VIRBAC: exceptional first-half momentum (+16.2% at constant exchange rates) driven by all regions

17 July 2024 - 1:45AM

UK Regulatory

VIRBAC: exceptional first-half momentum (+16.2% at constant

exchange rates) driven by all regions

|

KEY FIGURES |

Revenue in first half of 2024

€703.1M |

Growth at constant exchange rates

and scope1

+11.3% including

companion animals +15.1%

farm

animals

+7.0% |

Growth at constant

exchange rates2

+16.2%

|

Overall

change

+15.2%

|

1growth at constant

exchange rates and scope corresponds to organic growth of sales,

excluding exchange rate variations, by calculating the indicator

for the financial year in question and the indicator for the

previous financial year on the basis of identical exchange

rates (the exchange rate used is the previous financial year), and

excluding material change in scope, by calculating the indicator

for the financial year in question on the basis of the scope of

consolidation for the previous financial year

2this change is calculated on the actual

scope of consolidation, including scope impacts arising from

acquisitions (Globion and

Sasaeah), for which the indicator in question is

calculated on the basis of the previous year's exchange

rate

Quarterly consolidated

revenue

Our second-quarter revenue amounted €357.4 million, strongly up by

+21.8% at constant exchange rates compared with the same period in

2023. After adjusting for the scope effect of recent acquisitions

(Globion in India and Sasaeah in Japan), revenue growth reached

+13.1% at constant exchange rates and scope. In a buoyant market

context, our remarkable achievement reflects the strong organic

growth momentum observed in all our regions, as well as, to a

lesser extent, a favorable base effect (specifically the limitation

of our dog and cat vaccine production capacity last year). In

Europe (+11.8% at constant exchange rates and scope), all our

sub-zones achieved double-digit growth, mainly thanks to the

contribution of the companion animal segment, and more particularly

the vaccines, petfood/pet care and parasiticides ranges. Our U.S.

subsidiary posted growth of +18.1% at constant exchange rates and

scope, driven by the success of our specialty products for

companion animals, particularly the dental range. Latin America

ended the quarter with the Group's strongest growth (+20.0% at

constant exchange rates and scope), thanks to contributions from

Mexico, Central America and Chile where parasiticides products from

our aquaculture range are in strong demand; while Brazil returned

to growth over the period. Growth in the India Middle East Africa

region (IMEA, +12.1% at constant exchange rates and scope) was

mainly driven by India, which benefited from a good dynamic for our

bovine products, particularly the micronutrition range. With more

modest growth rates, Asian countries are also progressing (+3.7% at

constant exchange rates and scope), notably China where the

companion animal segment is growing strongly. Finally, after a

sluggish first quarter, sales in the Pacific region returned to

growth (+8.2% at constant exchange rates and scope) thanks to

demand for livestock products and the launch of new products.

Cumulative consolidated revenue at the

end of June

Over the first half, our revenue reached €703.1 million compared to

€610.5 million in 2023, representing an overall change of +15.2%.

Excluding currency effects, revenue rose significantly by +16.2%.

The integration of recently acquired companies (Globion in India

and Sasaeah in Japan) contributed +4.9 growth points. At constant

exchange rates and scope, first-half organic growth reached +11.3%,

favorably impacted by the concomitant increase in volumes and

prices (price effect estimated at ~3.5 growth points) despite a

slowdown in inflation. It should be noted that the first half of

the year benefited from a favorable basis for comparison, due in

particular to the increase in our production capacity for dog and

cat vaccines since the beginning of this year.

The Europe zone (+12.3% at constant exchange

rates and scope) accounted for almost half of the Group's organic

growth, benefiting from a strong rebound in the dog and cat vaccine

range, as well as increased demand for our petfood/pet care ranges.

As the beginning of 2023 was marked by distributors’ destocking

effect, the performance of North America (+22.2% at constant

exchange rates and scope) benefited from a favorable base effect

together with sustained sales momentum on our specialty products

for companion animals. Latin America (+10.5% at constant exchange

rates and scope) benefited from remarkable performances in Chile,

Mexico and Central America, which more than offset the slight

downturn in Uruguay and Brazil. India continues to fuel our

expansion in the IMEA region (+9.5% at constant exchange rates and

scope), recording a significant increase (~20% at real rate and

actual scope) thanks to the expansion of our portfolio following

the acquisition of Globion's poultry vaccines. China and South-East

Asia countries were behind our growth in Asia (+8.8% at constant

exchange rates and scope). Despite the rebound seen in the second

quarter, the Pacific region ended the half-year slightly down

(-0.8% at constant exchange rates and scope), penalized by an

unfavorable basis for comparison, as business at the start of 2023

benefited from a particularly favorable agricultural and climatic

context (prices and herd stock increases).

In terms of species, the

companion animal segment posted strong growth of +15.1% at constant

exchange rates and scope, driven by the good momentum of our

dental, dermatology, petfood and specialty product ranges, as well

as our dog and cat vaccine range following the increase in our

production capacity. The farm animal segment posted growth of +7.0%

at constant exchange rates and scope, mainly driven by the ruminant

sector together with strong growth in the aquaculture segment.

Outlook 2024

We confirm our revised forecasts: in line with our press release of

July 8, 2024, at constant exchange rates and scope, we now

anticipate revenue growth between 7% and 9%, and an adjusted

Ebit3 ratio of around 16%. The contribution of recent

external growth operations4 is expected at around +5.5

growth points on revenue, with a slightly accretive impact on Group

profitability. At constant exchange rates and actual scope, revenue

growth is therefore expected to be between 12.5% and 14.5%.

3“current operating profit before

amortization of assets resulting from acquisitions” to “revenue”

ratio

4acquisitions of Globion

in India and Sasaeah in Japan

Consolidated revenue by

quarter

CONSOLIDATED FIGURES

Non-audited figures

in € million |

2024 |

2023 |

Growth |

Growth

at constant exchange rates2 |

Growth

at constant exchange rates and scope1 |

|

First quarter revenue |

345.7 |

314.8 |

+9.8% |

+10.8% |

+9.7% |

|

Second quarter revenue |

357.4 |

295.7 |

+20.9% |

+21.8% |

+13.1% |

|

Revenue for first half year |

703.1 |

610.5 |

+15.2% |

+16.2% |

+11.3% |

Cumulated consolidated revenue at the

end of June by region

CONSOLIDATED FIGURES

Non-audited figures

in € million |

2024 |

2023 |

Growth |

Growth

at constant exchange rates2 |

Growth

at constant exchange rates and scope1 |

|

Europe |

281.2 |

251.2 |

+12.0% |

+12.3% |

+12.3% |

|

North America |

95.5 |

78.1 |

+22.2% |

+22.2% |

+22.2% |

|

Latin America |

111.5 |

98.2 |

+13.6% |

+10.5% |

+10.5% |

|

Asia |

58.5 |

38.2 |

+53.4% |

+66.3% |

+8.8% |

|

Pacific |

62.5 |

64.8 |

-3.5% |

-0.8% |

-0.8% |

|

IMEA5 |

93.9 |

80.0 |

+17.3% |

+19.1% |

+9.5% |

|

Revenue for first half year |

703.1 |

610.5 |

+15.2% |

+16.2% |

+11.3% |

1growth at constant

exchange rates and scope corresponds to organic growth of sales,

excluding exchange rate variations, by calculating the indicator

for the financial year in question and the indicator for the

previous financial year on the basis of identical exchange

rates (the exchange rate used is the previous financial year), and

excluding material change in scope, by calculating the indicator

for the financial year in question on the basis of the scope of

consolidation for the previous financial year

2this change is calculated on the actual

scope of consolidation, including scope impacts arising from

acquisitions (Globion and

Sasaeah), for which the indicator in question is

calculated on the basis of the previous year's exchange

rate

5lndia, Middle East and

Africa

First half 2024 key events

-

April,1 Acquisition

of Sasaeah, a leading animal health player in Japan.

-

June,21 Finalization

of the acquisition of Globion, an Indian specialist in poultry

vaccines.

-

July,8 Announcement

of the resignation of Sébastien Huron - CEO, and upward revision of

the 2024 guidance.

A lifelong commitment to animal

health

At Virbac, we provide innovative solutions to veterinarians,

farmers and animal owners in more than 100 countries around the

world. Covering more than 50 species, our range of products and

services enables us to diagnose, prevent and treat the majority of

pathologies. Every day, we are committed to improving the quality

of life of animals and to shaping the future of animal health

together.

Virbac: Euronext Paris - subfund A - ISIN code:

FR0000031577/MNEMO: VIRP

Financial Affairs department: tel. +33 4 92 08 71 32 - email:

finances@virbac.com - Website: corporate.virbac.com

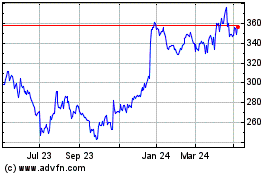

Virbac (EU:VIRP)

Historical Stock Chart

From Nov 2024 to Dec 2024

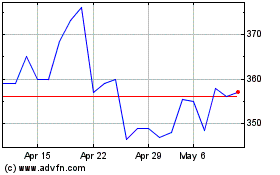

Virbac (EU:VIRP)

Historical Stock Chart

From Dec 2023 to Dec 2024