Form 8-K/A date of report 03-04-24

true

0001506928

0001506928

2024-03-04

2024-03-04

--12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 4, 2024

Avinger, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-36817

|

20-8873453

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

400 Chesapeake Drive

Redwood City, California 94063

(Address of principal executive offices, including zip code)

(650) 241-7900

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

AVGR

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Statement

This Current Report on Form 8-K/A (the “Amendment”) amends the Current Report on Form 8-K for Avinger, Inc. (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) on March 7, 2024 (the “Initial 8-K”). This Amendment is solely for the purpose of adding Item 3.03, “Material Modification to Rights of Security Holders.” No other changes have been made to the Initial 8-K.

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Strategic Partnership

On March 4, 2024, Avinger, Inc. (“Avinger” or the “Company”) entered into a License and Distribution Agreement (the “License Agreement”) with Zylox-Tonbridge Medical Technology Co., Ltd. (“Zylox-Tonbridge”) effective as of the Initial Closing (defined below), pursuant to which the Company will license and distribute certain of the Company’s products (including consumables) in the Greater China region, including mainland China, Hong Kong, Macao, and Taiwan (the “Territory”). Zylox-Tonbridge will lead all regulatory activities for the registration of the Avinger products in the Territory. Avinger will also license its intellectual property and know-how related to Avinger products to Zylox-Tonbridge so that Zylox-Tonbridge can manufacture the localized products in the Territory. Avinger will supply Avinger products to Zylox-Tonbridge until Zylox-Tonbridge’s manufacturing capability has been established and Zylox-Tonbridge has obtained the regulatory approval of the localized products manufactured by Zylox-Tonbridge. All sales of Avinger products locally manufactured by Zylox-Tonbridge with regulatory approval by the regulatory authorities in the Territory and commercialized in the Territory will be royalty bearing to Avinger at a rate from a mid-single to high-single digit percentage depending on the amount of gross revenue as defined in the License Agreement, with certain increases depending on the amount of product gross margin. The License Agreement has an initial term of 20 years, which shall be further automatically extended for additional 20-year terms, subject to certain conditions. The License Agreement may not be terminated by either party, other than for certain uncured material breaches or the other party’s insolvency.

In connection with the License Agreement, on March 4, 2024, the Company and Zylox-Tonbridge also entered into a Strategic Cooperation and Framework Agreement in conjunction with the Initial Closing (the “Collaboration Agreement” and, together with the License Agreement, the “Strategic Collaboration”), which provides the opportunity for the Company to access certain Zylox-Tonbridge peripheral vascular products for distribution in the U.S. and Germany. The agreement also provides the option for Avinger to source finished goods inventory from Zylox-Tonbridge following registration of Zylox-Tonbridge’s manufacturing facility with the U.S. Food & Drug Administration (“FDA”).

The foregoing description of the License Agreement and Collaboration Agreement is a summary and is qualified in its entirety by reference to the form of License Agreement and Collaboration Agreement. The form of License Agreement will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the period ending March 31, 2024 and the form of Collaboration Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Financing Agreements

On March 4, 2024, in connection with the Strategic Collaboration, the Company and Zylox-Tonbridge Medical Limited, a wholly-owned subsidiary of Zylox-Tonbridge (the “Purchaser”), entered into a Securities Purchase Agreement (the “Purchase Agreement”), pursuant to which the Purchaser agreed to purchase, in two tranches, up to an aggregate of $15 million in shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), and shares of two new series of the Company’s preferred stock (the “Private Placement”). On March 5, 2024, (the “Initial Closing”), the Company issued to the Purchaser 75,327 shares of the Common Stock at a purchase price per share of $3.664 (the “Purchase Price”), and 7,224 shares of a newly authorized Series F convertible preferred stock, par value $0.001 per share (the “Series F Preferred Stock”), for an aggregate purchase price of $7.5 million.

Each share of Series F Preferred Stock has a stated value of $1,000 and is initially convertible into approximately 273 shares of Common Stock at a conversion price equal to the Purchase Price, subject to the terms of the Certificate of Designation of Preferences, Rights, and Limitations of the Series F Preferred Stock (the “Series F Certificate of Designation”).

Upon completion of the following as mutually agreed upon by the Company and the Purchaser: (i) the successful registration and listing under 21 CFR part 807 with the FDA of the Purchaser and one of its designated affiliates to manufacture Avinger’s products, and (ii) the Company achieving an aggregate of $10 million in gross revenue within any four consecutive fiscal quarters after the Initial Closing, excluding any gross revenue achieved by Avinger under the License Agreement discussed above (together, the “Milestones”), the Purchaser will invest an additional $7.5 million (the “Milestone Closing”) to purchase shares of the Company new Series G convertible preferred stock, par value $0.001 per share (the “Series G Preferred Stock”). Each share of Series G Preferred Stock will have a stated value of $1,000 and will be convertible into shares of Common Stock at a conversion price of equal to the lowest of (x) the Purchase Price, (y) the closing price of the Common Stock on the date immediately preceding the Milestone Closing, and (z) the average of the closing price for the last five trading days preceding the Milestone Closing, provided that the conversion price will be no less than $0.20.

The Company’s obligations to (i) accept conversion of the shares of Series F Preferred Stock in excess of 19.99% of the Company’s outstanding common stock as of the date of the Purchase Agreement and (ii) issue and sell shares of Series G Preferred Stock upon completion of the Milestones are each subject to receipt of the approval of the Company’s stockholders as is necessary under the rules and regulations of Nasdaq (including, without limitation, Nasdaq Rule 5635(d)).

Additionally, pursuant to the terms of the Purchase Agreement, the Company provided the Purchaser the right to appoint one member of the Company’s Board of Directors (the “Board”). Upon the Initial Closing, the Company has appointed Jonathon Zhong Zhao as a member of the Board.

In connection with the Purchase Agreement, the Company and the Purchaser also entered into a Registration Rights Agreement (the “Registration Rights Agreement”) in conjunction with the Initial Closing, pursuant to which the Company agreed to file an initial registration statement with the Securities and Exchange Commission (the “SEC”) within 30 days following the Initial Closing for purposes of registering the resale of the shares of Common Stock issued in the Private Placement at the Initial Closing. The Company also agreed to use reasonable best efforts to cause the SEC to declare the registration statement effective as soon as practicable and no later than the earlier of (i) the 60th calendar day following the closing of the Private Placement (or 90th calendar day in the event of a full review by the SEC) and (ii) the 5th trading day after the date the Company is notified by the SEC that the Registration Statement will not be reviewed or will not be subject to further review. The Company further agreed to file additional registration statements as necessary to register additional registrable securities not registered in the initial registration statement, including the shares of Common Stock issuable upon conversion of the Series G Preferred Stock. The Company also agreed to use its reasonable best efforts to keep each registration statement continuously effective until the earlier of (i) the date on which the securities may be resold without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144 or (ii) all of the securities have been sold or otherwise have ceased to be outstanding.

The foregoing description of the Purchase Agreement and the Registration Rights Agreement is a summary and is qualified in its entirety by reference to the Purchase Agreement and form of Registration Rights Agreement filed as Exhibit 10.2 and Exhibit 10.3, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

A copy of the Company’s press release, dated March 5, 2024, announcing the Strategic Collaboration and the Private Placement is attached hereto as Exhibit 99.1.

The Company engaged Cantor Fitzgerald & Co. (“Cantor”) and Piper Sandler & Co. (“Piper”) as financial advisors to the Company in connection with the transactions. The Company agreed to pay Piper a cash fee equal to 2% of the gross proceeds to the Company in the Private Placement.

The Company agreed to pay Cantor a cash fee equal to 5% of the gross proceeds to the Company in the Private Placement. The Company also agreed to issue to Cantor warrants to purchase an aggregate number of shares of Common Stock equal to 2% of the gross proceeds to the Company in the Private Placement. In connection with the Initial Closing, the Company issued to Cantor warrants (the “Warrants”) to purchase 40,938 shares of Common Stock. The Warrants have an exercise price equal to $3.664 per share of Common Stock and a term of five years from the Initial Closing. The Warrants may also be exercised on a cashless basis if at the time of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for, the resale of the shares of Common Stock underlying the Warrants. A holder (together with its affiliates) of the Warrants may not exercise any portion of the Warrants to the extent that the holder would own more than 4.99% (or 9.99% at the election of the holder) of the outstanding common stock immediately after exercise, which percentage may be changed at the holder’s election to a lower percentage at any time or to a higher percentage not to exceed 9.99% upon 61 days’ notice to the Company.

In the event of any fundamental transaction, as described in the Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of common stock, subject to certain exceptions, then upon any subsequent exercise of the Warrants, the holder will have the right to receive as alternative consideration, for each share of common stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of Common Stock for which the Warrants are exercisable immediately prior to such event.

The foregoing description of the Warrants is a summary and is qualified in its entirety by reference to the form of Warrant filed as Exhibit 10.5 to this Current Report on Form 8-K and incorporated herein by reference.

Series A Preferred Stock Exchange

In connection with the Strategic Collaboration and the Private Placement, on March 5, 2024, the Company entered into a Securities Purchase Agreement (the “A-1 Securities Purchase Agreement”) to exchange all outstanding shares of its Series A Preferred Stock for 10,000 shares of Series A-1 Preferred Stock (the “Exchange”). Among other things, the shares of Series A-1 Preferred Stock: (i) are convertible into an aggregate of approximately 2,729,257 shares of Common Stock at a conversion price equal to the Purchase Price, (ii) do not accrue or pay dividends payable solely on the Series A-1 Preferred Stock, (iii) will have no liquidation preference and (iv) will be junior in rank to shares of the Company’s Series E Preferred Stock, Series F Preferred Stock and Series G Preferred Stock. The foregoing description does not purport to be complete and is qualified in its entirety by reference to the A-1 Securities Purchase Agreement, a copy of which is filed herewith as Exhibit 10.6. Additional information regarding the rights, preferences, privileges and restrictions applicable to the Series A-1 Preferred Stock is set forth under Item 5.03 of this report.

The Company also entered into a new Registration Rights Agreement (the “A-1 Registration Rights Agreement”) with the holders of the Series A-1 Preferred Stock on substantially the same terms as the Registration Rights Agreement entered into with the holders of the Series A Preferred Stock. The terms of the A-1 Registration Rights Agreement provide that the Company will, upon request of the majority holders of the Series A-1 Preferred Stock, effect the registration of all shares of the Series A-1 Preferred Stock. Additionally, the Securities Registration Rights Agreement provides that the holders of Series A-1 Preferred Stock will be entitled to have their stock included on any Company initiated registration statements, subject to limitations including a reduction in the number of shares included in registration statements based on the discretion of any underwriters. The foregoing description does not purport to be complete and is qualified in its entirety by reference to the A-1 Registration Rights Agreement, a copy of which is filed herewith as Exhibit 10.7.

CRG Loan Amendment

In connection with the Strategic Collaboration and the Private Placement, the Company also entered into Amendment No. 9 to Term Loan Agreement effective as of the Initial Closing (the “Loan Amendment”) with CRG Partners III L.P. and certain of its affiliates as lenders (collectively in such capacity, the “Lenders”), which amends the Term Loan Agreement, dated as of September 22, 2015, by and among the Company, certain of its subsidiaries from time to time party thereto as guarantors and the Lenders (as amended, the “Term Loan Agreement”). The Loan Amendment amends the Term Loan Agreement to, among other things:

| |

-

|

extend the interest-only period through December 31, 2026;

|

| |

-

|

provide that interest payable through December 31, 2026 may be payable in kind rather than in cash; and

|

| |

-

|

permit the payment of dividends on the preferred stock issued or issuable to the Purchaser.

|

The foregoing description of the Loan Amendment is qualified in its entirety by reference to the full text of the Loan Amendment, a copy of which is attached hereto as Exhibit 10.4, and which is incorporated herein in its entirety by reference.

The License Agreement, Collaboration Agreement, Purchase Agreement, Loan Amendment, and the above descriptions have been included to provide investors and security holders with information regarding the terms of such agreements. They are not intended to provide any other factual information about the Company, Zylox-Tonbridge, or the Lenders or their respective subsidiaries or affiliates or stockholders. The representations, warranties and covenants contained in each agreement were made only for purposes of such agreement and as of specific dates; were solely for the benefit of the parties to such agreement; and may be subject to limitations agreed upon by the parties, including being qualified by confidential disclosures made by each contracting party to the other for the purposes of allocating contractual risk between them that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any description thereof as characterizations of the actual state of facts or condition of the Company, Zylox-Tonbridge, or the Lenders or any of their respective subsidiaries, affiliates, businesses or stockholders. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the relevant date of such agreement, which subsequent information may or may not be fully reflected in public disclosures or statements by the Company, Zylox-Tonbridge, or the Lenders. Accordingly, investors should read the representations and warranties in the License Agreement, Collaboration Agreement, Purchase Agreement, and Loan Amendment not in isolation but only in conjunction with the other information about the Company, Zylox-Tonbridge, or the Lenders and their respective subsidiaries that the respective companies include in reports, statements and other filings made with the U.S. Securities and Exchange Commission.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information included in Item 1.01 of this Current Report on Form 8-K is also incorporated by reference into this Item 2.03 of this Current Report on Form 8-K.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The disclosure included in Item 1.01 and Item 5.03 of this report is incorporated under this Item by reference.

None of the shares of the Common Stock, Series F Preferred Stock or Series A-1 Preferred Stock or the Warrants issued or to be issued in the transactions described in Item 1.01 of this report have been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws. The Company relied on exemption from registration available under Section 4(a)(2) of the Securities Act in connection with the Private Placement, the Exchange, and the issuance of the Warrants.

|

Item 3.03

|

Material Modification to Rights of Security Holders.

|

The information included in Item 1.01 and Item 5.03 of this Current Report on Form 8-K is also incorporated by reference into this Item 3.03 of this Current Report on Form 8-K.

|

Item 5.02

|

Departure of Director or Certain Officers; Election of Directors; Appointment of Certain Officers, Compensatory Arrangements with Certain Officers.

|

The information contained above in Item 1.01 is hereby incorporated by reference into this Item 5.02.

Pursuant to the terms of the Purchase Agreement, effective as of the Initial Closing, the size of the Board was set at five directors and Jonathon Zhong Zhao was appointed to serve as a Class II member of the Board. Mr. Zhao’s term will expire at the 2026 annual meeting of stockholders, until his successor is duly elected and qualified or until his earlier death, resignation or removal.

Mr. Zhao will participate in the Company's outside director compensation policy. A complete description of the outside director compensation policy is set forth in the Company's proxy statement for the 2023 Annual Meeting of Stockholders, filed with the Securities and Exchange Commission on August 17, 2023 and is incorporated herein by this reference.

There are no family relationships between Mr. Zhao and any director or executive officer of the Company, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K, other than the transactions described in Item 1.01 of this report relating to Zylox-Tonbridge. .

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

Certificate of Designation of Series F Preferred Stock

Pursuant to the Purchase Agreement, on March 4, 2024, the Company filed the Series F Certificate of Designation, designating 7,224 shares of Series F Preferred Stock. The Series F Preferred Stock shall carry a 5% per year cumulative dividend, which is compounded annually and is payable in cash or additional shares of Series F Preferred Stock at the election of the Company, until the third anniversary of the issuance date. Following the third anniversary of the issuance date, the Series F Preferred Stock will carry an 8% per year cumulative dividend, which is compounded annually and is payable in cash or additional shares of Series F Preferred Stock at the election of the holders. The Series F Preferred Stock’s cumulative dividend is senior to, and must be paid prior to, any dividends upon other classes and series of the Company’s capital stock.

In the event of any liquidation, dissolution, winding up or change in control of the Company, the holders of Series F Preferred Stock shall be entitled to receive, prior and in preference to any other class or series of the Company’s capital stock, an amount equal to the greater of (1) $750 per share of Series F Preferred Stock plus accrued and unpaid dividends or (2) an amount per share equal to that payable had the Series F Preferred Stock been converted to Common Stock immediately prior to such payment.

Each share of Series F Preferred Stock is initially convertible into approximately 273 shares of Common Stock, subject to customary adjustments for stock dividends and stock splits, pro rata distributions, or the occurrence of a merger, reorganization, or similar transaction. Shares of Series F Preferred Stock cannot be converted into Common Stock if the applicable holder would beneficially own in excess of 19.9% of the Company’s outstanding voting power, unless approved by the Company’s stockholders in accordance with Nasdaq Listing Rule 5635(b).

The holders of the Series F Preferred Stock are entitled to vote on any matter presented to the Company’s stockholders, on an as-converted basis, provided that in no event shall any holder (together with its affiliates or any other person whose beneficial ownership would be aggregated) of the shares of the Series F Preferred Stock be entitled to vote, on an as-converted basis and in the aggregate, more than 19.9% of the voting power of the Company’s outstanding shares of capital stock (the “Voting Cap”), unless approved by the Company’s stockholders in accordance with Nasdaq Listing Rule 5635(b), at which time the Voting Cap will be increased to 49.9%. In addition, the Company will not take any of the following actions without the affirmative vote of the holders of a majority of the outstanding shares of the Series F Preferred Stock: (1) the liquidation, dissolution, winding up or other changes in control of the Company, (2) amendments of the Company’s certificate of incorporation or bylaws in a manner adverse to the Series F Preferred Stock, (3) amendments of the powers, preferences or rights given to the Series F Preferred Stock or amendments to the Series F Certificate of Designation, (4) the increase of the number of authorized shares of the Series F Preferred Stock or any additional class or series of capital stock of the Company unless the same ranks junior to the Series F Preferred Stock with respect to its rights, preferences and privileges, (5) the issuance of any shares of a new class or series of capital stock unless such new class or series of capital ranks junior to the Series F Preferred Stock, (6) the reclassification, alteration or amendment of any existing security with respect to dividend rights and rights in a liquidation of the Company that would render such security senior to the Series F Preferred Stock and (7) the repurchase or redemption of, or the payment of any dividend or distribution to, other classes or series of the Company’s capital stock, subject to certain exceptions.

The foregoing description of the Series F Preferred Stock does not purport to be complete, and is qualified in its entirety by reference to the Series F Certificate of Designation, a form of which is filed herewith as Exhibit 3.1.

Certificate of Designation of Series A-1 Preferred Stock

In connection with the Exchange, on March 4, 2024, the Company filed the Series A-1 Certificate of Designation, designating shares of Series A-1 Preferred Stock. The Series A-1 Preferred Stock have a conversion price equal to the Purchase Price, subject to customary adjustments for stock dividends and stock splits, pro rata distributions, or the occurrence of a merger, reorganization, or similar transaction.

The foregoing description of the Series A-1 Preferred Stock does not purport to be complete, and is qualified in its entirety by reference to Certificate of Designation of Preferences, Rights and Limitations of Series A-1 Convertible Preferred Stock, a form of which is filed herewith as Exhibit 3.2.

Amendment of Certificate of Designation Series E

Prior to the Exchange, on March 4, 2024, the Company filed a Certificate of Amendment to the Certificate of Designation of Preferences, Rights and Limitations of Series E Convertible Preferred Stock (the “Series E Amendment”). The Company’s Series E Convertible Preferred Stock, par value $0.001 (“Series E preferred stock”), is convertible into shares of common stock, provided that, prior to filing the Amendment, the Series E preferred stock could not be converted to the extent that, following such conversion, the holder would beneficially own more than 19.99% of the number of shares of the Company’s common stock outstanding immediately after giving effect to such conversion (the “Beneficial Ownership Limitation”).

The Amendment reduced the initial Beneficial Ownership Limitation to 9.99%. Increases in the Beneficial Ownership Limitation require at least 61 days’ advance notice from the holder of Series E preferred stock. Pursuant to the Amendment, any future decreases to the Beneficial Ownership Limitation are effective immediately upon notice to the Company.

The foregoing description of the Amendment does not purport to be complete, and is qualified in its entirety by reference to the Amendment, a copy of which is filed herewith as Exhibit 3.3.

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

On March 4, 2024, the holders of all of the outstanding shares of the Series A Preferred Stock and Series E Preferred Stock approved the License Agreement, the Purchase Agreement, and the transactions contemplated thereby, including the amendment, the issuance of the Series F Preferred Stock and Series G Preferred stock, the Exchange, and the Series E Amendment, by written consent.

The disclosure included in Item 1.01 and Item 5.03 of this report is incorporated under this Item by reference.

Forward-Looking Statements

Certain information contained in this Current Report on Form 8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We may in some cases use terms such as “predicts,” “believes,” “potential,” “continue,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “likely,” “will,” “should” or other words that convey uncertainty of the future events or outcomes to identify these forward-looking statements. Our forward-looking statements are based on current beliefs and expectations of our management team that involve risks, potential changes in circumstances, assumptions, and uncertainties, including statements regarding the issuance of the Series G Preferred Stock, and our ability to realize any benefits from the License Agreement or Collaboration Agreement. Any or all of the forward-looking statements may turn out to be wrong or be affected by assumptions we make that later turn out to be incorrect, or by known or unknown risks and uncertainties. These forward-looking statements are subject to risks and uncertainties including risks related to our ability to satisfy all closing conditions to the Purchase Agreement and the milestones for the Series G Preferred Stock, and the other risks set forth in our filings with the Securities and Exchange Commission, including in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. For all these reasons, actual results and developments could be materially different from those expressed in or implied by our forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which are made only as of the date of this Current Report on Form 8-K. We undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances unless required by law.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit No.

|

Description

|

|

3.1

|

|

|

3.2

|

|

|

3.3

|

|

|

10.1

|

|

|

10.2

|

|

|

10.3

|

|

|

10.4

|

|

|

10.5

|

|

|

10.6

|

|

|

10.7

|

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

AVINGER, INC.

|

| |

|

|

| |

|

|

|

Date: March 8, 2024

|

By:

|

/s/ Jeffrey M. Soinski

|

| |

|

Jeffrey M. Soinski

|

| |

|

Chief Executive Officer

|

v3.24.0.1

Document And Entity Information

|

Mar. 04, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Avinger, Inc.

|

| Current Fiscal Year End Date |

--12-31

|

| Document, Type |

8-K/A

|

| Document, Period End Date |

Mar. 04, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36817

|

| Entity, Tax Identification Number |

20-8873453

|

| Entity, Address, Address Line One |

400 Chesapeake Drive

|

| Entity, Address, City or Town |

Redwood City

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94063

|

| City Area Code |

650

|

| Local Phone Number |

241-7900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AVGR

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Description |

Form 8-K/A date of report 03-04-24

|

| Amendment Flag |

true

|

| Entity, Central Index Key |

0001506928

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

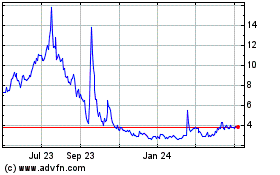

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

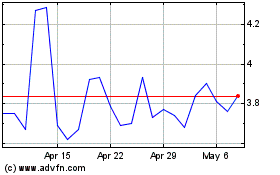

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Apr 2023 to Apr 2024