0001520262FalseAlkermes plc.00015202622024-12-022024-12-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 2, 2024

ALKERMES PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Ireland |

|

001-35299 |

|

98-1007018 |

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

|

|

|

Connaught House, 1 Burlington Road |

Dublin 4, Ireland D04 C5Y6 |

(Address of principal executive offices) |

Registrant's telephone number, including area code: + 353-1-772-8000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Ordinary shares, $0.01 par value |

|

ALKS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On December 2, 2024, Alkermes plc made available a copy of its updated corporate presentation. A copy of the presentation is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, and in Exhibit 99.1 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALKERMES PLC |

|

|

Date: December 2, 2024 |

By: |

|

/s/ David J. Gaffin |

|

|

|

David J. Gaffin |

|

|

|

Secretary |

Alkermes 2024: �Profitable, Pure-play Neuroscience Company December 2024 Exhibit 99.1

Forward-Looking Statements Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: the company’s expectations with respect to its current and future financial and operating performance, business plans or prospects, including its expected cash generation and profitability, capital allocation strategy, revenue and growth drivers, potential transactional opportunities and return of capital to shareholders; the potential therapeutic and commercial value of the company’s marketed products and development candidates; expectations regarding the patent life for VUMERITY® and generic competition for VIVITROL®; the company’s plans and expectations regarding clinical development activities, including study timelines and design for ALKS 2680, and strategy and timelines for the company’s other orexin portfolio candidates; and the company’s plans to advance and expand its neuroscience pipeline. The company cautions that forward-looking statements are inherently uncertain. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks, assumptions and uncertainties. These risks, assumptions and uncertainties include, among others: whether the company is able to sustain profitability; the unfavorable outcome of arbitration or litigation, including so-called “Paragraph IV” litigation or other patent litigation which may lead to competition from generic drug manufacturers, or other disputes related to the company’s products or products using the company’s proprietary technologies; the company’s commercial activities may not result in the benefits that the company anticipates; clinical development activities may not be completed on time or at all; the results of the company’s development activities, including those related to ALKS 2680, may not be positive, or predictive of final results from such activities, results of future development activities or real-world results; potential changes in the cost, scope, design or duration of the company’s development activities; the U.S. Food and Drug Administration (“FDA”) or other regulatory authorities may not agree with the company’s regulatory approval strategies or components of the company’s marketing applications and may make adverse decisions regarding the company’s products; the company and its licensees may not be able to continue to successfully commercialize their products or support growth of such products; there may be a reduction in payment rate or reimbursement for the company’s products or an increase in the company’s financial obligations to government payers; the company’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the company’s Annual Report on Form 10-K for the year ended Dec. 31, 2023 and in subsequent filings made by the company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov, and on the company’s website at www.alkermes.com in the ‘Investors – SEC filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Note Regarding Trademarks: The company and its affiliates are the owners of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO®, LYBALVI® and VIVITROL®. VUMERITY® is a registered trademark of Biogen MA Inc., used by Alkermes under license. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

Alkermes 2024: Profitable, Pure-play Neuroscience Company >$1B commercial business driven primarily by 4 �core products* Proven development capabilities with advancing neuroscience pipeline Positioned for sustained profitability and significant cash generation *Based on revenues from VIVITROL®, ARISTADA®, VUMERITY® and LYBALVI® for twelve months ended Dec. 31, 2023

2024 Strategic Priorities Driven by 4 core products�and streamlined operating structure Initiate phase 2 program Advance internal development candidates and explore external pipeline opportunities Deliver strong commercial growth and profitability Advance orexin 2 receptor agonist �program Expand neuroscience pipeline Plan for significant �cash generation Continue focus on capital allocation, including potential opportunities to return capital to shareholders

>$1B Commercial Business Primarily Driven by 4 Core Products

Topline Growth and Diversification Reflect Evolving Business *Inclusive of ARISTADA INITIO® **Licensed product (royalty & manufacturing revenue) R12M: Rolling 12 Months Key Product Revenues ($M) $574 $715 $893 $1,049 $1,151

LYBALVI®: Oral Treatment Option for Schizophrenia and �Bipolar I Disorder Once-daily, oral atypical antipsychotic composed of olanzapine, an established antipsychotic agent, and samidorphan, a new chemical entity Indicated for the treatment of: Schizophrenia in adults Bipolar I disorder in adults Acute treatment of manic or mixed episodes �as monotherapy and as adjunct to lithium or valproate Maintenance monotherapy treatment Full prescribing information for LYBALVI, including Boxed Warning, may be found at www.lybalvi.com/lybalvi-prescribing-information.pdf

LYBALVI® Launch Growth Trends *Source: IQVIA NPA Weekly Post-Launch Weekly TRx* (Through 11/15/2024) Week LYBALVI Quarterly Net Sales ($M)

ARISTADA®: LAI for the Treatment of Schizophrenia With Dosing Flexibility *ARISTADA INITIO + single 30 mg oral dose of aripiprazole replaces need for concomitant three weeks of oral aripiprazole for initiation of ARISTADA. The first ARISTADA dose may be administered on the same day as ARISTADA INITIO or up to 10 days thereafter. Full prescribing information for ARISTADA, including Boxed Warning, may be found at www.aristada.com/downloadables/ARISTADA-PI.pdf ARISTADA Annual Net Sales** ($M) **Inclusive of ARISTADA INITIO® Long-acting injectable (LAI) atypical antipsychotic indicated for the treatment of schizophrenia in adults Novel molecular entity designed to address the �real-world needs of patients and providers Ability to fully dose on day one for up to two �months with ARISTADA INITIO® regimen* $241 $275 $302 $328

VIVITROL®: LAI for the Treatment of Alcohol Dependence and Opioid Dependence VIVITROL Annual Net Sales ($M) Extended-release opioid antagonist provides therapeutic levels of naltrexone for a one-month period Indicated for the treatment of alcohol dependence (AD) in patients able to abstain from alcohol in an outpatient setting prior to initiation of treatment with VIVITROL Indicated for the prevention of relapse to opioid dependence (OD), following opioid detoxification Generics expected to enter the market under license from Alkermes in January 2027 or earlier under certain circumstances $311 $344 $380 $400 Full prescribing information for VIVITROL may be found at www.vivitrol.com/content/pdfs/prescribing-information.pdf. �Treatment with VIVITROL should be part of a comprehensive management program that includes psychosocial support.

VUMERITY® Offers Long-Term Revenue Growth Opportunity VUMERITY Royalty & Manufacturing Revenue ($M) $23 $87 $115 $129 Novel oral fumarate for the treatment of relapsing forms of multiple sclerosis (MS) Biogen holds exclusive, worldwide license to commercialize 15% royalty to Alkermes on worldwide net sales Discovered and developed by Alkermes Composition of matter patent extends into 2033* *Subject to Paragraph IV litigation related to an abbreviated new drug application seeking FDA approval of a generic version.

Proven Drug Development Capabilities with Advancing Neuroscience Pipeline

Common Symptoms in Narcolepsy Type 1, Narcolepsy Type 2 and Idiopathic Hypersomnia Symptoms NT1 NT2 IH Excessive daytime sleepiness (EDS) Sleep-onset REM periods (SOREMP) Cataplexy Disrupted nighttime sleep Needed naps: short, refreshing Sleep-related hallucinations Sleep paralysis Brain fog Long sleep Severe sleep inertia Needed naps: long, unrefreshing Almost always (90 to 100% of people with this disorder have this symptom) Less common (11 to 40% of people with this disorder have this symptom) More common (41 to 89% of people with this disorder have this symptom) Rare (0 to 10% of people with this disorder have this symptom) Symptom Commonality Across Sleep Disorders Results in Diagnostic Challenges www.hypersomniafoundation.org/classification/; Sateia MJ. International classification of sleep disorders-third edition: highlights and modifications. Chest. 2014;146:1387–94.; Rassu, Evangelista, Barateau, et al. J Clin Sleep Medicine. 2022, 617-629.� NT1: Narcolepsy type 1; NT2: Narcolepsy type 2; IH: Idiopathic hypersomnia; REM: rapid eye movement

Narcolepsy and Idiopathic Hypersomnia in the U.S. Narcolepsy prevalence 200,000a 100,000�diagnosedb Idiopathic Hypersomnia 40,000 �diagnosedc aNarcolepsy Network Fast Facts bCohen et al., Sleep Med 43:14 (2018) and Longstreth et al., Sleep Med 10:422 (2009) prevalence rates applied to U.S. population cAcquavella et al., J Clin Sleep Med 16:1255 (2020)

ALKS 2680: Investigational Oral Orexin 2 Receptor Agonist for the Treatment of Narcolepsy and Idiopathic Hypersomnia ALKS 2680 is a highly potent, selective OX2R agonist ≥10-fold more potent than orexin Aa >5,000-fold selectivity relative to OX1Ra ALKS 2680 phase 1 data demonstrated desired pharmaceutical properties: Orally bioavailable PK profile supportive of once-daily dosing Mimics natural sleep/wake cycle 2024 Clinical Program Status aData from preclinical studies using CHO (Chinese hamster ovary) cells.; OX1R: orexin 1 receptor; OX2R: orexin 2 receptor; PK: pharmacokinetic; NT1: Narcolepsy type 1; NT2: Narcolepsy type 2; IH: Idiopathic hypersomnia Phase 1 single ascending dose and multiple ascending dose study complete Phase 1b proof-of-concept study complete Vibrance-1 phase 2 NT1 study enrolling Vibrance-2 phase 2 NT2 study enrolling Vibrance-3 phase 2 IH study planning underway Open-label, long-term safety study expected to initiate in Q4 2024

ALKS 2680 Phase 1b: Randomized, Double-Blind, PBO-Controlled Study in Patients With NT1, NT2 and IH Provides Proof-of-Concept Patients had a confirmed diagnosis with no baseline criteria for MWT Key objectives: Safety and tolerability Mean sleep latency on Maintenance of Wakefulness Test (MWT) at baseline and each day of dosing Safety �follow-up Day �14 (±1) Patient screening Days �-28 to -7 Baseline assessment ALKS 2680 ALKS 2680 ALKS 2680 Placebo ALKS 2680 ALKS 2680 Placebo ALKS 2680 ALKS 2680 Placebo ALKS 2680 ALKS 2680 Placebo ALKS 2680 ALKS 2680 ALKS 2680 48-hours between dosing Assessment�(Days -2 to 9) 1:1:1:1 ≥14-day�washout Patient Population n ALKS 2680 �Doses NT1 10 1, 3 & 8 mg NT2 9 5, 12 & 25 mg IH 8 5, 12 & 25 mg PBO: Placebo; NT1: Narcolepsy type 1; NT2: Narcolepsy type 2; IH: Idiopathic hypersomnia

ALKS 2680 Phase 1b: Generally Well-Tolerated at all Doses Tested in NT1, NT2 and IH Most TEAEs were mild in severity and transient No deaths, serious TEAEs, severe TEAEs, or TEAEs leading to discontinuation Treatment-related TEAEs* reported in >1 subject in each population listed below: NT1: insomnia, pollakiuria, salivary hypersecretion, decreased appetite, dizziness, and nausea NT2: pollakiuria, insomnia, and dizziness IH: pollakiuria, insomnia, and dizziness No clinically meaningful changes in laboratory parameters No cardiovascular safety signals in vital signs or ECGs *Relationship per investigator determination. Insomnia includes TEAE terms of insomnia, middle insomnia, and initial insomnia. Dizziness includes TEAE terms of dizziness and dizziness postural. NT1: Narcolepsy type 1; NT2: Narcolepsy type 2; IH: Idiopathic hypersomnia; TEAE: Treatment-Emergent Adverse Event; ECG: Electrocardiogram

Absolute Mean Sleep Latency on Maintenance of Wakefulness Test (MWT) - Mean SE ALKS 2680 Phase 1b: Demonstrated Meaningful, Consistent and Dose-Dependent Effect on Wakefulness in NT1, NT2 & IH Patients Minutes Narcolepsy Type 1 (n = 10) 40 Narcolepsy Type 2 (n = 9) Idiopathic Hypersomnia (n = 8) LS mean (95% CI) difference vs placebo1 p-value 18.38�(10.95, 28.80) 0.0002 22.57�(15.56,29.58) 0.0001 33.97�(26.72,41.21) <0.0001 11.60�(2.22, 20.98) 0.0178 18.55�(9.17, 27.93) 0.0005 20.96�(11.58, 30.34) 0.0001 8.07�(0.06, 16.07) 0.0484 11.05�(3.04, 19.05) 0.0096 17.67�(9.67, 25.68) 0.0002 1: Primary analysis based on a mixed effect model of repeated measurement with the dose level and the period as fixed factors, and the average sleep latency on Day -1 is included as the baseline covariate�SE: standard error; LS: least squares Primary Analysis

ALKS 2680 Phase 2 Clinical Program Evaluating Once-Daily Administration Across a Range of Patient Populations Study n ALKS 2680 �Doses Screening Period Double-blind Treatment Period Open-label Extension Period Follow-up Period Primary Endpoint Initial Washout Narcolepsy Type 1 VIBRANCE-1 80 4, 6 & 8 mg 4-weeks 2-weeks 6-weeks 7-weeks 2-weeks MWT �at week 6 Narcolepsy Type 2 VIBRANCE-2 80 10, 14 & 18 mg 4-weeks 2-weeks 8-weeks 5-weeks 2-weeks MWT �at week 8 Idiopathic Hypersomnia VIBRANCE-3 Study design in progress Study design in progress Initial screening Safety �follow-up Washout MWT: Maintenance of Wakefulness Test; : change from baseline Randomization Double-blind treatment Open-label extension With dose adjustment option ALKS 2680 dose 1 ALKS 2680 dose 2 ALKS 2680 dose 3 Placebo

Orexin 2 Receptor Agonist Pathway May Have Potential Applicability in Broad Range of Indications Select disease states which intersect across �aspects of wakefulness, fatigue, mood and cognition Neurology Attention-deficit/hyperactivity disorder Multiple sclerosis fatigue Parkinson’s disease Psychiatry Bipolar disorder Cognitive impairment in schizophrenia Negative symptoms of schizophrenia Major depressive disorder Seasonal affective disorder Orphan/ultra-orphan disorders AM: amygdala; BF: basal forebrain; Cg: cingulate cortex; DR: dorsal raphe; HIP: hippocampus; �HYP: hypothalamus; NA: nucleus accumbens; PFC: prefrontal cortex; SN: substantia nigra; TH: thalamus; �TMN: tuberomammillary nucleus; VTA: ventral tegmental area.

Advancing Multiple Orexin Development Candidates for Treatment of Neurology & Psychiatry Disorders Discovery Preclinical Phase 1 Phase 2 Phase 3 Next Planned Milestone ALKS 2680 Narcolepsy Type 1 Phase 2 data H2 2025 Phase 2 Data Narcolepsy Type 2 Phase 2 data H2 2025 Idiopathic Hypersomnia Phase 2 initiation 2025 Project Saturn: Additional OX2R molecules expected to enter the clinic in 2025 Phase 1 initiation�Mid-2025 Phase 1 initiation�H2 2025 OX2R: Orexin 2 receptor agonist

Positioned for Robust Profitability and Significant Cash Generation

Commercial Performance and Efficient Cost Structure Expected to Drive Meaningful Profitability >$1B commercial business driven primarily by 4 core products* Positioned for sustained profitability and significant cash generation Ended 2023 with $813M in cash and investments *Based on revenues from VIVITROL®, ARISTADA®, VUMERITY® and LYBALVI® for twelve months ended Dec. 31, 2023

Capital Allocation Strategy Maximize the potential of proprietary commercial products with primary focus on LYBALVI® Pursue external opportunities to expand portfolio with assets that are a strong strategic fit Invest in internal development pipeline �to advance new neuroscience candidates Return excess cash to shareholders

2024 Strategic Priorities Driven by 4 core products�and streamlined operating structure Initiate phase 2 program Advance internal development candidates and explore external pipeline opportunities Deliver strong commercial growth and profitability Advance orexin 2 receptor agonist �program Expand neuroscience pipeline Plan for significant �cash generation Continue focus on capital allocation, including potential opportunities to return capital to shareholders

www.alkermes.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

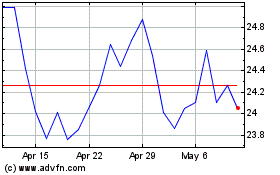

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Jan 2025 to Feb 2025

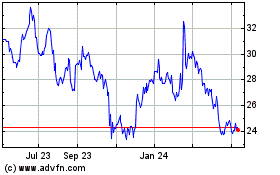

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Feb 2024 to Feb 2025