UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed

by the Registrant |

|

☒ |

| Filed

by a party other than the Registrant |

|

☐ |

Check

the appropriate box:

| ☐ |

|

Preliminary Proxy Statement |

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

|

Definitive Proxy Statement |

| ☐ |

|

Definitive Additional Materials |

| ☐ |

|

Soliciting Material under § 240.14a-12 |

Aditxt,

Inc.

(Name of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment

of Filing Fee (Check all boxes that apply): |

| |

| ☒ |

|

No

fee required |

| |

|

|

| ☐ |

|

Fee

paid previously with preliminary materials. |

| |

|

|

| ☐ |

|

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

737

N. Fifth Street, Suite 200

Richmond,

VA 23219

October 21, 2022

NOTICE

OF 2022 SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on November 11, 2022

Dear

Stockholder:

We

are pleased to invite you to attend the special meeting of stockholders (the “Special Meeting”) of Aditxt, Inc. (the “Company”),

which will be held on November 11, 2022, at 12:00 p.m. Eastern Time.

Due

to the continuing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees

and stockholders, the Special Meeting will be held in a virtual-only meeting format at www.virtualshareholdermeeting.com/ADTX2022SM.

In addition to voting by submitting

your proxy prior to the Special Meeting, you also will be able to vote your shares electronically during the Special Meeting. Further

details regarding the virtual meeting are included in the accompanying proxy statement. At the Special Meeting, the holders of our outstanding

common stock will act on the following matters:

| |

1. |

To approve, for the purposes of Listing Rule 5635(d) of The Nasdaq

Stock Market LLC (“Nasdaq”), the issuance of shares of common stock underlying warrants originally issued by the Company in

August 2022; and |

| |

2. |

To transact such other matters as may properly come before the Special Meeting and any adjournment or postponement thereof. |

Our board of directors has fixed October 14, 2022 as the record date

(the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting and at

any adjournment or postponement of the meeting.

IF

YOU PLAN TO ATTEND:

To

be admitted to the Special Meeting at you must have your control number available and follow the instructions found on your proxy card

or voting instruction form. You may vote during the Special Meeting by following the instructions available on the meeting website during

the meeting. Please allow sufficient time before the Special Meeting to complete the online check-in process. Your vote is very important.

If

you have any questions or need assistance voting your shares, please call Kingsdale Advisors at:

Strategic

Stockholder Advisor and Proxy Solicitation Agent

745

Fifth Avenue, 5th Floor, New York, NY 10151

North

American Toll Free Phone:

+1

(888) 564-7333

Email:

contactus@kingsdaleadvisors.com

Call

Collect Outside North America: +1 (646) 664-1397

| |

By

Order of the Board of Directors |

| |

|

| October 21, 2022 |

/s/ Amro

Albanna |

| |

Amro

Albanna

Chief

Executive Officer

Chairman

of the Board of Directors |

Whether

or not you expect to attend the Special Meeting virtually, we urge you to vote your shares via proxy at your earliest convenience. This

will ensure the presence of a quorum at the Special Meeting. Promptly voting your shares will save the Company the expenses and extra

work of additional solicitation. Submitting your proxy now will not prevent you from voting your shares electronically at the Special

Meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today!

737

N. Fifth Street, Suite 200

Richmond,

VA 23219

PROXY

STATEMENT FOR THE

2022 SPECIAL MEETING OF STOCKHOLDERS

To

be held on November 11, 2022

The

board of directors of Aditxt, Inc. (“Aditxt” or the “Company”) is soliciting your proxy to vote at the Special

Meeting of Stockholders (the “Special Meeting”) to be held on November 11, 2022, at 12:00 p.m. Eastern Time, in a virtual-only

format online by accessing www.virtualshareholdermeeting.com/ADTX2022SM and at any adjournment thereof.

This

proxy statement contains information relating to the Special Meeting. The Special Meeting of stockholders will be held as a virtual

meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at

an in-person meeting.

You

will be able to attend and participate in the Special Meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/ADTX2022SM.

In addition to voting by submitting your proxy prior to the Special Meeting, you also will be able to vote your shares electronically

during the Special Meeting.

Important

Notice Regarding the Availability of Proxy Materials

for the Special Meeting of Stockholders to be Held on November 11, 2022:

The Notice of Meeting, Proxy Statement, and our 2021 Annual Report

on Form 10-K are available at: www.proxyvote.com |

ADITXT,

INC.

TABLE

OF CONTENTS

QUESTIONS

AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

What

is a proxy?

A

proxy is the legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone

as your proxy in a written document, that document is also called a proxy or a proxy card. By completing, signing and returning the accompanying

proxy card, you are designating Amro Albanna, Chief Executive Officer of the Company, and Corinne Pankovcin, President of the Company,

as your proxies for the Special Meeting and you are authorizing Mr. Albanna and Ms. Pankovcin to vote your shares at the Special Meeting

as you have instructed on the proxy card. This way, your shares will be voted whether or not you attend the Special Meeting. Even if

you plan to attend the Special Meeting, we urge you to vote in one of the ways described below so that your vote will be counted even

if you are unable or decide not to attend the Special Meeting.

What

is a proxy statement?

A

proxy statement is a document that we are required by regulations of the SEC to give you when we ask you to sign a proxy card designating

Mr. Albanna and Ms. Pankovcin as proxies to vote on your behalf.

Why

did you send me this proxy statement?

We

sent you this proxy statement and proxy card because our board of directors is soliciting your proxy to vote at the Special Meeting and

any adjournment and postponement thereof. This proxy statement summarizes information related to your vote at the Special Meeting. All

stockholders who find it convenient to do so are cordially invited to attend the Special Meeting virtually. However, you do not need

to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the proxy card by mail or vote over the

Internet, by phone or by fax.

On

or about October 21, 2022, we intend to begin mailing to each stockholder this proxy statement and our Annual Report on

Form 10-K for the year ended December 31, 2021 Only stockholders who owned our common stock on October 14, 2022 are entitled to vote at the Special

Meeting.

What

Does it Mean if I Receive More than one set of proxy materials?

If

you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please

complete, sign, and return each proxy card to ensure that all of your shares are voted.

How

do I attend the Special Meeting?

The Special Meeting will

be held on November 11, 2022, at 12:00 p.m. Eastern Time in a virtual format online by accessing www.virtualshareholdermeeting.com/ADTX2022SM.

Information on how to vote in person at the Special Meeting is discussed below.

Who is Entitled to Vote?

The board of directors has

fixed the close of business on October 14, 2022 as the record date (the “Record Date”) for the determination of stockholders

entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. On the Record Date, there were

4,161,129 shares of common stock outstanding. Each share of common stock represents one vote that may be voted on each proposal

that may come before the Special Meeting.

What

is the Difference Between Holding Shares as a Record Holder and as a Beneficial Owner (Holding Shares in Street Name)?

If

your shares are registered in your name with our transfer agent, VStock Transfer, LLC, you are the “record holder” of those

shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If

your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner”

of those shares held in “street name.” If your shares are held in street name, the Notice has been forwarded to you by that

organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special

Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. See “How Will my

Shares be Voted if I Give No Specific Instruction?” below for information on how shares held in street name will be voted without

instructions provided.

Who

May Attend the Special Meeting?

Only

record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Special Meeting. If your shares

of common stock are held in street name, you will need to provide a copy of a brokerage statement or other documentation reflecting your

stock ownership as of the Record Date.

What

am I Voting on?

There

is one matter scheduled for a vote:

| |

1. |

To approve, for the purposes of Nasdaq Listing Rule 5635(d), the

issuance of shares of common stock underlying warrants originally issued by the Company in August 2022. |

What

if another matter is properly brought before the Special Meeting?

The

board of directors knows of no other matters that will be presented for consideration at the Special Meeting. The proxies also have discretionary

authority to vote to adjourn the Special Meeting, including for the purpose of soliciting votes in accordance with our board’s

recommendations. If any other matters are properly brought before the Special Meeting, it is the intention of the person named in the

accompanying proxy to vote on those matters in accordance with his best judgment.

How

Do I Vote?

Stockholders of Record

If you are a registered

stockholder, you may vote by mail, fax, phone or online at the Special Meeting by following the instructions in the Notice. You also may

submit your proxy by mail by following the instructions included with your proxy card. The deadline for submitting your proxy by Internet

is 11:59 p.m. Eastern Time on November 10, 2022. Our board’s designated proxies, Mr. Albanna and Ms. Pankovcin, will vote your shares

according to your instructions. If you attend the live webcast of the Special Meeting you also will be able to vote your shares electronically

at the meeting up until the time the polls are closed.

Beneficial Owners of Shares Held in Street Name

If you are a street

name holder, your broker or nominee firm is the legal, registered owner of the shares, and it may provide you with the Notice. Follow

the instructions on the Notice to access our proxy materials and vote or to request a paper or email copy of our proxy materials. The

materials include a voting instruction card so that you can instruct your broker or nominee how to vote your shares. Please check the

Notice or voting instruction card or contact your broker or other nominee to determine whether you will be able to deliver your voting

instructions by Internet in advance of the meeting and whether, if you attend the live webcast of the Special Meeting, you will be able

to vote your shares electronically at the meeting up until the time the polls are closed.

All shares entitled

to vote and represented by a properly completed and executed proxy received before the Special Meeting and not revoked will be voted at

the Special Meeting as instructed in a proxy delivered before the Special Meeting. We provide Internet proxy voting to allow you to vote

your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please

be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone

companies.

How Many Votes do I Have?

On each matter

to be voted upon, you have one vote for each share of common stock you own as of the close of business on the Record Date.

Is My Vote Confidential?

Yes, your vote

is confidential. Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access

for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

What Constitutes a Quorum?

To carry on business at the Special Meeting, we must have a quorum.

A quorum is present when one-third of the shares entitled to vote, as of the Record Date, are represented in person or by proxy. Thus,

1,387,043 shares must be represented in person or by proxy to have a quorum at the Special Meeting. Your shares will be counted towards the

quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person

at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by the Company are

not considered outstanding or considered to be present at the Special Meeting. If there is not a quorum at the Special Meeting, either

the chairperson of the Special Meeting or our stockholders entitled to vote at the Special Meeting may adjourn the Special Meeting.

How Will my Shares be Voted if I Give No Specific Instruction?

We must vote your

shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized

us generally to vote the shares, they will be voted as follows:

| 1. | “For” the approval, for the purposes of Nasdaq Listing

Rule 5635(d), of the issuance of shares of common stock underlying warrants originally issued by the Company in August 2022. |

This authorization

would exist, for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how its shares

are to be voted on one or more proposals. If other matters properly come before the Special Meeting and you do not provide specific voting

instructions, your shares will be voted at the discretion of Amro Albanna and Corinne Pankovcin, the board of directors’ designated

proxies.

If your shares

are held in street name, see “What is a Broker Non-Vote?” below regarding the ability of banks, brokers and other such holders

of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

How are Votes Counted?

Votes will be

counted by the inspector of election appointed for the Special Meeting, who will separately count “For” and “Against,”

abstentions and broker non-votes with respect to the proposal. Broker non-votes will not be included in the tabulation of the voting results

of the proposal and, therefore, will have no effect on such proposal.

What is a Broker Non-Vote?

A “broker

non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to

a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the

broker lacks the authority to vote the shares at their discretion.

Our common stock

is listed on The Nasdaq Capital Market. However, under current New York Stock Exchange (“NYSE”) rules and interpretations

that govern broker non-votes Proposal No. 1 for the approval of the shares of common stock that may be issued upon exercise of the warrants

originally issued by the Company in August 2022 is considered a non-discretionary matter, and a broker will not be permitted to exercise

its discretion to vote uninstructed shares on the proposal. Because NYSE rules apply to all brokers that are members of the NYSE, this

prohibition applies to the Special Meeting even though our common stock is listed on The Nasdaq Capital Market.

What is an Abstention?

An abstention

is a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present

and entitled to vote at the Special Meeting. Generally, unless provided otherwise by applicable law, our Amended and Restated Bylaws (the

“Bylaws”) provide that an action of our stockholders (other than the election of directors) is approved if a majority of the

number of shares of stock entitled to vote thereon and present (either in person or by proxy) vote in favor of such action. Therefore,

abstentions will have no effect with respect to Proposal 1.

The table below

summarizes the proposal that will be voted on, the vote required to approve such proposal and how votes are counted:

| Proposal |

|

Votes Required |

|

Voting Options |

|

Impact of

“Withhold” or

“Abstain” Votes |

|

Broker

Discretionary

Voting Allowed |

| Proposal No. 1: Approval of the shares of common stock issuable upon the exercise of the warrants issued originally by the Company in August 2022 |

|

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Special Meeting by the holders entitled to vote thereon. |

|

“FOR” “AGAINST” “ABSTAIN” |

|

None(1) |

|

No(2) |

| (1) | A vote marked as an “Abstention” is not considered

a vote cast and will, therefore, not affect the outcome of this proposal. |

| (2) | As this proposal is not considered a discretionary matter,

brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. |

What Are the Voting Procedures?

In voting by proxy

with regard to the proposal, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should

specify your choice on the accompanying proxy card or your vote instruction form.

Is My Proxy Revocable?

You may revoke

your proxy and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Corporate Secretary of

the Company by delivering a properly completed, later-dated proxy card or vote instruction form or by voting in person at the Special

Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Aditxt,

Inc., 737 N. Fifth Street, Suite 200, Richmond, VA 23219 Attention: Corporate Secretary. Your most current proxy card or Internet

proxy is the one that will be counted.

Who is Paying for the Expenses Involved in Preparing

and Mailing this Proxy Statement?

All of the expenses involved in preparing, assembling and mailing these

proxy materials and all costs of soliciting proxies will be paid by us. In addition to the solicitation by mail, proxies may be solicited

by our officers and other employees by telephone or in person. Such persons will receive no compensation for their services other than

their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward

solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable

out of pocket expenses incurred by them in forwarding solicitation materials. We have retained Kingsdale Advisors as our strategic stockholder

advisor and proxy solicitation agent in connection with the solicitation of proxies for the Special Meeting. If you have any questions

or require any assistance with completing your proxy, please contact Kingsdale Advisors by telephone (toll-free within North America)

at +1 (888) 564-7333 or call collect outside North America at +1 (646) 664-1397 or by email at contactus@kingsdaleadvisors.com.

Do I Have Dissenters’ Rights of Appraisal?

Stockholders do

not have appraisal rights under Delaware law or under the Company’s governing documents with respect to the matters to be voted

upon at the Special Meeting.

How can I Find out the Results of the Voting at the

Special Meeting?

Preliminary voting

results will be announced at the Special Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K

that we expect to file with the SEC within four business days after the Special Meeting. If final voting results are not available to

us in time to file a Form 8-K with the SEC within four business days after the Special Meeting, we intend to file a Form 8-K to publish

preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final

results.

PROPOSAL 1:

THE AUGUST 2022 TRANSACTION PROPOSAL

On August 4, 2022,

August 11, 2022 and September 12, 2022, we entered into Securities Purchase Agreements (the “Purchase Agreements”) with certain

accredited investors (the “Investors”) for the offering, sale, and issuance (the “Offering”) of an aggregate of

$2,388,888 in principal amount of Senior Secured Promissory Notes (the “Notes”). Concurrently with the sale of the Notes,

pursuant to the Purchase Agreements, we also issued an aggregate of 47,780 shares of our common

stock as commitment fees and warrants (the “August Warrants”) to purchase up to 229,773 shares of our common stock to the

Investors.

Furthermore,

on August 31, 2022, we entered into an Agreement for the Purchase and Sale of Future Receipts (the “Agreement”) with a commercial

funding source (the “Funder”) pursuant to which we, among other things, issued the Funder a warrant (the “Funder

Warrant” and together with the August Warrants, the “Warrants”) to purchase up to 26,667 shares of our common stock.

The Purchase Agreements

require that we call and hold a meeting of our stockholders for the purpose of requesting approval (“Stockholder Approval”)

of the issuance of shares of common stock underlying the Notes and the Warrants pursuant to Nasdaq Listing Rule 5635(d).

Nasdaq Listing

Rule 5635(d) provides that stockholder approval is required prior to the issuance of securities in a transaction, other than a public

offering, involving the sale, issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable

for common stock), which equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance, at

a price less than the lower of: (i) the closing price immediately preceding the signing of the binding agreement, or (ii) the

average closing price of the common stock for the five trading days immediately preceding the signing of the binding agreement for the

transaction. See “— Reasons for Stockholder Approval” below.

In light of this

rule, the Purchase Agreements, the Notes and the Warrants provide that, unless we obtain the approval of our stockholders as required

by Nasdaq, the Company is prohibited from issuing any shares of common stock pursuant to the terms of the Notes and Warrants, if (i) the

issuance of such shares of common stock pursuant to the Notes and Warrants would exceed 19.99% of the Company’s outstanding shares

of common stock as of August 4, 2022, or, (ii) if such issuance would otherwise exceed the aggregate number of shares of common stock

which the Company may issue without breaching its obligations under the rules and regulations of Nasdaq. If Stockholder Approval is not

obtained at the Special Meeting, we may, among other things, be required to make certain payments to the holders of the Notes and Warrants.

See “— Effect of Failure to Obtain Stockholder Approval” below.

On or about September

30, 2022, prior to the issuance of any shares of common stock upon conversion of the Notes, we repaid the outstanding balance of the Notes,

including all accrued and unpaid interest thereon.

Accordingly, at

the Special Meeting, stockholders will vote on the approval of the issuance of securities in the transaction contemplated by the Purchase

Agreements and the Warrants, including the shares of common stock issuable upon exercise of the Warrants.

The following

is a summary of the material features of the Warrants. This summary is qualified in its entirety by the full text of the Form of

Warrant, a copy of which is attached to this Proxy Statement as Appendix A.

The Warrants

The Warrants are exercisable for a period of five years commencing

on the Commencement Date (as defined in the Warrants) at an initial exercise price of $11.78 per share, which was subsequently adjusted

to $7.50, and may be subject to additional adjustment (including cashless exercise).

The Company is

prohibited from effecting an exercise of the Warrants to the extent that, as a result of such exercise, the holder of the Warrant together

with the holder’s affiliates, would beneficially own more than 4.99% of the number of shares of common stock of the Company outstanding

immediately after giving effect to the issuance of such shares.

Effect on Current Stockholders

The issuance of

securities pursuant to the Warrants will not affect the rights of the holders of outstanding common stock, but such issuances will have

a dilutive effect on the existing stockholders, including the voting power and economic rights of the existing stockholders.

The Warrant provides

that the holder is prohibited from exercising the warrant to the extent the holder would beneficially own more than 4.99% of the Company’s

outstanding shares of common stock after such conversion or exercise.

Unlike Nasdaq Rule 5635(d), which limits the aggregate number

of shares the Company may issue to the holder of the Warrant, this beneficial ownership limitation limits the number of shares the holder

may beneficially own at any one time. Consequently, the number of shares the holder may beneficially own in compliance with the beneficial

ownership limitation may increase over time as the number of outstanding shares of common stock increases over time. In addition, the

holder may sell some or all of the shares it receives under the Warrant, permitting it to acquire additional shares in compliance with

the beneficial ownership limitation.

Description of Common Stock

The Company is

currently authorized to issue 100,000,000 shares of common stock, par value $0.001, and 3,000,000 shares of preferred stock, par value

$0.001.

Common Stock

Voting

The holders of

our common stock are entitled to one vote for each share held on all matters to be voted on by the Company’s stockholders. There

is no cumulative voting.

Liquidation

In the event of

any voluntary or involuntary liquidation, dissolution or winding up of our affairs, the holders of our common stock will be entitled to

share ratably in the net assets legally available for distribution to stockholders after the payment of or provision for all of our debts

and other liabilities.

Fully Paid and Non-assessable

All outstanding

shares of common stock are duly authorized, validly issued, fully paid and non-assessable.

Dividends

The Company has

not paid any cash dividends on its common stock to date. Any future decisions regarding dividends will be made by its board of directors.

The Company does not anticipate paying dividends in the foreseeable future but expect to retain earnings to finance the growth of its

business. The Company’s board of directors has complete discretion on whether to pay dividends. Even if the Company’s board

of directors decides to pay dividends, the form, frequency and amount will depend upon the Company’s future operations and earnings,

capital requirements and surplus, general financial condition, contractual restrictions and other factors the board of directors may deem

relevant.

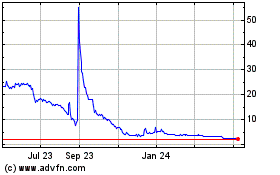

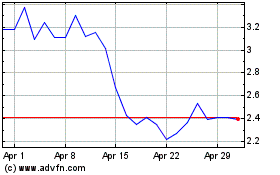

Market

The Company’s

common stock is traded on the Nasdaq Capital Market under the symbol “ADTX.”

Anti-Takeover Provisions

Provisions of

the General Corporation Law of the State of Delaware (“DGCL”) and the Company’s Certificate of Incorporation and Bylaws

could make it more difficult to acquire the Company by means of a tender offer, a proxy contest or otherwise, or to remove incumbent officers

and directors. These provisions, summarized below, are expected to discourage certain types of coercive takeover practices and takeover

bids that the Company’s board of directors may consider inadequate and to encourage persons seeking to acquire control of the Company

to first negotiate with its board of directors. The Company believes that the benefits of increased protection of its ability to negotiate

with the proponent of an unfriendly or unsolicited proposal to acquire or restructure the Company outweigh the disadvantages of discouraging

takeover or acquisition proposals because, among other things, negotiation of these proposals could result in improved terms for its stockholders.

Delaware Anti-Takeover

Statute. We may become subject to Section 203 of the DGCL, which prohibits persons deemed to be “interested

stockholders” from engaging in a “business combination” with a publicly-held Delaware corporation for three years following

the date these persons become interested stockholders unless the business combination is, or the transaction in which the person became

an interested stockholder was, approved in a prescribed manner or another prescribed exception applies. Generally, an “interested

stockholder” is a person who, together with affiliates and associates, owns, or within three years prior to the determination of

interested stockholder status did own, 15% or more of a corporation’s voting stock. Generally, a “business combination”

includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. The existence

of this provision may have an anti-takeover effect with respect to transactions not approved in advance by the board of directors. A Delaware

corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an

express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a

majority of the outstanding voting shares. We have not opted out of these provisions. As a result, mergers or other takeover or change

in control attempts of us may be discouraged or prevented.

Vacancies in

the Board of Directors. Our Certificate of Incorporation and Bylaws provide that, subject to limitations, any

vacancy occurring in its board of directors for any reason may be filled by a majority of the remaining members of its board of directors

then in office. Each director elected to fill a vacancy resulting from the death, resignation or removal of a director shall hold office

until the expiration of the term of the director whose death, resignation or removal created the vacancy.

Advance Notice

of Nominations and Stockholder Proposals. Our Bylaws establish an advance notice procedure for stockholder

proposals to be brought before an annual meeting of our stockholders, including proposed nominations of persons for election to our board

of directors. At an annual meeting, stockholders may only consider proposals or nominations specified in the notice of meeting or brought

before the meeting by or at the direction of our board of directors. Stockholders may also consider a proposal or nomination by a person

who was a stockholder at the time of giving notice and at the time of the meeting, who is entitled to vote at the meeting and who has

complied with the notice requirements of our Bylaws in all respects. Our Bylaws do not give our board of directors the power to approve

or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted at a special or annual meeting

of our stockholders. However, our Bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper

procedures are not followed. These provisions may also discourage or deter a potential acquirer from conducting a solicitation of proxies

to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

No Cumulative

Voting. The DGCL provides that stockholders are denied the right to cumulate votes in the election of directors

unless our Certificate of Incorporation provides otherwise. Our Certificate of Incorporation does not provide for cumulative voting.

Calling of

a Stockholder Meeting. Our Bylaws provide that a special meeting of our stockholders may be called only by

our Chairman or by resolution adopted by a majority of our board of directors. Because our stockholders do not have the right to call

a special meeting, a stockholder could not force stockholder consideration of a proposal over the opposition of our board of directors

by calling a special meeting of stockholders prior to such time as a majority of our board of directors, the chairperson of our board

of directors, the president or the chief executive officer believed the matter should be considered or until the next annual meeting provided

that the requestor met the notice requirements. The restriction on the ability of stockholders to call a special meeting means that a

proposal to replace our board of directors also could be delayed until the next annual meeting.

Exclusive Forum. Our

Certificate of Incorporation provides that unless the Company consents in writing to the selection of an alternative forum, the State

of Delaware is the sole and exclusive forum for: (i) any derivative action or proceeding brought on behalf of us, (ii) any action

asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders, (iii) any

action asserting a claim against the us, our directors, officers or employees arising pursuant to any provision of the DGCL or our Certificate

of Incorporation or the Bylaws, or (iv) any action asserting a claim against us, our directors, officers, employees or agents governed

by the internal affairs doctrine, except for, as to each of (i) through (iv) above, any claim as to which the Court of Chancery

determines that there is an indispensable party not subject to the jurisdiction of the Court of Chancery (and the indispensable party

does not consent to the personal jurisdiction of the Court of Chancery within ten days following such determination), which is vested

in the exclusive jurisdiction of a court or forum other than the Court of Chancery, or for which the Court of Chancery does not have subject

matter jurisdiction.

Additionally,

our Bylaws provide that unless we consent in writing to the selection of an alternative forum, the federal district courts of the United States

of America will be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act.

Any person or entity purchasing or otherwise acquiring any interest in shares of our capital stock are deemed to have notice of and consented

to this provision. The Supreme Court of Delaware has held that this type of exclusive federal forum provision is enforceable. There may

be uncertainty, however, as to whether courts of other jurisdictions would enforce such a provision, if applicable.

Reasons for Stockholder Approval

Our common stock

is listed on The Nasdaq Capital Market, and, as such, we are subject to the Nasdaq Listing Rules. Nasdaq Listing Rule 5635(d) requires

stockholder approval prior to the issuance of securities in a transaction, other than a public offering, involving the sale, issuance

or potential issuance by us of common stock (or securities convertible into or exercisable for common stock), which equals 20% or more

of the common stock or 20% or more of the voting power outstanding before the issuance, at a price less than the lower of: (i) the

closing price immediately preceding the signing of the binding agreement, or (ii) the average closing price of the common stock for

the five trading days immediately preceding the signing of the binding agreement for the transaction.

The board has

determined that the ability to issue securities pursuant to the Warrants is in the best interests of the Company and its stockholders

in order to comply with the terms of the Purchase Agreements and to receive the economic benefits of the Warrants upon exercise thereof.

Effect of Failure to Obtain Stockholder Approval

Pursuant to the

Purchase Agreement we are obligated to cause stockholder meetings to be held until Stockholder Approval is obtained.

Effect of Approval

Upon obtaining

Stockholder Approval requested in this Proposal No. 1, we would no longer be bound by Nasdaq Listing Rule 5635(d)’s restriction

on the number or shares of common stock we are able to issue under the Warrants. As the exercise price of the Warrants could be adjusted

downwards upon the occurrence of certain events in the future, we are unable to accurately predict how many shares may be issuable upon

full exercise of the Warrants. As such, the additional shares that the Company could issue to the holder of the Warrants may result in

significant dilution to existing stockholders, a decline in our share price, or greater price volatility.

Each additional

common share that would be issuable to the holders of the Warrants would have the same rights and privileges as each of our currently

authorized common shares. See “— Description of Common Stock” above.

Interests of Officers and Directors in this Proposal

Our officers and

directors do not have any substantial interest, direct or indirect, in in this proposal.

Required Vote of Stockholders

The affirmative

vote of a majority of the votes cast at the Special Meeting is required to approve Proposal 1.

Board Recommendation

The board of directors

unanimously recommends a vote “FOR” Proposal 1.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The

following table sets forth certain information regarding beneficial ownership of shares of our common stock as of October 14, 2022, based

on 4,161,129 shares outstanding by (i) each person known to

beneficially own more than 5% of our outstanding common stock, (ii) each of our directors, (iii) our executive officers and

(iv) all directors and executive officers as a group. Shares are beneficially owned when an individual has voting and/or investment

power over the shares or could obtain voting and/or investment power over the shares within 60 days of the October 14, 2022. Except

as otherwise indicated, the persons named in the table have sole voting and investment power with respect to all shares beneficially owned,

subject to community property laws, where applicable. Unless otherwise indicated, the address of each beneficial owner listed below is

c/o Aditxt, Inc., 737 N. Fifth Street, Suite 200, Richmond, VA 23219.

| | |

Number of

shares of

Common

Stock

Beneficially

Owned | | |

Percentage | |

| Directors and Officers: | |

| | |

| |

| Shahrokh Shabahang, D.D.S., MS, Ph.D. (1) | |

| 28,630 | | |

| * | % |

| Amro Albanna (2) | |

| 27,873 | | |

| * | % |

| Corinne Pankovcin (3) | |

| 9,061 | | |

| * | % |

| Rowena Albanna (4) | |

| 9,760 | | |

| * | % |

| Brian Brady (5) | |

| 680 | | |

| * | % |

| Namvar Kiaie (6) | |

| 498 | | |

| * | % |

| Jeffrey Runge, M.D. (7) | |

| 480 | | |

| * | % |

| Thomas J. Farley (8) | |

| 3,638 | | |

| * | % |

| Matthew Shatzkes (9) | |

| 6,300 | | |

| * | % |

| All directors and executive officers as a group (9 persons) | |

| 86,920 | | |

| 2.08 | % |

| (1) |

Includes (i) 20,301 beneficially owned by Shabahang-Hatami Family Trust, of which Shahrokh Shabahang, D.D.S., MS, Ph.D. is the Trustee; (ii) warrants to purchase 4,404 shares, including 945 Series A Warrants issued as part of the conversion of outstanding accrued compensation through March 31, 2020, and 3,459 warrants beneficially owned by the Shabahang-Hatami Family Trust; (iii) 2,200 shares issuable pursuant to options that are fully vested or will vest within 60 days of October 14, 2022; (iv) 262 shares issuable pursuant to restricted stock units that are fully vested or will vest within 60 days of October 14, 2022; (v) 1,463 shares directly owned by Mr. Shabahang. |

| (2) |

Includes (i) 12,000 shares issuable pursuant to options that are fully vested or will vest within 60 days of October 14, 2022; (ii) 6,000 shares beneficially owned by the Albanna Family Trust, of which Mr. Albanna is the Trustee; (iii) 9,111 shares directly owned by Mr. Albanna; and (iv) 762 Series A Warrants issued as part of the conversion of outstanding accrued compensation through March 31, 2020. Mr. Albanna may be deemed to beneficially own the securities held by his wife Rowena Albanna, the Company’s Chief Operating Officer. |

| (3) |

Includes (i) 3,385 shares held directly by Ms. Pankovcin; and (ii) 5,676 shares issuable pursuant to options that are fully vested or will vest within 60 days of October 14, 2022. |

| (4) |

Includes (i) 2,798 shares held directly by Ms. Albanna; (ii) 6,000 shares issuable pursuant to options that are fully vested or will vest within 60 days of October 14, 2022; and (iii) 712 Series A Warrants issued as part of the conversion of outstanding accrued compensation through March 31, 2020; (iv) 250 shares issuable pursuant to restricted stock units that are fully vested or will vest within 60 days of October 14, 2022. Ms. Albanna may be deemed to beneficially own the securities held by her husband Amro Albanna, the Company’s Chief Executive Officer. |

| (5) |

Includes (i) 480 shares held directly by Mr. Brady; and (ii) 200 shares issuable pursuant to options that have vested as of October 14, 2022. |

| (6) |

Includes (i) 275 shares held directly by Mr. Kiaie; (ii) 23 shares issuable upon exercise of Series A Warrants; and (iii) 200 shares issuable pursuant to options that have vested as of October 14, 2022. |

| (7) |

Includes (i) 50 shares held by Biologue, Inc., over which Dr. Runge has voting and dispositive control; (ii) 230 shares held directly by Dr. Runge; and (iii) 200 shares issuable pursuant to options and restricted stock units that have vested as of October 14, 2022. |

| (8) |

Includes (i) 2,050 shares held directly by Mr. Farley; and (ii) 1,200 shares issuable pursuant to options that have vested or will vest within 60 days of October 14, 2022; (iii) 388 shares issuable pursuant to restricted stock units that are fully vested or will vest within 60 days of October 14, 2022. |

| (9) |

Includes (i) 5,475 shares held directly by Mr. Shatzkes; (ii) 825 shares issuable pursuant to restricted stock units that are fully vested or will vest within 60 days of October 14, 2022. |

OTHER MATTERS

The board of directors

knows of no other business, which will be presented to the Special Meeting. If any other business is properly brought before the Special

Meeting, proxies will be voted in accordance with the judgment of the persons voting the proxies. The proxies also have discretionary

authority to vote to adjourn the Special Meeting, including for the purpose of soliciting votes in accordance with our board of director’s

recommendations.

We will bear the

cost of soliciting proxies in the accompanying form. In addition to the use of mailing, proxies may also be solicited by our directors,

officers or other employees, personally or by telephone, facsimile or email, none of whom will be compensated separately for these solicitation

activities. We have engaged Kingsdale Advisors to assist in the solicitation of proxies. We will pay a fee of approximately $9,100 plus

reasonable out-of-pocket charges.

If you do not

plan to attend the Special Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign,

date and return your proxy promptly. In the event you are able to attend the Special Meeting virtually, at your request, we will cancel

your previously submitted proxy.

HOUSEHOLDING

The SEC has adopted

rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and other Special

Meeting materials with respect to two or more stockholders sharing the same address by delivering a proxy statement or other Special Meeting

materials addressed to those stockholders. This process, which is commonly referred to as householding, potentially provides extra convenience

for stockholders and cost savings for companies. Stockholders who participate in householding will continue to be able to access and receive

separate proxy cards.

If you share an

address with another stockholder and have received multiple copies of our proxy materials, you may write or call us at the address and

phone number below to request delivery of a single copy of the notice and, if applicable, other proxy materials in the future. We undertake

to deliver promptly upon written or oral request a separate copy of the proxy materials, as requested, to a stockholder at a shared address

to which a single copy of the proxy materials was delivered. If you hold stock as a record stockholder and prefer to receive separate

copies of our proxy materials either now or in the future, please contact us at 737 N. Fifth Street, Suite 200, Richmond, VA 23219,

Attn: Corporate Secretary. If your stock is held through a brokerage firm or bank and you prefer to receive separate copies of our proxy

materials either now or in the future, please con

ANNUAL REPORT

Copies of our

Annual Report on Form 10-K for the fiscal year ended December 31, 2021 may be obtained without charge by writing to the Company’s

Secretary, Aditxt, Inc., 737 N. Fifth Street, Suite 200, Richmond, VA 23219. The Notice, our Annual Report on Form 10-K and

this proxy statement are also available online at www.proxyvote.com.

| |

By Order of the Board of Directors |

| |

|

| October 21, 2022 |

/s/ Amro

Albanna |

| |

Amro Albanna

Chief Executive Officer

Chairman of the Board of Directors |

APPENDIX A

FORM OF WARRANT

NEITHER THIS SECURITY NOR THE SECURITIES

AS TO WHICH THIS SECURITY MAY BE EXERCISED HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION

OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”),

AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT

TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE

WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH

SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY. THIS SECURITY AND THE SECURITIES ISSUABLE UPON EXERCISE OF THIS SECURITY MAY BE PLEDGED

IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN SECURED BY SUCH SECURITIES.

COMMON STOCK

PURCHASE WARRANT

ADITXT, INC.

Warrant Shares: ________

Date of Issuance: ________, 2022 (“Issuance

Date”)

This COMMON STOCK

PURCHASE WARRANT (the “Warrant”) certifies that, for value received (in connection with the issuance of the senior

secured promissory note in the principal amount of $________ to the Holder (as defined below) of even date) (the “Note”),

______________, a _____________ (including any permitted and registered assigns, the “Holder”), is entitled, upon the

terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time during the Exercise Period, to

purchase from ADITXT, INC., a Delaware corporation (the “Company”), _________ shares of Common Stock (the “Warrant

Shares”) (whereby such number may be adjusted from time to time pursuant to the terms and conditions of this Warrant) at the

Exercise Price per share then in effect. This Warrant is issued by the Company as of the date hereof in connection with that certain securities

purchase agreement dated ________, 2022, by and among the Company and the Holder (the “Purchase Agreement”). In the

event the Exercise Price (as defined in this Warrant) is reduced for any reason, including but not limited to pursuant to Section 2 of

this Warrant, the number of Warrant Shares issuable hereunder shall be increased such that the aggregate Exercise Price payable hereunder,

after taking into account the decrease in the Exercise Price, shall be equal to the aggregate Exercise Price prior to such adjustment.

Capitalized terms

used in this Warrant shall have the meanings set forth in the Purchase Agreement unless otherwise defined in the body of this Warrant

or in Section 12 below. For purposes of this Warrant, the term “Exercise Price” shall mean $0.15, subject to adjustment as

provided herein (including but not limited to cashless exercise), and the term “Exercise Period” shall mean the period commencing

on the Commencement Date (as defined in this Warrant) and ending on 5:00 p.m. eastern standard time on the date that is five (5) years

after the Issuance Date. “Commencement Date” shall mean the date on which the Company obtains approval by from the shareholders

of the Company with respect to the issuance of any Warrant Shares.

1.

EXERCISE OF WARRANT.

(a) Mechanics

of Exercise. Subject to the terms and conditions hereof, the rights represented by this Warrant may be exercised in whole or in part

at any time or times during the Exercise Period by delivery of a written notice, in the form attached hereto as Exhibit A (the

“Exercise Notice”), of the Holder’s election to exercise this Warrant. The Holder shall not be required to deliver

the original Warrant in order to effect an exercise hereunder. Partial exercises of this Warrant resulting in purchases of a portion of

the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable

hereunder in an amount equal to the applicable number of Warrant Shares purchased. On or before the second Trading Day (the “Warrant

Share Delivery Date”) following the date on which the Holder sent the Exercise Notice to the Company or the Company’s

transfer agent, and upon receipt by the Company of payment to the Company of an amount equal to the applicable Exercise Price multiplied

by the number of Warrant Shares as to which all or a portion of this Warrant is being exercised (the “Aggregate Exercise Price”

and together with the Exercise Notice, the “Exercise Delivery Documents”) in cash or by wire transfer of immediately

available funds (or by cashless exercise, in which case there shall be no Aggregate Exercise Price provided), the Company shall (or direct

its transfer agent to) issue and deliver by overnight courier to the address as specified in the Exercise Notice, a certificate, registered

in the Company’s share register in the name of the Holder or its designee, for the number of shares of Common Stock to which the

Holder is entitled pursuant to such exercise (or deliver such shares of Common Stock in electronic format if requested by the Holder).

Upon delivery of the Exercise Delivery Documents, the Holder shall be deemed for all corporate purposes to have become the holder of record

of the Warrant Shares with respect to which this Warrant has been exercised, irrespective of the date of delivery of the certificates

evidencing such Warrant Shares. If this Warrant is submitted in connection with any exercise and the number of Warrant Shares represented

by this Warrant submitted for exercise is greater than the number of Warrant Shares being acquired upon an exercise, then the Company

shall as soon as practicable and in no event later than three business days after any exercise and at its own expense, issue a new Warrant

(in accordance with Section 6) representing the right to purchase the number of Warrant Shares purchasable immediately prior to such exercise

under this Warrant, less the number of Warrant Shares with respect to which this Warrant is exercised.

If the Company fails

to cause its transfer agent to issue to the Holder the respective shares of Common Stock by the respective Warrant Share Delivery Date,

then the Holder will have the right to rescind such exercise in Holder’s sole discretion in addition to all other rights and remedies

at law, under this Warrant, or otherwise, and such failure shall also be deemed an event of default under the Note, a material breach

under this Warrant, and a material breach under the Purchase Agreement.

If the Market Price

of one share of Common Stock is greater than the Exercise Price, then, unless there is an effective non-stale registration statement of

the Company which contains a prospectus that complies with Section 5(b) and Section 10 of the Securities Act of 1933 at the time of exercise

and covers the Holder’s immediate resale of all of the Warrant Shares at prevailing market prices (and not fixed prices) without

any limitation, the Holder may elect to receive Warrant Shares pursuant to a cashless exercise, in lieu of a cash exercise, equal to the

value of this Warrant determined in the manner described below (or of any portion thereof remaining unexercised) by surrender of this

Warrant and an Exercise Notice, in which event the Company shall issue to Holder a number of Common Stock computed using the following

formula:

| |

Where X = |

the number of Shares to be issued to Holder. |

| |

|

|

| |

Y = |

the number of Warrant Shares that the Holder elects to purchase under this Warrant (at the date of such calculation). |

| |

|

|

| |

A = |

the Market Price (at the date of such calculation). |

| |

|

|

| |

B = |

Exercise Price (as adjusted to the date of such calculation). |

(b) No

Fractional Shares. No fractional shares shall be issued upon the exercise of this Warrant as a consequence of any adjustment pursuant

hereto. All Warrant Shares (including fractions) issuable upon exercise of this Warrant may be aggregated for purposes of determining

whether the exercise would result in the issuance of any fractional share. If, after aggregation, the exercise would result in the issuance

of a fractional share, the Company shall, in lieu of issuance of any fractional share, pay the Holder otherwise entitled to such fraction

a sum in cash equal to the product resulting from multiplying the then-current fair market value of a Warrant Share by such fraction.

(c) Holder’s

Exercise Limitations. Notwithstanding anything to the contrary contained herein, the Company shall not effect any exercise of this

Warrant, and a Holder shall not have the right to exercise any portion of this Warrant, pursuant to Section 1 or otherwise, to the extent

that after giving effect to such issuance after exercise as set forth on the applicable Exercise Notice, the Holder (together with the

Holder’s affiliates (the “Affiliates”), and any other Persons acting as a group together with the Holder or any of the

Holder’s Affiliates (such Persons, “Attribution Parties”)), would beneficially own in excess of the Beneficial Ownership

Limitation (as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by the

Holder and Attribution Parties shall include the number of shares of Common Stock issuable upon exercise of this Warrant with respect

to which such determination is being made, but shall exclude the number of shares of Common Stock which would be issuable upon (i) exercise

of the remaining, nonexercised portion of this Warrant beneficially owned by the Holder or any of its Affiliates or Attribution Parties

and (ii) exercise or conversion of the unexercised or nonconverted portion of any other securities of the Company (including, without

limitation, any other Common Stock Equivalents) subject to a limitation on conversion or exercise analogous to the limitation contained

herein beneficially owned by the Holder or any of its Affiliates or Attribution Parties. Except as set forth in the preceding sentence,

for purposes of this Section 1(c), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the

rules and regulations promulgated thereunder, it being acknowledged by the Holder that the Holder is solely responsible for any schedules

required to be filed in accordance therewith. In addition, a determination as to any group status as contemplated above shall be determined

in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of this Section

1(c), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common

Stock as reflected in (A) the Company’s most recent periodic or annual report filed with the Commission, as the case may be, (B)

a more recent public announcement by the Company or (C) a more recent written notice by the Company or the Company’s transfer agent

setting forth the number of shares of Common Stock outstanding. Upon the written or oral request of a Holder, the Company shall within

two Trading Days confirm orally and in writing to the Holder the number of shares of Common Stock then outstanding. In any case, the number

of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company,

including this Warrant, by the Holder or its Affiliates or Attribution Parties since the date as of which such number of outstanding shares

of Common Stock was reported. The “Beneficial Ownership Limitation” shall be 4.99% of the number of shares of the Common Stock

outstanding at the time of the respective calculation hereunder. In addition to the beneficial ownership limitations provided in this

Warrant, the sum of the number of shares of Common Stock that may be issued under the August 2022 Securities (as defined in the Purchase

Agreement), which includes the Warrant Shares under this Warrant, shall be limited to 19.99% of the Company’s outstanding shares

of Common Stock as of the Issuance Date (the “Exchange Cap”), unless Shareholder Approval (as defined in the Purchase Agreement)

is obtained by the Company to issue more than the Exchange Cap. The Exchange Cap shall be appropriately adjusted for any reorganization,

recapitalization, non-cash dividend, stock split (including forward and reverse), or other similar transaction. The limitations contained

in this paragraph shall apply to a successor holder of this Warrant.

(d) Compensation

for Buy-In on Failure to Timely Deliver Warrant Shares Upon Exercise. In addition to any other rights available to the Holder, if

the Company fails to cause the Company’s transfer agent to transmit to the Holder the Warrant Shares in accordance with the provisions

of this Warrant (including but not limited to Section 1(a) above pursuant to an exercise on or before the respective Warrant Share Delivery

Date, and if after such date the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s

brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which

the Holder anticipated receiving upon such exercise (a “Buy-In”), then the Company shall (A) pay in cash to the Holder, within

one (1) business day of Holder’s request, the amount, if any, by which (x) the Holder’s total purchase price (including brokerage

commissions, if any) for the shares of Common Stock so purchased exceeds (y) the product of (1) the number of Warrant Shares that the

Company was required to deliver to the Holder in connection with the exercise at issue times (2) the price at which the sell order giving

rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the portion of the Warrant and equivalent

number of Warrant Shares for which such exercise was not honored (in which case such exercise shall be deemed rescinded) or deliver to

the Holder within one (1) business day of Holder’s request the number of shares of Common Stock that would have been issued had

the Company timely complied with its exercise and delivery obligations hereunder. For example, if the Holder purchases, or effectuates

a cashless exercise hereunder for, Common Stock having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted

exercise of shares of Common Stock with an aggregate sale price giving rise to such purchase obligation of $10,000, under clause (A) of

the immediately preceding sentence, the Company shall be required to pay the Holder $1,000. The Holder shall provide the Company written

notice indicating the amounts payable to the Holder in respect of the Buy-In and, upon request of the Company, evidence of the amount

of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity

including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to

timely deliver shares of Common Stock upon exercise of the Warrant as required pursuant to the terms hereof.

2. ADJUSTMENTS.

The Exercise Price and the number of Warrant Shares shall be adjusted from time to time as follows:

(a) Distribution

of Assets. If the Company shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets)

to holders of shares of Common Stock, by way of return of capital or otherwise (including without limitation any distribution of cash,

stock or other securities, property or options by way of a dividend, spin off, reclassification, corporate rearrangement or other similar

transaction) (a “Distribution”), at any time after the issuance of this Warrant, then, in each such case:

(i) any

Exercise Price in effect immediately prior to the close of business on the record date fixed for the determination of holders of shares

of Common Stock entitled to receive the Distribution shall be reduced, effective as of the close of business on such record date, to a

price determined by multiplying such Exercise Price by a fraction (i) the numerator of which shall be the Closing Sale Price of the shares

of Common Stock on the Trading Day immediately preceding such record date minus the value of the Distribution (as determined in good faith

by the Company’s Board of Directors) applicable to one share of Common Stock, and (ii) the denominator of which shall be the Closing

Sale Price of the shares of Common Stock on the Trading Day immediately preceding such record date; and

(ii) the

number of Warrant Shares shall be increased to a number of shares equal to the number of shares of Common Stock obtainable immediately

prior to the close of business on the record date fixed for the determination of holders of shares of Common Stock entitled to receive

the Distribution multiplied by the reciprocal of the fraction set forth in the immediately preceding clause (i); provided, however, that

in the event that the Distribution is of shares of common stock of a company (other than the Company) whose common stock is traded on

a national securities exchange or a national automated quotation system (“Other Shares of Common Stock”), then the

Holder may elect to receive a warrant to purchase Other Shares of Common Stock in lieu of an increase in the number of Warrant Shares,

the terms of which shall be identical to those of this Warrant, except that such warrant shall be exercisable into the number of shares

of Other Shares of Common Stock that would have been payable to the Holder pursuant to the Distribution had the Holder exercised this

Warrant immediately prior to such record date and with an aggregate exercise price equal to the product of the amount by which the exercise

price of this Warrant was decreased with respect to the Distribution pursuant to the terms of the immediately preceding clause (i) and

the number of Warrant Shares calculated in accordance with the first part of this clause (ii).

(b) Anti-Dilution

Adjustments to Exercise Price. If the Company or any Subsidiary thereof, as applicable, at any time beginning on the Issuance Date

and continuing through the date that the second Subsequent Placement (as defined in the Purchase Agreement) occurs after the date that

the Note is extinguished in the entirety (for the avoidance of doubt, this shall include the second Subsequent Placement that occurs after

the date that the Note is extinguished in the entirety), shall sell or grant any option to purchase, or sell or grant any right to reprice,

or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any Common Stock

or securities (including but not limited to Common Stock Equivalents) entitling any person or entity (for purposes of clarification, including

but not limited to the Holder pursuant to (i) any other security of the Company currently held by Holder, (ii) any other security of the

Company issued to Holder on or after the Issuance Date (including but not limited to the Note), or (iii) any other agreement entered into

between the Company and Holder) to acquire shares of Common Stock (upon conversion, exercise or otherwise), at an effective price per

share less than the then Exercise Price (such lower price, the “Base Share Price” and such issuances collectively, a “Dilutive

Issuance”) (if the holder of the Common Stock or Common Stock Equivalents so issued shall at any time, whether by operation of purchase

price adjustments, elimination of an applicable floor price for any reason in the future (including but not limited to the passage of

time or satisfaction of certain condition(s)), reset provisions, floating conversion, exercise or exchange prices or otherwise, or due

to warrants, options or rights per share which are issued in connection with such issuance, be entitled or potentially entitled to receive

shares of Common Stock at an effective price per share which is less than the Exercise Price at any time while such Common Stock or Common

Stock Equivalents are in existence, such issuance shall be deemed to have occurred for less than the Exercise Price on such date of the

Dilutive Issuance (regardless of whether the Common Stock or Common Stock Equivalents are (i) subsequently redeemed or retired by the

Company after the date of the Dilutive Issuance or (ii) actually converted or exercised at such Base Share Price), then the Exercise Price

shall be reduced at the option of the Holder and only reduced to equal the Base Share Price. Such adjustment shall be made whenever such

Common Stock or Common Stock Equivalents are issued, regardless of whether the Common Stock or Common Stock Equivalents are (i) subsequently

redeemed or retired by the Company after the date of the Dilutive Issuance or (ii) actually converted or exercised at such Base Share

Price by the holder thereof (for the avoidance of doubt, the Holder may utilize the Base Share Price even if the Company did not actually

issue shares of its common stock at the Base Share Price under the respective Common stock Equivalents). The Company shall notify the

Holder in writing, no later than the Trading Day following the issuance of any Common Stock or Common Stock Equivalents subject to this

Section 2(b), indicating therein the applicable issuance price, or applicable reset price, exchange price, conversion price and other

pricing terms (such notice the “Dilutive Issuance Notice”). For purposes of clarification, regardless of whether (i) the Company

provides a Dilutive Issuance Notice pursuant to this Section 2(b) upon the occurrence of any Dilutive Issuance or (ii) the Holder accurately

refers to the number of Warrant Shares or Base Share Price in the Exercise Notice, the Holder is entitled to receive the Base Share Price

upon the occurrence of any Dilutive Issuance.

(c) Subdivision

or Combination of Common Stock. If the Company at any time on or after the Issuance Date subdivides (by any stock split, stock dividend,

recapitalization or otherwise) one or more classes of its outstanding shares of Common Stock into a greater number of shares, the Exercise

Price in effect immediately prior to such subdivision will be proportionately reduced and the number of Warrant Shares will be proportionately

increased. If the Company at any time on or after the Issuance Date combines (by combination, reverse stock split or otherwise) one or

more classes of its outstanding shares of Common Stock into a smaller number of shares, the Exercise Price in effect immediately prior

to such combination will be proportionately increased and the number of Warrant Shares will be proportionately decreased. Any adjustment

under this Section 2(c) shall become effective at the close of business on the date the subdivision or combination becomes effective.

Each such adjustment of the Exercise Price shall be calculated to the nearest one-hundredth of a cent. Such adjustment shall be made successively

whenever any event covered by this Section 2(c) shall occur.

3. FUNDAMENTAL

TRANSACTIONS. If, at any time while this Warrant is outstanding, (i) the Company effects any merger of the Company with or into another

entity and the Company is not the surviving entity (such surviving entity, the “Successor Entity”), (ii) the Company

effects any sale of all or substantially all of its assets in one or a series of related transactions, (iii) any tender offer or exchange

offer (whether by the Company or by another individual or entity, and approved by the Company) is completed pursuant to which holders

of Common Stock are permitted to tender or exchange their shares of Common Stock for other securities, cash or property and the holders

of at least 50% of the Common Stock accept such offer, or (iv) the Company effects any reclassification of the Common Stock or any compulsory

share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (other

than as a result of a subdivision or combination of shares of Common Stock) (in any such case, a “Fundamental Transaction”),

then, upon any subsequent exercise of this Warrant, the Holder shall have the right to receive the number of shares of Common Stock of

the Successor Entity or of the Company and any additional consideration (the “Alternate Consideration”) receivable

upon or as a result of such reorganization, reclassification, merger, consolidation or disposition of assets by a holder of the number

of shares of Common Stock for which this Warrant is exercisable immediately prior to such event (disregarding any limitation on exercise

contained herein solely for the purpose of such determination). For purposes of any such exercise, the determination of the Exercise Price

shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect

of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration

in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common

Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be

given the same choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction.

To the extent necessary to effectuate the foregoing provisions, any Successor Entity in such Fundamental Transaction shall issue to the

Holder a new warrant consistent with the foregoing provisions and evidencing the Holder’s right to exercise such warrant into Alternate

Consideration.

4. NON-CIRCUMVENTION.

The Company covenants and agrees that it will not, by amendment of its certificate of incorporation, bylaws or through any reorganization,

transfer of assets, consolidation, merger, scheme of arrangement, dissolution, issue or sale of securities, or any other voluntary action,

avoid or seek to avoid the observance or performance of any of the terms of this Warrant, and will at all times in good faith carry out

all the provisions of this Warrant and take all action as may be required to protect the rights of the Holder. Without limiting the generality

of the foregoing, the Company (i) shall not increase the par value of any shares of Common Stock receivable upon the exercise of this

Warrant above the Exercise Price then in effect, (ii) shall take all such actions as may be necessary or appropriate in order that the

Company may validly and legally issue fully paid and non-assessable shares of Common Stock upon the exercise of this Warrant, and (iii)

shall, beginning on the date that is sixty (60) calendar days after the Issuance Date and for so long as this Warrant is outstanding,

have authorized and reserved, free from preemptive rights, two (2) times the number of shares of Common Stock into which the Warrants

are then exercisable into to provide for the exercise of the rights represented by this Warrant (without regard to any limitations on

exercise).

5. WARRANT

HOLDER NOT DEEMED A STOCKHOLDER. Except as otherwise specifically provided herein, this Warrant, in and of itself, shall not entitle

the Holder to any voting rights or other rights as a stockholder of the Company. In addition, nothing contained in this Warrant shall

be construed as imposing any liabilities on the Holder to purchase any securities (upon exercise of this Warrant or otherwise) or as a

stockholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

6.

REISSUANCE.

(a) Lost,