UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2023

Commission

File Number: 001-38992

Afya Limited

(Exact name of registrant as specified

in its charter)

Alameda Oscar Niemeyer, No. 119,

Salas 502, 504, 1,501 and 1,503

Vila da Serra, Nova Lima, Minas Gerais

Brazil

+55 (31) 3515 7550

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

|

Afya Limited |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Virgilio Deloy Capobianco Gibbon |

| |

|

|

|

Name: |

Virgilio Deloy Capobianco Gibbon |

| |

|

|

|

Title: |

Chief Executive Officer |

Date: November 13, 2023

Afya

Limited Announces Third Quarter and Nine Months 2023 Financial Results

Guidance on Track

Strong Cash Conversion

Nova Lima, Brazil, November 13, 2023

– Afya Limited (Nasdaq: AFYA; B3: A2FY34) (“Afya” or the “Company”), the leading medical education group

and digital health services provider in Brazil, reported today financial and operating results for the three and nine-month period ended

September 30, 2023. Financial results are expressed in Brazilian Reais and are presented in accordance with International Financial Reporting

Standards (IFRS).

Third

Quarter 2023 Highlights

| § | 3Q23 Adjusted Net Revenue increased

24.6% YoY to R$723.0 million. Adjusted Net Revenue excluding acquisitions grew 13.6%, reaching R$659.0 million. |

| § | 3Q23 Adjusted EBITDA increased

21.7% YoY, reaching R$278.4 million, with an Adjusted EBITDA Margin of 38.5%. Adjusted EBITDA excluding acquisitions grew 8.9%, reaching

R$249.0 million, with an Adjusted EBITDA Margin of 37.8%. |

Nine

Months 2023 Highlights

| § | 9M23 Adjusted Net Revenue increased

24.4% YoY to R$2,144.6 million. Adjusted Net Revenue excluding acquisitions grew 13.5%, reaching R$1,957.2 million. |

| § | 9M23 Adjusted EBITDA increased

21.8% YoY reaching R$876.8 million, with an Adjusted EBITDA Margin of 40.9%. Adjusted EBITDA excluding acquisitions grew 10.5%, reaching

R$795.1 million, with an Adjusted EBITDA Margin of 40.6%. |

| § | Cash conversion of 109.3% generating

R$933.8 million of cash flow from operating activities that resulted in a solid cash position of R$822.0 million. |

| § | Over 285 thousand monthly active

physicians and medical students using Afya’s Digital Service. |

| Table 1: Financial Highlights |

|

|

|

|

|

|

|

|

|

|

|

| |

For the three months period ended September 30, |

|

For the nine months period ended September 30, |

| (in thousand of R$) |

2023 |

2023 Ex Acquisitions* |

2022 |

% Chg |

% Chg Ex Acquisitions |

|

2023 |

2023 Ex Acquisitions* |

2022 |

% Chg |

% Chg Ex Acquisitions |

| (a) Net Revenue |

723,479 |

659,477 |

580,575 |

24.6% |

13.6% |

|

2,146,047 |

1,958,652 |

1,745,055 |

23.0% |

12.2% |

| (b) Adjusted Net Revenue (1) |

722,986 |

658,984 |

580,198 |

24.6% |

13.6% |

|

2,144,606 |

1,957,211 |

1,723,993 |

24.4% |

13.5% |

| (c) Adjusted EBITDA (2) |

278,393 |

249,005 |

228,730 |

21.7% |

8.9% |

|

876,766 |

795,100 |

719,717 |

21.8% |

10.5% |

| (d) = (c)/(b) Adjusted EBITDA Margin |

38.5% |

37.8% |

39.4% |

-90 bps |

-160 bps |

|

40.9% |

40.6% |

41.7% |

-80 bps |

-110 bps |

| *For the three months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: UNIT Alagoas and FITS Jaboatão dos Guararapes (July to September, 2023; Closing of UNIT and FITS was in January 2023). |

| *For the nine months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: Alem da Medicina (January & February 2023; Closing of Alem da Medicina was in March, 2022), Cardiopapers (January to March 2023; Closing of Cardiopapers was in April, 2022), Glic (January to May, 2023; Closing of Glic was in May, 2022), and UNIT Alagoas and FITS Jaboatão dos Guararapes (January to September, 2023; Closing of UNIT and FITS was in January 2023). |

| (1) Includes mandatory discounts in tuition fees granted by state decrees and individual/collective legal proceedings and public civil proceedings due to COVID 19 on site classes restriction and excludes any recovery of these discounts that were invoiced based on the Supreme Court decision. |

| (2) See more information on "Non-GAAP Financial Measures" (Item 07). |

Message

from Management

We are pleased to announce

our third quarter results, a quarter was marked by significant increases in Net Revenue in our three segments, high Adjusted EBITDA margins,

cash generation, and a consistent business expansion. All these factors combined enable us to reassure our 2023 guidance, reinforcing

our business strategy execution.

Our Continuing Education

segment stands out with remarkable expansion for the nine months, showing a Net Revenue growth of 43% when compared to the same period

of the prior year. This accomplishment is the result of a robust intake process and the maturation of our courses, aligned with our growth

and expansion plan.

In our Digital Health

Services segment, we have seen a robust 22% increase in Net Revenue compared to the nine months of the prior year. This reaffirms the

immense potential of digital services. This surge can be attributed to the success of our B2B engagements, where we've secured new contracts

with pharmaceutical industry leaders. Furthermore, the continuous growth in B2P subscribers reflects our unwavering dedication to expanding

our reach.

On the Undergrad side of the education segment,

we grew Adjusted Net Revenue by 24% when compared to the same period last year. Our core business remains as robust as ever, with Medicine

courses increasing tickets higher than inflation, maturation of medical seats, and an ongoing integration of the UNIT Alagoas and FITS

Jaboatão dos Guararapes, acquired in January 2023.

We are enthusiastic about

our current initiatives and the promising opportunities that lie ahead. A new avenue for growth unfolds with the launch of Mais Médicos

3, presenting a significant opportunity to expand Afya's medical courses in Brazil and address the pressing need for more healthcare professionals

in underserved areas. Afya is committed to engaging in the program, with high-quality proposals and enhancing the standards of medicine

courses throughout the country.

High and predictable growth, strong

cash generation, guidance on track for the year, and segments ramp-up: this proves how we are evolving and empowering our vision to transform

health with those who have medicine as a vocation.

| 1. | Key Events in the Quarter: |

| § | Afya (Nasdaq: AFYA, B3: A2FY34)

announced, in July 2023, the start of negotiation of its non-sponsored Brazilian Depositary Receipts (BDRs), with a 1-for-2 stock split,

aimed to provide investment opportunities on Afya for Brazilian investors. |

| § | Afya hosted, in July 2023,

its Investor and ESG Day. Attendees heard from Afya’s business executives the Company's evolution, business strategy, ESG initiatives,

present and future perspectives. More details on: https://ir.afya.com.br/afya-day/ |

| § | On August 10, 2023, Unigranrio

entered into a tax amnesty program on interest and penalties to settle a tax proceeding in respect to ISS (city tax on services) with

the municipality of Rio de Janeiro, which result in a payment of R$14,819 to settle the claim. The selling shareholders of Unigranrio

agreed to pay R$5,438 regarding this matter. The Company had a provision of R$53,302 and an indemnification asset from the selling shareholders

of R$20,000 (in light of the indemnification clauses as defined at acquisition of Unigranrio), in respect to such tax proceeding. The

difference between the provision, indemnification asset and the actual paid amount was recorded as Other income (expenses), net on the

consolidated statement of income and comprehensive income. |

| 2. | Subsequent Events in the

quarter |

| § | On October 4th, The Ministry of Education (MEC)

announced the rules for the new Mais Médicos program, which define the criteria for opening new undergraduate medical school seats. The

new program will allow the opening of nearly 10,000 new undergraduate seats, of which 5,700 will be distributed through the new program,

approximately 2,000 will be allocated to existing private institutions and approximately 2,000 will be allocated to the public system. The

Mais Medicos seats (5,700) will be distributed across 95 cities, considering 60 seats per institution. |

| § | On October 31st, Afya announced, through its wholly owned

subsidiary Afya Participações S.A. (“Afya Brazil”), the acquisition of an additional 15% in Centro de Ciências

em Saúde de Itajubá S.A. ("CCSI”;” FMIT”), consolidating our position of ownership to 75% of the

total share capital. The aggregate purchase price for the additional 15% was R$21.0 million paid 100% in cash on the closing date. |

| 3. | Full Year 2023 Guidance

Reaffirmed |

The Company is reaffirming its previously issued

guidance for FY23, which already considered the impact of the increase of the FG-FIES, as Afya successfully concluded acceptances of new

medical students for the second semester, ensuring 100% occupancy in all its medical schools.

The guidance for FY2023 is defined in the following

table:

| |

|

Guidance for 2023 |

| Adjusted Net Revenue* |

|

R$ 2,750 mn ≤ ∆ ≤ R$ 2,850 mn |

| Adjusted EBITDA |

|

R$ 1,100 mn ≤ ∆ ≤ R$ 1,200 mn |

| |

|

|

*Includes UNIT Alagoas and FITS Jaboatão dos Guararapes' acquisitions;

Includes the increase of 64 medical seats of Faculdade Santo Agostinho, in the city of Itabuna;

Excludes any acquisition that may be concluded after the issuance of the guidance. |

Operational

Review

Afya

is the only company offering educational and technological solutions to support physicians across every stage of the medical career, from

undergraduate students in their medical school years through medical residency preparatory courses, medical specialization programs and

continuing medical education. The Company also offers solutions to empower the physicians in their daily routine including supporting

clinic decisions through mobile app subscription, delivering practice management tools through a Software as a Service (SaaS) model, and

assisting physicians in their relationship with their patients.

The Company reports

results for three distinct business units. The first, Undergrad – medical schools, other healthcare programs and ex-health degrees.

Revenue is generated from the monthly tuition fees the Company charges students enrolled in the undergraduate programs. The second, Continuing

Education – specialization programs and graduate courses for physicians. Revenue is also generated from the monthly tuition fees

the Company charges students enrolled in the specialization and graduate courses. The third is Digital Services – digital services

offered by the Company at every stage of the medical career. This business unit is divided into Business to Physician (which encompasses

Content & Technology for Medical Education, Clinical Decision Software, Practice Management Tools & Electronic Medical Records,

Physician-Patient Relationship, Telemedicine, and Digital Prescription) and Business to Business (which provides access and demand for

the healthcare players). Revenue is generated from printed books and e-books, which is recognized at the point in time when control is

transferred to the customer, and subscription fees, which are recognized as the services are transferred over time.

Key Revenue Drivers – Undergraduate

Courses

| Table 2: Key Revenue Drivers |

Nine months period ended September 30, |

| |

2023 |

2022 |

% Chg |

| Undergrad Programs |

|

|

|

| MEDICAL SCHOOL |

|

|

|

| Approved Seats |

3,163 |

2,759 |

14.6% |

| Operating Seats (1) |

3,113 |

2,709 |

14.9% |

| Total Students (end of period) |

21,556 |

17,997 |

19.8% |

| Average Total Students |

21,056 |

17,692 |

19.0% |

| Average Total Students (ex-Acquisitions)* |

18,978 |

17,692 |

7.3% |

| Tuition Fees (Total - R$ '000) |

1,922,472 |

1,522,393 |

26.3% |

| Tuition Fees (ex- Acquisitions* - R$ '000) |

1,744,263 |

1,522,393 |

14.6% |

| Medical School Gross Avg. Ticket (ex- Acquisitions* - R$/month) |

10,212 |

9,561 |

6.8% |

| Medical School Net Avg. Ticket (ex- Acquisitions* - R$/month) |

8,556 |

7,859 |

8.9% |

| UNDERGRADUATE HEALTH SCIENCE |

|

|

|

| Total Students (end of period) |

21,564 |

18,114 |

19.0% |

| Average Total Students |

21,447 |

19,932 |

7.6% |

| Average Total Students (ex-Acquisitions)* |

19,738 |

19,932 |

-1.0% |

| Tuition Fees (Total - R$ '000) |

293,367 |

254,613 |

15.2% |

| Tuition Fees (ex- Acquisitions* - R$ '000) |

271,194 |

254,613 |

6.5% |

| OTHER UNDERGRADUATE |

|

|

|

| Total Students (end of period) |

24,286 |

23,085 |

5.2% |

| Average Total Students |

24,625 |

23,746 |

3.7% |

| Average Total Students (ex-Acquisitions)* |

21,432 |

23,746 |

-9.7% |

| Tuition Fees (Total - R$ '000) |

230,149 |

201,116 |

14.4% |

| Tuition Fees (ex- Acquisitions* - R$ '000) |

199,410 |

201,116 |

-0.8% |

| TOTAL TUITION FEES |

|

|

|

| Tuition Fees (Total - R$ '000) |

2,445,988 |

1,978,122 |

23.7% |

| Tuition Fees (ex- Acquisitions* - R$ '000) |

2,214,867 |

1,978,122 |

12.0% |

| *For the nine months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: UNIT Alagoas and FITS Jaboatão dos Guararapes (January to September, 2023; Closing of UNIT and FITS was in January 2023). |

| (1) The difference between approved and operating seats is 'Cametá'. A campus for which we already have the license but haven't started operations. |

Key

Revenue Drivers – Continuing Education and Digital Services

| Table 3: Key Revenue Drivers |

Nine months period ended September 30, |

| |

2023 |

2022 |

% Chg |

| Continuing Education |

|

|

|

| Medical Specialization & Others |

|

|

|

| Total Students (end of period) |

4,954 |

4,036 |

22.7% |

| Average Total Students |

4,791 |

3,686 |

30.0% |

| Average Total Students (ex-Acquisitions) |

4,791 |

3,686 |

30.0% |

| Net Revenue from courses (Total - R$ '000) |

108,263 |

75,568 |

43.3% |

| Net Revenue from courses (ex- Acquisitions¹) |

108,263 |

75,568 |

43.3% |

| Digital Services |

|

|

|

| Content & Technology for Medical Education |

|

|

|

| Medcel Active Payers |

|

|

|

| Prep Courses & CME - B2P |

6,026 |

12,886 |

-53.2% |

| Prep Courses & CME - B2B |

5,420 |

5,704 |

-5.0% |

| Além da Medicina Active Payers |

6,700 |

5,696 |

17.6% |

| Cardiopapers Active Payers |

8,327 |

5,090 |

63.6% |

| Medical Harbour Active Payers |

10,346 |

5,080 |

103.7% |

| Clinical Decision Software |

|

|

|

| Whitebook Active Payers |

150,796 |

133,926 |

12.6% |

| Clinical Management Tools² |

|

|

|

| iClinic Active Payers |

25,702 |

22,596 |

13.7% |

| Shosp Active Payers |

3,579 |

2,348 |

52.4% |

| |

|

|

|

| Digital Services Total Active Payers (end of period) |

216,896 |

193,326 |

12.2% |

| Net Revenue from Services (Total - R$ '000) |

164,036 |

134,243 |

22.2% |

| Net Revenue - B2P |

134,225 |

117,256 |

14.5% |

| Net Revenue - B2B |

29,843 |

16,987 |

75.7% |

| Net Revenue From Services (ex-Acquisitions¹) |

156,947 |

134,243 |

16.9% |

| *For the nine months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: Alem da Medicina (January & February 2023; Closing of Alem da Medicina was in March, 2022), Cardiopapers (January to March 2023; Closing of Cardiopapers was in April, 2022), Glic (January to May, 2023; Closing of Glic was in May, 2022). |

| (2) Clinical management tools includes Telemedicine and Digital Prescription features. |

Key

Operational Drivers – Digital Services

Monthly Active Users (MaU) represents the number

of unique individuals that consumed Digital Services content in each one of our products in the last 30 days of a specific period. Total

monthly active users reached over 285 thousand.

Monthly Active Unique Users (MUAU) represents

the number of unique individuals, without overlap of users among products, in the last 30 days of a specific period.

| Table 4: Key Operational Drivers for Digital Services - Monthly Active Users (MaU) |

|

|

|

| |

3Q23 |

3Q22 |

% Chg YoY |

2Q23 |

1Q23 |

| Content & Technology for Medical Education |

26,012 |

21,811 |

19.3% |

24,973 |

31,549 |

| Clinical Decision Software |

230,732 |

239,640 |

-3.7% |

230,338 |

237,003 |

| Clinical Management Tools¹ |

26,944 |

23,036 |

17.0% |

24,880 |

24,568 |

| Physician-Patient Relationship |

1,583 |

1,397 |

13.3% |

1,782 |

1,773 |

| Total Monthly Active Users (MaU) - Digital Services |

285,271 |

285,884 |

-0.2% |

281,973 |

294,893 |

| 1) Clinical management tools includes Telemedicine and Digital Prescription features |

|

|

|

| Includes Shosp, Medicinae and Além da Medicina starting in 1Q22 and Cardiopapers and Glic starting in 2Q22 |

| Table 5: Key Operational Drivers for Digital Services - Monthly Unique Active Users (MuaU) |

|

|

| |

3Q23 |

3Q22 |

% Chg QoQ |

2Q23 |

1Q23 |

| |

|

|

|

|

|

| Total Monthly Unique Active Users (MuaU) - Digital Services |

254,894 |

263,587 |

-3.3% |

251,487 |

262,137 |

| 1) Total Monthly Unique Active Users excludes non-integrated companies: Medical Harbour, Medicinae, Shosp, Além da Medicina, Cardiopapers and Glic |

Seasonality

Undergrad’s

tuition revenues are related to the intake process and monthly tuition fees charged to students over the period; thus, does not have significant

fluctuations during the semester. Continuing Education revenues are related to monthly intakes and tuition fees and do not have a considerable

concentration in any period. Digital Services is comprised mainly of Medcel, Pebmed, and iClinic revenues. While Pebmed and iClinic do

not have significant fluctuation regarding seasonality, Medcel’s revenue is concentrated in the first and last quarter of the year

due to the enrollments of Medcel’s clients period. In addition, the majority of Medcel’s revenues are derived from printed

books and e-books, which are recognized at the point in time when control is transferred to the customer. Consequently, the Digital Services

segment generally has higher revenues and results of operations in the first and last quarters of the year than in the second and third

quarters.

Revenue

Adjusted Net Revenue for the third quarter of 2023

was R$723.0 million, an increase of 24.6% over the same period of the prior year. Excluding acquisitions, Adjusted Net Revenue in the

third quarter increased 13.6% YoY to R$659.0 million, mainly due to: higher net tickets in Medicine courses, maturation of medical seats

and the growth of Continuing Education and Digital Services segments.

Net Revenue of Continuing Education for the third

quarter of 2023 was R$37.7 million, an increase of 35.0% YoY, boosted by the growth in the number of students.

Digital services increased 19.2% YoY, totaling R$53.1

million for this quarter. The organic growth is a combination of (a) an increase in the B2B engagements, increasing B2B Net Revenue by

61.7%, and (b) the expansion of the active payers in the B2P, mainly in Whitebook, IClinic, Cardiopapers, Além da Medicina, Medical

Harbour and Shosp.

For the nine-month period ended September 30, 2023,

Adjusted Net Revenue was R$2,144.6 million, an increase of 24.4% over the same period of last year. Excluding acquisitions, Adjusted Net

Revenue in the nine-month period increased 13.5% YoY to R$1,957.2 million.

| Table 6: Revenue & Revenue Mix |

|

|

|

|

|

|

|

|

|

|

|

| (in thousands of R$) |

|

For the three months period September 30, |

|

For the nine months period ended September 30, |

| |

|

2023 |

2023 Ex Acquisitions* |

2022 |

% Chg |

% Chg Ex Acquisitions |

|

2023 |

2023 Ex Acquisitions* |

2022 |

% Chg |

% Chg Ex Acquisitions |

| Net Revenue Mix |

|

|

|

|

|

|

|

|

|

|

|

|

| Undergrad |

|

636,849 |

572,847 |

509,097 |

25.1% |

12.5% |

|

1,883,089 |

1,702,782 |

1,538,037 |

22.4% |

10.7% |

| Adjusted Undergrad¹ |

|

636,356 |

572,354 |

508,720 |

25.1% |

12.5% |

|

1,881,648 |

1,701,341 |

1,516,975 |

24.0% |

12.2% |

| Continuing Education |

|

37,679 |

37,679 |

27,906 |

35.0% |

35.0% |

|

108,263 |

108,263 |

75,568 |

43.3% |

43.3% |

| Digital Services |

|

53,106 |

53,106 |

44,548 |

19.2% |

19.2% |

|

164,036 |

156,947 |

134,243 |

22.2% |

16.9% |

| Inter-segment transactions |

|

-4,155 |

-4,155 |

-976 |

325.7% |

325.7% |

|

-9,341 |

-9,341 |

-2,793 |

234.4% |

234.4% |

| Total Reported Net Revenue |

|

723,479 |

659,477 |

580,575 |

24.6% |

13.6% |

|

2,146,047 |

1,958,652 |

1,745,055 |

23.0% |

12.2% |

| Total Adjusted Net Revenue ¹ |

|

722,986 |

658,984 |

580,198 |

24.6% |

13.6% |

|

2,144,606 |

1,957,211 |

1,723,993 |

24.4% |

13.5% |

| *For the three months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: UNIT Alagoas and FITS Jaboatão dos Guararapes (July to September, 2023; Closing of UNIT and FITS was in January 2023). |

| *For the nine months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: Alem da Medicina (January & February 2023; Closing of Alem da Medicina was in March, 2022), Cardiopapers (January to March 2023; Closing of Cardiopapers was in April, 2022), Glic (January to May, 2023; Closing of Glic was in May, 2022), and UNIT Alagoas and FITS Jaboatão dos Guararapes (January to September, 2023; Closing of UNIT and FITS was in January 2023). |

| (1) Includes mandatory discounts in tuition fees granted by state decrees and individual/collective legal proceedings and public civil proceedings due to COVID 19 on site classes restriction and excludes any recovery of these discounts that were invoiced based on the Supreme Court decision. |

| (2) See more information on "Non-GAAP Financial Measures" (Item 07). |

Adjusted

EBITDA

Adjusted EBITDA for the three-month period ended

September 30, 2023, increased 21.7% to R$278.4 million, up from R$228.7 million in the same period of the prior year, while the Adjusted

EBITDA Margin decreased 90 basis points to 38.5%. For the nine-month period ended September 30, 2023, Adjusted EBITDA was R$876.8 million,

an increase of 21.8% over the same period of the prior year, with an Adjusted EBITDA Margin decrease of 80 basis points in the same period.

The Adjusted EBITDA Margin reduction is due to: (a)

Mix of Net Revenue, with higher participation of Continuing Education segments, and (b) the consolidation of 4 new Mais Médicos

campuses (operation started on 3Q22) and UNIT Alagoas and FITS Jaboatão dos Guararapes which are performing better than expected

but still present lower margins when compared to the integrated companies.

| Table 7: Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

| (in thousands of R$) |

For the three months period ended September 30, |

|

For the nine months period ended June 30, |

| |

2023 |

2023 Ex Acquisitions* |

2022 |

% Chg |

% Chg Ex Acquisitions |

|

2023 |

2023 Ex Acquisitions* |

2022 |

% Chg |

% Chg Ex Acquisitions |

| Adjusted EBITDA |

278,393 |

249,005 |

228,730 |

21.7% |

8.9% |

|

876,766 |

795,100 |

719,717 |

21.8% |

10.5% |

| % Margin |

38.5% |

37.8% |

39.4% |

-90 bps |

-160 bps |

|

40.9% |

40.6% |

41.7% |

-80 bps |

-110 bps |

| *For the three months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: UNIT Alagoas and FITS Jaboatão dos Guararapes (July to September, 2023; Closing of UNIT and FITS was in January 2023). |

| *For the nine months period ended September 30, 2023, "2023 Ex Acquisitions" excludes: Alem da Medicina (January & February 2023; Closing of Alem da Medicina was in March, 2022), Cardiopapers (January to March 2023; Closing of Cardiopapers was in April, 2022), Glic (January to May, 2023; Closing of Glic was in May, 2022), and UNIT Alagoas and FITS Jaboatão dos Guararapes (January to September, 2023; Closing of UNIT and FITS was in January 2023). |

Adjusted

Net Income

Net Income for the third quarter of 2023 was R$98.2

million, an increase of 22.1% over the same period of the prior year, mainly due to the increase in operational results and Unigranrio’s

tax amnesty program (more details in “Key Events in the Quarter”)

Adjusted Net Income for the third quarter of 2023

was R$128.4 million, an increase of 6.9% over the same period of the prior year, mainly due to the increase in operational results, which

was partially offset by higher financial expenses primarily related to the increase in leverage due to UNIT Alagoas and FITS Jaboatao

business combination and higher interest rates, when compared to the same period of the prior year. Adjusted Net Income for the nine months

of 2023 was R$ 426.7 million, an increase of 5.0% year over year.

Adjusted EPS reached R$4.58 per share for the nine

months ended September 30, 2023, an increase of 5.7% year over year.

| Table 8: Adjusted Net Income |

|

|

|

|

|

| (in thousands of R$) |

For the three months period ended September 30, |

|

For the nine months period ended September 30, |

| |

2023 |

2022 |

% Chg |

|

2023 |

2022 |

% Chg |

| Net income |

98,220 |

80,410 |

22.1% |

|

303,530 |

321,425 |

-5.6% |

| Amortization of customer relationships and trademark (1) |

26,593 |

18,952 |

40.3% |

|

80,779 |

55,959 |

44.4% |

| Share-based compensation |

6,684 |

8,833 |

-24.3% |

|

20,082 |

20,414 |

-1.6% |

| Non-recurring (income) expenses: |

- 3,104 |

11,861 |

n.a. |

|

22,284 |

8,586 |

159.5% |

| - Integration of new companies (2) |

7,769 |

7,063 |

10.0% |

|

19,951 |

17,015 |

17.3% |

| - M&A advisory and due diligence (3) |

703 |

1,388 |

-49.4% |

|

12,377 |

3,194 |

287.5% |

| - Gain on tax amnesty (4) |

- 16,812 |

- |

n.a. |

|

- 16,812 |

- |

n.a. |

| - Expansion projects (5) |

2,007 |

1,079 |

86.0% |

|

2,536 |

2,358 |

7.5% |

| - Restructuring expenses (6) |

3,722 |

2,708 |

37.4% |

|

5,673 |

7,081 |

-19.9% |

| - Mandatory Discounts in Tuition Fees (7) |

- 493 |

- 377 |

30.8% |

|

- 1,441 |

-21,062 |

-93.2% |

| Adjusted Net Income |

128,393 |

120,056 |

6.9% |

|

426,675 |

406,384 |

5.0% |

| Basic earnings per share - in R$ (8) |

1.04 |

0.84 |

23.2% |

|

3.21 |

3.39 |

-5.4% |

| Adjusted earnings per share - in R$ (9) |

1.38 |

1.28 |

7.3% |

|

4.58 |

4.33 |

5.7% |

| (1) Consists of amortization of customer relationships and trademark recorded under business combinations. |

| (2) Consists of expenses related to the integration of newly acquired companies. |

|

|

|

|

|

|

| (3) Consists of expenses related to professional and consultant fees in connection with due diligence services for our M&A transactions. |

| (4) On August 10, 2023, Unigranrio entered into a tax amnesty program on interest and penalties to settle a tax proceeding in respect to ISS (city tax on services) with the municipality of Rio de Janeiro, which result in a payment of R$14,819 to settle the claim. The selling shareholders of Unigranrio agreed to pay R$5,438 regarding this matter. The Company had a provision of R$53,302 and an indemnification asset from the selling shareholders of R$20,000 (in light of the indemnification clauses as defined at acquisition of Unigranrio), in respect to such tax proceeding. The difference between the provision, indemnification asset and the actual paid amount was recorded as Other income (expenses), net on the consolidated statement of income and comprehensive income. |

| (5) Consists of expenses related to professional and consultant fees in connection with the opening of new campuses. |

| (6) Consists of expenses related to the employee redundancies in connection with the organizational restructuring of our acquired companies. |

| (7) Consists of mandatory discounts in tuition fees granted by state decrees, individual/collective legal proceedings and public civil proceedings due to COVID 19 on site classes restriction and excludes any recovery of these discounts that were invoiced based on the Supreme Court decision. |

| (8) Basic earnings per share: Net Income/Weighted average number of outstanding shares. |

|

|

|

|

|

| (9) Adjusted earnings per share: Adjusted Net Income attributable to equity holders of the Parent/Weighted average number of outstanding shares. |

Cash

and Debt Position

On September 30, 2023, Cash and Cash Equivalents

were R$822.0 million, a decrease of 24.8% over December 31, 2022, due to UNIT Alagoas and FITS Jaboatão dos Guararapes business

combination.

For the nine-month period ended September 30, 2023,

Afya reported cash flow from operating activities of R$933.8 million, up from R$743.8 million in the same period of the previous year,

an increase of 25.5% YoY, boosted by the solid operational results. Operating Cash Conversion Ratio was strong once again, achieving 109.3%

for the nine-month period ended September 30, 2023, compared to 104.6% in the same period of the previous year.

On September 30, 2023, Net Debt, excluding the effect

of IFRS 16, totaled R$1,787.8 million. When compared to December 31, 2022, Net Debt added to R$825 million related to UNIT Alagoas and

FITS Jaboatão dos Guararapes business combination closed on January 2, 2023, the Net Debt reduced R$ 418 million due to the strong

Cash flow from operating activities in the nine months.

| Table 9: Operating Cash Conversion Ratio Reconciliation |

For the nine months period ended September 30, |

| (in thousands of R$) |

Considering the adoption of IFRS 16 |

| |

2023 |

2022 |

% Chg |

| (a) Net cash flows from operating activities |

896,202 |

715,881 |

25.2% |

| (b) Income taxes paid |

37,599 |

27,940 |

34.6% |

| (c) = (a) + (b) Cash flow from operating activities |

933,801 |

743,821 |

25.5% |

| |

|

|

|

| (d) Adjusted EBITDA |

876,766 |

719,717 |

21.8% |

| (e) Non-recurring (income) expenses: |

22,284 |

8,586 |

159.5% |

| - Integration of new companies (1) |

19,951 |

17,015 |

17.3% |

| - M&A advisory and due diligence (2) |

12,377 |

3,194 |

287.5% |

| - Gain on tax amnesty (3) |

-16,812 |

- |

n.a. |

| - Expansion projects (4) |

2,536 |

2,358 |

7.5% |

| - Restructuring Expenses (5) |

5,673 |

7,081 |

-19.9% |

| - Mandatory Discounts in Tuition Fees (6) |

-1,441 |

-21,062 |

-93.2% |

| (f) = (d) - (e) Adjusted EBITDA ex- non-recurring expenses |

854,482 |

711,131 |

20.2% |

| (g) = (c) / (f) Operating cash conversion ratio |

109.3% |

104.6% |

470 bps |

| (1) Consists of expenses related to the integration of newly acquired companies. |

| (2) Consists of expenses related to professional and consultant fees in connection with due diligence services for M&A transactions. |

| (3) On August 10, 2023, Unigranrio entered into a tax amnesty program on interest and penalties to settle a tax proceeding in respect to ISS (city tax on services) with the municipality of Rio de Janeiro, which result in a payment of R$14,819 to settle the claim. The selling shareholders of Unigranrio agreed to pay R$5,438 regarding this matter. The Company had a provision of R$53,302 and an indemnification asset from the selling shareholders of R$20,000 (in light of the indemnification clauses as defined at acquisition of Unigranrio), in respect to such tax proceeding. The difference between the provision, indemnification asset and the actual paid amount was recorded as Other income (expenses), net on the consolidated statement of income and comprehensive income. |

| (4) Consists of expenses related to professional and consultant fees in connection with the opening of new campuses. |

| (5) Consists of expenses related to the employee redundancies in connection with the organizational restructuring of acquired companies. |

| (6) Consists of mandatory discounts in tuition fees granted by state decrees, individual/collective legal proceedings and public civil proceedings due to COVID 19 on site classes restriction and excludes any recovery of these discounts that were invoiced based on the Supreme Court decision. |

The following table shows more information regarding

the cost of debt for 9M23, considering loans and financing, capital market and accounts payable to selling shareholders. Afya’s

capital structure remains solid with a conservative leveraging position and a low cost of debt, Afya’s Net Debt (excluding the effect

of IFRS16) divided by Adjusted EBITDA mid guidance for 2023 would be 1.6x.

| Table 10: Gross Debt and Average Cost of Debt |

|

|

| (in millions of R$) |

For the closing of the nine months period ended in September 30, |

| |

|

|

|

|

Cost of Debt |

| |

Gross Debt |

Duration (Years) |

Per year |

%CDI* |

| |

3Q23 |

2022 |

3Q23 |

2022 |

3Q23 |

2022 |

3Q23 |

2022 |

| Loans and financing: Softbank |

826 |

824 |

2.6 |

3.4 |

6.5% |

6.5% |

50% |

53% |

| Loans and financing: Debentures |

512 |

500 |

3.9 |

4.6 |

15.5% |

15.7% |

114% |

114% |

| Loans and financing: Others |

620 |

621 |

1.3 |

2.1 |

14.5% |

14.1% |

107% |

113% |

| Accounts payable to selling shareholders |

651 |

529 |

0.9 |

1.2 |

12.3% |

11.6% |

92% |

94% |

| Average |

2,610 |

2,474 |

2.2 |

2.9 |

11.5% |

10.2% |

86% |

83% |

| *Based on the annualized Interbank Certificates of Deposit ("CDI") rate for the period as a reference: 9M23: ~12.65% p.y. and for 2022 full year: ~12,39% p.y. |

| Table 11: Cash and Debt Position |

|

|

|

|

|

| (in thousands of R$) |

|

|

|

|

|

| |

3Q23 |

FY2022 |

% Chg |

3Q22 |

% Chg |

| (+) Cash and Cash Equivalents |

822,008 |

1,093,082 |

-24.8% |

715,644 |

14.9% |

| Cash and Bank Deposits |

11,107 |

57,509 |

-80.7% |

27,161 |

-59.1% |

| Cash Equivalents |

810,901 |

1,035,573 |

-21.7% |

688,483 |

17.8% |

| (-) Loans and Financing |

1,908,299 |

1,882,901 |

1.3% |

1,399,724 |

36.3% |

| Current |

186,903 |

145,202 |

28.7% |

259,638 |

-28.0% |

| Non-Current |

1,721,396 |

1,737,699 |

-0.9% |

1,140,086 |

51.0% |

| (-) Accounts Payable to Selling Shareholders |

651,068 |

528,678 |

23.2% |

598,367 |

8.8% |

| Current |

382,500 |

261,711 |

46.2% |

241,560 |

58.3% |

| Non-Current |

268,568 |

266,967 |

0.6% |

356,807 |

-24.7% |

| (-) Other Short and Long Term Obligations |

50,469 |

62,176 |

-18.8% |

65,748 |

-23.2% |

| (=) Net Debt (Cash) excluding IFRS 16 |

1,787,828 |

1,380,673 |

29.5% |

1,348,195 |

32.6% |

| (-) Lease Liabilities |

869,729 |

769,525 |

13.0% |

782,224 |

11.2% |

| Current |

36,705 |

32,459 |

13.1% |

28,685 |

28.0% |

| Non-Current |

833,024 |

737,066 |

13.0% |

753,539 |

10.5% |

| Net Debt (Cash) with IFRS 16 |

2,657,557 |

2,150,198 |

23.6% |

2,130,419 |

24.7% |

CAPEX

Capital expenditures consists of the purchase of

property and equipment and intangible assets, including expenditures mainly related to the expansion and maintenance of our campuses and

headquarters including leasehold improvements, and the development of new solutions in the digital segment, among others.

For the nine-month period ending September 30, 2023,

CAPEX went from R$238.4 million to R$155.1 million, a decrease of 34.9% over the same period of the prior year. As of September 30, 2023,

the Capex to Revenue, excluding licenses acquisition and goodwill remeasurement, was 7.2% a decrease from 10.1% in the same period of

the previous year, reflecting the discipline on capital allocation.

| Table 12: CAPEX |

| (in thousands of R$) |

For the nine months period ended September 30, |

| |

2023 |

2022 |

% Chg |

| CAPEX |

155,127 |

238,363 |

-34.9% |

| Property and equipment |

88,014 |

116,641 |

-24.5% |

| Intanglibe assets |

67,113 |

121,722 |

-44.9% |

| - Licenses |

0 |

24,408 |

n.a. |

| - Goodwill |

0 |

39,100 |

n.a. |

| - Others |

67,113 |

58,214 |

15.3% |

ESG

Metrics

ESG

commitment is an important part of Afya’s strategy and permeates the Company’s core values. Afya has been advancing year after

year on its core pillars and, since 2021, ESG metrics have been disclosed in the Company’s quarterly financial results.

The

2022 Sustainability Report can be found at: https://ir.afya.com.br/corporate-governance/sustainability/

| Table 13: ESG Metrics |

3Q23 |

3Q22 |

2022 |

2021 |

2020 |

2019 |

| # |

GRI |

Governance and Employee Management |

|

|

|

|

|

|

| 1 |

405-1 |

Number of employees |

9,868 |

9,039 |

8,708 |

8,079 |

6,100 |

3,369 |

| 2 |

405-1 |

Percentage of female employees |

58% |

57% |

57% |

55% |

55% |

57% |

| 3 |

405-1 |

Percentage of female employees in the board of directors |

36% |

27% |

40% |

18% |

18% |

22% |

| 4 |

102-24 |

Percentage of independent member in the board of directors |

36% |

36% |

30% |

36% |

36% |

22% |

| |

|

Environmental |

|

|

|

|

|

|

| 4 |

302-1 |

Total energy consumption (kWh) |

6,078,952 |

4,355,340 |

17,011,842 |

12,176,966 |

8,035,845 |

5,928,450 |

| 4.1 |

302-1 |

Consumption per campus |

132,151 |

98,985 |

412,747 |

385,573 |

321,434 |

395,230 |

| 5 |

302-1 |

% supplied by distribution companies |

56.7% |

71.6% |

72.4% |

91.3% |

83.4% |

96.2% |

| 6 |

302-1 |

% supplied by other sources |

43.3% |

28.4% |

27.6% |

8.7% |

16.6% |

3.8% |

| |

|

Social |

|

|

|

|

|

|

| 8 |

413-1 |

Number of free clinical consultations offered by Afya |

146,294 |

128,686 |

494,635 |

341,286 |

427,184 |

270,000 |

| 9 |

|

Number of physicians graduated in Afya's campuses |

18,965 |

17,176 |

18,104 |

16,772 |

12,691 |

8,306 |

| 10 |

201-4 |

Number of students with financing and scholarship programs (FIES and PROUNI) |

10,628 |

10,329 |

10,965 |

7,881 |

4,999 |

2,808 |

| 11 |

|

% students with scholarships over total undergraduate students |

15.8% |

17.4% |

18.8% |

12.9% |

13.7% |

11.7% |

| 12 |

413-1 |

Hospital, clinics and city halls partnerships |

664 |

481 |

662 |

447 |

432 |

60 |

| (1) Some factors can influence in the adequate proportionality analysis of data over the years, such as: climate changes, COVID-19 pandemic effects, seasonalities, number of employees, number of students, number of active units, among others. |

| (2) "Other sources" refers to: (a) Derived from renewable sources, such as solar panels installed in the units; and (b) Derived from the search for alternative energy options in the market. |

| (3) Starting in 2Q22, previously disclosed environmental data were updated to consider: (a) GHG Protocol guidelines improvements, and (b) additional data-collection criteria refinements. |

| (4) Starting in 2Q22, previously disclosed social data were updated to consider: (a) the number of graduated physicians considering all units after its closing, and (b) partnerships related only to medical schools. |

5.

Conference Call and Webcast Information

When: November

13, 2023, at 5:00 p.m. EST.

| Who: |

|

Mr. Virgilio Gibbon, Chief Executive Officer

Mr. Luis André Blanco, Chief Financial Officer

Ms. Renata Costa Couto, IR Director

|

Dial-in: Brazil: +55 11 4632 2236 or +55 11 4632 2237 or +55 11

4680 6788 or +55 11 4700 9668 or +55 21 3958 7888.

United States: +1 929 205 6099 or +1 301 715 8592 or +1 305 224 1968 or

+1 309 205 3325 or +1 312 626 6799 or +1 646 931 3860 or +1 346 248 7799 or +1 360 209 5623 or +1 386 347 5053 or +1 507 473 4847 or +1

564 217 2000 or +1 669 444 9171 or +1 669 900 6833 or +1 689 278 1000 or +1 719 359 4580 or +1 253 205 0468 or +1 253 215 8782.

Webinar ID: 974 1075 1315

Other Numbers: https://afya.zoom.us/u/ak0CTBDQC

OR

Webcast: https://afya.zoom.us/j/97410751315

6.

About Afya Limited (Nasdaq: AFYA)

Afya is the leading

medical education group in Brazil based on number of medical school seats. It delivers an end-to-end physician-centric ecosystem that

serves and empowers students to be lifelong medical learners, from the moment they enroll as medical students, through their medical residency

preparation, graduate program, and continuing medical education activities. Afya also offers content and clinical decision applications

for healthcare professionals through its products WhiteBook, Nursebook and Portal PEBMED. For more information, please visit www.afya.com.br.

7.

Forward – Looking Statements

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties.

All statements other than statements of historical fact could be deemed forward looking, and include risks and uncertainties related to

statements about our competition; our ability to attract, upsell and retain students; our ability to increase tuition prices and prep

course fees; our ability to anticipate and meet the evolving needs of students and professors; our ability to source and successfully

integrate acquisitions; general market, political, economic, and business conditions; and our financial targets such as revenue, share

count and IFRS and non-IFRS financial measures including gross margin, operating margin, net income (loss) per diluted share, and free

cash flow. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about

the potential impacts of the COVID-19 pandemic on our business operations, financial results and financial position and the Brazilian

economy.

The Company undertakes

no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of

this press release or to reflect new information or the occurrence of unanticipated events, except as required by law. The achievement

or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions.

If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from

the results expressed or implied by the forward-looking statements we make. Readers should not rely upon forward-looking statements as

predictions of future events. Forward-looking statements represent management’s beliefs and assumptions only as of the date such

statements are made. Further information on these and other factors that could affect the Company’s financial results are included

in the filings made with the United States Securities and Exchange Commission (SEC) from time to time, including the section titled “Risk

Factors” in the most recent Rule 434(b) prospectus. These documents are available on the SEC Filings section of the investor relations

section of our website at: https://ir.afya.com.br/.

8.

Non-GAAP Financial Measures

To supplement the Company's consolidated financial

statements, which are prepared and presented in accordance with International Financial Reporting Standards as issued by the International

Accounting Standards Board—IASB, Afya uses Adjusted EBITDA and Operating Cash Conversion Ratio information, which are non-GAAP financial

measures, for the convenience of investors. A non-GAAP financial measure is generally defined as one that intends to measure financial

performance but excludes or includes amounts that would not be equally adjusted in the most comparable GAAP measure.

Afya calculates Adjusted EBITDA as net income plus/minus

net financial result plus income taxes expense plus depreciation and amortization plus interest received on late payments of monthly tuition

fees, plus share-based compensation plus/minus share of income of associate plus/minus non-recurring expenses. The calculation of Adjusted

Net Income is net income plus amortization of customer relationships and trademark, plus share-based compensation. We calculate Operating

Cash Conversion Ratio as the Cash flow from operating activities, adjusted with income taxes paid divided by Adjusted EBITDA plus/minus

non-recurring expenses.

Management presents

Adjusted EBITDA, because it believes these measures provide investors with a supplemental measure of financial performance of the core

operations that facilitates period-to-period comparisons on a consistent basis. Afya also presents Operating Cash Conversion Ratio because

it believes this measure provides investors with a measure of how efficiently the Company converts EBITDA into cash. The non-GAAP financial

measures described in this prospectus are not a substitute for the IFRS measures of earnings. Additionally, calculations of Adjusted EBITDA

and Operating Cash Conversion Ratio may be different from the calculations used by other companies, including competitors in the education

services industry, and therefore, Afya’s measures may not be comparable to those of other companies.

9.

Investor Relations Contact

E-mail: ir@afya.com.br

10.

Financial Tables

Unaudited

interim condensed consolidated statements of income and comprehensive income

For the three and nine-month periods ended September 30, 2023, and 2022

(In thousands of Brazilian reais, except earnings per share)

| |

|

Three-month period ended |

Nine-month period ended |

| |

|

September 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

| |

|

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

| Net revenue |

|

723,479 |

580,575 |

2,146,047 |

1,745,055 |

| Cost of services |

|

(288,234) |

(216,691) |

(820,136) |

(622,663) |

| Gross profit |

|

435,245 |

363,884 |

1,325,911 |

1,122,392 |

| |

|

|

|

|

|

| General and administrative expenses |

|

(257,002) |

(210,692) |

(739,808) |

(596,621) |

| Other revenues (expenses), net |

|

12,043 |

(7,173) |

10,365 |

(8,739) |

| |

|

|

|

|

|

| Operating income |

|

190,286 |

146,019 |

596,468 |

517,032 |

| |

|

|

|

|

|

| Finance income |

|

34,771 |

29,202 |

86,259 |

76,618 |

| Finance expenses |

|

(115,306) |

(91,933) |

(353,572) |

(256,873) |

| Finance result |

|

(80,535) |

(62,731) |

(267,313) |

(180,255) |

| |

|

|

|

|

|

| Share of income of associate |

|

615 |

3,819 |

7,671 |

10,260 |

| |

|

|

|

|

|

| Income before income taxes |

|

110,366 |

87,107 |

336,826 |

347,037 |

| |

|

|

|

|

|

| Income taxes expenses |

|

(12,146) |

(6,697) |

(33,296) |

(25,612) |

| |

|

|

|

|

|

| Net income |

|

98,220 |

80,410 |

303,530 |

321,425 |

| |

|

|

|

|

|

| Other comprehensive income |

|

- |

- |

- |

- |

| Total comprehensive income |

|

98,220 |

80,410 |

303,530 |

321,425 |

| |

|

|

|

|

|

| Income attributable to |

|

|

|

|

|

| Equity holders of the parent |

|

93,347 |

75,760 |

288,263 |

306,875 |

| Non-controlling interests |

|

4,873 |

4,650 |

15,267 |

14,550 |

| |

|

98,220 |

80,410 |

303,530 |

321,425 |

| Basic earnings per share |

|

|

|

|

|

| Per common share |

|

1.04 |

0.84 |

3.21 |

3.39 |

|

Diluted earnings per share

Per common share |

|

1.03 |

0.84 |

3.18 |

3.38 |

| |

|

|

|

|

|

|

Unaudited interim condensed consolidated

statements of financial position

As of September 30, 2023, and December 31, 2022

(In thousands of Brazilian reais)

| |

|

September

30, 2023 |

|

December

31, 2022 |

| Assets |

|

(unaudited) |

|

|

| Current

assets |

|

|

|

|

| Cash

and cash equivalents |

|

822,008 |

|

1,093,082 |

| Trade

receivables |

|

480,556 |

|

452,831 |

| Inventories |

|

4,501 |

|

12,190 |

| Recoverable

taxes |

|

63,319 |

|

27,809 |

| Other

assets |

|

51,991 |

|

51,745 |

| Total current assets |

|

1,422,375 |

|

1,637,657 |

| |

|

|

|

|

| Non-current

assets |

|

|

|

|

| Trade

receivables |

|

43,593 |

|

42,568 |

| Other

assets |

|

144,084 |

|

191,756 |

| Investment

in associate |

|

53,284 |

|

53,907 |

| Property

and equipment |

|

598,802 |

|

542,087 |

| Right-of-use

assets |

|

770,036 |

|

690,073 |

| Intangible

assets |

|

4,798,915 |

|

4,041,491 |

| Total

non-current assets |

|

6,408,714 |

|

5,561,882 |

| |

|

|

|

|

| Total

assets |

|

7,831,089 |

|

7,199,539 |

| |

|

|

|

|

| Liabilities |

|

|

|

|

| Current

liabilities |

|

|

|

|

| Trade

payables |

|

85,655 |

|

71,482 |

| Loans

and financing |

|

186,903 |

|

145,202 |

| Lease

liabilities |

|

36,705 |

|

32,459 |

| Accounts

payable to selling shareholders |

|

382,500 |

|

261,711 |

| Notes

payable |

|

50,469 |

|

62,176 |

| Advances

from customers |

|

137,664 |

|

133,050 |

| Labor

and social obligations |

|

255,235 |

|

154,518 |

| Taxes

payable |

|

27,400 |

|

26,221 |

| Income

taxes payable |

|

40,582 |

|

16,151 |

| Other

liabilities |

|

3,411 |

|

2,719 |

| Total

current liabilities |

|

1,206,524 |

|

905,689 |

| |

|

|

|

|

| Non-current

liabilities |

|

|

|

|

| Loans

and financing |

|

1,721,396 |

|

1,737,699 |

| Lease

liabilities |

|

833,024 |

|

737,066 |

| Accounts

payable to selling shareholders |

|

268,568 |

|

266,967 |

| Taxes

payable |

|

90,578 |

|

92,888 |

| Provision

for legal proceedings |

|

134,068 |

|

195,854 |

| Other

liabilities |

|

27,898 |

|

13,218 |

| Total

non-current liabilities |

|

3,075,532 |

|

3,043,692 |

| Total

liabilities |

|

4,282,056 |

|

3,949,381 |

| |

|

|

|

|

| Equity |

|

|

|

|

| Share

capital |

|

17 |

|

17 |

| Additional

paid-in capital |

|

2,371,577 |

|

2,375,344 |

| Share-based

compensation reserve |

|

143,620 |

|

123,538 |

| Treasury

stock |

|

(310,003) |

|

(304,947) |

| Retained

earnings |

|

1,293,149 |

|

1,004,886 |

| Equity

attributable to equity holders of the parent |

|

3,498,360 |

|

3,198,838 |

| Non-controlling

interests |

|

50,673 |

|

51,320 |

| Total

equity |

|

3,549,033 |

|

3,250,158 |

| |

|

|

|

|

| Total

liabilities and equity |

|

7,831,089 |

|

7,199,539 |

Unaudited

interim condensed consolidated statements of cash flow

For the nine-month periods ended September 30, 2023, and 2022

(In thousands of Brazilian reais)

| |

|

September 30, 2023 |

September 30, 2022 |

| Operating activities |

|

(unaudited) |

(unaudited) |

| |

Income before income taxes |

|

336,826 |

347,037 |

| |

|

Adjustments to reconcile income before income taxes |

|

|

|

| |

|

|

Depreciation and amortization |

|

212,172 |

151,706 |

| |

|

|

Write-off of property and equipment |

|

1,209 |

683 |

| |

|

|

Write-off of intangible assets |

|

288 |

6 |

| |

|

|

Provision for expected credit losses |

|

57,160 |

29,441 |

| |

|

|

Share-based compensation expense |

|

20,082 |

20,414 |

| |

|

|

Net foreign exchange differences |

|

448 |

293 |

| |

|

|

Accrued interest |

|

224,349 |

147,839 |

| |

|

|

Accrued lease interest |

|

74,867 |

63,458 |

| |

|

|

Share of income of associate |

|

(7,671) |

(10,260) |

| |

|

|

Provision (reversal) for legal proceedings |

|

(27,119) |

8,531 |

| Changes in assets and liabilities |

|

|

|

| |

Trade receivables |

|

(52,169) |

(60,167) |

| |

Inventories |

|

7,828 |

(661) |

| |

Recoverable taxes |

|

(34,921) |

(16,931) |

| |

Other assets |

|

35,960 |

5,858 |

| |

Trade payables |

|

1,920 |

1,398 |

| |

Taxes payables |

|

25,321 |

10,709 |

| |

Advances from customers |

|

(27,883) |

(16,075) |

| |

Labor and social obligations |

|

94,465 |

70,608 |

| |

Other liabilities |

|

(9,331) |

(10,066) |

| |

|

|

933,801 |

743,821 |

| |

Income taxes paid |

|

(37,599) |

(27,940) |

| |

|

|

|

|

| |

Net cash flows from operating activities |

|

896,202 |

715,881 |

| |

|

|

|

|

| Investing activities |

|

|

|

| |

Acquisition of property and equipment |

|

(88,014) |

(116,641) |

| |

Acquisition of intangibles assets |

|

(67,113) |

(70,423) |

| |

Dividends received |

|

8,294 |

2,837 |

| |

Acquisition of subsidiaries, net of cash acquired |

|

(726,530) |

(225,452) |

| |

Payments of interest from acquisition of subsidiaries |

|

(36,674) |

(17,300) |

| |

Net cash flows used in investing activities |

|

(910,037) |

(426,979) |

| |

|

|

|

| Financing activities |

|

|

|

| |

Payments of principal of loans and financing |

|

(12,216) |

(922) |

| |

Payments of interest of loans and financing |

|

(124,468) |

(68,053) |

| |

Proceeds from loans and financing |

|

5,288 |

- |

| |

Payments of lease liabilities |

|

(100,658) |

(84,509) |

| |

Treasury shares buy-back |

|

(12,369) |

(152,317) |

| |

Proceeds from exercise of stock options |

|

3,546 |

- |

| |

Dividends paid to non-controlling shareholders |

|

(15,914) |

(15,726) |

| |

Net cash flows used in financing activities |

|

(256,791) |

(321,527) |

| |

Net foreign exchange differences |

|

(448) |

(293) |

| |

Net decrease in cash and cash equivalents |

|

(271,074) |

(32,918) |

| |

Cash and cash equivalents at the beginning of the period |

|

1,093,082 |

748,562 |

| |

Cash and cash equivalents at the end of the period |

|

822,008 |

715,644 |

Reconciliation

between Net Income and Adjusted EBITDA

| Reconciliation between Adjusted EBITDA and Net Income |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (in thousands of R$) |

For the three months period September 30, |

|

For the nine months period ended September 30, |

| |

2023 |

2022 |

% Chg |

|

2023 |

2022 |

% Chg |

| Net income |

98,220 |

80,410 |

22.1% |

|

303,530 |

321,425 |

-5.6% |

| Net financial result |

80,535 |

62,731 |

28.4% |

|

267,313 |

180,255 |

48.3% |

| Income taxes expense |

12,146 |

6,697 |

81.4% |

|

33,296 |

25,612 |

30.0% |

| Depreciation and amortization |

73,908 |

52,617 |

40.5% |

|

212,172 |

151,706 |

39.9% |

| Interest received (1) |

10,619 |

9,400 |

13.0% |

|

25,760 |

21,979 |

17.2% |

| Income share associate |

(615) |

(3,819) |

-83.9% |

|

(7,671) |

(10,260) |

-25.2% |

| Share-based compensation |

6,684 |

8,833 |

-24.3% |

|

20,082 |

20,414 |

-1.6% |

| Non-recurring (income) expenses: |

(3,104) |

11,861 |

n.a. |

|

22,284 |

8,586 |

159.5% |

| - Integration of new companies (2) |

7,769 |

7,063 |

10.0% |

|

19,951 |

17,015 |

17.3% |

| - M&A advisory and due diligence (3) |

703 |

1,388 |

-49.4% |

|

12,377 |

3,194 |

287.5% |

| - Gain on tax amnesty (4) |

(16,812) |

- |

n.a. |

|

(16,812) |

- |

n.a. |

| - Expansion projects (5) |

2,007 |

1,079 |

86.0% |

|

2,536 |

2,358 |

7.5% |

| - Restructuring expenses (6) |

3,722 |

2,708 |

37.4% |

|

5,673 |

7,081 |

-19.9% |

| - Mandatory Discounts in Tuition Fees (7) |

(493) |

(377) |

30.8% |

|

(1,441) |

(21,062) |

-93.2% |

| Adjusted EBITDA |

278,393 |

228,730 |

21.7% |

|

876,766 |

719,717 |

21.8% |

| Adjusted EBITDA Margin |

38.5% |

39.4% |

-90 bps |

|

40.9% |

41.7% |

-80 bps |

| (1) Represents the interest received on late payments of monthly tuition fees. |

| (2) Consists of expenses related to the integration of newly acquired companies. |

| (3) Consists of expenses related to professional and consultant fees in connection with due diligence services for our M&A transactions. |

| (4) On August 10, 2023, Unigranrio entered into a tax amnesty program on interest and penalties to settle a tax proceeding in respect to ISS (city tax on services) with the municipality of Rio de Janeiro, which result in a payment of R$14,819 to settle the claim. The selling shareholders of Unigranrio agreed to pay R$5,438 regarding this matter. The Company had a provision of R$53,302 and an indemnification asset from the selling shareholders of R$20,000 (in light of the indemnification clauses as defined at acquisition of Unigranrio), in respect to such tax proceeding. The difference between the provision, indemnification asset and the actual paid amount was recorded as Other income (expenses), net on the consolidated statement of income and comprehensive income. |

| (5) Consists of expenses related to professional and consultant fees in connection with the opening of new campuses. |

| (6) Consists of expenses related to the employee redundancies in connection with the organizational restructuring of our acquired companies. |

|

| (7) Consists of mandatory discounts in tuition fees granted by state decrees, individual/collective legal proceedings and public civil proceedings due to COVID 19 on site classes restriction and excludes any recovery of these discounts that were invoiced based on the Supreme Court decision. |

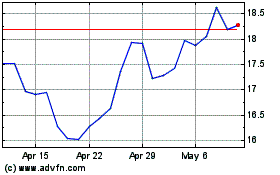

Afya (NASDAQ:AFYA)

Historical Stock Chart

From Mar 2024 to May 2024

Afya (NASDAQ:AFYA)

Historical Stock Chart

From May 2023 to May 2024