Biotalys Obtains Subscription Commitments for EUR 15 Million

through a Private Placement of New Shares with New and Current

Investors

Additional Funds to further Build the AGROBODY™ Platform

and Strengthen the Biocontrol Pipeline

Ghent, BELGIUM, Oct. 14, 2024 (GLOBE NEWSWIRE) --

Regulated information - Inside Information

Public announcement in

accordance with article 7:97, §4/1 Belgian Companies and

Associations Code

Biotalys NV (Euronext Brussels:

BTLS) (the “Company” or “Biotalys”), an Agricultural Technology

(AgTech) company developing protein-based biocontrol solutions for

sustainable crop protection, today announced that it has

successfully obtained subscription commitments for an amount of

EUR 15 million through a private investment in a public equity

(“Private Placement”). The transaction involves the issue of

5,300,352 new shares (being approximately 16.5% of the Company’s

shares outstanding prior to the transaction) at an issue price of

EUR 2.83 per share, representing a discount of 10% compared to the

volume weighted average price of the Company’s share on Euronext

Brussels during the period of 30 days from (and including) 11

September 2024 till (and including) 10 October 2024.

Current shareholders, Ackermans & van Haaren

NV and Agri Investment Fund BV, participated in the Private

Placement, as well as a new investor, the Dutch asset management

firm ASR Vermogensbeheer NV.

Ko van Nieuwenhuijzen, Senior Portfolio

Manager at ASR Vermogensbeheer, commented: “We were

impressed by Biotalys’ technology and the team’s ability to develop

the biofungicide EVOCA™ which is currently awaiting regulatory

approval, while a second product candidate is now being tested in

field trials. ASR’s participation in Biotalys’ capital increase

fits with our strategy of investing for the long-term in

developments that benefit people and the planet.”

Piet Bevernage, Member of the Executive

Committee of Ackermans & van Haaren and of the Biotalys

Board, said: “We first invested in Biotalys in 2019,

further supported the company during the IPO in 2021 and today are

pleased to further increase our position in the company. We

strongly believe in the AGROBODY™ technology platform to develop

efficacious new biocontrols for growers to protect their crops

while reducing the impact on the environment. We are a committed

long-term partner and will continue to offer strategic guidance, in

addition to our current financial support.”

Patrik Haesen, CEO at AIF and permanent

representative of AIF on the Biotalys Board of Directors,

stated: “With rising resistance and stricter regulatory

constraints, growers are in dire need of new solutions to fight

crop pests and diseases. We are committed to supporting innovators

such as Biotalys, which is developing products with new modes of

action to help growers in Belgium and abroad to protect their

livelihood and deliver healthy, sustainable produce.”

Kevin Helash, Biotalys’ CEO,

said: "We are proud to welcome ASR Vermogensbeheer as a new

investor to our company and are very appreciative of the additional

support of our current shareholders, AvH and AIF. We are committed

to being good stewards of this investment, maintaining our culture

of cost consciousness. We will strategically deploy these funds to

advance our R&D pipeline with a target of launching one new

project annually, such as the recently announced addition of

BioFun-8 for expanded fungal control. The timing of this investment

extends our cash runway as we await final regulatory approvals for

EVOCA and move toward commercializing EVOCA NG and generating a

strong and increasing revenue stream long-term.”

Biotalys is developing a strong and diverse

pipeline of effective biocontrol products with a favorable safety

profile that aim to address key crop pests and diseases across the

whole value chain. The pipeline is based on Biotalys’ proprietary

AGROBODY™ technology platform, enabling the discovery and

development of a variety of solutions against multiple targets such

as fungi and harmful insects that cause significant crop

losses.

Biotalys intends to use the proceeds of the

Private Placement as follows:

- To support the regulatory process

for the first product candidate EVOCA™ and the further development

of EVOCA NG and BioFun-6, including field trials and regulatory

approvals;

- To further develop and advance the

Company’s pipeline, including discovery and development, aimed at

increasing the number of programs within crop protection and along

the food value chain, potentially also through partnerships;

- To fund continuous platform

development and intellectual property capture to maintain the

Company’s competitiveness and increase the efficiency of Biotalys’

AGROBODY Foundry™ platform;

- To support the recruitment and

retention of key talent; and

- For general corporate purposes.

The payment and delivery of the new shares is

scheduled to take place on Wednesday 16 October 2024. Following

such date, the new shares will also be listed on Euronext Brussels.

These new shares will have the same rights and benefits as, and

rank pari passu in all respects with, the existing and outstanding

shares of Biotalys at the time of their issuance.

As a result of the issuance of new shares, the

Company’s share capital will increase by EUR 783,922 from EUR

4,755,005.78 to EUR 5,538,927.78, and its issued and outstanding

shares will increase from 32,157,210 to 37,457,562 shares,

representing an increase in the number of shares outstanding of

approximately 16.5%.

KBC Securities NV, Belfius Bank NV/SA in

cooperation with Kepler Cheuvreux SA, and Coöperatieve Rabobank

U.A. are acting as Joint Global Coordinators of the Private

Placement.

About Biotalys

Biotalys is an Agricultural Technology (AgTech)

company developing protein-based biocontrol solutions for the

protection of crops and aiming to provide alternatives to

conventional chemical pesticides for a more sustainable and safer

food supply. Based on its novel AGROBODY™ technology platform,

Biotalys is developing a strong and diverse pipeline of effective

product candidates with a favorable safety profile that aim to

address key crop pests and diseases across the whole value chain,

from soil to plate. Biotalys was founded in 2013 as a spin-off from

the VIB (Flanders Institute for Biotechnology) and has been listed

on Euronext Brussels since July 2021. The company is based in the

biotech cluster in Ghent, Belgium. More information can be found on

www.biotalys.com.

For further information, please

contact:

Toon Musschoot, Head of IR &

Communication

T: +32 (0)9 274 54 00

E: IR@biotalys.com

Additional information

The following information is provided pursuant to Article 7:97 of

the Belgian Companies and Associations Code (“BCCA”).

The new shares were offered pursuant to a

private investment in a public equity, which is expected to be

completed on 16 October 2024 by means of a capital increase of the

Company by way of contribution in cash under the authorised capital

for an amount of EUR 14,999,996.16 (including issue premium)

through the issuance of 5,300,352 new shares with cancellation of

the statutory preferential right of the existing shareholders of

the Company in favour of certain specified persons who are not

members of the Company's personnel (the “Capital Increase”).

The investors that will subscribe to the new

shares are (i) Agri Investment Fund BV, with registered office

address at Diestsevest 32 bus 5b, 3000 Leuven, with company number

0893.885.781, RPR Leuven, existing holder of 2,969,606 shares and

director of the Company (“A.I.F.”), (ii) Ackermans & Van

Haaren, with registered office address at Begijnenvest 113, 2000

Antwerpen, with company number 0404.616.494, existing holder of

4,016,281 shares of the Company (“AvH”) and (iii) ASR Nederland NV,

with registered office address at Archimedeslaan 10, letter box

2072, 3584 BA Utrecht, The Netherlands, with company number

30070695, which currently holds no shares of the Company

(“A.S.R.”).

As a result of the Capital Increase and the

cancellation of the statutory preferential rights, after the

Capital Increase, A.I.F. will hold 4,736,390 shares (consisting of

1,766,784 new shares and 2,969,606 current, previously held shares)

(12.64%) in the Company, AvH will hold 5,783,065 shares (consisting

of 1,766,784 new shares and 4,016,281 current, previously held

shares) (15.44%) in the Company after the Capital Increase and

A.S.R. will hold 1,766,784 shares (all new shares) (4.72%) in the

Company after the Capital Increase.

In this context, the board of directors of the

Company (the “Board”) applied the related parties procedure of

article 7:97 BCCA.

Within the context of the aforementioned

procedure, prior to resolving on the Private Placement, a committee

of independent directors of the Company (the "Committee") issued an

advice to the Board in which the Committee assessed the Capital

Increase. In its advice to the Board, the Committee concluded the

following: "Based on the information provided, the Committee

considers that the proposed Capital Increase is in line with the

strategy pursued by the Company, will be done on market terms, and

is unlikely to lead to disadvantages for the Company and its

shareholders (in terms of dilution) that are not sufficiently

compensated by the advantages that the Capital Increase offers the

Company and other elements in the Company’s policy, or would be

manifestly unlawful.”

The Board approved the principle of the Private

Placement and did not deviate from the Committee's advice. The

Company’s statutory auditor's assessment of the Committee's advice

and the minutes of the meeting of the Board, is as follows:

"Based on our review, nothing has come to our attention that

causes us to believe that the financial and accounting information

included in the report of the ad hoc committee of independent

directors and in the minutes of the meeting of the board of

directors dated 11 October 2024, justifying the proposed

transaction, are not accurate and sufficient in all material

respects compared to the information available to us in the context

of our mission.

Our mission has been conducted solely within

the framework of the provisions of article 7:97 of the Code of

companies and associations and our report may therefore not be used

in any other context."

Important notices

This announcement is for informational purposes

only and is directed only at persons who are located outside the

United States. This announcement does not constitute an offer to

sell or the solicitation of an offer to buy shares or any other

security and shall not constitute an offer, solicitation or sale in

the United States or in any jurisdiction in which, or to any

persons to whom, such offering, solicitation or sale would be

unlawful. The shares have not been, and will not be, registered

under the U.S. Securities Act or the securities laws of any state

of the United States or any other jurisdiction, and may not be

offered or sold within the United States, or to, or for the account

or benefit of, U.S. persons, except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the U.S. Securities Act and applicable state or local securities

laws. Accordingly, the shares are being offered and sold (i) in the

United States only to qualified institutional buyers in accordance

with Rule 144A under the U.S. Securities Act and (ii) in “offshore

transactions” to non-U.S. persons outside the United States in

accordance with Regulation S under the U.S. Securities Act. There

is no assurance that the offering will be completed or, if

completed, as to the terms on which it will be completed.

This announcement has been prepared on the basis

that any offer of the shares in any Member State of the European

Economic Area (the “EEA”) is or will be made pursuant to an

exemption under the Prospectus Regulation from the requirement to

publish a prospectus for offers of the shares. The expression

“Prospectus Regulation” means Regulation (EU) 2017/1129 (as amended

or superseded) any implementing measure in each relevant Member

State of the EEA.

This announcement is only addressed to and

directed at persons in Member States of the EEA who are "qualified

investors" within the meaning of Article 2(e) of the Prospectus

Regulation, or such other investors as shall not constitute an

offer to the public within the meaning of Article 3.1 of the

Prospectus Regulation.

The offer, sale and admission to trading of the

shares will be made pursuant to an exception under the Prospectus

Regulation from the requirement to produce a prospectus for offers

or admissions to trading of securities. This press release does not

constitute a prospectus within the meaning of the Prospectus

Regulation or an offer to the public.

The distribution of this press release into

certain jurisdictions may be restricted by law. Persons into whose

possession this announcement comes should inform themselves about

and observe any such restrictions. Any failure to comply with these

restrictions may constitute a violation of the laws of any such

jurisdiction.

Biotalys, its business, prospects and financial

position remain exposed and subject to risks and

uncertainties. A description of and reference to these risks

and uncertainties can be found in the annual report on the

consolidated annual accounts published on the company’s

website.

This announcement contains statements which are

"forward-looking statements" or could be considered as such. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the words ‘aim’, 'believe',

'estimate', 'anticipate', 'expect', 'intend', 'may', 'will',

'plan', 'continue', 'ongoing', 'possible', 'predict', 'plans',

'target', 'seek', 'would' or 'should', and contain statements made

by the company regarding the intended results of its strategy. By

their nature, forward-looking statements involve risks and

uncertainties and readers are warned that none of these

forward-looking statements offers any guarantee of future

performance. Biotalys’ actual results may differ materially from

those predicted by the forward-looking statements. Biotalys makes

no undertaking whatsoever to publish updates or adjustments to

these forward-looking statements, unless required to do so by

law.

- Biotalys Press Release Private Placement - 14 October 2024

- Biotalys Persbericht Private Plaatsing - 14 oktober 2024

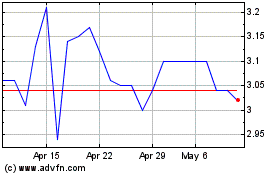

Biotalys (EU:BTLS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Biotalys (EU:BTLS)

Historical Stock Chart

From Feb 2024 to Feb 2025