Loonie Plummets To Multi-day Lows Against Majors Amid Canadian Rate Decision

21 October 2009 - 4:21AM

RTTF2

The Canadian currency plunged sharply against major opponents

following the announcement of Bank Of Canada's interest rate

decision during New York morning trading on Tuesday.

The Bank Of Canada maintained its overnight rate target

unchanged at 0.25 percent in October. The BoC may be continue to

keep the rate unchanged for a long period unless the inflation

outlook changes.

Statistics Canada reported today that Canadian wholesale sales

fell by 1.4% in August after a 2.6% gain in the previous month.

Economists expected wholesale sales to rise 1% following a revised

2.6% increase in July.

The Stats Canada also said that Canadian leading indicators

index rose by 1.1% in September from August.

Extending previous session's downtrend, the loonie declined

further against its US counterpart in New York morning deals today.

At 11:35 am ET, the loonie dropped to an 11-day low of 1.0530

versus the greenback, compared to yesterday's close of 1.0286.

The U.S. Labor Department revealed that producer prices fell 0.6

percent in September. Economists were looking producer prices to

slip by 0.3 percent in the month. Core prices, which exclude the

volatile food and energy sectors, edged down by 0.1 percent for

September. Economists were looking for an advance of 0.1

percent.

The U.S. Commerce Department released a report today showing

that housing starts edged up 0.5 percent to an annual rate of

590,000 in September from the revised August estimate of 587,000.

Economists had expected starts to rise to 610,000 from the 598,000

originally reported for the previous month.

Additionally, the report showed that building permits, an

indicator of future housing demand, fell 1.2 percent to an annual

rate of 573,000 in September from the revised August rate of

580,000.

Against the euro, the loonie traded down sharply in today's New

York morning session and slipped to a 2-week low of 1.5686 at about

11:35 am ET. The pair was worth 1.5393 at yesterday's close. The

next downside target level for the Canadian currency is seen at

1.5748.

The Canadian dollar tumbled further against the Japanese yen in

morning deals and edged down to a new multi-day low of 86.35 by

about 10:20 am ET. The loonie-yen pair that closed Monday's New

York session at 88.09, is currently trading near 86.55.

The loonie also traded lower against the Australian dollar in

today's New York deals. At 11:00 am ET, the loonie slipped to a

fresh multi-month low of 0.9702 versus the yen, which may be

compared to yesterday's closing value of 0.9561.

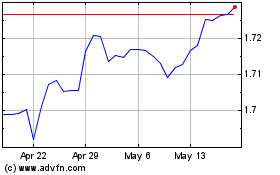

Sterling vs CAD (FX:GBPCAD)

Forex Chart

From Feb 2025 to Mar 2025

Sterling vs CAD (FX:GBPCAD)

Forex Chart

From Mar 2024 to Mar 2025