Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the

Company”), a leading Canadian producer of hot and cold rolled steel

sheet and plate products, today provided guidance for its fiscal

second quarter ending September 30, 2024. Unless otherwise

specified, all amounts are in Canadian dollars.

Fiscal 2025 second quarter total steel shipments

are expected to be in the range of 510,000 to 520,000 tons and

Adjusted EBITDA is expected to be in the range of $5 million to

negative $5 million, which includes the initial recovery of

insurance proceeds estimated at approximately $20 million.

Michael Garcia, Algoma’s Chief Executive

Officer, stated, “Our operations are performing in line with

expectations for the fiscal second quarter, despite operating

against a backdrop of challenging market conditions for steel

demand and pricing. Operationally we are well-positioned to

capitalize on opportunities as market fundamentals improve and

demand rebounds. Importantly, we remain on track with our Electric

Arc Furnace project with commissioning activities expected to begin

by calendar year-end. This milestone will mark the beginning of

Algoma Steel's transformation into one of the most environmentally

sustainable steel producers in North America.”

About Algoma Steel Inc.

Based in Sault Ste. Marie, Ontario, Canada,

Algoma is a fully integrated producer of hot and cold rolled steel

products including sheet and plate. Driven by a purpose to build

better lives and a greener future, Algoma is positioned to deliver

responsive, customer-driven product solutions to applications in

the automotive, construction, energy, defense, and manufacturing

sectors. Algoma is a key supplier of steel products to customers in

North America and is the only producer of discrete plate products

in Canada. Its state-of-the-art Direct Strip Production Complex

(“DSPC”) is one of the lowest-cost producers of hot rolled sheet

steel (HRC) in North America.

Algoma is on a transformation journey,

modernizing its plate mill and adopting electric arc technology

that builds on the strong principles of recycling and environmental

stewardship to significantly lower carbon emissions. Today Algoma

is investing in its people and processes, working safely, as a team

to become one of North America’s leading producers of green

steel.

As a founding industry in their community,

Algoma is drawing on the best of its rich steelmaking tradition to

deliver greater value, offering North America the comfort of a

secure steel supply and a sustainable future as your partner in

steel.

Cautionary Statement Regarding

Forward-Looking Statements

This news release contains “forward-looking

information” under applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”), including statements regarding

expected total steel shipments and Adjusted EBITDA, the improvement

of market fundamentals and rebound in demand, the supply of raw

materials and other key inputs in the steelmaking process, Algoma’s

transition to EAF steelmaking, including the progress, costs and

timing of completion of the Company’s EAF project, Algoma’s future

as a leading producer of green steel, Algoma’s modernization of its

plate mill facilities, transformation journey, ability to deliver

greater and long-term value, ability to offer North America a

secure steel supply and a sustainable future, and investment in its

people, and processes, plans or future financial or operating

performance. These forward-looking statements generally are

identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “design,” “pipeline,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions. Many

factors could cause actual future events to differ materially from

the forward-looking statements in this document. Readers should

also consider the other risks and uncertainties set forth in the

section entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Information” in Algoma’s Annual Information Form,

filed by Algoma with applicable Canadian securities regulatory

authorities (available under the company’s SEDAR+ profile at

www.sedarplus.ca) and with the SEC, as part of Algoma’s Annual

Report on Form 40-F (available at www.sec.gov), as well as in

Algoma’s current reports with the Canadian securities regulatory

authorities and SEC. Forward-looking statements speak only as of

the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and Algoma assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Non-IFRS Financial

Measures

To supplement our financial statements, which

are prepared in accordance with International Financial Reporting

Standards as issued by the International Accounting Standards Board

(“IFRS”), we use certain non-IFRS measures to evaluate the

performance of Algoma. These terms do not have any standardized

meaning prescribed within IFRS and, therefore, may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS measures by providing a further understanding

of our financial performance from management’s perspective.

Accordingly, they should not be considered in isolation nor as a

substitute for analysis of our financial information reported under

IFRS.

Adjusted EBITDA, as we define it, refers to net

(loss) income before amortization of property, plant, equipment and

amortization of intangible assets, finance costs, interest on

pension and other post-employment benefit obligations, income

taxes, restructuring costs, impairment reserve, foreign exchange

gain, finance income, inventory write-downs, carbon tax, changes in

fair value of warrant, earnout and share-based compensation

liabilities, transaction costs, share-based compensation, and past

service costs related to pension benefits and post-employment

benefits. Adjusted EBITDA margin is calculated by dividing Adjusted

EBITDA by revenue for the corresponding period. Adjusted EBITDA is

not intended to represent cash flow from operations, as defined by

IFRS, and should not be considered as alternatives to net earnings,

cash flow from operations, or any other measure of performance

prescribed by IFRS. Adjusted EBITDA, as we define and use it, may

not be comparable to Adjusted EBITDA as defined and used by other

companies. We consider Adjusted EBITDA to be a meaningful measure

to assess our operating performance in addition to IFRS measures.

It is included because we believe it can be useful in measuring our

operating performance and our ability to expand our business and

provide management and investors with additional information for

comparison of our operating results across different time periods

and to the operating results of other companies. Adjusted EBITDA is

also used by analysts and our lenders as a measure of our financial

performance. In addition, we consider Adjusted EBITDA margin to be

a useful measure of our operating performance and profitability

across different time periods that enhance the comparability of our

results. However, these measures have limitations as analytical

tools and should not be considered in isolation from, or as

alternatives to, net income, cash flow from operations or other

data prepared in accordance with IFRS. Because of these

limitations, such measures should not be considered as measures of

discretionary cash available to invest in business growth or to

reduce indebtedness. We compensate for these limitations by relying

primarily on our IFRS results using such measures only as

supplements to such results.

For more information, please

contact:

Michael MoracaVice President – Corporate

Development & TreasurerAlgoma Steel Group Inc.Phone:

705.945.3300E-mail: IR@algoma.com

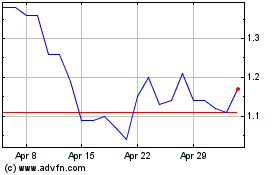

Algoma Steel (NASDAQ:ASTLW)

Historical Stock Chart

From Jan 2025 to Feb 2025

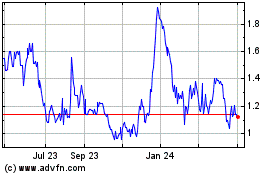

Algoma Steel (NASDAQ:ASTLW)

Historical Stock Chart

From Feb 2024 to Feb 2025