Filed Pursuant

to Rule 424(b)(3)

Registration No. 333-276334

PROSPECTUS SUPPLEMENT NO.

20

(to Prospectus dated June 25, 2024)

Up to 1,997,116 Shares of Common Stock

1,700,884 Shares of Common Stock Underlying

the Warrants

This

prospectus supplement is being filed to update and supplement the information contained in the prospectus dated June 25, 2024 (the “Prospectus”),

which forms a part of our Registration Statement on Form S-11 (File No. 333-276334) with the information contained in our Current

Report on Form 8-K, filed with the U.S. Securities and Exchange Commission on February 10, 2025 (the “Current Report”). Accordingly,

we have attached the Current Report to this prospectus supplement.

Our common stock is currently

listed on the Nasdaq Capital Market (“Nasdaq”) under the ticker symbol “AIRE.” On February 7, 2025, the closing

price of our common stock was $1.80.

This prospectus supplement

updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in

combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction

with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should

rely on the information in this prospectus supplement.

We are a “controlled company” under

the Nasdaq listing rules because Giri Devanur, our chief executive officer and chairman, owns approximately 60.01% of our outstanding

common stock. As a controlled company, we are not required to comply with certain of Nasdaq’s corporate governance requirements;

however, we will not take advantage of any of these exceptions.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 5 OF

THE PROSPECTUS.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if the Prospectus or this prospectus supplement is accurate or complete. Any representation to the contrary is a criminal offense.

The date

of this prospectus supplement is February 10, 2025.

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (date

of earliest event reported): February 4, 2025

reAlpha Tech Corp.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

6515 Longshore Loop,

Suite 100, Dublin, OH 43017

(Address of principal

executive offices and zip code)

(707) 732-5742

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

2025 Short-Term Incentive Plan

On February 4, 2025, the

compensation committee (the “compensation committee”) of the board of directors (the “Board”) of reAlpha Tech

Corp. (the “Company”) approved the Company’s 2025 Short-Term Incentive Plan (the “STIP”) providing for quarterly

awards of performance-based restricted stock units (the “Awards”) granted under the Company’s 2022 Equity Incentive

Plan, as amended, a successor or replacement plan adopted by the Board and approved by the stockholders of the Company, or outside of

an equity incentive plan, as determined by the compensation committee, in its discretion, to be granted to the Company’s executive

officers and/or other participating employees and consultants selected by the compensation committee. The compensation committee established

the STIP to drive revenue growth and profitability, help focus key employees on building stockholder value, provide significant award

potential for achieving outstanding Company performance, and enhance the ability of the Company to attract and retain highly talented

individuals.

Under

the STIP, participants may earn Awards based on the Company’s achievement of certain pre-determined quarterly performance targets

for three different performance target categories for each fiscal quarter. These performance targets will be approved by the compensation

committee at the beginning of each fiscal year but may be adjusted on a fiscal quarterly basis at the compensation committee’s sole

discretion during the fiscal year depending on the Company’s results. The quarterly performance targets consist of (i) the amount

of organic revenue for the quarter; (ii) the number of brokerage transactions consummated by the Company’s in-house brokerage firm

for the fiscal quarter; and (iii) the quality of acquisitions consummated by the Company during the fiscal quarter, which quality determination

will be determined at the sole discretion of the compensation committee based on the compensation committee’s evaluation of the

acquisitions’ fit with the Company’s business model.

Each performance target

category is weighted differently based on the participant’s position with the Company, and the achievement of the goals for each

performance target category is determined independently of the others. The weight of each performance target category for each participant

will be set by the compensation committee at the beginning of each fiscal year, subject to change by the compensation committee on a fiscal

quarterly basis depending on the Company’s results. Further, the percentage of the participant’s base salary that will be

used in determining the Awards, if any, will also be set by the compensation committee at the beginning of each fiscal year based on the

participant’s position with the Company.

The performance target category

weights, and applicable percentage of base salary used in determining any Awards, for the Company’s executive officers for the fiscal

year ending December 31, 2025, was set by the compensation committee as set forth below:

| Name | |

Title | |

Organic

Revenue | | |

Brokerage

Transactions | | |

Acquisitions | | |

Percentage of

Base Salary

Used to

Determine

Awards | |

| Giri Devanur | |

Chief Executive Officer and Chairman | |

| 50 | % | |

| 20 | % | |

| 30 | % | |

| 100 | % |

| Michael J. Logozzo | |

Chief Operating Officer and President | |

| 50 | % | |

| 30 | % | |

| 20 | % | |

| 100 | % |

| Piyush Phadke | |

Chief Financial Officer | |

| 50 | % | |

| 10 | % | |

| 40 | % | |

| 100 | % |

| Jorge Aldecoa | |

Chief Product Officer | |

| 20 | % | |

| 70 | % | |

| 10 | % | |

| 100 | % |

For

each fiscal quarter, the Awards earned by each participant for each performance target category will be equal to the percentage of

the goal for such performance target category that is achieved by the Company multiplied by the participant’s Target Award (as

defined below) for such performance target category for the fiscal quarter, up to a maximum of 500% of the participant’s

Target Award. For each participant, the “Target Award” for a particular performance target category for a given fiscal

quarter will be equal to the applicable percentage of the participant’s base salary used to determine the Awards for such

participant multiplied by (i) the weight of such performance target category and (ii) the participant’s base salary for the

applicable fiscal quarter.

The

Awards earned in a fiscal quarter, if any, will vest as follows: (i) 50% will vest on the date that is 12 months from the date of grant,

(ii) 12.5% will vest on the date that is 15 months from the date of grant, (iii) 12.5% will vest on the date that is 18 months from the

date of grant, (iv) 12.5% will vest on the date that is 21 months from the date of grant and (v) 12.5% will vest on the date that is 24

months from the date of grant. The date of grant of the Awards for a given fiscal quarter will be 30 calendar days after the last calendar

day of such fiscal quarter, or if such date is a non-Trading Day (as defined

in the STIP), the Trading Day immediately prior to such date of grant. The vesting of the Awards is subject to the participant’s

compliance with the terms of the STIP, including, among other things, the participant’s continued service to the Company (or an

affiliate) in accordance with the terms of the participant’s employment agreement through each applicable vesting date. The Company

believes that the Awards will further align the Company’s executive officers’ and other participating employees’ interests

with those of the Company’s stockholders, while serving as a key retention mechanism over the long-term. All Awards will be subject

to the Company’s clawback policy.

The foregoing description

of the STIP is not complete and is qualified in its entirety by reference to the full text of the STIP, a copy of which is attached hereto

as Exhibit 10.1, and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: February 10, 2025 |

reAlpha Tech Corp. |

| |

|

|

| |

By: |

/s/ Giri Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

Exhibit 10.1

reAlpha 2025 Short-Term

Incentive Plan

Last Updated: February 10, 2025

The 2025 Short-Term Incentive Plan (“STIP”)

represents an important component of the total rewards philosophy of reAlpha Tech Corp. (“reAlpha”). The STIP provides quarterly

equity incentives (“STIP Awards”) for the achievement of reAlpha annual objectives in alignment with the following guiding

principles:

| a. | Offer competitive rewards that attract, motivate and retain best talent |

| b. | Drive superior execution of annual operational plans as part of long-term value creation |

| c. | Provide right balance between operational measures to ensure appropriate focus and collaboration across

the reAlpha organization |

All of our executive officers, any other executive

officer role that may be created from time to time, and employees and consultants selected by the Compensation Committee (the “Compensation

Committee”) of reAlpha’s Board of Directors (the “Board”) are eligible to participate in the STIP (each, a “Participant,”

and collectively, the “Participants”). The Participants are eligible upon the first date of hire or promotion and must be

employed by reAlpha, or one of its subsidiaries, at the time of a Payout (as defined below) to qualify for a quarterly STIP Award, unless

otherwise provided in an agreement between the Participant and/or one of its subsidiaries.

The STIP time frame is split into quarterly periods,

aligning with the reAlpha fiscal year, which starts on January 1 and finishes on December 31.

Period 1: January 1 - March 31

Period 2: April 1 - June 30

Period 3: July 1 - September 30

Period 4: October 1 - December 31

Hereafter each referred to as (a “Payment

Period” or collectively, the “Payment Periods”).

| 4) | COMPONENTS AND PAYOUT DETERMINATION |

The STIP Awards are a function of the Participant’s

annual salary, Incentive Target and STIP Payout Factor (each as defined below, and collectively, the “Payout Multipliers”):

Incentive Target (% of Annual Base Salary)

The incentive target is expressed as a percentage

of annual base salary for each Participant as set by the Compensation Committee, considering the Participant’s position with reAlpha,

corresponding responsibilities and scope of such position and competitive market data (the “Incentive Target”).

STIP Payout Factor

The payout factor is determined by the level of

reAlpha performance for the Payment Period (the “STIP Payout Factor”). reAlpha’s performance level during the Payment

Period will be assessed through three performance target categories (each, a “Performance Target Category,” and collectively,

the “Performance Target Categories”), consisting of: (i) organic revenue achieved by reAlpha, (ii) number of brokerage transactions

consummated by reAlpha’s in-house brokerage firm, and (iii) the quality of acquisitions consummated by reAlpha, as determined in

the sole discretion of the Compensation Committee. These Performance Target Categories are set by the Compensation Committee at the beginning

of the fiscal year, but can be changed quarterly depending on reAlpha’s results and priorities. The actual STIP Payout Factor achieved

can range from 0% to 500%.

Performance Target Category Percentage Weight

Each Performance Target Category is assigned a

different percentage weight for each Participant, depending on the Participant’s scope of responsibility, which percentage weights

will add up to 100% for any given fiscal quarter. STIP Awards for Participants with corporate responsibilities or those spanning all divisions

are based solely on reAlpha consolidated growth performance, whereas the STIP Awards for division presidents are tied to both their respective

division and consolidated reAlpha financial performance. This is to ensure appropriate balance between line of sight and common shared

objectives. The Compensation Committee determines the respective percentage weights for each Participant and each Performance Target Category

at the beginning of each fiscal year, subject to change by the Compensation Committee on a fiscal quarterly basis depending on reAlpha’s

results.

Following the Payment Period end, a STIP Payout

Factor is determined by the Compensation Committee according to the level of performance achieved for each measure and its respective

weighting. STIP Payout Factors for financial measures are determined by calculating the percent achievement of actual financial results

compared to the targets set by the Compensation Committee at the beginning of the fiscal year, as those may be adjusted from time to time.

STIP Payout Factors that are subjective are determined at the sole discretion of the Compensation Committee’s evaluations of such

Payout Multiplier.

Payout Calculation

Once the Payout Multipliers are determined, including

the STIP Payout Factor for each Performance Target Category, the actual quarterly payout amount per Performance Target Category is calculated

using the formula below (each, a “Payout,” and collectively, the “Payouts”):

Quarterly Payout

per Performance Target Category = (Annual Base Salary/4) * Incentive Target (% of Annual Base Salary) * STIP Payout Factor * Performance

Target Category Percentage Weight

Each Payout will be paid in reAlpha’s restricted stock units (“RSUs”) under reAlpha’s 2022 Equity Incentive Plan,

as amended from time to time, or any successor or replacement plan adopted by the Board and approved by the stockholders of reAlpha, that

will be subject to a vesting period set forth in Section 7 herein. The RSU issuance price will be the closing price of reAlpha’s

common stock, par value $0.001 per share, as reported on The Nasdaq Stock Market LLC (“Nasdaq”) on the Grant Date (as defined

below).

The Compensation Committee may, in its sole discretion,

to the full extent permitted by applicable federal, state, provincial and other local law and to the extent it determines it is in the

best interests of reAlpha to do so in accordance with reAlpha’s Clawback Policy currently in effect (or any successor or replacement

plan adopted by the Board) (the “Clawback Policy”), require reimbursement of all or a portion of the STIP Award received by

a Participant or a former Participant under certain conditions.

| 6) | ADMINISTRATIVE PROVISIONS |

New Hires

The STIP Awards for Participants hired by reAlpha

during the Payment Period are prorated based on the number of days of active employment during such Payment Period, specifically from

the Participant’s date of hire until the last day of the Payment Period.

Promotion or Transfer

If a Participant is promoted or transferred to

another executive officer position eligible under the STIP that has different Payout Multipliers, a STIP Award for each role will be calculated

in accordance with Section 4 herein with respect to such role and then prorated for the time worked in each position.

Termination

If a Participant resigns (leaves voluntarily)

or is terminated for any reason prior to the Grant Date of a Payout, such Participant is not eligible to receive any Payout, unless otherwise

provided in an agreement between the Participant and reAlpha or one of its subsidiaries.

Disability and Leave of Absence

If a Participant leaves on short or long-term

disability during the Payment Period or approved leave of absence, the Payouts, if any, will be pro-rated based on actual time worked

during the Payment Period.

Grant Date

The date of grant of any STIP Awards for a given

fiscal quarter will be 30 calendar days after the last calendar day of such fiscal quarter (the “Grant Date”), or if such

date is a non-Trading Day (defined below), the Trading Day immediately prior to such date of grant. The Board retains the right, in its

sole and exclusive discretion, to review, modify and adjust targets and results and reduce individual Payouts earned under the STIP. For

purposes herein, “Trading Day” means any day on which Nasdaq is open for the transaction of business, excluding weekends and

public holidays on which trading is suspended or closed.

Vesting Schedule

The STIP Awards earned in a fiscal quarter, if

any, will vest as follows: (i) 50% will vest on the date that is 12 months from the date of grant, (ii) 12.5% will vest on the date that

is 15 months from the date of grant, (iii) 12.5% will vest on the date that is 18 months from the date of grant, (iv) 12.5% will vest

on the date that is 21 months from the date of grant and (v) 12.5% will vest on the date that is 24 months from the date of grant.

Administration

The Compensation Committee shall have full power

to administer and interpret the STIP and, in its sole discretion, may establish or amend rules of general application for the administration

of the STIP.

No Assignment

No STIP Award may be assigned, alienated, pledged,

attached, sold or otherwise transferred or encumbered by a Participant other than by will or the laws of descent and distribution.

Unfunded Plan

The STIP shall at all times be entirely unfunded

and no provision shall at any time be made with respect to segregating assets of reAlpha or any of its subsidiaries for payment of any

amounts hereunder. No Participant, beneficiary, or other person shall have any interest in any particular assets of reAlpha or any of

its subsidiaries by reason of the right to receive any STIP Award under the STIP. To the extent that any Participant acquires a right

to receive any payment pursuant to a STIP Award, such right shall be no greater than the right of any general unsecured creditor of reAlpha

and its subsidiaries.

Governing Law

The STIP shall be construed in accordance with

the laws of Delaware, without giving effect to principles of conflict of laws.

Tax Requirements

reAlpha or an applicable subsidiary of reAlpha

shall have the power and the right to deduct or withhold, or require a Participant to remit, an amount sufficient to satisfy applicable

taxes and mandatory government deductions required by law to be withheld with respect to any STIP Award payment to a Participant.

No Payout shall be earned, due or payable unless

the Participant has at all times fully complied with the requirements of this Section 7.

| a. | Every Participant eligible for awards under the STIP is expected to perform his/her job functions in a

professional manner and in a way that reflects positively on reAlpha. |

| b. | All Participants must comply with all of reAlpha’s policies at all times, and abide by reAlpha’

Code of Business Conduct & Ethics (the “Code of Conduct”) available in the company handbook in all business activities.

The Code of Conduct is subject to update from time to time. Each Participant may be asked periodically to review and reaffirm the Code

of Conduct and is expected to do so promptly. |

| c. | The failure of a Participant to comply with reAlpha’s policies or its Code of Conduct, or any action

taken by a Participant to the detriment of reAlpha or a customer or business partner, may result in forfeiture of all Payouts, as determined

by the Compensation Committee. |

| d. | Each Participant must fully comply with the terms of his or her employment agreement or other agreement

relating to the terms of employment or relating to restrictive covenants or the treatment of intellectual property and confidential information. |

| e. | The rights with respect to any award granted pursuant to the STIP of each Participant who is subject to

the Clawback Policy shall in all events be subject to reduction, cancellation, forfeiture or recoupment to the extent necessary to comply

with (i) any right that reAlpha may have under the Clawback Policy, or (iii) any other agreement or arrangement with a Participant, or

(iii) applicable law. |

Sections 4, 5, 6 and 7 are subject to and may

be superseded by the local laws of the country and/or state in which the Participant resides.

Nothing in the STIP implies contractual agreement

nor should be interpreted as a guarantee of continued employment or interfere with or restrict in any way the right of reAlpha or any

of its subsidiaries to discharge any Participant at any time (subject to any contract rights of such Participant). reAlpha reserves the

right to amend, modify, suspend, or discontinue the STIP at any time and for any reason in whole or in parts, in its sole and exclusive

discretion.

| 10) | SPECIAL PROVISIONS RELATED TO SECTION 409A OF THE U.S. INTERNAL REVENUE CODE |

Note: This section is applicable only to the Participants

subject to taxation in the U.S.

This section sets forth special provisions of

the STIP intended to be compliance with Section 409A of the United States Internal Revenue Code of 1986, as amended. It is intended that

the provisions of the STIP comply with or are exempt from Section 409A of the U.S. Internal Revenue Code of 1986, as amended (the “Code”),

and all provisions of the STIP will be construed and interpreted in a manner consistent with the requirements for avoiding taxes or penalties

under Section 409A of the Code. reAlpha cannot make any representations or guarantees with respect to compliance with such requirements,

and it and/or any affiliate will not have any obligation to indemnify a Participant or otherwise hold him/her harmless from any or all

of such taxes or penalties. For purposes of Section 409A of the Code, each installment payment, as applicable hereunder will be deemed

a “separate payment” within the meaning of Treas. Reg. Section 1.409A-2(b)(iii). With respect to the timing of payments of

any deferred compensation payable upon a termination of employment hereunder, references in this document to “termination of employment”

(and substantially similar phrases) mean “separation from service” within the meaning of Section 409A of the Code.

Notwithstanding anything in the STIP Plan to the

contrary, if, at the time of termination of employment hereunder, the Participant is deemed to be a “specified employee” of

reAlpha and/or any affiliate within the meaning of Section 409A of the Code, then (a) only to the extent necessary to comply with the

requirements of Section 409A of the Code, any payments to which the Participant is entitled under the STIP in connection with such termination

that are subject to Section 409A of the Code (and not otherwise exempt from its application) that constitute “nonqualified deferred

compensation” for purposes of Section 409A shall be withheld until the first business day of the seventh month following the date

of such termination (the “Delayed Payment Date”), (b) on the Delayed Payment Date, the Participant shall receive a lump sum

payment in an amount equal to the aggregate amount of such payments that otherwise would have been made to the Participant prior to the

Delayed Payment Date and (c) following the Delayed Payment Date, the Participant shall receive the payments otherwise due to the Participant

in accordance with the payment terms and schedule set forth herein.

Separate Payments. For purposes of Section

409A of the Code, each payment that may be made to a Participant pursuant to the STIP is designated as a “separate payment”

for purposes of Treas. Reg. Section 1.409A-2(b)(iii).

Amendment of This Section

The Board shall retain the power and authority

to amend or modify this section to the extent the Board in its sole discretion deems necessary or advisable to comply with any guidance

issued under Section 409A. Such amendments may be made without the approval of any Participant.

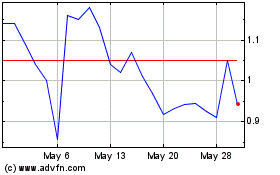

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Jan 2025 to Feb 2025

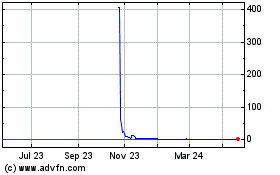

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Feb 2024 to Feb 2025