In a still difficult health environment,

outstanding first quarter performances, with revenue from the

tourism businesses 2% higher than the pre-crisis level1

Regulatory News:

Pierre & Vacances-Center Parcs (Paris:VAC):

1]

Revenue

Under IFRS standards, Q1 2021/2022 revenue totalled €314.2

million (€271.6 million for the tourism activities and €42.6

million for the property development activities).

The Group nevertheless continues to comment on its revenue and

the associated financial indicators, in compliance with its

operational reporting namely:

- with the presentation of joint undertakings

in proportional consolidation, - excluding the impact of IFRS16

application

A reconciliation table presenting revenue stemming from

operational reporting and revenue under IFRS accounting is

presented at the end of the press release.

The operational and legal reorganisation implemented since 1

February 2021 resulting in the regrouping of each of the Group’s

activities into distinct and autonomous Business Lines, has also

led to a change in sectoral information in application of IFRS8.

The main consequence for communication of the Group’s revenue is

the presentation of the contribution from the Adagio operating

entity. The entity includes the contribution from leases taken out

by the PVCP Group and entrusted to the joint-venture Adagio SAS for

management, as well as the share of the contribution from Adagio

SAS held by the Group.

Finally, the Group has changed its operational reporting to

comply with the presentation chosen by the majority of tourism

players concerning holiday marketing fees. Revenue from

accommodation rental is therefore presented in gross terms before

these fees, whereas it was previously presented net of these

commission fees. This change in presentation has no impact on the

overall amount of revenue from the tourism businesses.

Accommodation turnover in 2019/2020 and 2020/2021 has been

adjusted accordingly in the table below.

€ millions

2021/2022

2020/2021

Change vs. 2020/ 2021

2019/2020

Change vs. 2019/ 2020

operational reporting

proforma operational

reporting*

proforma operational

reporting*

Tourism

287.7

102.7

+180.0%

281.9

+2.1%

- Center Parcs Europe

199.4

71.8

+177.6%

185.7

+7.4%

- Pierre & Vacances

Tourisme

51.6

17.8

+190.1%

51.8

-0.4%

- Adagio

36.7

13.1

+179.5%

44.4

-17.4%

o/w accommodation revenue*

227.8

83.9

+171.6%

219.9

+3.6%

- Center Parcs Europe

159.0

59.0

+169.7%

143.0

+11.3%

- Pierre & Vacances

Tourisme

35.7

11.0

+224.7%

35.9

-0.4%

- Adagio

33.0

13.9

+137.7%

41.0

-19.6%

Property development

67.8

64.4

+5.2%

93.1

-27.2%

Total Q1

355.5

167.2

+112.7%

375.0

-5.2%

* Tourism revenue expressed in gross terms before marketing

fees

Following the outstanding performances seen over the summer

season, business continued to grow in Q1 2021/2022 with revenue up

180% relative to the year-earlier period (harshly affected by the

effects of the health crisis with virtually all Pierre &

Vacances and Center Parcs sites closed from mid-November 2020).

The performance in Q1 2021/2022 was even better than that of

Q1 2019/2020 prior to the Covid-19 crisis (2.1% increase in

revenue, of which +3.6% for accommodation), with:

- revenue growth in the Center Parcs Europe division of 7.4%,

primarily related to the rise in average letting rates, and

benefiting all domains (+11.3% in accommodation, of which +13.9%

for the French domains and +9.9% for the domains located in BNG2).

The average occupancy rate was close to 72% over the quarter,

identical to the level in 2019.

- a stable level of business for Pierre & Vacances

(-0.4%):

- accommodation revenue at the residences in France (89% of

revenue in the segment in Q1) was up 6.5% (despite a 5.2% decline

in the offer), including +9.4% for mountain destinations and +4.2%

for seaside destinations. The occupancy rate for mountain

residences was almost at 85% over the quarter (similar to the 2019

level), while that of seaside residences was over 62%, up by more

than 4 points relative to the level in 2019.

- revenue in Spain remained affected by a lack of foreign

customers and was down over the quarter (-33.6% in

accommodation).

- Only Adagio reported lower revenue than the pre-crisis level

(-17.4%) due to the lack of international and corporate customers.

The occupancy rate was nevertheless close to 70% (vs. 40% in Q1

2020/2021 and 75% in Q1 20219/2020).

- Revenue from property development

Q1 2021/2022 property development revenue totalled €67.8

million, compared with €64.4 million in Q1 2020/2021, mainly

representing the contributions from:

- Seniorales residences (€13.9 million vs.

€16.9 million in 2020/2021), - Center Parcs Landes de Gascogne

(Lot-et-Garonne) (€12.2 million vs €7.9 million in 2020/2021), -

Renovation operations at Center Parcs domains (€36.7 million vs

€26.9 million in 2020/2021).

2] Outlook – Tourism businesses

In view of tourism reservations to date for the second quarter

of 2021/2022 and compared with the second quarter of 2018/2019

(pre-Covid), the Group currently expects:

- growth in the revenue for the Center Parcs

Europe business line, benefiting especially from a sharp increase

in average letting rates driven by the premiumisation of most of

the domains, - a similar level of revenue for Pierre & Vacances

in France, adjusted for the decline in the number of apartments

marketed (-11% vs. 2018/2019), - revenue still in decline at

Adagio, even though the recovery in reservations is picking up.

3] Reconciliation table – Revenue

€ millions

2021/2022

operational reporting

Restatement IFRS11

Impact IFRS16

2021/2022 IFRS

Tourism

287.7

-16.1

271.6

- Center Parcs Europe

199.4

-7.4

192.0

- Pierre & Vacances Tourisme

Europe

- Adagio

51.6

36.7

-8.7

51.6

28.0

Property development

67.8

-1.7

-23.4

42.6

Total Q1 2021/2022

355.5

-17.9

-23.4

314.2

€ millions

2020/2021

operational reporting

Restatement IFRS11

Impact IFRS16

2020/2021 IFRS

Tourism revenue

102.7

-4.1

98.7

- Center Parcs Europe

71.8

-1.4

70.4

- Pierre & Vacances Tourisme

- Adagio

17.8

13.1

-2.7

17.8

10.4

Property development revenue

64.4

-4.3

-17.1

43.1

Total Q1 2020/2021

167.2

-8.4

-17.1

141.7

IFRS11 adjustments: for

its operational reporting, the Group continues to integrate joint

operations under the proportional integration method, considering

that this presentation is a better reflection of its performance.

In contrast, joint ventures are consolidated under equity

associates in the consolidated IFRS accounts.

Impact of IFRS16: The

application of IFRS16 as of 1 October 2019 leads to the

cancellation in the financial statements, of a share of revenue and

the capital gain for disposals undertaken as part of property

operations with third-parties (given the Group’s right-of-use

rights). See below for the impact on Q1 revenue.

Given that the Group’s business model is based on two distinct

businesses, as monitored and presented in its operational

reporting, adjustment for this would not measure and reflect the

underlying performance of the Group’s property business, and for

this reason in its financial communication, the Group continues to

present property development operations as they are recorded from

its operational monitoring.

1 Comparison vs Q1 2019/2020 2 Belgium, the Netherlands,

Germany

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220120005721/en/

For further information:

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

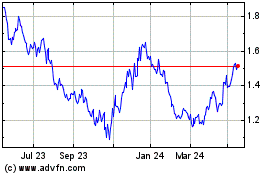

Pierre & Vacances (EU:VAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

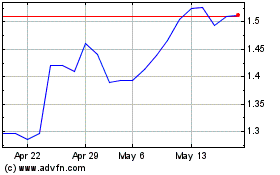

Pierre & Vacances (EU:VAC)

Historical Stock Chart

From Jan 2024 to Jan 2025