Fiscal 2024 net sales of $3.2 billion vs.

$3.3 billion in the prior year

Fiscal 2024 GAAP EPS of $1.62 vs. $1.88

a year ago, non-GAAP EPS of $2.13 vs. $2.07 a year ago

Expects fiscal 2025 non-GAAP EPS to be $2.20

or better

Central Garden & Pet Company (NASDAQ: CENT) (NASDAQ: CENTA)

("Central"), a market leader in the pet and garden industries,

today announced results for its fourth quarter and fiscal year

ended September 28, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241125974807/en/

"We have a lot to be proud of this year. We increased non-GAAP

EPS, continued margin expansion, made significant progress on our

Cost and Simplicity program, and achieved strong profits in our Pet

segment and record cash flow for the company. We accomplished this

despite continued soft demand across our Pet segment, in particular

in durable pet products, and a difficult garden season," said Niko

Lahanas, Central Garden & Pet's new CEO. "While we expect the

external environment to remain challenging, I am confident we have

the right strategy and people in place to deliver profitable growth

in fiscal 2025 and for the long term."

Fiscal 2024 Results

Net sales were $3.2 billion compared to $3.3 billion in the

prior year, a decrease of 3%. Fiscal 2023 benefited from an

additional week in the fourth quarter. Organic net sales decreased

4% excluding the impact of the acquisition of TDBBS in fiscal 2024

and the sale of the independent garden channel distribution

business in fiscal 2023.

Net sales for the Pet segment were $1.83 billion compared to

$1.88 billion a year ago, a decrease of 2%. Pet organic net sales

decreased 6%. Net sales for the Garden segment were $1.37 billion

compared to $1.43 billion in the prior year, a decrease of 5%.

Garden organic net sales decreased 1%.

Gross margin expanded by 90 basis points to 29.5% from 28.6% in

the prior year. On a non-GAAP basis, gross margin expanded by 110

basis points to 30.0% from 28.9% a year ago driven by productivity

efforts and moderating inflation.

Operating income was $185 million compared to $211 million in

the prior year, a decrease of 12%. On a non-GAAP basis, operating

income was $223 million compared to $227 million a year ago.

Operating margin was 5.8% compared to 6.4% in the prior year. On a

non-GAAP basis, operating margin expanded to 7.0% from 6.9% a year

ago due to improved gross margin and continued cost discipline in

selling, general and administrative expense.

Net interest expense was $38 million compared to $50 million in

the prior year driven by higher interest income.

Other expense was $5.1 million compared to other income of $1.5

million a year ago due to the impairment of two underperforming

equity investments in the fourth quarter.

Net income was $108 million compared to $126 million in the

prior year. On a non-GAAP basis, net income increased to $142

million from $138 million a year ago. Earnings per share were $1.62

compared to $1.88 in the prior year. On a non-GAAP basis, earnings

per share increased to $2.13 from $2.07 a year ago.

Adjusted EBITDA was $334 million compared to $343 million in the

prior year.

The effective tax rate for the fiscal year was 23.2% compared to

22.4% a year ago primarily due to an increase in the blended state

income tax rate in the current year compared to the prior year.

Fourth Quarter Fiscal 2024 Results

Net sales were $669 million compared to $750 million a year ago,

a decrease of 11%. The prior year quarter benefited from an extra

week. Organic net sales decreased 13% excluding the impact of the

acquisition of TDBBS and the sale of the independent garden channel

distribution business.

Gross margin contracted by 110 basis points to 25.2% compared to

26.3% a year ago primarily driven by the impairment of grass seed

inventory more than offsetting moderating inflation and

productivity efforts. On a non-GAAP basis, gross margin contracted

by 60 basis points to 26.0% from 26.6% in the prior year.

Operating loss was $32 million compared to operating income of

$9 million a year ago. On a non-GAAP basis, operating loss was $11

million compared to operating income of $12 million reflecting

lower volumes, the inventory impairment, and the timing of expenses

related to productivity and commercial initiatives. Operating

margin was (4.8)% compared to 1.2% in the prior year. On a non-GAAP

basis, operating margin contracted to (1.7)% from 1.6% a year

ago.

Other expense was $6 million compared to $2 million in the prior

year.

Net interest expense was $6 million compared to $8 million a

year ago.

Net loss was $34 million compared to net income of $3 million in

the prior year. On a non-GAAP basis, net loss was $12 million

compared to net income $5 million a year ago. Loss per share was

$0.51 compared to earnings per share of $0.04 in the prior year. On

a non-GAAP basis, loss per share was $0.18 compared to earnings per

share of $0.08 a year ago.

Adjusted EBITDA was $17 million compared to $42 million in the

prior year.

Pet Segment Fourth Quarter Fiscal 2024 Results

Net sales for the Pet segment were $435 million compared to $483

million in the prior year, a decrease of 10%. The decrease was

primarily due to an extra week in the prior year quarter. Organic

net sales decreased 14% excluding the impact of the acquisition of

TDBBS.

The Pet segment’s operating income was $14 million compared to

$43 million a year ago. On a non-GAAP basis, operating income was

$35 million compared to $48 million in the prior year due to lower

volume and the timing of expenses related to productivity and

commercial initiatives. Operating margin was 3.3% compared to 9.0%

in the prior year. On a non-GAAP basis, operating margin was 8.0%

compared to 9.9% a year ago.

Pet segment adjusted EBITDA was $45 million compared to $58

million in the prior year quarter.

Garden Segment Fourth Quarter Fiscal 2024 Results

Net sales for the Garden segment were $234 million compared to

$267 million a year ago, a decrease of 12%. The decrease was

primarily due to an extra week in the prior year quarter. Organic

net sales decreased 11% excluding the impact of the sale of the

independent garden channel distribution business.

The Garden segment’s operating loss was $29 million compared to

a loss of $3 million in the prior year. On a non-GAAP basis,

operating loss was $25 million compared to a loss of $5 million a

year ago due to lower volume as well as the impairment of grass

seed inventory. Operating margin was (12.3)% compared to (1.3)% in

the prior year. On a non-GAAP basis, operating margin was (10.6)%

compared to (2.0)% a year ago.

Garden segment adjusted EBITDA was $(14) million compared to $6

million in the prior year.

Liquidity and Debt

At September 28, 2024, cash and cash equivalents was $754

million, compared to $489 million a year ago. The increase in cash

and cash equivalents was driven by converting inventory to cash

over the last 12 months and lower capital expenditures.

Cash provided by operations for fiscal 2024 was $395 million,

compared to $382 million in the prior year. The increase in cash

provided by operations was primarily due to changes in working

capital driven by the reduction in inventory.

Total debt at September 28, 2024 and September 30, 2023 was $1.2

billion. The gross leverage ratio, calculated using the definitions

for Indebtedness and EBITDA in Central's credit agreement, at the

end of the quarter was 3.1x, in line with the prior year. Central

repurchased 270,032 shares or $9 million of its stock during the

quarter. Subsequent to the fiscal year end, Central purchased an

additional 1,663,479 shares or $52 million of its stock through

November 21, 2024.

Non-GAAP Adjustments

Fiscal 2024

Central recognized $45 million in non-GAAP charges in fiscal

2024, $28 million of which related to Cost & Simplicity

initiatives.

Within the Garden segment, this included closure and

consolidation of one manufacturing facility, six distribution

facilities and one research facility as well as beginning the

wind-down of Central's pottery business. Within the Pet segment,

this included the announced closure and consolidation of two

manufacturing facilities related to a durable pet supply business

as well as impairment of intangible assets related to this business

due to changing market conditions and increased international

competition.

In addition to Cost & Simplicity related charges, Central

recognized $4 million in charges related to the impairment of

equity investments in two underperforming private businesses,

partially offset by a gain on the settlement of a litigation.

The $45 million overall charge was mostly noncash, with $16

million included in cost of goods sold, $21 million in selling,

general and administrative expense, and $8 million in other

expense.

Fourth Quarter Fiscal 2024

Non-GAAP charges for the fourth quarter were $29 million, $12

million of which related to Cost & Simplicity initiatives, $13

million related to intangible impairments, and $4 million related

to the equity investment write downs and partially offsetting a

gain on the settlement of a litigation.

The $29 million overall charge was mostly noncash, with $5

million included in cost of goods sold, $16 million in selling,

general and administrative expense, and $8 million in other

expense.

Outlook for Fiscal 2025

Central currently expects fiscal 2025 non-GAAP EPS to be $2.20

or better. This outlook takes into consideration deflationary

pressure in certain commodity businesses, evolving consumer

behavior in an environment of macroeconomic and geopolitical

uncertainty, and the challenging brick-and-mortar retail

environment. Central expects fiscal 2025 capital spending to be in

the range of $60-70 million. This outlook excludes the impact of

any acquisitions, divestitures or restructuring activities that may

occur during fiscal 2025, including projects under the Cost and

Simplicity program.

Conference Call

Central will hold a conference call today at 4:30 p.m. Eastern

Time (1:30 p.m. Pacific Time), hosted by Niko Lahanas, CEO, and

Brad Smith, CFO, to discuss these results and to provide a general

business update. The conference call and related materials can be

accessed at http://ir.central.com.

Alternatively, to listen to the call by telephone, dial (201)

689-8345 (domestic and international) using confirmation

#13748436.

About Central Garden & Pet

Central Garden & Pet Company (NASDAQ: CENT) (NASDAQ: CENTA)

understands home is central to life and has proudly nurtured happy

and healthy homes for over 40 years. With fiscal 2024 net sales of

$3.2 billion, Central is on a mission to lead the future of the pet

and garden industries. The Company’s innovative and trusted

products are dedicated to helping lawns grow greener, gardens bloom

bigger, pets live healthier, and communities grow stronger. Central

is home to a leading portfolio of more than 65 high-quality brands

including Amdro®, Aqueon®, Cadet®, C&S®, Farnam®, Ferry-Morse®,

Four Paws®, Kaytee®, Nylabone® and Pennington®, strong

manufacturing and distribution capabilities, and a passionate,

entrepreneurial growth culture. Central is based in Walnut Creek,

California, with 6,450 employees primarily across North America.

Visit www.central.com to learn more.

Safe Harbor Statement

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: The statements contained in this release which

are not historical facts, including statements concerning evolving

consumer demand and unfavorable retailer dynamics, productivity

initiatives and estimated capital spending, and earnings guidance

for fiscal 2025, are forward-looking statements that are subject to

risks and uncertainties that could cause actual results to differ

materially from those set forth in or implied by forward-looking

statements. All forward-looking statements are based upon Central's

current expectations and various assumptions. There are a number of

risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements contained in this

release including, but not limited to, the following factors:

- economic uncertainty, and other adverse macro-economic

conditions;

- impacts of tariffs or a trade war;

- risks associated with international sourcing, including from

China;

- fluctuations in energy prices, fuel and related petrochemical

costs;

- declines in consumer spending and the associated increased

inventory risk;

- seasonality and fluctuations in our operating results and cash

flow;

- adverse weather conditions;

- the success of our Central to Home strategy and our Cost and

Simplicity program;

- fluctuations in market prices for seeds and grains and other

raw materials, including the impact of the recent significant

decline in grass seed market prices on our inventory

valuation;

- risks associated with new product introductions, including the

risk that our new products will not produce sufficient sales to

recoup our investment;

- dependence on a small number of customers for a significant

portion of our business;

- consolidation trends in the retail industry;

- supply shortages in pet birds, small animals and fish;

- reductions in demand for our product categories;

- competition in our industries;

- continuing implementation of an enterprise resource planning

information technology system;

- regulatory issues;

- potential environmental liabilities;

- access to and cost of additional capital;

- the impact of product recalls;

- risks associated with our acquisition strategy, including our

ability to successfully integrate acquisitions and the impact of

purchase accounting on our financial results;

- potential goodwill or intangible asset impairment;

- the potential for significant deficiencies or material

weaknesses in internal control over financial reporting,

particularly of acquired companies;

- our dependence upon our key executives;

- our ability to recruit and retain members of our management

team and employees to support our businesses;

- potential costs and risks associated with actual or potential

cyberattacks;

- our ability to protect our trademarks and other proprietary

rights;

- litigation and product liability claims;

- the impact of new accounting regulations and the possibility

our effective tax rate will increase as a result of future changes

in the corporate tax rate or other tax law changes;

- potential dilution from issuance of authorized shares; and

- the voting power associated with our Class B stock.

These risks and others are described in Central’s Securities and

Exchange Commission filings. Central undertakes no obligation to

publicly update these forward-looking statements to reflect new

information, subsequent events or otherwise.

CENTRAL GARDEN & PET

COMPANY

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

ASSETS

September 28, 2024

September 30, 2023

Current assets:

Cash and cash equivalents

$

753,550

$

488,730

Restricted cash

14,853

14,143

Accounts receivable, net

326,220

332,890

Inventories, net

757,943

838,188

Prepaid expenses and other

34,240

33,172

Total current assets

1,886,806

1,707,123

Plant, property and equipment, net

379,166

391,768

Goodwill

551,361

546,436

Other intangible assets, net

473,280

497,228

Operating lease right-of-use assets

205,137

173,540

Other assets

57,689

62,553

Total

$

3,553,439

$

3,378,648

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

212,606

$

190,902

Accrued expenses

245,226

216,241

Current lease liabilities

57,313

50,597

Current portion of long-term debt

239

247

Total current liabilities

515,384

457,987

Long-term debt

1,189,809

1,187,956

Long-term lease liabilities

173,086

135,621

Deferred income taxes and other long-term

obligations

117,615

144,271

Equity:

Common stock ($.01 par value; 80 million

shares authorized; 11,074,620 and 11,077,612 issued,

respectively)

111

111

Class A common stock ($.01 par value; 100

million shares authorized; 54,446,194 and 54,472,902 issued,

respectively)

544

544

Class B stock ($.01 par value; 3 million

shares authorized; 1,602,374 and 1,602,374 issued,

respectively)

16

16

Additional paid-in capital

598,098

594,282

Retained earnings

959,511

859,370

Accumulated other comprehensive loss

(2,626

)

(2,970

)

Total Central Garden & Pet

shareholders’ equity

1,555,654

1,451,353

Noncontrolling interest

1,891

1,460

Total equity

1,557,545

1,452,813

Total

$

3,553,439

$

3,378,648

CENTRAL GARDEN & PET

COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

Fiscal Year Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Net sales

$

669,489

$

750,147

$

3,200,460

$

3,310,083

Cost of goods sold

500,537

552,694

2,256,725

2,363,241

Gross profit

168,952

197,453

943,735

946,842

Selling, general and administrative

expenses

201,360

188,084

758,348

736,196

Operating (loss) income

(32,408

)

9,369

185,387

210,646

Interest expense

(14,115

)

(13,138

)

(57,527

)

(57,025

)

Interest income

7,639

5,075

19,655

7,362

Other income (expense), net

(6,137

)

(1,685

)

(5,090

)

1,462

Income (loss) before income taxes and

noncontrolling interest

(45,021

)

(379

)

142,425

162,445

Income tax (benefit) expense

(10,621

)

(3,098

)

33,112

36,348

Net income (loss) including noncontrolling

interest

(34,400

)

2,719

109,313

126,097

Net income (loss) attributable to

noncontrolling interest

(242

)

(116

)

1,330

454

Net income (loss) attributable to Central

Garden & Pet Company

$

(34,158

)

$

2,835

$

107,983

$

125,643

Net income (loss) per share attributable

to Central Garden & Pet Company:

Basic

$

(0.52

)

$

0.04

$

1.64

$

1.92

Diluted

$

(0.51

)

$

0.04

$

1.62

$

1.88

Weighted average shares used in the

computation of net income per share:

Basic

65,939

65,265

65,711

65,493

Diluted

66,917

66,671

66,860

66,783

CENTRAL GARDEN & PET

COMPANY

CONSOLIDATED STATEMENTS OF

CASH FLOWS

Fiscal Year Ended

September 28, 2024

September 30, 2023

September 24, 2022

(in thousands)

Cash flows from operating activities:

Net income

$

109,313

$

126,097

$

152,672

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

90,807

87,700

80,948

Amortization of deferred financing

costs

2,687

2,698

2,657

Non-cash lease expense

56,180

51,868

48,656

Stock-based compensation

20,583

27,990

25,817

Debt extinguishment costs

—

—

169

Gain on sale of business

—

(5,845

)

—

Deferred income taxes

(14,482

)

(12,253

)

28,128

Facility closures and business exit

costs

27,842

15,674

—

Impairment of intangibles

12,790

—

—

Other asset impairments

7,462

750

—

Other

906

(525

)

(648

)

Changes in assets and liabilities

(excluding businesses acquired):

Receivables

11,857

43,980

7,004

Inventories

84,306

86,980

(256,443

)

Prepaid expenses and other assets

11,944

8,813

(6,031

)

Accounts payable

18,373

(19,962

)

(31,209

)

Accrued expenses

17,152

6,766

(33,495

)

Other long-term obligations

(12,631

)

9,595

(7,728

)

Operating lease liabilities

(50,197

)

(48,692

)

(44,527

)

Net cash provided by (used in) operating

activities

394,892

381,634

(34,030

)

Cash flows from investing activities:

Additions to property, plant and

equipment

(43,135

)

(53,966

)

(115,205

)

Business acquired, net of cash

acquired

(60,226

)

—

—

Proceeds from sale of business

—

20,000

—

Payments for investments

(1,650

)

(500

)

(27,818

)

Other investing activities

(175

)

(115

)

40

Net cash used in investing activities

(105,186

)

(34,581

)

(142,983

)

Cash flows from financing activities:

Repayments on revolving line of credit

—

(48,000

)

—

Borrowings on revolving line of credit

—

48,000

—

Repayments of long-term debt

(370

)

(338

)

(1,096

)

Repurchase of common stock, including

shares surrendered for tax withholding

(24,075

)

(37,161

)

(62,287

)

Payments of contingent consideration

(95

)

(54

)

(216

)

Distribution to noncontrolling

interest

(899

)

—

(806

)

Payment of financing costs

—

—

(2,410

)

Net cash used in financing activities

(25,438

)

(37,553

)

(66,815

)

Effect of exchange rate changes on cash

and equivalents

1,261

1,189

(3,510

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

265,530

310,689

(247,338

)

Cash, cash equivalents and restricted cash

at beginning of year

502,873

192,184

439,522

Cash, cash equivalents and restricted cash

at end of year

$

768,403

$

502,873

$

192,184

Supplemental information:

Cash paid for interest

$

57,531

$

57,143

$

57,928

Cash paid for income taxes – net of

refunds

53,582

17,910

34,964

Non-cash investing and financing

activities:

Capital expenditures incurred but not

paid

1,936

2,243

8,016

Liability for contingent performance based

payments

(20

)

(374

)

(847

)

Shares of common stock repurchased but not

settled

536

—

911

Lease liabilities arising from obtaining

right-of-use assets

95,391

42,777

70,794

Use of Non-GAAP Financial Measures

We report our financial results in accordance with GAAP.

However, to supplement the financial results prepared in accordance

with GAAP, we use non-GAAP financial measures including non-GAAP

net income and diluted net income per share, non-GAAP operating

income, non-GAAP gross profit and gross margin, non-GAAP selling,

general and administrative expense, adjusted EBITDA and organic net

sales. Management uses these non-GAAP financial measures that

exclude the impact of specific items (described below) in making

financial, operating and planning decisions and in evaluating our

performance.

Management believes that these non-GAAP financial measures may

be useful to investors in their assessment of our ongoing operating

performance and provide additional meaningful comparisons between

current results and results in prior operating periods. While

Management believes that non-GAAP measures are useful supplemental

information, such adjusted results are not intended to replace our

GAAP financial results and should be read in conjunction with those

GAAP results.

Adjusted EBITDA is defined by us as income before income tax,

net other expense, net interest expense and depreciation and

amortization and stock-based compensation expense (or operating

income plus depreciation and amortization expense and stock-based

compensation expense). Adjusted EBITDA further excludes one-time

charges related to facility closures exits of business, intangible

and investment impairments and gains from a litigation settlement.

We present adjusted EBITDA because we believe that adjusted EBITDA

is a useful supplemental measure in evaluating the cash flows and

performance of our business and provides greater transparency into

our results of operations. Adjusted EBITDA is used by our

management to perform such evaluations. Adjusted EBITDA should not

be considered in isolation or as a substitute for cash flow from

operations, income from operations or other income statement

measures prepared in accordance with GAAP. We believe that adjusted

EBITDA is frequently used by investors, securities analysts and

other interested parties in their evaluation of companies, many of

which present adjusted EBITDA when reporting their results. Other

companies may calculate adjusted EBITDA differently and it may not

be comparable.

The reconciliations of these non-GAAP measures to the most

directly comparable financial measures calculated and presented in

accordance with GAAP are shown in the tables below.

We have not provided a reconciliation of non-GAAP guidance

measures to the corresponding GAAP measures on a forward-looking

basis as we cannot do so without unreasonable efforts due to the

potential variability and limited visibility of excluded items. For

the same reasons, we are unable to address the probable

significance of the unavailable information.

Non-GAAP financial measures reflect adjustments based on the

following items:

- Facility closures and business exit: we have excluded charges

related to the closure of distribution and manufacturing facilities

and our decision to exit the pottery business as they represent

infrequent transactions that impact the comparability between

operating periods. We believe these exclusions supplement the GAAP

information with a measure that may be useful to investors in

assessing the sustainability of our operating performance.

- Asset impairment charges: we exclude the impact of asset

impairments on intangible assets and investments as such non-cash

amounts are inconsistent in amount and frequency. We believe that

the adjustment of these charges supplements the GAAP information

with a measure that can be used to assess the performance of our

ongoing operations.

- Gain from litigation settlement: we exclude the gain from a

litigation settlement as it is a one-time occurrence. We believe

that the exclusion of this gain supplements the GAAP information

with a measure that can be used to assess the performance of our

ongoing operations.

- Gain on sale of a business or service line: we exclude the

impact of the gain on the sale of a business as it represents an

infrequent transaction that occurs in limited circumstances that

impacts the comparability between operating periods. We believe the

adjustment of this gain supplements the GAAP information with a

measure that may be used to assess the performance of our ongoing

operations.

- Tax impact: adjustment represents the impact of the tax effect

of the pre-tax non-GAAP adjustments excluded from non-GAAP net

income. The tax impact of the non-GAAP adjustments is calculated

based on the consolidated effective tax rate on a GAAP basis,

applied to the non-GAAP adjustments, unless the underlying item has

a materially different tax treatment.

From time to time in the future, there may be other items that

we may exclude if we believe that doing so is consistent with the

goal of providing useful information to investors and

management.

The non-GAAP adjustments made reflect the following:

Facility closures and business exits

(1) During the fourth quarter of fiscal year

2024, we recognized incremental expense of $7.5 million in our Pet

segment in the consolidated statement of operations, from the

closure of manufacturing facilities in California and Arizona.

Additionally, we recognized incremental expense in our Garden

segment of $3.9 million related to facility closures and business

exits announced in fiscal 2023 and earlier in fiscal 2024.

(2) During the third quarter of fiscal 2024,

we recognized incremental expense of $11.1 million in the

consolidated statement of operations, from the decision to exit the

pottery business, the closure of a live goods distribution facility

in Delaware and the relocation of our grass seed research

facility.

(3) During the second quarter of fiscal 2024,

we recognized incremental expense of $5.3 million in the

consolidated statement of operations from the closure of a

manufacturing facility in California and the consolidation of our

Southeast distribution network.

(4) During the fourth quarter of fiscal 2023,

we recognized a gain of $5.8 million from the sale of our

independent garden center distribution business, which includes the

impact of associated facility closure costs. The gain is included

in selling, general and administrative expense in the consolidated

statement of operations.

(5) In fiscal 2023, we recognized incremental

expense of $13.9 million in our Pet segment in the consolidated

statement of operations from the closure of a manufacturing and

distribution facility in Texas. Additionally, we recognized

incremental expense of $1.8 million in our Pet segment in the

consolidated statement of operations, from the closure of a second

manufacturing and distribution facility in Texas.

Intangible Impairments

(6) During the fourth quarter of fiscal 2024,

we recognized a non-cash impairment charge in our Pet segment of

$12.8 million related to the impairment of intangible assets due

primarily to changing market conditions resulting from the decline

in demand for durable products and increased international

competition.

(7) In fiscal 2023, we recognized a non-cash

impairment charge in our Pet segment of $2.8 million related to the

impairment of intangible assets caused by the loss of a significant

customer in our live fish business. Also, we recognized a non-cash

impairment charge in our Garden segment of $3.9 million related to

the impairment of intangible assets due to reduced demand for

products we sold under an acquired trade name. The impairments were

recorded as part of selling, general and administrative costs.

Gain from litigation and investment impairment

(8) Within corporate, the Company received

$3.2 million during the fourth quarter of fiscal 2024 in settlement

of litigation which gain is included in selling, general and

administrative expense. Additionally, we recognized a $7.5 million

non-cash impairment charge for two related private company

investments that is included within Other income (expense) in the

consolidated statement of operations.

Net Income and Diluted Net Income Per

Share Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended

Fiscal Year Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

(in thousands, except per

share amount)

GAAP net (loss) income attributable to

Central Garden & Pet Company

$

(34,158

)

$

2,835

$

107,983

$

125,643

Facility closures

(1)(2)(3)(5)

11,457

1,751

27,842

15,672

Intangible impairments

(6)(7)

12,790

6,731

12,790

6,731

Litigation settlement

(8)

(3,200

)

—

(3,200

)

—

Independent channel distribution business

sale

(4)

—

(5,844

)

—

(5,844

)

Investment impairment

(8)

7,461

—

7,461

—

Tax effect of adjustments

(6,725

)

(332

)

(10,437

)

(3,705

)

Non-GAAP net (loss) income attributable to

Central Garden & Pet Company

$

(12,375

)

$

5,141

$

142,439

$

138,497

GAAP diluted net income per share

$

(0.51

)

$

0.04

$

1.62

$

1.88

Non-GAAP diluted net income per share

$

(0.18

)

$

0.08

$

2.13

$

2.07

Shares used in GAAP and non-GAAP diluted

net income per share calculation

66,917

66,671

66,860

66,783

Operating Income Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended September

28, 2024

Fiscal Year Ended September

28, 2024

GAAP

Adjustments(1)(6)(8)

Non-GAAP

GAAP

Adjustments(1)(2)(3)(6)(8)

Non-GAAP

(in thousands)

Net sales

$

669,489

$

—

$

669,489

$

3,200,460

$

—

$

3,200,460

Cost of goods sold and occupancy

500,537

5,209

495,328

2,256,725

16,349

2,240,376

Gross profit

168,952

(5,209

)

174,161

943,735

(16,349

)

960,084

Selling, general and administrative

expenses

201,360

15,838

185,522

758,348

21,083

737,265

(Loss) Income from operations

$

(32,408

)

$

(21,047

)

$

(11,361

)

$

185,387

$

(37,432

)

$

222,819

Gross margin

25.2

%

26.0

%

29.5

%

30.0

%

Operating margin

(4.8

)%

(1.7

)%

5.8

%

7.0

%

Operating Income Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended September

30, 2023

Fiscal Year Ended September

30, 2023

GAAP

Adjustments(4)(5)(7)

Non-GAAP

GAAP

Adjustments(4)(5)(7)

Non-GAAP

(in thousands)

Net sales

$

750,147

$

—

$

750,147

$

3,310,083

$

—

$

3,310,083

Cost of goods sold and occupancy

552,694

1,751

550,943

2,363,241

9,761

2,353,480

Gross profit

197,453

(1,751

)

199,204

946,842

(9,761

)

956,603

Selling, general and administrative

expenses

188,084

887

187,197

736,196

6,798

729,398

Income from operations

$

9,369

$

(2,638

)

$

12,007

$

210,646

$

(16,559

)

$

227,205

Gross margin

26.3

%

26.6

%

28.6

%

28.9

%

Operating margin

1.2

%

1.6

%

6.4

%

6.9

%

Pet Segment Operating Income

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended

Fiscal Year Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

(in thousands)

GAAP operating income

$

14,310

$

43,225

$

203,425

$

198,004

Facility closures

(1)(5)

7,549

1,751

7,549

15,672

Intangible impairments

(6)(7)

12,790

2,785

12,790

2,785

Non-GAAP operating income

$

34,649

$

47,761

$

223,764

$

216,461

GAAP operating margin

3.3

%

9.0

%

11.1

%

10.5

%

Non-GAAP operating margin

8.0

%

9.9

%

12.2

%

11.5

%

Garden Segment Operating Income

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended

Fiscal Year Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

(in thousands)

GAAP operating income

$

(28,806

)

$

(3,432

)

$

81,893

$

123,455

Facility closures

(1)(2)(3)

3,908

—

20,293

—

Independent channel distribution business

sale

(4)

—

(5,844

)

—

(5,844

)

Intangible impairments

(7)

—

3,946

—

3,946

Non-GAAP operating income (loss)

$

(24,898

)

$

(5,330

)

$

102,186

$

121,557

GAAP operating margin

(12.3

)%

(1.3

)%

6.0

%

8.6

%

Non-GAAP operating margin

(10.6

)%

(2.0

)%

7.5

%

8.5

%

Organic Net Sales

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended September

28, 2024

Fiscal Year Ended September

28, 2024

Net sales (GAAP)

Effect of acquisitions &

divestiture on net sales

Net sales organic

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

(in millions)

Reported net sales FY 2024

$

669.5

$

18.0

$

651.5

$

3,200.5

$

66.4

$

3,134.1

Reported net sales FY 2023

750.1

3.7

746.4

3,310.1

48.1

3,262.0

$ decrease

$

(80.6

)

$

14.3

$

(94.9

)

$

(109.6

)

$

18.3

$

(127.9

)

% decrease

(10.7

)%

(12.7

)%

(3.3

)%

(3.9

)%

Organic Pet Segment Net Sales

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended September

28, 2024

Fiscal Year Ended September

28, 2024

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

(in millions)

Reported net sales FY 2024

$

435.3

$

18.0

$

417.3

$

1,832.8

$

66.4

$

1,766.4

Reported net sales FY 2023

482.8

—

482.8

1,877.2

—

1,877.2

$ decrease

$

(47.5

)

$

18.0

$

(65.5

)

$

(44.4

)

$

66.4

$

(110.8

)

% decrease

(9.8

)%

(13.6

)%

(2.4

)%

(5.9

)%

Organic Garden Segment Net Sales

Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended September

28, 2024

Fiscal Year Ended September

28, 2024

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

Net sales (GAAP)

Effect of acquisitions &

divestitures on net sales

Net sales organic

(in millions)

Reported net sales FY 2024

$

234.2

$

—

$

234.2

$

1,367.7

$

—

$

1,367.7

Reported net sales FY 2023

267.3

3.7

263.6

1,432.9

48.1

1,384.8

$ decrease

$

(33.1

)

$

(3.7

)

$

(29.4

)

$

(65.2

)

$

(48.1

)

$

(17.1

)

% decrease

(12.4

)%

(11.2

)%

(4.6

)%

(1.2

)%

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Fiscal Year Ended September

28, 2024

Pet

Garden

Corp

Total

(in thousands)

Net income attributable to Central Garden

& Pet

$

—

$

—

$

—

$

107,983

Interest expense, net

—

—

—

37,872

Other expense

—

—

—

5,090

Income tax expense

—

—

—

33,112

Net income attributable to noncontrolling

interest

—

—

—

1,330

Sum of items below operating income

—

—

—

77,404

Income (loss) from operations

203,425

81,893

(99,931

)

185,387

Depreciation & amortization

43,642

44,403

2,762

90,807

Noncash stock-based compensation

—

—

20,583

20,583

Non-GAAP adjustments

(1)(2)(3)(6)(8)

20,339

20,293

(3,200

)

37,432

Adjusted EBITDA

$

267,406

$

146,589

$

(79,786

)

$

334,209

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Fiscal Year Ended September

30, 2023

Pet

Garden

Corp

Total

(in thousands)

Net income attributable to Central Garden

& Pet

$

—

$

—

$

—

$

125,643

Interest expense, net

—

—

—

49,663

Other income

—

—

—

(1,462

)

Income tax expense

—

—

—

36,348

Net income attributable to noncontrolling

interest

—

—

—

454

Sum of items below operating income

—

—

—

85,003

Income (loss) from operations

198,004

123,455

(110,813

)

210,646

Depreciation & amortization

41,126

43,375

3,199

87,700

Noncash stock-based compensation

—

—

27,990

27,990

Non-GAAP adjustments

(4)(5)(7)

18,457

(1,898

)

—

16,559

Adjusted EBITDA

$

257,587

$

164,932

$

(79,624

)

$

342,895

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended September

28, 2024

Pet

Garden

Corp

Total

(in thousands)

Net loss attributable to Central Garden

& Pet

$

—

$

—

$

—

$

(34,158

)

Interest expense, net

—

—

—

6,476

Other expense

—

—

—

6,137

Income tax benefit

—

—

—

(10,621

)

Net loss attributable to noncontrolling

interest

—

—

—

(242

)

Sum of items below operating income

—

—

—

1,750

Income (loss) from operations

14,310

(28,806

)

(17,912

)

(32,408

)

Depreciation & amortization

10,741

11,375

622

22,738

Noncash stock-based compensation

—

—

5,445

5,445

Non-GAAP adjustments

(1)(2)(3)(6)(8)

20,339

3,908

(3,200

)

21,047

Adjusted EBITDA

$

45,390

$

(13,523

)

$

(15,045

)

$

16,822

Adjusted EBITDA Reconciliation

GAAP to Non-GAAP

Reconciliation

Three Months Ended September

30, 2023

Pet

Garden

Corp

Total

(in thousands)

Net income attributable to Central Garden

& Pet

$

—

$

—

$

—

$

2,835

Interest expense, net

—

—

—

8,063

Other expense

—

—

—

1,685

Income tax benefit

—

—

—

(3,098

)

Net loss attributable to noncontrolling

interest

—

—

—

(116

)

Sum of items below operating income

—

—

—

6,534

Income (loss) from operations

43,225

(3,432

)

(30,424

)

9,369

Depreciation & amortization

10,479

10,892

825

22,196

Noncash stock-based compensation

—

—

7,358

7,358

Non-GAAP adjustments

(4)(5)(7)

4,536

(1,898

)

—

2,638

Adjusted EBITDA

$

58,240

$

5,562

$

(22,241

)

$

41,561

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125974807/en/

Investor & Media Contact Friederike Edelmann VP of

Investor Relations & Corporate Sustainability (925) 412 6726 |

fedelmann@central.com

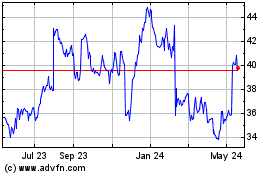

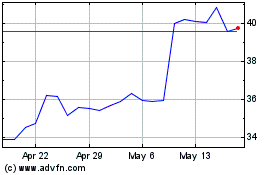

Central Garden and Pet (NASDAQ:CENTA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Central Garden and Pet (NASDAQ:CENTA)

Historical Stock Chart

From Dec 2023 to Dec 2024