Current Report Filing (8-k)

23 January 2023 - 10:31PM

Edgar (US Regulatory)

0001860657

false

0001860657

2023-01-23

2023-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 23, 2023

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

|

24 School Street, 2nd Floor Boston, MA |

|

02108 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed on Form 8-K filed with

the Commission on December 12, 2022, on December 9, 2022, the Company and 3i, LP (“3i”), the holder of outstanding shares

of Series A Convertible Preferred Stock (“Series A Preferred Stock”) entered into a letter agreement (“Letter Agreement”)

which provided that pursuant to Section 8(g) of the Certificate of Designations for the Series A Preferred Stock, the parties agreed that

the Conversion Price (as defined in such Certificate of Designations”) was modified to mean the lower of: (i) the Closing Sale Price

(as defined in the Certificate of Designations) on the trading date immediately preceding the Conversion Date (as defined in the Certificate

of Designations and (ii) the average Closing Sale Price of the common stock for the five trading days immediately preceding the Conversion

Date, for the Trading Days (as defined in the Certificate of Designations) through and inclusive of January 19, 2023.

On January 23, 2023, the Company and 3i amended

the Letter Agreement to provide the term Conversion Price will be in effect until terminated by the Company and 3i.

The shares of Series A Preferred Stock was acquired

by 3i pursuant to the terms that certain Securities Purchase Agreement dated as of May 20, 2021 and the other related transaction documents

by and between the Company and 3i. In addition to the material relationship with 3i relating to the Series A Preferred Stock, as previously

disclosed, 3i is also a holder of a secured promissory note issued by the Company pursuant to a Secured Note Purchase Agreement and a

Security Agreement by and between the Company and 3i, each of which is dated as of November 22, 2022.

Item 3.03. Material Modification to

Rights of Security Holders.

As previously disclosed in Item 1.01, the Company’s

Board of Directors and 3i approved an amendment to the Letter Agreement dated December 9, 2022, to provide that the term Conversion Price

as defined in the Letter Agreement will continue to be utilized until terminated by the Company and 3i.

Item 7.01 Regulation FD Disclosure

The Company is announcing its proposed annual budget

for the calendar year. For the year ending December 31, 2023, the Company anticipates that its annual budget will consist of (1) milestone

payments pursuant to license agreements and, to a lesser extent, patents of approximately $4,924,000; (2) development costs, including

clinical trial costs, of approximately $10,496,000; and (3) general and operating expenses of approximately $6,262,000. The Company’s

proposed budget represents its projected total annual expenditures for the 2023 calendar year, and actual expenses and payments will differ

from month to month due to the timing of development costs and contractual milestone payments. The Company intends to finance its budget

through the raising of capital; no assurance can be given that the Company will be able to raise a sufficient amount of capital to finance

its budget for 2023.

This discussion contains forward-looking statements

based upon our current expectations that involve risks and uncertainties. Our actual results could differ materially from those anticipated

in these forward-looking statements as a result of various factors. Reference is made to the “Risk Factors” section contained

in our Form 10-K for the year ended December 31, 2022 and other periodic reports that we file with the Commission.

This information is furnished pursuant to Item

7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934

or otherwise subject to the liabilities of that Section, unless we specifically incorporate it by reference in a document filed under

the Securities Act of 1933 or the Securities Exchange Act of 1934. By furnishing this information on this Current Report on Form 8-K,

we make no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation

FD.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem |

| |

|

Chief Executive Officer |

| |

|

|

| Dated: January 23, 2023 |

|

|

2

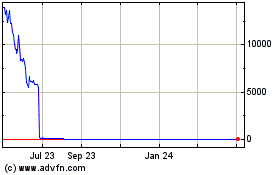

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

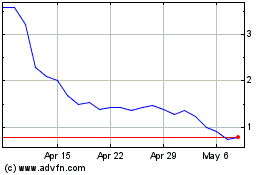

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Apr 2023 to Apr 2024