| |

Filed by Arrowroot Acquisition Corp.

pursuant to Rule 425 under the Securities

Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Arrowroot Acquisition Corp.

Commission File No. 001-40129

Date: June 6, 2023 |

C

O R P O R A T E P A R T I C I P A N T S

Harish

Chidambaran, Founder and Chief Executive Officer, iLearningEngines

Matthew

Safaii, Founder, Arrowroot Capital

Farhan

Naqvi, Chief Financial Officer, iLearningEngines

Tom

Olivier, President and Chief Financial Officer, Arrowroot Acquisition Corp.

P

R E S E N T A T I O N

Harish

Chidambaran

Hello.

It is a pleasure to present iLearningEngines to all of you. I am Harish Chidambaran, Founder and CEO of iLearningEngines.

iLearningEngines is an enterprise AI platform for learning and work automation and information intelligence. Companies use our

platform to productize their institutional knowledge, to make their institutional knowledge into valuable IP used to drive mission

critical outcomes at scale.

Before

we begin, I would like to note that this presentation contains forward-looking statements, including iLearningEngines’s

and Arrowroot’s expectations of future financial and business performance and conditions, and the industry outlook. Forward-looking

statements are subject to risks and uncertainties. The information discussed today is qualified in its entirety by the filings with the

Securities and Exchange Commission that have been filed to date and will be filed in the future by Arrowroot Acquisition Corp.

Turning

to the business, we are an AI platform at scale, powering 3.2 million users. We have invested over 100,000 hours of R&D to build

a proprietary AI and learning platform and what we consider a category defining company in the area of learning in work automation and

information intelligence. We believe we are a disruptor in the world of learning and work automation, largely driven by our specialized

data sets, and a strong supervision of our AI outputs, which is a huge value add versus the uncontrolled Open AI approaches out there.

Enterprises can get both the power of AI without the downside risks. The result is one of the fastest growing technology companies over

the past few years, while being profitable.

Starting

at Slide 8 of our Investor Deck, I want to touch on some of the key highlights for the Company. We closed 2022 with GAAP revenue of $309

million, a 42% growth over the previous year. The Company has strong gross margin of 70%, and a strong net dollar retention rate of 119%,

largely on the back of our organic growth strategy. As we go forward with our partnership with Arrowroot, we will look to compliment

that organic growth with a strong M&A strategy as well. We have been able to generate this growth while also achieving profitability.

We achieved $12 million dollars in EBITDA in 2022.

What

is really exciting is that we are addressing an enormous market opportunity here at the intersection of two $200-plus billion plus markets,

the global AI, and the global e-learning markets, so there is tremendous room for growth for many years to come.

We

are an AI powered learning automation and information intelligence platform. We have a very strong and specific use cases, using AI to

improve learning and learning automation inside organizations. We think this is a very critical use of AI, and as I just noted, we think

it will be an enormously large addressable market.

We

met the Arrowroot team almost a year ago and have worked very closely with them since then. They bring a deep understanding of and a

very strong track record in both enterprise software and mergers and acquisitions. Having them as a partner in this journey is something

we are very excited about.

Let

me now introduce Matthew Safaii.

Matthew

Safaii

Thanks

Harish, I am Matthew Safaii, the Founder of Arrowroot Capital. We are equally excited about this partnership. As Harish stated, this

is an AI business, which we believe is the most exciting sector in the world right now. iLearningEngines has a proven enterprise grade

learning automation platform, and they are doing it at scale.

With

me is Tom Olivier, President and CFO of Arrowroot Acquisition Corporation, the privately sponsored SPAC, with a profile on Slide 10.

Arrowroot

Capital is a 10-year-old growth equity firm focused solely on enterprise software. Over two years ago we started Arrowroot Acquisition

Corporation, and the overarching thesis was that we were going to look for category defining software businesses. We believe we certainly

found one of those here with iLearningEngines and this is why we are excited about this transaction.

To

further go on why are we excited? Let me provide some reasons on Slide 11. We are talking about a valuation of roughly a 3x 2023 ARR

for a recurring revenue business with a substantial portion of revenue that is already contracted. We think that's a very attractive

valuation. The Company is in rarified air when it comes to the size and metrics of a private business that is coming public. They've

been profitable, and as Harish likes to say, they’ve been profitable before it was in vogue. This is an extremely cash efficient

business, extremely sticky business. It's in a massive, exciting market in AI. It's got a global and diverse customer base.

Finally,

we believe there's a big opportunity for M&A here. Harish will go into how this technology makes other platforms better with its

AI technology. We believe that there are many $5 million to $20-plus million ARR businesses is this space to be consolidated, and as

a public entity, we'd be able to do that. And of course, it's a fantastic management team that we’re excited to partner with.

With

that background, let me turn it back over to Harish to walk you through some details.

Harish

Chidambaran

So

beginning on Slide 13, we are positioned to be a category disruptor in the area of AI, and its very specific use case around learning

and work automation. We feel like we have a very strong first mover advantage, we have built some very significant moats in our business

especially around our specialized learning and engagement data sets. Learning and work automation is a product really positioned at the

intersection of two very large markets, our $200-plus billion global e-learning market and a similar sized global AI market. At the intersection

of these two is a sweet spot around learning automation. We feel like this is a category defining opportunity that impacts several industry

verticals.

Turning

to Slide 14, in addition to the sheer size of the market opportunity, we have two specific tailwinds behind us. First is the demand for

automation and autonomous learning inside enterprises. The corporate learning market is one of the fastest growing markets with significant

tailwinds, and there is big demand for automation here.

The

second strong trend is a desire to productize enterprise knowledge. Historically, we heard things like the McKinsey way, the Amazon way,

the HP way. This kind of institutional knowledge has built over time, and people actually coming into work every day. As we move towards

a more distributed work environment, there's a strong need for a platform for every company to really preserve institutional knowledge

and enhance institutional knowledge. In particular, education systems need to build out learning products that can expand revenue. So,

the private education market is an area where we have seen strong interest.

On

the back of these two trends, we think there's a tremendous opportunity for us.

Turning

to Slide 16. iLearning at its core. is a learning automation and information intelligence platform. We work inside organizations. Companies

use our platform to productize their institutional knowledge, to make their institutional knowledge into valuable IP used to drive mission

critical outcomes at scale.

When

we go into any company, the first thing we do is help them build out an intelligent Knowledge Cloud, which you can think of as the enterprise

brain, or productization of institutional knowledge. All the content that is home grown inside the enterprise, any content the Company

has licensed from third parties, or from the open Internet, this is the place all that gets stored. Our AI platform is able to ingest

that content, convert it into learning and knowledge artifacts and embed intelligence into these artifacts.

For

example, a platform can take a PDF document or a video and convert that content into a course or learning module, embedding a lot of

intelligence into it as it gets stored in the Knowledge Cloud. Once the Knowledge Cloud has been built, our product uses what's called

a no-code AI canvas to help set up workflows to connect it to this Knowledge Cloud and the content from this Knowledge Cloud is then

used broadly to do three things.

One,

to feed that content into a learning automation ecosystem, an autonomous learning infrastructure, so companies can deliver very company-specific

training to their employees and other stakeholders.

Second,

this content is fed into various enterprise expert chat bots of cognitive assistance so subject matter expertise around every process

is available to the users at their fingertips.

The

third thing is you can take this content from the Knowledge Cloud and feed it into various smart decision-making systems such as smart

risk management systems inside insurance companies.

So,

using this Knowledge Cloud as the core infrastructure, we are able to deliver highly cross functional and multi-vertical offerings into

various enterprises business units.

Matthew

Safaii

We

were very impressed when we saw what iLearning can do. What this business does, is integrates into all the various corporate systems,

human capital systems, CRM, Slack channels, etc, as well as all the various interactions and content within an organization and it creates

this Knowledge Cloud. Then via AI in automated fashion can create ingestible content for the learner and curriculums around it including

creating quizzes and various whatnots around it using AI.

So,

the Knowledge Cloud is changing, so is the curriculum, and this makes the best outcome for the end user. That's the paradigm shift in

this market. That's the power of AI and that's what iLearning has created.

Harish

Chidambaran

Turning

to Slide 17, what we are really excited about is that we’re disrupting this category. We have pioneered the concept of learning

automation and autonomous learning inside enterprises. What we are doing to the learning world is similar to what Apple and Google have

done with their smartphones, or what Slack and Zoom have done to the Communications industry. We are very excited about the kind of power

we have here.

On

Slide 18 we have been spending a significant amount of time building our own AI platform, we have invested over 100,000 hours of R&D

to develop 40-plus proprietary algorithms. The core team at iLE has come from Silicon Valley from the pedigree of computer architectures,

microprocessor design, and building highly robust scalable systems. That's really what we set out to build here, a proprietary AI platform

that can truly transform learning inside the enterprise. Over to you Matt.

Matthew

Safaii

iLearning

has met with a lot of Fortune 500 companies, in the past 60 days, what we’ve seen, that’s completely unscheduled, is that

these companies are bringing in the CEO to the meetings. It’s because AI technology is a global strategy for them, and they have

to learn about it.

One

of their fears with Chat GPT is that it might go off the rails and say something out of their control. This is due to ingesting all public

data. With iLearning you're using a definitive data set from the enterprise, so it'll stay within that sort of buffer zone. In learning,

corporate or and even ed-tech, you can't go off the rails and that's what iLearningEngines protects. They bring in the subset data points

to train the machine up.

Harish

Chidambaran

Matt,

that's very well said. When it comes to any mission critical application close enough is not good enough, you have to be absolutely right.

Now I just want to focus on a few key accelerators and what some of the capabilities are.

Starting

on Slide 19, the core of what iLE has is what we call a no-code AI canvas. This canvas provides the ability to integrate to all the various

systems inside an organization. So, we have a fully integrated platform without writing custom code. This AI canvas allows you to integrate

to all the systems inside the enterprise. The platform is also used to set up various workflows to connect to the Knowledge Cloud. Using

these integrations, iLE is able to extract both process gaps and competency gaps. So, if you are an e-commerce company, you can look

at this and say, hey, how are we doing on our supply chain metrics? Or if you're an oil and gas company, how are we doing on safety metrics,

both from a process perspective and a human competency perspective.

Turning

to Slide 20. On the other side, our platform now connects to all the different content systems, homegrown systems, content that's licensed,

all content from the open Internet. iLE, in an automated or intelligent fashion, is then able to deliver this content to end users to

remedy any process or competency gaps, and this content is delivered through the various systems of productivity inside the company.

For

example, if a company is using Microsoft teams inside their enterprise or Slack, the content is delivered to such messenger channels.

So, in many ways, iLE is kind of embedded inside the enterprise, running in the background is what we call the GPS of learning.

Moving

to Slide 21, another significant capability of the iLE is the ability to augment existing content. While we don't do independent content

offering or development, what we are able to do is help organizations take existing content from the enterprise, whether it's in a PDF

format, or any other format like video or audio, our AI is able to scan a paragraph inside a document and generate questions around what's

being discussed in the paragraph. Identify where the answers are. Where the review sections are. So, in a very short time, we are able

to take a base content, and convert it to a learning modular course.

Subject

matter experts around each process inside the enterprise can take what the AI is putting out there and tailoring it for their most specific

users and most specific needs. This is an example of where AI is really a productivity enhancer. Without this the process of converting

content into a course, it would take much longer and would be much more expensive to create a course. Using our technology companies

can create learning artifacts and have a content strategy that is really disruptive.

Turning

to Slide 22 we do the same thing with content in audio or video form. So, using these capabilities, companies can create a vast array

of learning prescriptions which are then stored into the Knowledge Cloud. The Knowledge Cloud can be viewed as where all the enterprise

content is managed as Enterprise IP and owned by the Enterprise IP.

Moving

to Slide 23 you can almost think of the Knowledge Cloud as the company brain. The Company’s entire institutional knowledge is established

here. As I said earlier, this need to productize institutional knowledge has never been greater. We have gone to a world where we are

very much in a very distributed work environment today. The big concern for most companies is, if we are now pivoting to a distributed

workplace, how do we create and build this company knowledge and culture? The Knowledge Cloud, we think, is a very strong representation

of that.

By

disrupting both the cost and effort involved in building content, we are able to impact learning at scale, for applications that go well

beyond learning into broader work automation.

On

Slide 24 I want to spend a few minutes just talking about our specialized data sets, which we think create a very strong, competitive

moat. One of the key things in intelligent learning is to understand how people engage with learning content. So, if you are an enterprise

shipping company, how are people inside the enterprise engaging with safety or maintenance content? How do finance folks engage with

compliance or other training content? This is highly specialized data that we are able to generate inside these organizations. This is

not content that is available readily available out there, and this creates very significant competitive moat.

Turning

to Slide 25, I just want to talk a little bit about a case study that brings this all together. We had a shipping company that came to

us because they were recovering from a significant accident. Most companies wouldn’t get a second chance from something like this.

They were fortunate to get a second chance, and they knew they wouldn't get a third chance. So, their big problem was, how do we make

sure accidents like this don’t happen again, how do we stop it? It was no longer a theoretical decision of what kind of learning

is better, audio or video, in-house versus online, it is how do we put a system of learning in place to reduce employee errors.

The

first thing that we did was to help them create the institutional Knowledge Cloud, the institutional cloud built on the key KPIs. On

the other side, our AI was integrating to the various systems, like the crew manifest systems and the vessel management systems to really

capture process and competency gaps. The system was rolled out, and what we saw was the amount of content being consumed in the organization

went up 58 times, but the key thing was the impact around the various metrics. The company achieved 130% increase in eye on safety cards

and had zero time lost due to injuries over the last three years.

I

want to pivot to our go-to-market strategy on Slide 26. Today, iLE is in 12 industry verticals, today supporting 1,000 plus end-customers.

We have a Channel strategy that allows us to go into these verticals with Channel partners who bring an expertise and understanding of

these industry verticals.

A

core aspect of our selling is proof of concept-based selling, and what we call it a defined POC. The power of seeing how iLE works inside

their own network is very powerful, and for us this has been incredibly successful, historically we’ve had over 70% conversion

rate on our POCs. This has allowed us to have an efficient sales cycle of around six to eight months.

On

top of this organic growth opportunity, there's an opportunity here, from an M&A perspective, particularly in the learning world.

There are a lot of very fragmented players, largely with legacy technology products.

Matthew

Safaii

I

do want to stress the M&A strategy. eLearning is a fragmented market in various sub sectors, in tech and in corporate training, where

iLearning could make target company’s product better, especially as we absorb subset data sets and create curriculums around them.

This is something that Arrowroot Capital really can help with.

Harish

Chidambaran

The

last thing I want say is the ability for us to build an iLE inside ecosystem, much like the intel inside strategy that we all heard about.

The opportunity for us to build an ecosystem where iLE AI is powering content players, software players, and data and analytics players

is incredibly exciting.

Turning

to our pricing strategy, there are two key components in our pricing strategy. iLE has both a per user strategy as well as a per subject

matter expert strategy. Subject matter would be staff level people within organizations who can be seen as the gatekeepers of institutional

knowledge.

Turning

now to Slide 27, as I mentioned, we work very closely with our Channel partners. We have some concentration with our Channel partners,

but each of these Channel partners has a number of end customers behind them.

Turning

now to the competitive environment on Slide 29. As a learning automation platform, we feel there are two broad markets of competitors.

One is the legacy learning platforms with companies such as Cornerstone, Skillsoft, etc. These are typically companies who sell to HR

departments inside enterprises. At iLE, we are always focused on selling into the business units. One of the key requirements for any

business unit is they want us to be integrated into the various systems, take their content, augment that for learning and deliver that

learning into their various messaging channels.

The

other competitive group is really the traditional AI ML platforms. The legacy AI players, like IBM Watson and others. One of our biggest

differentiators is our specialized data sets, and our no code AI that allows us to integrate with enterprise systems and simplify implementation.

In

both of these categories we feel like we have a pretty strong competitive advantages. That said, there are always new players coming

into the market, and will continue to work very hard to keep our edge.

With

that, I would like to hand it over to our CFO Farhan.

Farhan

Naqvi

Thanks,

Harish, and hello everyone. I am Farhan Naqvi, the CFO of iLearningEngines. I would like to start with a high-level overview of the Company’s

financials on Slide 31.

In

the last year alone, we grew our business north of 40% from about $218 million in 2021 to $309 million last year. This year we are on

track to achieve our projection of about $419 million in revenue.

We

are an AI first, R&D company, and the growth highlighted above has primarily been driven by the investments that we've made into

our R&D and product development. To give you an idea, our R&D spend last year was about 32% of our revenue base, which is significantly

higher than the industry average, and in the top right quadrant of even the most R&D focused software companies. We have funded this

investment and generated this growth while being profitable. We broke even for the first time in 2020 and have been EBITDA positive since

then. The heavy R&D and Sales & Marketing spends also provides us very important tools to closely manage our cash flow going

forward. I'll get into the details on this point in a few minutes.

Turning

to Slide 32 I’ll dig deeper into the quality of the revenue, and within that I would like you to take note of two key points.

First,

is the recurring nature of the revenue. As illustrated in the P&L in the appendix, almost 97% of our revenue is subscription based,

and hence recurring in nature and that shows up complete in our ARR.

The

second point is the high retention rates. Given this product is built on a platform basis, the retention rates that we have are very

high. We had net retention of 119% in 2022.

On

Slide 33 I’ll shift briefly to what does the future look like for us? We expect the growth rates to remain at this high level.

We expect to improve our margin in the short term. A significant portion of that improvement will come from our ability to reduce the

R&D as a percentage of revenue. While the absolute amount of R&D expense will continue to be high, as a percentage, we expect

it will come down moving forward as we grow our revenue.

The

last thing that I would like to draw your attention to is the visibility of the pipeline. Most of our contracts are multi-year in nature,

which gives us very good visibility into the numbers that we project out for this year, and for the year going forward.

That

concludes the high-level overview. I will now turn it over to Tom to cover some details of the transaction.

Tom

Olivier

Thanks

Farhan. I’d like to take a few minutes to walk through the DeSPAC transaction on Slide 36. We are valuing the Company with a total

enterprise value of $1.4 billion at the close of the combination. That represents an implied pro forma enterprise value to revenue multiple

of 3.3x for calendar year 2023. The purchase multiple assumes revenue of $419 million for 2023.

The

transaction is going to be funded via about $145 million in gross cash proceeds. The proceeds are to come from as follows: $100 million

will come from additional financing that we will endeavor to raise here between signing and closing. Approximately $45 million is currently

in the Arrowroot Acquisition Trust.

As

Matt alluded to earlier, the net cash proceeds that are going to the balance sheet here will be used to continue to fund research and

development, and to pursue what we think will be a very robust M&A strategy. A portion of the cash may be used to extinguish existing

debt.

It’s

important to note that both management and existing investors are rolling a very significant portion of their holdings into this transaction.

We view this as not an endpoint, but a first step in the evolution of iLearningEngines to become a category defining entity going forward.

On

Slide 37 we provide a comp group split into two parts, the first are Ed Tech companies and the second are high growth mission critical

software companies. The key takeaway here is that iLearning is right at the top end of the range in terms of expected 2023 revenue growth.

Their expected growth rate is well above the 25% average for the peer companies, with only Snowflake and Cloudflare expected to grow

faster.

On

Slide 38 you can see the valuations of this peer group, and we think based on this investors will be getting in at an attractive valuation.

As I said earlier, we're valuing iLearningEngines at approximately 3.3 times current year's revenue. This is a significant discount to

our public company peers, where the mean valuation is 9.2x. So we priced this deal at a value that we think delivers extreme value to

shareholders coming into the transaction, and we expect their investment to drive our M&A and growth strategy.

Looking

finally at Slide 39 we are highlighting the scarcity of quality assets in the EDtech, and frankly, AI markets. We think iLE is going

to be positioned as a premium asset. It has both scale and growth and proprietary technology, which we think will make it the category

leader we've been talking about.

With

that, let me turn it back over to Harish to wrap things up.

Harish

Chidambaran

Thanks

Tom. Like Tom mentioned, we are rolling almost all our equity into this transaction because we are very bullish about where we are taking

this company. We have a chance to be a category defining company around learning and work automation. As a company we historically have

had very top tier SaaS metrics, strong retention, strong sales, and efficiencies.

We

are a profitable high growth company at scale. We have a highly differentiated AI product that is filling an enormous need in the area

of learning. This industry has significant tailwinds. We have a highly diversified base of customers, and we are very excited about our

strategy ahead.

We

are building this on the back of a very strong, operationally focused Management team. Our focus is going to be on scaling that strong

foundation further as we continue to grow.

Thank

you.

Forward-Looking Statements Legend

This communication contains certain forward-looking statements within

the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 with respect

to the proposed transaction (“Business Combination”) between iLearningEngines, Inc. (“iLearningEngines”) and Arrowroot

Acquisition Corp. (“ARRW”). These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “propose,” “forecast,” “expect,”

“seek,” “target” “may,” “should,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions,

projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject

to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in

this document, including but not limited to: (i) the risk that the Business Combination may not be completed in a timely manner or at

all, which may adversely affect the price of ARRW’s securities, (ii) the risk that the Business Combination may not be completed

by ARRW’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if

sought by ARRW, (iii) the failure to satisfy the conditions to the consummation of the Business Combination, including the adoption of

the Merger Agreement by the shareholders of ARRW, the satisfaction of the minimum amount following redemptions by ARRW’s public

shareholders and the receipt of certain governmental and regulatory approvals in the Trust Account, (iv) the lack of a third party valuation

in determining whether or not to pursue the Business Combination, (v) the inability to complete the transactions contemplated by the Forward

Purchase Agreement (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger

Agreement, (vii) the effect of the announcement or pendency of the transaction on iLearningEngines’s business relationships, operating

results, and business generally, (viii) risks that the Business Combination disrupts current plans and operations of iLearningEngines,

(ix) the outcome of any legal proceedings that may be instituted against iLearningEngines or against ARRW related to the Merger Agreement

or the Business Combination, (x) the ability to maintain the listing of ARRW’s securities on a national securities exchange, (xi)

changes in the competitive and regulated industries in which iLearningEngines operates, variations in operating performance across competitors,

changes in laws and regulations affecting iLearningEngines’s business and changes in the combined capital structure, (xii) the ability

to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize

additional opportunities, (xiii) the risk of downturns and a changing regulatory landscape in the highly competitive retail e-commerce

industry, (xiv) the potential benefits of the Business Combination (including with respect to shareholder value), (xv) the effects of

competition on iLearningEngines’s future business, (xvi) risks related to political and macroeconomic uncertainty, (xvii) the amount

of redemption requests made by ARRW’s public shareholders, (xviii) the ability of ARRW or the combined company to issue equity or

equity-linked securities in connection with the Business Combination or in the future and (xix) the impact of the COVID-19 pandemic. The

foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of ARRW’s registration on Form S-1 (File No. 333-252997), the registration statement

on Form S-4 discussed below and other documents filed, or to be filed, by ARRW from time to time with the SEC. These filings identify

and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and iLearningEngines and ARRW assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither iLearningEngines nor ARRW

gives any assurance that either iLearningEngines or ARRW, or the combined company, will achieve its expectations.

Additional Information and Where to Find It

The Business Combination will be submitted to the shareholders of ARRW

for their consideration and approval at the special meeting of shareholders (the “Special Meeting”). ARRW intends to

file a registration statement on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”), which will

include a document that serves as a prospectus and proxy statement of ARRW, referred to as a proxy statement/prospectus. A proxy statement/prospectus

will be sent to all ARRW shareholders. The proxy statement/prospectus will contain important information about the Business Combination

and the other matters to be voted upon at the Special Meeting. ARRW also will file other documents regarding the Business Combination

with the SEC. Before making any voting decision, investors and security holders of ARRW are urged to read the registration statement,

the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed

transaction as they become available because they will contain important information about the Business Combination.

Investors and security holders will be able to obtain free copies of

the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by

ARRW through the website maintained by the SEC at www.sec.gov.

The documents filed by ARRW with the SEC also may be obtained free

of charge upon written request to Arrowroot Acquisition Corp., 4553 Glencoe Ave, Suite 200, Manta Del Rey, California 90292.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED

OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE BUSINESS COMBINATION

OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in Solicitation

ARRW, iLearningEngines and certain of their respective directors and

executive officers and other members of management and employees may, under SEC rules, be deemed participants in the solicitation of proxies

from ARRW’s shareholders in connection with the Business Combination. ARRW shareholders and other interested persons may obtain,

without charge, more detailed information regarding the directors and officers of ARRW in ARRW’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, which was filed with the SEC on March 31, 2023. To the extent that holdings of ARRW’s securities

have changed from the amounts reported in such Form 10-K, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of

proxies to ARRW shareholders in connection with the Business Combination and other matters to be voted upon at the Special Meeting will

be set forth in the proxy statement/prospectus when available. You may obtain free copies of these documents as described in this communication.

Shareholders and other investors should read the proxy statement/prospectus carefully when it becomes available before making any voting

or investment decisions.

Disclaimer

This communication relates to a proposed transaction between iLearningEngines

and ARRW. This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any

securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

10

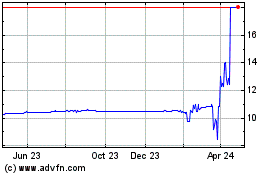

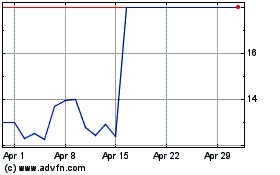

Arrowroot Acquisition (NASDAQ:ARRW)

Historical Stock Chart

From Feb 2025 to Mar 2025

Arrowroot Acquisition (NASDAQ:ARRW)

Historical Stock Chart

From Mar 2024 to Mar 2025