Allbirds, Inc. (NASDAQ: BIRD), a global lifestyle brand that

innovates with naturally derived materials to make better footwear

and apparel products in a better way, today reported financial

results for the first quarter ended March 31, 2024.

First Quarter 2024 Overview

- First quarter net revenue decreased

27.6% to $39.3 million versus a year ago, within the Company’s

guidance range.

- First quarter gross margin improved

680 basis points to 46.9% versus a year ago.

- First quarter net loss of $27.3

million, or $0.18 per basic and diluted share.

- First quarter adjusted EBITDA1 loss of of $20.9 million, above

the Company’s guidance range.

- Inventory at quarter end of $60.6

million, representing a decrease of 45% versus a year ago.

- As of March 31, 2024, the Company

had $102.1 million of cash and cash equivalents and no outstanding

borrowings under its $50.0 million revolving credit facility.

- Entered into distributor agreements

for two new regions, the Gulf Countries and Southeast Asia.

“We are pleased to begin the year with solid

progress under our strategic transformation plan,” said Joe

Vernachio, Chief Executive Officer. “The operational and financial

rigor we’ve developed, and strong execution by our teams, enabled

us to meet or exceed expectations on our key metrics.”

Vernachio added, “We are focusing on bringing a fresh, updated

product offering to consumers, supported by effective storytelling.

Our recent launches, including the Wool Runner 2 and Tree Runner

Go, have met with strong consumer response, reaffirming our

conviction that Allbirds is a beloved brand. Looking further ahead,

as we continue to drive improvement in our cost structure and

underlying operating model, we believe the business is on the right

path to achieve long-term profitable growth and deliver shareholder

value.”

First Quarter Operating

Results

In the first quarter of 2024, net revenue

decreased 27.6% to $39.3 million compared to $54.4 million in the

first quarter of 2023. The year-over-year decrease is primarily

attributable to lower overall demand, as well as the impact of

international distributor transitions and retail store

closures.

Gross profit totaled $18.5 million compared to $21.8 million in

the first quarter of 2023, and gross margin improved 680 basis

points to 46.9% compared to 40.1% in the first quarter of 2023. The

decline in gross profit is primarily due to a decrease in units

sold, and the improvement in gross margin is primarily due to lower

freight and product costs per unit, and a decrease in inventory

write-downs resulting from a healthier inventory composition versus

a year ago.

Selling, general, and administrative expense (SG&A) was

$39.7 million, or 101.0% of net revenue, compared to $42.8 million,

or 78.7% of net revenue in the first quarter of 2023. The decrease

is primarily attributable to decreases in stock-based compensation,

personnel expenses, and occupancy costs.

Marketing expense totaled $7.8 million, or 19.7% of net revenue,

compared to $11.5 million, or 21.1% of net revenue, in the first

quarter of 2023, driven by decreased digital advertising spend.

Restructuring expense totaled $0.8 million, or 2.0% of net

revenue compared to $3.3 million, or 6.0% of net revenue, in the

first quarter of 2023, primarily as a result of reduced expenses

associated with execution of the strategic transformation plan

announced in March 2023.

In the first quarter of 2024, net loss was $27.3 million

compared to $35.2 million in the first quarter of 2023, and net

loss margin was 69.5% compared to 64.7% in the first quarter of

2023.

In the first quarter of 2024, adjusted EBITDA1

was a loss of $20.9 million, a 3.6% improvement compared to a loss

of $21.7 million in the first quarter of 2023, and adjusted EBITDA

margin1 declined to (53.1)% compared to (39.8)% in the first

quarter of 2023.

________________________

1 For a reconciliation of each non-GAAP

financial measure to its most directly comparable GAAP financial

measure, please refer to the reconciliation tables in the section

titled “Non-GAAP Financial Measures” below.

Strategic Transformation

In Q1 2024, Allbirds delivered a fifth consecutive quarter of

operational and financial progress under its strategic

transformation plan:

- Reignite product and brand:

Executing an icon-focused brand strategy to drive resonance with

the consumer through fresh, innovative products, as well as more

impactful storytelling and marketing.

- Optimize U.S. distribution and retail store profitability:

Closing certain underperforming Allbirds stores, driving traffic

and conversion within our U.S. store portfolio and creating a

balanced U.S. marketplace. In Q1, the Company closed three U.S.

retail stores and remains on track with its previously communicated

plan to close 10-15 U.S. locations in 2024.

- Evaluate transition of international go-to-market strategy:

Transitioning to a distributor model in certain international

markets to grow those regions in a cost- and capital-efficient

manner. The Company has completed the transition to a distributor

model in Canada and South Korea, and remains on track to complete

its previously announced transition to a distributor model in

Australasia and Japan mid-year. During Q1, Allbirds signed

definitive agreements with distributors in two new regions, the

Gulf Countries and Southeast Asia.

- Improve cost savings and capital efficiency: Tracking to

achieve the cost of goods savings and SG&A savings previously

outlined for 2025 and optimizing cash.

Balance Sheet Highlights

Allbirds ended the quarter with $102.1 million

of cash and cash equivalents and no outstanding borrowings under

its $50 million revolving credit facility. Inventories totaled

$60.6 million, a decrease of 45% versus a year ago, reflecting

fewer units of on hand inventory and a healthier overall

composition.

2024 Financial Outlook

The Company is reiterating its full year 2024

guidance as follows:

- Net revenue of $190 million to $210

million

- U.S. net revenue of $150 million to

$165 million, including a $7 million to $9 million impact resulting

from anticipated store closures

- International net revenue of $40

million to $45 million, including $25 million to $28 million of

impact resulting from anticipated transitions to a distributor

model in certain international markets

- Gross margin of 42% to 45%

- Adjusted EBITDA2 loss of $78

million to $63 million.

Allbirds is providing the following guidance for

the second quarter of 2024:

- Net revenue of $48 million to $53

million

- U.S. net revenue of $35 million to

$37 million

- International net revenue of $13

million to $16 million

- Adjusted EBITDA2 loss of $20

million to $17 million.

________________________

2 A reconciliation of these non-GAAP financial measures to

corresponding GAAP financial measures is not available on a

forward-looking basis without unreasonable effort as we are

currently unable to predict with a reasonable degree of certainty

certain expense items that are excluded in calculating adjusted

EBITDA, although it is important to note that these factors could

be material to our results computed in accordance with GAAP. We

have provided a reconciliation of GAAP to non-GAAP financial

measures in the section titled “Reconciliation of GAAP to Non-GAAP

Financial Measures” for our first quarter 2024 and 2023 results

included in this press release.

Conference Call Information

Allbirds will host a conference call to discuss

the results, followed by Q&A, at 5:00 p.m. Eastern Time today,

May 8, 2024. A live webcast and replay of the conference call will

be available on the investor relations section of the Allbirds

website at https://www.ir.allbirds.com. Information on the

Company’s website is not, and will not be deemed to be, a part of

this press release or incorporated into any other filings the

Company may make with the Securities and Exchange Commission. A

replay of the webcast will also be archived on the Allbirds website

for 12 months.

About Allbirds, Inc.

Based in San Francisco, with its roots in New Zealand, Allbirds

launched in 2016 with a single shoe: the now iconic Wool Runner. In

the years since, Allbirds has sold millions of pairs of shoes, and

has maintained its commitment to incredible comfort, versatile

style and unmatched quality. This is made possible with materials

like Allbirds’s sugarcane-based midsole technology, SweetFoam™, and

textiles made with eucalyptus fibers and Merino wool – so consumers

don't have to compromise between the best products and their impact

on the earth. www.allbirds.com.

Forward-Looking Statements

This press release and related conference call

contain “forward-looking” statements, as the term is defined under

federal securities laws, that are based on management’s beliefs and

assumptions and on information currently available to management.

All statements other than statements of historical facts, including

statements regarding our strategic transformation plan and related

efforts, future financial performance, including our financial

outlook on financial results and guidance targets, planned

transition to a distributor model in certain international markets,

anticipated distributor model arrangements, focus on improving

efficiencies and driving profitability, restructuring charges,

estimated and/or targeted cost savings, medium-term financial

targets, market position, future results of operations, financial

condition, business strategy and plans, reducing the carbon

footprint of our products, materials innovation and new product

launches, and objectives of management for future operations are

forward-looking statements. In some cases, you can identify

forward-looking statements because they contain words such as

“designed,” “objective,” “anticipate,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would” or the negative of these words or other similar terms or

expressions. Forward-looking statements are subject to numerous

assumptions, risks and uncertainties which could cause actual

results or facts to differ materially from those statements

expressed or implied in the forward-looking statements, including,

but not limited to: unfavorable economic conditions; our ability to

execute our strategic transformation plans, simplification

initiatives or our long-term growth strategy; fluctuations in our

operating results; our ability to achieve the financial outlook and

guidance targets for the second quarter of 2024; our ability to

complete transitions to a distributor model in certain

international markets; our ability to achieve our cost savings

targets by 2025; deteriorating economic conditions, including

economic recession, inflation, tax rates, foreign currency exchange

rates, or the availability of capital; impairment of long-lived

assets; the strength of our brand; our net losses since inception;

the competitive marketplace; our reliance on technical and

materials innovation; our use of sustainable high-quality materials

and environmentally friendly manufacturing processes and supply

chain practices; our ability to attract new customers and increase

sales to existing customers; the impact of climate change and

government and investor focus on sustainability issues; our ability

to anticipate product trends and consumer preferences, including

with respect to the product launches we have planned for the first

half of 2024; breaches of security or privacy of business

information; and our ability to forecast consumer demand. Moreover,

we operate in a very competitive and rapidly changing environment

in which new risks emerge from time to time. It is not possible for

our management to predict all risks, nor can we assess the impact

of all factors on our business or the extent to which any factor,

or combination of factors, may cause our actual results or

performance to differ materially from those contained in any

forward-looking statements we may make.

A further discussion of these and other factors that could cause

our financial results, performance, and achievements to differ

materially from any results, performance, or achievements

anticipated, expressed, or implied by these forward-looking

statements is included in the filings we make with the SEC,

including our Annual Report on Form 10-K for the year ended

December 31, 2023, and future reports we may file with the SEC from

time to time. The forward-looking statements contained in this

press release and related conference call relate only to events as

of the date stated or, if no date is stated, as of the date of this

press release and related conference call. We undertake no

obligation to update any forward-looking statements made in this

press release to reflect events or circumstances after the date of

this press release or to reflect new information or the occurrence

of unanticipated events, except as required by law. We may not

actually achieve the plans, intentions or expectations disclosed in

or expressed by, and you should not place undue reliance on our

forward-looking statements. Our forward-looking statements do not

reflect the potential impact of any future acquisitions, mergers,

dispositions, joint ventures or investments.

Use of Non-GAAP Financial Measures

This press release and accompanying financial

tables include references to adjusted EBITDA and adjusted EBITDA

margin, which are non-GAAP financial measures. We believe that

providing these non-GAAP financial measures, when reviewed in

conjunction with GAAP financial measures, and not in isolation or

as substitutes for analysis of our results of operations under

GAAP, are useful to investors as they are widely used measures of

performance, and the adjustments we make to these non-GAAP

financial measures may provide investors further insight into our

profitability and additional perspectives in comparing our

performance to other companies and in comparing our performance

over time on a consistent basis. These non-GAAP financial measures

should not be considered as alternatives to net loss or net loss

margin as calculated and presented in accordance with GAAP.

Adjusted EBITDA is defined as net loss before stock-based

compensation expense, depreciation and amortization expense,

impairment expense, restructuring expense (consisting of

professional fees, personnel and related expenses, and other

related charges resulting from our strategic initiatives), non-cash

gains or losses on the sales of businesses relating to our March

2023 initiatives, other income or expense (consisting of non-cash

gains or losses on foreign currency, non-cash gains or losses on

sales of property and equipment, and non-cash gains or losses on

modifications or terminations of leases), interest income or

expense, and income tax provision or benefit.

Adjusted EBITDA margin is defined as adjusted EBITDA divided by

net revenue.

Other companies, including companies in our industry, may

calculate these adjusted financial measures differently, which

reduces their usefulness as comparative measures. Because of these

limitations, we consider, and investors should consider, these

adjusted financial measures together with other operating and

financial performance measures presented in accordance with

GAAP.

Investor Relations:

ir@allbirds.com

Media Contact:

press@allbirds.com

| Condensed

Consolidated Statements of Operations and Comprehensive

Loss(in thousands, except share, per share

amounts, and percentages)(unaudited) |

| |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

revenue |

$ |

39,327 |

|

|

$ |

54,352 |

|

| Cost of

revenue |

|

20,871 |

|

|

|

32,535 |

|

| Gross

profit |

|

18,456 |

|

|

|

21,817 |

|

| Operating

expense: |

|

|

|

|

Selling, general, and administrative expense |

|

39,706 |

|

|

|

42,764 |

|

|

Marketing expense |

|

7,760 |

|

|

|

11,493 |

|

|

Restructuring expense |

|

800 |

|

|

|

3,239 |

|

|

Total operating expense |

|

48,266 |

|

|

|

57,496 |

|

|

Loss from operations |

|

(29,810 |

) |

|

|

(35,679 |

) |

| Interest

income |

|

1,020 |

|

|

|

808 |

|

| Other income

(expense) |

|

1,698 |

|

|

|

(74 |

) |

| Loss before

provision for income taxes |

|

(27,092 |

) |

|

|

(34,945 |

) |

| Income tax

provision |

|

(239 |

) |

|

|

(221 |

) |

| Net

loss |

$ |

(27,331 |

) |

|

$ |

(35,166 |

) |

| |

|

|

|

| Net loss per

share data: |

|

|

|

|

Net loss per share attributable to common stockholders, basic and

diluted |

$ |

(0.18 |

) |

|

$ |

(0.23 |

) |

|

Weighted-average shares used in computing net loss per share

attributable to common stockholders, basic and diluted |

|

155,380,544 |

|

|

|

150,082,295 |

|

| |

|

|

|

| Other

comprehensive (loss) income: |

|

|

|

|

Foreign currency translation (loss) income |

|

(1,213 |

) |

|

|

230 |

|

| Total

comprehensive loss |

$ |

(28,544 |

) |

|

$ |

(34,936 |

) |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Statements of Operations Data, as a Percentage of Net

Revenue: |

|

|

|

| Net

revenue |

|

100.0 |

% |

|

|

100.0 |

% |

| Cost of

revenue |

|

53.1 |

% |

|

|

59.9 |

% |

| Gross

profit |

|

46.9 |

% |

|

|

40.1 |

% |

| Operating

expense: |

|

|

|

|

Selling, general, and administrative expense |

|

101.0 |

% |

|

|

78.7 |

% |

|

Marketing expense |

|

19.7 |

% |

|

|

21.1 |

% |

|

Restructuring expense |

|

2.0 |

% |

|

|

6.0 |

% |

|

Total operating expense |

|

122.7 |

% |

|

|

105.8 |

% |

| Loss from

operations |

|

(75.8 |

)% |

|

|

(65.6 |

)% |

| Interest

income |

|

2.6 |

% |

|

|

1.5 |

% |

| Other income

(expense) |

|

4.3 |

% |

|

|

(0.1 |

)% |

| Loss before

provision for income taxes |

|

(68.9 |

)% |

|

|

(64.3 |

)% |

| Income tax

provision |

|

(0.6 |

)% |

|

|

(0.4 |

)% |

| Net

loss |

|

(69.5 |

)% |

|

|

(64.7 |

)% |

| |

|

|

|

| Other

comprehensive loss: |

|

|

|

|

Foreign currency translation (loss) income |

|

(3.1 |

)% |

|

|

0.4 |

% |

| Total

comprehensive loss |

|

(72.6 |

)% |

|

|

(64.3 |

)% |

| Condensed

Consolidated Balance Sheets (in thousands, except

share amounts)(unaudited) |

|

|

|

|

|

| |

March

31, |

|

December

31, |

|

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

102,084 |

|

|

$ |

130,032 |

|

|

Accounts receivable |

|

5,703 |

|

|

|

8,188 |

|

|

Inventory |

|

60,624 |

|

|

|

57,763 |

|

|

Prepaid expenses and other current assets |

|

16,813 |

|

|

|

16,423 |

|

|

Total current assets |

|

185,224 |

|

|

|

212,406 |

|

| |

|

|

|

| Property and

equipment—net |

|

22,397 |

|

|

|

26,085 |

|

| Operating

lease right-of-use assets |

|

58,283 |

|

|

|

67,085 |

|

| Other

assets |

|

6,459 |

|

|

|

7,129 |

|

|

Total assets |

$ |

272,363 |

|

|

$ |

312,705 |

|

| |

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

| |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

|

13,144 |

|

|

|

5,851 |

|

|

Accrued expenses and other current liabilities |

|

15,302 |

|

|

|

22,987 |

|

|

Current lease liabilities |

|

14,003 |

|

|

|

15,218 |

|

|

Deferred revenue |

|

4,261 |

|

|

|

4,551 |

|

|

Total current liabilities |

|

46,710 |

|

|

|

48,607 |

|

| |

|

|

|

| Noncurrent

liabilities: |

|

|

|

|

Noncurrent lease liabilities |

|

65,348 |

|

|

|

78,731 |

|

|

Other long-term liabilities |

|

38 |

|

|

|

38 |

|

|

Total noncurrent liabilities |

|

65,386 |

|

|

|

78,769 |

|

|

Total liabilities |

$ |

112,096 |

|

|

$ |

127,376 |

|

| |

|

|

|

| Commitments

and contingencies (Note 11) |

|

|

|

| |

|

|

|

|

Stockholders' equity: |

|

|

|

|

Class A Common Stock, $0.0001 par value; 2,000,000,000 shares

authorized as of March 31, 2024 and December 31, 2023; 103,223,614

and 102,579,222 shares issued and outstanding as of March 31, 2024

and December 31, 2023, respectively |

|

10 |

|

|

|

10 |

|

|

Class B Common Stock, $0.0001 par value; 200,000,000 shares

authorized as of March 31, 2024 and December 31, 2023; 52,547,761

and 52,547,761 shares issued and outstanding as of March 31, 2024

and December 31, 2023, respectively |

|

5 |

|

|

|

5 |

|

|

Additional paid-in capital |

|

583,330 |

|

|

|

579,848 |

|

|

Accumulated other comprehensive loss |

|

(4,548 |

) |

|

|

(3,335 |

) |

|

Accumulated deficit |

|

(418,530 |

) |

|

|

(391,199 |

) |

|

Total stockholders' equity |

|

160,267 |

|

|

|

185,329 |

|

| |

|

|

|

|

Total liabilities and stockholders' equity |

$ |

272,363 |

|

|

$ |

312,705 |

|

| Condensed

Consolidated Statements of Cash Flows(in

thousands)(unaudited) |

| |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash

flows from operating activities: |

|

|

|

|

Net loss |

$ |

(27,331 |

) |

|

$ |

(35,166 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

4,846 |

|

|

|

5,077 |

|

|

Amortization of debt issuance costs |

|

8 |

|

|

|

12 |

|

|

Stock-based compensation |

|

3,344 |

|

|

|

5,670 |

|

|

Inventory write-down |

|

893 |

|

|

|

2,357 |

|

|

Provision for bad debt |

|

802 |

|

|

|

— |

|

|

Impairment of note receivable |

|

404 |

|

|

|

— |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

1,630 |

|

|

|

3,297 |

|

|

Inventory |

|

(3,991 |

) |

|

|

5,089 |

|

|

Prepaid expenses and other current assets |

|

(419 |

) |

|

|

430 |

|

|

Operating lease right-of-use assets and current and noncurrent

lease liabilities |

|

(5,755 |

) |

|

|

738 |

|

|

Accounts payable and accrued expenses |

|

(333 |

) |

|

|

(8,028 |

) |

|

Deferred revenue |

|

(299 |

) |

|

|

(389 |

) |

|

Net cash used in operating activities |

|

(26,201 |

) |

|

|

(20,913 |

) |

| |

|

|

|

| Cash

flows from investing activities: |

|

|

|

|

Purchase of property and equipment |

|

(1,122 |

) |

|

|

(3,035 |

) |

|

Changes in security deposits |

|

52 |

|

|

|

(50 |

) |

|

Proceeds from sales of businesses |

|

304 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(766 |

) |

|

|

(3,085 |

) |

| |

|

|

|

| Cash

flows from financing activities: |

|

|

|

|

Proceeds from the exercise of stock options |

|

34 |

|

|

|

123 |

|

|

Taxes withheld and paid on employee stock awards |

|

(1 |

) |

|

|

(61 |

) |

|

Net cash provided by financing activities |

|

33 |

|

|

|

62 |

|

| |

|

|

|

| Effect of

foreign exchange rate changes on cash, cash equivalents, and

restricted cash |

|

(814 |

) |

|

|

110 |

|

| Net decrease

in cash, cash equivalents, and restricted cash |

|

(27,748 |

) |

|

|

(23,826 |

) |

| Cash, cash

equivalents, and restricted cash—beginning of period |

|

130,673 |

|

|

|

167,767 |

|

| Cash, cash

equivalents, and restricted cash—end of period |

$ |

102,925 |

|

|

$ |

143,941 |

|

| |

|

|

|

|

Supplemental disclosures of cash flow

information: |

|

|

|

|

Cash paid for interest |

$ |

48 |

|

|

$ |

20 |

|

|

Cash paid for taxes |

$ |

655 |

|

|

$ |

273 |

|

|

Noncash investing and financing activities: |

|

|

|

|

Purchase of property and equipment included in accounts

payable |

$ |

53 |

|

|

$ |

542 |

|

|

Stock-based compensation included in capitalized internal-use

software |

$ |

87 |

|

|

$ |

242 |

|

|

Reconciliation of cash, cash equivalents, and restricted

cash: |

|

|

|

|

Cash and cash equivalents |

$ |

102,084 |

|

|

$ |

143,307 |

|

|

Restricted cash included in prepaid expenses and other current

assets |

|

841 |

|

|

|

634 |

|

|

Total cash, cash equivalents, and restricted cash |

$ |

102,925 |

|

|

$ |

143,941 |

|

| |

|

|

|

|

Reconciliation of GAAP to Non-GAAP Financial

Measures(in thousands, except share, per share

amounts, and percentages)(unaudited) |

|

|

The following tables present a reconciliation of

adjusted EBITDA to its most comparable GAAP measure, net loss, and

presentation of net loss margin and adjusted EBITDA margin for the

periods indicated: :

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

loss |

$ |

(27,331 |

) |

|

$ |

(35,166 |

) |

|

Add (deduct): |

|

|

|

|

|

|

Stock-based compensation expense |

3,344 |

|

|

5,670 |

|

|

Depreciation and amortization expense |

4,771 |

|

|

5,111 |

|

|

Restructuring expense |

800 |

|

|

3,239 |

|

|

Other (income) expense |

|

(1,698 |

) |

|

74 |

|

|

Interest (income) expense |

|

(1,020 |

) |

|

|

(808 |

) |

| Income tax

provision |

239 |

|

|

221 |

|

| Adjusted

EBITDA |

$ |

(20,895 |

) |

|

$ |

(21,659 |

) |

| |

| |

Three Months Ended March 31, |

| |

2024 |

|

|

2023 |

|

|

Net revenue |

$ |

39,327 |

|

|

$ |

54,352 |

|

| |

|

|

|

|

|

| Net

loss |

$ |

(27,331 |

) |

|

$ |

(35,166 |

) |

| Net loss

margin |

(69.5 |

)% |

|

(64.7 |

)% |

| |

|

|

|

|

|

| Adjusted

EBITDA |

$ |

(20,895 |

) |

|

$ |

(21,659 |

) |

| Adjusted

EBITDA margin |

(53.1 |

)% |

|

(39.8 |

)% |

| |

|

|

|

|

|

| |

|

|

| Net Revenue

and Store Count by Primary Geographical Market(in

thousands, except for store

count)(unaudited) |

| |

| |

Net Revenue by Primary Geographical Market |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| United

States |

$ |

29,232 |

|

|

$ |

40,836 |

|

|

International |

|

10,095 |

|

|

|

13,516 |

|

|

Total net revenue |

$ |

39,327 |

|

|

$ |

54,352 |

|

| |

|

|

|

| |

Store Count by Primary Geographical Market |

|

|

March 31,2022 |

|

June 30,2022 |

|

September 30,2022 |

|

December 31,2022 |

|

March 31,2023 |

|

June 30,2023 |

|

September 30,2023 |

|

December 31,2023 |

|

March 31,2024 |

| United

States |

27 |

|

32 |

|

38 |

|

42 |

|

42 |

|

44 |

|

45 |

|

45 |

|

42 |

|

International [1] |

12 |

|

14 |

|

13 |

|

16 |

|

17 |

|

18 |

|

15 |

|

15 |

|

15 |

|

Total stores |

39 |

|

46 |

|

51 |

|

58 |

|

59 |

|

62 |

|

60 |

|

60 |

|

57 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] In the third

quarter of 2023, we transitioned the operations of two stores in

Canada and one store in South Korea to unrelated third-party

distributors, resulting in a reduction of three international

stores. In the first quarter of 2024, we closed the operations of

three stores in the US. |

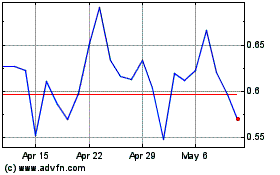

Allbirds (NASDAQ:BIRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Allbirds (NASDAQ:BIRD)

Historical Stock Chart

From Nov 2023 to Nov 2024