Alliance Resource Partners, L.P. Declares Quarterly Distribution of $0.70 Per Unit

29 January 2025 - 8:50AM

Business Wire

Alliance Resource Partners, L.P. (NASDAQ: ARLP) today announced

that the Board of Directors of ARLP’s general partner approved a

cash distribution to its unitholders for the quarter ended December

31, 2024 (the "2024 Quarter").

ARLP unitholders of record as of the close of trading on

February 7, 2025 will receive a cash distribution for the 2024

Quarter of $0.70 per unit (an annualized rate of $2.80 per unit),

payable on February 14, 2025. The announced distribution is

consistent with the cash distributions of $0.70 per unit for the

quarters ended December 31, 2023 and September 30, 2024.

As previously announced, ARLP will report financial results for

the 2024 Quarter before the market opens on Monday, February 3,

2025 and Alliance management will discuss these results during a

conference call beginning at 10:00 a.m. Eastern that same day.

To participate in the conference call, dial (877) 407-0784 and

request to be connected to the Alliance Resource Partners, L.P.

earnings conference call. International callers should dial (201)

689-8560 and request to be connected to the same call. Investors

may also listen to the call via the "Investors" section of ARLP’s

website at www.arlp.com.

An audio replay of the conference call will be available for

approximately one week. To access the audio replay, dial U.S. Toll

Free (844) 512-2921; International Toll (412) 317-6671 and request

to be connected to replay using access code 13750955.

Concurrent with this announcement we are providing qualified

notice to brokers and nominees that hold ARLP units on behalf of

non-U.S. investors under Treasury Regulation Section 1.1446-4(b)

and (d) and Treasury Regulation Section 1.1446(f)-4(c)(2)(iii).

Brokers and nominees should treat one hundred percent (100%) of

ARLP’s distributions to non-U.S. investors as being attributable to

income that is effectively connected with a United States trade or

business. In addition, brokers and nominees should treat one

hundred percent (100%) of the distribution as being in excess of

cumulative net income for purposes of determining the amount to

withhold. Accordingly, ARLP’s distributions to non-U.S. investors

are subject to federal income tax withholding at a rate equal to

the highest applicable effective tax rate plus ten percent (10%).

Nominees, and not ARLP, are treated as the withholding agents

responsible for withholding on the distributions received by them

on behalf of non-U.S. investors.

About Alliance Resource Partners, L.P.

ARLP is a diversified energy company that is currently the

second largest coal producer in the eastern United States,

supplying reliable, affordable energy domestically and

internationally to major utilities, metallurgical and industrial

users. ARLP also generates operating and royalty income from

mineral interests it owns in strategic coal and oil & gas

producing regions in the United States. In addition, ARLP is

evolving and positioning itself as a reliable energy partner for

the future by pursuing opportunities that support the advancement

of energy and related infrastructure.

News, unit prices and additional information about ARLP,

including filings with the Securities and Exchange Commission

("SEC"), are available at www.arlp.com. For more information,

contact the investor relations department of ARLP at (918) 295-7673

or via e-mail at investorrelations@arlp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128421549/en/

Investor Relations Contact

Cary P. Marshall Senior Vice President and Chief Financial

Officer 918-295-7673 investorrelations@arlp.com

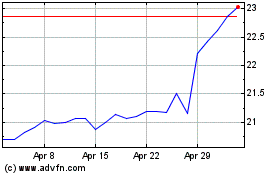

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Jan 2025 to Feb 2025

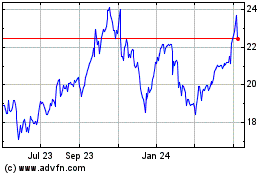

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Feb 2024 to Feb 2025