0001490906false00014909062024-01-232024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January 23, 2024

| | | | | | | | | | | | | | |

| | | | |

| CAPITOL FEDERAL FINANCIAL, INC. |

|

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| | |

| Maryland | 001-34814 | 27-2631712 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 700 South Kansas Avenue, | Topeka | Kansas | 66603 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code

(785) 235-1341

| | | | | | | | | | | | | | |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

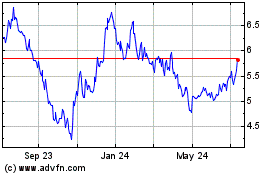

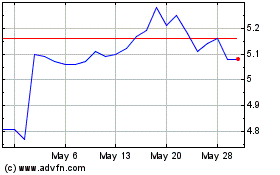

| Common Stock, par value $0.01 per share | CFFN | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

The Company’s press release dated January 24, 2024, announcing financial results for the first quarter of fiscal year 2024 is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

ITEM 7.01 REGULATION FD DISCLOSURE

The Company's press release dated January 23, 2024, announcing a quarterly cash dividend of $0.085 per share on outstanding Company common stock payable on February 16, 2024, to stockholders of record as of the close of business on February 2, 2024, is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit 104 – Cover page interactive data file, formatted in Inline XBRL.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| |

| CAPITOL FEDERAL FINANCIAL, INC. |

| Date: January 24, 2024 | By: /s/ Kent G. Townsend | |

| | |

| | |

| Kent G. Townsend, Executive Vice-President, | |

| Chief Financial Officer, and Treasurer | |

NEWS RELEASE

FOR IMMEDIATE RELEASE

January 24, 2024

CAPITOL FEDERAL FINANCIAL, INC.®

REPORTS FIRST QUARTER FISCAL YEAR 2024 RESULTS

Topeka, KS - Capitol Federal Financial, Inc.® (NASDAQ: CFFN) (the "Company," "we" or "our"), the parent company of Capitol Federal Savings Bank (the "Bank"), announced results today for the quarter ended December 31, 2023. For best viewing results, please view this release in Portable Document Format (PDF) on our website, https://ir.capfed.com.

The highlights for the quarter include:

•Completed a strategic securities transaction ("securities strategy") to improve earnings;

•net interest margin of 1.71%, an improvement of 50 basis points from the prior quarter;

•earnings per share of $0.02; excluding the losses from the securities strategy, earnings per share would have been $0.10;

•paid dividends of $0.085 per share;

•on January 23, 2024, announced a cash dividend of $0.085 per share, payable on February 16, 2024 to stockholders of record as of the close of business on February 2, 2024.

Securities Strategy to Improve Earnings

During the current quarter, the Company completed a securities strategy by selling $1.30 billion of securities with a weighted average yield of 1.22% and an average duration of 3.6 years and purchased $632.0 million of securities yielding 5.75% and paid down $500.0 million of borrowings with a cost of 4.70%. The Company plans to hold the remaining cash associated with the securities strategy at the Federal Reserve Bank ("FRB") earning interest at the reserve balances rate, until such time as it can be used to fund commercial loan activity or other Bank operations. The Company recognized net interest margin benefits in the current quarter associated with the securities strategy and total assets were reduced below $10.0 billion at December 31, 2023 to $9.58 billion.

Since the Company did not have the intent to hold the $1.30 billion of securities to maturity at September 30, 2023, the Company recognized an impairment loss on those securities, $192.6 million of which was reflected in the Company's financial statements for the quarter ended September 30, 2023. During the current quarter, $13.3 million, or $0.08 per share, of additional loss related to the sale of the securities was recorded, which reflected the market value loss on these securities generated from October 1, 2023 until the sale of such securities.

Comparison of Operating Results for the Three Months Ended December 31, 2023 and September 30, 2023

For the quarter ended December 31, 2023, the Company recognized net income of $2.5 million, or $0.02 per share, compared to a net loss of $140.4 million, or $(1.05) per share, for the quarter ended September 30, 2023. The net loss for prior quarter was due to the securities strategy discussed above. Excluding the securities strategy, earnings per share would have been $0.10 for the current quarter and $0.04 for the prior quarter. The increase in earnings per share, excluding the net losses related to the securities strategy, was due primarily to an increase in the net interest margin due to securities and borrowings activity related to the securities strategy. The net interest margin increased 50 basis points, from 1.21% for the prior quarter to 1.71% for the current quarter. Excluding the effects of the leverage strategy during the prior quarter, the net interest margin increased 47 basis points, from 1.24% for the prior quarter to 1.71% for the current quarter. The leverage strategy was in place during a portion of the prior quarter and was not in place during the current quarter. The leverage strategy was suspended at times during the prior quarter and during all of the current quarter when the strategy was not profitable. See additional discussion in the "Leverage Strategy" section below.

Interest and Dividend Income

The following table presents the components of interest and dividend income for the time periods presented, along with the change measured in dollars and percent. The weighted average yield on mortgage-backed securities ("MBS") increased 282 basis points and the weighted average yield on investment securities increased 311 basis points compared to the prior quarter as a result of the securities strategy.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | September 30, | | Change Expressed in: |

| 2023 | | 2023 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| INTEREST AND DIVIDEND INCOME: | | | | | | | |

| Loans receivable | $ | 75,941 | | | $ | 74,031 | | | $ | 1,910 | | | 2.6 | % |

| MBS | 5,859 | | | 4,399 | | | 1,460 | | | 33.2 | |

| Cash and cash equivalents | 4,778 | | | 6,139 | | | (1,361) | | | (22.2) | |

| Federal Home Loan Bank Topeka ("FHLB") stock | 2,586 | | | 2,796 | | | (210) | | | (7.5) | |

| Investment securities | 2,528 | | | 894 | | | 1,634 | | | 182.8 | |

| Total interest and dividend income | $ | 91,692 | | | $ | 88,259 | | | $ | 3,433 | | | 3.9 | |

The increase in interest income on loans receivable was due to an increase in the weighted average yield of the portfolio, along with an increase in the average balance of commercial loans, which also contributed to the increase in the overall portfolio yield. The increase in the weighted average yield was due primarily to originations at higher market rates and one- to four-family adjustable-rate loans repricing to higher market interest rates, as well as disbursements on commercial construction loans at rates higher than the overall portfolio rate. The increase in interest income on MBS and investment securities was due to an increase in the weighted average yield of the portfolios due the securities strategy, partially offset by a decrease in the average balance as not all of the proceeds from the securities sales were reinvested into the securities portfolios. The decrease in interest income on cash and cash equivalents and FHLB stock was due mainly to the leverage strategy being in place for a portion of the prior quarter, and not being in place during the current quarter. Excluding the leverage strategy, the average balance of cash and cash equivalents increased during the current quarter as a result of the securities strategy.

Interest Expense

The following table presents the components of interest expense for the time periods presented, along with the change measured in dollars and percent. The weighted average rate paid on deposits increased 21 basis points and the weighted average rate paid on borrowings not associated with the leverage strategy decreased 18 basis points compared to the prior quarter.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | September 30, | | Change Expressed in: |

| 2023 | | 2023 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| INTEREST EXPENSE: | | | | | | | |

| Deposits | $ | 32,443 | | | $ | 29,778 | | | $ | 2,665 | | | 8.9 | % |

| Borrowings | 19,656 | | | 27,746 | | | (8,090) | | | (29.2) | |

| Total interest expense | $ | 52,099 | | | $ | 57,524 | | | $ | (5,425) | | | (9.4) | |

The increase in interest expense on deposits was due almost entirely to increases in the weighted average rate paid and average balance of the retail certificate of deposit portfolio. The growth in the retail certificate of deposit portfolio was in terms less than 17 months. Management continues to competitively price certain short-term retail certificate of deposit products so that if rates were to decrease in the near future, the Bank would be able to more quickly reprice those balances to lower market rates at maturity. During the current quarter, interest expense on borrowings not associated with the leverage strategy decreased $4.9 million, due primarily to the pay down of $500.0 million of borrowings under the Federal Reserve's Bank Term Funding Program ("BTFP"), as part of the securities strategy. Interest expense on borrowings associated with the leverage strategy decreased $3.2 million due to the leverage strategy being in place during a portion of the prior quarter and not being in place during the current quarter.

Provision for Credit Losses

For the quarter ended December 31, 2023, the Bank recorded a provision for credit losses of $123 thousand, compared to a provision for credit losses of $963 thousand for the prior quarter. The provision for credit losses in the current quarter was comprised of a $400 thousand increase in the allowance for credit losses ("ACL") for loans, partially offset by a $277 thousand decrease in the reserve for off-balance sheet credit exposures. The provision for credit losses associated with the ACL was due primarily to commercial loan

growth. The release of provision for credit losses associated with the reserve for off-balance sheet credit exposures was due primarily to commercial construction loans converting to permanent loans.

Non-Interest Income

The following table presents the components of non-interest income for the time periods presented, along with the change measured in dollars and percent.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | September 30, | | Change Expressed in: |

| 2023 | | 2023 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| NON-INTEREST INCOME: | | | | | | | |

| Deposit service fees | $ | 2,575 | | | $ | 2,758 | | | $ | (183) | | | (6.6) | % |

| Insurance commissions | 863 | | | 927 | | | (64) | | | (6.9) | |

| Net loss from securities transactions | (13,345) | | | (192,622) | | | 179,277 | | | 93.1 |

| Other non-interest income | 1,013 | | | 1,233 | | | (220) | | | (17.8) |

| Total non-interest income | $ | (8,894) | | | $ | (187,704) | | | $ | 178,810 | | | 95.3 |

The net loss from securities transactions in the current quarter and prior quarter relate to the securities strategy. The decrease in other non-interest income was due mainly to a decrease in loan fees during the current quarter, along with several other miscellaneous non-interest income items.

Non-Interest Expense

The following table presents the components of non-interest expense for the time periods presented, along with the change measured in dollars and percent.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | September 30, | | Change Expressed in: |

| 2023 | | 2023 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| NON-INTEREST EXPENSE: | | | | | | | |

| Salaries and employee benefits | $ | 12,992 | | | $ | 11,804 | | | $ | 1,188 | | | 10.1 | % |

| Information technology and related expense | 5,369 | | | 6,448 | | | (1,079) | | | (16.7) | |

| Occupancy, net | 3,372 | | | 3,638 | | | (266) | | | (7.3) | |

| Federal insurance premium | 1,860 | | | 1,167 | | | 693 | | | 59.4 | |

| Regulatory and outside services | 1,643 | | | 1,765 | | | (122) | | | (6.9) | |

| Advertising and promotional | 988 | | | 692 | | | 296 | | | 42.8 | |

| Deposit and loan transaction costs | 542 | | | 778 | | | (236) | | | (30.3) | |

| Office supplies and related expense | 361 | | | 689 | | | (328) | | | (47.6) | |

| | | | | | | |

| Other non-interest expense | 1,381 | | | 1,213 | | | 168 | | | 13.8 | |

| Total non-interest expense | $ | 28,508 | | | $ | 28,194 | | | $ | 314 | | | 1.1 | |

The increase in salaries and employee benefits was mainly related to accruals associated with the Bank's short-term performance plan for fiscal year 2024 as the prior quarter included a reversal of the entire fiscal year 2023 accrual because the plan does not allow for the payment of incentive compensation if, as was the case for fiscal year 2023, the Company has a net loss for the fiscal year. The decrease in information technology and related expense was due primarily to a reduction in IT professional services and software maintenance expenses due mainly to costs associated with the Company's digital transformation during the prior quarter. The increase in the federal insurance premium was due mainly to an increase in the Federal Deposit Insurance Corporation ("FDIC") assessment rate as a result of the way the rate is adjusted for the occurrence of a net loss. The increase in advertising and promotional expense was due mainly to the timing of campaigns. The decrease in deposit and loan transaction costs was due primarily to lower electronic banking expenses due mainly to non-recurring fees paid during the prior quarter associated with the digital transformation. The decrease in office supplies and related expense was due mainly to postage expense associated with the digital transformation mailings in the prior quarter.

The Company's efficiency ratio was 92.86% for the current quarter compared to (17.96)% for the prior quarter. Excluding the net losses from the securities strategy, the efficiency ratio would have been 64.73% for the current quarter and 79.08% for the prior

quarter. The improvement in the efficiency ratio, excluding the securities strategy, was due primarily to higher net interest income. The efficiency ratio is a measure of a financial institution's total non-interest expense as a percentage of the sum of net interest income (pre-provision for credit losses) and non-interest income. A higher value generally indicates that it is costing the financial institution more money to generate revenue, relative to its net interest income and non-interest income.

Income Tax Expense

The following table presents pretax income, income tax expense, and net income for the time periods presented, along with the change measured in dollars and percent and the effective tax rate.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | September 30, | | Change Expressed in: |

| 2023 | | 2023 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| Income (loss) before income tax (benefit) | $ | 2,068 | | | $ | (186,126) | | | $ | 188,194 | | | (101.1) | % |

| Income tax (benefit) | (475) | | | (45,736) | | | 45,261 | | | (99.0) | |

| Net income (loss) | $ | 2,543 | | | $ | (140,390) | | | $ | 142,933 | | | (101.8) | |

| | | | | | | |

| Effective Tax Rate | (23.0 | %) | | 24.6 | % | | | | |

The income tax benefit in the current quarter was a result of treating the $13.3 million net loss associated with the securities strategy as a discrete tax benefit in the current quarter. The tax benefit related to the net loss was $3.3 million. Excluding the $3.3 million benefit, income tax expense would have been $2.8 million and the effective tax rate, excluding the $13.3 million net loss, would have been 18.0% for the current quarter. The income tax benefit in the prior quarter was a result of the pretax loss. The pretax loss, combined with the Company's permanent differences, contributed to the increase in the effective tax rate. Generally, the Company's permanent differences lower the effective tax rate when the Company has pretax income and tax expense, but as a result of the prior quarter pretax loss, the Company's permanent differences have the impact of raising the effective tax rate.

Comparison of Operating Results for the Three Months Ended December 31, 2023 and 2022

The Company recognized net income of $2.5 million, or $0.02 per share, for the current quarter, compared to net income of $16.2 million, or $0.12 per share, for the prior year quarter. The lower net income for the current quarter was primarily a result of the $13.3 million net loss associated with securities strategy, along with higher interest expense, partially offset by lower provision for credit losses and the income tax benefit in the current quarter. Excluding the effects of the securities strategy, earnings per share would have been $0.10 for the current quarter. The net interest margin increased ten basis points, from 1.61% for the prior year quarter to 1.71% for the current quarter. The leverage strategy was in place during the prior year quarter and not in place during the current quarter. When the leverage strategy is in place, it reduces the net interest margin due to the amount of earnings from the transaction in comparison to the size of the transaction. Excluding the effects of the leverage strategy, the net interest margin decreased 17 basis points, from 1.88% for the prior year quarter to 1.71% for the current quarter. The decrease in the net interest margin excluding the effects of the leverage strategy was due mainly to an increase in the cost of deposits and borrowings, which exceeded the increase in yields on securities and loans.

Interest and Dividend Income

The following table presents the components of interest and dividend income for the time periods presented, along with the change measured in dollars and percent.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | Change Expressed in: |

| 2023 | | 2022 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| INTEREST AND DIVIDEND INCOME: | | | | | | | |

| Loans receivable | $ | 75,941 | | | $ | 64,819 | | | $ | 11,122 | | | 17.2 | % |

| MBS | 5,859 | | | 4,811 | | | 1,048 | | | 21.8 |

| Cash and cash equivalents | 4,778 | | | 16,671 | | | (11,893) | | | (71.3) | |

| FHLB stock | 2,586 | | | 4,158 | | | (1,572) | | | (37.8) | |

| Investment securities | 2,528 | | | 881 | | | 1,647 | | | 186.9 | |

| Total interest and dividend income | $ | 91,692 | | | $ | 91,340 | | | $ | 352 | | | 0.4 | |

The increase in interest income on loans receivable was due to an increase in the weighted average yield and the average balance of the loan portfolio. The increase in the weighted average yield was due primarily to originations and purchases at higher market yields between periods, as well as disbursements on commercial construction loans at rates higher than the overall portfolio rate and upward repricing of existing adjustable-rate loans due to higher market interest rates. The increase in the average balance was mainly in the commercial real estate and correspondent one-to four-family loan portfolios. The increase in interest income on MBS and investment securities was due mainly to an increase in the weighted average yield, partially offset by a decrease in the average balance, both a result of the securities strategy. The decrease in interest income on cash and cash equivalents and the decrease in dividend income on FHLB stock was due mainly to the leverage strategy being utilized during the prior year quarter and not being utilized during the current quarter. Excluding the leverage strategy, the average balance of cash and cash equivalents increased during the current quarter as a result of the securities strategy.

Interest Expense

The following table presents the components of interest expense for the time periods presented, along with the change measured in dollars and percent.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | Change Expressed in: |

| 2023 | | 2022 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| INTEREST EXPENSE: | | | | | | | |

| Deposits | $ | 32,443 | | | $ | 11,904 | | | $ | 20,539 | | | 172.5 | % |

| Borrowings | 19,656 | | | 33,608 | | | (13,952) | | | (41.5) | |

| Total interest expense | $ | 52,099 | | | $ | 45,512 | | | $ | 6,587 | | | 14.5 | |

The increase in interest expense on deposits was due almost entirely to an increase in the weighted average rate paid on the deposit portfolio, specifically retail certificates of deposit and money market accounts. Interest expense on borrowings associated with the leverage strategy decreased $17.3 million compared to the prior year quarter due to the leverage strategy being in place during the prior year quarter and not being in place during the current quarter. Interest expense on borrowings not associated with the leverage strategy increased $3.3 million due to new borrowings added between periods, at market interest rates higher than the overall portfolio rate, to replace maturing advances and to fund operational needs.

Provision for Credit Losses

The Bank recorded a provision for credit losses during the current quarter of $123 thousand, compared to a provision for credit losses of $3.7 million during the prior year quarter. See "Comparison of Operating Results for the Three Months Ended December 31, 2023 and September 30, 2023" above for additional information regarding the provision for credit losses for the current quarter.

Non-Interest Income

The following table presents the components of non-interest income for the time periods presented, along with the change measured in dollars and percent.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | Change Expressed in: |

| 2023 | | 2022 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| NON-INTEREST INCOME: | | | | | | | |

| Deposit service fees | $ | 2,575 | | | $ | 3,461 | | | $ | (886) | | | (25.6) | % |

| Insurance commissions | 863 | | | 795 | | | 68 | | | 8.6 | |

| Net loss from securities transactions | (13,345) | | | — | | | (13,345) | | | N/A |

| Other non-interest income | 1,013 | | | 1,096 | | | (83) | | | (7.6) | |

| Total non-interest income | $ | (8,894) | | | $ | 5,352 | | | $ | (14,246) | | | (266.2) | |

The decrease in deposit service fees was due primarily to a change in the fee structure of certain deposit products after the digital transformation. The net loss from securities transactions relates to the securities strategy.

Non-Interest Expense

The following table presents the components of non-interest expense for the time periods presented, along with the change measured in dollars and percent.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | Change Expressed in: |

| 2023 | | 2022 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| NON-INTEREST EXPENSE: | | | | | | | |

| Salaries and employee benefits | $ | 12,992 | | | $ | 13,698 | | | $ | (706) | | | (5.2) | % |

| Information technology and related expense | 5,369 | | | 5,070 | | | 299 | | | 5.9 | |

| Occupancy, net | 3,372 | | | 3,474 | | | (102) | | | (2.9) | |

| Federal insurance premium | 1,860 | | | 812 | | | 1,048 | | | 129.1 | |

| Regulatory and outside services | 1,643 | | | 1,533 | | | 110 | | | 7.2 | |

| Advertising and promotional | 988 | | | 833 | | | 155 | | | 18.6 | |

| Deposit and loan transaction costs | 542 | | | 611 | | | (69) | | | (11.3) | |

| Office supplies and related expense | 361 | | | 633 | | | (272) | | | (43.0) | |

| | | | | | | |

| Other non-interest expense | 1,381 | | | 1,109 | | | 272 | | | 24.5 | |

| Total non-interest expense | $ | 28,508 | | | $ | 27,773 | | | $ | 735 | | | 2.6 | |

The decrease in salaries and employee benefits was a result of a decrease in full-time equivalent employees between the two quarter ends as a result of management's decision to not backfill non-critical employees through natural attrition. During fiscal year 2023, the Bank moved to a new branch staffing model comprised of decision makers and well-rounded employees that is intended to add an elevated experience for customers who choose in-person banking activities. The increase in information technology and related expenses was due mainly to higher software licensing expenses resulting from new agreements associated with the digital transformation, partially offset by lower software maintenance and third-party project management expenses provided in association with the Bank's digital transformation project during the prior year quarter. The increase in the federal insurance premium was due to an increase in the FDIC assessment rate as a result of the way the rate is adjusted for the occurrence of a net loss. The increase in advertising and promotional expense was due to the timing of campaigns. The decrease in office supplies and related expense was due primarily to the write-off of the Bank's remaining inventory of unissued non-contactless debit cards during the prior year quarter, which had become obsolete, along with lower postage expense. The increase in other non-interest expense was due mainly to an increase in fraud losses and other miscellaneous expenses.

The Company's efficiency ratio was 92.86% for the current quarter compared 54.27% the prior year quarter. Excluding the net losses from the securities strategy, the efficiency ratio would have been 64.73% for the current quarter. The change in the efficiency ratio, excluding the securities strategy, was due primarily to lower net interest income in the current quarter compared to the prior year quarter.

Income Tax Expense

The following table presents pretax income, income tax expense, and net income for the time periods presented, along with the change measured in dollars and percent and effective tax rate.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | |

| December 31, | | Change Expressed in: |

| 2023 | | 2022 | | Dollars | | Percent |

| (Dollars in thousands) | | |

| | | | | | | |

| Income before income tax (benefit) expense | $ | 2,068 | | | $ | 19,747 | | | $ | (17,679) | | | (89.5) | % |

| Income tax (benefit) expense | (475) | | | 3,507 | | | (3,982) | | | (113.5) | |

| Net income | $ | 2,543 | | | $ | 16,240 | | | $ | (13,697) | | | (84.3) | |

| | | | | | | |

| Effective Tax Rate | (23.0 | %) | | 17.8 | % | | | | |

The income tax benefit in the current quarter was a result of treating the $13.3 million net loss associated with the securities strategy as a discrete tax benefit in the current quarter. The tax benefit related to the net loss was $3.3 million. Excluding the $3.3 million benefit, income tax expense would have been $2.8 million and the effective tax rate, excluding the $13.3 million net loss, would have been 18.0% for the current quarter.

Fiscal Year 2024 Outlook

The federal insurance premium is anticipated to be approximately $1.5 million higher in fiscal year 2024 compared to fiscal year 2023 due to the increase in the FDIC assessment rate as discussed above. Management anticipates the effective tax rate for fiscal year 2024 will be approximately 18%.

Financial Condition as of December 31, 2023

The following table summarizes the Company's financial condition at the dates indicated.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | Annualized | | | | |

| December 31, | | September 30, | | Percent | | | | |

| 2023 | | 2023 | | Change | | | | |

| (Dollars and shares in thousands) |

| Total assets | $ | 9,576,064 | | | $ | 10,177,461 | | | (23.6) | % | | | | |

| Available-for-sale ("AFS") securities | 740,462 | | | 1,384,482 | | | (186.1) | | | | | |

| Loans receivable, net | 7,947,510 | | | 7,970,949 | | | (1.2) | | | | | |

| Deposits | 6,021,595 | | | 6,051,220 | | | (2.0) | | | | | |

| Borrowings | 2,373,064 | | | 2,879,125 | | | (70.3) | | | | | |

| Stockholders' equity | 1,034,121 | | | 1,044,054 | | | (3.8) | | | | | |

| Equity to total assets at end of period | 10.8 | % | | 10.3 | % | | | | | | |

| Average number of basic shares outstanding | 132,353 | | | 133,225 | | | (2.6) | | | | | |

| Average number of diluted shares outstanding | 132,353 | | | 133,225 | | | (2.6) | | | | | |

| | | | | | | | | |

During the current quarter, total assets decreased $601.4 million, to $9.58 billion at December 31, 2023, due primarily to the securities strategy. The loan portfolio decreased $23.4 million, or 1.2% annualized, during the current quarter. The loan portfolio mix continued to shift from one- to four-family loans to commercial loans during the current quarter with a $66.4 million decrease in one- to four-family loans, including a $45.1 million decrease in one- to four-family correspondent loans, partially offset by a $42.1 million increase in commercial loans. The Bank continues to reduce purchases of correspondent loans with the intention of minimizing correspondent purchases, which will continue to decrease the balance of that portfolio.

Total liabilities decreased $591.5 million during the current quarter as $500.0 million of BTFP borrowings were paid off as part of the securities strategy, along with a $38.1 million decrease in advances by borrowers due to the payment of property taxes during the current quarter and a $29.6 million decrease in deposits. The decrease in deposits was primarily in non-maturity deposits and public unit certificates of deposit, partially offset by an increase in retail certificates of deposit. The increase in retail certificates of deposit was in terms less than 17 months. Management estimates that the Bank had $2.70 billion in additional liquidity available at December 31, 2023 based on the Bank's blanket collateral agreement with FHLB and unencumbered securities.

The following table summarizes loan originations and purchases, deposit activity, and borrowing activity, along with certain related weighted average rates, during the periods indicated. The borrowings presented in the table have original contractual terms of one year or longer.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | |

| December 31, 2023 | | September 30, 2023 | | |

| Amount | | Rate | | Amount | | Rate | | | | |

| (Dollars in thousands) |

| Loan originations, purchases, and participations | | | | | | | | |

| One- to four-family and consumer: | | | | | | | | | | | |

| Originated | $ | 81,066 | | | 7.11 | % | | $ | 103,713 | | | 6.64 | % | | | | |

| Purchased | 3,497 | | | 5.91 | | | 13,598 | | | 5.97 | | | | | |

| | | | | | | | | | | |

| Commercial: | | | | | | | | | | | |

| Originated | 20,336 | | | 6.56 | | | 46,191 | | | 7.57 | | | | | |

| Participations/Purchased | — | | | — | | | 17,200 | | | 6.80 | | | | | |

| $ | 104,899 | | | 6.96 | | | $ | 180,702 | | | 6.84 | | | | | |

| | | | | | | | | | | |

| Deposit Activity | | | | | | | | | | | |

| Non-maturity deposits | $ | (38,260) | | | | | $ | (131,862) | | | | | | | |

| Retail/Commercial certificates of deposit | 35,838 | | | | | 115,200 | | | | | | | |

| | | | | | | | | | | |

| Borrowing activity | | | | | | | | | | | |

| Maturities and repayments | (157,418) | | | 3.46 | | | $ | (107,418) | | | 2.28 | | | | | |

| New borrowings | 150,000 | | | 4.66 | | | — | | | — | | | | | |

| BTFP, net | (500,000) | | | 4.70 | | | — | | | — | | | | | |

Leverage Strategy

At times, the Bank has utilized a leverage strategy to increase earnings which entails entering into short-term FHLB advances and depositing the proceeds from the borrowings, net of the required FHLB stock holdings, at the Federal Reserve Bank of Kansas City ("FRB of Kansas City"). The borrowings are repaid prior to quarter end, or earlier if the strategy is suspended. The leverage strategy was not in place during the current quarter due to the strategy being unprofitable, but it was in place at points during the September 30, 2023 quarter. When the leverage strategy is in place, it reduces the net interest margin due to the amount of earnings from the transaction in comparison to the size of the transaction. Management continues to monitor the net interest rate spread and overall profitability of the leverage strategy.

Stockholders' Equity

Stockholders' equity totaled $1.03 billion at December 31, 2023, a decrease of $9.9 million from September 30, 2023. The decrease in stockholders' equity during the current quarter was due to a $12.0 million decrease in additional paid-in capital, due mainly to share repurchases, and a $8.8 million decrease in retained earnings, due primarily to dividend payments, partially offset by a $10.5 million increase in accumulated other comprehensive income due to an increase in unrealized gains on AFS securities, partially offset by a reduction in unrealized gains on derivatives. During the quarter ended December 31, 2023, the Company paid a regular quarterly cash dividend totaling $11.3 million, or $0.085 per share. On January 23, 2024, the Company announced a regular quarterly cash dividend of $0.085 per share, or approximately $11.1 million, payable on February 16, 2024 to stockholders of record as of the close of business on February 2, 2024.

Consistent with our goal to operate a sound and profitable financial organization, we actively seek to maintain a well-capitalized status for the Bank in accordance with regulatory standards. As of December 31, 2023, the Bank's capital ratios exceeded the well-capitalized requirements and the Bank also exceeded all internal policy thresholds for sensitivity to changes in interest rates. As of December 31, 2023, the Bank's tier 1 leverage ratio was 8.9%, which exceeded the minimum requirement.

At December 31, 2023, Capitol Federal Financial, Inc., at the holding company level, had $63.2 million in cash on deposit at the Bank. For fiscal year 2024, it is the intention of the Board of Directors to pay out the regular quarterly cash dividend of $0.085 per share, totaling $0.34 per share for the year. To the extent that earnings in fiscal year 2024 exceed $0.34 per share, the Board of Directors will consider the payment of additional dividends. Dividend payments depend upon a number of factors, including the Company's financial condition and results of operations, regulatory capital requirements, regulatory limitations on the Bank's ability to make capital distributions to the Company, and the amount of cash at the holding company level.

During the current quarter, the Company repurchased 2,034,000 shares of common stock at an average price of $5.79 per share. There remains $9.4 million authorized under the existing stock repurchase plan for additional purchases of the Company's common stock. Shares may be repurchased from time to time based upon market conditions, available liquidity and other factors. This plan has no expiration date; however, the FRB of Kansas City's existing approval for the Company to repurchase shares expires in August 2024.

The following table presents a reconciliation of total to net shares outstanding as of December 31, 2023.

| | | | | |

| Total shares outstanding | 133,908,375 | |

| Less unallocated Employee Stock Ownership Plan ("ESOP") shares and unvested restricted stock | (2,854,175) | |

| Net shares outstanding | 131,054,200 | |

Capitol Federal Financial, Inc. is the holding company for the Bank. The Bank has 49 branch locations in Kansas and Missouri, and is one of the largest residential lenders in the State of Kansas. News and other information about the Company can be found at the Bank's website, http://www.capfed.com.

Forward-Looking Statements

Except for the historical information contained in this press release, the matters discussed herein may be deemed to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements about our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions. The words "may," "could," "should," "would," "will," "believe," "anticipate," "estimate," "expect," "intend," "plan," and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks and uncertainties, including: changes in policies or the application or interpretation of laws and regulations by regulatory agencies and tax authorities; other governmental initiatives affecting the financial services industry; changes in accounting principles, policies or guidelines; fluctuations in interest rates and the effects of inflation or a potential recession, whether caused by Federal Reserve action or otherwise; the impact of bank failures or adverse developments at other banks and related negative press about the banking industry in general on investor or depositor sentiment; demand for loans in the Company's and its correspondent banks' market areas; the future earnings and capital levels of the Bank, which could affect the ability of the Company to pay dividends in accordance with its dividend policies; competition; and other risks detailed from time to time in documents filed or furnished by the Company with the Securities and Exchange Commission (SEC). Actual results may differ materially from those currently expected. These forward-looking statements represent the Company's judgment as of the date of this release. The Company disclaims, however, any intent or obligation to update these forward-looking statements.

For further information contact:

| | | | | | |

| Kent Townsend | | Investor Relations |

| Executive Vice President, | | (785) 270-6055 |

| Chief Financial Officer and Treasurer | | investorrelations@capfed.com |

| (785) 231-6360 | | |

| ktownsend@capfed.com | | |

SUPPLEMENTAL FINANCIAL INFORMATION

| | |

|

| CAPITOL FEDERAL FINANCIAL, INC. AND SUBSIDIARY |

| CONSOLIDATED BALANCE SHEETS (Unaudited) |

| (Dollars in thousands, except per share amounts) |

| | | | | | | | | | | | | |

| December 31, | | September 30, | | |

| 2023 | | 2023 | | |

| ASSETS: | | | | | |

| Cash and cash equivalents (includes interest-earning deposits of $287,748 and $213,830) | $ | 320,357 | | | $ | 245,605 | | | |

| | | | | |

| AFS securities, at estimated fair value (amortized cost of $721,612 and $1,385,992) | 740,462 | | | 1,384,482 | | | |

| | | | | |

| Loans receivable, net (ACL of $24,178 and $23,759) | 7,947,510 | | | 7,970,949 | | | |

| | | | | |

| FHLB stock, at cost | 110,166 | | | 110,714 | | | |

| Premises and equipment, net | 91,475 | | | 91,531 | | | |

| Income taxes receivable, net | 3,939 | | | 8,531 | | | |

| Deferred income tax assets, net | 34,076 | | | 29,605 | | | |

| Other assets | 328,079 | | | 336,044 | | | |

| TOTAL ASSETS | $ | 9,576,064 | | | $ | 10,177,461 | | | |

| | | | | |

| LIABILITIES: | | | | | |

| Deposits | $ | 6,021,595 | | | $ | 6,051,220 | | | |

| Borrowings | 2,373,064 | | | 2,879,125 | | | |

| | | | | |

| Advances by borrowers | 24,839 | | | 62,993 | | | |

| | | | | |

| | | | | |

| Other liabilities | 122,445 | | | 140,069 | | | |

| Total liabilities | 8,541,943 | | | 9,133,407 | | | |

| | | | | |

| STOCKHOLDERS' EQUITY: | | | | | |

| Preferred stock, $0.01 par value; 100,000,000 shares authorized, no shares issued or outstanding | — | | | — | | | |

| Common stock, $0.01 par value; 1,400,000,000 shares authorized, 133,908,375 and 135,936,375 shares issued and outstanding as of December 31, 2023 and September 30, 2023, respectively | 1,339 | | | 1,359 | | | |

| Additional paid-in capital | 1,154,655 | | | 1,166,643 | | | |

| Unearned compensation, ESOP | (27,671) | | | (28,083) | | | |

| Retained earnings | (113,357) | | | (104,565) | | | |

| Accumulated other comprehensive income, net of tax | 19,155 | | | 8,700 | | | |

| Total stockholders' equity | 1,034,121 | | | 1,044,054 | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 9,576,064 | | | $ | 10,177,461 | | | |

| | |

|

| CAPITOL FEDERAL FINANCIAL, INC. AND SUBSIDIARY |

| CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

| (Dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | |

| December 31, | | September 30, | | December 31, | | |

| 2023 | | 2023 | | 2022 | | | | |

| INTEREST AND DIVIDEND INCOME: | | | | | | | | | |

| Loans receivable | $ | 75,941 | | | $ | 74,031 | | | $ | 64,819 | | | | | |

| MBS | 5,859 | | | 4,399 | | | 4,811 | | | | | |

| Cash and cash equivalents | 4,778 | | | 6,139 | | | 16,671 | | | | | |

| FHLB stock | 2,586 | | | 2,796 | | | 4,158 | | | | | |

| Investment securities | 2,528 | | | 894 | | | 881 | | | | | |

| Total interest and dividend income | 91,692 | | | 88,259 | | | 91,340 | | | | | |

| | | | | | | | | |

| INTEREST EXPENSE: | | | | | | | | | |

| Deposits | 32,443 | | | 29,778 | | | 11,904 | | | | | |

| Borrowings | 19,656 | | | 27,746 | | | 33,608 | | | | | |

| | | | | | | | | |

| Total interest expense | 52,099 | | | 57,524 | | | 45,512 | | | | | |

| | | | | | | | | |

| NET INTEREST INCOME | 39,593 | | | 30,735 | | | 45,828 | | | | | |

| | | | | | | | | |

| PROVISION FOR CREDIT LOSSES | 123 | | | 963 | | | 3,660 | | | | | |

| NET INTEREST INCOME AFTER | | | | | | | | | |

| PROVISION FOR CREDIT LOSSES | 39,470 | | | 29,772 | | | 42,168 | | | | | |

| | | | | | | | | |

| NON-INTEREST INCOME: | | | | | | | | | |

| Deposit service fees | 2,575 | | | 2,758 | | | 3,461 | | | | | |

| Insurance commissions | 863 | | | 927 | | | 795 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net loss from securities transactions | (13,345) | | | (192,622) | | | — | | | | | |

| Other non-interest income | 1,013 | | | 1,233 | | | 1,096 | | | | | |

| Total non-interest income | (8,894) | | | (187,704) | | | 5,352 | | | | | |

| | | | | | | | | |

| NON-INTEREST EXPENSE: | | | | | | | | | |

| Salaries and employee benefits | 12,992 | | | 11,804 | | | 13,698 | | | | | |

| Information technology and related expense | 5,369 | | | 6,448 | | | 5,070 | | | | | |

| Occupancy, net | 3,372 | | | 3,638 | | | 3,474 | | | | | |

| Federal insurance premium | 1,860 | | | 1,167 | | | 812 | | | | | |

| Regulatory and outside services | 1,643 | | | 1,765 | | | 1,533 | | | | | |

| Advertising and promotional | 988 | | | 692 | | | 833 | | | | | |

| Deposit and loan transaction costs | 542 | | | 778 | | | 611 | | | | | |

| Office supplies and related expense | 361 | | | 689 | | | 633 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other non-interest expense | 1,381 | | | 1,213 | | | 1,109 | | | | | |

| Total non-interest expense | 28,508 | | | 28,194 | | | 27,773 | | | | | |

| INCOME (LOSS) BEFORE INCOME TAX EXPENSE (BENEFIT) | 2,068 | | | (186,126) | | | 19,747 | | | | | |

| INCOME TAX (BENEFIT) EXPENSE | (475) | | | (45,736) | | | 3,507 | | | | | |

| NET INCOME (LOSS) | $ | 2,543 | | | $ | (140,390) | | | $ | 16,240 | | | | | |

Average Balance Sheets

The following tables present the average balances of our assets, liabilities, and stockholders' equity, and the related annualized weighted average yields and rates on our interest-earning assets and interest-bearing liabilities for the periods indicated, as well as selected performance ratios and other information for the periods shown. Weighted average yields are derived by dividing income (annualized for the three-month periods) by the average balance of the related assets, and weighted average rates are derived by dividing expense (annualized for the three-month periods) by the average balance of the related liabilities, for the periods shown. Average outstanding balances are derived from average daily balances. The weighted average yields and rates include amortization of fees, costs, premiums and discounts, which are considered adjustments to yields/rates. Weighted average yields on tax-exempt securities are not calculated on a fully taxable equivalent basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended |

| | | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| | | Average | | Interest | | | | Average | | Interest | | | | Average | | Interest | | |

| | | Outstanding | | Earned/ | | Yield/ | | Outstanding | | Earned/ | | Yield/ | | Outstanding | | Earned/ | | Yield/ |

| | | Amount | | Paid | | Rate | | Amount | | Paid | | Rate | | Amount | | Paid | | Rate |

| | | (Dollars in thousands) |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | |

| One- to four-family loans: | | | | | | | | | | | | | | | | | | | |

| Originated | | | $ | 4,025,539 | | | $ | 35,060 | | | 3.48 | % | | $ | 4,036,609 | | | $ | 34,584 | | | 3.43 | % | | $ | 4,049,790 | | | $ | 33,364 | | | 3.29 | % |

| Correspondent purchased | | | 2,413,900 | | | 19,660 | | | 3.26 | | | 2,454,407 | | | 19,794 | | | 3.23 | | | 2,305,362 | | | 17,261 | | | 2.99 | |

| Bulk purchased | | | 136,609 | | | 694 | | | 2.03 | | | 138,922 | | | 524 | | | 1.51 | | | 147,091 | | | 434 | | | 1.18 | |

| Total one- to four-family loans | | | 6,576,048 | | | 55,414 | | | 3.37 | | | 6,629,938 | | | 54,902 | | | 3.31 | | | 6,502,243 | | | 51,059 | | | 3.14 | |

| Commercial loans | | | 1,306,917 | | | 18,267 | | | 5.47 | | | 1,249,498 | | | 16,930 | | | 5.30 | | | 1,025,402 | | | 11,993 | | | 4.58 | |

| Consumer loans | | | 105,958 | | | 2,260 | | | 8.46 | | | 104,252 | | | 2,199 | | | 8.37 | | | 102,760 | | | 1,767 | | | 6.82 | |

Total loans receivable(1) | | | 7,988,923 | | | 75,941 | | | 3.78 | | | 7,983,688 | | | 74,031 | | | 3.69 | | | 7,630,405 | | | 64,819 | | | 3.38 | |

MBS(2) | | | 526,733 | | | 5,859 | | | 4.45 | | | 1,078,957 | | | 4,399 | | | 1.63 | | | 1,221,035 | | | 4,811 | | | 1.58 | |

Investment securities(2)(3) | | | 266,873 | | | 2,528 | | | 3.79 | | | 524,574 | | | 894 | | | 0.68 | | | 525,081 | | | 881 | | | 0.67 | |

FHLB stock(4) | | | 108,648 | | | 2,586 | | | 9.44 | | | 120,159 | | | 2,796 | | | 9.23 | | | 197,577 | | | 4,158 | | | 8.35 | |

Cash and cash equivalents(5) | | | 346,220 | | | 4,778 | | | 5.40 | | | 453,486 | | | 6,139 | | | 5.30 | | | 1,801,493 | | | 16,671 | | | 3.62 | |

| Total interest-earning assets | | | 9,237,397 | | | 91,692 | | | 3.95 | | | 10,160,864 | | | 88,259 | | | 3.45 | | | 11,375,591 | | | 91,340 | | | 3.19 | |

| Other non-interest-earning assets | | | 466,084 | | | | | | | 271,074 | | | | | | | 248,022 | | | | | |

| Total assets | | | $ | 9,703,481 | | | | | | | $ | 10,431,938 | | | | | | | $ | 11,623,613 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Liabilities and stockholders' equity: | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

| Checking | | | $ | 886,530 | | | 445 | | | 0.20 | | | $ | 900,526 | | | 449 | | | 0.20 | | | $ | 1,007,569 | | | 289 | | | 0.11 | |

| Savings | | | 472,819 | | | 138 | | | 0.12 | | | 492,737 | | | 145 | | | 0.12 | | | 545,885 | | | 100 | | | 0.07 | |

| Money market | | | 1,364,565 | | | 6,737 | | | 1.96 | | | 1,404,496 | | | 6,913 | | | 1.95 | | | 1,759,804 | | | 3,035 | | | 0.68 | |

| Retail certificates | | | 2,555,375 | | | 23,199 | | | 3.60 | | | 2,498,839 | | | 20,268 | | | 3.22 | | | 2,064,929 | | | 7,767 | | | 1.49 | |

| Commercial certificates | | | 49,558 | | | 463 | | | 3.70 | | | 30,735 | | | 273 | | | 3.53 | | | 34,298 | | | 104 | | | 1.20 | |

| Wholesale certificates | | | 130,857 | | | 1,461 | | | 4.43 | | | 158,598 | | | 1,730 | | | 4.33 | | | 97,828 | | | 609 | | | 2.47 | |

| Total deposits | | | 5,459,704 | | | 32,443 | | | 2.36 | | | 5,485,931 | | | 29,778 | | | 2.15 | | | 5,510,313 | | | 11,904 | | | 0.86 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Borrowings(6) | | | 2,467,410 | | | 19,656 | | | 3.15 | | | 3,150,179 | | | 27,746 | | | 3.48 | | | 4,260,685 | | | 33,608 | | | 3.10 | |

| Total interest-bearing liabilities | | | 7,927,114 | | | 52,099 | | | 2.61 | | | 8,636,110 | | | 57,524 | | | 2.64 | | | 9,770,998 | | | 45,512 | | | 1.84 | |

| Non-interest-bearing deposits | | | 537,144 | | | | | | | 540,607 | | | | | | | 576,519 | | | | | |

| Other non-interest-bearing liabilities | | | 202,743 | | | | | | | 191,978 | | | | | | | 191,474 | | | | | |

| Stockholders' equity | | | 1,036,480 | | | | | | | 1,063,243 | | | | | | | 1,084,622 | | | | | |

| Total liabilities and stockholders' equity | | $ | 9,703,481 | | | | | | | $ | 10,431,938 | | | | | | | $ | 11,623,613 | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net interest income(7) | | | | | $ | 39,593 | | | | | | | $ | 30,735 | | | | | | | $ | 45,828 | | | |

| Net interest-earning assets | | | $ | 1,310,283 | | | | | | | $ | 1,524,754 | | | | | | | $ | 1,604,593 | | | | | |

Net interest margin(8)(9) | | | | | | | 1.71 | | | | | | | 1.21 | | | | | | | 1.61 | |

| | | | | | | | | | | | | | | | | | | |

| Ratio of interest-earning assets to interest-bearing liabilities | | 1.17x | | | | | | 1.18x | | | | | | 1.16x |

| | | | | | | | | | | | | | | | | | | |

| Selected performance ratios: | | | | | | | | | | | | | | | | | | | |

Return on average assets (annualized)(9) | | | | 0.10 | % | | | | | | (5.38 | %) | | | | | | 0.56 | % |

Return on average equity (annualized)(9) | | | | 0.98 | | | | | | | (52.82) | | | | | | | 5.99 | |

| Average equity to average assets | | | | | | | 10.68 | | | | | | | 10.19 | | | | | | | 9.33 | |

Operating expense ratio (annualized)(10) | | | | 1.18 | | | | | | | 1.08 | | | | | | | 0.96 | |

Efficiency ratio(9)(11) | | | | | | | 92.86 | | | | | | | (17.96) | | | | | | | 54.27 | |

Pre-tax yield on leverage strategy(12) | | | | — | | | | | | | 0.07 | | | | | | | 0.20 | |

(1)Balances are adjusted for unearned loan fees and deferred costs. Loans that are 90 or more days delinquent are included in the loans receivable average balance with a yield of zero percent.

(2)AFS securities are adjusted for unamortized purchase premiums or discounts.

(3)The average balance of investment securities includes an average balance of nontaxable securities of $201 thousand, $1.0 million and $1.1 million for the quarters ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively.

(4)There was no FHLB stock related to the leverage strategy for the quarter ended December 31, 2023. Included in this line, for the quarters ended September 30, 2023 and December 31, 2022, respectively, is FHLB stock related to the leverage strategy with an average outstanding balance of $10.8 million and $84.3 million, respectively, and dividend income of $251 thousand and $1.8 million, respectively, at a weighted average yield of 9.25% and 8.49%, respectively. Included in this line for the quarters ended December 31, 2023, September 30, 2023 and December 31, 2022, respectively, is FHLB stock not related to the leverage strategy with an average outstanding balance of $108.6 million, $109.4 million and $113.3 million, respectively, and dividend income of $2.6 million, $2.5 million, and $2.4 million respectively, at a weighted average yield of 9.44%, 9.23%, and 8.24%, respectively.

(5)There was no cash and cash equivalents related to the leverage strategy during the quarter ended December 31, 2023. The average balance of cash and cash equivalents includes an average balance of cash related to the leverage strategy of $228.4 million and $1.79 billion during the quarters ended September 30, 2023 and December 31, 2022, respectively.

(6)There were no borrowings related to the leverage strategy during the quarter ended December 31, 2023. Included in this line, for the quarters ended September 30, 2023 and December 31, 2022, are FHLB borrowings related to the leverage strategy with an average outstanding balance of $239.1 million and $1.87 billion, respectively, and interest paid of $3.3 million and $17.3 million, respectively, at a weighted average rate of 5.33% and 3.61% respectively. Included in this line for the quarters ended December 31, 2023, September 30, 2023, and December 31, 2022 were borrowings not related to the leverage strategy with an average outstanding balance of $2.47 billion, $2.91 billion, and $2.39 billion respectively, and interest paid of $19.7 million, $24.5 million, and $16.3 million respectively, at a weighted average rate of 3.15%, 3.33%, and 2.70% respectively. The FHLB advance amounts and rates included in this line include the effect of interest rate swaps and are net of deferred prepayment penalties.

(7)Net interest income represents the difference between interest income earned on interest-earning assets and interest paid on interest-bearing liabilities. Net interest income depends on the average balance of interest-earning assets and interest-bearing liabilities, and the interest rates earned or paid on them.

(8)Net interest margin represents annualized net interest income as a percentage of average interest-earning assets.

(9)The table below provides a reconciliation between performance measures presented in accordance with accounting standards generally accepted in the United States of America ("GAAP") and the same performance measures excluding the effects of the leverage strategy and the net loss on securities transactions associated with the securities strategy, which are not presented in accordance with GAAP. Management believes it is important for comparability purposes to provide the performance measures without the leverage strategy because of the unique nature of the leverage strategy and the net loss on securities transactions due to the non-recurring nature of the securities strategy. The leverage strategy was not in place for the quarter ended December 31, 2023. For the quarters ended September 30, 2023 and December 31, 2022, the Excluding Leverage Strategy (Non-GAAP) columns and the Excluding Securities Strategy (Non-GAAP) columns each begin with Actual (GAAP) before applying the respective strategy adjustments. The leverage strategy reduces some of our performance measures due to the amount of earnings associated with the transaction in comparison to the size of the transaction, while increasing our net income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| | | | | | | | | Excluding | | | | | | Excluding | | | | Excluding | | | | | | Excluding |

| | | | | | | | | Securities | | | | | | Leverage | | | | Securities | | | | | | Leverage |

| Actual | | | | | | Securities | | Strategy | | Actual | | Leverage | | Strategy | | Securities | | Strategy | | Actual | | Leverage | | Strategy |

| (GAAP) | | | | | | Strategy | | (Non-GAAP) | | (GAAP) | | Strategy | | (Non-GAAP) | | Strategy | | (Non-GAAP) | | (GAAP) | | Strategy | | (Non-GAAP) |

| Yield on interest-earning assets | 3.95 | % | | | | | | | | | | 3.45 | % | | 0.05 | % | | 3.40 | % | | | | | | 3.19 | % | | 0.13 | % | | 3.06 | % |

| Cost of interest-bearing liabilities | 2.61 | | | | | | | | | | | 2.64 | | | 0.08 | | | 2.56 | | | | | | | 1.84 | | | 0.42 | | | 1.42 | |

| Return on average assets (annualized) | 0.10 | | | | | | | (0.42) | % | | 0.52 | % | | (5.38) | | | 0.13 | | | (5.51) | | | (5.58) | % | | 0.20 | % | | 0.56 | | | (0.07) | | | 0.63 | |

| Return on average equity (annualized) | 0.98 | | | | | | | (3.89) | | | 4.87 | | | (52.82) | | | 0.01 | | | (52.83) | | | (54.79) | | | 1.97 | | | 5.99 | | | 0.28 | | | 5.71 | |

| Net interest margin | 1.71 | | | | | | | | | | | 1.21 | | | (0.03) | | | 1.24 | | | | | | | 1.61 | | | (0.27) | | | 1.88 | |

| Efficiency Ratio | 92.86 | | | | | | | 28.13 | | | 64.73 | | | (17.96) | | | (0.03) | | | (17.93) | | | (97.04) | | | 79.08 | | | 54.27 | | | (0.87) | | | 55.14 | |

| Earnings per share | $ | 0.02 | | | | | | | $ | (0.08) | | | $ | 0.10 | | | | | | | | | $ | (1.09) | | | $ | 0.04 | | | | | | | |

(10)The operating expense ratio represents annualized non-interest expense as a percentage of average assets.

(11)The efficiency ratio represents non-interest expense as a percentage of the sum of net interest income (pre-provision for credit losses) and non-interest income.

(12)The pre-tax yield on the leverage strategy represents annualized pre-tax income resulting from the transaction as a percentage of the average interest-earning assets associated with the transaction.

Loan Portfolio

The following table presents information related to the composition of our loan portfolio in terms of dollar amounts, weighted average rates, and percentage of total as of the dates indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| | | | | % of | | | | | | % of | | | | | | % of |

| Amount | | Rate | | Total | | Amount | | Rate | | Total | | Amount | | Rate | | Total |

| (Dollars in thousands) |

| One- to four-family: | | | | | | | | | | | | | | | | | |

| Originated | $ | 3,986,479 | | | 3.44 | % | | 50.1 | % | | $ | 3,978,837 | | | 3.39 | % | | 49.9 | % | | $ | 4,007,596 | | | 3.25 | % | | 51.5 | % |

| Correspondent purchased | 2,360,843 | | | 3.45 | | | 29.7 | | | 2,405,911 | | | 3.44 | | | 30.1 | | | 2,353,335 | | | 3.25 | | | 30.2 | |

| Bulk purchased | 134,504 | | | 2.10 | | | 1.7 | | | 137,193 | | | 1.85 | | | 1.7 | | | 145,209 | | | 1.31 | | | 1.9 | |

| Construction | 43,631 | | | 4.47 | | | 0.5 | | | 69,974 | | | 3.68 | | | 0.9 | | | 70,869 | | | 3.01 | | | 0.9 | |

| Total | 6,525,457 | | | 3.42 | | | 82.0 | | | 6,591,915 | | | 3.38 | | | 82.6 | | | 6,577,009 | | | 3.20 | | | 84.5 | |

| Commercial: | | | | | | | | | | | | | | | | | |

| Commercial real estate | 1,019,431 | | | 5.27 | | | 12.8 | | | 995,788 | | | 5.29 | | | 12.5 | | | 833,444 | | | 4.34 | | | 10.7 | |

| Commercial and industrial | 113,686 | | | 6.46 | | | 1.4 | | | 112,953 | | | 6.36 | | | 1.4 | | | 88,327 | | | 5.21 | | | 1.1 | |

| Construction | 196,493 | | | 5.41 | | | 2.5 | | | 178,746 | | | 5.01 | | | 2.2 | | | 188,516 | | | 5.97 | | | 2.4 | |

| Total | 1,329,610 | | | 5.39 | | | 16.7 | | | 1,287,487 | | | 5.35 | | | 16.1 | | | 1,110,287 | | | 4.69 | | | 14.2 | |

| Consumer loans: | | | | | | | | | | | | | | | | | |

| Home equity | 96,952 | | | 8.84 | | | 1.2 | | | 95,723 | | | 8.83 | | | 1.2 | | | 95,352 | | | 7.55 | | | 1.2 | |

| Other | 9,670 | | | 5.32 | | | 0.1 | | | 9,256 | | | 5.20 | | | 0.1 | | | 9,022 | | | 4.43 | | | 0.1 | |

| Total | 106,622 | | | 8.52 | | | 1.3 | | | 104,979 | | | 8.51 | | | 1.3 | | | 104,374 | | | 7.28 | | | 1.3 | |

| Total loans receivable | 7,961,689 | | | 3.82 | | | 100.0 | % | | 7,984,381 | | | 3.76 | | | 100.0 | % | | 7,791,670 | | | 3.47 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | |

| Less: | | | | | | | | | | | | | | | | | |

| ACL | 24,178 | | | | | | | 23,759 | | | | | | | 19,189 | | | | | |

| Deferred loan fees/discounts | 30,653 | | | | | | | 31,335 | | | | | | | 30,513 | | | | | |

| Premiums/deferred costs | (40,652) | | | | | | | (41,662) | | | | | | | (41,390) | | | | | |

| Total loans receivable, net | $ | 7,947,510 | | | | | | | $ | 7,970,949 | | | | | | | $ | 7,783,358 | | | | | |

Loan Activity: The following table summarizes activity in the loan portfolio, along with weighted average rates where applicable, for the periods indicated, excluding changes in ACL, deferred loan fees/discounts, and premiums/deferred costs. Loans that were paid off as a result of refinances are included in repayments. Loan endorsements are not included in the activity in the following table because a new loan is not generated at the time of the endorsement. The endorsed balance and rate are included in the ending loan portfolio balance and rate. Commercial loan renewals are not included in the activity presented in the following table unless new funds are disbursed at the time of renewal. The renewal balance and rate are included in the ending loan portfolio balance and rate.

| | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | | | |

| December 31, 2023 | | | | |

| Amount | | Rate | | | | | | | | |

| (Dollars in thousands) |

| Beginning balance | $ | 7,984,381 | | | 3.76 | % | | | | | | | | |

| Originated and refinanced | 101,402 | | | 7.00 | | | | | | | | | |

| Purchased and participations | 3,497 | | | 5.91 | | | | | | | | | |

| Change in undisbursed loan funds | 83,246 | | | | | | | | | | | |

| Repayments | (210,611) | | | | | | | | | | | |

| Principal (charge-offs)/recoveries, net | (1) | | | | | | | | | | | |

| Other | (225) | | | | | | | | | | | |

| Ending balance | $ | 7,961,689 | | | 3.82 | | | | | | | | | |

One- to Four-Family Loans: The following table presents, for our portfolio of one- to four-family loans, excluding construction loans, the amount, percent of total, weighted average rate, weighted average credit score, weighted average loan-to-value ("LTV") ratio, and average balance per loan as of December 31, 2023. Credit scores were updated in September 2023 from a nationally recognized consumer rating agency. The LTV ratios were based on the current loan balance and either the lesser of the purchase price or original appraisal, or the most recent Bank appraisal, if available. In most cases, the most recent appraisal was obtained at the time of origination.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | % of | | | | Credit | | | | Average |

| Amount | | Total | | Rate | | Score | | LTV | | Balance |

| (Dollars in thousands) | | |

| Originated | $ | 3,986,479 | | | 61.5 | % | | 3.44 | % | | 771 | | | 60 | % | | $ | 165 | |

| Correspondent purchased | 2,360,843 | | | 36.4 | | | 3.45 | | | 767 | | | 64 | | | 412 | |

| Bulk purchased | 134,504 | | | 2.1 | | | 2.10 | | | 771 | | | 55 | | | 287 | |

| $ | 6,481,826 | | | 100.0 | | | 3.42 | | | 770 | | | 61 | | | 214 | |

The following table presents originated and correspondent purchased activity in our one- to four-family loan portfolio, excluding endorsement activity, along with associated weighted average rates, weighted average LTVs and weighted average credit scores for the periods indicated. The majority of the correspondent loans purchased during the current quarter were from applications in the pipeline at September 30, 2023 as the Bank continues to reduce correspondent purchases to near zero.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | |

| December 31, 2023 | | |

| | | | | | | Credit | | | | | | | | |

| Amount | | Rate | | LTV | | Score | | | | | | | | |

| (Dollars in thousands) |

| Originated | $ | 69,504 | | | 6.83 | % | | 75 | % | | 765 | | | | | | | | | |

| Correspondent purchased | 3,497 | | | 5.91 | | | 70 | | | 765 | | | | | | | | | |

| $ | 73,001 | | | 6.79 | | | 74 | | | 765 | | | | | | | | | |

As of December 31, 2023 the Bank had one- to four-family loan origination and refinance commitments of $20.7 million at a weighted average rate of 6.75%. There were no one- to four-family correspondent loan purchase commitments at December 31, 2023.

Commercial Loans: During the three months ended December 31, 2023, the Bank originated $20.3 million of commercial loans. The Bank did not enter into any commercial loan participations during the current quarter. The Bank also processed commercial loan disbursements, excluding lines of credit, of approximately $64.6 million at a weighted average rate of 6.27%.

As of December 31, 2023, September 30, 2023, and December 31, 2022, the Bank's commercial and industrial gross loan amounts (unpaid principal plus undisbursed amounts) totaled $157.2 million, $158.5 million, and $113.2 million, respectively, and commitments totaled $2.4 million at December 31, 2023.

The following table presents the Bank's commercial real estate and commercial construction loans by type of primary collateral as of the dates indicated. As of December 31, 2023, the Bank had seven commercial real estate and commercial construction loan commitments totaling $100.4 million, at a weighted average rate of 7.52%. Because the commitments to pay out undisbursed funds are not cancellable by the Bank, unless the loan is in default, we generally anticipate fully funding the related projects. Of the total commercial real estate and commercial construction undisbursed amounts and commitments outstanding as of December 31, 2023, management anticipates funding approximately $94 million during the March 2024 quarter, $84 million during the June 2024 quarter, $77 million during the September 2024 quarter, and $137 million during the December 2024 quarter or later.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | |

| | | Unpaid | | Undisbursed | | Gross Loan | | Gross Loan | | |

| Count | | Principal | | Amount | | Amount | | Amount | | |

| | | (Dollars in thousands) |

| Retail building | 139 | | | $ | 269,399 | | | $ | 79,629 | | | $ | 349,028 | | | $ | 352,499 | | | |

| Senior housing | 36 | | | 317,630 | | | 12,447 | | | 330,077 | | | 331,207 | | | |

| Multi-family | 42 | | | 105,657 | | | 197,251 | | | 302,908 | | | 308,846 | | | |

| Hotel | 13 | | | 214,082 | | | 17,905 | | | 231,987 | | | 233,012 | | | |

| Office building | 79 | | | 127,741 | | | 1,607 | | | 129,348 | | | 130,921 | | | |

| One- to four-family property | 360 | | | 60,016 | | | 5,567 | | | 65,583 | | | 70,265 | | | |

| Single use building | 30 | | | 36,260 | | | 7,555 | | | 43,815 | | | 47,193 | | | |

| Other | 111 | | | 85,139 | | | 3,110 | | | 88,249 | | | 88,995 | | | |

| 810 | | | $ | 1,215,924 | | | $ | 325,071 | | | $ | 1,540,995 | | | $ | 1,562,938 | | | |

| | | | | | | | | | | |

| Weighted average rate | | | 5.29 | % | | 6.01 | % | | 5.44 | % | | 5.47 | % | | |

The following table summarizes the Bank's commercial real estate and commercial construction loans by state as of the dates indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | |

| | | Unpaid | | Undisbursed | | Gross Loan | | Gross Loan | | |

| Count | | Principal | | Amount | | Amount | | Amount | | |

| | | (Dollars in thousands) |

| Kansas | 602 | | | $ | 486,440 | | | $ | 176,316 | | | $ | 662,756 | | | $ | 670,498 | | | |

| Texas | 17 | | | 280,034 | | | 67,791 | | | 347,825 | | | 348,707 | | | |

| Missouri | 159 | | | 275,153 | | | 51,440 | | | 326,593 | | | 332,610 | | | |

| Colorado | 8 | | | 43,223 | | | 6,205 | | | 49,428 | | | 49,385 | | | |

| Tennessee | 2 | | | 26,132 | | | 13,437 | | | 39,569 | | | 42,136 | | | |

| Nebraska | 8 | | | 36,678 | | | 1,121 | | | 37,799 | | | 37,609 | | | |

| Other | 14 | | | 68,264 | | | 8,761 | | | 77,025 | | | 81,993 | | | |

| 810 | | | $ | 1,215,924 | | | $ | 325,071 | | | $ | 1,540,995 | | | $ | 1,562,938 | | | |

The following table presents the Bank's commercial loan portfolio and outstanding loan commitments, categorized by gross loan amount (unpaid principal plus undisbursed amounts) or outstanding loan commitment amount, as of December 31, 2023.

| | | | | | | | | | | |

| Count | | Amount |

| (Dollars in thousands) |

| Greater than $30 million | 10 | | | $ | 493,952 | |

| >$15 to $30 million | 20 | | | 417,774 | |

| >$10 to $15 million | 12 | | | 142,942 | |

| >$5 to $10 million | 30 | | | 222,228 | |

| $1 to $5 million | 142 | | | 340,059 | |

| Less than $1 million | 1,201 | | | 184,112 | |

| 1,415 | | | $ | 1,801,067 | |

Asset Quality

The following tables present loans 30 to 89 days delinquent, non-performing loans, and other real estate owned ("OREO") as of the dates indicated. The amounts in the table represent the unpaid principal balance of the loans less related charge-offs, if any. Of the loans 30 to 89 days delinquent at December 31, 2023, approximately 82% were 59 days or less delinquent. Nonaccrual loans are loans that are 90 or more days delinquent or in foreclosure and other loans required to be reported as nonaccrual pursuant to accounting and/or regulatory reporting requirements and/or internal policies, even if the loans are current. Non-performing assets include nonaccrual loans and OREO. The increase in one- to four-family loans 30 to 89 days delinquent and in nonaccrual loans was due mainly to delinquencies returning to more historical levels as government payment assistance programs expire. The increase in commercial loans 30 to 89 days delinquent was a mix of several different borrowers and property types. There was not one underlying reason for the increase in delinquencies. Management is working closely with the borrowers to address payment issues.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans Delinquent for 30 to 89 Days at: |

| December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount |

| (Dollars in thousands) |

| One- to four-family: | | | | | | | | | | | | | | | | | | | |

| Originated | 77 | | | $ | 7,746 | | | 88 | | | $ | 9,078 | | | 67 | | | $ | 6,377 | | | 45 | | | $ | 4,116 | | | 56 | | | $ | 4,708 | |

| Correspondent purchased | 16 | | | 6,049 | | | 17 | | | 5,192 | | | 20 | | | 6,704 | | | 10 | | | 3,436 | | | 4 | | | 1,216 | |

| Bulk purchased | 4 | | | 583 | | | 1 | | | 149 | | | — | | | — | | | 3 | | | 287 | | | 3 | | | 865 | |

| Construction | — | | | — | | | 4 | | | 1,123 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Commercial | 14 | | | 3,809 | | | 5 | | | 94 | | | 6 | | | 573 | | | 5 | | | 389 | | | 6 | | | 191 | |

| Consumer | 40 | | | 766 | | | 30 | | | 730 | | | 22 | | | 469 | | | 22 | | | 352 | | | 24 | | | 626 | |

| 151 | | | $ | 18,953 | | | 145 | | | $ | 16,366 | | | 115 | | | $ | 14,123 | | | 85 | | | $ | 8,580 | | | 93 | | | $ | 7,606 | |

| 30 to 89 days delinquent loans | | | | | | | | | | | | | | | | | | |

| to total loans receivable, net | | 0.24 | % | | | | 0.21 | % | | | | 0.18 | % | | | | 0.11 | % | | | | 0.10 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-Performing Loans and OREO at: |

| December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount | | Number | | Amount |

| (Dollars in thousands) |

| Loans 90 or More Days Delinquent or in Foreclosure: | | | | | | | | | | | | | | | | |

| One- to four-family: | | | | | | | | | | | | | | | | | | | |

| Originated | 29 | | | $ | 3,749 | | | 24 | | | $ | 2,246 | | | 16 | | | $ | 1,582 | | | 15 | | | $ | 1,084 | | | 13 | | | $ | 1,034 | |

| Correspondent purchased | 10 | | | 4,164 | | | 9 | | | 3,410 | | | 8 | | | 1,854 | | | 7 | | | 1,803 | | | 14 | | | 4,126 | |

| Bulk purchased | 2 | | | 942 | | | 2 | | | 942 | | | 3 | | | 1,149 | | | 3 | | | 1,212 | | | 4 | | | 1,492 | |

| Commercial | 8 | | | 1,198 | | | 12 | | | 2,183 | | | 8 | | | 1,225 | | | 7 | | | 1,152 | | | 7 | | | 1,152 | |

| Consumer | 5 | | | 116 | | | 9 | | | 113 | | | 3 | | | 51 | | | 7 | | | 51 | | | 11 | | | 126 | |

| 54 | | | 10,169 | | | 56 | | | 8,894 | | | 38 | | | 5,861 | | | 39 | | | 5,302 | | | 49 | | | 7,930 | |

| | | | | | | | | | | | | | | | | | | |

| Loans 90 or more days delinquent or in foreclosure | | | | | | | | | | | | | | | | |

| as a percentage of total loans | | | 0.13 | % | | | | 0.11 | % | | | | 0.07 | % | | | | 0.07 | % | | | | 0.10 | % |

| | | | | | | | | | | | | | | | | | | |

Nonaccrual loans less than 90 Days Delinquent:(1) | | | | | | | | | | | | | | | | |

| One- to four-family: | | | | | | | | | | | | | | | | | | | |

| Originated | — | | | $ | — | | | 2 | | | $ | 215 | | | 3 | | | $ | 295 | | | 2 | | | $ | 187 | | | 3 | | | $ | 219 | |

| Correspondent purchased | — | | | — | | | 1 | | | 282 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Bulk purchased | — | | | — | | | — | | | — | | | 1 | | | 257 | | | 1 | | | 257 | | | — | | | — | |

| Commercial | 1 | | | 18 | | | 1 | | | 18 | | | 2 | | | 29 | | | 3 | | | 104 | | | 2 | | | 84 | |

| Consumer | — | | | — | | | — | | | — | | | 1 | | | 37 | | | — | | | — | | | — | | | — | |

| 1 | | | 18 | | | 4 | | | 515 | | | 7 | | | 618 | | | 6 | | | 548 | | | 5 | | | 303 | |

| Total nonaccrual loans | 55 | | | 10,187 | | | 60 | | | 9,409 | | | 45 | | | 6,479 | | | 45 | | | 5,850 | | | 54 | | | 8,233 | |

| | | | | | | | | | | | | | | | | | | |

| Nonaccrual loans as a percentage of total loans | | 0.13 | % | | | | 0.12 | % | | | | 0.08 | % | | | | 0.07 | % | | | | 0.11 | % |

| | | | | | | | | | | | | | | | | | | |

| OREO: | | | | | | | | | | | | | | | | | | | |

| One- to four-family: | | | | | | | | | | | | | | | | | | | |

Originated(2) | 2 | | | $ | 225 | | | — | | | $ | — | | | — | | | $ | — | | | 2 | | | $ | 160 | | | 2 | | | $ | 161 | |

| Correspondent purchased | 1 | | | 219 | | | 1 | | | 219 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Consumer | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1 | | | 21 | |

| | | | | | | | | | | | | | | | | | | |

| 3 | | | 444 | | | 1 | | | 219 | | | — | | | — | | | 2 | | | 160 | | | 3 | | | 182 | |

| Total non-performing assets | 58 | | | $ | 10,631 | | | 61 | | | $ | 9,628 | | | 45 | | | $ | 6,479 | | | 47 | | | $ | 6,010 | | | 57 | | | $ | 8,415 | |

| | | | | | | | | | | | | | | | | | | |

| Non-performing assets as a percentage of total assets | | 0.11 | % | | | | 0.09 | % | | | | 0.06 | % | | | | 0.06 | % | | | | 0.08 | % |