Australian Dollar Drops Before Fed Decision

21 September 2022 - 2:23PM

RTTF2

The Australian dollar fell against its most major counterparts

in the Asian session on Wednesday, as investors awaited the Federal

Reserve's policy meeting where a hefty rate hike is certain.

Markets focus on the updated economic projections and dot plot

estimates, which will be published along with the Fed's policy

statement due out later in the day.

The Fed is expected to raise rates by 75 basis points, which

will take the target range for the Fed Funds rate to 3.00 percent -

3.25 percent.

Markets forecast rates to peak around 4.5 percent by early

2023.

The monetary policy decisions from the Bank of Japan, Swiss

National Bank and Bank of England are due on Thursday.

The aussie weakened to more than a 2-year low of 0.6655 against

the greenback and a fresh 2-week low of 95.50 against the yen, from

its early highs of 0.6703 and 96.26, respectively. The aussie is

seen finding support around 0.64 against the greenback and 92.00

against the yen.

The aussie edged down to 1.1322 against the kiwi and 0.8911

against the loonie, down from an early high of 1.1351 and 8-day

high of 0.8956, respectively. The aussie is poised to find support

around 1.11 against the kiwi and 0.87 against the loonie.

The aussie, however, appreciated against the euro, touching a

6-day high of 1.4841. On the upside, 1.45 is possibly seen as its

next resistance level.

Looking ahead, U.S. existing home sales for August will be

published in the New York session.

At 2:00 pm ET, the Fed announces its decision on interest rate.

The central bank is expected to raise the target range for the

federal funds rate by 75 basis points to 3.00 percent - 3.25

percent.

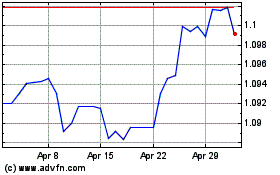

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

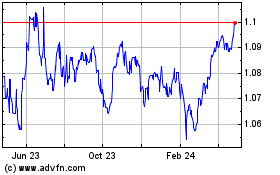

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024