false

0000933136

0000933136

2025-01-09

2025-01-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 10, 2025 (January

9, 2025)

Mr. Cooper Group Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-14667 |

|

91-1653725 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

8950 Cypress Waters Blvd.

Coppell, TX 75019

(Address of Principal Executive Offices, and Zip Code)

(469) 549-2000

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

COOP |

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

On January 9, 2025, Mike Rawls, EVP & Chief Executive Officer of Xome, notified Mr. Cooper

Group Inc. (the “Company”) of his intention to retire from his position at the Company effective June 30, 2025.

The Company also announced that effective immediately, Chris Marshall, former Vice Chairman

and President of the Company, will join Xome to lead its operations in a consulting role. Mr. Marshall will work with Mr. Rawls over the

coming months to ensure a smooth transition.

Mr. Marshall’s initial compensation for his consulting services shall be consistent with

the previously disclosed terms of the consulting agreement attached to the Employment and Transition Agreement, dated October 24, 2023,

between the Company and Mr. Marshall that was filed as Exhibit 10.2 to the Company’s Form 10-Q for the quarterly period ended

September 30, 2023. A description of the material terms of the consulting agreement is also set forth in the Company’s Form 10-Q

for the quarterly period ended September 30, 2023. The Company and Mr. Marshall intend to negotiate additional terms to his consulting

arrangement in consideration of Mr. Marshall’s additional responsibilities leading Xome.

| Item 7.01 | Regulation FD Disclosure. |

In connection with the leadership transition at Xome, the Company issued a press release on

January 9, 2025, a copy of which is attached as Exhibit 99.1 and is incorporated by reference in this Item 7.01.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including

Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that section. The information in this Item 7.01 shall not be incorporated by reference into

any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference

in such filing or document.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

Mr. Cooper Group Inc. |

| |

|

|

| Date: January 10, 2025 |

By: |

|

/s/ Kurt G. Johnson |

| |

|

|

Kurt G. Johnson

EVP & Chief Financial Officer |

Exhibit 99.1

Mr. Cooper Group Announces Leadership

Transition at Xome

Dallas, Texas – (January 9, 2025)

– Mr. Cooper Group Inc. (NASDAQ: COOP) announced today that Mike Rawls, Chief Executive Officer

of Xome®, plans to retire effective June 30, 2025, and Chris Marshall, former Vice Chairman and

President at Mr. Cooper, will join Xome to lead its operations. Rawls and Marshall will work together over the coming months to ensure

a smooth transition.

“Since taking on the role of CEO in 2020, Mike has skillfully led Xome

to become the powerhouse real estate marketplace it is today, with tremendous opportunity for growth as we move into 2025. We are sincerely

grateful for Mike’s thoughtful leadership and innovative spirit over his 25 years with the Mr. Cooper Group team, and we wish him

all the best,” said Jay Bray, Chairman and CEO of Mr. Cooper Group.

As Marshall steps in to lead Xome, he brings with him

decades of experience in financial services, mortgage operations and technology, most recently serving as Vice Chairman and President

of Mr. Cooper. He will work closely with Xome’s leadership team to prioritize market share growth and accelerate new revenue opportunities.

“With Mike’s upcoming retirement,

we are pleased to have Chris Marshall step in to lead Xome as we position the company for continued success. Chris is an industry

expert when it comes to driving revenue growth and building partnerships. In his time at Mr. Cooper, our team realized exponential growth

and greater financial strength, and I am confident that Xome will unlock new avenues for growth and bolster its market position under

Chris’ leadership,” said Bray.

“The Xome team has built an innovative, state-of-the-art

real estate platform and fostered strong relationships with leading industry players, and I am looking forward to helping the team sustain

this momentum as Xome continues to elevate its market position,” said Marshall.

In addition to his new role with Xome, Marshall will

continue in his role as Chairman for Sagent.

About Mr. Cooper Group

Mr. Cooper Group Inc. (NASDAQ: COOP) provides

customer-centric servicing, origination and transaction-based services related principally to single-family residences throughout the

United States with operations under its primary brands: Mr. Cooper®, Xome® and Rushmore Servicing®. Mr. Cooper is the largest

home loan servicer in the country focused on delivering a variety of servicing and lending products, services and technologies. For more

information, visit www.mrcoopergroup.com.

Forward Looking Statements

Any statements in this release that are

not historical or current facts are forward looking statements. Forward looking statements involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance, or achievements to be materially different from any future results,

performance or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described

in the “Risk Factors” section of Mr. Cooper Group’s most recent annual reports and other required documents as filed

with the SEC which are available at the SEC’s website at http://www.sec.gov. Mr. Cooper undertakes

no obligation to publicly update or revise any forward-looking statement contained herein, and the statements made in this press release

are current as of the date of this release only.

Media Inquiries:

MediaRelations@mrcooper.com

Investor Inquiries:

Shareholders@mrcooper.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

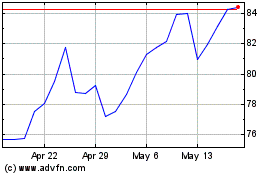

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Dec 2024 to Jan 2025

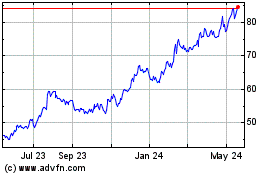

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jan 2024 to Jan 2025