TIDMCOD

RNS Number : 1892T

Compagnie de Saint-Gobain

12 November 2019

PRESS RELEASE

November 12, 2019

SAINT-GOBAIN ENTERS INTO DEFINITIVE AGREEMENT TO ACQUIRE

CONTINENTAL BUILDING PRODUCTS

Saint-Gobain and Continental Building Products (NYSE: CBPX)

today announce that they have entered into a definitive agreement

pursuant to which Saint-Gobain will acquire all of the outstanding

shares of Continental Building Products for $37.00 per share, in

cash, in a transaction valued at approximately $1.4 billion

(approximately EUR1.3 billion). The business combination has been

unanimously approved by the Board of Directors of Saint-Gobain and

by Continental Building Products' Board of Directors.

Continental Building Products, a highly respected plasterboard

player in North America, employs 645 people and is expected to

generate 2019 revenues of approximately $510 million and adjusted

EBITDA of approximately $130 million per broker consensus. The

business has strong geographic complementarity with Saint-Gobain's

North American operations, good positioning in growth regions in

the East and South-East of the United States and strong

profitability.

Strategic Benefits

-- Broadens Saint-Gobain's asset portfolio and enhances ability

to provide wider customer base with innovative solutions.

Continental Building Products has developed a top-tier platform in

plasterboard in North America with strong customer relationships.

The combination will allow customers to benefit from an enriched

product portfolio supported by Saint-Gobain's global R&D and

product development infrastructure.

-- Increases Saint-Gobain's presence in growth regions in the United States. The geographical complementarity of the production sites will allow better commercial coverage and more efficient logistics services, in particular in high growth regions in the United States.

-- Creates opportunity for approximately $50 million in cost

synergies and performance improvements. These cost synergies are

expected by the end of the third year following transaction close.

Saint-Gobain expects the synergies will be captured through the

integration of Continental Building Products' operations into

Saint-Gobain's North America gypsum business. The categories of

benefits include logistics optimization, purchasing, operations and

SG&A efficiencies. In addition, Saint-Gobain expects to benefit

from additional sales thanks to an enlarged commercial platform and

its ability in transversal innovation, to the benefit of North

American consumers.

-- Similar culture and shared values. Continental Building

Products' teams will be integrated into the Group's gypsum business

in North America, which will in turn be able to lean on their

expertise and know-how. Continental Building Products' continuous

operational improvement program, Bison Way, rests on the same

pillars as the World Class Manufacturing program at Saint-Gobain.

The integration of both companies will be enabled by close business

cultures and operational models, which will allow the acceleration

of value creation for our shareholders and our customers.

The agreed upon price represents a premium of 34.4% to the

volume weighted average price for the 60 trading days ending

November 11, 2019, a multiple (before synergies) of approximately

11.0x Continental Building Product's 2019E adjusted EBITDA of $130

million per broker consensus estimates and a multiple of 7.9x

EBITDA post run-rate synergies. Saint-Gobain will largely finance

the acquisition using the proceeds from divestments made by the

Group. Saint-Gobain expects the transaction to be value creative by

the third year following transaction close, in line with the

Group's acquisition criteria.

Edward Bosowski, Chairman of Continental Building Products and

Jay Bachmann, Chief Executive Officer, commented:

"This is an exciting day for Continental Building Products, our

shareholders, customers and employees and represents the

culmination of the hard work of our highly talented workforce.

Saint-Gobain is the ideal strategic partner with the resources to

support our development, commitment to operational excellence and

global platform that will enable us to continue to provide

outstanding customer service. We believe this is a terrific outcome

for our shareholders and thank the teams at Continental Building

Products for the fantastic work they have done over many

years."

Pierre-André de Chalendar, Chairman and Chief Executive Officer

of Saint-Gobain, and Benoit Bazin, Chief Operating Officer,

commented:

"The acquisition of Continental Building Products is a unique

opportunity allowing Saint-Gobain to move to the forefront of

plasterboard and construction solutions in North America. With the

very strong industrial platform and expert teams that Continental

Building Products brings, Saint-Gobain will be able to accelerate

the deployment of its innovative product offering in order to

better serve customers. We are very impressed by the quality of

work accomplished by the Continental Building Products' teams over

many years and are very happy to welcome them to Saint-Gobain. We

share the same industrial and commercial cultures as the

Continental Building Products' teams and are confident that

together we can leverage our expertise and know-how to drive

sustainable and profitable growth, to the benefit of our customers

and the end consumer. This transaction will enable Saint-Gobain to

enhance its growth and profitability profile, in line with the

'Transform & Grow' program, and to create value for our

shareholders."

This transaction is part of Saint-Gobain's portfolio

optimization strategy, one of the two pillars of the transformation

program "Transform & Grow". Divestments completed or signed by

the Group to date represent sales of around EUR3.3 billion with

cash proceeds of over EUR1 billion, for an EBITDA multiple of

around 10x and an operating income multiple of around 15x. The

full-year operating margin impact is more than 40 basis points,

ahead of the target of the "Transform & Grow" program of a gain

of 40 basis points in the operating margin. Saint-Gobain is

continuing its divestment program even though the initial target of

over EUR3 billion in sales divested by the end of the year has

already been met.

With regard to acquisitions, the Group has closed 12

transactions since the beginning of the year including Pritex

(Mobility, acoustic solutions), Plaka Mexico (plasterboard), Celima

(Mortars in Peru), as well as transactions to optimize our

positioning in Distribution in Nordic countries.

Closing of the transaction is subject to Continental Building

Products shareholders' approval, U.S. antitrust approval and

fulfillment of other customary closing conditions with expected

closing in the second half of 2020.

Lazard and Morgan Stanley are acting as financial advisors, and

Cleary Gottlieb Steen & Hamilton is acting as legal counsel to

Saint-Gobain in connection with the transaction.

ABOUT SAINT-GOBAIN

Saint-Gobain designs, manufactures and distributes materials and

solutions which are key ingredients in the wellbeing of each of us

and the future of all. They can be found everywhere in our living

places and our daily life: in buildings, transportation,

infrastructure and in many industrial applications. They provide

comfort, performance and safety while addressing the challenges of

sustainable construction, resource efficiency and climate

change.

EUR41.8 billion in sales in 2018

Operations in 68 countries

More than 180,000 employees

For more information about Saint-Gobain

Visit www.saint-gobain.com

and follow us on Twitter @saintgobain

Analyst/Investor relations Press relations

+33 1 47 62 +33 1 47 62 30

44 29 10

+33 1 47 62 +33 1 47 62

Vivien Dardel 35 98 Laurence Pernot 51 37

Floriana Michalowska +33 1 47 62 Patricia Marie +33 1 47 62

Christelle Gannage 30 93 Susanne Trabitzsch 43 25

----------------------- -------------- -------------------- ---------------

Analyst/Investor Conference Call on November 13, 2019 at 8:00

a.m. Paris time (GMT + 1)

Dial-in: + 33 (0) 1 72 72 74 03 or +1 646 722 4916 (code

32935652#)

Please dial in 5 to 10 minutes prior to the scheduled start

time

Replay: +33 (0) 1 70 71 01 60 or +1 646 722 4969 (code

418887531#), from 10:30 a.m. Paris time until December 13, 2019

A presentation regarding the transaction will be available

before the conference call on

Saint-Gobain's website at:

https://www.saint-gobain.com/en/finance/events-and-financial-results

Forward-Looking Statements

This press release contains forward-looking statements.

Forward-looking statements may be identified by the use of words

such as "anticipate", "believe", "expect", "estimate", "plan",

"outlook", and "project" and other similar expressions that predict

or indicate future events or trends or that are not statements of

historical matters.

Forward-looking statements should not be read as a guarantee of

future performance or results, and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved.

Forward-looking statements are based on historical information

available at the time the statements are made and are based on

management's reasonable belief or expectations with respect to

future events, and are subject to risks and uncertainties, many of

which are beyond the Company's control, that could cause actual

performance or results to differ materially from the belief or

expectations expressed in or suggested by the forward-looking

statements.

Forward-looking statements speak only as of the date on which

they are made and the Company undertakes no obligation to update

any forward-looking statement to reflect future events,

developments or otherwise, except as may be required by applicable

law.

Investors are referred to information published by the Company

on its web site (www.saint-gobain.com) and filed with the Autorité

des marchés financiers, including its Annual Report and its

Quarterly Reports for additional information regarding the risks

and uncertainties that may cause actual results to differ

materially from those expressed in any forward-looking

statement.

This communication does not constitute an offer to purchase,

sell or exchange, or the solicitation of an offer to purchase, sell

or exchange, any securities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQBTBBTMBTBTBL

(END) Dow Jones Newswires

November 13, 2019 02:15 ET (07:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

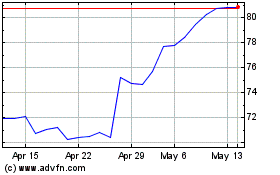

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

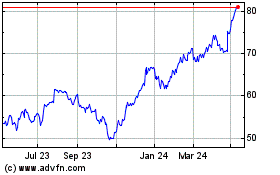

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Dec 2023 to Dec 2024