Yen Falls After Ishiba's Surprise Win

01 October 2024 - 4:37PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Tuesday, as markets reacted to incoming PM Shigeru

Ishiba's support for the Bank of Japan's moves to raise interest

rates from their near-zero level and also backed other policies,

such as possibly raising corporate taxes.

With a majority of votes in both chambers of parliament, Ishiba,

the head of Japan's ruling Liberal Democratic Party (LDP), was

formally named prime minister on Tuesday. The market has been

keenly observing the implementation of his economic

initiatives.

Markets also reacted positively to remarks by U.S. Fed Chair

Jerome Powell, who suggested the central bank will continue to

lower interest rates but stressed the downward path for rates is

not on a preset course.

Powell's remarks partly offset optimism the Fed will continue to

lower interest rates aggressively in the coming months.

The Fed's next monetary policy meeting is scheduled for November

6-7, with CME Group's FedWatch Tool currently indicating a 65.3

percent chance the central bank will lower rates by 25 basis points

and a 34.7 percent chance of another 50-basis point rate cut.

In economic news, the unemployment rate in Japan came in at a

seasonally adjusted 2.5 percent in August, the ministry of Internal

Affairs and Communications said on Tuesday. That was below

expectations for 2.6 percent and down from 2.7 percent in July. The

jobs-to-applicant ratio was 1.23, which missed forecasts for 1.24 -

which would have been unchanged from the previous month. The

anticipation rate ticked up to 63.6 percent from 63.5 percent a

month earlier.

The latest survey from Jibun Bank revealed that the

manufacturing sector in Japan continued to contract in September,

and at a faster rate, with a manufacturing PMI score of 49.7.

That's down from 49.8 in August and it moves further beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

Meanwhile, the Bank of Japan's quarterly Tankan Survey of

business sentiment showed large manufacturing in Japan was steady

in the third quarter of 2024, with a diffusion index score of +13.

That beat forecasts for a reading of +12 and was unchanged from

three months ago. The outlook came in at +14, matching expectations

and steady from the previous quarter.

The large non-manufacturers index came in at +34, beating

forecasts for +32 and up from +33. The outlook was +28, down from

+34 three months earlier. The medium manufacturing index was at +8

with an outlook of +9, while the medium non-manufacturing index was

at +23 with an outlook of +16. The small manufacturing index was at

0, while the small non-manufacturing index was at +14.

In the Asian trading today, the yen fell to 4-day lows of 160.91

against the euro, 193.37 against the pound and 170.71 against the

Swiss franc, from yesterday's closing quotes of 159.91, 192.02 and

169.82, respectively. If the yen extends its downtrend, it is

likely to find support around 167.00 against the euro, 198.00

against the pound and 174.00 against the franc.

Against the U.S., Australia, the New Zealand and the Canadian

dollars, the yen slipped to 4-day lows of 144.54, 100.11, 91.50 and

106.89 from Monday's closing quotes of 143.62, 99.27, 91.17 and

106.18, respectively. The yen is likely to find support around

149.00 against the greenback, 102.00 against the aussie, 93.00

against the kiwi and 110.00 against the loonie.

Looking ahead, manufacturing PMI reports from U.S. and Canada

for September and U.S. construction spending data for August are

slated for release in the New York session.

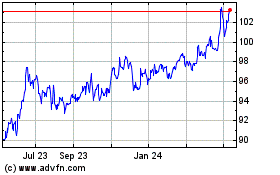

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Oct 2024 to Nov 2024

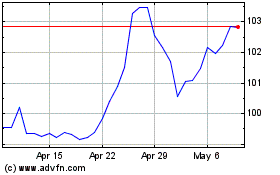

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Nov 2023 to Nov 2024