Post-Transaction the Company is Operating

with a Cash Balance that Exceeds Remaining Debt

BuzzFeed, Inc. (Nasdaq: BZFD) (the “Company”) today announced

the closing of its sale of First We Feast to a consortium led by an

affiliate of Soros Fund Management LLC in an $82.5 million all-cash

deal. The proceeds of the transaction combined with a partial

prepayment of the Company’s outstanding convertible notes has the

Company operating with a cash balance that exceeds its remaining

debt. Refer to the Company’s 8-K filed with the SEC on December 12,

2024 for additional details.

The divestiture of First We Feast completes the Company’s

strategic shift away from lower-margin content products, allowing

for a greater focus on high-margin, tech-enabled revenue lines:

programmatic advertising and affiliate commerce.

“The sale of First We Feast and continued reduction of our

convertible debt marks an important step in BuzzFeed, Inc.’s

strategic transformation into a media company positioned to fully

benefit from the ongoing AI revolution,” said BuzzFeed founder

and CEO Jonah Peretti. “In the coming years, we will continue

to invest in our most scalable and tech enabled services, launching

new AI-powered interactive experiences, and delivering for our

loyal audience and business partners.”

During the fourth quarter of 2024, the Company concluded that

First We Feast was classified as a held for sale asset and met the

criteria for discontinued operations in accordance with U.S. GAAP.

Therefore, the performance of First We Feast will be presented as a

discontinued operation within our financial results.

Today the Company also issued guidance for the fourth quarter

ending December 31, 2024 on a continuing operations basis, which

excludes expected fourth quarter contributions from First We

Feast.

- Fourth quarter revenues on a continuing operations basis are

expected to be in the range of $54 million to $58 million.

- Fourth quarter Adjusted EBITDA1 on a continuing operations

basis is now expected to be in the range of $4 million to $9

million.

“As we close out 2024, we are poised to deliver year-over-year

growth in Programmatic Advertising and Affiliate Commerce combined

revenue for the third consecutive quarter,” said Matt Omer, CFO

of BuzzFeed, Inc. “Our focus on these high-margin businesses

has also positioned us to drive significant improvement in Adjusted

EBITDA profitability this year, with Adjusted EBITDA expected to

grow by $12.7 million at the midpoint versus 2023 — and that's

without one full quarter of the $23 million of annualized

compensation savings implemented in Q1 2024.”

“We now have removed more than $150 million of debt since

December 31, 2023 and enter 2025 with a stronger balance sheet, so

that we can focus on growth and driving expanded

profitability.”

The Company acquired “First We Feast” as a part of “Complex

Networks” in December 2021 for approximately $198 million in cash

and 2.5 million split-adjusted shares of equity. “Complex” was sold

to NTWRK earlier this year for $108.6 million plus $5.7 million in

related fees received from NTWRK.

The Company plans to release its fourth quarter and full year

2024 financial results on March 13, 2025, after the market closes.

BuzzFeed, Inc. Founder and CEO Jonah Peretti and CFO Matt Omer will

host a conference call to discuss the results at 5:00 PM ET.

The financial results conference call will be available via

webcast at investors.buzzfeed.com under the heading News and

Events. A replay will be made available at the same URL. To

participate in the conference call, interested parties must

register in advance.

UBS Investment Bank served as the exclusive financial advisor to

BuzzFeed, Inc. on the transaction. Freshfields US LLP served as

external legal counsel to BuzzFeed, Inc.

About BuzzFeed, Inc.

BuzzFeed, Inc. is home to the best of the Internet. Across pop

culture, entertainment, shopping, food and news, our brands drive

conversation and inspire what audiences watch, read, and buy now —

and into the future. Born on the Internet in 2006, BuzzFeed is

committed to making it better: providing trusted, quality,

brand-safe news and entertainment to hundreds of millions of

people; making content on the Internet more inclusive, empathetic,

and creative; and inspiring our audience to live better lives.

Non-GAAP Financial Measures

Adjusted EBITDA is a non-GAAP financial measure and represents a

key metric used by management and our board of directors to measure

the operational strength and performance of our business, to

establish budgets, and to develop operational goals for managing

our business. We define Adjusted EBITDA as net income (loss) from

continuing operations, excluding the impact of net income (loss)

attributable to noncontrolling interests, income tax (benefit)

provision, interest expense, net, other (income) expense, net,

depreciation and amortization, stock-based compensation, change in

fair value of warrant liabilities, change in fair value of

derivative liability, restructuring costs, transaction-related

costs, and other non-cash and non-recurring items that management

believes are not indicative of ongoing operations.

We believe Adjusted EBITDA is relevant and useful information

for investors because it allows investors to view performance in a

manner similar to the method used by our management. There are

limitations to the use of Adjusted EBITDA and our Adjusted EBITDA

may not be comparable to similarly titled measures of other

companies. Other companies, including companies in our industry,

may calculate non-GAAP financial measures differently than we do,

limiting the usefulness of those measures for comparative purposes.

Adjusted EBITDA should not be considered a substitute for measures

prepared in accordance with GAAP.

While Adjusted EBITDA is a non-GAAP financial measure, we have

not provided guidance for the most directly comparable GAAP

financial measure — net income (loss) from continuing operations —

due to the inherent difficulty in forecasting and quantifying

certain amounts that are necessary to forecast such a measure.

Forward-Looking Statements

Certain statements in this press release may be considered

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which statements

involve substantial risks and uncertainties. Our forward-looking

statements include, but are not limited to, statements regarding

the benefits of the First We Feast transaction, our expected future

performance (including future revenue, pro forma enterprise value,

cash balance and our guidance for the quarter and year ended

December 31, 2024), market opportunities for BuzzFeed, HuffPost,

and Tasty, and the overall digital publishing market and statements

regarding our management team’s expectations, hopes, beliefs,

intentions or strategies regarding the future. In addition, any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements. The words

“affect,” “anticipate,” “believe,” “can,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “seek,” “should,” “target,” “will,” “would” and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements include all matters

that are not historical facts. The forward-looking statements

contained in this press release are based on current expectations

and beliefs concerning future developments and their potential

effects on us. There can be no assurance that future developments

affecting us will be those that we have anticipated. These

forward-looking statements involve a number of risks, (some of

which are beyond our control) uncertainties or other assumptions

that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to: (1) developments relating to our competitors and the

digital media industry, including overall demand of advertising in

the markets in which we operate; (2) demand for our products and

services or changes in traffic or engagement with our brands and

content; (3) changes in the business and competitive environment in

which we and our current and prospective partners and advertisers

operate; (4) macroeconomic factors including: adverse economic

conditions in the United States and globally, including the

potential onset of recession; current global supply chain

disruptions; potential government shutdowns or a failure to raise

the U.S. federal debt ceiling or to fund the federal government;

the ongoing conflicts between Russia and Ukraine and between Israel

and Hamas and any related sanctions and geopolitical tensions, and

further escalation of trade tensions between the United States and

China; the inflationary environment; high unemployment; high

interest rates, currency fluctuations; and the competitive labor

market; (5) our future capital requirements, including, but not

limited to, our ability to obtain additional capital in the future,

to settle conversions of our unsecured convertible notes,

repurchase the notes upon a fundamental change such as the

delisting of our Class A common stock or repay the notes in cash at

their maturity, including upon the holders of the notes requiring

repayment of their notes, any restrictions imposed by, or

commitments under, the indenture governing our unsecured notes or

agreements governing any future indebtedness, and any restrictions

on our ability to access our cash and cash equivalents; (6)

significant volatility in the trading of our Class A common stock

as a result of the potential inability to repay the notes upon

request by the holders of the notes; (7) developments in the law

and government regulation, including, but not limited to, revised

foreign content and ownership regulations, and the outcomes of

legal proceedings, regulatory disputes or governmental

investigations to which we are subject; (8) the benefits of our

cost savings measures; (9) our success divesting of companies,

assets or brands we sell or in integrating and supporting the

companies we acquire; (10) technological developments including

artificial intelligence; (11) the impact of activist shareholder

activity, including on our strategic direction; (12) our success in

retaining or recruiting, or changes required in, officers, other

key employees or directors; (13) use of content creators and

on-camera talent and relationships with third parties managing

certain of our branded operations outside of the United States;

(14) the security of our information technology systems or data;

(15) disruption in our service, or by our failure to timely and

effectively scale and adapt our existing technology and

infrastructure; (16) our ability to maintain the listing of our

Class A common stock and warrants on The Nasdaq Stock Market LLC;

and (17) those factors described under the sections entitled “Risk

Factors” in the Company’s annual and quarterly filings with the

Securities and Exchange Commission.

Should one or more of these risks or uncertainties materialize,

or should any of our assumptions prove incorrect, actual results

may vary in material respects from those projected in these

forward-looking statements. There may be additional risks that we

consider immaterial or which are unknown. It is not possible to

predict or identify all such risks. We do not undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

_____________________________ 1 As presented throughout,

Adjusted EBITDA is a Non-GAAP Financial Measure; refer to "Non-GAAP

Financial Measures" for additional details.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212770493/en/

Media & Investor

Relations Juliana Clifton, BuzzFeed:

juliana.clifton@buzzfeed.com Lizzie Grams, BuzzFeed:

lizzie.grams@buzzfeed.com

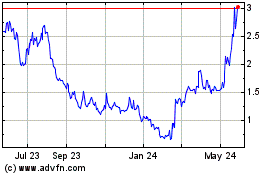

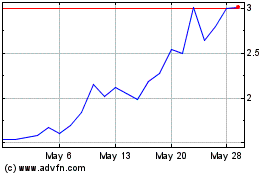

BuzzFeed (NASDAQ:BZFD)

Historical Stock Chart

From Jan 2025 to Feb 2025

BuzzFeed (NASDAQ:BZFD)

Historical Stock Chart

From Feb 2024 to Feb 2025