter we have seen a further increase of clients

looking for alternative energy solutions as they accelerate the

transition to net zero carbon emissions and prioritize secure and

renewable sources, which has been an important contributor to the

organic backlog growth of 7.6%, to a record level of €2.3 billion.

The organic revenue growth also improved to 5.6% this quarter.

Notwithstanding the geopolitical instability, the increase in

energy costs and high inflation in a number of regions, as well as

renewed COVID-19 lockdowns in China, our order intake and record

backlog this quarter positions us well for the remainder of the

year.

Going forward, our focus will include a further increase of our

efforts and investments to provide an attractive workplace for the

most talented people in our industry. Our strong purpose of

improving quality of life, combined with our global reach and our

capabilities for delivering sustainable solutions to our clients

creates a solid foundation for further growth.” 1)underlying

growth excluding the impact of currency

movements, acquisitions or footprint reductions, such as the

Middle East, winddowns or divestments

KEY FIGURES

| in € millions |

First quarter |

|

| Period

ended 31 March 2022 |

2022 |

2021 |

change |

| Gross revenues |

879 |

812 |

8% |

| Net revenues |

688 |

632 |

9% |

| Organic growth1) |

5.6% |

|

|

| EBITDA |

87 |

84 |

4% |

| EBITDA margin |

12.6% |

13.2% |

|

| EBITA |

65 |

57 |

15% |

| EBITA margin |

9.5% |

9.0% |

|

| Operating EBITA2) |

64 |

58 |

11% |

| Operating EBITA margin |

9.4% |

9.2% |

|

| Free Cash Flow3) |

-51 |

-39 |

-31% |

| Net Working Capital % |

12.9% |

15.3% |

|

| Days Sales Outstanding |

70 |

78 |

|

| Net Debt |

205 |

376 |

-45% |

| Backlog net revenues (billions) |

2.3 |

2.1 |

11% |

|

Backlog organic growth (y-o-y)1) |

7.6% |

|

|

1) underlying growth excluding the impact of currency

movements, acquisitions or footprint reductions, such as the

Middle East, winddowns or divestments2) excluding restructuring,

acquisition & divestment costs3) Free Cash flow: Cash Flow from

Operations – Capex – Lease liabilities

INCOME STATEMENT & BACKLOGNet revenues totaled €688 million

and increased organically 5.6%. Growth was driven by all three

GBAs, with Mobility being particularly strong in US and UK. The

currency impact was 5%. The operating EBITA margin improved to 9.4%

(Q1 2021: 9.2%), driven by all three GBAs.

At the end of March 2022 backlog was at a record high of €2.3

billion (Q1 2021: €2.1 billion). Organic backlog increased by 7.6%

year-over-year, with a positive contribution of all three GBAs.

Book to Bill was 1.141) in the quarter, driven by order intake from

Key Clients. 1)Excluding footprint reductions, such as the Middle

East, winddowns or divestments

BALANCE SHEET & CASH FLOWNet working capital as a percentage

of annualized gross revenues improved to 12.9% (Q1

2021: 15.3%) and Days Sales Outstanding (DSO) decreased

to 70 days (Q1 2021: 78 days), resulting from

our disciplined working capital management. The balance sheet

strengthened year-on-year, resulting in a significantly lower net

debt of €205 million (Q1 2021: €376 million).Good free cash flow

performance of €-51 million during the first quarter (Q1 2021: €-39

million), considering the one-off effect in Q1 2021 of a very low

accounts payable position as of Dec 31st, 2020.

REVENUES BY GLOBAL BUSINESS AREAAs of January 1st, 2022 Arcadis

transitioned to a its new global structure and now operates through

three Global Business Areas (GBAs): Resilience, Places and

Mobility. This will enable clients to benefit from Arcadis’ global

resources, expertise and capabilities.

RESILIENCEThe Resilience GBA focuses on services and solutions

to protect, adapt and improve our natural environment and water

resources, while sustainably powering our world for future

generations. During the first quarter, Arcadis’ clients have

accelerated their investments in energy transition, notably in the

UK and the Netherlands, and we experienced increased demand for

consultancy services as well as remediation and restoration

services for oil and gas clients. Arcadis’ US leadership position

in PFAS remediation was scaled to Belgium, where the government has

tightened the PFAS emission standards.

| (41% of net revenues) |

|

|

|

| in € millions |

First

quarter |

|

| Period

ended 31 March 2022 |

2022 |

2021 |

change |

| Net revenues |

281 |

251 |

12% |

|

Organic growth1) |

6.9% |

|

|

PLACESThe Places GBA is focused on creating smart and

sustainable places for owners, investors, users and communities

across the real estate sector. The construction and operation of

buildings generates up to 40% of annual global greenhouse gas

emissions and one of Arcadis’ priorities is to help clients reduce

carbon over the full lifecycle of their assets.Growth in the first

quarter was driven by UK and Australia, while China was impacted by

COVID-19 lockdowns and CallisonRTKL declined year-on-year from

turnaround measures. Strong order intake from clients developing

intelligent buildings, including the development of Datacenters and

Giga-factories for electric vehicle battery production.

| (33% of net revenues) |

|

|

|

| in € millions |

First

quarter |

|

| Period

ended 31 March 2022 |

2022 |

2021 |

change |

| Net revenues |

228 |

219 |

4% |

|

Organic growth1) |

1.1% |

|

|

MOBILITYWith better transport links crucial to creating thriving

and connected cities and communities, the Mobility GBA collaborates

with transport owners, operators and contractors to deliver design,

asset and program management for mobility solutions across the

world. Drawing on Arcadis’ experience in rail, and electric vehicle

adoption, we have seen strong revenue growth across the board and

particularly in the US, UK and Australia.

| (26% of net revenues) |

|

|

|

| in € millions |

First

quarter |

|

| Period

ended 31 March 2022 |

2022 |

2021 |

change |

| Net revenues |

179 |

162 |

11% |

|

Organic growth1) |

9.4% |

|

|

1)underlying growth excluding the impact of currency

movements, acquisitions or footprint reductions, such as the

Middle East, winddowns or divestments

FINANCIAL CALENDAR

- 12 May 2022 – Annual General Meeting of Shareholders 2021

- 28 July 2022 – Q2 and half year 2022 Results

- 27 October 2022 – Q3 2022 Trading update

For further information please contact:Arcadis Investor

RelationsChristine DischMobile: +31 (0)6 1537 6020E-mail:

christine.disch@arcadis.com

Arcadis Corporate CommunicationsChris WigganMobile: +44 (0)7966

404889E-mail: chris.wiggan@arcadis.com

Analyst meetingArcadis will hold an analyst webcast to discuss

the Q1 results for 2022. The analyst meeting will be held at 10.00

hours CET today. The webcast can be accessed via the investor

relations section on the company’s website at

https://www.arcadis.com/en/investors/investor-calendar/2022/trading-update-q1-2022

About ArcadisArcadis is a leading global Design &

Consultancy organization for natural and built assets. Applying our

deep market sector insights and collective design, consultancy,

engineering, project and management services we work in partnership

with our clients to deliver exceptional and sustainable outcomes

throughout the lifecycle of their natural and built assets. We are

29,000 people, active in over 70 countries that generate €3.4

billion in revenues. We support UN-Habitat with knowledge

and expertise to improve the quality of life in rapidly

growing cities around the world. www.arcadis.com.

REGULATED INFORMATIONThis press release contains information

that qualifies or may qualify as inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

FORWARD LOOKING STATEMENTSStatements included in this press

release that are not historical facts (including any statements

concerning investment objectives, other plans and objectives of

management for future operations or economic performance, or

assumptions or forecasts related thereto) are forward-looking

statements. These statements are only predictions and are not

guarantees. Actual events or the results of our operations could

differ materially from those expressed or implied in the

forward-looking statements. Forward-looking statements are

typically identified by the use of terms such as “may”, “will”,

“should”, “expect”, “could”, “intend”, “plan”, “anticipate”,

“estimate”, “believe”, “continue”, “predict”, “potential” or the

negative of such terms and other comparable terminology. The

forward-looking statements are based upon our current expectations,

plans, estimates, assumptions and beliefs that involve numerous

risks and uncertainties. Assumptions relating to the foregoing

involve judgments with respect to, among other things, future

economic, competitive and market conditions and future business

decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond our control. Although we

believe that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, our actual results

and performance could differ materially from those set forth in the

forward-looking statements.

- Arcadis Q1 2022 Trading Update

- Arcadis Q1 2022 results presentation

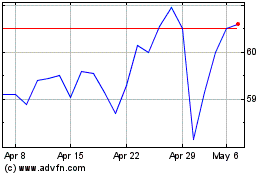

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Feb 2024 to Feb 2025