Antipodean Currencies Fall Amid Risk Aversion

15 March 2024 - 2:09PM

RTTF2

Antipodean currencies such as the Australia and the New Zealand

dollars weakened against their major currencies in the Asian

session on Friday, as the Asian shares fell amid renewed concerns

about the U.S. Fed further postponing its first interest rate cut

to after June, following the release of hotter-than-expected

producer price inflation data for February.

According to analysts, sticky February U.S. consumer and

producer price inflation figures would be enough to knock the U.S.

central bank off course for rate cuts in June.

Losses in mining, financial and technology stocks, also weighed

on the investor sentiment.

Moreover, Asian markets traded lower, with Hong Kong's Hang Seng

index falling more than 2 percent as the People's Bank of China

held a key rate steady and drained cash from the banking system on

a net basis, signaling a cautious approach of using its monetary

policy to boost growth.

Also, data showed China's home prices dropped 1.4 percent

year-on-year in February, marking the steepest drop in 13 months

amid regulatory crackdowns.

In economic news, data from BusinessNZ showed that the

manufacturing sector in New Zealand continued to contract in

February, albeit at a slower pace, with a Performance of

Manufacturing Index score of 49.3. That's up from the upwardly

revised 47.5 reading in January, although it remains beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

In the Asian trading today, the Australian dollar fell to a

3-day low of 1.6542 against the euro and a 2-day low of 97.33

against the yen, from yesterday's closing quotes of 1.6529 and

97.59, respectively. If the aussie extends its downtrend, it is

likely to find support around 1.67 against the euro and 95.00

against the yen.

Against the U.S. and the Canadian dollars, the aussie dropped to

a 9-day low of 0.6557 and an 8-day low of 0.8881 from Thursday's

closing quotes of 0.6580 and 0.8904, respectively. The aussie may

test support near 0.64 against the greenback and 0.87 against the

loonie.

The NZ dollar fell to a 1-1/2-month low of 1.0770 against the

Australian dollar and a 4-day low of 90.44 against the yen, from

yesterday's closing quotes of 1.0729 and 90.91, respectively. If

the kiwi extends its downtrend, it is likely to find support around

1.08 against the aussie and 89.00 against the yen.

Against the U.S. dollar and the euro, the kiwi dropped to 9-day

lows of 0.6095 and 1.7839 from Thursday's closing quotes of 0.6129

and 1.7742, respectively. The kiwi may test support near 0.59

against the greenback and 1.80 against the euro.

Meanwhile, the safe-haven currency, or the U.S. dollar rose

against its major rivals in the Asian session amid risk

aversion.

The U.S. dollar rose to 8-day highs of 1.0873 against the euro

and 148.66 against the yen, from yesterday's closing quotes of

1.0881 and 148.32, respectively. If the greenback extends its

uptrend, it is likely to find resistance around 1.07 against the

euro and 150.00 against the yen.

The greenback edged up to 1.2730 against the pound, from

yesterday's closing value of 1.2751. On the upside, 1.26 is seen as

the next resistance level for the greenback.

Against the Swiss franc and the Canadian dollar, the greenback

advanced to 9-day highs of 0.8851 and 1.3543 from Thursday's

closing quotes of 0.8838 and 1.3532, respectively.The greenback may

test resistance around 0.89 against the franc and 1.36 against the

loonie.

Looking ahead, Canada housing starts for February and wholesale

sales data for January, U.S. import and export price indices for

February, U.S. NY Empire State manufacturing index for March, U.S.

industrial production for February, U.S. University of Michigan

consumer sentiment for March and U.S. Baker Hughes oil rig count

data are slated for release in the New York session.

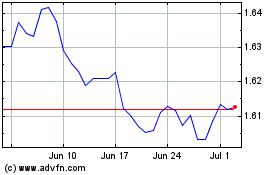

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024