Yen Rises On BoJ Rate Hike Bets

25 February 2025 - 5:39PM

RTTF2

The Japanese yen strengthened against other major currencies in

the European session on Tuesday amid rising speculation that the

Bank of Japan (BoJ) will hike interest rates further.

The BoJ rate rise stance is supported by Japan's Services

Producer Pricing Index (PPI), which was released earlier on

Tuesday.

Data from the Bank of Japan showed that the Japan preliminary

services-sector inflation accelerated to 3.1 percent in January,

from a 3.0 percent rise a year earlier.

On a monthly basis, the services producer price index fell 0.5

percent in January, after remaining flat in December.

European stocks traded lower after the S&P 500 posted its

third consecutive session loss on tariff worries and apprehensions

over the artificial intelligence-driven narratives.

Amid rising geopolitical risks and trade war concerns, investors

now look ahead to Home Depot's earnings release due before the U.S.

opening bell later today and AI-chip darling Nvidia's

fiscal-fourth-quarter results after the close of trading on

Wednesday for further direction.

Meanwhile, in a major policy shift, the U.S. on Monday sided

with Russia on a UN General Assembly draft resolution that called

for a de-escalation, an early cessation of hostilities and a

peaceful resolution of the war in Ukraine.

U.S. President Donald Trump moved to curb Chinese investments

and announced he would proceed with tariffs on Canada and Mexico,

following a one-month delay.

In the European trading today, the yen rose to a 4-day high of

188.18 against the pound, from an early 4-day low of 189.67. The

yen may test resistance around the 186.00 region.

Against the U.S. dollar and the Swiss franc, the yen edged up to

149.20 and 166.37 from an early 4-day lows of 150.30 and 167.46,

respectively. If the yen extends its uptrend, it is likely to find

resistance around 148.00 against the greenback, 165.00 against the

franc

The yen edged up to 156.00 against the euro, from an early low

of 157.24. On the upside, 155.00 is seen as the next resistance

level for the yen.

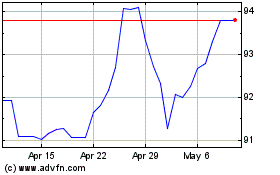

Against the Australia and the New Zealand dollars, the yen

advanced to more than 2-week highs of 94.54 and 85.40 from early

lows of 95.32 and 86.04, respectively. If the yen extends its

uptrend, it is likely to find resistance around 93.00 against the

aussie and 83.00 against the kiwi.

The yen climbed to more than a 5-month high of 104.55 against

the Canadian dollar, from an early low of 105.34. The yen is likely

to find resistance around the 102.00 region.

Looking ahead, Canada manufacturing sales data for January, U.S.

Redbook report, U.S. house price index for December, U.S. Consumer

Board's consumer confidence for February and U.S. Richmond

manufacturing index for February are slated for release in the New

York session.

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Jan 2025 to Feb 2025

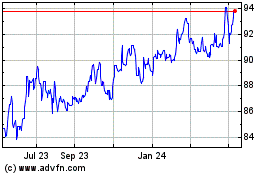

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Feb 2024 to Feb 2025