Current Report Filing (8-k)

14 January 2022 - 8:14AM

Edgar (US Regulatory)

FALSE000180770700018077072022-01-102022-01-100001807707us-gaap:CommonStockMember2022-01-102022-01-100001807707us-gaap:WarrantMember2022-01-102022-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2022

AppHarvest, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-39288

|

82-5042965

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

500 Appalachian Way

Morehead, KY

|

40351

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (606) 653-6100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

APPH

|

|

The Nasdaq Stock Market LLC

|

|

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

|

APPHW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 10, 2022, AppHarvest Pulaski Farm, LLC, a Delaware limited liability company (the “Borrower Subsidiary”) and wholly-owned indirect subsidiary of AppHarvest, Inc. (the “Company”), entered into an amended and restated promissory note (the “Amended Note”) in favor of JPMorgan Chase Bank, N.A. (the “Bank”), which amends the promissory note dated September 24, 2021 only for reference purposes (the “Existing Note”, and together with the Amended Note the “Note”). Capitalized terms used in this Current Report on Form 8-K (this “Form 8-K”) but not otherwise defined herein have the meanings ascribed to them in the Amended Note.

The material changes effected to the terms of the Existing Note by the Amended Note include the following: (i) the increase of the existing line of credit facility in the maximum amount from $25 million to $50 million; and (ii) the implementation of SOFR as the replacement of LIBOR as a benchmark interest rate for U.S. dollar borrowings.

The interest rate on the Loans is an agreed rate between the Borrower Subsidiary and the Bank that is (a) the CB Floating Rate plus the Applicable Margin, (b) the Fixed Rate for the applicable Interest Period or (c) the Adjusted Term SOFR Rate plus the Applicable Margin, payable in arrears on the last day of the applicable Interest Period for such Loan, and, if such Interest Period is in excess of three months, on the last day of each three month interval after the date such Loan is made, at maturity and thereafter, on demand. Any Loan not paid when due will bear interest of 2% per annum above the CB Floating Rate plus the Applicable Margin. The Borrower Subsidiary may not prepay any Fixed Rate Loan or SOFR Loan prior to the last date of the applicable Interest Period. CB Floating Rate Loans may be prepaid by the Borrower Subsidiary at any time without premium or penalty upon at least 1 business day prior written notice to the Bank. All outstanding principal and accrued interest are due upon maturity of the JPM Loan. As of the filing date of this Form 8-K, the Company has borrowed approximately $24.3 million under the Note.

AppHarvest Operations, Inc. (the “Guarantor”) and wholly-owned subsidiary of the Company, which previously executed a Guaranty-Multiple Subsidiaries (the “Guaranty”) and Assignment of Deposit Account (“Assignment”), each dated September 24, 2021 only for reference purposes, and filed by the Company, (i) acknowledged and consented to all of the terms and conditions of the Amended Note, (ii) confirmed that all obligations under the Note constitute Liabilities under and as defined in the Guaranty, and (iii) confirmed that there is no default under the Guaranty or event or occurrence which would constitute an event of default.

Consistent with the Existing Note, the Amended Note contains customary events of default, including, among others, those relating to failure to make a payment, bankruptcy, material defaults on other indebtedness, breaches of representations, material adverse changes and defaults under the Guaranty or the Assignment.

The foregoing description of the Amended Note is qualified in its entirety by reference to the full text of the Amended Note, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth above under Item 1.01 is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

AppHarvest, Inc.

|

|

|

|

|

Dated: January 13, 2022

|

|

|

|

By:

|

/s/ Loren Eggleton

|

|

|

|

Loren Eggleton

|

|

|

|

Chief Financial Officer

|

|

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

AppHarvest (NASDAQ:APPH)

Historical Stock Chart

From Apr 2024 to May 2024

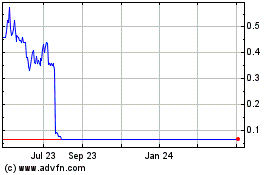

AppHarvest (NASDAQ:APPH)

Historical Stock Chart

From May 2023 to May 2024