UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

_________________________________________________________________

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| o | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| ý | Soliciting Material Pursuant to §240.14a-12 |

AXONICS, INC.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ý | | No fee required. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| | |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | | | |

| | | | |

This Schedule 14A filing consists of the following communications from Axonics, Inc., a Delaware corporation (the “Company”), relating to the Agreement and Plan of Merger, dated January 8, 2024, by and among the Company, Boston Scientific Corporation, a Delaware corporation, and Sadie Merger Sub, Inc., a Delaware corporation, and the proposed transactions thereunder:

•CEO Employee Email

•Employee FAQ

•Email to Healthcare Providers

•Email to Customers

•Email to Suppliers

•Email to Commercial Team

•LinkedIn and X (formerly Twitter) Posts

Each item above was first used or made available on January 8, 2024.

CEO Employee Email

Subject: Boston Scientific Announces Agreement to Acquire Axonics

Dear Colleagues,

We are pleased to inform you that Axonics has entered into a definitive agreement to be acquired by Boston Scientific Corporation (NYSE: BSX), a global medical technology leader with a broad and deep portfolio of industry- leading technologies for treating urological conditions. This is an exciting development for Axonics and a significant recognition of what our team has accomplished since inception. Attached is the press release.

Becoming part of Boston Scientific will enable Axonics to continue our mission of improving the lives of people with bladder and bowel dysfunction. As part of Boston Scientific, Axonics will benefit from the company’s significant global reach and resources, allowing our products to reach even more patients, including in geographies outside the United States.

As of today, nothing changes – it is business as usual for everyone at Axonics. This means we must continue to focus on meeting our individual goals and company objectives. Axonics will continue to operate as a separate and independent entity until the closing of the merger.

The transaction is expected to be completed in the first half of 2024, subject to customary closing conditions, including approval of Axonics’ stockholders and receipt of required regulatory approvals, at which time Axonics will become a wholly owned subsidiary of Boston Scientific.

It will take the next several months to plan the integration of Axonics into Boston Scientific. In the interim, we will provide updates as they become available.

Several meetings to provide additional information will take place today and in the coming weeks for Irvine-based, field-based and remote employees. We have also attached an FAQ document to answer questions.

Please continue to diligently execute on your responsibilities. Maintaining quality in our day-to-day operations and activities will ensure we continue to provide the “Axonics experience” to patients and healthcare providers.

Best regards,

Raymond W Cohen

Chief Executive Officer

Axonics, Inc.

Additional Information and Where to Find It

In connection with the contemplated transaction, Axonics intends to file with the U.S. Securities and Exchange Commission (“SEC”) preliminary and definitive proxy statements relating to the contemplated transaction and other relevant documents. The definitive proxy statement will be mailed to Axonics’ stockholders as of a record date to be established for voting on the contemplated transaction and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated transaction and any other matters to be voted on at the special meeting. Information regarding the names, affiliations and interests of such directors and executive officers will be included in the preliminary and definitive proxy statements (when available) for the contemplated transaction. Additional

information regarding such directors and executive officers is included in Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Axonics’ stockholders in connection with the contemplated transaction and any other matters to be voted upon at the special meeting will be set forth in the preliminary and definitive proxy statements (when available) for the contemplated transaction. These documents (when available) are available free of charge as described in the preceding section.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: the ability of the parties to consummate the contemplated transaction in a timely manner or at all; the satisfaction or waiver of the conditions to closing the contemplated transaction, including the failure to obtain antitrust or other regulatory approvals and clearances or approval of Axonics’ stockholders; potential delays in consummating the contemplated transaction; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the merger agreement for the contemplated transaction; the ability to realize the anticipated benefits of the contemplated transaction; the ability to successfully integrate the businesses; the effect of the announcement or pendency of the contemplated transaction on Axonics’ business relationships, operating results and business generally; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the contemplated transaction. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this communication are made only as of the date of this communication, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. Further information on factors that could cause actual results to differ materially from the results anticipated by Axonics’ forward-looking statements is included in the reports Axonics has filed or will file with the SEC, including Axonics’ Annual Report on Form 10-K for the year ended December 31, 2022 and Axonics’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These filings, when available, are available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov.

Employee FAQ

Employee FAQ regarding Boston Scientific announcement

1.What was announced this morning by Axonics and Boston Scientific?

Axonics has entered into a definitive agreement under which Boston Scientific Corporation will acquire Axonics for $71 per share. This represents an equity value of approximately $3.7 billion.

The transaction is anticipated to close in the first half of 2024, subject to customary closing conditions, including approval of Axonics’ stockholders and receipt of required regulatory approvals, at which time Axonics will become a wholly owned subsidiary of Boston Scientific.

2.Who is Boston Scientific and what do they do?

Boston Scientific is a Fortune 500 company that has been a global leader in medical technology for more than 40 years. Boston Scientific provides physicians and patients with innovative products in 5 main businesses: urology, endoscopy, neuromodulation, cardiology and peripheral interventions.

Boston Scientific is headquartered in Massachusetts and employs 45,000 people globally. The company generated ~$13 billion of sales in 2022 and has an equity market capitalization of ~$85 billion (NYSE: BSX).

Fortune has named Boston Scientific to its list of World’s Most Admired Companies; Forbes has named Boston Scientific to its list of World’s Best Employers; Glassdoor has named Boston Scientific to its list of Employees’ Choice Best Places to Work.

3.Why does this transaction make sense strategically?

Axonics brings a highly complementary product portfolio to the Boston Scientific Urology business.

We believe the acquisition by a leading global medical technology company that shares our commitment to innovation should accelerate growth and increase awareness and adoption of our advanced incontinence therapies worldwide.

4.Why is Axonics being acquired at this time?

The Axonics board of directors believes that the Boston Scientific offer represents compelling value for Axonics shareholders.

5.What does this agreement mean for Axonics? What are the transition plans?

Nothing will change between the signing (today) and closing (1H24) of the transaction, as Axonics and Boston Scientific remain, and must continue to operate as, separate, independent companies until the transaction closes. Certain laws require Axonics and Boston Scientific to remain separate, and not to integrate or engage in joint activities until regulatory reviews are complete and the closing has occurred.

We do not anticipate any changes to Axonics’ organizational structure prior to closing. An integration planning team comprised of members from both companies will work to ensure there will be a smooth transition upon closing. We expect to continue to

operate at full speed in order to support customers and their patients, maintain production and continue the momentum Axonics has generated for its SNM and Bulkamid products.

6.What will my role be at the combined company?

Until the transaction closes, it is business as usual and there will be no changes. During this period between signing and closing, it is our responsibility to continue to operate as a separate and independent company. Integration of operations, which will happen post-closing, will involve detailed planning and deliberation. As the transition period progresses, we will continue to share further updates with you. Our objective is to communicate promptly and directly and to treat people fairly, and we ask for your support and continued focus on executing the current business priorities of your department.

7.Will Axonics stay in its current Irvine location?

As planned, we intend to move to the new Sand Canyon facility in 2024 and the cross-functional team will operate out of this site. This move is critical to our continued growth and success.

8.What information can I share with Boston Scientific employees while the transaction is pending?

Outside of formal integration planning teams, employees of Axonics should not engage with employees at Boston Scientific while the transaction is pending.

9.Why didn’t you tell us about the transaction before the press release was issued publicly?

Because Axonics and Boston Scientific are both publicly traded companies, it was necessary to treat this with strict confidentiality.

10.What will happen to Axonics compensation and benefits (medical, paid time off, etc.)?

Prior to close of the transaction, no changes are anticipated. Both companies are committed to providing a competitive compensation and benefits package that will allow them to continue to attract and retain great talent. As the closing of the transaction approaches, more information will be communicated to Axonics employees as to the transition of benefit plans and offerings.

11.What happens to my AXNX equity awards?

Until the transaction closes, equity awards generally continue to vest as per their terms. All unvested restricted stock awards will vest upon closing and both vested and unvested shares will be exchanged for a cash payment. As we get closer to the closing date, employees with equity will be provided with additional details.

12.Will my 401(k) program be affected?

Until the transaction closes, there are no changes anticipated to existing 401(k) plans in the U.S. Following the close, any changes will be communicated as they become available.

13.I am a hiring manager and have an open position on my team. Should I still fill this position?

Please review any openings with your manager for further direction.

14.Who will I report to? Will my manager change?

You will continue to report to your current manager. After the transaction closes, your manager will speak with you further about the integration process, including any potential changes to reporting structures.

15.Does Boston Scientific offer training and professional development opportunities?

Boston Scientific is a large global company with significant resources that highly values its employees and offers comprehensive training and professional development programs.

16.Are there other possible career opportunities for Axonics employees at Boston Scientific?

Boston Scientific is a global medical technology leader with approximately 45,000 employees worldwide. There are many opportunities for career advancement in various functions across regions.

17.How will Axonics notify our customers and suppliers?

Axonics leadership will be sending letters to customers and suppliers to notify them about the transaction.

Additional Information and Where to Find It

In connection with the contemplated transaction, Axonics intends to file with the U.S. Securities and Exchange Commission (“SEC”) preliminary and definitive proxy statements relating to the contemplated transaction and other relevant documents. The definitive proxy statement will be mailed to Axonics’ stockholders as of a record date to be established for voting on the contemplated transaction and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated transaction and any other matters to be voted on at the special meeting. Information regarding the names, affiliations and interests of such directors and executive officers will be included in the preliminary and definitive proxy statements (when available) for the contemplated transaction. Additional information regarding such directors and executive officers is included in Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Axonics’ stockholders in connection with the contemplated transaction and any other matters to be voted upon at the special meeting will be set forth in the preliminary and definitive proxy statements (when available) for the contemplated transaction. These documents (when available) are available free of charge as described in the preceding section.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: the ability of the parties to consummate the contemplated transaction in a timely manner or at all; the satisfaction or waiver of the conditions to closing the contemplated transaction, including the failure to obtain antitrust or other regulatory approvals and clearances or approval of Axonics’ stockholders; potential delays in consummating the contemplated transaction; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the merger agreement for the contemplated transaction; the ability to realize the anticipated benefits of the contemplated transaction; the ability to successfully integrate the businesses; the effect of the announcement or pendency of the contemplated transaction on Axonics’ business relationships, operating results and business generally; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the contemplated transaction. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this communication are made only as of the date of this communication, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. Further information on factors that could cause actual results to differ materially from the results anticipated by Axonics’ forward-looking statements is included in the reports Axonics has filed or will file with the SEC, including Axonics’ Annual Report on Form 10-K for the year ended December 31, 2022 and Axonics’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These filings, when available, are available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov.

Email to Healthcare Providers

Subject: Boston Scientific Announces Agreement to Acquire Axonics

Dear Esteemed Healthcare Provider,

We are pleased to inform you that Axonics has entered into a definitive agreement to be acquired by Boston Scientific Corporation, a global medical technology leader with a broad and deep portfolio of industry leading technologies for treating urological conditions.

As you know, our mission at Axonics is providing patient-centric solutions to improve the quality of life for people with urinary and bowel dysfunction. To that end, we believe the global reach and capabilities of Boston Scientific will offer patients and physicians a wider range of treatment options while we continue to provide best-in-class clinical support and raise awareness for our therapies.

Our innovative therapies – Bulkamid® and Axonics® SNM – have enabled physicians like you to improve the lives of over 100,000 people in 2023 alone.

Until the acquisition is completed, Axonics will continue to operate as a separate and independent entity. You can continue to count on your local Axonics team for support. All processes associated with working with Axonics remain unchanged at this time.

We sincerely appreciate the opportunity to work with you, your practice, and your patients, and we look forward to future collaboration. We are more excited than ever about helping patients find life-changing relief through the combined capabilities of Axonics and Boston Scientific.

Thank you for your trust and continued engagement.

Best regards,

Raymond W Cohen

Chief Executive Officer

Axonics, Inc.

Additional Information and Where to Find It

In connection with the contemplated transaction, Axonics intends to file with the U.S. Securities and Exchange Commission (“SEC”) preliminary and definitive proxy statements relating to the contemplated transaction and other relevant documents. The definitive proxy statement will be mailed to Axonics’ stockholders as of a record date to be established for voting on the contemplated transaction and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated transaction and any other matters to be voted on at the special meeting. Information regarding the names, affiliations and interests of such directors and executive officers will be included in the preliminary and definitive proxy statements (when available) for the contemplated transaction. Additional information regarding such directors and executive officers is included in Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC

on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Axonics’ stockholders in connection with the contemplated transaction and any other matters to be voted upon at the special meeting will be set forth in the preliminary and definitive proxy statements (when available) for the contemplated transaction. These documents (when available) are available free of charge as described in the preceding section.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: the ability of the parties to consummate the contemplated transaction in a timely manner or at all; the satisfaction or waiver of the conditions to closing the contemplated transaction, including the failure to obtain antitrust or other regulatory approvals and clearances or approval of Axonics’ stockholders; potential delays in consummating the contemplated transaction; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the merger agreement for the contemplated transaction; the ability to realize the anticipated benefits of the contemplated transaction; the ability to successfully integrate the businesses; the effect of the announcement or pendency of the contemplated transaction on Axonics’ business relationships, operating results and business generally; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the contemplated transaction. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this communication are made only as of the date of this communication, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. Further information on factors that could cause actual results to differ materially from the results anticipated by Axonics’ forward-looking statements is included in the reports Axonics has filed or will file with the SEC, including Axonics’ Annual Report on Form 10-K for the year ended December 31, 2022 and Axonics’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These filings, when available, are available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov.

Email to Customers

Subject: Boston Scientific Announces Agreement to Acquire Axonics

Dear Esteemed Customer,

We are pleased to inform you that Axonics has entered into a definitive agreement to be acquired by Boston Scientific Corporation, a global medical technology leader with a deep portfolio of industry leading technologies for treating urological conditions.

As you know, our mission at Axonics is providing patient-centric solutions to improve the quality of life for people with urinary and bowel dysfunction. To that end, we believe the global reach and capabilities of Boston Scientific will offer patients and physicians a wider range of treatment options while we continue to provide best-in-class clinical support and raise awareness for our therapies.

Our innovative therapies – Bulkamid® and Axonics® SNM – have enabled physicians like you to improve the lives of over 100,000 people in 2023 alone.

Until the acquisition is completed, Axonics will continue to operate as a separate and independent entity. You can continue to count on your local Axonics team for support. All processes associated with working with Axonics remain unchanged at this time, including processes for ordering, shipping, and invoicing.

We sincerely appreciate the opportunity to work with you, your practice, and your patients, and we look forward to future collaboration. We are more excited than ever about helping patients find life-changing relief through the combined capabilities of Axonics and Boston Scientific.

Thank you for your trust and continued engagement.

Best regards,

Raymond W Cohen

Chief Executive Officer

Axonics, Inc.

Additional Information and Where to Find It

In connection with the contemplated transaction, Axonics intends to file with the U.S. Securities and Exchange Commission (“SEC”) preliminary and definitive proxy statements relating to the contemplated transaction and other relevant documents. The definitive proxy statement will be mailed to Axonics’ stockholders as of a record date to be established for voting on the contemplated transaction and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated transaction and any other matters to be voted on at the special meeting. Information regarding the names, affiliations and interests of such directors and executive officers will be included in the preliminary and definitive proxy statements (when available) for the contemplated transaction. Additional information regarding such directors and executive officers is included in Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC

on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Axonics’ stockholders in connection with the contemplated transaction and any other matters to be voted upon at the special meeting will be set forth in the preliminary and definitive proxy statements (when available) for the contemplated transaction. These documents (when available) are available free of charge as described in the preceding section.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: the ability of the parties to consummate the contemplated transaction in a timely manner or at all; the satisfaction or waiver of the conditions to closing the contemplated transaction, including the failure to obtain antitrust or other regulatory approvals and clearances or approval of Axonics’ stockholders; potential delays in consummating the contemplated transaction; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the merger agreement for the contemplated transaction; the ability to realize the anticipated benefits of the contemplated transaction; the ability to successfully integrate the businesses; the effect of the announcement or pendency of the contemplated transaction on Axonics’ business relationships, operating results and business generally; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the contemplated transaction. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this communication are made only as of the date of this communication, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. Further information on factors that could cause actual results to differ materially from the results anticipated by Axonics’ forward-looking statements is included in the reports Axonics has filed or will file with the SEC, including Axonics’ Annual Report on Form 10-K for the year ended December 31, 2022 and Axonics’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These filings, when available, are available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov.

Email to Suppliers

Subject: Boston Scientific Announces Agreement to Acquire Axonics

Dear Valued Axonics Supplier,

As you are a valued supplier of Axonics, I wanted to personally inform you that Axonics has entered into a definitive agreement to be acquired by Boston Scientific Corporation, a global medical technology leader with a broad and deep portfolio of industry leading technologies for treating urological conditions.

Becoming part of Boston Scientific will enable Axonics to continue our mission of improving the lives of people with bladder and bowel dysfunction. As part of Boston Scientific, Axonics will benefit from the company’s significant global reach and resources, enabling our products to reach even more patients, including in geographies outside the United States.

Upon completion of the transaction, expected in the first half of 2024 and subject to customary closing conditions, including approval of Axonics’ stockholders and receipt of required regulatory approvals, Axonics will become a wholly owned subsidiary of Boston Scientific. Axonics and Boston Scientific will continue to operate as separate and independent companies until the transaction is completed.

It’s critically important that we ensure continuity of our product supply, quality and service to our customers and patients around the world. As such, there are no planned changes to current ordering and payment processes or procurement contacts. Our previously communicated build plans and POs for 2024 are unaffected.

We will keep you informed of any changes. In the meantime, if you have any questions regarding this announcement, please contact me.

Thank you for being a valued supply chain partner. We appreciate your support and look forward to our continued collaboration.

Sincerely,

Rinda K. Sama

Chief Operating Officer

Axonics, Inc.

Additional Information and Where to Find It

In connection with the contemplated transaction, Axonics intends to file with the U.S. Securities and Exchange Commission (“SEC”) preliminary and definitive proxy statements relating to the contemplated transaction and other relevant documents. The definitive proxy statement will be mailed to Axonics’ stockholders as of a record date to be established for voting on the contemplated transaction and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated transaction and any other matters to be voted on at the special meeting. Information regarding the names, affiliations and interests of such directors and executive officers will be included in the preliminary and definitive proxy statements (when available) for the contemplated transaction. Additional information regarding such directors and executive officers is included in Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain

Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Axonics’ stockholders in connection with the contemplated transaction and any other matters to be voted upon at the special meeting will be set forth in the preliminary and definitive proxy statements (when available) for the contemplated transaction. These documents (when available) are available free of charge as described in the preceding section.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: the ability of the parties to consummate the contemplated transaction in a timely manner or at all; the satisfaction or waiver of the conditions to closing the contemplated transaction, including the failure to obtain antitrust or other regulatory approvals and clearances or approval of Axonics’ stockholders; potential delays in consummating the contemplated transaction; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the merger agreement for the contemplated transaction; the ability to realize the anticipated benefits of the contemplated transaction; the ability to successfully integrate the businesses; the effect of the announcement or pendency of the contemplated transaction on Axonics’ business relationships, operating results and business generally; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the contemplated transaction. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this communication are made only as of the date of this communication, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. Further information on factors that could cause actual results to differ materially from the results anticipated by Axonics’ forward-looking statements is included in the reports Axonics has filed or will file with the SEC, including Axonics’ Annual Report on Form 10-K for the year ended December 31, 2022 and Axonics’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These filings, when available, are available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov.

Email to Commercial Team

Subject: Boston Scientific Announces Agreement to Acquire Axonics

CONFIDENTIAL – DO NOT FORWARD

Dear Commercial Team,

I trust that you have already seen this morning’s email from Ray, and realize you may have some questions.

To close the loop, please note that you will receive an invitation shortly for a Microsoft Teams call today at 8:00 am PST (11:00 am EST).

With respect to our customers, note that Axonics marketing will send an email this morning to all customers informing them of the announcement. There is nothing additional you need to communicate, however, if your customers inquire about this announcement, you may state the following:

•We are quite pleased about the definitive agreement between Axonics, Inc. and Boston Scientific Corporation

•We believe the global reach and capabilities of Boston Scientific will provide patients and physicians with a wider range of treatment options while raising awareness for our therapies and continuing to provide best-in-class clinical support.

•Until the acquisition is completed, Axonics will continue to operate as a separate, independent entity. You can continue to count on your local Axonics team for support. All processes associated with working with Axonics remain unchanged at this time.

•I look forward to sharing additional information with you after the transaction has closed.

Looking forward to speaking with you shortly.

Best regards,

John Woock

EVP, Chief Marketing and Strategy Officer

Axonics, Inc.

Additional Information and Where to Find It

In connection with the contemplated transaction, Axonics intends to file with the U.S. Securities and Exchange Commission (“SEC”) preliminary and definitive proxy statements relating to the contemplated transaction and other relevant documents. The definitive proxy statement will be mailed to Axonics’ stockholders as of a record date to be established for voting on the contemplated transaction and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated transaction and any other matters to be voted on at the special meeting. Information regarding the names, affiliations and interests of such directors and executive officers will be included in the preliminary and definitive proxy statements (when available) for the contemplated transaction. Additional information regarding such directors and executive officers is included in Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC

on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Axonics’ stockholders in connection with the contemplated transaction and any other matters to be voted upon at the special meeting will be set forth in the preliminary and definitive proxy statements (when available) for the contemplated transaction. These documents (when available) are available free of charge as described in the preceding section.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: the ability of the parties to consummate the contemplated transaction in a timely manner or at all; the satisfaction or waiver of the conditions to closing the contemplated transaction, including the failure to obtain antitrust or other regulatory approvals and clearances or approval of Axonics’ stockholders; potential delays in consummating the contemplated transaction; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the merger agreement for the contemplated transaction; the ability to realize the anticipated benefits of the contemplated transaction; the ability to successfully integrate the businesses; the effect of the announcement or pendency of the contemplated transaction on Axonics’ business relationships, operating results and business generally; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the contemplated transaction. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this communication are made only as of the date of this communication, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. Further information on factors that could cause actual results to differ materially from the results anticipated by Axonics’ forward-looking statements is included in the reports Axonics has filed or will file with the SEC, including Axonics’ Annual Report on Form 10-K for the year ended December 31, 2022 and Axonics’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These filings, when available, are available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov.

LinkedIn Post

X (formerly Twitter) Post

Additional Information and Where to Find It

In connection with the contemplated transaction, Axonics intends to file with the U.S. Securities and Exchange Commission (“SEC”) preliminary and definitive proxy statements relating to the contemplated transaction and other relevant documents. The definitive proxy statement will be mailed to Axonics’ stockholders as of a record date to be established for voting on the

contemplated transaction and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated transaction and any other matters to be voted on at the special meeting. Information regarding the names, affiliations and interests of such directors and executive officers will be included in the preliminary and definitive proxy statements (when available) for the contemplated transaction. Additional information regarding such directors and executive officers is included in Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Axonics’ stockholders in connection with the contemplated transaction and any other matters to be voted upon at the special meeting will be set forth in the preliminary and definitive proxy statements (when available) for the contemplated transaction. These documents (when available) are available free of charge as described in the preceding section.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: the ability of the parties to consummate the contemplated transaction in a timely manner or at all; the satisfaction or waiver of the conditions to closing the contemplated transaction, including the failure to obtain antitrust or other regulatory approvals and clearances or approval of Axonics’ stockholders; potential delays in consummating the contemplated transaction; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the merger agreement for the contemplated transaction; the ability to realize the anticipated benefits of the contemplated transaction; the ability to successfully integrate the businesses; the effect of the announcement or pendency of the contemplated transaction on Axonics’ business relationships, operating results and business generally; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the contemplated transaction. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this communication are made only as of the date of this communication, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. Further information on factors that could cause actual results to differ materially from the results anticipated by Axonics’ forward-looking statements is included in the reports Axonics has filed or will file with the SEC, including Axonics’ Annual Report on Form 10-K for the year ended December 31, 2022 and Axonics’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These filings, when available, are available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov.

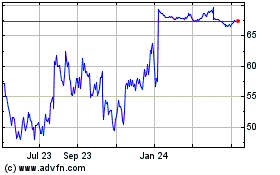

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

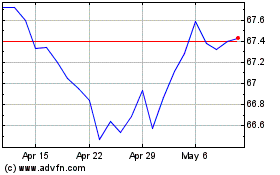

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Apr 2023 to Apr 2024