Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283850

PROSPECTUS

Asset Entities Inc.

2,412,976 Shares of Class B Common Stock

This prospectus relates to the offer and resale from time to time of

up to 2,412,976 shares of Class B Common Stock, $0.0001 par value per share (the “Class B Common Stock”), of Asset Entities

Inc., a Nevada corporation (the “Company,” “we,” “us,” or “our”), by Ionic Ventures, LLC,

a California limited liability company (“Ionic” or the “Selling Stockholder”), issuable upon the conversion of

a variable amount of up to 206 shares of Series A Convertible Preferred Stock, $0.0001 par value per share, of the Company (the “Series

A Preferred Stock”), including 156 shares of Series A Preferred Stock that are outstanding and 50 shares of Series A Preferred Stock

the full conversion of which is held in abeyance, as of the date of this prospectus, which were issued to the Selling Stockholder on May

24, 2024 or July 29, 2024, pursuant to the Securities Purchase Agreement, dated as of May 24, 2024, between the Company and Ionic, as

amended by the First Amendment to Securities Purchase Agreement, dated as of June 13, 2024, between the Company and Ionic (as amended,

the “Ionic Purchase Agreement”), and the Certificate of Designation of Series A Convertible Preferred Stock of the Company

filed with the Secretary of State of the State of Nevada on May 24, 2024, as amended by the Certificate of Amendment to Designation filed

with the Secretary of State of the State of Nevada on June 14, 2024, as amended by the Certificate of Amendment to Designation filed with

the Secretary of State of the State of Nevada on September 4, 2024 at 9:58 AM Pacific Daylight Time, as amended by the Certificate of

Amendment to Designation filed with the Secretary of State of the State of Nevada on September 4, 2024 at 11:38 AM Pacific Daylight Time

(as amended, the “Certificate of Designation”), having an initial stated value (“Stated Value”) of $10,000 per

share of Series A Preferred Stock, a cumulative annual dividend rate on the Stated Value of 6% (which will increase to 12% if a Triggering

Event (as defined in the Certificate of Designation) occurs until such Triggering Event, if curable, is cured) payable in shares of Class

B Common Stock (or cash at the Company’s option) upon conversion or redemption of the Series A Preferred Stock, an initial conversion

price (“Conversion Price”) of $3.75 per share of Class B Common Stock, subject to adjustment including adjustments due to

full-ratchet anti-dilution provisions, and an alternate Conversion Price equal to 85% (or 70% if the Class B Common Stock is suspended

from trading on or delisted from a principal trading market or upon occurrence of a Triggering Event (as defined in the Certificate of

Designation)) of the average of the lowest daily volume weighed average price of the Class B Common Stock during the Alternate Conversion

Measuring Period (as defined in the Certificate of Designation) (the “Alternate Conversion Price”), subject to applicable

limitations or restrictions (see “Prospectus Summary – Private Placement with Ionic Ventures, LLC”).

A holder of Series A Preferred Stock may not

convert the Series A Preferred Stock into Class B Common Stock to the extent that such conversion would cause such holder’s beneficial

ownership of Class B Common Stock to exceed 4.99% of the outstanding Class B Common Stock immediately after conversion, which may be

increased by the holder to up to 9.99% upon no fewer than 61 days’ prior notice (the “Series A Beneficial Ownership Limitation”).

Any conversion of shares of Series A Preferred Stock that would result in the holder beneficially owning in excess of 4.99% of the shares

of Class B Common Stock will not be effected, and the shares of Class B Common Stock that would cause such excess will be held in abeyance

and not issued to the holder until the date the Company is notified by the holder that its ownership is less than 4.99%, at the applicable

Conversion Price, and subject to the holder’s compliance with other applicable procedural requirements for conversion. Holders

of Series A Preferred Stock are not prohibited from delivering a Conversion Notice (as defined by the Certificate of Designation) while

another Conversion Notice remains outstanding.

The Conversion Price also may not be lower than

a separate floor price (the “Floor Price”) of $0.4275 per share, subject to adjustment for stock splits and similar transactions.

If the Conversion Price would be less than the Floor Price, then, subject to the terms and conditions of the Certificate of Designation,

the Stated Value will automatically increase in the manner provided pursuant to the Certificate of Designation. See “Description

of Securities – Series A Preferred Stock”.

We are not selling any securities under this

prospectus and will not receive any of the proceeds from the sale of our Class B Common Stock by the Selling Stockholder. See

“Use of Proceeds” beginning on page 14 of this prospectus.

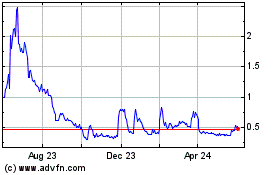

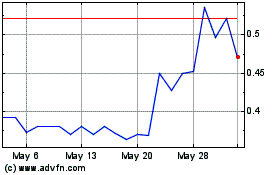

The Class B Common Stock is listed on The Nasdaq Capital Market tier

of The Nasdaq Stock Market LLC (“Nasdaq”), under the symbol “ASST.” As of December 13, 2024, the last reported

sales price of the Class B Common Stock on Nasdaq was $0.528. Unless otherwise noted, the

share and per share information in this prospectus have been adjusted to give effect to the one-for-five (1-for-5) reverse stock split

(the “Reverse Stock Split”) of each of the Company’s authorized and issued and outstanding Class A Common Stock, $0.0001

par value per share (the “Class A Common Stock”), and the authorized and issued and outstanding Class B Common Stock, which

became effective as of 5:00 p.m. Eastern Time on July 1, 2024.

We have two classes of authorized Common Stock, $0.0001 par value per

share (“common stock”), Class A Common Stock and Class B Common Stock. The rights of the holders of Class A Common Stock and

Class B Common Stock are identical, except with respect to voting and conversion. Each share of Class A Common Stock is entitled to ten

votes per share and is convertible into one share of Class B Common Stock. Each share of Class B Common Stock is entitled to one vote

per share. As of December 13, 2024, Asset Entities Holdings, LLC, a Texas limited liability company (“AEH”), the holder of

all of the outstanding Class A Common Stock, holds approximately 55.3% of the voting power of our outstanding capital stock and is therefore

our controlling stockholder. In addition, as of December 13, 2024, the officers, managers and beneficial owners of the shares held by

AEH, all of whom are also some of our officers and directors, had controlling voting power in the Company by collectively controlling

approximately 57.7% of all voting rights. As a result, we are a “controlled company” under Nasdaq’s rules, although

we do not intend to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the rules

of Nasdaq. See Item 1A. “Risk Factors – Risks Related to Ownership of Our Class B Common Stock – As a ‘controlled

company’ under the rules of Nasdaq, we may choose to exempt our company from certain corporate governance requirements that could

have an adverse effect on our public stockholders.” in our Annual Report on Form 10-K for the fiscal year ended December

31, 2023 (the “2023 Annual Report”), which is incorporated by reference into this prospectus.

We are an “emerging growth company”,

as defined in the Jumpstart Our Business Startups Act of 2012, under applicable U.S. federal securities laws, and are eligible for reduced

public company reporting requirements. See Item 1A. “Risk Factors – Risks Related to Ownership of Our Class B Common Stock

– We are subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are

not emerging growth companies and our stockholders could receive less information than they might expect to receive from more mature

public companies.” in the 2023 Annual

Report, which is incorporated by reference into this prospectus.

The Selling Stockholder may offer and sell the

securities being offered by means of this prospectus from time to time in public or private transactions, or both. These sales will occur

at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated prices.

The Selling Stockholder may sell the securities being offered to or through underwriters, broker-dealers or agents, who may receive compensation

in the form of discounts, concessions or commissions from the Selling Stockholder, the purchasers of the securities being offered by

means of this prospectus, or both. The Selling Stockholder may offer all, some or none of the securities being offered by means of this

prospectus. The Selling Stockholder and any participating broker-dealer or affiliate of a broker-dealer may be deemed to be “underwriters”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions

or discounts given to any such broker-dealer, affiliates of a broker-dealer or other “underwriters” within the meaning of

the Securities Act may be regarded as underwriting commissions or discounts under the Securities Act. See “Plan of Distribution”

for a more complete description of the ways in which the securities being offered by means of this prospectus may be sold.

Investing in our securities is highly speculative

and involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus, in any applicable prospectus

supplement, in any related free writing prospectus, and in the documents incorporated by reference into this prospectus, any accompanying

prospectus supplement and any related free writing prospectus before you make an investment decision.

Neither the U.S. Securities and Exchange Commission

nor any state or provincial securities commission has approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is December 20, 2024.

TABLE OF CONTENTS

You should rely only on the information that

we have provided or incorporated by reference in this prospectus, any supplement to this prospectus, and any related free writing prospectus

that we may authorize to be provided to you. We have not authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in or incorporated by reference in this

prospectus, any prospectus supplement, or any related free writing prospectus that we may authorize to be provided to you. You must not

rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only

under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, prospectus

supplement, or any related free writing prospectus is accurate only as of the date on the front of the document and that any information

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of

delivery of this prospectus, any supplement to this prospectus, or any related free writing prospectus, or any sale of a security.

Trademarks, Trade Names and Service Marks

We use various trademarks, trade names and service

marks in our business, including “AE 360 DDM”, “Asset Entities Where Assets Are Created”, “SiN”,

“Social Influencer Network”, “Ternary D”, “Options Swing”, and associated marks. For convenience,

we may not include the ℠, ® or ™ symbols, but such omission is not meant to indicate that we would

not protect our intellectual property rights to the fullest extent permitted by law. Any other trademarks, trade names or service marks

referred to in this prospectus or any document incorporated by reference into this prospectus are the property of their respective owners.

Industry and Market Data

We are responsible for the information contained

in this prospectus or any document incorporated by reference into this prospectus. This prospectus and documents incorporated by reference

into this prospectus include industry data and forecasts that we obtained from industry publications and surveys as well as public filings

and internal company sources. Industry publications, surveys and forecasts generally state that the information contained therein has

been obtained from sources believed to be reliable. Statements as to our ranking, market position and market estimates are based on third-party

forecasts, management’s estimates and assumptions about our markets and our internal research. We have not independently verified

such third-party information, nor have we ascertained the underlying economic assumptions relied upon in those sources. While we believe

that all such information contained in this prospectus is accurate and complete, nonetheless such data involve uncertainties and risks,

including risks from errors, and is subject to change based on various factors, including those discussed under “Risk Factors”

and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus and documents incorporated by reference

into this prospectus.

PROSPECTUS

SUMMARY

This summary highlights selected information

contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the

information that you should consider before deciding whether to invest in our securities. You should carefully read the entire prospectus

and the other information incorporated by reference into this prospectus, including the risks associated with an investment in our company

discussed in the “Risk Factors” section of this prospectus and the other documents incorporated by reference into

this prospectus, before making an investment decision. Some of the statements in this prospectus and the other documents incorporated

by reference into this prospectus are forward-looking statements. See the section titled “Cautionary Note Regarding Forward-Looking

Statements”.

Unless otherwise noted, the share and per

share information in this prospectus reflects the Reverse Stock Split ratio of 1-for-5 as if it had occurred at the beginning

of the earliest period presented.

Company Overview

Asset Entities is a

technology company providing social media marketing and content delivery services across Discord, TikTok, and other social media platforms.

We also design, develop and manage servers for communities on Discord. Based on the growth of our Discord servers and social media following,

we have developed three categories of services: (1) our Discord investment education and entertainment services, (2) social media and

marketing services, and (3) our “AE.360.DDM” brand services. We also offer Ternary v2, a cloud-based subscription management

and payment processing solution for Discord communities, which includes a suite of customer relations management tools and Stripe-verified

payment processing. All of our services are based on our effective use of Discord as well as other social media including TikTok, X,

Instagram, and YouTube.

Our Discord investment

education and entertainment service is designed primarily by and for enthusiastic Generation Z, or Gen Z, retail investors, creators

and influencers. Gen Z is commonly considered to be people born between 1997 and 2012. Our investment education and entertainment service

focuses on stock, real estate, cryptocurrency, and NFT community learning programs designed for the next generation. While we believe

that Gen Z will continue to be our primary market, our Discord server offering features education and entertainment content covering

real estate investments, which is expected to appeal strongly to older generations as well. Our current combined server user membership

was approximately 200,000 as of September 30, 2024.

Our social media and

marketing services utilize our management’s social influencer backgrounds by offering social media and marketing campaign services

to business clients. Our team of social influencer independent contractors, which we call our “SiN” or “Social Influencer

Network”, can perform social media and marketing campaign services to expand our clients’ Discord server bases and drive

traffic to their businesses, as well as increase membership in our own servers.

Our “AE.360.DDM,

Design Develop Manage” service, or “AE.360.DDM”, is a suite of services to individuals and companies seeking to create

a server on Discord. We believe we are the first company to provide “Design, Develop and Manage,” or DDM, services for any

individual, company, or organization that wishes to join Discord and create their own community. With our AE.360.DDM rollout, we are

uniquely positioned to offer DDM services in the growing market for Discord servers.

Through Ternary v2,

our subscription management and payment processing solution for Discord communities, subscribers can monetize and manage their Discord

users. Ternary v2 simplifies the process for our subscribers to: (i) sell memberships to their Discord servers on their websites and

collect payments through Stripe with daily payouts; (ii) add digital products and services and designate purchase options to their Discord

servers; (iii) customize their user Discord permissions and roles and other Discord settings; and (iv) utilize our Discord

bot to automatically apply their Discord user settings to authenticate new users, apply customizable permission sets to users, and remove

users when their subscriptions expire. As a Stripe-verified partner through Ternary v2, we can also assist subscribers with integrating

other platforms into their Discord servers with open application programming interfaces, further extending our platform’s capabilities.

We believe that we are

a leading provider of all of these services, and that demand for all of our services will continue to grow. We expect to experience rapid

revenue growth from our services. We believe that we have built a scalable and sustainable business model and that our competitive strengths

position us favorably in each aspect of our business.

Our revenue depends

on the number of paying subscribers to our Discord servers. During the three months ended September 30, 2024 and 2023, we received revenue

from 1,184 and 298 Asset Entities Discord server paying subscribers, respectively.

Corporate Information

Our principal executive

offices are located at 100 Crescent Court, 7th Floor, Dallas, TX 75201, and our telephone number is (214) 459-3117. We maintain a website

at https://assetentities.com. Information available on our website is not incorporated by reference in and is not deemed a part of this

prospectus.

Retrospective Presentation of Reverse Stock

Split

Except as otherwise indicated, all references

to our common stock, share data, per share data and related information has been adjusted for the Reverse Stock Split ratio of 1-for-5

as if it had occurred at the beginning of the earliest period presented.

Private Placement with Ionic Ventures, LLC

Securities Purchase

Agreement

On May 24, 2024, we

entered into the Ionic Purchase Agreement, as amended on June 13, 2024, with Ionic for the issuance and sale of up to 330 shares of the

Company’s newly designated Series A Preferred Stock for maximum gross proceeds of $3,000,000. The shares of the Series A Preferred

Stock are convertible into shares of Class B Common Stock. Pursuant to the Ionic Purchase Agreement, we are required to issue and sell

165 shares of Series A Preferred Stock at each of two closings subject to the satisfaction of the terms and conditions for each closing.

The first closing (the “First Closing”) occurred on May 24, 2024 for the issuance and sale of 165 shares of Series A Preferred

Stock for gross proceeds of $1,500,000. The second closing (the “Second Closing”), for the issuance and sale of 165 shares

of Series A Preferred Stock for gross proceeds of $1,500,000, occurred on July 29, 2024, which was the first business day on which the

conditions specified in the Ionic Purchase Agreement for the Second Closing were satisfied or waived, including the filing and effectiveness

of the First Registration Statement (as defined below) and the effectiveness of the Stockholder Approval (as defined below).

Registration Rights

Agreement

In connection with the Ionic Purchase Agreement, the Company agreed

to provide certain registration rights to Ionic, pursuant to the Registration Rights Agreement, dated as of May 24, 2024, between the

Company and Ionic (the “Ionic Registration Rights Agreement”). The Ionic Registration Rights Agreement provides for the registration

for resale of any and all shares of Class B Common Stock issuable to Ionic with respect to the shares of Series A Preferred Stock under

the Ionic Purchase Agreement (the “Registrable Conversion Shares”). Within the later of 15 calendar days of the First Closing

or May 24, 2024, the Company was required to file a registration statement (the “First Registration Statement”) for the offer

and resale of the maximum number of Registrable Conversion Shares permitted to be covered in accordance with applicable Securities and

Exchange Commission (“SEC”) rules, regulations and interpretations. The First Registration Statement was required to be declared

effective within 45 days of the First Closing, or 90 days if the First Registration Statement received a review. Pursuant to these requirements,

a Registration Statement on Form S-1 (File No. 333-280020) was originally filed by the Company with the SEC on June 7, 2024, and as amended,

registered the offer and resale of 385,894 shares of Class B Common Stock by Ionic, which, together with certain other securities

registered for resale on the same registration statement, was considered the maximum number of Registrable Conversion Shares permitted

to be covered in accordance with applicable SEC rules, regulations and interpretations, and was declared effective by the SEC on July

24, 2024. Following the Second Closing, which occurred on July 29, 2024, for the issuance and sale of an additional 165 shares of Series

A Preferred Stock for gross proceeds of $1,500,000, the Company was required to file a registration statement (the “Second Registration

Statement”) within 15 days of the Second Closing for the offer and resale of the maximum number of Registrable Conversion Shares

permitted to be covered in accordance with applicable SEC rules, regulations and interpretations. The Second Registration Statement was

required to be declared effective within 45 days of the Second Closing, or 90 days if the Second Registration Statement received a review.

Pursuant to these requirements, a Registration Statement on Form S-1 (File No. 333-281438) was originally filed by the Company with the

SEC on August 9, 2024, and as amended, registered the offer and resale of 482,120 shares of Class B Common Stock by Ionic, which, together

with certain other securities registered for resale on the same registration statement, was considered the maximum number of Registrable

Conversion Shares permitted to be covered in accordance with applicable SEC rules, regulations and interpretations, and was declared effective

by the SEC on September 11, 2024.

In the event the number of shares of Class B Common Stock available

under the First Registration Statement and the Second Registration Statement is insufficient to cover all of the Registrable Conversion

Shares, we are required to file at least one additional registration statement (each of such additional registration statement, the First

Registration Statement, and the Second Registration Statement, and collectively, the “Registration Statement”) within 14 days

of the date that the necessity arises and that such additional Registration Statement may be filed under SEC rules to cover such Registrable

Conversion Shares up to the maximum permitted to be covered under SEC rules, which must be made effective within 45 days of such date,

or 90 days if such additional Registration Statement receives a review. Pursuant to these requirements, a Registration Statement on Form

S-1 (File No. 333-282921), was originally filed by the Company with the SEC on October 31, 2024, and as amended, registered the offer

and resale of 1,484,632 shares of Class B Common Stock by Ionic, which was considered the maximum number of Registrable Conversion Shares

permitted to be covered in accordance with applicable SEC rules, regulations and interpretations, and was declared effective by the SEC

on November 25, 2024. In addition, pursuant to these requirements, the registration statement of which this prospectus forms a part was

filed with the SEC.

Any failure to meet

the filing deadline for either the First Registration Statement or the Second Registration Statement (“Filing Failure”) would

have resulted in liquidated damages of 20,000 shares of Class B Common Stock. Any failure to meet the effectiveness deadline for any

Registration Statement (“Effectiveness Failure”) will result in liquidated damages of 20,000 shares of Class B Common Stock.

Each of the shares issuable upon a Filing Failure or an Effectiveness Failure must also be covered by a Registration Statement to the

same extent as the Registrable Conversion Shares. We are required to use our best efforts to keep each Registration Statement effective

until all such shares of Class B Common Stock are sold or may be sold without restriction pursuant to Rule 144 under the Securities Act

(“Rule 144”), and without the requirement for us to be in compliance with the current public information requirement under

Rule 144.

Terms of Series

A Convertible Preferred Stock under Certificate of Designation and Securities Purchase Agreement

The Certificate of Designation

designated 660 shares of the Company’s preferred stock as “Series A Convertible Preferred Stock,” and set forth the

voting and other powers, preferences and relative, participating, optional or other rights of the Series A Preferred Stock. Each share

of Series A Preferred Stock has an initial Stated Value of $10,000 per share.

The Series A Preferred

Stock ranks senior to all other capital stock of the Company with respect to the payment of dividends, distributions and payments upon

the liquidation, dissolution and winding up of the Company, unless the holders of the majority of the outstanding shares of Series A

Preferred Stock consent to the creation of other capital stock of the Company that is senior or equal in rank to the Series A Preferred

Stock.

Holders of Series A

Preferred Stock will be entitled to receive cumulative dividends in shares of Class B Common Stock (or cash at the Company’s option)

on the Stated Value at an annual rate of 6% (which will increase to 12% if a Triggering Event occurs until such Triggering Event, if

curable, is cured). Dividends will be payable upon conversion or redemption of the Series A Preferred Stock.

Holders of Series A

Preferred Stock will be entitled to convert shares of Series A Preferred Stock into a number of shares of Class B Common Stock determined

by dividing the Stated Value of such shares (plus any accrued but unpaid dividends and other amounts due, unless paid by the Company

in cash) by the Conversion Price. The initial Conversion Price is $3.75, subject to adjustment including adjustments due to full-ratchet

anti-dilution provisions. Holders may elect to convert shares of Series A Preferred Stock to Class B Common Stock at the Alternate Conversion

Price equal to 85% (or 70% if the Company’s Class B Common Stock is suspended from trading on or delisted from a principal trading

market or upon occurrence of a Triggering Event) of the average of the lowest daily volume weighed average price of the Class B Common

Stock during the Alternate Conversion Measuring Period.

A holder of Series A

Preferred Stock may not convert the Series A Preferred Stock into Class B Common Stock to the extent that such conversion would cause

such holder’s beneficial ownership of Class B Common Stock to exceed the Series A Beneficial Ownership Limitation. Any conversion

of shares of Series A Preferred Stock that would result in the holder beneficially owning in excess of 4.99% of the shares of Class B

Common Stock will not be effected, and the shares of Class B Common Stock that would cause such excess will be held in abeyance and not

issued to the holder until the date the Company is notified by the holder that its ownership is less than 4.99%, at the applicable Conversion

Price, and subject to the holder’s compliance with other applicable procedural requirements for conversion. Holders of Series A

Preferred Stock are not prohibited from delivering a Conversion Notice while another Conversion Notice remains outstanding.

The Certificate of Designation

provides that the Conversion Price may not be lower than the Floor Price, which is currently $0.4275 per share, subject to adjustment

for stock splits and similar transactions. The Series A Preferred Stock also may not be converted except to the extent that the shares

of Class B Common Stock issuable upon such conversion may be resold pursuant to Rule 144 or an effective and available registration statement.

If a conversion of Series

A Preferred Stock would have resulted in the issuance of an amount of shares of Class B Common Stock exceeding 19.99% of the Company’s

common stock outstanding as of the date of the signing of the related binding agreement, which number of shares would be reduced, on

a share-for-share basis, by the number of shares of common stock issued or issuable pursuant to any transaction or series of transactions

that may be aggregated with the transactions contemplated by the Certificate of Designation under applicable rules of Nasdaq, including

Nasdaq Listing Rule 5635(d) (such amount, the “Exchange Limitation”), the Conversion Price would have been required to be

at least equal to the price (the “Minimum Price”) that would be the lower of the last closing price of the stock immediately

preceding the signing of the related binding agreement and the average closing price for the five Trading Days (as defined below) immediately

preceding the signing of the related binding agreement, before the effectiveness of the approval of such number of the holders of the

outstanding shares of the Company’s voting securities as required by the Bylaws of the Company (the “Bylaws”) and the

Nevada Revised Statutes (the “NRS”), to ratify and approve all of the transactions contemplated by the Transaction Documents

(as defined in the Ionic Purchase Agreement), including the issuance of all of the shares of Series A Preferred Stock and shares of Class

B Common Stock upon conversion of the shares of Series A Preferred Stock, all as may be required by the applicable rules and regulations

of The Nasdaq Capital Market tier of Nasdaq (or any successor entity) (the “Stockholder Approval”). In the event that the

Conversion Price on a Conversion Date (as defined in the Certificate of Designation) would have been less than the applicable Minimum

Price or the Floor Price if not for the immediately preceding sentence, then, upon any conversion of shares of Series A Preferred Stock,

the Stated Value will automatically be increased by an amount equal to the product obtained by multiplying (A) the higher of (I) the

highest price that the Class B Common Stock trades at on the Trading Day immediately preceding the Conversion Date and (II) the applicable

Conversion Price and (B) the difference obtained by subtracting (I) the number of shares of Class B Common Stock delivered (or to be

delivered) to the holder on the applicable Conversion Date with respect to such conversion of shares of Series A Preferred Stock from

(II) the quotient obtained by dividing (x) the Stated Value (plus any accrued but unpaid dividends and other amounts due on such shares)

of the Series A Preferred Stock being converted that the holder has elected to be the subject of the applicable conversion, by (y) the

applicable Conversion Price.

The Ionic Purchase Agreement

required that the Company obtain the Stockholder Approval, by the prior written consent of the requisite stockholders as required by

the Bylaws and the NRS, to ratify and approve all of the transactions contemplated by the Transaction Documents, including the issuance

of all of the shares of Series A Preferred Stock and shares of Class B Common Stock issuable upon conversion of such shares pursuant

to the Ionic Purchase Agreement, all as may be required by the applicable rules and regulations of The Nasdaq Capital Market tier of

Nasdaq (or any successor entity). The Ionic Purchase Agreement and the Certificate of Designation further required that the Company file

a Preliminary Information Statement on Schedule 14C with the SEC within 10 days of the date of the First Closing followed by the filing

of a Definitive Information Statement on Schedule 14C with the SEC within 20 days of the date of the First Closing, or within 45 days

of the date of the First Closing if delayed due to a court or regulatory agency, including but not limited to the SEC, which was required

to disclose the Stockholder Approval. In accordance with the rules of the SEC, the Stockholder Approval was required to become effective

20 days after the Definitive Information Statement was sent or given in accordance with SEC rules.

In accordance with the

requirements and provisions described above, on May 24, 2024, the Company obtained the execution of a written consent in lieu of a special

meeting of a majority of the voting power of the stockholders of the Company approving a resolution approving the issuance of Class B

Common Stock in aggregate in excess of the limitations provided by Nasdaq Listing Rule 5635(d), including that an amount of shares of

Class B Common Stock equal to or greater than 20% of the total common stock or voting power outstanding on the date of the Certificate

of Designation may be issued pursuant to the Certificate of Designation at a price that may be less than the Minimum Price. On May 31,

2024, the Company filed a Preliminary Information Statement on Schedule 14C with the SEC. On June 13, 2024, the Company filed a Definitive

Information Statement on Schedule 14C with the SEC disclosing the Stockholder Approval. As of the 20th day following actions

meeting these and other applicable requirements, the Company is permitted to issue more than the limited number of shares as defined

by the Exchange Limitation, at a Conversion Price that may be below the Minimum Price.

Under the Ionic Purchase

Agreement, if the closing price of the Class B Common Stock falls below $3.75 per share, the holder’s total sales of Class B Common

Stock will be restricted. The holder may only sell either the greater of $25,000 per Trading Day or 15% of the daily trading volume of

the Class B Common Stock reported by Bloomberg, LP, until the closing price exceeds $3.75. “Trading Day” is defined as a

day on which the principal trading market for the Class B Common Stock is open for trading for at least six hours.

In addition, while any

of the shares of Series A Preferred Stock are outstanding, if the closing price of the Class B Common Stock is equal to or less than

$0.4275 per share for a period of ten consecutive Trading Days, then the Company will promptly take all corporate action necessary to

authorize a reverse stock split of the Class B Common Stock by a ratio equal to or greater than 300% of the quotient obtained by dividing

$0.4275 by the lowest closing price of the Class B Common Stock during such ten-Trading Day period, including calling a special meeting

of stockholders to authorize such reverse stock split or obtaining written consent for such reverse stock split, and voting the management

shares of the Company in favor of such reverse stock split.

The Series A Preferred

Stock will automatically convert to Class B Common Stock upon the 24-month anniversary of the initial issuance date of the Series A Preferred

Stock.

The Company will have

the right at any time to redeem all or any portion of the Series A Preferred Stock then outstanding at a price equal to 110% of the Stated

Value plus any accrued but unpaid dividends and other amounts due.

Holders of the Series

A Preferred Stock will generally have the right to vote on an as-converted basis with the Class B Common Stock, subject to the Series

A Beneficial Ownership Limitation.

Under the Ionic Purchase

Agreement, the Company may not, directly or indirectly, redeem, or declare or pay any cash dividend or distribution on, any securities

of the Company without the prior express written consent of Ionic (other than as required by the Certificate of Designation). In addition,

the Company generally may not sell securities in a financing transaction while Ionic beneficially owns any shares of Series A Preferred

Stock or common stock until the end of the 30-day period following the initial date of the effectiveness of each Registration Statement

or during any Alternate Conversion Measuring Period. In addition, the Company may not file any other registration statement or any offering

statement under the Securities Act, other than a registration statement on Form S-8 or supplements or amendments to registration statements

that were filed and effective as of the date of the Ionic Purchase Agreement (solely to the extent necessary to keep such registration

statements effective and available and not with respect to any Subsequent Placement), unless each of the First Registration Statement

and the Second Registration Statement is effective and the respective prospectuses are available for use, or the outstanding shares of

Series A Preferred Stock and underlying shares of Class B Common Stock may be resold without limitation under Rule 144. However, see

“—Waivers and Consents to ATM Financing” below.

Issuance of Warrants

and Assignment of Rights to July 2024 Boustead Warrant

The engagement letter

agreement, dated November 29, 2021 (the “Boustead Engagement Letter”), between the Company and Boustead Securities, LLC,

a registered broker-dealer (“Boustead”), provides in relevant part that during the term that began on November 29, 2021 and

ending 12 months following the termination or expiration of the Boustead Engagement letter, which occurred on February 7, 2024, if the

Company sells securities in an investment transaction, the Company must compensate Boustead with a cash fee equal to 7% of gross proceeds,

a non-accountable expense allowance equal to 1% of gross proceeds, and warrants that may be exercised to purchase an amount of shares

that is equal to 7% of the shares issued or underlying the securities issued in the investment transaction. Pursuant to the Underwriting

Agreement, dated February 2, 2023, between the Company and Boustead, as representative of the underwriters of the Company’s initial

public offering (the “Underwriting Agreement”), all terms and conditions of the Boustead Engagement Letter that are not subject

to the terms and conditions of the Underwriting Agreement, including the ongoing compensation terms under the Boustead Engagement Letter,

remain in full force and effect. However, see “—Waivers and Consents to ATM Financing” below.

Pursuant to the ongoing

compensation terms of the Boustead Engagement Letter and the Underwriting Agreement, the Company was required to pay Boustead a fee equal

to 7% of the aggregate purchase price and a non-accountable expense allowance equal to 1% of the aggregate purchase price for the Series

A Preferred Stock. On the date of each of the First Closing and the Second Closing, the Company therefore paid Boustead $120,000, for

a total amount of $240,000. In addition, on the date of the First Closing (May 24, 2024), the Company was required to issue a warrant

to Boustead for the purchase of 30,800 shares of Class B Common Stock, equal to 7% of the number of shares of Class B Common Stock that

may be issued upon conversion of the shares of Series A Preferred Stock sold at the First Closing at the initial Conversion Price of

$3.75 per share (the “May 2024 Boustead Warrant”). On the date of the Second Closing (July 29, 2024), the Company was required

to issue a warrant (the “July 2024 Boustead Warrant”) to Boustead for the purchase of 30,800 shares of Class B Common Stock,

equal to 7% of the number of shares of Class B Common Stock that may be issued upon conversion of the shares of Series A Preferred Stock

sold at the Second Closing at the initial Conversion Price of $3.75 per share, subject to the Exchange Limitation before the effectiveness

of the Stockholder Approval.

Pursuant

to an Assignment and Assumption Agreement, dated as of July 30, 2024, among Boustead, Sutter

Securities, Inc., a registered broker-dealer and an affiliate of Boustead (“Sutter”),

and the Company (the “First July 2024 Boustead Warrant Assignment Agreement”),

all of the rights to the July 2024 Boustead Warrant were assigned by Boustead to Sutter.

Pursuant to an Assignment and Assumption Agreement, dated as of July 30, 2024, among Sutter,

Michael R. Jacks (the “Boustead Warrant Assignee”), Boustead, and the Company

(the “Second July 2024 Boustead Warrant Assignment Agreement”), all of the rights

to the July 2024 Boustead Warrant were assigned by Sutter to the Boustead Warrant Assignee,

a registered representative of Sutter. Pursuant to the First July 2024 Boustead Warrant Assignment

Agreement and the Second July 2024 Boustead Warrant Assignment Agreement, the July 2024 Boustead

Warrant was cancelled, and a warrant (the “July 2024 Boustead Assignee Warrant”)

was issued to the Boustead Warrant Assignee. The terms of the July 2024 Boustead Assignee

Warrant are identical to those of the July 2024 Boustead Warrant.

The May 2024 Boustead Warrant and the July 2024

Boustead Assignee Warrant have an exercise price of $3.75 per share, are exercisable for a period of five years, and contain cashless

exercise provisions.

Pursuant to the ongoing

compensation terms of the Boustead Engagement Letter and the Underwriting Agreement, we will be required to issue 1,400 shares of Class

B Common Stock to Boustead upon the occurrence of any Effectiveness Failure. Notwithstanding certain provisions in the Boustead Engagement

Letter, the May 2024 Boustead Warrant and the July 2024 Boustead Assignee Warrant will not contain piggyback registration rights and

will not contain anti-dilution provisions for future stock issuances, etc., at a price or at prices below the exercise price per share,

or provide for automatic exercise immediately prior to expiration. The May 2024 Boustead Warrant and the July 2024 Boustead Assignee

Warrant may be deemed to be compensation by the Financial Industry Regulatory Authority, Inc. (“FINRA”), and may be subject

to limits on exercise under FINRA rules.

Waivers and Consents to ATM Financing

On September 20, 2024,

the Company entered into a Waiver and Consent, dated as of September 20, 2024 (the “Ionic ATM Waiver”), between the Company

and Ionic, pursuant to which Ionic waived any prohibition, restriction or adverse adjustment that would otherwise apply to any action

of the Company relating to an “at the market offering” (as defined in Rule 415(a)(4) under the Securities Act), of equity

securities of up to $5 million (“Waived ATM Financing”) under the Ionic Purchase Agreement or the Certificate of Designation.

Pursuant to the Ionic ATM Waiver, regardless of the terms and conditions of the Ionic Purchase Agreement and the Certificate of Designation,

the Company may at any time enter into any agreement relating to a Waived ATM Financing, the filing of a prospectus supplement to a prospectus

contained in an effective registration statement that was filed under the Securities Act relating to a Waived ATM Financing, the announcement

of a Waived ATM Financing, the issuance, offer, sale, or grant of any shares of Class B Common Stock relating to a Waived ATM Financing,

or the issuance, offer, sale, or grant of any securities in connection with either the provision of goods or services or settlement of

any obligations that may otherwise arise with respect to a Waived ATM Financing. In addition, pursuant to the Ionic ATM Waiver, Ionic

waived any adjustment to the applicable Conversion Price, which partly determines the number of shares of Class B Common Stock issuable

upon conversion of a share of Series A Preferred Stock, that would otherwise occur as a result of any Waived ATM Financing under the

terms of the Certificate of Designation.

On September 26, 2024,

the Company entered into a Limited Waiver and Consent, dated as of September 26, 2024 (the “Boustead ATM Waiver”), between

the Company and Boustead. Pursuant to the Boustead ATM Waiver, Boustead waived any condition on, restriction on, compensation rights,

or rights of first refusal that would be applicable under the Boustead Engagement Letter and the Underwriting Agreement in relation to

a Waived ATM Financing. Pursuant to the Boustead ATM Waiver, the Company may at any time enter into any agreement relating to a Waived

ATM Financing, the filing of a prospectus supplement to a prospectus contained in an effective registration statement that was filed

under the Securities Act relating to a Waived ATM Financing, the announcement of a Waived ATM Financing, the issuance, offer, sale, or

grant of any shares of the Class B Common Stock relating to a Waived ATM Financing, or the issuance, offer, sale, or grant of any securities

in connection with either the provision of goods or services or settlement of any obligations that may otherwise arise with respect to

a Waived ATM Financing. As consideration, the Boustead ATM Waiver provides that the Company will promptly pay Boustead 3.0% of the gross

sales price of all shares of Class B Common Stock sold in connection with any Waived ATM Financing until the end of the applicability

of the provisions of the right of first refusal provisions of the Boustead Engagement Letter.

The

Offering

| Class B Common Stock offered by the Selling Stockholder: |

|

This prospectus relates to 2,412,976 shares of Class B Common Stock

which may be sold from time to time by the Selling Stockholder upon the conversion of shares of Series A Preferred Stock issued to the

Selling Stockholder pursuant to the Ionic Purchase Agreement and the Certificate of Designation, subject to applicable limitations or

restrictions. |

| |

|

|

| Use of proceeds: |

|

We will not receive any proceeds from any sales of the Class B Common Stock by the Selling Stockholder. |

| |

|

|

| Risk factors: |

|

Investing in our Class B Common

Stock involves a high degree of risk. As an investor, you should be able to bear a complete loss

of your investment. You should carefully consider the information set forth in the “Risk

Factors” section beginning on page 11 before deciding to invest in our Class B Common Stock.

|

| |

|

|

| Trading market and symbol: |

|

Our Class B Common Stock is listed on The Nasdaq Capital Market tier of Nasdaq under the symbol “ASST”. |

DESCRIPTION

OF SECURITIES

The description of our authorized capital stock

and our outstanding securities as of the date of the filing of the 2023 Annual Report is incorporated by reference to Exhibit

4.1 to the 2023 Annual Report, and supplemented or updated as follows:

General

The authorized capital stock of the Company currently

consists of 90,000,000 shares, consisting of (i) 40,000,000 shares of Common Stock, $0.0001 par value per share, of which 2,000,000 shares

are designated Class A Common Stock, $0.0001 par value per share, and 38,000,000 shares are designated as Class B Common Stock, $0.0001

par value per share; and (ii) 50,000,000 shares of “blank check” Preferred Stock, $0.0001 par value per share, of which 660

shares are designated as Series A Convertible Preferred Stock, $0.0001 par value per share.

As of December 13, 2024, there were 1,000,000 shares of Class A Common

Stock outstanding and owned by one stockholder of record, 7,710,598 shares of Class B Common Stock were outstanding and owned by 24 stockholders

of record, 156 shares of Series A Preferred Stock were outstanding and 50 shares of Series A Preferred Stock the full conversion of which

was held in abeyance and owned by one stockholder of record, and no other shares of common stock or preferred stock were issued and outstanding.

The numbers of owners of record stated above do not include holders whose shares are held in nominee or “street name” accounts

through banks, brokers or other financial institutions.

Series A Preferred Stock

The Certificate of Designation

designated 660 shares of the Company’s preferred stock as “Series A Convertible Preferred Stock,” and set forth the

voting and other powers, preferences and relative, participating, optional or other rights of the Series A Preferred Stock. Each share

of Series A Preferred Stock has an initial Stated Value of $10,000 per share.

The Series A Preferred

Stock ranks senior to all other capital stock of the Company with respect to the payment of dividends, distributions and payments upon

the liquidation, dissolution and winding up of the Company, unless the holders of the majority of the outstanding shares of Series A

Preferred Stock consent to the creation of other capital stock of the Company that is senior or equal in rank to the Series A Preferred

Stock.

Holders of Series A

Preferred Stock will be entitled to receive cumulative dividends, in shares of Class B Common Stock (or cash at the Company’s option)

on the Stated Value at an annual rate of 6% (which will increase to 12% if a Triggering Event occurs until such Triggering Event, if

curable, is cured). Dividends will be payable upon conversion or redemption of the Series A Preferred Stock.

Holders of Series A

Preferred Stock will be entitled to convert shares of Series A Preferred Stock into a number of shares of Class B Common Stock determined

by dividing the Stated Value of such shares (plus any accrued but unpaid dividends and other amounts due, unless paid by the Company

in cash) by the Conversion Price. The initial Conversion Price is $3.75, subject to adjustment including adjustments due to full-ratchet

anti-dilution provisions. Holders may elect to convert shares of Series A Preferred Stock to Class B Common Stock at the Alternate Conversion

Price equal to 85% (or 70% if the Company’s Class B Common Stock is suspended from trading on or delisted from a principal trading

market or upon occurrence of a Triggering Event) of the average of the lowest daily volume weighed average price of the Class B Common

Stock during the Alternate Conversion Measuring Period.

A holder of Series A

Preferred Stock may not convert the Series A Preferred Stock into Class B Common Stock to the extent that such conversion would cause

such holder’s beneficial ownership of Class B Common Stock to exceed the Series A Beneficial Ownership Limitation. Any conversion

of shares of Series A Preferred Stock that would result in the holder beneficially owning in excess of 4.99% of the shares of Class B

Common Stock will not be effected, and the shares of Class B Common Stock that would cause such excess will be held in abeyance and not

issued to the holder until the date the Company is notified by the holder that its ownership is less than 4.99%, at the applicable Conversion

Price, and subject to the holder’s compliance with other applicable procedural requirements for conversion. Holders of Series A

Preferred Stock are not prohibited from delivering a Conversion Notice while another Conversion Notice remains outstanding.

The Ionic Purchase Agreement

provides that the Conversion Price may not be lower than the Floor Price, which is currently $0.4275 per share, subject to adjustment

for stock splits and similar transactions. The Series A Preferred Stock also may not be converted except to the extent that the shares

of Class B Common Stock issuable upon such conversion may be resold pursuant to Rule 144 or an effective and available registration statement.

If a conversion of Series

A Preferred Stock would have resulted in the issuance of an amount of shares of Class B Common Stock exceeding the Exchange Limitation,

the Conversion Price would have been required to be at least equal to the Minimum Price, before the effectiveness of the Stockholder

Approval. In the event that the Conversion Price on a Conversion Date would have been less than the applicable Minimum Price or the Floor

Price if not for the immediately preceding sentence, then, upon any conversion of shares of Series A Preferred Stock, the Stated Value

will automatically be increased by an amount equal to the product obtained by multiplying (A) the higher of (I) the highest price that

the Class B Common Stock trades at on the Trading Day immediately preceding the Conversion Date and (II) the applicable Conversion Price

and (B) the difference obtained by subtracting (I) the number of shares of Class B Common Stock delivered (or to be delivered) to the

holder on the applicable Conversion Date with respect to such conversion of shares of Series A Preferred Stock from (II) the quotient

obtained by dividing (x) the Stated Value (plus any accrued but unpaid dividends and other amounts due on such shares) of the Series

A Preferred Stock being converted that the holder has elected to be the subject of the applicable conversion, by (y) the applicable Conversion

Price.

The Ionic Purchase Agreement

required that the Company obtain the Stockholder Approval, by the prior written consent of the requisite stockholders as required by

the Bylaws and the NRS, to ratify and approve all of the transactions contemplated by the Transaction Documents, including the issuance

of all of the shares of Series A Preferred Stock and shares of Class B Common Stock issuable upon conversion of such shares pursuant

to the Ionic Purchase Agreement, all as may be required by the applicable rules and regulations of The Nasdaq Capital Market tier of

Nasdaq (or any successor entity). The Ionic Purchase Agreement and the Certificate of Designation further required that the Company file

a Preliminary Information Statement on Schedule 14C with the SEC within 10 days of the date of the First Closing followed by the filing

of a Definitive Information Statement on Schedule 14C with the SEC within 20 days of the date of the First Closing, or within 45 days

of the date of the First Closing if delayed due to a court or regulatory agency, including but not limited to the SEC, which was required

to disclose the Stockholder Approval. In accordance with the rules of the SEC, the Stockholder Approval was required to become effective

20 days after the Definitive Information Statement was sent or given in accordance with SEC rules.

In accordance with the

requirements and provisions described above, on May 24, 2024, the Company obtained the execution of a written consent in lieu of a special

meeting of a majority of the voting power of the stockholders of the Company approving a resolution approving the issuance of Class B

Common Stock in aggregate in excess of the limitations provided by Nasdaq Listing Rule 5635(d), including that an amount of shares of

Class B Common Stock equal to or greater than 20% of the total common stock or voting power outstanding on the date of the Certificate

of Designation may be issued pursuant to the Certificate of Designation at a price that may be less than the Minimum Price. On May 31,

2024, the Company filed a Preliminary Information Statement on Schedule 14C with the SEC. On June 13, 2024, the Company filed a Definitive

Information Statement on Schedule 14C with the SEC disclosing such written consent. As of the 20th day following actions meeting

these and other applicable requirements, the Company is permitted to issue more than the limited number of shares as defined by the Exchange

Limitation, at a Conversion Price that may be below the Minimum Price.

Under the Ionic Purchase

Agreement, if the closing price of the Class B Common Stock falls below $3.75 per share, the holder’s total sales of Class B Common

Stock will be restricted. The holder may only sell either the greater of $25,000 per Trading Day or 15% of the daily trading volume of

the Class B Common Stock reported by Bloomberg, LP, until the closing price exceeds $3.75. “Trading Day” is defined as a

day on which the principal trading market for the Class B Common Stock is open for trading for at least six hours.

In addition, while any

of the shares of Series A Preferred Stock are outstanding, if the closing price of the Class B Common Stock is equal to or less than

$0.4275 per share for a period of ten consecutive Trading Days, then the Company will promptly take all corporate action necessary to

authorize a reverse stock split of the Class B Common Stock by a ratio equal to or greater than 300% of the quotient obtained by dividing

$0.4275 by the lowest closing price of the Class B Common Stock during such ten-Trading Day period, including calling a special meeting

of stockholders to authorize such reverse stock split or obtaining written consent for such reverse stock split, and voting the management

shares of the Company in favor of such reverse stock split.

The Series A Preferred

Stock will automatically convert to Class B Common Stock upon the 24-month anniversary of the initial issuance date of the Series A Preferred

Stock.

The Company will have

the right at any time to redeem all or any portion of the Series A Preferred Stock then outstanding at a price equal to 110% of the Stated

Value plus any accrued but unpaid dividends and other amounts due.

Holders of the Series

A Preferred Stock will generally have the right to vote on an as-converted basis with the Class B Common Stock, subject to the Series

A Beneficial Ownership Limitation.

Under the Ionic Purchase

Agreement, the Company may not, directly or indirectly, redeem, or declare or pay any cash dividend or distribution on, any securities

of the Company without the prior express written consent of Ionic (other than as required by the Certificate of Designation). In addition,

the Company generally may not sell securities in a financing transaction while Ionic beneficially owns any shares of Series A Preferred

Stock or common stock until the end of the 30-day period following the initial date of the effectiveness of each Registration Statement

or during any Alternate Conversion Measuring Period. In addition, the Company may not file any other registration statement or any offering

statement under the Securities Act, other than a registration statement on Form S-8 or supplements or amendments to registration statements

that were filed and effective as of the date of the Ionic Purchase Agreement (solely to the extent necessary to keep such registration

statements effective and available and not with respect to any Subsequent Placement), unless each of the First Registration Statement

and the Second Registration Statement is effective and the respective prospectuses are available for use, or the outstanding shares of

Series A Preferred Stock and underlying shares of Class B Common Stock may be resold without limitation under Rule 144. However, see

“Prospectus Summary – Waivers and Consents to ATM Financing”.

Ionic also has certain registration rights with respect to the Registrable

Conversion Shares under the Ionic Registration Rights Agreement. The Ionic Registration Rights Agreement provides for the registration

for resale of the Registrable Conversion Shares, which consist of any and all shares of Class B Common Stock issuable to Ionic with respect

to the shares of Series A Preferred Stock under the Ionic Purchase Agreement. Within the later of 15 calendar days of the First Closing

or May 24, 2024, we were required to file the First Registration Statement for the offer and resale of the maximum number of Registrable

Conversion Shares permitted to be covered in accordance with applicable SEC rules, regulations and interpretations. The First Registration

Statement was required to be declared effective within 45 days of the First Closing, or 90 days if the First Registration Statement received

a review. Pursuant to these requirements, a Registration Statement on Form S-1 (File No. 333-280020) was originally filed by the Company

with the SEC on June 7, 2024 to register the offer and resale of 385,894 shares of Class B Common Stock by Ionic, which, together

with certain other securities registered for resale on the same registration statement, was considered the maximum number of Registrable

Conversion Shares permitted to be covered in accordance with applicable SEC rules, regulations and interpretations, and was declared effective

by the SEC on July 24, 2024. Following the Second Closing, which occurred on July 29, 2024, for the issuance and sale of an additional

165 shares of Series A Preferred Stock for gross proceeds of $1,500,000, the Company was required to file the Second Registration Statement

within 15 days of the Second Closing for the offer and resale of the maximum number of Registrable Conversion Shares permitted to be covered

in accordance with applicable SEC rules, regulations and interpretations. The Second Registration Statement was required to be declared

effective within 45 days of the Second Closing, or 90 days if the Second Registration Statement received a review. Pursuant to these requirements,

a Registration Statement on Form S-1 (File No. 333-281438), was originally filed by the Company with the SEC on August 9, 2024, and as

amended, registered the offer and resale of 482,120 shares of Class B Common Stock by Ionic, which, together with certain other securities

registered for resale on the same registration statement, was considered the maximum number of Registrable Conversion Shares permitted

to be covered in accordance with applicable SEC rules, regulations and interpretations, and was declared effective by the SEC on September

11, 2024.

In the event the number of shares of Class B Common Stock available

under the First Registration Statement and the Second Registration Statement is insufficient to cover all of the Registrable Conversion

Shares, we are required to file at least one additional Registration Statement within 14 days of the date that the necessity arises and

that such additional Registration Statement may be filed under SEC rules to cover such Registrable Conversion Shares up to the maximum

permitted to be covered under SEC rules, which must be made effective within 45 days of such date, or 90 days if such additional Registration

Statement receives a review. Pursuant to these requirements, a Registration Statement on Form S-1 (File No. 333-282921), was originally

filed by the Company with the SEC on October 31, 2024, and as amended, registered the offer and resale of 1,484,632 shares of Class B

Common Stock by Ionic, which was considered the maximum number of Registrable Conversion Shares permitted to be covered in accordance

with applicable SEC rules, regulations and interpretations, and was declared effective by the SEC on November 25, 2024. In addition, pursuant

to these requirements, the registration statement of which this prospectus forms a part was filed with the SEC.

Any Filing Failure would have resulted in liquidated

damages of 20,000 shares of Class B Common Stock. Any Effectiveness Failure will result in liquidated damages of 20,000 shares of Class

B Common Stock. Each of the shares issuable upon a Filing Failure or an Effectiveness Failure must also be covered by a Registration

Statement to the same extent as the Registrable Conversion Shares. We are required to use our best efforts to keep each Registration

Statement effective until all such shares of Class B Common Stock are sold or may be sold without restriction pursuant to Rule 144, and

without the requirement for us to be in compliance with the current public information requirement under Rule 144.

May 2024 Boustead

Warrant and July 2024 Boustead Assignee Warrant

The Boustead Engagement

Letter provides in relevant part that during the term that began on November 29, 2021 and ending 12 months following the termination

or expiration of the Boustead Engagement letter, which occurred on February 7, 2024, if the Company sells securities in an investment

transaction, the Company must compensate Boustead with a cash fee equal to 7% of gross proceeds, a non-accountable expense allowance

equal to 1% of gross proceeds, and warrants that may be exercised to purchase an amount of shares that is equal to 7% of the shares issued

or underlying the securities issued in the investment transaction. Pursuant to the Underwriting Agreement, all terms and conditions of

the Boustead Engagement Letter that are not subject to the terms and conditions of the Underwriting Agreement, including the ongoing

compensation terms under the Boustead Engagement Letter, remain in full force and effect. However, see “Prospectus Summary –

Waivers and Consents to ATM Financing”.

Pursuant to the ongoing

compensation terms of the Boustead Engagement Letter and the Underwriting Agreement, the Company was required to pay Boustead a fee equal

to 7% of the aggregate purchase price and a non-accountable expense allowance equal to 1% of the aggregate purchase price for the Series

A Preferred Stock. On the date of each of the First Closing and the Second Closing, the Company therefore paid Boustead $120,000, for

a total amount of $240,000. In addition, on the date of the First Closing (May 24, 2024), the Company was required to issue the May 2024

Boustead Warrant to Boustead for the purchase of 30,800 shares of Class B Common Stock, equal to 7% of the number of shares of Class

B Common Stock that may be issued upon conversion of the shares of Series A Preferred Stock sold at the First Closing at the initial

Conversion Price of $3.75 per share. On the date of the Second Closing (July 29, 2024), the Company was required to issue the July 2024

Boustead Warrant to Boustead for the purchase of 30,800 shares of Class B Common Stock, equal to 7% of the number of shares of Class

B Common Stock that may be issued upon conversion of the shares of Series A Preferred Stock sold at the Second Closing at the initial

Conversion Price of $3.75 per share, subject to the Exchange Limitation before the effectiveness of the Stockholder Approval.

Pursuant to the First

July 2024 Boustead Warrant Assignment Agreement, all of the rights to the July 2024 Boustead Warrant were assigned by Boustead to Sutter,

an affiliate of Boustead. Pursuant to the Second July 2024 Boustead Warrant Assignment Agreement, all of the rights to the July 2024

Boustead Warrant were assigned by Sutter to the Boustead Warrant Assignee, a registered representative of Sutter. Pursuant to the First

July 2024 Boustead Warrant Assignment Agreement and the Second July 2024 Boustead Warrant Assignment Agreement, the July 2024 Boustead

Warrant was cancelled, and the July 2024 Boustead Assignee Warrant was issued to the Boustead Warrant Assignee. The terms of the July

2024 Boustead Assignee Warrant are identical to those of the July 2024 Boustead Warrant.

The May 2024 Boustead Warrant and the July 2024

Boustead Assignee Warrant have an exercise price of $3.75 per share, are exercisable for a period of five years, and contain cashless

exercise provisions.

RISK FACTORS

An investment in our Class B Common Stock

involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained

in this prospectus, and the financial and other information set forth under Item 1A. “Risk Factors” of the 2023 Annual

Report, which is incorporated herein by reference, and in other filings we make with the SEC, before purchasing our Class B Common

Stock. We have listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant

risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors

could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your

investment. Some statements in this prospectus and in the reports incorporated herein by reference, including statements in the following

risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary Note Regarding Forward-Looking

Statements”.

Risks Related to This Offering

Substantial future sales or issuances of

our common stock or securities convertible into, or exercisable or exchangeable for, our common stock, or the perception in the public

markets that these sales or issuances may occur, may depress our stock price. Also, future issuances of our common stock or rights to

purchase common stock could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price

to fall.

The conversion or exercise of our outstanding

convertible or exercisable securities and resale of the underlying common stock, and any other future issuances of our common stock or

securities convertible into, or exercisable or exchangeable for, our common stock, would result in a decrease in the ownership percentage

of existing stockholders, i.e., dilution, which may cause the market price of our common stock to decline. We cannot predict the effect,

if any, of future issuances, conversions, or exercises of our securities, on the price of our common stock. In all events, future issuances

of our common stock would result in the dilution of your holdings. In addition, the perception that new issuances of our securities are

likely to occur, or the perception that holders of securities convertible or exercisable for common stock are likely to sell their securities,

could adversely affect the market price of our common stock. The effect of such dilution may be magnified as to all shares that are not

or may eventually not be subject to restrictions on resale as enumerated below.

An indeterminate number of shares of Class B Common Stock will be required

to be issued if Ionic converts the shares of Series A Preferred Stock at the Alternate Conversion Price, which is defined as the price

that is equal to 85% (or 70% if the Class B Common Stock is suspended from trading on or delisted from a principal trading market or upon

occurrence of a Triggering Event (as defined in the Certificate of Designation)) of the average of the lowest daily volume weighed average

price of the Class B Common Stock during the Alternate Conversion Measuring Period (as defined in the Certificate of Designation). The

applicable Conversion Price may also be reduced as a result of a downward adjustment to the Conversion Price upon application of full-ratchet

anti-dilution provisions. An additional 20,000 shares of Class B Common Stock must also be issued for any Effectiveness Failure, and an

additional 1,400 shares of Class B Common Stock must be issued to Boustead in connection with each such issuance. As a result, there may

be significant dilution to our stockholders’ ownership, voting power and right to participate in dividends or other payments from

future earnings, if any, in connection with the private placement transaction with Ionic, which may cause a decline in the market price

of our Class B Common Stock. Moreover, the Registration Statement, during the period in which it is effective, will allow such shares

to be resold immediately into the public market without restriction, which may also adversely affect the market price of our common stock.

A decline in our market price could also impair our ability to raise funds in additional equity or debt financings.

As of December 13, 2024, we have also granted 479,246 shares of Class

B Common Stock under the Asset Entities Inc. 2022 Equity Incentive Plan (the “Plan”) to officers, directors, employees, and

consultants that remained outstanding. We have filed a Registration Statement on Form S-8 (File No. 333-269598) to register the offering

of these shares as well as other shares under stock options or other equity compensation that may be granted to our officers, directors,

employees, and consultants or reserved for future issuance under the Plan. Subject to the satisfaction of vesting conditions, all of these

shares registered under the Registration Statement on Form S-8 will be available for resale immediately in the public market without restriction

other than those restrictions imposed on sales by affiliates pursuant to Rule 144.

Additionally, our employees, executive officers,

and directors may enter into Rule 10b5-1 trading plans providing for sales of shares of our common stock from time to time. Under a Rule

10b5-1 trading plan, a broker executes trades pursuant to parameters established by the employee, director, or officer when entering

into the plan, without further direction from the employee, officer, or director. A Rule 10b5-1 trading plan may be amended or terminated

in some circumstances. Our employees, executive officers, and directors also may buy or sell additional shares outside of a Rule 10b5-1

trading plan when they are not in possession of material, non-public information, subject to the Rule 144 requirements referred to above.

Actual or potential resales of our common stock by our employees, executive officers, and directors as restrictions end or pursuant to

registration rights may make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate.

These sales could also cause the trading price of our common stock to decline and make it more difficult for you to sell shares of our

common stock. The market price of shares of our common stock may drop significantly when restrictions on resale by our existing stockholders

and beneficial owners lapse. The effect of these grants on the value of your shares may therefore be substantial.

We also expect that significant additional capital

may be needed in the future beyond that raised in this offering to continue our planned operations, including potential acquisitions,

hiring new personnel, marketing our products, and continuing activities as an operating public company. To the extent we raise additional

capital by issuing equity securities, our stockholders may experience substantial dilution. We may sell common stock, convertible securities

or other equity securities in one or more transactions at prices and in a manner we determine from time to time. If we sell common stock,

convertible securities, or other equity securities in more than one transaction, investors may be materially diluted by subsequent sales.

Such sales may also result in material dilution to our existing stockholders, and new investors could gain rights superior to our existing

stockholders.

In the event that the market price of shares

of our common stock drops significantly when the restrictions on resale by our existing stockholders lapse, existing stockholders’

dilution might be reduced to the extent that the decline in the price of shares of our common stock impedes our ability to raise capital

through the issuance of additional shares of our common stock or other equity securities. However, in the event that our capital-raising