false

0000796505

0000796505

2024-08-28

2024-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): August

28, 2024

Clearfield, Inc.

(Exact name of registrant as specified in charter)

| Minnesota |

|

000-16106 |

|

41-1347235 |

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 7050 Winnetka

Avenue North, Suite 100, Brooklyn Park, MN |

|

55428 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (763) 476-6866 |

| Registrant’s telephone number, including area code |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

|

Common Stock, $0.01 par value

|

CLFD |

The

Nasdaq Stock Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers. |

On August 28, 2024, the Compensation Committee of

the Board of Directors of Clearfield, Inc. (the “Company”) approved and adopted the Clearfield, Inc. Incentive Bonus Plan

(the “Plan”) effective October 1, 2024 (the “Effective Date”) for bonus awards granted on or after the Effective

Date. The Plan provides for a cash payment to be made to the executive officers and certain other employees of the Company selected for

participation in the Plan, based upon the achievement of certain financial and other performance targets established by the Compensation

Committee. The Compensation Committee has the authority to designate the participants in the Plan; determine the applicable performance

period; determine the amount of each bonus award; select applicable performance targets; identify the weights of applicable performance

targets; determine the relationship between the degree to which performance targets have been achieved and bonus payments; and adjust

bonus payments based on unusual or unique circumstances or the impact of acquisitions, divestitures or other major unusual events.

The foregoing summary of

the Plan does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of the Plan, a

copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

104 |

Cover Page Interactive Data File (included within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

CLEARFIELD, INC. |

| |

|

|

| |

By: |

/s/ Cheryl Beranek |

| Dated: September 4, 2024 |

|

Cheryl Beranek, Chief Executive Officer |

Exhibit 10.1

CLEARFIELD, INC.

INCENTIVE BONUS PLAN

1.

Definitions. When the following terms are used herein with initial capital letters, they shall have the following meanings:

1.1

Affiliate – any entity that (i) directly or indirectly through one or more intermediaries, is controlled by

the Company or in which the Company has a significant equity interest, in each case as determined by the Committee, and (ii) has adopted

the Plan.

1.2

Base Salary – the annualized base salary paid to a Participant.

1.3

Board – the Board of Directors of Clearfield, Inc.

1.4

Bonus Award – the incentive structure established for each Participant by the Committee for each Performance

Period pursuant to Section 3.1 hereof.

1.5

Bonus Payment – an amount payable to a Participant pursuant to Section 3.2 hereof.

1.6

Cause – unless otherwise defined in an employment or other governing agreement between a Participant and the

Company or an Affiliate, a determination by the Company that a Participant has (a) been convicted of, or pled guilty or no contest to,

any felony or other criminal act involving moral turpitude or likely to cause material, including reputational, harm to the Company or

an Affiliate; (b) engaged in gross misconduct or any act of fraud, disloyalty or dishonesty related to or connected with the Participant’s

employment; (c) willfully violated the Company’s or an Affiliate’s written policies or codes of conduct; (d) wrongfully appropriated

Company or Affiliate funds or property or other breach of fiduciary duties to the Company or an Affiliate; (e) willfully and/or materially

breached any employment agreement between Participant and the Company; (f) engaged in “Detrimental Conduct” as defined under

the Recoupment Policy; or (g) engaged in conduct that constitutes “Cause” under the Company’s 2007 Stock Compensation

Plan, 2022 Stock Compensation Plan or other equity compensation plan under which Participant has received an award.

1.7

Change in Control – the definition of this term in the Company’s 2022 Stock Compensation Plan.

1.8

Committee – the Compensation Committee of the Board or other committee of the Board as the Board may designate

to have responsibility for administration of this Plan. In the event the Board does not designate a committee as responsible for the administration

of this Plan, the references herein to Committee shall refer to the Board.

1.9

Company – Clearfield, Inc., a Minnesota corporation.

1.10

Disability – a disability for which a Participant is eligible for benefits under the Company’s long-term

disability benefit plan.

1.11

Eligible Employee – any employee of the Company or of an Affiliate.

1.12

Participant – an Eligible Employee designated by the Committee as eligible to receive a Bonus Award under the

Plan.

1.13

Performance Period – the Company’s fiscal year or such other period as determined by the Committee from

time to time.

1.14

Performance Target(s) – the financial and other target(s) established by the Committee for a Performance Period

in accordance with the terms of the Plan.

1.15

Plan – this Clearfield, Inc. Incentive Bonus Plan, as it may be amended from time to time.

1.16

Recoupment Policy – the Company’s Compensation Recoupment Policy adopted September 23, 2021, as amended

from time to time.

1.17

Retirement – termination of a Participant’s employment for any reason other than Cause upon or after

attaining age 65, or between age 55 and 65 after providing 10 or more years of service to the Company or an Affiliate.

1.18

Section 409A – Section 409A of the Internal Revenue Code of 1986, as amended.

1.19

Termination Event – the termination of a Participant’s employment with the Company or an Affiliate for

any reason, voluntarily or involuntarily, with or without Cause, including by reason of the Participant’s death, Disability, or

Retirement; provided, however, a Termination Event shall not be deemed to occur if there is a simultaneous reemployment or continuing

employment of the Participant by the Company or any Affiliate, or, in the discretion of the Committee, the Participant’s service

is interrupted for any approved leaves of absence. The Committee, in its discretion, shall determine the effect of all matters and questions

relating to whether a Termination Event has occurred, including whether a particular leave of absence constitutes a Termination Event.

2.

Administration.

2.1 Authority

of Committee. This Plan will be administered and interpreted by the Committee in its absolute discretion, consistent with this

Plan. The Committee shall have the authority, subject to the terms of the Plan, to (i) make Bonus Awards, (ii) determine when and to

whom Bonus Awards will be granted, (iii) determine the form, amount and other terms and conditions of each Bonus Award, (iv) set the

Performance Period and establish the Performance Target(s) and relationship between the Performance Target(s) and Bonus Payments,

and (v) otherwise administer the Plan. The Committee’s interpretation of the Plan and of any Bonus Payments made or to be made

under the Plan shall be final and binding on all persons with an interest therein. The Committee shall have the power to establish

regulations to administer the Plan and to change such regulations.

2.2

Delegation. The Committee may delegate to the Chief Executive Officer the authority, with respect to Participants

who are not executive officers of the Company, to (i) determine which of such Eligible Employees will be granted Bonus Awards under the

Plan, (ii) determine the amount and terms of Bonus Awards under the Plan for such Participants and (iii) take all other actions of the

Committee, including administration and interpretation of such Bonus Awards. Bonus Awards granted pursuant to such delegated authority

shall be made consistent with the criteria established by the Committee and shall be subject to any other restrictions placed on the delegation

by the Committee.

3.

Bonus Award for a Performance Period.

3.1

Bonus Award.

(a)

Grant of Bonus Award. The Committee shall designate which Eligible Employees will be granted a Bonus Award for each

Performance Period; determine the amount of the potential Bonus Payment, which may be expressed as a percentage of Base Salary; select

applicable Performance Target(s); identify the weights thereof; and determine the relationship between the degree to which Performance

Targets have been achieved and Bonus Payments.

(b)

Performance Targets.

(1) Performance

Targets shall be based on one or more financial, operational or strategic performance metrics approved by the Committee,

including, but not limited to: stock price, net sales, gross profit, net earnings, pre-tax earnings, operating earnings,

earnings before interest and taxes, earnings before interest, taxes, depreciation, and amortization, operating cash flow, free cash

flow, cash flow from operations, return on equity, return on assets, return on invested capital, expenses, earnings per share, and

total shareholder return. All such metrics applicable to Bonus Awards shall be applied in a manner consistent with usual Company

practice and such rules and conditions as the Committee may establish. Financial metrics shall be computed in accordance with United

States generally accepted accounting principles as in effect from time to time and as applied by the Company in the preparation of

its financial statements, except the Committee may provide that one or more objectively determinable adjustments shall be made to

the financial metrics on which the Performance Targets are based, which may include adjustments that would cause such metrics to be

considered “non-GAAP financial measures” within the meaning of Rule 101 under Regulation G promulgated by the Securities

and Exchange Commission, such as excluding specified amounts or excluding the impact of specified unusual or nonrecurring events

such as acquisitions, divestitures, restructuring activities, asset write-downs, litigation judgments or settlements, or changes in

tax laws or accounting principles.

(2)

Any Performance Target may be expressed in absolute amounts, on a per share basis (basic or diluted), relative to one or

more of the other strategic, operational, or financial measures, as a growth rate or change from preceding periods, or as a comparison

to the performance of specified companies, indices or other external measures, and may relate to one or any combination of two or more

of corporate (consolidated), group, unit, division, Affiliate or Participant performance.

3.2

Bonus Payment. Following the close of each Performance Period and prior to the making of any Bonus Payment, the Committee

shall determine whether and to what extent Performance Target(s) and all other factors upon which the Bonus Payment is based have been

attained. In determining whether and to what extent a Performance Target has been attained, the Committee may make adjustments based on

unusual or unique circumstances or the impact of acquisitions, divestitures or other major unusual events. A Participant who is employed

by the Company or any Affiliate through the last day of the Performance Period shall be eligible for a Bonus Payment, if any such Bonus

Payment is made, provided such Participant continues to be employed by the Company or such Affiliate on the date such Bonus Payment is

made. Subject to any deferred compensation election pursuant to any such plans of the Company, the Bonus Payment shall be made by March

15 of the year following the calendar year in which the Performance Period ends.

3.3

Limitations.

(a)

If Performance Targets are not Achieved. If Performance Targets (or, at minimum, the threshold levels of such Performance

Targets) are not achieved during the Performance Period, no Bonus Payments shall be made under the Plan.

(b) Pro-ration

or Elimination of Bonus Payment. Participation in the Plan ceases upon a Termination Event. Upon a Termination Event due to

Retirement, death or Disability during the Performance Period, a Participant will be eligible to receive a pro-rated Bonus Payment

to be determined in the discretion of the Committee. Upon a Termination Event for any other reason (other than Cause) during the

Performance Period, a Participant will be ineligible for a Bonus Payment unless the Committee determines otherwise. Any Bonus

Payments made pursuant to this Section 3.3(b) shall be based on actual achievement of the Performance Target(s) as

determined by the Committee at the end of the applicable Performance Period, and prorated based on the number of days in the

Performance Period the Participant was employed by the Company or an Affiliate. Notwithstanding anything to the contrary in this

Plan, a Participant who is terminated for Cause will not be eligible to receive any Bonus Payment, regardless of whether such

termination occurs during or after the Performance Period. Any pro-rated Bonus Payment will be paid at the same time as such Bonus

Payment would have been made had the Participant remained employed for the entire Performance Period.

(c)

Adjustments. The Committee is authorized at any time prior to the payment of a Bonus Award, in its discretion and

based on such considerations as it deems appropriate, to adjust the amount otherwise payable to the Participant in connection with such

Bonus Award.

(d)

Effect of a Change in Control. Upon a Change in Control prior to the end of a Performance Period, the Committee shall

have discretion to determine that Performance Targets have been met and to accelerate the timing of a Bonus Payment.

4.

Nontransferability. Participants and beneficiaries shall not have the right to assign, encumber or otherwise anticipate

the payments to be made under the Plan, and the benefits provided hereunder shall not be subject to seizure for payment of any debts or

judgments against any Participant or any beneficiary.

5.

Tax Withholding. In order to comply with all applicable federal, provincial, state or local income tax laws or regulations,

the Company or an Affiliate may take such action as it deems appropriate to ensure that all applicable federal, provincial, state or local

payroll, withholding, income or other taxes, which are the sole and absolute responsibility of a Participant, are withheld or collected

from such Participant.

6.

Amendment. The Committee may amend the Plan prospectively at any time and for any reason deemed sufficient by it without

prior notice to any person affected by the Plan, except that no such amendment may materially impair the rights of any Participant with

respect to an outstanding Bonus Award without the Participant’s consent, unless such amendment is necessary to comply with applicable

law or stock exchange rules.

7.

Miscellaneous.

7.1

Effective Date. October 1, 2024.

7.2

Term of the Plan. The Plan shall continue in existence until terminated by the Committee, which it may do at any

time. No Bonus Award shall be granted after the termination of the Plan; provided, however, that a Bonus Payment with respect to a Performance

Period which begins before such termination may be made thereafter.

7.3

Headings. Headings are given to the sections and subsections of the Plan solely as a convenience to facilitate reference.

Such headings shall not be deemed in any way material or relevant to the construction or interpretation of the Plan or any provision thereof.

7.4 Applicability

to Successors. The Plan shall be binding upon and inure to the benefit of the Company and each Participant, the successors and

assigns of the Company, and the beneficiaries, personal representatives and heirs of each Participant. If the Company becomes a

party to any merger, consolidation or reorganization, the Plan shall remain in full force and effect as an obligation of the Company

or its successors in interest.

7.5

Employment Rights and Other Benefit Programs.

(a)

Neither the Plan nor the grant of a Bonus Award shall give any Participant any right to be retained in the employment of

the Company or any Affiliate. The Plan shall not replace any contract of employment, whether oral or written, between the Company or any

Affiliate and any Participant, but shall be considered a supplement thereto.

(b)

Neither the Plan nor the grant of a Bonus Award shall give any Participant a right to (i) participate in any other compensation

or other employee benefit plan of the Company or an Affiliate, (ii) receive the same employee benefits as any other employee of the Company

or an Affiliate, or (iii) receive any other Bonus Award under this Plan.

(c)

Bonus Payments received by a Participant pursuant to the Plan shall not be deemed a part of the Participant’s regular,

recurring compensation for purposes of the termination, indemnity or severance pay law of any country and shall not be included in, or

have any effect on, the determination of benefits under any other employee benefit plan, contract or similar arrangement provided by the

Company or any Affiliate unless expressly so provided by such plan, contract or arrangement, or unless the Committee expressly determines

that a Bonus Payment or portion of a Bonus Payment should be included to accurately reflect competitive practices or to recognize that

a Bonus Payment has been made in lieu of a portion of competitive cash compensation.

7.6

No Trust or Fund Created. The Plan shall not create or be construed to create a trust or separate fund of any kind

or a fiduciary relationship between the Company or any Affiliate and a Participant or any other person. To the extent that any person

acquires a right to receive payments from the Company or any Affiliate pursuant to the Plan, such right shall be an unfunded and unsecured

promise to pay money in the future, and no Participant shall have any rights that are greater than those of an unsecured general creditor

of the Company or of any Affiliate.

7.7

No Guarantee of Tax Consequences. Neither the Committee nor the Company or any Affiliate provides or has provided

any tax advice to any Participant or any other person or makes or has made any assurance, commitment or guarantee that any federal, provincial,

state, local, or other tax treatment will (or will not) apply or be available to any Participant or other person and assumes no liability

with respect to any tax or associated liabilities to which any Participant or other person may be subject.

7.8

Code Section 409A.

(a)

The Plan is intended to be exempt from Section 409A as a short-term deferral, and shall be administered and interpreted

consistent with such intent.

(b)

To the extent the Plan, Bonus Award or Bonus Payment made hereunder is deemed to be subject to Section 409A, a Bonus Payment

that is payable on account of a termination of employment will be deemed to refer to the Participant’s “separation from service”

within the meaning of Section 409A. If at the time of the Participant’s separation from service, the Participant is a “specified

employee” as defined in Section 409A, any Bonus Payment will be made or provided no earlier than the first day of the seventh month

following such Participant’s separation from service (or upon the Participant’s death, if earlier). In no event will the Company

or Committee be responsible for any tax, penalty, interest or liability that arises as a result of a violation of Section 409A.

7.9

Governing Law. To the extent that federal law does not otherwise control, the validity, construction and effect of

the Plan or any bonus payable under the Plan shall be determined in accordance with the laws of the State of Minnesota, without giving

effect to principles of conflicts of laws that would require the application of the laws of any other jurisdiction.

7.10

Severability. If any provision of the Plan is or becomes or is deemed to be invalid, illegal or unenforceable in

any jurisdiction such provision shall be construed or deemed amended to conform to applicable laws, or if it cannot be so construed or

deemed amended without, in the determination of the Committee, materially altering the purpose or intent of the Plan, such provision shall

be stricken as to such jurisdiction, and the remainder of the Plan shall remain in full force and effect.

7.11

Compensation Recovery Policy. Bonus Awards and any compensation associated therewith, including any Bonus Payment,

may be made subject to forfeiture, recovery by the Company or other action pursuant to the Recoupment Policy or any other compensation

recovery policy adopted by the Board of Directors or Committee at any time, including in response to the requirements of Section 10D of

the Securities Exchange Act of 1934, as amended, and any implementing rules and regulations thereunder, or as otherwise required by law.

The terms of any Bonus Award may be unilaterally amended by the Committee to comply with the Recoupment Policy or any other such compensation

recovery policy.

7

v3.24.2.u1

Cover

|

Aug. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 28, 2024

|

| Entity File Number |

000-16106

|

| Entity Registrant Name |

Clearfield, Inc.

|

| Entity Central Index Key |

0000796505

|

| Entity Tax Identification Number |

41-1347235

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity Address, Address Line One |

7050 Winnetka

Avenue North

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Brooklyn Park

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55428

|

| City Area Code |

(763)

|

| Local Phone Number |

476-6866

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

CLFD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

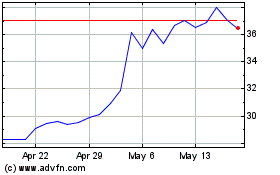

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Nov 2023 to Nov 2024