EU Drops Probe Into Banks on Derivatives

05 December 2015 - 12:00AM

Dow Jones News

European antitrust authorities have dropped a high-profile

investigation into 13 of the world's largest investment banks over

alleged collusion in the lucrative credit-derivatives market.

The European Commission, the bloc's top antitrust regulator, had

charged the banks two years ago with colluding to prevent the

multitrillion-dollar market for credit-default swaps from moving

onto regulated exchanges and away from markets controlled by the

banks.

But in a low-profile statement on Friday, the commission

admitted that the "evidence was not sufficiently conclusive to

confirm the commission's concerns with regards to the 13 investment

banks."

It said the decision was "based on a thorough analysis of all

information received from the parties in their replies and during

the oral hearing of May 2014, as well as on documents obtained

through additional fact finding."

The statement was buried at the bottom of a daily news email

sent out by the EU's executive arm.

Credit-default swaps, the derivatives that act as insurance

against a debt default by a company or a government, were blamed

for accelerating the spread of the financial crisis after the

collapse of Lehman Brothers Inc. in 2008. Before the financial

crisis erupted, trading CDSs were a source of big profits for

financial institutions.

European authorities argued that the banks, including Goldman

Sachs Group Inc., J.P. Morgan Chase & Co., and Deutsche Bank

AG, conspired to prevent trading from moving onto potentially less

risky, more-transparent platforms, where their profits would be

significantly lower.

The banks controlled the data that allowed the market to

function and conducted trades "over the counter," in direct

transactions among one another, in ways that bolstered profits and

prevented other firms from entering the market, European Union

authorities said.

The charges were sent out by the EU's former antitrust chief,

Joaquí n Almunia, in July 2013. At the time, Mr. Almunia said

exchange operators Deutsche Bö rse AG and the CME Group Inc. had

attempted to open the market between 2006 and 2009, but were foiled

by the banks' anticompetitive practices.

The banks charged were Merrill Lynch, now a unit of Bank of

America Corp., Barclays PLC, J.P. Morgan Chase & Co. as well as

the Bear Stearns operation it bought during the crisis, BNP Paribas

SA, Citigroup Inc., Credit Suisse AG, Deutsche Bank, Goldman Sachs,

HSBC Holdings PLC, Morgan Stanley, Royal Bank of Scotland Group PLC

and UBS Group AG. The commission also sent charges to the

International Swaps and Derivatives Association, an industry group

controlled by the banks, and Markit, a data provider owned by the

banks.

In its statement on Friday, the commission said it would

continue to investigate ISDA and Markit. It will also "continue

monitoring the practices of investment banks in financial markets,

including in the credit default swaps sector."

Write to Tom Fairless at tom.fairless@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 04, 2015 07:45 ET (12:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

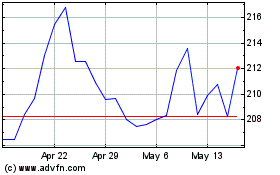

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

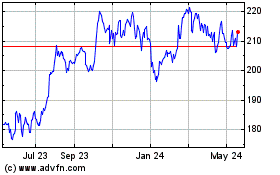

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024