Yen Retreats After BoJ Surprises Rate Hike

31 July 2024 - 1:56PM

RTTF2

The Japanese yen retreated from recent highs against other major

currencies in the Asian session on Wednesday, after the Bank of

Japan raised its benchmark rate by 15 basis points and also

announced its plan to reduce bond purchases.

The policy board voted 7-2 to lift the uncollateralized

overnight call rate to around 0.25 percent.

In a unanimous vote, the board decided to reduce the amount of

its monthly outright purchase of government bonds to around JPY 3

trillion by the first quarter of 2026.

The central bank expects 2.5 percent inflation for the fiscal

2024, which was down from 2.8 percent projected in April. The BoJ

said the new forecast is lower mainly because of measures taken by

the government to push down energy prices.

Meanwhile, the outlook for 2025 was lifted to 2.1 percent from

1.9 percent. The fiscal 2026 inflation forecast was retained at 1.9

percent.

Due to the statistical revision to the GDP figures for the

fiscal 2023, the bank downgraded its growth outlook for the fiscal

2024 to 0.6 percent from 0.8 percent. Projections for both the

fiscal 2025 and 2026 were maintained at 1.0 percent.

In economic news, data from the Cabinet Office showed that

Japan's consumer sentiment increased for the second straight month

in July, though marginally. The seasonally adjusted consumer

confidence index rose to a 3-month high of 36.7 in July from 36.4

in June. Economists had forecast the index to rise to 36.5.

Similarly, the index for employment rose by 0.3 points to 42.0,

while the only sub-index showing a decline was income growth, which

dropped somewhat to 40.4 from 40.6.

In economic news, the value of retail sales in Japan was up a

seasonally adjusted 3.7 percent on month in June, the Ministry of

Economy, Trade and Industry or METI said on Wednesday - coming in

at 13.678 trillion yen. That beat expectations for an increase of

3.3 percent following the 2.8 percent gain in May. On a monthly

basis, retail sales rose 0.6 percent. For the second quarter of

2024, retail sales gained 1.8 percent on quarter and 2.8 percent on

year at 40.632 trillion yen.

The METI also said industrial output in Japan dropped a

seasonally adjusted 3.6 percent on month in June. That exceeded

expectations for a decline of 4.2 percent following the 3.6 percent

increase in May. On a yearly basis, industrial output slumped 7.3

percent after rising 1.1 percent in the previous month. Upon the

release of the data, the METI downgraded its assessment of

industrial production, saying that it fluctuates indecisively but

has weakened.

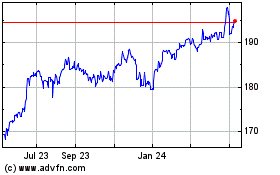

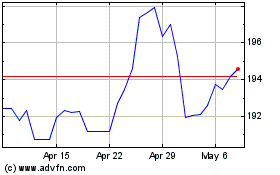

In the Asian trading today, the yen retreated to 166.56 against

the euro and 197.62 against the pound, from a recent near 3-month

highs of 164.17 and 194.75, respectively. If the yen extends its

downtrend, it is likely to find support around 173.00 against the

euro and 204.00 against the pound.

Against the U.S. dollar and the Swiss franc, the yen slipped to

153.89 and 174.24 from a recent near 4-month high of 151.63 and a

2-month high of 172.09, respectively. The yen may test support near

156.00 against the greenback and 180.00 against the franc.

The yen slipped to 111.16 against the Canadian dollar, from a

recent near 5-month high of 109.55. On the downside, 116.00 is seen

as the next support level for the yen.

Looking ahead, Eurozone flash harmonized inflation data for July

is slated for release in the European session.

In the New York session, U.S. MBA weekly mortgage approvals

data, U.S. ADP Nonfarm employment data for July, Canada GDP data

for May, U.S. pending home sales for June and U.S. EIA crude oil

data are slated for release.

At 2:00 pm ET, the U.S. Federal Reserve will announce its fifth

interest rate decision for 2024 later tonight after a two-day

Federal Open Market Committee (FOMC) meeting today. The central

bank is expected to maintain its benchmark interest rates between

5.25 per cent - 5.50 percent.

Half-an-hour later, U.S. Fed Chairman Powell will conduct a

press conference about the final monetary policy announcement.

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Oct 2024 to Nov 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Nov 2023 to Nov 2024