UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: December

2024

Commission file number

001-36898

COLLIERS INTERNATIONAL GROUP

INC.

(Translation of registrant’s name into English)

1140 Bay Street,

Suite 4000

Toronto, Ontario,

Canada

M5S 2B4

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

Exhibit 99.1 of

this Form 6-K shall be incorporated by reference as an exhibit to the registrant’s registration statement on Form F-10 (File No.

333-277184).

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

COLLIERS INTERNATIONAL GROUP INC. |

| |

|

| |

|

| Date: December 9, 2024 |

/s/ Christian Mayer |

| |

Name: Christian Mayer |

| |

Title: Chief Financial Officer |

EXHIBIT INDEX

Exhibit

99.1

COLLIERS

INTERNATIONAL GROUP INC. MATERIAL CHANGE REPORT

(Form

51-102F3)

| 1. | Name

and Address of Company |

Colliers

International Group Inc. ("Colliers") 1140 Bay Street, Suite 4000

Toronto,

Ontario M5S 2B4

| 2. | Date

of Material Changes |

November

29, 2024

A

news release was disseminated on November 29, 2024 through GlobeNewswire.

| 4. | Summary

of Material Changes |

On

November 29, 2024, Colliers announced the expansion and extension of its unsecured multi-currency revolving credit facility.

| 5. | Full

Description of Material Changes |

The

news release annexed hereto as Schedule "A" provides a full description of the material change. A copy of the fourth amendment

to the sustainability linked third amended and restated credit agreement entered into in connection with the material change has been

filed on SEDAR at www.sedar.com.

| 6. | Reliance

on Subsection 7.1(2) of National Instrument 51-102 |

This

report is not being filed on a confidential basis.

No

significant facts remain confidential in, and no information has been omitted from, this report.

If

further information is required, please contact Christian Mayer, Chief Financial Officer, at (416) 960-9500.

DATED

at Toronto, Ontario this 9th day of December, 2024.

Schedule “A”

COMPANY

CONTACT:

Christian

Mayer

Chief

Financial Officer

(416)

960-9500

Colliers

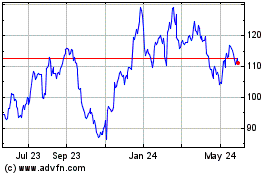

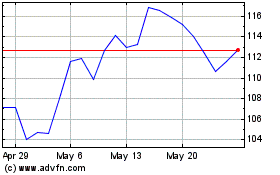

expands credit facility to US$2.25 billion

Extends

term, enhances flexibility to continue funding global growth

TORONTO,

Canada, November 29, 2024 – Colliers International Group Inc. (TSX and NASDAQ: CIGI) ("Colliers") today announced the

expansion and extension of its unsecured multi-currency revolving credit facility (the “Credit Facility”) for a new five-year

term, maturing November 2029. The updated Credit Facility replaces the previous agreement which was set to mature in May 2027 and increases

borrowing capacity to $2.25 billion from $1.75 billion. With this expansion, Colliers has over $1 billion of capacity to invest in new

growth initiatives. Financial covenants and other key terms remain unchanged.

The

transaction was led by Bank of Montreal and was syndicated to 12 additional banks including JP Morgan Chase Bank, U.S. Bank, Mizuho Bank,

Bank of America, HSBC Bank, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Toronto-Dominion Bank, Royal Bank of Canada, National

Bank of Canada, Wells Fargo Bank and Desjardins. The Credit Facility ranks pari passu with Colliers’ existing privately placed

fixed rate senior notes maturing in 2028 and 2031.

“The

expanded and extended Credit Facility enhances our capacity and flexibility to support Colliers’ ongoing global growth, both organically

and through acquisitions,” said Christian Mayer, Chief Financial Officer. “We appreciate the continued support and confidence

of our relationship banking group as we execute on our long-term growth strategy,” he concluded.

About

Colliers

Colliers

(NASDAQ, TSX: CIGI) is a leading global diversified professional services company, specializing in commercial real estate services, engineering

consultancy and investment management. With operations in 70 countries, our 22,000 enterprising professionals provide exceptional service

and expert advice to clients. For nearly 30 years, our experienced leadership – with substantial inside ownership – has consistently

delivered approximately 20% compound annual investment returns for shareholders. With annual revenues exceeding $4.5 billion and $99

billion of assets under management, Colliers maximizes the potential of property, infrastructure and real assets to accelerate the success

of our clients, investors and people. Learn more at

corporate.colliers.com, Twitter @Colliers or LinkedIn.

Forward-looking

Statements

Certain

information included in this news release is forward-looking, within the meaning of applicable securities laws. Much of this information

can be identified by words such as “believe”, “expects”, “expected”, “will”, “intends”,

“projects”, “anticipates”, “estimates”, “continues” or similar expressions suggesting

future outcomes or events. Colliers believes the expectations reflected in such forward-looking statements are reasonable but no assurance

can be given that these expectations will prove to be correct and such forward-looking statements should not be unduly relied upon.

Forward-looking

statements are based on current information and expectations that involve a number of risks and uncertainties, which could cause actual

results or events to differ materially from those anticipated. These risks include, but are not limited to, risks associated with: (i)

general economic and business conditions, which will, among other things, impact demand for Colliers’ services and the cost of

providing services; (ii) the ability of Colliers to implement its business strategy, including Colliers’ ability to identify and

acquire suitable acquisition candidates on acceptable terms and successfully integrate newly acquired businesses with its existing businesses;

(iii) changes in or the failure to comply with government regulations; and (iv) such factors as are identified in the Annual Information

Form of Colliers for the year ended December 31, 2023 under the heading “Risk Factors” (which factors are adopted herein

and a copy of which can be obtained at www.sedarplus.ca). Forward looking statements contained in this news release are made as

of the date hereof and are subject to change. All forward-looking statements in this news release are qualified by these cautionary statements.

Except as required by applicable law, Colliers undertakes no obligation to publicly update or revise any forward-looking statement, whether

as a result of new information, future events or otherwise.

Exhibit 99.2

FOURTH AMENDMENT TO

SUSTAINABILITY LINKED THIRD

AMENDED AND RESTATED CREDIT AGREEMENT

THIS FOURTH AMENDMENT TO SUSTAINABILITY LINKED THIRD AMENDED AND RESTATED

CREDIT AGREEMENT (the “Fourth Amendment”) is executed by the parties hereto as of the 29th day of November,

2024.

|

AMONG: |

COLLIERS INTERNATIONAL GROUP INC., a corporation duly

organized and existing under the laws of Ontario (the “Canadian Borrower”) |

|

AND: |

COLLIERS MACAULAY NICOLLS INC., a corporation duly organized and existing under the laws of Ontario

(“CMN”) |

|

AND: |

COLLIERS INTERNATIONAL HOLDINGS (USA), INC., a corporation

duly organized and existing under the laws of the State of Delaware (the “US Borrower”) |

|

AND: |

COLLIERS INVESTMENT MANAGEMENT HOLDINGS, INC., a corporation duly organized and existing under the

laws of the State of Delaware (“US Holdings”) |

|

AND: |

GLOBESTAR LIMITED, a company incorporated in England and Wales with company number 05159841 (“Globestar”) |

|

AND: |

COLLIERS INTERNATIONAL EMEA HOLDINGS LIMITED, a company incorporated in England and Wales with company

number 10053084 (“EMEA Holdings”) |

|

AND: |

COÖPERATIE CMN NETHERLANDS HOLDCO U.A., a cooperative with excluded liability (coöperatie

met uitgesloten aansprakelijkheid) incorporated under the laws of the Netherlands, having its corporate seat (statutaire zetel) in Eindhoven,

the Netherlands and registered with the Dutch trade register under number 51267713 (the “Dutch Borrower”) |

|

AND: |

COLLIERS INTERNATIONAL HOLDINGS (AUSTRALIA) LIMITED ACN 008 178 238, a corporation duly incorporated

and existing under the laws of Australia (the “Australian Borrower” and, together with the Canadian Borrower, CMN,

the US Borrower, US Holdings, Globestar, EMEA Holdings and the Dutch Borrower, collectively, the “Borrowers”) |

|

AND: |

The Subsidiaries named on the execution pages hereof,

as Guarantors (the “Guarantors”) |

|

AND: |

The banks named on the execution pages hereof, as Lenders

(collectively, the “Lenders” and each individually, a “Lender”) |

|

AND: |

BMO CAPITAL MARKETS, as Sustainability Structuring Agent (the “Sustainability Structuring

Agent”) |

|

AND: |

BANK OF MONTREAL, LONDON BRANCH, as European administration agent (the “European Agent”) |

|

AND: |

HSBC BANK AUSTRALIA LIMITED, as Australian administration agent (the “Australian Agent”) |

|

AND: |

BANK OF MONTREAL, as the administration agent and as

the Canadian administration agent (in its capacity as the administration agent, the “Administration Agent”, in its

capacity as the Canadian administration agent, the “Canadian Agent” and in its capacity as the U.S. administration

agent, the “U.S. Agent”). |

WHEREAS the Borrowers, the Guarantors, the Lenders,

the Administration Agent, the Sustainability Structuring Agent, the Canadian Agent, the U.S. Agent, the European Agent, the Australian

Agent (collectively, the “Agents”), BMO Capital Markets, as Sole Bookrunner, Co-Lead Arranger and Sustainability Structuring

Agent, HSBC UK Bank plc, Mizuho Bank, Ltd., Canada Branch, JPMorgan Chase Bank, N.A., Bank of America, N.A., Canada Branch, and U.S. Bank

National Association, as Co-Lead Arrangers and Co-Syndication Agents, The Bank of Nova Scotia and Canadian Imperial Bank of Commerce,

as Co-Documentation Agents, among others, have entered into a sustainability linked third amended and restated credit agreement dated

May 27, 2022, as amended by the first amendment to sustainability linked third amended and restated credit agreement dated as of November

2, 2022, the second amendment to sustainability linked third amended and restated credit agreement dated as of April 28, 2023 and the

third amendment to sustainability linked third amended and restated credit agreement dated as of June 26, 2024 (the “Existing

Credit Agreement” and, as amended by this Fourth Amendment and as may be further amended, restated, amended and restated, supplemented,

replaced and otherwise modified from time to time, the “Credit Agreement”);

AND WHEREAS the Borrowers have requested (i)

an aggregate U.S.$500,000,000 increase in the Total Commitments, (ii) that the Final Maturity Date be extended by a period of five (5)

years from the Amendment Effective Date (defined below) and (iii) certain amendments to the sustainability criteria, as set forth herein;

AND WHEREAS the Borrowers, the Agents and the

Lenders have agreed to amend certain provisions of the Existing Credit Agreement (collectively, the “Amendments”),

but only to the extent and subject to the provisions set forth in this Fourth Amendment;

NOW THEREFORE, for good and valuable consideration,

the sufficiency of which is hereby acknowledged, the parties hereby agree as follows:

Article

1 – INTERPRETATION

1.1 Capitalized

terms referred to and not defined herein shall have the meanings ascribed thereto in the Credit Agreement.

1.2 Each

of the Borrowers and each of the Guarantors agrees that the recitals form an integral part of this Fourth Amendment.

Article

2 – AMENDMENTS

2.1 With

effect as of the Amendment Effective Date (defined below), the Existing Credit Agreement is hereby amended as follows:

|

(a) |

the grid appearing in the definition of “Applicable Sustainability Margin Adjustment” in Section

1.1 (Definitions) is hereby deleted in its entirety and the following substituted therefor: |

| SPT Metric |

Fiscal

Year Ending |

Level |

Target |

Adjustment

to the fees, rates and margins in the pricing grid referred to in the definition of Applicable Margin (in bps) (excluding Commitment Fees) |

Adjustment

to the Commitment Fees (in bps) referred to in the definition of Applicable Margin |

| GHG

Emission Intensity (measured against Baseline GHG Emission Intensity) |

December

31, 2022 |

I |

SBTi Submission |

-2.0 |

-0.4 |

| III |

No SBTi Submission

|

2.0 |

0.4 |

| December

31, 2023 |

I |

If GHG Emission

Intensity has decreased by 16.7% or more |

-2.0 |

-0.4 |

| II |

If GHG Emission

Intensity has decreased by less than 16.7% but 9.9% or more |

-1.0 |

-0.2 |

| III |

If GHG Emission

Intensity has decreased by less than 9.9% or increased by less than 5.0% |

No change |

No change |

| IV |

If GHG Emission

Intensity has increased by 5.0% or more but less than 8.4% |

1.0 |

0.2 |

| V |

If GHG Emission

Intensity has increased by 8.4% or more |

2.0 |

0.4 |

| December

31, 2024 |

I |

If GHG Emission

Intensity has decreased by 24.6% or more |

-2.0 |

-0.4 |

| II |

If GHG Emission

Intensity has decreased by less than 24.6% but 14.6% or more |

-1.0 |

-0.2 |

| III |

If GHG Emission

Intensity has decreased by less than 14.6% or increased by less than 0.0% |

No change |

No change |

| IV |

If GHG Emission

Intensity has increased by 0.0% or more but less than 4.2% |

1.0 |

0.2 |

| V |

If GHG Emission

Intensity has increased by 4.2% or more |

2.0 |

0.4 |

| December

31, 2025 |

I |

If GHG Emission

Intensity has decreased by 32.2% or more |

-3.0 |

-0.6 |

| II |

If GHG Emission

Intensity has decreased by less than 32.2% but 19.2% or more |

-2.0 |

-0.4 |

| III |

If GHG Emission

Intensity has decreased by less than 19.2% but more than 5.0% |

No change |

No change |

| IV |

If GHG Emission

Intensity has decreased by 5.0% or more but less than 0.0% |

2.0 |

0.4 |

| V |

If GHG Emission

Intensity has increased by more than 0.0% |

3.0 |

0.6 |

| December

31, 2026 |

I |

If GHG Emission

Intensity has decreased by 39.8% or more |

-3.0 |

-0.6 |

| II |

If GHG Emission

Intensity has decreased by less than 39.8% but more than 23.7% |

-2.0 |

-0.4 |

| III |

If GHG Emission

Intensity has decreased by less than 23.7% but 9.9% or more |

No change |

No change |

| IV |

If GHG Emission

Intensity has decreased by less than 9.9% but more than 4.2% |

2.0 |

0.4 |

| IV |

If GHG Emission

Intensity has decreased by 4.2% or less |

3.0 |

0.6 |

Percentage of Women in

Management Roles

|

December

31, 2022 |

I |

Percentage

of Women in Management Roles is 33.2% or more |

-2.0 |

-0.4 |

| II |

Percentage of

Women in Management Roles is less than 33.2% but more than 30.4% |

No change |

No change |

| III |

Percentage of

Women in Management Roles is 30.4% or less |

2.0 |

0.4 |

| December

31, 2023 |

I |

Percentage of

Women in Management Roles is 34.1% or more |

-2.0 |

-0.4 |

| II |

Percentage of

Women in Management Roles is less than 34.1% but more than 31.4% |

No change |

No change |

| III |

Percentage of

Women in Management Roles is 31.4% or less |

2.0 |

0.4 |

| December

31, 2024 |

I |

Percentage of

Women in Management Roles is 34.9% or more |

-2.0 |

-0.4 |

| II |

Percentage of

Women in Management Roles is less than 34.9% but more than 32.4% |

No change |

No change |

| III |

Percentage of

Women in Management Roles is 32.4% or less |

2.0 |

0.4 |

| December

31, 2025 |

I |

Percentage of

Women in Management Roles is 35.8% or more |

-2.0 |

-0.4 |

| II |

Percentage of

Women in Management Roles is less than 35.8% but more than 33.4% |

No change |

No change |

| III |

Percentage of

Women in Management Roles is 33.4% or less |

2.0 |

0.4 |

| December

31, 2026 |

I |

Percentage of

Women in Management Roles is 36.6% or more |

-2.0 |

-0.4 |

| II |

Percentage of

Women in Management Roles is less than 36.6% but more than 34.4% |

No change |

No change |

| III |

Percentage of

Women in Management Roles is 34.4% or less |

2.0 |

0.4 |

| Percentage of WELL-Certified

Properties |

December

31, 2022 |

I |

Percentage

of WELL Certified Properties is 10% or more |

-1.0 |

-0.2 |

| II |

Percentage of

WELL Certified Properties is more than 0.0% but less than 10% |

No change |

No change |

| III |

Percentage of

WELL Certified Properties is 0.0% |

1.0 |

0.2 |

| December

31, 2023 |

I |

Percentage of

WELL Certified Properties is 30% or more |

-1.0 |

-0.2 |

| II |

Percentage of

WELL Certified Properties is more than 15% but less than 30% |

No change |

No change |

| III |

Percentage of

WELL Certified Properties is 15% or less |

1.0 |

0.2 |

| December

31, 2024 |

I |

Percentage of WELL Certified Properties is 75%

or more |

-1.0 |

-0.2 |

| II |

Percentage of WELL Certified Properties is more

than 45% but less than 75% |

No change |

No change |

| III |

Percentage of WELL Certified Properties is 45%

or less |

1.0 |

0.2 |

| |

|

|

|

|

(b) |

the definition of “Australian Revolving Facility Commitment” in Section 1.1 (Definitions) is hereby

amended by deleting the reference to “U.S.$75,000,000” appearing therein and substituting “U.S.$100,000,000” therefor; |

|

(c) |

the definition of “Borrowers” in Section 1.1 (Definitions) is hereby amended by (i) adding “U.S.

Holdings,” immediately following the reference to “the U.S. Borrower” appearing therein, and (ii) adding “Globestar,”

immediately following the reference to “the UK Borrower” appearing therein; |

|

(d) |

the definition of “Business Day” in Section 1.1 (Definitions) is hereby amended by (i) adding

“or Montreal, Quebec” immediately following the reference to “Toronto” appearing in clause (a) therein; (ii) adding

“and Montreal” immediately following the reference to “Toronto” appearing in clause (b) therein; (iii) adding

“, Toronto, Ontario or Montreal Quebec” immediately following the reference to “London, England” appearing in

clause (c) therein; and (iv) adding “or Montreal” immediately following the reference to “Toronto” appearing in

clause (f) therein; |

|

(e) |

the definition of “Canadian Revolving Facility Commitment” in Section 1.1 (Definitions) is hereby

amended by deleting the reference to “U.S.$840,000,000” appearing therein and substituting “U.S.$1,085,000,000”

therefor; |

|

(f) |

the definitions of “Canadian Swingline A Commitment” and “Canadian Swingline A Lender”

in Section 1.1 (Definitions), and each reference to “Canadian Swingline A Commitment” and “Canadian Swingline A Lender”,

are hereby deleted in their entirety; |

|

(g) |

the definition of “Colliers EMEA Revolving Facility Commitment” in Section 1.1 (Definitions) is

hereby amended by deleting the reference to “U.S.$100,000,000” appearing therein and substituting “U.S.$125,000,000”

therefor; |

|

(h) |

Section 1.1 (Definitions) is hereby amended by adding the following new definitions thereto in the appropriate

alphabetical order: |

| |

|

|

| |

|

““Declassification Event” means a failure by the Canadian Borrower and the Administration

Agent (acting on the instructions of the Majority Lenders) to establish SPT Metrics in respect of GHG Emissions and Percentage of Women

in Management Roles, or one or more Alternative SPT Metrics in accordance with Section 4.14(c), within 15 months after the last Applicable

Sustainability Margin Adjustment; provided, that, the last day of effectiveness of the most recent Applicable Sustainability

Margin Adjustment shall be the day that is 12 months after the most recent Sustainability Margin Adjustment Date.”; |

| |

|

|

| |

|

““Englobe Properties” means, collectively, the properties municipally described as

[REDACTED]; |

| |

|

|

| |

|

““Globestar” means Globestar Limited, a company incorporated in England and Wales

with company number 05159841.”; |

| |

|

|

| |

|

““U.S. Holdings” means Colliers Investment Management Holdings, Inc., a corporation

duly organized and existing under the laws of the State of Delaware.”; |

| |

|

|

| |

|

“”Register” has the meaning ascribed thereto in Section 13.18.”; |

|

(i) |

the definition of “Final Maturity Date” in Section 1.1 (Definitions) is hereby amended by deleting

the reference to “May 27, 2027” appearing therein and substituting “November 29, 2029” therefor; |

|

(j) |

the definition of “Percentage of WELL Certified Properties” in Section 1.1 (Definitions) is hereby

deleted in its entirety and the following substituted therefor: |

| |

|

|

| |

|

““Percentage of WELL Certified Properties” means the total number of Sustainability

Eligible Locations occupied by the Canadian Borrower and its Subsidiaries which have received a WELL Health-Safety Rating calculated at

the end of the most recently completed Fiscal Year (provided that the Englobe Properties shall not be included in such calculation), the

criteria of such rating are available at https://www.wellcertified.com/health-safety, divided by the total number of Sustainability Eligible

Locations occupied by the Canadian Borrower and its Subsidiaries calculated at the end of the most recently completed Fiscal Year (provided

that the Englobe Properties shall not be included in such calculation), as set out in the Sustainability Report and verified by the Sustainability

Auditor on a limited assurance basis.”, |

| |

|

|

| |

|

provided, that, effective January 1, 2025, the definition of “Percentage of WELL Certified

Properties”, and each reference thereto appearing in the Credit Agreement, shall be automatically and without further action deleted

in its entirety; |

|

(k) |

the definition of “Total Australian Commitments” in Section 1.1 (Definitions) is hereby amended

by deleting the reference to “U.S.$75,000,000” appearing therein and substituting “U.S.$100,000,000” therefor; |

|

(l) |

the definition of “Total Canadian Commitments” in Section 1.1 (Definitions) is hereby amended

by deleting the reference to “U.S.$875,000,000” appearing therein and substituting “U.S.$1,100,000,000” therefor; |

|

(m) |

the definition of “Total Colliers EMEA Commitments” in Section 1.1 (Definitions) is hereby amended

by deleting the reference to “U.S.$100,000,000” appearing therein and substituting “U.S.$125,000,000” therefor; |

|

(n) |

the definition of “Total Commitments” in Section 1.1 (Definitions) is hereby amended by deleting

the reference to “U.S.$1,750,000,000” appearing therein and substituting “U.S.$2,250,000,000” therefor; |

|

(o) |

the definition of “Total U.S. Commitments” in Section 1.1 (Definitions) is hereby amended by deleting

the reference to “U.S.$625,000,000” appearing therein and substituting “U.S.$825,000,000” therefor; |

|

(p) |

the definition of “Total UK Commitments” in Section 1.1 (Definitions) is hereby amended by deleting

the reference to “U.S.$75,000,000” appearing therein and substituting “U.S.$100,000,000” therefor; |

|

(q) |

the definition of “UK Revolving Facility Commitment” in Section 1.1 (Definitions) is hereby amended

by deleting the reference to “U.S.$75,000,000” appearing therein and substituting “U.S.$100,000,000” therefor; |

|

(r) |

the definition of “U.S. Revolving Facility Commitment” in Section 1.1 (Definitions) is hereby

amended by deleting the reference to “U.S.$590,000,000” appearing therein and substituting “U.S.$790,000,000”

therefor; |

|

(s) |

Article 4 (Interest, Letter of Credit Fee and Commitment Fees) is hereby amended by adding the following new

sections thereto: |

| |

|

|

| |

|

“4.15 Declassification Event |

| |

|

|

| |

|

(a) On and at any time after the occurrence of the Declassification Event the Facilities will no longer be

classified or re-classified as “sustainability-linked”. |

| |

|

|

| |

|

(b) With effect on and from the Declassification Event: |

| |

|

|

| |

|

(i) the definition of “Applicable Sustainability Margin Adjustment”

and each other provision and definition of this Agreement related to this Agreement being “sustainability-linked”, including,

without limitation, Sections 4.14 and 9.6, shall cease to apply; and |

| |

|

|

| |

|

(ii) no Applicable Sustainability Margin Adjustment will apply to any

utilization of the Facilities. |

| |

|

|

| |

|

4.16 Sustainability Publicity |

| |

|

|

| |

|

The Canadian Borrower shall not, and shall ensure that no other Borrower or Guarantor or Subsidiary thereof

will, make any disclosure that references the Facilities or any utilization thereof as "sustainability-linked" at any time on

or after the Declassification Event.” |

|

(t) |

Section 5.3(a) (Conditions Precedent to Borrowings to Make Acquisitions) is hereby amended by deleting the

reference to “Schedule “J”” appearing therein and substituting “Schedule “I”” therefor; |

|

(u) |

Section 8.2(h)(iv) (Positive Covenants) is hereby amended by adding the following to the end of such section: |

| |

|

|

| |

|

“, provided, further that no Sustainability Certificate shall be required to be delivered

after a Declassification Event”; |

|

(v) |

Article 13 (The Agents) is hereby amended by adding a new section 13.18 thereto: |

| |

|

|

| |

|

“13.18 Register. The Administration Agent, acting solely as

a non-fiduciary agent of the Borrowers, shall maintain at one of its offices a copy of a register (the “Register”)

for the recordation of the names and addresses of the Lenders and the Commitments of and obligations (including principal and stated interest)

owing to the applicable Lender. Without limitation of any other provision of this Agreement, no transfer of an interest in a Loan or Commitment

hereunder shall be effective unless and until recorded in the Register. Notwithstanding anything to the contrary hereunder, the entries

in the Register shall be conclusive absent manifest error and each Borrower, Guarantor and Lender shall treat each person whose name is

recorded in the Register as a Lender hereunder for all purposes of a Loan Document notwithstanding any notice to the contrary. The Register

shall be available for inspection by each Lender and Borrower at any reasonable time upon reasonable request therefor and from time to

time upon reasonable prior notice.” |

|

(w) |

Schedule “A” (List of Unrestricted Entities), Schedule “B” (Form of Repayment Notice),

Schedule “C” (Form of Transfer Certificate), Schedule “D” (Form of Conversion Notice), Schedule “E”

(Form of Drawdown Notice), Schedule “F” ([Reserved]), Schedule “G” (Form of Compliance Certificate), Schedule

“I” (Form of Officer’s Certificate Re: Acquisition Facility), Schedule “J” (Permitted Encumbrances), Schedule

“K” (Form of [U.S.] [UK] [Colliers EMEA] [Australian] Promissory Note), Schedule “L” (Form of Sustainability Certificate)

and Schedule “M” (Baseline Sustainability Levels) are hereby amended by (i) removing references therein to “Bank of

Montreal, Chicago Branch, as U.S. Administration Agent” and substituting “Bank of Montreal, as U.S. Administration Agent”

therefor, and (ii) where applicable in such Schedules, adding reference to “Colliers Investment Management Holdings, Inc.”,

as a U.S. Borrower and including a signature block for “Colliers Investment Management Holdings, Inc.” where applicable; |

|

(x) |

Schedule “H-1” (Canadian Commitments) is hereby deleted and replaced with Schedule H-1 (Canadian

Commitments) attached hereto as Exhibit A; |

|

(y) |

Schedule “H-2” (U.S. Commitments) is hereby deleted and replaced with Schedule H-2 (U.S. Commitments)

attached hereto as Exhibit B; |

|

(z) |

Schedule “H-3” (UK Commitments) is hereby deleted and replaced with Schedule H-3 (UK Commitments)

attached hereto as Exhibit C; |

|

(aa) |

Schedule “H-4” (EMEA Commitments) is hereby deleted and replaced with Schedule H-4 (EMEA Commitments)

attached hereto as Exhibit D; |

|

(bb) |

Schedule “H-5” (Australian Commitments) is hereby deleted and replaced with Schedule H-5 (Australian

Commitments) attached hereto as Exhibit E; |

|

(cc) |

Schedule “H-6” (Total Commitments) is hereby deleted and replaced with Schedule H-6 (Australian

Commitments) attached hereto as Exhibit F. |

Article

3 – FEES AND COSTS

3.1 All

costs incurred by the Administration Agent in preparing this Fourth Amendment (including all legal fees incurred by the Administration

Agent) shall be on the account of the Borrowers, and shall form part of the Obligations. The Borrowers hereby authorize the Administration

Agent to debit any accounts it may have with the Administration Agent in an amount equal to such fees and costs.

Article

4 – CONDITIONS TO EFFECTIVENESS

4.1 This

Fourth Amendment shall become effective upon the satisfaction of the following conditions precedent in form and substance satisfactory

to the Administration Agent (the date and fulfillment of such conditions being herein referred to as the “Amendment Effective

Date”):

|

(a) |

delivery to the Administration Agent of a fully executed copy of this Fourth Amendment, dated the Amendment

Effective Date, as executed by the Borrowers, the Guarantors, the Agents and the Lenders (with an original wet-ink counterpart signature

page to be provided by Colliers International Germany Holding GmbH (the “German Guarantor”) promptly following closing); |

|

(b) |

delivery to the Administration Agent of a customary officer’s or director’s certificate of each

Borrower and each Guarantor which is incorporated or otherwise formed in the jurisdiction of organization or formation of a Borrower,

signed by an authorized officer or director of such Borrower or Guarantor, certifying and attaching (i) copies of its constitutive documents

or confirming that they remain in full force and effect and have not been revoked, suspended, amended or modified since they were previously

provided to the Administration Agent, (ii) resolutions authorizing the execution, delivery and performance of this Fourth Amendment, and

(iii) incumbencies setting forth the signatures and titles of its authorized signatories certifying their authority to sign this Fourth

Amendment and any documents contemplated hereby or provided in connection herewith; |

|

(c) |

delivery to the Administration Agent of a certificate of the Canadian Borrower, signed by an authorized officer

of the Canadian Borrower, for and on behalf of the Guarantors (to the extent not already provided by the Guarantors pursuant to paragraph

4.1(b) above), confirming certain customary matters of fact; |

|

(d) |

delivery to the Administration Agent of certificates of good standing (to the extent such concept exists)

in respect of each Borrower from the applicable Governmental Authority; |

|

(e) |

delivery to the Administration Agent of customary legal opinions in respect of each Borrower; |

|

(f) |

the Administration Agent shall have received payment from the Borrowers of the fees as set forth in that certain

fee letter dated November 12, 2024 between the Canadian Borrower and the Canadian Agent; |

|

(g) |

the Borrowers shall have provided the documentation and other information reasonably requested in writing

by the Administration Agent and the Lenders as they reasonably determine is required by regulatory authorities under applicable "know

your customer", beneficial ownership and anti-money-laundering rules and regulations, including, without limitation, the Patriot

Act and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada), in each case at least three (3) Business Days prior

to the Amendment Effective Date (or such shorter period as the Administration Agent shall otherwise agree); and |

|

(h) |

delivery to the Administration Agent such other documents and information which the Administration Agent or

the Lenders may reasonably request. |

Article

5 – REPRESENTATIONS AND WARRANTIES

| 5.1 |

Each Borrower and each Guarantor warrants and represents to the Agents and the Lenders that the following statements are true,

correct and complete: |

| |

|

|

|

(a) |

Authorization, Validity, and Enforceability of this Fourth Amendment. Each Borrower and each Guarantor

has the corporate power and authority to execute and deliver this Fourth Amendment and to perform its obligations under the Existing Credit

Agreement, as amended by this Fourth Amendment. Each Borrower and each Guarantor has taken all necessary corporate action (including,

without limitation, obtaining approval of its shareholders if necessary) to authorize its execution and delivery of this Fourth Amendment

and the performance of the Credit Agreement. This Fourth Amendment has been duly executed and delivered by each Borrower and each Guarantor

and this Fourth Amendment and the Credit Agreement constitute the legal, valid and binding obligations of each Borrower and each Guarantor,

enforceable against each of them in accordance with their respective terms without defence, compensation, setoff or counterclaim. Each

Borrower’s and each Guarantor’s execution and delivery of this Fourth Amendment and the performance by each Borrower and each

Guarantor of the Credit Agreement do not and will not conflict with, or constitute a violation or breach of, or constitute a default under,

or result in the creation or imposition of any Lien upon the property of any Borrower or any Guarantor by reason of the terms of (a) any

contract, mortgage, hypothec, Lien, lease, agreement, indenture, or instrument to which any Borrower or any Guarantor is a party or which

is binding on any of them, (b) any requirement of law applicable to any Borrower or any Guarantor, or (c) the certificate or articles

of incorporation or amalgamation or association or bylaws or memorandum of association or constitution of any Borrower or any Guarantor. |

|

(b) |

Governmental Authorization. No approval, consent, exemption, authorization, or other action by, or

notice to, or filing with, any governmental authority or other person is necessary or required in connection with the execution, delivery

or performance by, or enforcement against each Borrower and each Guarantor of this Fourth Amendment or the Credit Agreement except for

such as have been obtained. |

|

(c) |

Incorporation of Representations and Warranties from Credit Agreement. The representations and warranties

contained in Article 8 of the Credit Agreement and the other Loan Documents are and will be true, correct and complete in all material

respects on and as of the Amendment Effective Date to the same extent as though made on and as of that date, except to the extent such

representations and warranties specifically relate to an earlier date, in which case they were true, correct and complete in all material

respects on and as of such earlier date. |

|

(d) |

Absence of Default. No event has occurred and is continuing or will result from the consummation of

the transactions contemplated by this Fourth Amendment that would constitute a Default or an Event of Default. |

|

(e) |

No Other Amendment. Except to the extent set forth herein no additional amendment, consent or waiver

of any other term, condition, covenant, agreement or any other aspect of the Credit Agreement is intended or implied and except as covered

by this Fourth Amendment, no other aspect of the covenants referred to herein is amended or waived, including without limitation for any

other period or circumstance, and no such amendment, waiver or consent is intended or implied. |

|

(f) |

KYC, etc. All information provided by the Borrowers to the Administration Agent and the Lenders under

applicable "know your customer", beneficial ownership and anti-money-laundering rules and regulations, including, without limitation,

the Patriot Act and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada), remains true, complete and accurate

as of the Amendment Effective Date. |

Article

6 – MISCELLANEOUS

6.1 (a)

Each Borrower and each Guarantor (i) reaffirms its Obligations under the Credit Agreement and the other Loan Documents to which it is

a party, and (ii) agrees that the Credit Agreement and the other Loan Documents to which it is a party remain in full force and effect,

except as amended hereby, and are hereby ratified and confirmed. The Guarantors (i) consent to and approve the execution and delivery

of this Fourth Amendment by the parties hereto, (ii) agree that this Fourth Amendment does not and shall not limit or diminish in any

manner the obligations of the Guarantors under their guarantees (collectively, the “Guarantees”) and that such obligations

would not be limited or diminished in any manner even if such Guarantors had not executed this Fourth Amendment, (iii) agree that this

Fourth Amendment shall not be construed as requiring the consent of such Guarantors in any other circumstance, (iv) reaffirm each of their

obligations under the Guarantees and the other Loan Documents to which they are a party, and (v) agree that the Guarantees and the other

Loan Documents to which they are a party remain in full force and effect and are hereby ratified and confirmed. (b) The German Guarantor

hereby confirms to the Administration Agent for the benefit of the Administration Agent and the Lenders that (i) the Guarantee (as defined

in the credit guarantee agreement dated as of June 1, 2015, as amended and confirmed from time to time prior to the date hereof, the “German

Guarantee”) continues to exist, and (ii) the Guaranteed Obligations (as defined in the German Guarantee) shall include the Obligations

(as defined in the Existing Credit Agreement, as amended by this Fourth Amendment) and for the avoidance of doubt, the Guaranteed Obligations

shall not include any Excluded Swap Obligation (as defined in the Existing Credit Agreement, as amended by this Fourth Amendment).

6.2 Nothing

contained in this Fourth Amendment or any other communication between the Administration Agent and/or the Lenders and the Borrowers (or

any Guarantor) shall be a waiver of any other present or future violation, Default or Event of Default under the Credit Agreement or any

other Loan Document (collectively, “Other Violations”). Similarly, nothing contained in this Fourth Amendment shall

directly or indirectly in any way whatsoever either (i) impair, prejudice or otherwise adversely affect the Agents’ or the Lenders’

right at any time to exercise any right, privilege or remedy in connection with the Credit Agreement or any other Loan Document with respect

to any Other Violations (including, without limiting the generality of the foregoing, in respect of the non-conformity to any representation,

warranty or covenant contained in any Loan Document), (ii) except as specifically provided in Article 3 hereof, amend or alter any provision

of the Credit Agreement or any other Loan Document or any other contract or instrument, or (iii) constitute any course of dealing or other

basis for altering any obligation of any Borrower or any Guarantor under the Loan Documents or any right, privilege or remedy of the Agents

or the Lenders under the Credit Agreement or any other Loan Document or any other contract or instrument with respect to Other Violations.

Nothing in this Fourth Amendment shall be construed to be a consent by any Agent or the Lenders to any Other Violations.

6.3 This

Fourth Amendment will not discharge or constitute novation of any debt, obligation, covenant or agreement contained in the Credit Agreement

or any of the documents delivered pursuant thereto but same shall remain in full force and effect save to the extent same are amended

by the provisions of this Fourth Amendment.

6.4 All

reasonable expenses of the Administration Agent in connection with this Fourth Amendment and the related documentation, including all

reasonable legal fees and disbursements incurred by the Administration Agent, shall be for the account of the Borrowers.

6.5 This

Fourth Amendment enures to the benefit of and binds the parties and their respective successors and permitted assigns.

6.6 Each

party shall from time to time promptly execute and deliver all further documents and take all further action necessary to give effect

to the provisions and intent of this Fourth Amendment.

6.7 This

Fourth Amendment may be executed and delivered in one or more counterparts, including by way of facsimile, or electronically, each of

which shall be deemed to be an original, but all of which together shall constitute one and the same instrument.

6.8 (a)

Subject to Section 6.8(b) below, this Fourth Amendment shall be governed by and construed in accordance with the laws of the Province

of Ontario and the federal laws of Canada applicable therein.

(b) To the extent that Section 6.1(a) above relates to

reaffirmations, agreements or confirmations in connection with Loan Documents governed by and construed in accordance with laws other

than the laws of the Province of Ontario and the federal laws of Canada, the law governing those Loan Documents shall apply to the applicable

reaffirmations, agreements or confirmations.

[Signature pages commence on the following page]

IN WITNESS WHEREOF, the parties hereto have caused this Fourth Amendment

to Sustainability Linked Third Amended and Restated Credit Agreement to be executed as of the date first above written.

| |

COLLIERS INTERNATIONAL GROUP INC., as a Canadian Borrower

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Vice President, Legal Counsel & Corporate Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS MACAULAY NICOLLS INC., as a Canadian Borrower

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL HOLDINGS (USA), INC., as a U.S. Borrower

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

|

|

| |

|

COLLIERS INVESTMENT MANAGEMENT HOLDINGS, INC., as a U.S. Borrower

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary/Treasurer |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| |

COÖPERATIE CMN NETHERLANDS HOLDCO U.A., as Dutch Borrower

|

| |

|

Per: |

<Signed> Davoud Amel-Azizpour |

| |

|

|

Name: |

Davoud Amel-Azizpour |

| |

|

|

Title: |

Authorized Signatory |

| |

|

|

|

|

| |

|

I have the authority to bind the Company |

| |

GLOBESTAR LIMITED, a company incorporated in England and Wales with registration number

05159841, as a UK Borrower

|

| |

|

Per: |

<Signed> Davoud Amel-Azizpour |

| |

|

|

Name: |

Davoud Amel-Azizpour |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Company |

| |

COLLIERS INTERNATIONAL EMEA HOLDINGS LIMITED, a company incorporated in England and Wales

with registration number 10053084, as a UK Borrower

|

| |

|

Per: |

<Signed> Davoud Amel-Azizpour |

| |

|

|

Name: |

Davoud Amel-Azizpour |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Company |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| Executed by Colliers International Holdings (Australia)

Limited ACN 008 178 238 as Australian Borrower in accordance with section 127 of the Corporations Act 2001: |

|

|

|

<Signed> John Marasco |

|

<Signed> Simon Martin Hunt |

|

Director/company secretary

|

|

Director |

| JOHN MARASCO |

|

SIMON MARTIN HUNT |

Name of director/company secretary

(BLOCK LETTERS) |

|

Name of director

(BLOCK LETTERS) |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| |

COLLIERS INTERNATIONAL USA, LLC, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

CIVAS HOLDINGS, LLC, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL WA, LLC, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL REMS US, LLC, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL CA, INC., as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| |

COLLIERS INTERNATIONAL GREATER LOS ANGELES, INC. as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

|

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL VALUATION & ADVISORY SERVICES, LLC, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

FS WILLIAMS ACQUISITIONCO LLC, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS PARRISH INTERNATIONAL, INC., as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Vice President/Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| |

COLLIERS INTERNATIONAL FLORIDA, LLC, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL FINCO (CANADA) INC., as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

President/Secretary |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| Executed by COLLIERS INTERNATIONAL (NSW) PTY LIMITED ACN 001 401 681 as a Guarantor in accordance

with section 127 of the Corporations Act 2001: |

|

|

|

<Signed. Andrew Charles Watson |

|

<Signed> Jullia Batterley |

|

Director/company secretary

|

|

Director |

| ANDREW CHARLES WATSON |

|

JULIA BATTERLEY |

Name of director/company secretary

(BLOCK LETTERS) |

|

Name of director

(BLOCK LETTERS) |

| Executed by COLLIERS INTERNATIONAL (VICTORIA) PTY LTD ACN 005 032 940 as a Guarantor in accordance

with section 127 of the Corporations Act 2001: |

|

|

|

<Signed> John Marasco |

|

<Signed> Robert Joyes |

|

Director/company secretary

|

|

Director |

| JOHN MARASCO |

|

ROBERT JOYES |

Name of director/company secretary

(BLOCK LETTERS) |

|

Name of director

(BLOCK LETTERS) |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| |

COLLIERS NEW ZEALAND LIMITED, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Authorized Signor |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL GERMANY HOLDING GMBH, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Davoud Amel-Azizpour |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS MACAULAY NICOLLS (CYPRUS) LIMITED, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL HOLDINGS LIMITED, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Company |

| |

COLLIERS INTERNATIONAL CONSULTANTS LIMITED, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Company |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

| |

COLLIERS INTERNATIONAL (HONG KONG) LIMITED, as a Guarantor

|

| |

|

Per: |

<Signed> Matthew Hawkins |

| |

|

|

Name: |

Matthew Hawkins |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

Signed by a director of GLOBESTAR LIMITED for and on behalf of, and as

corporate member of, COLLIERS INTERNATIONAL PROPERTY ADVISERS UK LLP, a limited liability partnership incorporated in England and Wales

with registration number OC385143, as a Guarantor

|

| |

|

Per: |

<Signed> Davoud Amel-Azizpour |

| |

|

|

Name: |

Davoud Amel-Azizpour |

| |

|

|

Title: |

Director |

| |

COLLIERS INTERNATIONAL PROPERTY CONSULTANTS LIMITED, a company incorporated in England and

Wales with registration number 07996509, as a Guarantor

|

| |

|

Per: |

<Signed> Davoud Amel-Azizpour |

| |

|

|

Name: |

Davoud Amel-Azizpour |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

| |

COLLIERS INTERNATIONAL EMEA FINCO PLC, a company incorporated in England and Wales with

registration number 11313832, as a Guarantor

|

| |

|

Per: |

<Signed> Davoud Amel-Azizpour |

| |

|

|

Name: |

Davoud Amel-Azizpour |

| |

|

|

Title: |

Director |

| |

|

|

|

|

| |

|

I have the authority to bind the Corporation |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

AGENTS

| |

BANK OF MONTREAL, as Administration

Agent, Canadian Administration Agent and U.S. Administration Agent

|

| |

|

Per: |

<Signed> Sean P. Gallaway |

| |

|

|

Name: |

Sean P. Gallaway |

| |

|

|

Title: |

Managing Director |

| |

|

Draw Requests, Conversion Requests, Repayment Notices

Bank of Montreal

250 Yonge Street, 11th Floor

Toronto, Ontario M5B 2L7

Attention: Agency Services

Tel: [REDACTED]

Fax: [REDACTED]

Email: [REDACTED]

All Other Notices

BMO Capital Markets

100 King Street West, 5th Floor

Toronto, ON M5X 1H3

Attention: Corporate Banking

Email: [REDACTED] |

| |

BANK OF MONTREAL, LONDON BRANCH, as

European Agent

|

| |

|

Per: |

<Signed> Andrew Nelson |

| |

|

|

Name: |

Andrew Nelson |

| |

|

|

|

| |

|

Per: |

<Signed> Scott Matthews |

| |

|

|

Name: |

Scott Matthews |

| |

|

|

Title: |

CFO |

| |

HSBC BANK AUSTRALIA LIMITED, as Australian

Agent

|

| |

|

Per: |

<Signed> Matthew Sargent |

| |

|

|

Name: |

Matthew Sargent |

| |

|

|

Title: |

Director |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS

| |

Fédération des Caisses Desjardins

du Québec

|

| |

Per: |

<Signed> Sophia Soofi |

| |

|

Name: Sophia Soofi |

| |

|

Title: Managing Director, Corporate Banking

|

| |

Per: |

<Signed> Gian Guerrero |

| |

|

Name: Gian Guerrero |

| |

|

Title: Director, Corporate Banking

|

| |

Address for Notice: [REDACTED]

Attn:

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

HSBC UK BANK plc

|

| |

Per: |

<Signed> Caroline Winter-Nolan |

| |

|

Name: Caroline Winter-Nolan |

| |

|

Title: Senior Legal Counsel |

| |

Address for Notice:

[REDACTED]

Tel.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

THE TORONTO-DOMINION BANK

|

| |

Per: |

<Signed> Tim Thomas |

| |

|

Name: Tim Thomas |

| |

|

Title: Managing Director

|

| |

Per: |

<Signed> Aman Cheema |

| |

|

Name: Aman Cheema |

| |

|

Title: Vice President

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

JPMORGAN CHASE BANK, N.A., Toronto

Branch

|

| |

Per: |

<Signed> Jeffrey Coleman |

| |

|

Name: Jeffrey Coleman |

| |

|

Title: Executive Director

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

BANK OF MONTREAL

|

| |

Per: |

<Signed> Sean P. Gallaway |

| |

|

Name: Sean P. Gallaway |

| |

|

Title: Director

|

| |

Address for Notice:

[REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

ROYAL BANK OF CANADA

|

| |

Per: |

<Signed> Scott Robinson |

| |

|

Name: Scott Robinson |

| |

|

Title: Vice President – CCG Finance

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title:

|

| |

Address for Notice:

{REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

THE BANK OF NOVA SCOTIA

|

| |

Per: |

<Signed> Steve Holyman |

| |

|

Name: Steve Holyman |

| |

|

Title: Managing Director

|

| |

Per: |

<Signed> Mitali Kakran |

| |

|

Name: Mitali Kakran |

| |

|

Title: Associate

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

BANK OF AMERICA, N.A., Canada Branch

|

| |

Per: |

<Signed> Sanaa Khatri-Ahmed |

| |

|

Name: Sanaa Khatri-Ahmed |

| |

|

Title: Senior Vice President

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

CANADIAN IMPERIAL BANK OF COMMERCE

|

| |

Per: |

<Signed> Jeff McInenly |

| |

|

Name: Jeff McInenly |

| |

|

Title: Executive Director

|

| |

Per: |

<Signed> Martin Danaj |

| |

|

Name: Martin Danaj |

| |

|

Title: Executive Director

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

NATIONAL BANK OF CANADA

|

| |

Per: |

<Signed> Michelle Fiebig |

| |

|

Name: Michelle Fiebig |

| |

|

Title: Managing Director

|

| |

Per: |

<Signed> David Torrey |

| |

|

Name: David Torrey |

| |

|

Title: Managing Director & Head

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

U.S. BANK NATIONAL ASSOCIATION

|

| |

Per: |

<Signed> Kenneth S. Wong |

| |

|

Name: Kenneth S. Wong |

| |

|

Title: Senior Vice-President

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

WELLS FARGO BANK, N.A., Canadian Branch

|

| |

Per: |

<Signed> Marc-Philippe Piche |

| |

|

Name: Marc Philippe Piche |

| |

|

Title: Regional Vice President

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title: |

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

CANADIAN LENDERS CONT’D

| |

MIZUHO BANK, LTD., CANADA BRANCH

|

| |

Per: |

<Signed> James K.G. Campbell |

| |

|

Name: James K.G. Campbell |

| |

|

Title: Director

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title: |

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS

| |

the TORONTO-DOMINION BANK, NEW YORK Branch

|

| |

Per: |

<Signed> Manisha Sandhu |

| |

|

Name: Manisha Sandhu |

| |

|

Title: Authorized Signatory

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title:

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

HSBC UK BANK plc

|

| |

Per: |

<Signed> Caroline Winter-Nolan |

| |

|

Name: Caroline Winter-Nolan |

| |

|

Title: Senior Legal Counsel |

| |

Address for Notice:

[REDACTED]

Tel.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

Fédération des Caisses Desjardins du Québec

|

| |

Per: |

<Signed> Sophia Soofi |

| |

|

Name: Sophia Soofi |

| |

|

Title: Managing Director, Corporate Banking |

| |

|

|

| |

Per: |

<Signed> Gian Guerrero |

| |

|

Name: Gian Guerrero |

| |

|

Title: Director, Corporate Banking

|

| |

Address for Notice: [REDACTED]

Attn:

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

JPMORGAN CHASE BANK, N.A. |

| |

|

| |

Per: |

<Signed> Ryan P. Viaclovsky |

| |

|

Name: Ryan P. Viaclovsky |

| |

|

Title: Authorized Officer

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

BANK OF MONTREAL, Chicago Branch |

| |

|

| |

Per: |

<Signed> Jonathan Sarmini |

| |

|

Name: Jonathan Sarmini |

| |

|

Title: Vice President

|

| |

Address for Notice:

[REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

Royal bank of canada |

| |

|

| |

Per: |

<Signed> Scott Robinson |

| |

|

Name: Scott Robinson |

| |

|

Title: Vice President – CCG Finance |

| |

|

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title:

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

THE BANK OF NOVA SCOTIA |

| |

|

| |

Per: |

<Signed> Steve Holyman |

| |

|

Name: Steve Holyman |

| |

|

Title: Managing Director |

| |

|

|

| |

Per: |

<Signed> Mitali Kakran |

| |

|

Name: Mitali Kakran |

| |

|

Title: Associate

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

BANK OF AMERICA, N.A., Canada Branch |

| |

|

| |

Per: |

<Signed> Sanaa Khatri-Ahmed |

| |

|

Name: Sanaa Khatri-Ahmed |

| |

|

Title: Senior Vice President

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

CANADIAN IMPERIAL BANK OF COMMERCE |

| |

|

| |

Per: |

<Signed> Jeff McInenly |

| |

|

Name: Jeff McInenly |

| |

|

Title: Executive Director |

| |

|

|

| |

Per: |

<Signed> Martin Danaj |

| |

|

Name: Martin Danaj |

| |

|

Title: Executive Director

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

NATIONAL BANK OF CANADA |

| |

|

| |

Per: |

<Signed> Michelle Fiebig |

| |

|

Name: Michelle Fiebig |

| |

|

Title: Managing Director |

| |

|

|

| |

Per: |

<Signed> David Torrey |

| |

|

Name: David Torrey |

| |

|

Title: Managing Director & Head |

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

U.S. BANK NATIONAL ASSOCIATION |

| |

|

| |

Per: |

<Signed> Kenneth S. Wong |

| |

|

Name: Kenneth S. Wong |

| |

|

Title: Senior Vice-President

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED]

|

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

WELLS FARGO BANK, N.A., Canadian Branch |

| |

|

| |

Per: |

<Signed> Marc Philippe Piche |

| |

|

Name: Marc Philippe Piche |

| |

|

Title: Regional Vice President |

| |

|

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title: |

| |

|

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

U.S. LENDERS CONT’D

| |

MIZUHO BANK, LTD., CANADA BRANCH |

| |

|

| |

Per: |

<Signed> James K.G. Campbell |

| |

|

Name: James K.G. Campbell |

| |

|

Title: Director |

| |

|

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title: |

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

UK LENDERS

| |

THE toronto-dominion BANK, London Branch |

| |

|

| |

Per: |

<Signed> Philip Bates |

| |

|

Name: Philip Bates |

| |

|

Title: MD European Corporate Banking |

| |

|

|

| |

Per: |

|

| |

|

Name: |

| |

|

Title:

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

UK LENDERS CONT’D

| |

Fédération des Caisses Desjardins du Québec |

| |

|

| |

Per: |

<Signed> Sophia Soofi |

| |

|

Name: Sophia Soofi |

| |

|

Title: Managing Director, Corporate Banking |

| |

|

|

| |

Per: |

<Signed> Gian Guerrero |

| |

|

Name: Gian Guerrero |

| |

|

Title: Director, Corporate Banking

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to

Sustainability Linked Third Amended and Restated Credit Agreement - Colliers

UK LENDERS CONT’D

| |

JPMORGAN CHASE BANK, N.A. |

| |

|

| |

Per: |

<Signed> Ryan P. Viaclovsky |

| |

|

Name: Ryan P. Viaclovsky |

| |

|

Title: Authorized Officer

|

| |

Address for Notice:

[REDACTED]

Telecopier No.: [REDACTED]

Email: [REDACTED] |

Signature page to Fourth Amendment to