As

filed with the United States Securities and Exchange Commission on November 14, 2023

Registration

No. 333-[*]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Applied

uv, inc.

(Exact

name of registrant as specified in its charter).

| Nevada |

3648 |

84-4373308 |

| (State

or Other Jurisdiction of Incorporation or Organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

150

N. MacQuesten Parkway

Mount

Vernon, NY 10550

(914)

665-6100

(Address,

including zip code, and telephone number, including area code,

of

registrant’s principal executive offices)

Max

Munn

Chief

Executive Officer

Applied

UV, Inc.

150

N. MacQuesten Parkway

Mount

Vernon, NY 10550

(914)

665-6100

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

| Ross

D. Carmel, Esq. |

Anthony

W. Basch, Esq. |

| Jeffrey

P. Wofford, Esq. |

J.

Britton Williston, Esq. |

| Sichenzia

Ross Ference Carmel LLP |

Kaufman

& Canoles, P.C. |

| 1185

Avenue of the Americas, 31st Floor |

1021

E. Cary Street, Suite 1400 |

| New

York, New York 10036 |

Two

James Center |

| Telephone:

(212) 930-9700 |

Richmond,

VA 23219 |

| |

Telephone:

(804) 771-5700 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☒ No. 333-274879

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

This

Registration Statement shall become effective upon filing with the Securities and Exchange Commission in accordance with Rule 462(b)

under the Securities Act.

EXPLANATORY

NOTE AND INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

Pursuant

to Rule 462(b) under the Securities Act of 1933, as amended, Applied UV, Inc. (the “Registrant”) is filing this registration

statement with the Securities and Exchange Commission (the “Commission”). This registration statement relates to the public

offering of securities contemplated by the Registration Statement on Form S-1, as amended (File No. 333-274879), which the Registrant

originally filed on October 5, 2023 (the “Prior Registration Statement”), and which the Commission declared effective on

November 13, 2023.

The Registrant is filing this registration statement

for the sole purpose of increasing the aggregate number of units including a share of common stock or a pre-funded warrant in lieu thereof

offered by the Registrant by 2,666,666 units, all of which will be sold by the underwriter in the offering, 400,000 shares or 400,000

shares underlying pre-funded warrants in lieu thereof of which may be sold in the event the underwriters exercise their option to purchase

additional shares of the Registrant’s common stock or pre-funded warrants in lieu thereof, 40,000 shares underlying Series A Warrants,

of which may be sold in the event the underwriters exercise their option to purchase additional Series A Warrants, and 40,000 shares underlying

Series B Warrants, of which may be sold in the event the underwriters exercise their option to purchase additional Series B Warrants.

The additional securities that are being registered for sale are in an amount and at a price that together represent no more than 20%

of the maximum aggregate offering price set forth in the Calculation of Registration Fee table contained in the Prior Registration Statement.

The information set forth in the Prior Registration Statement and all exhibits thereto are hereby incorporated by reference in this filing.

The

required opinion, consents and filing fee table are listed on the Exhibit Index attached hereto and filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the City of Mount Vernon, State of New York on the 14th day of November, 2023.

| |

APPLIED

UV, INC. |

| |

|

| By: |

|

/s/

Max Munn |

| |

|

Max

Munn |

| |

|

Chief

Executive Officer |

| |

|

(Principal

Executive Officer) |

Pursuant

to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and

on the dates indicated.

| Name |

|

Capacity in Which Signed |

|

Date |

| |

|

|

|

|

| /s/

Max Munn |

|

Chief

Executive Officer and Director (Principal Executive Officer) |

|

November

14, 2023 |

| Max

Munn |

|

|

|

|

| |

|

|

|

|

| /s/

Michael Riccio |

|

Chief

Financial Officer (Principal Financial and Accounting officer) |

|

November

14, 2023 |

| Michael

Riccio |

|

|

|

|

| |

|

|

|

|

| /s/

Eugene Burleson |

|

Chairman

of the Board |

|

November

14, 2023 |

| Eugene

Burleson |

|

|

|

|

| |

|

|

|

|

| /s/

Joseph Luhukay |

|

Director |

|

November

14, 2023 |

| Joseph

Luhukay |

|

|

|

|

| |

|

|

|

|

| /s/

Brian Stern |

|

Director |

|

November

14, 2023 |

| Brian

Stern |

|

|

|

|

| |

|

|

|

|

| /s/

Dr. Dallas Hack |

|

Director |

|

November

14, 2023 |

| Dr.

Dallas Hack |

|

|

|

|

November 14, 2023

Applied UV, Inc.

150 N Macquesten Pkwy

Mt Vernon, NY 10550

Ladies and Gentlemen:

We have acted as counsel to Applied UV, Inc.,

a Nevada corporation (the “Company”), in connection with the Rule 462(b) Registration Statement on Form S-1 filed by the Company

with the Securities and Exchange Commission (the “Commission”) on November 14, 2023 (the “462(b) Registration Statement”),

pursuant to the Securities Act of 1933, as amended (the “Securities Act”), in connection with the offering of up to (i) 2,666,666

units, each consisting of (A) one (1) share (“Share”) of common stock, par value $0.0001, of the Company (“Common Stock”)

or one (1) pre-funded warrant (“Pre-Funded Warrant,” and each share of Common Stock underlying a Pre-Funded Warrant, a “Pre-Funded

Warrant Share”), to purchase one (1) share of Common Stock in lieu thereof, (B) one-tenth (1/10th) of a Series A warrant

(“Series A Warrant” and each share of Common Stock underlying a Series A Warrant, a “Series A Warrant Share”)

to purchase one (1) share of Common Stock and (C) one-tenth (1/10th) of a Series B warrant (“Series B Warrant”

and, together with the Series A Warrant, the “Warrants” and, each share of Common Stock underlying a Series B Warrant, a “Series

B Warrant Share” and, together with the Series A Warrant Share, the “Warrant Shares”) and (ii) (A) 400,000 shares of

Common Stock issued pursuant to the Over-Allotment Option (the “Over-Allotment Option Shares”) and/or Pre-Funded Warrants

in lieu thereof (the “Over-Allotment Option Pre-Funded Warrants,” and each share of Common Stock underlying an Over-Allotment

Option Pre-Funded Warrant, an “Over-Allotment Option Pre-Funded Warrant Share”) and/or (B) 40,000 Series A Warrants issued

pursuant to the Over-Allotment Option (the “Over-Allotment Option Series A Warrants,” and each share of Common Stock underlying

an Over-Allotment Series A Option Warrant, an “Over-Allotment Option Series A Warrant Share”) and/or (C) 40,000 Series B Warrants

issued pursuant to the Over-Allotment Option (the “Over-Allotment Option Series B Warrants,” and each share of Common Stock

underlying an Over-Allotment Option Series B Warrant, an “Over-Allotment Option Series B Warrant Share” and, together with

the Over-Allotment Option Series A Warrant Share, the “Over-Allotment Option Warrant Shares”), issuable upon the exercise

of an over-allotment option granted by the Company to the underwriters (the “Over-Allotment Option”). The Rule 462(b) Registration

Statement relates to the Company’s Registration Statement on Form S-1, as amended (File No. 333-274879) (the “Registration

Statement”), initially filed by the Company with the Commission on October 5, 2023 and declared effective by the Commission on October

13, 2023.

In connection with this opinion, we have examined

originals or copies (certified or otherwise identified to our satisfaction) of (i) the Company’s Articles of Incorporation, as currently

in effect, (ii) the Company’s Bylaws as currently in effect, (iii) the 462(b) Registration Statement and the Registration Statement

and related Prospectus, (iv) the underwriting agreement, (v) the Pre-Funded Warrant, (vi) the Series A Warrant, (vii) the Series B Warrant

and (viii) such corporate records, agreements, documents and other instruments, and such certificates or comparable documents of public

officials or of officers and representatives of the Company, as we have deemed relevant and necessary as a basis for the opinion hereinafter

set forth.

In such examination, we have assumed the genuineness

of all signatures, the legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, the conformity

to original documents of all documents submitted to us as certified, conformed or photostatic copies, and the authenticity of the originals

of such latter documents. As to certain questions of fact material to this opinion, we have relied upon certificates or comparable documents

of officers and representatives of the Company and have not sought to independently verify such facts.

Based on the foregoing, and in reliance thereon,

and subject to the qualifications, limitations, exceptions and assumptions set forth herein, we are of the opinion that, having been issued

and sold in exchange for payment in full to the Company of all consideration required therefor as applicable, including with regard to

the Shares, the Pre-Funded Warrants, the Pre-Funded Warrant Shares, the Warrants, the Warrant Shares, the Over-Allotment Option Shares,

the Over-Allotment Option Pre-Funded Warrants, the Over-Allotment Option Pre-Funded Warrant Shares, the Over-Allotment Option Warrants

and the Over-Allotment Option Warrant Shares and as described in the 462(b) Registration Statement:

| (i) | | The Shares are duly authorized for issuance by the Company,

and when the 462(b) Registration Statement becomes effective under the Securities Act and the Shares are issued and paid for in accordance

with the underwriting agreement and as contemplated in the Registration Statement, the Shares will be validly issued, fully paid, and

nonassessable shares of common stock of the Company; |

| (ii) | | When the 462(b) Registration Statement becomes effective under

the Securities Act and when the Pre-Funded Warrants are issued, delivered and paid for in accordance with the terms of the Pre-Funded

Warrants and, as contemplated by the Registration Statement, then such Pre-Funded Warrant will be a legally binding obligation of the

Company enforceable in accordance with their terms, except that (a) such enforceability may be limited by bankruptcy, insolvency or other

similar laws affecting the enforcement of creditors’ rights in general and (b) the remedies of specific performance and injunctive

and other forms of injunctive relief may be subject to equitable defenses; |

| (iii) | | The Pre-Funded Warrant Shares have been duly authorized by

all necessary corporate action on the part of the Company and when the 462(b) Registration Statement becomes effective under the Securities

Act and the Pre-Funded Warrant is issued and paid for in accordance with the Pre-Funded Warrant and as contemplated in the Registration

Statement, the Pre-Funded Warrant Shares underlying such Pre-Funded Warrant will be validly issued, fully paid and nonassessable shares

of common stock of the Company. |

| (iv) | | When the 462(b) Registration Statement becomes effective under

the Securities Act and when the Series A Warrants are issued, delivered and paid for in accordance with the terms of the Series A Warrants

and, as contemplated by the Registration Statement, then such Series A Warrant will be a legally binding obligation of the Company enforceable

in accordance with their terms, except that (a) such enforceability may be limited by bankruptcy, insolvency or other similar laws affecting

the enforcement of creditors’ rights in general and (b) the remedies of specific performance and injunctive and other forms of

injunctive relief may be subject to equitable defenses; |

| (v) | | The Series A Warrant Shares have been duly authorized by all

necessary corporate action on the part of the Company and when the 462(b) Registration Statement becomes effective under the Securities

Act and the Series A Warrant is issued and paid for in accordance with the Series A Warrant and as contemplated in the Registration Statement,

the Series A Warrant Shares underlying such Series A Warrant will be validly issued, fully paid and nonassessable shares of common stock

of the Company. |

| (vi) | | When the 462(b) Registration Statement becomes effective under

the Securities Act and when the Series B Warrants are issued, delivered and paid for in accordance with the terms of the Series B Warrants

and, as contemplated by the Registration Statement, then such Series B Warrant will be a legally binding obligation of the Company enforceable

in accordance with their terms, except that (a) such enforceability may be limited by bankruptcy, insolvency or other similar laws affecting

the enforcement of creditors’ rights in general and (b) the remedies of specific performance and injunctive and other forms of

injunctive relief may be subject to equitable defenses; |

| (vii) | | The Series B Warrant Shares have been duly authorized by all

necessary corporate action on the part of the Company and when the 462(b) Registration Statement becomes effective under the Securities

Act and the Series B Warrant is issued and paid for in accordance with the Series B Warrant and as contemplated in the Registration Statement,

the Series B Warrant Shares underlying such Series B Warrant will be validly issued, fully paid and nonassessable shares of common stock

of the Company. |

| (viii) | | The Over-Allotment Option Shares are duly authorized for issuance

by the Company, and when the 462(b) Registration Statement becomes effective under the Securities Act and the Shares are issued and paid

for in accordance with the underwriting agreement and as contemplated in the Registration Statement, the Over-Allotment Option Shares

will be validly issued, fully paid, and nonassessable shares of common stock of the Company; |

| (ix) | | When the 462(b) Registration Statement becomes effective under

the Securities Act and when the Over-Allotment Option Pre-Funded Warrants are issued, delivered and paid for in accordance with the terms

of the Pre-Funded Warrants and, as contemplated by the Registration Statement, then such Over-Allotment Option Pre-Funded Warrant will

be a legally binding obligation of the Company enforceable in accordance with their terms, except that (a) such enforceability may be

limited by bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights in general and (b) the remedies

of specific performance and injunctive and other forms of injunctive relief may be subject to equitable defenses. |

| (x) | | The Over-Allotment Option Pre-Funded Warrant Shares have been

duly authorized by all necessary corporate action on the part of the Company and when the 462(b) Registration Statement becomes effective

under the Securities Act and the Over-Allotment Option Pre-Funded Warrant is issued and paid for in accordance with the Pre-Funded Warrant

and as contemplated in the Registration Statement, the Over-Allotment Option Pre-Funded Warrant Shares underlying such Over-Allotment

Option Pre-Funded Warrant will be validly issued, fully paid and nonassessable shares of common stock of the Company. |

| (xi) | | When the 462(b) Registration Statement becomes effective under

the Securities Act and when the Over-Allotment Option Series A Warrants are issued, delivered and paid for in accordance with the terms

of the Series A Warrants and, as contemplated by the Registration Statement, then such Over-Allotment Option Series A Warrant will be

a legally binding obligation of the Company enforceable in accordance with their terms, except that (a) such enforceability may be limited

by bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights in general and (b) the remedies

of specific performance and injunctive and other forms of injunctive relief may be subject to equitable defenses; |

| (xii) | | The Over-Allotment Option Series A Warrant Shares have been

duly authorized by all necessary corporate action on the part of the Company and when the 462(b) Registration Statement becomes effective

under the Securities Act and the Over-Allotment Option Series A Warrant is issued and paid for in accordance with the Series A Warrant

and as contemplated in the Registration Statement, the Over-Allotment Option Series A Warrant Shares underlying such Over-Allotment Option

Series A Warrant will be validly issued, fully paid and nonassessable shares of common stock of the Company. |

| (xiii) | | When the 462(b) Registration Statement becomes effective under

the Securities Act and when the Over-Allotment Option Series B Warrants are issued, delivered and paid for in accordance with the terms

of the Series B Warrants and, as contemplated by the Registration Statement, then such Over-Allotment Option Series B Warrant will be

a legally binding obligation of the Company enforceable in accordance with their terms, except that (a) such enforceability may be limited

by bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights in general and (b) the remedies

of specific performance and injunctive and other forms of injunctive relief may be subject to equitable defenses; |

| (xiv) | | The Over-Allotment Option Series B Warrant Shares have been

duly authorized by all necessary corporate action on the part of the Company and when the 462(b) Registration Statement becomes effective

under the Securities Act and the Over-Allotment Option Series B Warrant is issued and paid for in accordance with the Series B Warrant

and as contemplated in the Registration Statement, the Over-Allotment Option Series B Warrant Shares underlying such Over-Allotment Option

Series B Warrant will be validly issued, fully paid and nonassessable shares of common stock of the Company. |

The opinion expressed herein is limited to the

Nevada Revised Statutes (including reported judicial decisions interpreting the Nevada Revised Statutes) and, with respect to the enforceability

of the Pre-Funded Warrants and the Warrants, the laws of the State of New York, and we express no opinion as to the effect on the matters

covered by this letter of the laws of any other jurisdiction.

We assume no obligation to update or supplement

any of our opinions to reflect any changes of law or fact that may occur. We hereby consent to the filing of this opinion letter with

the Commission as Exhibit 5.1 to the 462(b) Registration Statement and to the reference to this firm under the heading “Legal Matters”

in the prospectus forming a part thereof. In giving this consent, we do not thereby admit that we are experts with respect to any part

of the 462(b) Registration Statement or prospectus within the meaning of the term “expert” as used in Section 11 of the Securities

Act or the rules and regulations promulgated thereunder by the Commission, nor do we admit that we are within the category of persons

whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

Sichenzia Ross Ference Carmel LLP

Sichenzia Ross Ference Carmel LLP

Exhibit 107

Calculation of Filing Fee Tables

Form S-1

Applied UV, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Table 1: Newly Registered and Carry Forward

Securities

| |

|

Security Type |

|

Security Class Title |

|

Fee Calculation Rule or Carry Forward Rule |

|

Amount Registered(1) |

|

Proposed Maximum Offering Price Per Unit(2) |

|

Maximum Aggregate Offering Price(1) |

|

Fee Rate |

|

Amount of Registration Fee(5) |

| Fees to be Paid |

|

Equity |

|

Units, each consisting of: (i) one share of common stock, $0.0001 par value per share (“Common Stock”); (ii) one-tenth of a Series A Warrant to purchase one share of Common Stock (the “Series A Warrant”); and (iii) one-tenth of a Series B Warrant to purchase one share of Common Stock (together with the Series A Warrant, “Warrants”) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

460,000 |

|

|

|

.00014760 |

|

|

$ |

67.90 |

|

| |

|

Equity |

|

Common Stock included as part of the Units which include a share of Common Stock(2) |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

Other |

|

Units, each consisting of: (i) one Pre-Funded Warrant exercisable for one share of Common Stock; and (ii) the Warrants(3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

Other |

|

Pre-Funded Warrants to purchase Common Stock, included as part of the Units which include a Pre-Funded Warrant(3) |

|

|

457 |

(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

Equity |

|

Common Stock underlying Pre-Funded Warrants(4) |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

Other |

|

Warrants to Purchase Common Stock, included as part of the Units(4) |

|

|

457 |

(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

Equity |

|

Common Stock underlying Warrants |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

$ |

1,380,000 |

|

|

|

.00014760 |

|

|

$ |

203.68 |

|

| Carry Forward Securities |

|

– |

|

– |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,840,000 |

|

|

|

.00014760 |

|

|

$ |

271.58 |

|

| Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

| Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

| Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

271.58 |

|

| (1) | | Represents only the additional number of shares being registered and

includes $60,000 worth of Units including a share of common stock and/or Units including a Pre-Funded Warrant that the underwriters have

the option to purchase. This does not include the securities that the Registrant previously registered on the Registration Statement on

Form S-1, as amended (File No. 333-274879) (the “Prior Registration Statement”). |

| (2) | | Pursuant to Rule

416 under the Securities Act, this registration statement shall also cover any additional shares of the registrant’s securities

that become issuable by reason of any share splits, share dividends or similar transactions. |

| (3) | | The registrant

may issue Units which include a Pre-Funded Warrant to purchase Common Stock in lieu of a share of Common Stock in the offering. The purchase

price of each Unit which includes a Pre-Funded Warrant will equal the price per share at which Units which include a share of Common

Stock are being sold to the public in this offering, minus $0.00001, which constitutes the pre-funded portion of the exercise price of

the Pre-Funded Warrants, and the remaining unpaid exercise price of the Pre-Funded Warrants will equal $0.00001 per share (subject to

adjustment as provided for therein). The proposed maximum aggregate offering price of the Units which include a Pre-Funded Warrant will

be reduced on a dollar-for-dollar basis based on the offering price of any Units which include a Pre-Funded Warrant issued in the offering,

and the proposed maximum aggregate offering price of the Units which include a share of Common Stock to be issued in the offering will

be reduced on a dollar-for-dollar basis based on the offering price of any Units which include a share of Common Stock issued in the

offering. |

| (4) | | No separate registration

fee is payable pursuant to Rule 457(g) under the Securities Act. |

| (5) | | The registration

fee is calculated in accordance with Rule 457(a) under the Securities Act of 1933, as amended, or the Securities Act, based on the proposed

maximum aggregate offering price. The Registrant previously registered securities with an aggregate offering price not to exceed $35,700,000

on the Prior Registration Statement, which was declared effective by the Securities and Exchange Commission on November 13, 2023. In

accordance with Rule 462(b) under the Securities Act, an additional amount of securities having a proposed maximum aggregate offering

price of $1,840,000 are hereby registered, which includes shares subject to the underwriters’ option to purchase additional shares

and/or warrants. |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference

in the Registration Statement on Form S-1MEF of Applied UV, Inc. of our report dated March 31, 2023, on the consolidated financial statements

of Applied UV, Inc. as of December 31, 2022 and 2021 and for each of the two years in the period ended December 31, 2022, which are incorporated

by reference into the Registration Statement (File No. 333-274879) on Form S-1. We also consent to the incorporation by reference in the

Registration Statement on Form S-1MEF of Applied UV, Inc. to the reference to our Firm under the caption “Experts” in the

Registration Statement.

/s/ Mazars USA LLP

Fort Washington, PA

November 14, 2023

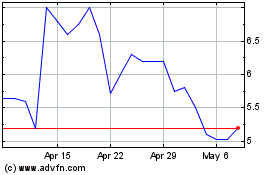

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From Apr 2024 to May 2024

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From May 2023 to May 2024