Enables AeroVironment’s Entry into Key Segments

and Strengthens Multi-Domain Capabilities

All-Stock Transaction Will Significantly

Enhance Growth and Diversification

Companies to Host Conference Call Today at 8:00

A.M. ET

AeroVironment, Inc. (NASDAQ: AVAV) (“AV” or the “Company”) and

BlueHalo LLC (“BlueHalo”) today announced the execution of a

definitive agreement under which AV will acquire BlueHalo in an

all-stock transaction with an enterprise value of approximately

$4.1 billion, creating a more diversified global leader in

all-domain defense technologies. The combined company will bring

together complementary capabilities to offer a comprehensive

portfolio of high-growth franchises, powered by cutting-edge

technology and focused on addressing the most important priorities

and needs of our nation and allies around the globe.

BlueHalo, an Arlington Capital Partners portfolio company, was

founded as a purpose-built platform providing industry-leading

capabilities in several key mission areas: Space Technologies,

Counter-Uncrewed Aircraft Systems (cUAS), Directed Energy,

Electronic Warfare, Cyber, Artificial Intelligence and other

Emerging Technologies including Uncrewed Underwater Vehicles

(UUVs). Since its founding in 2019, BlueHalo’s notable

accomplishments include being the first to successfully

operationally field directed energy (DE) laser weapon systems (LWS)

with its LOCUST LWS, being awarded Space Force’s multi-billion

dollar program to transform space operations with BADGER, its

adaptive phased array product and serving as a leader in Radio

Frequency Counter-Unmanned Aerial Systems (RF C-UAS), delivering

its 1000th system last year with its Titan and Titan-SV systems.

BlueHalo has focused on cutting-edge research and development

allowing for the development of products and services to transform

the future of global defense.

BlueHalo estimates that it will achieve more than $900 million

in revenues for 2024, in addition to funded backlog of nearly $600

million and a pipeline of multiple billion-dollar opportunities and

programs of record. BlueHalo generated approximately $886 million

of revenue in 2023, compared to $759 million and $660 million in

2022 and 2021, respectively.1

The acquisition of BlueHalo will create a diversified Defense

Tech company with a highly complementary and differentiated

portfolio of solutions in Uncrewed Systems, short and long range

Loitering Munitions, Counter UAS, Space Technologies, Electronic

Warfare and Cyber, powered by AI and Autonomy. This combination

will drive innovation, expand manufacturing capacity and enable us

to better support our customers and their critical missions. AV

expects that BlueHalo’s portfolio of 10 flagship solution families

and more than 100 patents will seamlessly integrate with AV’s

complementary existing expertise in the design, development,

manufacturing, training and servicing of Uncrewed Systems,

Loitering Munitions and Advanced Technologies. AV and BlueHalo

believe that these synergies will primarily be identified as

administrative and operational cost savings and sharing best

practices from each company. The companies’ shared culture of agile

innovation and mission expertise will enable the combined entity to

develop and deliver next-generation technologies that will have

significant military value and redefine the next era of Defense

Technology. On a pro forma basis, the combined company is expected

to deliver more than $1.7 billion in revenue.

“For over 50 years, AV has pioneered innovative solutions on the

battlefield, and today we are poised to usher in the next era of

defense technology through our combination with BlueHalo,” said

Wahid Nawabi, AV chairman, president and chief executive officer.

“BlueHalo not only brings key franchises and complementary

capabilities, but also a wealth of technologies, diverse customers

and exceptional talent to AV. Together, we will drive agile

innovation and deliver comprehensive, next-generation solutions

designed to redefine the future of defense. We are thrilled to

welcome the talented BlueHalo team as we unite our strengths,

expand our global impact and accelerate growth and value creation

for AV shareholders.”

Jonathan Moneymaker, chief executive officer of BlueHalo, said,

“BlueHalo was founded to address the most pressing challenges

confronting the defense and national security community, from

unconventional threats to near-peer adversaries. We have pioneered

solutions for drone warfare, distributed autonomy, and the need for

more robust and assured access to space in an increasingly

contested, crowded and competitive domain. Through these efforts,

we have earned our reputation as a trusted partner in defense

innovation. By uniting with AV, we are building an organization

equipped to meet emerging defense priorities and deliver

purpose-driven, state-of-the-art solutions with unmatched speed.

Together, we remain committed to protecting those who defend us

while driving the next generation of transformational advancements

in defense technology.”

Strategic and Financial Benefits:

- Creates a diversified industry leader. This transaction

brings together AV’s established portfolio of cutting-edge defense

solutions with BlueHalo’s emerging and industry-defining

technologies. This union will provide customers with a

comprehensive suite of solutions across multiple domains—including

air, land, sea, space and cyber. Together, AV and BlueHalo will

create a leader in integrated defense technologies with a global

footprint capable of addressing the full spectrum of modern

defense.

- Increases agility and speed, with enhanced infrastructure,

manufacturing capabilities and geographic footprint. The

combined company will benefit from greater resources, enabling

faster innovation and more efficient deployment of critical defense

systems.

- Supports AV’s entry into additional key defense segments and

builds on the Company’s strong track record of providing essential

solutions. With BlueHalo’s portfolio, AV will enter into new

segments that will significantly increase the Company’s total

addressable market, including Counter-UAS, Directed Energy,

Electronic Warfare, Cyber and Space technologies. The acquisition

will bring with it BlueHalo’s key programs of record, deep customer

relationships and strong backlog and pipeline, positioning the

future company as a more robust and sustainable prime defense

solution provider. This partnership will enhance AV’s ability to

meet the evolving needs of the Department of Defense (DoD) and

allied nations with a robust suite of innovative solutions.

- Diversifies mix of customers, products and revenue. The

combined company is expected to achieve a more balanced and

diversified customer base, product and revenue mix, benefiting from

BlueHalo’s established presence in key emerging defense markets.

The combined company will benefit from expanded geographical reach,

with the ability to provide BlueHalo’s solutions to AV’s larger

international customer base. By integrating complementary

capabilities, AV will be well-positioned to generate sustained

long-term value for shareholders.

- Generates attractive returns. AV expects the transaction

to be accretive to revenue, adjusted EBITDA and non-GAAP EPS in the

first full fiscal year post-close.

Transaction Details

The transaction, which has been unanimously approved by both

companies’ board of directors or managers, is expected to close in

the first half of calendar 2025, subject to regulatory and AV

shareholder approvals, as well as other customary closing

conditions.

Per the terms of the merger agreement, AV will issue

approximately 18.5 million shares of AV common stock to

BlueHalo.

Following the close of the transaction and based on AV’s shares

outstanding as of November 18, 2024, AV’s shareholders will own

approximately 60.5% of the combined company and BlueHalo’s equity

holders will own approximately 39.5%, subject to closing

adjustments. Arlington Capital Partners, an investment firm that is

the majority owner of BlueHalo, will retain a significant ownership

stake in the combined company.

We expect substantially all of the BlueHalo holders to enter

lock-up agreements with respect to their transaction consideration,

with 40% releasing 12 months post close and the remaining 60% to be

released in equal tranches 18 and 24 months after the close.

Leadership, Governance and Headquarters

Following the completion of the transaction, AV Chairman,

President and CEO Wahid Nawabi will be Chairman, President and CEO

of the combined company. Jonathan Moneymaker, CEO of BlueHalo, will

serve as a strategic advisor to Mr. Nawabi and the combined company

Management Team.

Upon closing, the AV Board of Directors will be expanded to

comprise 10 members. Arlington Capital Partners will have the right

to appoint two directors to the Board, subject to minimum ownership

thresholds.

The combined company will be at headquartered in Arlington,

Virginia, at AV’s corporate headquarters.

Conference Call and Webcast

AV will host a conference call to discuss the transaction.

Details are below.

Date: November 19, 2024 Time: 8:00 a.m. ET | 5:00 a.m. PT | 6:00

a.m. MT | 7:00 a.m. CT Participant registration URL:

https://register.vevent.com/register/BIe5d12b8272ca4a85b299c6205a7efea8

The live audio webcast will also be accessible via the Investor

Relations section of AV’s website, http://investor.avinc.com.

Please access the site 15 minutes before the event to ensure any

necessary software is downloaded.

Advisors

RBC Capital Markets is serving as financial advisor and Latham

& Watkins LLP is serving as legal advisor to AV. Joele Frank,

Wilkinson Brimmer Katcher is serving as strategic communications

advisor to AV. J.P. Morgan Securities LLC is serving as financial

advisor and Goodwin Procter LLP is serving as legal advisor to

Arlington Capital Partners and BlueHalo.

About AeroVironment, Inc.

AeroVironment (NASDAQ: AVAV) provides technology solutions at

the intersection of robotics, sensors, software analytics and

connectivity that deliver more actionable intelligence so you can

Proceed with Certainty. Headquartered in Virginia, AeroVironment is

a global leader in intelligent, multi-domain robotic systems, and

serves defense, government and commercial customers. For more

information, visit www.avinc.com.

About BlueHalo

BlueHalo is purpose-built to provide industry-leading

capabilities in the areas of Space, C-UAS and Autonomous Systems,

Electronic Warfare & Cyber, and AI/ML. The company develops and

brings to market next-generation capabilities to support customers’

critical missions and national security. Learn more at

http://www.bluehalo.com.

About Arlington Capital Partners

Arlington Capital Partners is a Washington, D.C.-area private

investment firm specializing in government-regulated industries.

The firm partners with founders and management teams to build

strategically important businesses in the government services and

technology, aerospace and defense, and healthcare sectors. Since

its inception in 1999, Arlington has invested in over 175 companies

and is currently investing out of its $3.8 billion Fund VI. For

more information, visit Arlington’s website at www.arlingtoncap.com

and follow Arlington on LinkedIn.

Statement Regarding Forward-Looking Information

This press release contains statements regarding the Company,

BlueHalo, the proposed transactions and other matters that are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). In some cases, forward-looking statements can be

identified by words such as “anticipate,” “approximate,” “believe,”

“plan,” “estimate,” “expect,” “project,” “could,” “should,”

“strategy,” “will,” “intend,” “may” and other similar expressions

or the negative of such words or expressions. Statements in this

press release concerning (i) the Company’s or BlueHalo’s expected

future financial position, results of operations, revenues,

business strategy, production capacity, competitive positions,

growth opportunities, employment opportunities and mobility, plans

and objectives of management and (ii) the Company’s proposed

acquisition of BlueHalo, the expected benefits of the acquisition,

including with respect to the business outlook or future economic

performance, anticipated profitability, revenues, expenses or other

financial items, and product or services line growth, the structure

of the proposed acquisition, the closing date of the proposed

acquisition, and plans following the closing of the proposed

acquisition, together with other statements that are not historical

facts, are forward-looking statements that are estimates reflecting

management’s best judgment based upon currently available

information. Such forward-looking statements are inherently

uncertain, and stockholders and other potential investors must

recognize that actual results may differ materially from

expectations as a result of a variety of factors, including,

without limitation, those discussed below. Such forward-looking

statements are based upon management’s current expectations and

include known and unknown risks, uncertainties and other factors,

many of which the Company and BlueHalo are unable to predict or

control, that may cause actual results, performance or plans to

differ materially from any future results, performance or plans

expressed or implied by such forward-looking statements. These

statements involve risks and uncertainties that could cause actual

results to differ materially from those anticipated in these

statements as a result of a number of factors, including, but not

limited to:

- the risk that the transaction described herein will not be

completed or will not provide the expected benefits, or that we

will not be able to achieve the cost or revenue synergies

anticipated;

- the failure to timely or at all obtain Company stockholder

approval for the acquisition;

- the inability to obtain required regulatory approvals for the

acquisition;

- the timing of obtaining such approvals and the risk that such

approvals may result in the imposition of conditions that could

adversely affect the combined company or the expected benefits of

the acquisition;

- the risk that a condition to closing of the acquisition may not

be satisfied on a timely basis or at all;

- the possible occurrence of an event, change or other

circumstance that would give rise to the termination of the

transaction agreement;

- the risk of shareholder litigation in connection with the

proposed transaction, including resulting expense or delay in delay

in closing of the transaction;

- the failure of the proposed transaction to close for any other

reason;

- the diversion of the attention of the Company and BlueHalo

management from ongoing business operations;

- unexpected costs, liabilities, charges or expenses resulting

from the acquisition;

- the risk that the integration of the Company and BlueHalo will

be more difficult, time-consuming or expensive than

anticipated;

- the risk of customer loss or other business disruption in

connection with the transaction, or of the loss of key

employees;

- the fact that unforeseen liabilities of the Company or BlueHalo

may exist;

- the risk of doing business internationally;

- the challenging macroeconomic environment, including

disruptions in the defense industry;

- risks that the Company may not be able to manage strains

associated with its growth;

- dependence on key personnel;

- stock price volatility;

- the effect of legislative initiatives or proposals, statutory

changes, governmental or other applicable regulations and/or

changes in industry requirements;

- the Company’s and BlueHalo’s ability to protect their

intellectual property and litigation risks; and

- other risks and uncertainties identified in the “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and “Business” sections of the Company’s

most recent Annual Report on Form 10-K and its subsequent Quarterly

Reports on Form 10-Q, and other risks as identified from time to

time in its Securities and Exchange Commission (“SEC”)

reports.

Other unknown or unpredictable factors also could have a

material adverse effect on the Company’s business, financial

condition, results of operations and prospects. Accordingly,

readers should not place undue reliance on these forward-looking

statements. These forward-looking statements are inherently subject

to uncertainties, risks and changes in circumstances that are

difficult to predict. Except as required by applicable law or

regulation, neither the Company nor BlueHalo undertakes (and each

of the Company and BlueHalo expressly disclaim) any obligation and

do not intend to publicly update or review any of these

forward-looking statements, whether as a result of new information,

future events or otherwise.

No Offer or Solicitation

This press release is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote in any jurisdiction pursuant to the

proposed transactions or otherwise, nor shall there be any sale,

issuance or transfer of securities in any jurisdiction in

contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act. Subject to certain exceptions to

be approved by the relevant regulators or certain facts to be

ascertained, the public offer will not be made directly or

indirectly, in or into any jurisdiction where to do so would

constitute a violation of the laws of such jurisdiction, or by use

of the mails or by any means or instrumentality (including without

limitation, facsimile transmission, telephone and the internet) of

interstate or foreign commerce, or any facility of a national

securities exchange, of any such jurisdiction.

Additional Information and Where to Find It

This press release is being made in respect of the proposed

transaction between the Company and BlueHalo. In connection with

the proposed transaction, the Company will file with the SEC a

registration statement on Form S-4, which will include a proxy

statement and a prospectus, to register the shares of the Company

stock that will be issued to BlueHalo’s shareholders (the “Proxy

and Registration Statement”), as well as other relevant documents

regarding the proposed transaction. INVESTORS ARE URGED TO READ IN

THEIR ENTIRETY THE PROXY AND REGISTRATION STATEMENT REGARDING THE

TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION.

A free copy of the Proxy and Registration Statement, as well as

other filings containing information about the Company, may be

obtained at the SEC’s website (http://www.sec.gov). You will also

be able to obtain these documents, free of charge, from the Company

at https://investor.avinc.com/ or by emailing ir@avinc.com.

Participants in the Solicitation

The Company and its respective directors and executive officers

may be deemed to be participants in the solicitation of proxies

from its respective stockholders in respect of the proposed

transactions contemplated by the Proxy and Registration Statement.

Information regarding the persons who are, under the rules of the

SEC, participants in the solicitation of the stockholders of the

Company in connection with the proposed transactions, including a

description of their direct or indirect interests, by security

holdings or otherwise, will be set forth in the Proxy and

Registration Statement when it is filed with the SEC. Information

regarding the Company’s directors and executive officers is

contained in its Annual Report on Form 10-K for the year ended

April 30, 2024 and its Proxy Statement on Schedule 14A, dated

August 12, 2024, which are filed with the SEC.

1 All revenue figures for BlueHalo are presented as if all

acquisitions made by BlueHalo and companies acquired by BlueHalo

had been owned by BlueHalo for the entirety of the applicable

calendar year, irrespective of the actual date of acquisition.

Amounts will differ from revenue figures reported for BlueHalo

under GAAP, which will only include revenue from and after the

applicable date of acquisition. Amounts will also differ from any

presentation made under Article 11 of Regulation S-X, which would

not require inclusion of certain insignificant or immaterial

acquisitions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119519687/en/

For AeroVironment:

Investors Jonah Teeter-Balin +1 (805) 520-8350 x4278

https://investor.avinc.com/contact-and-faq/contact-us

Media Joseph Sala / Woomi Yun / Jenna Shinderman Joele

Frank, Wilkinson Brimmer Katcher +1 (212) 355-4449

For BlueHalo:

Paul Frommelt paul.frommelt@bluehalo.com +1 (703) 609-9721

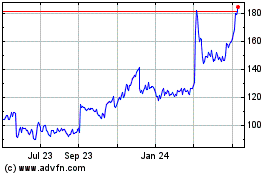

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Nov 2024 to Dec 2024

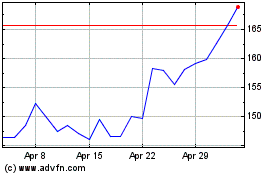

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Dec 2023 to Dec 2024