Commodity Currency's Slide As Crude Oil Prices Traded Lower

21 January 2025 - 2:26PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Tuesday, as oil prices dropped after the U.S.

President Donald Trump postponed imposing fresh tariffs and

unveiled a plan to increase U.S. oil and gas production.

The West Texas Intermediate Crude oil futures for March dropped

67 cents to $76.72 per barrel.

Brent crude futures fell 11 cents, or 0.14 percent, to $80.04

per barrel.

Oil prices fell as a result of President Donald Trump's

announcement of a plan to increase U.S. oil and gas output and his

suggestion to impose 25% tariffs on imports from Canada and Mexico

starting on February 1 rather than immediately.

Meanwhile, the markets reacted positively to U.S. President

Donald Trump's decision not to impose China-specific tariffs on his

first day in office.

Markets were bracing for major policy announcements and sweeping

changes in U.S. trade policies that could thrust businesses into

considerable uncertainty.

Trump also stated, "If we make a TikTok deal and China doesn't

approve it, we could maybe put tariffs on China." He made this

statement following his signing of an executive order postponing

the implementation of the TikTok ban by seventy-five days.

In economic news, data from Business NZ showed that the New

Zealand Performance of Service Index (PSI) fell to 47.9 in December

from 49.5 in November, extending its contraction streak to ten

consecutive months.

In the Asian trading today, the Australian dollar fell to an

8-day low of 1.6681 against the euro and a 6-day low of 1.1039

against the NZ dollar, from yesterday's closing quotes of 1.6593

and 1.1055, respectively. If the aussie extends its downtrend, it

is likely to find support around 1.68 against the euro and 1.08

against the kiwi.

The aussie edged down to 0.6209 against the U.S. dollar, from an

early more than a 2-week high of 0.6289. The aussie may test

support near the 0.60 region.

Against the yen, the aussie edged down to 96.83 from Monday's

closing value of 97.52. On the downside, 94.00 is seen as the next

support level for the aussie.

The NZ dollar fell to 0.5622 against the U.S. dollar, from an

early 2-week high of 0.5689. The next downside target for the kiwi

is seen around the 0.54 region.

Against the yen and the euro, the kiwi edged down to 87.60 and

1.8421 from yesterday's closing quotes of 88.21 and 1.8343,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 86.00 against the yen and 1.86 against the

euro.

The Canadian dollar fell to nearly a 5-year low of 1.4518

against the U.S. dollar and nearly a 4-week low of 1.5051 against

the euro, from Monday's closing quotes of 1.4303 and 1.4905,

respectively. If the loonie extends its downtrend, it is likely to

find support around 1.46 against the greenback and 1.52 against the

euro.

Against the yen and the Australian dollar, the loonie dropped to

more than 1-month lows of 107.34 and 0.9034 from yesterday's

closing quotes of 108.57 and 0.8983, respectively. The loonie may

test support near 104.00 against the yen and 0.92 against the

aussie.

Looking ahead, Germany's ZEW economic confidence survey results

for January are due at 5:00 am ET in the European session. The

economic sentiment index is expected to fall to 15.2 in January

from 15.7 in December.

In the New York session, Canada CPI reports for December are

slated for release.

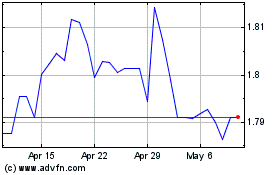

Euro vs NZD (FX:EURNZD)

Forex Chart

From Dec 2024 to Jan 2025

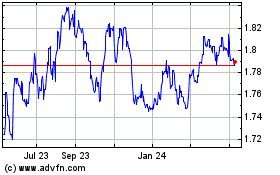

Euro vs NZD (FX:EURNZD)

Forex Chart

From Jan 2024 to Jan 2025