Success of the Tender Offer Initiated by SVF II STRATEGIC INVESTMENTS AIV LLC, which will hold 71.44% of Balyo’s Share Capital Following the First Offer Period

28 October 2023 - 3:11AM

Business Wire

Regulatory News:

Balyo (Paris:BALYO) and SVF II STRATEGIC INVESTMENTS

AIV LLC announce the results of the tender offer for Balyo’s

securities (the “Offer”) published by the French Autorité

des marchés financiers (“AMF”) following the completion of

the Offer on 25 October 2023.

Results of the Offer

Following the completion of the initial period of the Offer

initiated by SVF II STRATEGIC INVESTMENTS AIV LLC for Balyo

securities, SVF II STRATEGIC INVESTMENTS AIV LLC, a wholly-owned

subsidiary of SoftBank Group Corp (“SBG”), will hold

24,327,057 shares and 6,270 preferred shares representing, after

assimilation of the treasury shares and shares covered by a

liquidity agreement, 71.44% of Balyo’s capital and 71.43% of voting

rights on a non-diluted basis1, and 11,753,581 warrants amounting

to 100% of all of the outstanding warrants. The Offer is therefore

successful.

Balyo and SBG are pleased with the success of this first offer

period. The Board of Directors unanimously issued, on 4 August

2023, a favorable opinion on the Offer, judging it to be consistent

with the interests of the Group, its security holders and its

employees.

The settlement-delivery of the Offer will take place on 3

November 2023.

Reopening of the Offer

In compliance with the articles 232-4 of the AMF’s general

regulations, the Offer will be reopened, from 3 November 2023 until

16 November 2023, upon the same terms and conditions as the first

period of the Offer in particular at the same price, namely €0.85

per share, €0.01 per preferred share and €0.07 per warrant, in

order to allow security holders who have not yet tendered their

securities to do so.

The timetable of the Reopened Offer will be the following:

3 November 2023

Reopening of the Offer and

settlement-delivery of the securities tendered to the first period

of the Offer

16 November 2023

Closing of the Reopened Offer

21 November 2023

Publication of the results of the Reopened

Offer by the AMF

24 November 2023

Settlement-delivery of the securities

tendered to the Reopened Offer

The process for tendering the securities in the Reopened Offer

and the procedure for the centralization of the orders Reopened

Offer will be identical to that of the Offer, it being specified,

however, that orders to tender to the Reopened Offer will be

irrevocable.

If the required conditions are met, the Offeror indicated its

intention to implement a squeeze-out procedure pursuant to Articles

L. 433-4, II of the French Monetary and Financial Code and 237-1

and seq. of the AMF’s General Regulation.

The Offer Document, the Response Document and the results of the

Offer published today by the AMF are available on the websites of

Balyo (www.balyo.com) and of the AMF (www.amf-france.org/en).

About BALYO

Humans around the World deserve enriching and creative jobs. At

BALYO, we believe that pallet movements in DC and manufacturing

sites should be left to fully autonomous robots. To execute this

ambition, BALYO transforms standard forklifts into intelligent

robots thanks to its breakthrough Driven by Balyo™ technology. Our

leading geo guidance navigation system enables robots to locate

their position and navigate autonomously inside buildings - without

the need for any additional infrastructure. To accelerate the

material handling market conversion to autonomy, BALYO has entered

into two global partnerships with KION (Fenwick-Linde's parent

company) and Hyster-Yale Group. A full range of globally available

robots has been developed for virtually all traditional warehousing

applications; Tractor, Pallet, Stackers, Reach and VNA-robots.

BALYO and its subsidiaries in Boston and Singapore serve clients in

the Americas, Europe and Asia-Pacific. The company has been listed

on EURONEXT since 2017 and its sales revenue reached €24.1 million

in 2022. For more information, visit www.balyo.com.

About SoftBank Group The SoftBank Group invests in

breakthrough technology to improve the quality of life for people

around the world. The SoftBank Group is comprised of SoftBank Group

Corp. (TOKYO: 9984), an investment holding company that includes

stakes in AI, smart robotics, IoT, telecommunications, internet

services, and clean energy technology providers; the SoftBank

Vision Funds and SoftBank Latin America Funds, which are investing

more than US$160 billion to help extraordinary entrepreneurs

transform industries and shape new ones. To learn more, please

visit https://group.softbank/en.

Important Information

This press release has been prepared for information purposes

only.

It does not constitute an offer to purchase or a solicitation to

sell Balyo securities in any country, including France. It is not

intended for distribution in any country other than France, except

where such distribution is permitted by applicable laws and

regulations.

The dissemination, publication or distribution of this press

release, as well as the Offer and its acceptance, may be subject to

specific regulations or restrictions in certain countries. The

Offer will not be directed to persons subject to such restrictions,

either directly or indirectly, and may not be accepted from any

country where the Offer would be subject to such restrictions.

Accordingly, persons in possession of this press release are

required to inform themselves about and to observe any local

restrictions that may apply.

Balyo and SoftBank do not accept any liability for any breach of

these restrictions by any person.

1 Calculated on the basis of a share capital composed of

34,356,767 ordinary shares and 8,970 preferred shares deprived of

voting rights and including the assimilation of 34,894 ordinary

treasury shares and 180.000 ordinary shares and 2,700 preferred

shares covered by a liquidity agreement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231027387169/en/

BALYO Frank Chuffart investors@balyo.com

NewCap Financial Communication and Investor Relations Thomas

Grojean / Aurélie Manavarere Phone: +33 1 44 71 94 94

balyo@newcap.eu

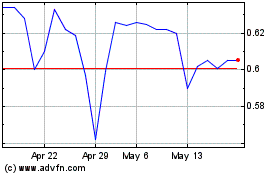

Balyo (EU:BALYO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Balyo (EU:BALYO)

Historical Stock Chart

From Apr 2023 to Apr 2024