Arhaus, Inc. (NASDAQ: ARHS; “Arhaus” or the “Company”), a rapidly

growing lifestyle brand and omni-channel retailer of premium

artisan-crafted home furnishings, reported financial results for

the second quarter ended June 30, 2022.

Second Quarter 2022 Highlights

- Net revenue increased 66.4% to $306 million

- Comparable Growth(1) of 65.2%

- Net and Comprehensive Income of $37 million

- Adjusted Net Income of $39 million

- Adjusted EBITDA increased 76.4% to $60 million

Year-to-Date 2022 Highlights, through June

30

- Net revenue increased 55.5% to $553 million

- Comparable Growth of 53.1%

- Net and Comprehensive Income of $53 million

- Adjusted Net Income of $56 million

- Adjusted EBITDA increased 53.4% to $92 million

2022 Outlook Raised

- Net revenue of $1,173 million to $1,193 million

- Comparable Growth(1) of 43% to 48%

- Net and Comprehensive Income of $92 million to $98 million

- Adjusted EBITDA of $173 million to $180 million

CEO Comments

John Reed, Co-Founder and Chief Executive Officer,

commented,

“We are pleased with our continued strong financial performance

in the second quarter. Net revenue, comparable growth, demand

comparable growth(2), and profitability were above expectations,

and our team executed with excellence, leveraging our supply chain

investments and further shrinking delivery times. Strong demand

trends throughout the quarter reflect our beautiful new product

assortments that are resonating with our clients, including our new

Outdoor collections, our inspirational showrooms and our new

website experience.

“During the quarter we opened two new showrooms in Colorado

Springs, Colorado and in White Plains, New York. Our new showrooms

continue to perform incredibly well and are driving increased brand

awareness as we continue to execute our growth strategy, moving

from 80 showrooms today to what we believe will be 165 total

traditional showrooms over time. Our target is to add five to seven

new traditional showrooms per year for the foreseeable future. We

are also excited to announce we have been so pleased with our

Design Studio performance to date that we are planning to open two

to three additional Design Studios in the next several months.

“I am incredibly proud of our team and all they continue to

accomplish. Given our strong first half of the year performance, we

are again increasing our full year outlook for 2022.”

Second Quarter 2022 Results

Net revenue increased 66.4% to $306 million, compared to $184

million in the second quarter of 2021. The increase was driven by

strong demand in both Showroom and eCommerce channels, as well as

continued improvements across our supply chain.

Comparable growth(1) in the quarter was 65.2%, compared to 71.4%

in the second quarter of 2021.

Income from operations increased to $50 million, compared to $9

million in the second quarter of 2021, primarily driven by higher

net revenue. This was partially offset by higher product costs,

transportation costs and variable rent expense related to the

increased net revenue, as well as higher SG&A expenses to

support the growth of the business and new public company related

costs. Higher SG&A expenses were partially offset by the

non-recurrence of derivative expense related to our prior term loan

agreement, that was recorded in the second quarter of 2021.

Net and comprehensive income was $37 million compared to $7

million in the second quarter of 2021. This increase was primarily

driven by higher net revenue, partially offset by the above factors

and a higher post-IPO tax rate. Adjusted net income was $39 million

in the second quarter of 2022 compared to $28 million in the second

quarter of 2021.

Adjusted EBITDA increased 76.4% to $60 million compared to $34

million in the second quarter of 2021. Adjusted EBITDA as a percent

of net revenue increased 110 basis points to 19.7% in the second

quarter of 2022, compared to 18.6% in the second quarter of

2021.

The Company ended the quarter with 80 total showrooms across 28

states.

Balance Sheet and Cash Flow Highlights, as of June 30,

2022

Cash and cash equivalents were $145 million, and the Company had

no long-term debt at June 30, 2022. Net merchandise inventory

increased 30.8% to $272 million, compared to $208 million as of

December 31, 2021.

For the six months ended June 30, 2022, net cash provided by

operating activities was $41 million, compared to $110 million for

the six months ended June 30, 2021. The decrease was the result of

several factors, including higher inventory levels, lower change in

client deposits from improved delivery of orders in backlog, lower

demand comparable growth in the first half of 2022 versus the first

half of 2021, and certain non-cash items, particularly the

non-recurrence of the derivative expense related to the change in

fair value of our prior term loan agreement which reduced net

income in the first six months of 2021 without a corresponding

adverse impact to our cash generation, partially offset by an

increase in accounts payable and accrued expenses.

For the six months ended June 30, 2022, net cash used in

investing activities was approximately $20 million which includes

landlord contributions of approximately $7 million and

company-funded capital expenditures(3) of approximately $13

million. For the six months ended June 30, 2021, net cash used in

investing activities was approximately $14 million, which included

landlord contributions of approximately $8 million and

company-funded capital expenditures of approximately $5 million.

The increase in company-funded capital expenditures was primarily

driven by growth-related investments, including new distribution

capacity and costs related to new Showroom openings and information

technology.

Outlook

The table below presents our updated expectations for selected

full year 2022 financial operating results.

|

Full Year 2022 |

Current Guidance |

Previous Guidance |

|

Net revenue |

$1,173 to $1,193 million |

$1,145 to $1,185 million |

|

Comparable growth(1) |

43% to 48% |

36% to 46% |

|

Net income(4) |

$92 to $98 million |

$73 to $83 million |

|

Adjusted EBITDA(5) |

$173 to $180 million |

$151 to $161 million |

|

Other estimates: |

|

Company-funded capital expenditures(3) |

$55 to $65 million |

$60 to $70 million |

|

Fully diluted shares |

~141 million |

~140 million |

|

Effective tax rate |

~26% |

~25% |

In addition to the two new Showrooms opened to date in 2022, the

Company plans to open two to three new Design Studios over the next

several months.

The Company recently opened its third distribution center in

Texas in July. It will encompass over 800,000 square

feet.________________________

(1) Comparable growth is a key

performance indicator and is defined as the year-over-year

percentage change of the dollar value of orders delivered (based on

purchase price), net of the dollar value of returns (based on

amount credited to client), from our comparable Showrooms and

eCommerce, including through our direct-mail catalog.(2)

Demand comparable growth is a key performance

indicator and is defined as the year-over-year percentage change of

demand from our comparable Showrooms and eCommerce, including

through our direct-mail catalog.(3) Company-funded capital

expenditures is defined as total net cash used in

investing activities less landlord contributions.(4) U.S. GAAP net

income. (5) We have not reconciled guidance for Adjusted EBITDA to

the corresponding GAAP financial measure because we do not provide

guidance for the various reconciling items. These items include,

but are not limited to, future share-based compensation expense,

income taxes, interest expense, and transaction costs. We are

unable to provide guidance for these reconciling items because we

cannot determine their probable significance, as certain items are

outside of our control and cannot be reasonably predicted due to

the fact that these items could vary significantly from period to

period. Accordingly, reconciliations to the corresponding GAAP

financial measure is not available without unreasonable effort.

Conference Call

You are invited to listen to Arhaus’ conference call to discuss

the second quarter 2022 financial results scheduled for today,

August 11, 2022, at 8:30 a.m. Eastern Time. The call will be

available over the Internet on our website (http://ir.arhaus.com)

or by dialing (877) 407-3982 within the U.S., or 1 (201) 493-6780,

outside the U.S. The conference ID is: 13725882.

A recorded replay of the conference call will be available

within approximately three hours of the conclusion of the call and

can be accessed online at https://ir.arhaus.com for

approximately twelve months.

About Arhaus

Founded in 1986, Arhaus is a rapidly growing lifestyle brand and

omni-channel retailer of premium home furnishings. Through a

differentiated proprietary model that directly designs and sources

products from leading manufacturers and artisans around the world,

Arhaus offers an exclusive assortment of heirloom quality products

that are sustainably sourced, lovingly made, and built to last.

With 80 showrooms across the United States, a team of interior

designers providing complimentary in-home design services, and

robust online and eCommerce capabilities, Arhaus is known for

innovative design, responsible sourcing, and client-first service.

For more information, please visit www.arhaus.com.

Investor Contact:

Wendy WatsonSVP, Investor Relations(440)

439-7700invest@arhaus.com

Non-GAAP Financial Measures

In addition to the results provided in accordance with GAAP,

this press release and related tables include adjusted EBITDA,

adjusted EBITDA as a percentage of net revenue and adjusted net

income, which present operating results on an adjusted basis.

We use non-GAAP measures to help assess the performance of our

business, identify trends affecting our business, formulate

business plans and make strategic decisions. In addition to our

results determined in accordance with U.S. GAAP, we believe that

providing these non-GAAP financial measures is useful to our

investors as they present an informative supplemental view of our

results from period to period by removing the effect of

non-recurring items. However, our inclusion of these adjusted

measures should not be construed as an indication that our future

results will be unaffected by unusual or infrequent items or that

the items for which we have made adjustments are unusual or

infrequent or will not recur. These non-GAAP measures are not a

substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. Because not all companies use

identical calculations, the presentations of these measures may not

be comparable to other similarly titled measures of other companies

and can differ significantly from company to company. These

measures should only be read together with the corresponding GAAP

measures. Please refer to the reconciliations of adjusted EBITDA

and adjusted net income to the most directly comparable financial

measures prepared in accordance with GAAP below.

Forward-Looking StatementsCertain statements

contained herein, including statements under the headings “2022

Outlook Raised” and “Outlook” are not based on historical fact and

are “forward-looking statements” within the meaning of applicable

securities laws.

Forward-looking statements can generally be identified by the

use of forward-looking terminology, including, but not limited to,

“may,” “could,” “seek,” “guidance,” “predict,” “potential,”

“likely,” “believe,” “will,” “expect,” “anticipate,” “estimate,”

“plan,” “intend,” “forecast,” or variations of these terms and

similar expressions, or the negative of these terms or similar

expressions. Past performance is not a guarantee of future results

or returns and no representation or warranty is made regarding

future performance. Such forward-looking statements involve known

and unknown risks, uncertainties and other important factors beyond

our control that could cause our actual results, performance or

achievements to be materially different from the expected results,

performance or achievements expressed or implied by such

forward-looking statements. These risks and uncertainties include,

but are not limited to: our reliance on third-party transportation

carriers and risks associated with increased freight and

transportation costs; disruption in our receiving and distribution

system, including delays in the integration of our new distribution

centers and the possibility that we may not realize the anticipated

benefits of multiple distribution centers; our ability to obtain

quality merchandise in sufficient quantities; risks as a result of

constraints in our supply chain; a failure of our vendors to meet

our quality standards; the COVID-19 pandemic and its effect on our

business; declines in general economic conditions that affect

consumer confidence and consumer spending that could adversely

affect our revenue; our ability to manage and maintain the growth

rate of our business; our ability to anticipate changes in consumer

preferences; risks related to maintaining and increasing showroom

traffic and sales; our ability to compete in our market; our

ability to adequately protect our intellectual property; the

possibility of cyberattacks and our ability to maintain adequate

cybersecurity systems and procedures; loss, corruption and

misappropriation of data and information relating to clients and

employees; changes in and compliance with applicable data privacy

rules and regulations; compliance with applicable governmental

regulations; effectively managing our eCommerce business and

digital marketing efforts; and compliance with SEC rules and

regulations as a public reporting company. These factors should not

be construed as exhaustive. Furthermore, the potential impact of

the COVID-19 pandemic on our business operations and financial

results and on the world economy as a whole may heighten the risks

and uncertainties that affect our forward-looking statements

described above. Further information on potential factors that

could affect the financial results of the Company and its

forward-looking statements is included in the Company’s filings

with the Securities and Exchange Commission. The Company assumes no

obligation to update any forward-looking statement, except as may

be required by law. These forward-looking statements speak only as

of the date of this release. All forward-looking statements are

qualified in their entirety by this cautionary statement.

|

Arhaus, Inc. and SubsidiariesCondensed

Consolidated Balance Sheets(Unaudited, amounts in

thousands, except share and per share data) |

| |

|

|

|

| |

June 30,2022 |

|

December 31,2021 |

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

144,628 |

|

|

$ |

123,777 |

|

| Restricted cash

equivalents |

|

6,985 |

|

|

|

7,131 |

|

| Accounts receivable, net |

|

1,500 |

|

|

|

228 |

|

| Merchandise inventory,

net |

|

272,478 |

|

|

|

208,343 |

|

| Prepaid and other current

assets |

|

29,509 |

|

|

|

28,517 |

|

|

Total current assets |

|

455,100 |

|

|

|

367,996 |

|

| Operating right-of-use

assets |

|

231,667 |

|

|

|

— |

|

| Financing right-of-use

assets |

|

39,602 |

|

|

|

— |

|

| Property, furniture and

equipment, net |

|

116,620 |

|

|

|

179,631 |

|

| Deferred tax asset |

|

22,833 |

|

|

|

27,684 |

|

| Goodwill |

|

10,961 |

|

|

|

10,961 |

|

| Other noncurrent assets |

|

249 |

|

|

|

278 |

|

|

Total assets |

$ |

877,032 |

|

|

$ |

586,550 |

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

$ |

62,331 |

|

|

$ |

51,429 |

|

| Accrued taxes |

|

8,594 |

|

|

|

7,302 |

|

| Accrued wages |

|

13,911 |

|

|

|

16,524 |

|

| Accrued other expenses |

|

26,718 |

|

|

|

61,047 |

|

| Client deposits |

|

276,968 |

|

|

|

264,929 |

|

| Current portion of operating

lease liabilities |

|

37,624 |

|

|

|

— |

|

| Current portion of financing

lease liabilities |

|

513 |

|

|

|

— |

|

|

Total current liabilities |

|

426,659 |

|

|

|

401,231 |

|

| Operating lease liabilities,

long-term |

|

268,061 |

|

|

|

— |

|

| Financing lease liabilities,

long-term |

|

51,981 |

|

|

|

— |

|

| Capital lease obligation |

|

— |

|

|

|

50,525 |

|

| Deferred rent and lease

incentives |

|

2,433 |

|

|

|

63,037 |

|

| Other long-term

liabilities |

|

4,004 |

|

|

|

1,992 |

|

|

Total liabilities |

$ |

753,138 |

|

|

$ |

516,785 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity |

|

|

|

| Class A shares, par value $0.001

per share (600,000,000 shares authorized, 51,360,235 and 50,427,390

shares issued and outstanding as of June 30, 2022 and

December 31, 2021, respectively) |

|

51 |

|

|

|

50 |

|

| Class B shares, par value $0.001

per share (100,000,000 shares authorized, 87,115,600 and 86,519,002

shares issued and outstanding as of June 30, 2022 and

December 31, 2021, respectively) |

|

87 |

|

|

|

87 |

|

| Accumulated Deficit |

|

(63,884 |

) |

|

|

(116,581 |

) |

| Additional Paid-in

Capital |

|

187,640 |

|

|

|

186,209 |

|

|

Total Arhaus, Inc. stockholders' equity |

|

123,894 |

|

|

|

69,765 |

|

|

Total liabilities and stockholders' equity |

$ |

877,032 |

|

|

$ |

586,550 |

|

|

|

|

|

|

|

|

|

|

|

Arhaus, Inc. and SubsidiariesCondensed

Consolidated Statements of Comprehensive Income

(Unaudited, amounts in thousands, except share and per

share data) |

| |

|

|

|

| |

Six months endedJune 30, |

|

Three months endedJune 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

| Net revenue |

$ |

552,565 |

|

|

$ |

355,357 |

|

$ |

306,265 |

|

|

$ |

184,043 |

| Cost of goods sold |

|

321,822 |

|

|

|

207,188 |

|

|

173,239 |

|

|

|

106,209 |

|

Gross margin |

|

230,743 |

|

|

|

148,169 |

|

|

133,026 |

|

|

|

77,834 |

| Selling, general and

administrative expenses |

|

157,622 |

|

|

|

128,177 |

|

|

82,774 |

|

|

|

69,139 |

| Loss on disposal of

assets |

|

— |

|

|

|

14 |

|

|

— |

|

|

|

— |

|

Income from operations |

|

73,121 |

|

|

|

19,978 |

|

|

50,252 |

|

|

|

8,695 |

| Interest expense |

|

2,616 |

|

|

|

2,726 |

|

|

1,316 |

|

|

|

1,359 |

| Other income |

|

(475 |

) |

|

|

— |

|

|

(117 |

) |

|

|

— |

|

Income before taxes |

|

70,980 |

|

|

|

17,252 |

|

|

49,053 |

|

|

|

7,336 |

| Income tax expense |

|

18,283 |

|

|

|

1,204 |

|

|

12,414 |

|

|

|

500 |

|

Net and comprehensive income |

$ |

52,697 |

|

|

$ |

16,048 |

|

$ |

36,639 |

|

|

$ |

6,836 |

| Less: Net income attributable

to noncontrolling interest |

|

— |

|

|

|

9,268 |

|

|

— |

|

|

|

3,951 |

| Net and comprehensive income

attributable to Arhaus, Inc. |

$ |

52,697 |

|

|

$ |

6,780 |

|

$ |

36,639 |

|

|

$ |

2,885 |

| |

|

|

|

|

|

|

|

| Net and comprehensive

income per share, basic |

|

|

|

|

|

|

|

|

Weighted-average number of common shares outstanding, basic |

|

137,662,601 |

|

|

|

112,058,742 |

|

|

137,840,691 |

|

|

|

112,058,742 |

|

Net and comprehensive income per share, basic |

$ |

0.38 |

|

|

$ |

0.06 |

|

$ |

0.27 |

|

|

$ |

0.03 |

| Net and comprehensive

income per share, diluted |

|

|

|

|

|

|

|

|

Weighted-average number of common shares outstanding, diluted |

|

139,394,055 |

|

|

|

112,058,742 |

|

|

139,454,109 |

|

|

|

112,058,742 |

|

Net and comprehensive income per share, diluted |

$ |

0.38 |

|

|

$ |

0.06 |

|

$ |

0.26 |

|

|

$ |

0.03 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Arhaus, Inc. and SubsidiariesCondensed

Consolidated Statements of Cash Flows(Unaudited,

amounts in thousands) |

| |

|

| |

Six months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows from

operating activities |

|

|

|

| Net income |

$ |

52,697 |

|

|

$ |

16,048 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities |

|

|

|

|

Depreciation and amortization |

|

11,995 |

|

|

|

8,909 |

|

|

Amortization of operating lease right-of-use asset |

|

14,508 |

|

|

|

— |

|

|

Amortization of deferred financing fees and interest on finance

lease in excess of principal paid |

|

5,489 |

|

|

|

825 |

|

|

Equity based compensation |

|

1,389 |

|

|

|

427 |

|

|

Deferred tax assets |

|

4,851 |

|

|

|

— |

|

| Derivative expense |

|

— |

|

|

|

29,805 |

|

| Loss on disposal of property,

furniture and equipment |

|

— |

|

|

|

14 |

|

|

Amortization and write-off of lease incentives |

|

(144 |

) |

|

|

(3,801 |

) |

|

Changes in operating assets and liabilities |

|

|

|

|

Accounts receivable |

|

(1,272 |

) |

|

|

132 |

|

|

Merchandise inventory |

|

(64,135 |

) |

|

|

(28,077 |

) |

|

Prepaid and other current assets |

|

(5,095 |

) |

|

|

4,112 |

|

|

Other noncurrent liabilities |

|

264 |

|

|

|

(890 |

) |

|

Accounts payable |

|

15,197 |

|

|

|

616 |

|

|

Accrued expenses |

|

8,728 |

|

|

|

3,852 |

|

|

Operating lease liabilities |

|

(15,401 |

) |

|

|

— |

|

|

Deferred rent and lease incentives |

|

— |

|

|

|

5,415 |

|

|

Client deposits |

|

12,039 |

|

|

|

72,116 |

|

|

Net cash provided by operating activities |

|

41,110 |

|

|

|

109,503 |

|

| |

|

|

|

| Cash flows from

investing activities |

|

|

|

| Purchases of property,

furniture and equipment |

|

(20,355 |

) |

|

|

(13,691 |

) |

|

Net cash used in investing activities |

|

(20,355 |

) |

|

|

(13,691 |

) |

| |

|

|

|

| Cash flows from

financing activities |

|

|

|

| Issuance of related party

notes |

|

— |

|

|

|

(1,000 |

) |

| Proceeds from related party

notes |

|

— |

|

|

|

1,000 |

|

| Principal payments under

capital leases |

|

— |

|

|

|

(127 |

) |

| Principal payments under

finance leases |

|

(50 |

) |

|

|

— |

|

| Shareholder distributions |

|

— |

|

|

|

(12,350 |

) |

| Distributions to

noncontrolling interest holders |

|

— |

|

|

|

(7,865 |

) |

|

Net cash used in financing activities |

|

(50 |

) |

|

|

(20,342 |

) |

|

Net increase in cash, cash equivalents and restricted cash

equivalents |

|

20,705 |

|

|

|

75,470 |

|

| |

|

|

|

| Cash, cash equivalents

and restricted cash equivalents |

|

|

|

| Beginning of period |

|

130,908 |

|

|

|

64,002 |

|

| End of period |

$ |

151,613 |

|

|

$ |

139,472 |

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information |

|

|

|

| Interest paid in cash |

$ |

2,155 |

|

|

$ |

2,799 |

|

| Income taxes paid in cash |

|

15,342 |

|

|

|

1,257 |

|

| Noncash operating

activities: |

|

|

|

|

Lease incentives |

|

4,494 |

|

|

|

665 |

|

| Noncash investing

activities: |

|

|

|

|

Purchase of property, furniture and equipment in accounts

payable |

|

1,673 |

|

|

|

241 |

|

| Noncash financing

activities: |

|

|

|

|

Derecognition of build-to-suit assets as a result of ASC 842

adoption |

|

(31,017 |

) |

|

|

— |

|

|

Capital contributions |

|

43 |

|

|

|

— |

|

|

Arhaus, Inc. and

SubsidiariesReconciliation of Net and

Comprehensive Income to Adjusted Net

Income(Unaudited, amounts in thousands, except

share and per share data) |

| |

|

|

|

| |

Six months ended June 30, |

|

Three months endedJune 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

| Net and comprehensive

income |

$ |

52,697 |

|

$ |

16,048 |

|

$ |

36,639 |

|

$ |

6,836 |

| Adjustments (pre-tax): |

|

|

|

|

|

|

|

|

Derivative expense (1) |

|

— |

|

|

29,805 |

|

|

— |

|

|

18,258 |

|

Other expenses (2) |

|

4,658 |

|

|

618 |

|

|

3,258 |

|

|

2,504 |

|

Total non-GAAP adjustments pre-tax |

|

4,658 |

|

|

30,423 |

|

|

3,258 |

|

|

20,762 |

| Less: Tax effect of

adjustments (3)(4) |

|

1,202 |

|

|

— |

|

|

827 |

|

|

— |

| Adjusted net income |

$ |

56,153 |

|

$ |

46,471 |

|

$ |

39,070 |

|

$ |

27,598 |

| |

|

|

|

|

|

|

|

| Adjusted net income

per share, basic |

|

|

|

|

|

|

|

|

Weighted-average number of common shares outstanding,

basic |

|

137,662,601 |

|

|

112,058,742 |

|

|

137,840,691 |

|

|

112,058,742 |

|

Adjusted net income per share,

basic |

$ |

0.41 |

|

$ |

0.41 |

|

$ |

0.28 |

|

$ |

0.25 |

| Adjusted net income

per share, diluted |

|

|

|

|

|

|

|

|

Weighted-average number of common shares outstanding,

diluted |

|

139,394,055 |

|

|

112,058,742 |

|

|

139,454,109 |

|

|

112,058,742 |

|

Adjusted net income per share,

diluted |

$ |

0.40 |

|

$ |

0.41 |

|

$ |

0.28 |

|

$ |

0.25 |

|

|

|

|

|

|

|

|

|

(1) We repaid our term loan in full on December 28, 2020. The

derivative expense relates to the change in the fair value of the

exit fee at the end of each reporting period. The Company used a

portion of the net proceeds from the IPO to pay the derivative

liability on November 8, 2021.

(2) Other expenses (income) represent costs and investments not

indicative of ongoing business performance, such as third-party

consulting costs, one-time project start-up costs, severance,

signing bonuses, recruiting and project-based strategic

initiatives. For the six and three months ended June 30, 2022,

these other expenses consisted largely of $3.1 million and $2.5

million of costs related to the opening and set-up of our Dallas

distribution center, respectively.

(3) The Company applied its normalized tax rate of 25.8% and

25.3% to the adjustment for the six and three months ended June 30,

2022, respectively.

(4) Prior to the Reorganization and IPO, the Company was a

limited liability company under the Internal Revenue Code with a

partnership tax election and did not pay federal or most state

corporate income taxes on its taxable income. Accordingly, the

adjustments for the six and three months ended June 30, 2021 are

not tax affected.

|

Arhaus, Inc. and

SubsidiariesReconciliation of Net and

Comprehensive Income to Adjusted EBITDA(Unaudited,

amounts in thousands) |

| |

|

|

|

| |

Six months endedJune 30, |

|

Three months endedJune 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

| Net and comprehensive

income |

$ |

52,697 |

|

$ |

16,048 |

|

$ |

36,639 |

|

$ |

6,836 |

| Interest expense |

|

2,616 |

|

|

2,726 |

|

|

1,316 |

|

|

1,359 |

| Income tax expense |

|

18,283 |

|

|

1,204 |

|

|

12,414 |

|

|

500 |

| Depreciation and

amortization |

|

11,995 |

|

|

8,909 |

|

|

6,119 |

|

|

4,446 |

| EBITDA |

|

85,591 |

|

|

28,887 |

|

|

56,488 |

|

|

13,141 |

| Equity based compensation |

|

1,389 |

|

|

427 |

|

|

692 |

|

|

351 |

| Derivative expense (1) |

|

— |

|

|

29,805 |

|

|

— |

|

|

18,258 |

| Other expenses (2) |

|

4,658 |

|

|

618 |

|

|

3,258 |

|

|

2,504 |

| Adjusted EBITDA |

$ |

91,638 |

|

$ |

59,737 |

|

$ |

60,438 |

|

$ |

34,254 |

|

|

|

|

|

|

|

|

|

(1) We repaid our term loan in full on December 28, 2020. The

derivative expense relates to the change in the fair value of the

exit fee at the end of each reporting period. The Company used a

portion of the net proceeds from the IPO to pay the derivative

liability on November 8, 2021.

(2) Other expenses (income) represent costs and investments not

indicative of ongoing business performance, such as third-party

consulting costs, one-time project start-up costs, severance,

signing bonuses, recruiting and project-based strategic

initiatives. For the six and three months ended June 30, 2022,

these other expenses consisted largely of $3.1 million and $2.5

million of costs related to the opening and set-up of our Dallas

distribution center, respectively.

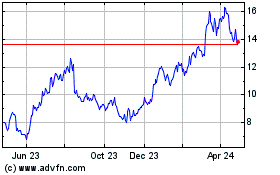

Arhaus (NASDAQ:ARHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

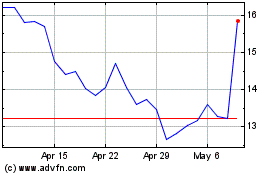

Arhaus (NASDAQ:ARHS)

Historical Stock Chart

From Apr 2023 to Apr 2024