Aussie Falls As Weaker GDP Growth Spurs RBA Rate Cut Speculation

04 December 2024 - 10:47AM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Wednesday, as slower domestic growth spurred

bets that the Reserve Bank of Australia (RBA) is likely to cut

interest rates in early 2025. Also, a private survey showed that

China's services sector grew less than expected in November.

Data from the Australian Bureau of Statistics showed that

Australia's gross domestic product expanded a seasonally adjusted

0.3 percent on quarter in the third quarter of 2024. That missed

expectations for an increase of 0.5 percent, although it was up

from 0.2 percent in the previous three months.

On an annualized basis, GDP was up 0.8 percent, again missing

forecasts for a gain of 1.1 percent and down from 1.0 percent in

the three months prior.

Data from Judo Bank showed that the services sector in China

continued to expand in November, albeit at a slower pace, with a

services PMI score of 51.5. That's down from 52.0 in October.

Also, the services sector in Australia continued to expand in

November, albeit at a slower pace, the latest survey from Judo Bank

revealed on Wednesday, with a services PMI score of 50.5. That's

down from 51.0 in October.

Worries about U.S. President-elect Donald Trump's impending

tariffs on various nation including China, also turned down the

currency.

Traders reacted to the political turmoil in South Korea, a

deepening political crisis in France and faltering economic growth

in China, with the South Korean market plunging over 2 percent.

They also remain optimistic about an interest rate cut by the U.S.

Fed in December.

Traders will keep an eye on the release of the closely watched

monthly U.S. jobs report on Friday that could impact the outlook

for interest rates ahead of the Fed's next monetary policy meeting

in mid-December.

CME Group's FedWatch Tool is currently indicating a 72.1 percent

chance the Fed cuts rates by another 25 basis points but a 27.9

percent chance the central bank leaves rates unchanged.

In the Asian trading today, the Australian dollar fell to more

than a 2-1/2-month low of 95.92 against the yen and nearly a

1-month low of 1.6368 against the euro, from yesterday's closing

quotes of 96.99 and 1.6195, respectively. If the aussie extends its

downtrend, it is likely to find support around 94.00 against the

yen and 1.66 against the euro.

Against the U.S., the Canada and the New Zealand dollars, the

aussie slipped to a 4-month low of 0.6409, nearly a 3-month low of

0.9023 and a 2-day low of 1.0981 from Tuesday's closing quotes of

0.6483, 0.9118 and 1.1022, respectively. The aussie may test

support near 0.62 against the greenback, 0.89 against the loonie

and 1.08 against the kiwi.

Looking ahead, Services PMI reports from various European

economies and U.K. for November are due to be released in the

European session.

In the New York session, U.S. MBA weekly mortgage approvals

data, U.S. and Canada services PMI data for November, U.S. EIA

weekly crude oil data and U.S. Fed Beige report are slated for

release.

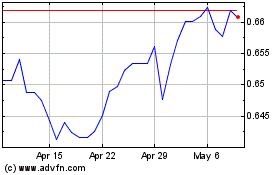

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Nov 2024 to Dec 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Dec 2023 to Dec 2024