Assertio Announces Exchange Offer of $30 Million of its Currently Outstanding 6.50% Convertible Senior Notes Due 2027

23 February 2023 - 11:14PM

Assertio Holdings, Inc. (“Assertio”) (NASDAQ: ASRT), a specialty

pharmaceutical company offering differentiated products to

patients, today announced it has entered into separate, privately

negotiated exchange agreements (the “Exchange Agreements”) with a

limited number of holders of Assertio’s currently outstanding 6.50%

Convertible Senior Notes due 2027 (the “Exchanged Notes”).

“Our preliminary 2022 results reported earlier

this week demonstrated strong cash flows from operations, leading

to this opportunity to improve our balance sheet even as we

continue to evaluate new growth opportunities,” said Dan Peisert,

Chief Executive Officer. “These transactions reduce our overall

debt by $30.0 million, or 42.9%, while consuming only $10.5 million

in cash. In addition, the transactions will save the Company $2.0

million in annual interest payments, reduce the potential dilution

from the exchanged convertible notes by 4.6%, and will be accretive

to our diluted EPS by $0.02 in 2023.”

Pursuant to the Exchange Agreements, Assertio

will exchange $30.0 million aggregate principal amount of Exchanged

Notes for a combination of (a) a cash payment and (b) an agreed

number of shares of Assertio’s common stock. Assertio will pay an

aggregate of $10.5 million in cash and issue an aggregate of

approximately 7.0 million shares of its common stock in the

transactions. Assertio will not receive any cash proceeds from the

issuance of the shares of its common stock.

The transactions are subject to customary

closing conditions and are expected to close on February 27, 2023.

The shares of Assertio’s common stock will be issued in private

placements exempt from registration in reliance on Section 4(a)(2)

of the Securities Act of 1933, as amended (the “Securities

Act”).

Upon completion of the transactions, Assertio

expects to have $40.0 million aggregate principal remaining

outstanding on its 6.50% Convertible Senior Notes due 2027.

SVB Securities LLC acted as Sole Exchange Agent

and Financial Advisor to Assertio in connection with the

transactions and Gibson, Dunn & Crutcher LLP acted as legal

counsel to Assertio.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Assertio

Assertio is a specialty pharmaceutical company offering

differentiated products to patients utilizing a non-personal

promotional model. We have built and continue to build our

commercial portfolio by identifying new opportunities within our

existing products as well as acquisitions or licensing of

additional approved products. To learn more about Assertio, visit

www.assertiotx.com.

Forward Looking Statements

Statements in this communication that are not

historical facts are forward-looking statements that reflect

Assertio's current expectations, assumptions and estimates of

future performance and economic conditions. These forward-looking

statements are made in reliance on the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These

forward-looking statements relate to, among other things, the

preliminary, unaudited financial results included in this press

release, future events or the future performance or operations of

Assertio, including our ability to realize the benefits from our

operating model, successfully acquire and integrate new assets and

explore new business development initiatives. All statements other

than historical facts may be forward-looking statements and can be

identified by words such as "anticipate," "believe," "could,"

"design," "estimate," "expect," "forecast," "goal," "guidance,"

"imply," "intend," "may", "objective," "opportunity," "outlook,"

"plan," "position," "potential," "predict," "project,"

"prospective," "pursue," "seek," "should," "strategy," "target,"

"would," "will," "aim" or other similar expressions that convey the

uncertainty of future events or outcomes and are used to identify

forward-looking statements. Such forward-looking statements are not

guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond the

control of Assertio, including the risks described in Assertio's

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed

with the U.S. Securities and Exchange Commission ("SEC") and in

other filings Assertio makes with the SEC from time to time.

Investors and potential investors are urged not to place undue

reliance on forward-looking statements in this communication, which

speak only as of this date. While Assertio may elect to update

these forward-looking statements at some point in the future, it

specifically disclaims any obligation to update or revise any

forward-looking-statements contained in this press release whether

as a result of new information or future events, except as may be

required by applicable law.

Investor Contact

Matt KrepsDarrow Associates Investor

Relations+1-214-597-8200mkreps@darrowir.com

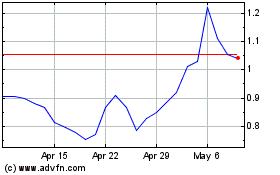

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2024 to May 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From May 2023 to May 2024