UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of June

2024

Commission File Number: 001-40543

Pop Culture Group Co.,

Ltd

3rd Floor, No. 168 Fengqi Road,

Jimei District, Xiamen

City, Fujian Province

The People’s

Republic of China

(Address of principal

executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Entry into Stock Purchase Agreement in

Respect of Yi Caishen (Xiamen) Trading Co., Ltd.

On May 29, 2024, Pop Culture

Group Co., Ltd, a Cayman Islands company (the “Company”), through its wholly owned subsidiary Pop Culture (HK) Holding Limited,

a private company incorporated under the laws of Hong Kong Special Administrative Region (“Pop Culture HK”), entered into

a stock purchase agreement (the “Stock Purchase Agreement”) with Shaorong Zheng, a current shareholder of Yi Caishen (Xiamen)

Trading Co., Ltd., a limited liability company incorporated in China (the “Target Company”), with respect to the Target Company.

Pursuant to the Stock Purchase

Agreement, Pop Culture HK agreed to acquire 98% of the equity interest in the Target Company (the “Target Equity”) from Shaorong

Zheng. In consideration of the sale of the Target Equity, the Company agreed to issue to Shaorong Zheng 1,000,000 Class A ordinary shares,

par value US$0.01 per share, of the Company with an aggregate value of $1,100,000. The parties agreed to close the transaction within

30 business days after May 29, 2024 or such other date as otherwise agreed by the two parties. The Stock Purchase Agreement contains other

customary obligations and rights of the parties.

The foregoing description

of the Stock Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Stock Purchase Agreement, which is filed as Exhibit 10.1 to this Form 6-K.

The Stock Purchase Agreement

and the transactions contemplated thereby were approved and authorized by the board of directors of the Company on May 29, 2024.

This Form 6-K is hereby incorporated

by reference into the registration statement on Form F-3 of the Company (File Number 333-266130), as amended, and into the base prospectus

and the prospectus supplement outstanding under the foregoing registration statement, to the extent not superseded by documents or reports

subsequently filed or furnished by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as

amended.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Pop Culture Group Co., Ltd |

| |

|

| Date: June 12, 2024 |

By: |

/s/ Zhuoqin Huang |

| |

Name: |

Zhuoqin Huang |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.1

发行股票收购协议

Stock Purchase Agreement

| 甲 方: | Pop Culture (HK) Holding Limited |

| | | |

| | Party A: Pop Culture (HK) Holding Limited |

| Party B: Zheng Shaorong | |

| | | |

| | 签订日期: 2024 年 5 月 29 日 | |

| | Date of signing: 2024 / 5 / 29 | |

发行股票收购协议

Stock Purchase Agreement

甲方:Pop

Culture (HK) Holding Limited

授权代表:黄卓勤

乙方:郑少容

Party A: Pop Culture (HK) Holding Limited

Authorized Representative: Huang Zhuoqin

Party B: Zheng Shaorong

鉴于:

Whereas:

| (1) | 甲方是一家根据香港特别行政区法律注册成立的私营公司。 |

Party A is a private company incorporated

under the laws of Hong Kong Special Administrative Region.

| (2) | 甲方拟以 Pop Culture Group Co. Ltd发行目标股票作为对价购买乙方持有易财神(厦门)贸易有限公司(“目标公司”)的98%股权,乙方同意将其持有的目标公司的98%股权转让给甲方,作为认购Pop

Culture Group Co. Ltd向其发行目标股票之对价。 |

Party A intends to purchase 98% of

the equity interest in Yi Caishen (Xiamen) Trading Co., Ltd. (the “Target Company”), a limited liability company duly incorporated

in China and engaged in the business of leasing, held by Party B as of the Execution Date and Pop Culture Group Co. Ltd shall issue the

CPOP Shares to Party B as Acquisition Consideration for such acquisition, and Party B agrees to sell 98% of the equity interests in the

Target Company to Party A in return for the CPOP Shares issued by Pop Culture Group Co. Ltd to Party B.

在本协议中,甲方和乙方单独称为“一方”,合称为“双方”,因此,双方经友好协商,就本次交易事宜签订本发行股票收购协议(“本协议”)如下。

In this Agreement, Party A and

Party B are individually referred to as the “Party” and collectively referred to as the “Parties”, therefore, the

two parties have entered into this Stock Purchase Agreement (the “Agreement”) as follows through friendly negotiation on the

subject matter of the Transaction.

第1条

释义

Section 1 Interpretation

除非另有说明,以下简称在本协议中的含义如下:

Unless otherwise specified, the following

shall have the following meanings in this Agreement:

“Party A” means the definition

set forth in the Preamble.

“Party B” means the definition

set out in the Preamble.

“Party”, “Parties”

mean the definitions set out in the Preamble.

| 1.4 | “本次交易”

指根据本协议的约定,Pop

Culture Group Co. Ltd向乙方非公开发行目标股票,作为甲方购买乙方持有的目标公司的98%股权之对价。 |

“Transaction” means that

according to the provisions of this Agreement, Pop Culture Group Co. Ltd will issue the CPOP Shares to Party B in a non-public manner

as Acquisition Consideration for the Party A’s acquisition of 98% of the equity of Target Company 98% held by Party B as of the

Execution Date.

“Agreement” means the definition

set out in the Preamble.

| 1.6 | “标的”

指 截至本协议生效日乙方独自持有的目标公司的98%股权。 |

“Target” means 98% equity

interest in Target Company, which is 98% held by Party B as of the as of the Execution Date.

| 1.7 | “收购对价”

指甲方通过Pop Culture Group Co. Ltd间接向乙方支付的收购标的的对价。 |

“Acquisition Consideration”

means the price paid by Party A through Pop Culture Group Co. Ltd to Party B as consideration for the acquisition of the Target.

| 1.8 | “非公开发行”

指Pop Culture Group Co. Ltd按本协议约定的条件和条款向乙方发行目标股票,用于支付甲方收购标的的收购对价的行为。 |

“Non-public offering” refers

to the act of Pop Culture Group Co. Ltd issuing the CPOP Shares to Party B in accordance with the terms and conditions agreed in this

Agreement to pay the Acquisition Consideration for Party A’s acquisition of Target.

| 1.9 | “目标股票”

指Pop Culture Group Co. Ltd根据本协议约定向乙方非公开发行的、每股面值为0.01美元的普通股。 |

“CPOP Shares” means the Class

A ordinary shares of par value of US$0.01 per share in the Capital of Pop Culture Group Co. Ltd to be issued by it to Party B in accordance

with the terms and conditions agreed in this Agreement.

| 1.10 | “目标股票发行价格”

指甲方向乙方非公开发行目标股票的价格,即每股1.1美元。 |

“CPOP Shares Issuance Price”

refers to the price per CPOP Share at which Pop Culture Group Co. Ltd issues the CPOP Shares to Party B on a non-public basis, i.e., US$1.1

per share.

| 1.11 | “交割日”

指生效日后的第三十(30)个工作日或双方另行约定的其他日期。于该日,标的应按照适用法律规定的程序过户至甲方和/或甲方指定甲方子公司名下并完成工商变更登记。 |

“Delivery Date” means the

thirtieth (30th) Business Day after the Execution Date (as defined below) or such other date as otherwise agreed by the Parties. On that

date, the Target shall be transferred to Party A and/or any Party A’s subsidiaries designated by Party A in accordance with the Applicable

Laws and procedures of the People’s Republic of China, and complete the necessary commercial registration.

| 1.12 | “完成日”

指登记机构依法将目标股票转移至乙方名下之日。 |

“Completion Date” refers

to the date on which Pop Culture Group Co. Ltd issues the CPOP Shares through Registrar to Party B in accordance with the Applicable Laws.

| 1.13 | “生效日”

指本协议第9.2条所述的所有生效条件均获满足之日。 |

“Execution Date” means the

date on which all of the conditions for entry into force set forth in section 9.2 of this Agreement are satisfied.

| 1.14 | “过渡期”

指本协议生效日起至完成日之间的期间。 |

“Transition Period” refers

to a period commencing from the Execution Date and conclude upon the Completion Date of this Agreement.

| 1.15 | “美国证监会” 指美国证券交易委员会 (United

States Securities and Exchange Commission)。 |

“SEC” means the United States

Securities and Exchange Commission.

| 1.16 | “登记机构”

指美国证券托管结算公司(Depository

Trust & Clearing Corporation)。 |

“Registrar” means the Depository

Trust & Clearing Corporation.

| 1.17 | “工作日”

指除美国、中国法定节假日和星期六、星期日之外的其他自然日。 |

“Business Day” means any

days other than statutory holidays as well as Saturdays and Sundays in the U.S. and China.

| 1.18 | “组织文件”

对于任何公司而言,指该公司的公司章程、营业执照、批准证书、股东协议,或与此相当的管理或组织文件。 |

“Organizational Documents”

means, for any company, the company’s articles of association, business license, certificate of approval, shareholders’ agreement, or

equivalent management or constitutive document.

| 1.19 | “适用法律”

对于任何人而言,指适用于该人或对该人或其任何财产有约束力的、公开、有效并且适用的法律、法规、决定、命令、地方性法规、自治条例和单行条例、国务院部门规章和地方政府规章以及其他形式的具有法律约束力的规范性文件。 |

“Applicable Law” means, for

any person, the laws, regulations, decisions, orders, local regulations, autonomous regulations and special regulations, departmental

rules of the State Council, local government rules and other forms of legally binding normative documents that are applicable to that

person or that are binding on that person or any of his or her property.

| 1.20 | “有权监管机构”

指对本次交易具有审批、核准权限的国家有关主管部门,包括但不限于美国证监会、美国纳斯达克证券交易所等。 |

“Competent Regulatory Authority”

means the relevant competent authorities of the state that have the authority to approve and approve the Transaction, including but not

limited to the SEC and Nasdaq.

在本协议中,除非上下文另有规定:

“United States” means the

United States of America in this Agreement.

In this Agreement, unless the context

otherwise requires:

| (1) | 凡提及本协议应包括对本协议的修订或补充的文件; |

Any reference to this Agreement shall

include any amendment or supplement to this Agreement;

| (2) | 凡提及条、款、附件是指本协议的条、款和附件; |

References to sections, paragraphs

and annexes are references to the sections, paragraphs and annexes to this Agreement;

| (3) | 本协议的目录和条款的标题仅为查阅方便而设置,不应构成对本协议的任何解释,不对标题之下的内容及其范围有任何限定; |

The table of contents and headings

of the terms and conditions of this Agreement are for convenience only and shall not constitute any interpretation of this Agreement,

and shall not limit the content and scope of the content under the headings;

| (4) | 除另有约定以外,本协议提及的日、天均为自然日。 |

Unless otherwise agreed, the days mentioned

in this Agreement are natural days.

第2条

标的

Section 2 Target

本协议项下的标的为截至本协议生效日乙方单独持有的目标公司的98%股权。

The Target of this Agreement refers

to 98% equity interest in Target Company, which is solely held by Party B as of the Execution Date.

第3条

购买标的

Section 3 Purchase of Target

| 3.1 | 双方同意根据本协议约定的条件和条款,由甲方向乙方收购第二条所述的标的。 |

Both Parties agree that Party A will

acquire the Target mentioned in Section 2 from Party B in accordance with the terms and conditions agreed in this Agreement.

| 3.2 | 双方同意,甲方以Pop

Culture Group Co. Ltd向乙方非公开发行目标股票的方式支付收购对价。 |

Both Parties agree that Pop Culture

Group Co. Ltd will conduct the non-public issuance of CPOP Shares to Party B as the Acquisition Consideration of Party A’s purchase.

第4条

非公开发行目标股票

Section 4 Non-public issuance of

CPOP Shares

| 4.1 | 双方同意,Pop

Culture Group Co. Ltd向乙方非公开发行目标股票,用以支付标的的收购对价。发行的目标股票的数量将按照下述公式确定: |

目标股票数量=标的收购对价/目标股票发行价格

标的收购对价应为110万美元,目标股票数量为100万普通股,每股票面价值为0.01美元。目标股票发行价格如本协议第4.2条所约定。实际发行股数待最终收购对价确定后按本条确定。本协议双方应根据适用法律法规规定承担相应税费,若甲方须依据有关法律法规代扣代缴乙方个人所得税,则甲方有权进行代扣代缴。

Both Parties agree that Pop Culture

Group Co. Ltd will issue the CPOP Shares to Party B on a non-public basis to pay the Acquisition Consideration. The number of CPOP Shares

to be issued will be determined according to the following formula:

Number of CPOP Shares = Acquisition

Consideration / CPOP Shares Issuance Price

The Acquisition Consideration shall

be US$110 million. The number of CPOP Shares to be issued by Pop Culture Group Co. Ltd to Party B shall be 1 million Class A ordinary

shares of par value US$0.01 each in the capital of Pop Culture Group Co. Ltd. The CPOP Shares Issuance Price is as described in Section

4.2. The final number of CPOP Shares remains to be determined in accordance with this Section upon the final determination of Acquisition

Consideration. Both Parties to this Agreement shall bear the corresponding taxes and fees in accordance with the Applicable Laws and regulations,

and if Party A is required to withhold and pay Party B’s individual income tax in accordance with relevant laws and regulations, Party

A shall have the right to withhold and pay it.

| 4.2 | 双方同意,目标股票的发行价格为每股1.1美元,系在双方协商的基础上确定。甲方如在本次交易实施前有派息、送股、资本公积金转增资本等除权除息事项发生,将按照证券交易所的相关规则对目标股票发行价格进行相应调整。 |

双方同意,如发生前述情形,双方将在前述事实发生后的合理时间内另行签订本协议的补充协议,以重新确定目标股票的发行价格,并依据适用法律的规定履行信息披露义务。

Both Parties agree that the CPOP Shares

Issuance Price is US$1.1 per CPOP Share, which is determined on the basis of negotiation between the Parties. If Pop Culture Group Co.

Ltd has dividends, share gifts, capital reserve conversion and other ex-rights and dividends before the implementation of this Transaction,

the CPOP Shares Issuance Price will be adjusted accordingly in accordance with the relevant rules of the stock exchange.

Both Parties agree that in the event

of the foregoing circumstances, the Parties will enter into a supplementary agreement to this Agreement within a reasonable time after

the occurrence of the foregoing facts to re-determine the CPOP Shares Issuance Price and perform the information disclosure obligations

in accordance with the provisions of Applicable Laws.

| 4.3 | 乙方承诺对目标股票锁定6个月,从目标股票上市之日起算。在该锁定期内,乙方将不会以任何方式转让目标股票。 |

Party B promises to lock up the CPOP

Shares for 6 months, counting from the Completion Date. During this lock-up period, Party B will not transfer the CPOP Shares in any way.

第5条

本次交易的实施与完成

Section 5 Implementation and Completion

of the Transaction

| 5.1 | 双方同意于交割日进行交割。乙方应于交割日将标的按照适用法律规定的程序变更登记至甲方或甲方指定甲方子公司名下。甲方于交割日持有标的,合法享有和承担标的所代表的一切权利和义务。 |

The Parties agree to settle the Transaction

on the Delivery Date. Party B shall, on the Delivery Date, change and register the Target to Party A or Party A’s designated subsidiary

in accordance with the procedures prescribed by Applicable Laws of People’s Republic of China. Party A holds the Target on the Delivery

Date and legally enjoys and assumes all the rights and obligations represented by the Target.

| 5.2 | 双方应尽最大努力在交割日之后尽快完成或促使完成非公开发行的相关程序,包括但不限于证券交易所及股票登记机构办理目标股票发行、登记、上市手续、甲方复牌手续及向美国证监会及其派出机构报告和备案等相关手续。本次交易于甲方在股票登记机构办理完毕目标股票登记手续之日完成。 |

Both Parties shall use their best efforts

to complete or facilitate the relevant procedures for the non-public offering and issuance of CPOP Shares to Party B as soon as possible

after the Delivery Date, including but not limited to the issuance of the CPOP Shares by the Registrar, if required by the Nasdaq Listing

Rules, a Listing of Additional Shares Notification Form to Nasdaq in connection with the Transaction contemplated hereby to be submitted

by Pop Culture Group Co. Ltd, and the reporting and filing procedures to the SEC and its affiliated agencies. The Transaction shall be

completed on the Completion Date when Pop Culture Group Co. Ltd completed the registration procedures for the CPOP Shares at the Registrar.

第6条

乙方的声明、保证和承诺

Section 6 Party B’s Representations,

Warranties and Undertakings

乙方于本协议生效日、交割日和完成日均向甲方做出如下声明、保证和承诺:

Party B makes the following representations,

warranties and commitments to Party A on the Execution Date, Delivery Date and Completion Date of this Agreement:

| 6.1 | 目标公司系依法设立且合法存续的法人实体,目标公司成立时已足额缴付认缴的出资; |

The Target Company is a legal entity

established and legally existing in accordance with the law, and the subscribed capital contribution has been paid in full at the time

of its establishment;

| 6.2 | 目标公司无其他负债或可能导致目标公司承担法律责任的事项。如本协议生效后,目标公司因本协议生效日前的未披露事项而受到任何的损失,或因乙方声明、保证和承诺不符合事实给甲方或目标公司造成损失的,乙方应赔偿全部该等损失。 |

The Target Company has no other liabilities

or matters that may give rise to legal liabilities of the Target Company. If after the Execution Date of this Agreement, the Target Company

suffers any losses due to the undisclosed matters before the Execution Date of this Agreement, or causes losses to Party A or the Target

Company due to the non-conformity of Party B’s statements, warranties and commitments, Party B shall compensate for all such losses.

| 6.3 | 乙方签署本协议的签字人为其合法授权人,有权签署本协议。本协议一经签署即对乙方具有约束力;本协议生效后,即对乙方构成可予执行的文件; |

The signatory of this Agreement on

behalf of Party B is legally authorized by Party B and has the right to sign this Agreement. This Agreement shall be binding on Party

B once both Parties sign it. After this Agreement comes into effect, it will constitute an enforceable document for Party B;

| 6.4 | 乙方签署、履行和完成本次交易,除本协议列明的之外,并不需要取得其他任何经济实体或个人的同意,且不违反任何对乙方具有约束力的协议或持有的批准的规定; |

Party B does not need to obtain the

consent of any other economic entity or individual other than as specified in this Agreement, and does not violate any binding agreement

or approval held by Party B to sign, perform and complete this Transaction;

| 6.5 | 乙方签署、履行和完成本次交易,不会违反或导致任何第三人有权终止或修改与其签订的任何重大合同、许可或其他文件,或违反与乙方和/或目标公司有关的任何命令、判决或法庭判令、政府或主管部门颁布的法令; |

Party B’s signing, performance and

completion of this Transaction will not violate or cause any third party to have the right to terminate or modify any material contract,

license or other document signed with Party B, or violate any order, judgment or court order related to Party B and/or the Target Company,

or the decree issued by the government or competent authority;

| 6.6 | 任何人均无权(无论是现在或将来)根据任何选择权或协议(包括转换权及优先购买权)要求发行、转换、分配、出售或转让任何股票或借贷资本,从而获取标的和/或标的之上的利润分配权; |

No person shall have the right (whether

now or in the future) to require the issuance, conversion, distribution, sale or transfer of any shares or borrowed capital under any

option or agreement (including conversion rights and pre-emptive rights) to obtain the right to distribute profits on and/or above the

Target;

| 6.7 | 签署并履行本协议是乙方真实意思表示,在签署本协议之前已认真审阅本协议的各项条款,其不会以本协议显失公平、存在重大误解等理由要求撤销、终止、解除、变更本协议的全部或部分条款、主张本协议全部或部分条款无效; |

Signing and performing this Agreement

is Party B’s true intention, and Party B has carefully reviewed the terms of this Agreement before signing this Agreement, and it will

not require the revocation, termination, rescission, or change of all or part of the terms of this Agreement on the grounds that this

Agreement is obviously unfair, there is a material misunderstanding, etc., and claim that all or part of the terms of this Agreement are

invalid;

| 6.8 | 乙方向甲方以及甲方委托的中介机构提供的与本协议有关的所有文件、资料和信息是真实、准确和有效的,不存在虚假记载、误导性陈述或重大遗漏; |

All documents, materials and information

related to this Agreement provided by it to Party A and the intermediaries entrusted by Party A are true, accurate and valid, and there

are no false records, misleading statements or material omissions;

| 6.9 | 乙方拥有对标的完整处置权,标的不存在任何形式的权利负担,不存在任何第三方权利已导致或将导致对标的拥有任何权利或可能引致标的(股权)被稀释,标的亦不存在任何重大诉讼、仲裁程序,亦无潜在的重大诉讼或仲裁; |

Party B has the right to dispose of

the Target completely, and there is no encumbrance of any form on the Target, and there is no third party right that has caused or will

lead to the ownership of any rights in the Target or may lead to dilution of the Target (equity), and there is no material litigation

or arbitration procedure in the Target, nor is there any potential material litigation or arbitration;

| 6.10 | 乙方将积极签署并准备与本次交易有关的一切必要文件,并与甲方共同向有权监管机构办理本次交易的审批手续;以及 |

Party B will actively sign and prepare

all necessary documents related to this Transaction, and work with Party A to go through the approval procedures for this transaction

with the Competent Regulatory Authorities; and

| 6.11 | 乙方承诺不实施任何违反上述声明、保证和承诺,或者影响本协议效力或有悖本协议目的的行为; |

Party B undertakes the obligation of

not to carry out any act that violates the above representations, warranties and undertakings, or affects the validity of this Agreement

or is contrary to the purpose of this Agreement;

| 6.12 | 目标公司全部资产(包括目标公司名下不动产)不存在任何权利负担,亦不存在任何影响甲方占有与使用情形(包括但不限于存在租约); |

There are no encumbrances on all the

assets of the Target Company (including the immovable property in the name of the Target Company), nor are there any circumstances that

affect the possession and use of Party A (including but not limited to the existence of a lease);

| 6.13 | 乙方将严格按照相关法律法规的要求履行纳税申报义务,若因乙方虚假申报、延迟申报、不申报或其他原因,导致本次交易产生任何额外的税费、罚款或其他法律责任,由乙方自行承担并应确保甲方免遭受任何损失及责任。 |

Party B will strictly comply with the

requirements of relevant laws and regulations to fulfill the tax declaration obligations, if Party B false declaration, late declaration,

non-declaration or other reasons, resulting in any additional taxes, fines or other legal liabilities arising from this Transaction, Party

B shall bear and shall ensure that Party A does not suffer any losses and liabilities.

第7条

甲方的声明、保证和承诺

Section 7 Party A’s Representations,

Warranties and Undertakings

甲方于本协议生效日、交割日和完成日均向乙方做出如下声明、保证和承诺:

On the Execution Date, Delivery Date

and Completion Date of this Agreement, Party A makes the following representations, warranties and undertakings to Party B:

| 7.1 | 拥有签署本协议和履行其项下义务的全部必要组织权力和职权。本协议一经签署即对甲方具有约束力;本协议生效后,即对甲方构成可予执行的文件; |

Party A has all necessary organizational

powers and powers to sign this Agreement and perform its obligations hereunder. This Agreement shall be binding on Party A once both Parties

sign it. After this Agreement comes into effect, it will constitute an enforceable document for Party A;

| 7.2 | 甲方对本协议的签署、交付和履行均不会与以下文件冲突,或者导致对以下文件的违反,或者导致任何义务的终止、撤销或加速履行权利的产生(在每种情况下都指由第三方行使的权利): |

The signing, delivery and performance

of this Agreement will not conflict with, or cause a breach of, or result in the termination, revocation or accelerated performance of

any obligation (in each case a right exercised by a third party) as regulated in:

Party A’s Organizational Documents,

| (2) | 甲方签署的或者对其有约束力的任何合同或政府批准,或者其任何资产是其标的的合同或政府批准,或 |

any contract or governmental approval

signed by or binding on Party A, or any of its assets being the Target of it, or

any Applicable Laws.

甲方也无任何已签署的合同,可能对甲方履行本协议构成重大不利影响;

There is no contract executed by Party

A which may have a material adverse effect on Party A’s performance of this Agreement;

| 7.3 | 签署并履行本协议是甲方真实意思表示,甲方在签署本协议之前已认真审阅本协议的各项条款,其不会以本协议显失公平、存在重大误解等理由要求撤销、终止、解除、变更本协议的全部或部分条款、主张本协议全部或部分条款无效; |

Signing and performing this Agreement

is Party A’s true intention, and Party A has carefully reviewed the terms of this Agreement before signing this Agreement, and will

not request to revoke, terminate, rescind, or change all or part of the provisions of this Agreement on the grounds that this Agreement

is obviously unfair or has a material misunderstanding, or claim that all or part of the provisions of this Agreement is invalid;

| 7.4 | 甲方将积极签署并准备或者积极促成签署、准备与本次交易有关的一切必要文件,并与乙方共同向有关审批部门办理本次交易的审批手续;以及 |

Party A will actively sign and prepare

or facilitate the signature and preparation all necessary documents related to this Transaction, and go through the approval procedures

for this Transaction with the relevant approval department together with Party B; and

| 7.5 | 甲方承诺不实施任何违反上述陈述与保证,或者影响本协议效力或有悖本协议目的的行为。 |

Party A undertakes the obligation of

not to carry out any act that violates the above representations and warranties, or affects the validity of this Agreement or is contrary

to the purpose of this Agreement.

第8条

过渡期

Section 8 Transition Period

| 8.1 | 在过渡期内,为实现业务的平稳过渡,在确有必要的情况下,如任一方在业务的开展过程中需要另一方予以配合(包括但不限于提供相关资料、出具说明、共同向有权监管机构开展申报行为等),则另一方应对此予以积极配合。 |

During the Transition Period, in order

to achieve a smooth transition of business, if it is necessary for either Party to cooperate with the other Party in the course of business

development (including but not limited to providing relevant materials, issuing explanations, jointly reporting to the Competent Regulatory

Authorities, etc.), the other Party shall actively cooperate with such Parties.

| 8.2 | 在过渡期内,若一方拟做出可能影响本次交易进展的行为,应提前书面通知对方,并应取得对方书面同意;若一方发生可能影响本次交易进展的事件,但确实无法提前通知的,应在该事件发生后十(10)个工作日内通知对方。 |

During the Transition Period, if one

Party intends to take any action that may affect the progress of the Transaction, it shall notify the other Party in writing in advance

and obtain the written consent of the other Party. If one Party knows an event that may affect the progress of the Transaction, but it

is indeed impossible to notify the other Party in advance, it shall notify the other arty within ten (10) Business Days after the occurrence

of the event.

第9条

本协议的生效及终止

Section 9 Effectiveness and Termination

of this Agreement

This Agreement shall be established

on the date of duly signed by both Parties.

This Agreement shall come into force

on the date on which all of the following conditions are fulfilled:

The Transaction is approved by the

board of directors of Party A and Party B;

| 9.2.2 | 本次交易涉及的相关事项取得其他有权监管机构的必要批准、核准、同意。 |

The relevant matters involved in this

Transaction have obtained the necessary approvals, approvals and consents of other Competent Regulatory Authorities.

This Agreement may be terminated under

one of the following circumstances:

with the unanimous written consent

of both Parties;

| 9.3.2 | 如果有管辖权的政府部门作出的限制、禁止和废止完成本次交易的永久禁令、法规、规则、规章和命令已属终局的和不可上诉,双方均有权以书面通知方式终止本协议; |

Each Party shall have the right to

terminate this Agreement by written notice if any permanent injunction, statute, rule, regulation or order of a government authority of

competent jurisdiction restricting, prohibiting or annulling the completion of the Transaction is final and non-appealable;

| 9.3.3 | 如果因为任何一方严重违反本协议约定,在守约方向违约方送达书面通知要求违约方对此等违约行为立即采取补救措施之日起三十(30)日内,此等违约行为未获得补救,守约方有权单方以书面通知方式终止本协议。 |

If, due to a serious breach of this

Agreement by either Party, the non-breaching party fails to obtain a remedy for such breach within thirty (30) days from the date on which

the breaching party serves written notice requesting the breaching party to take immediate remedial measures for such breach, the breaching

party shall have the right to unilaterally terminate this Agreement by written notice.

Legal consequences of termination of

this Agreement

| 9.4.1 | 如果本协议根据第9.3.1条和第9.3.2条的约定终止,双方均无需承担任何违约责任; |

If this Agreement is terminated in

accordance with Sections 9.3.1 and 9.3.2, neither Party shall be liable for any breach of contract;

| 9.4.2 | 如果本协议根据第9.3.3条的约定终止,违约方应承担违约责任,并赔偿由此给另一方造成的全部实际损失及费用(包括但不限于诉讼费、律师费、差旅费、保全费、保全保险费等)。 |

If this Agreement is terminated in

accordance with Section 9.3.3, the breaching Party shall be liable for breach of contract and compensate the other Party for all actual

losses and expenses (including but not limited to litigation costs, attorney fees, travel expenses, preservation fees, preservation insurance

premiums, etc.) caused thereby.

第10条

违约责任

Section 10 Liability for breach

of contract

| 10.1 | 如果本协议一方违反其声明、保证、承诺或存在虚假陈述行为,不履行其在本协议项下的任何责任与义务,则构成违约,违约方应当根据另一方的请求继续履行义务、采取补救措施,或给予其全面、及时、充分、有效的赔偿。 |

If a Party to this Agreement breaches

its representations, warranties, undertakings or makes false statements and fails to perform any of its responsibilities and obligations

under this Agreement, it shall constitute a breach of contract, and the breaching Party shall continue to perform its obligations, take

remedial measures, or give it full, timely, adequate and effective compensation at the request of the other Party.

| 10.2 | 非因双方的过错导致本协议无法生效或本次交易不能交割或不能完成的,双方均无须对此承担违约责任。 |

Neither Party shall be held liable

for any breach of contract if the Agreement cannot come into force or the Transaction cannot be delivered or completed is not due to the

fault of either Party.

第11条

本协议的转让、变更、修改、补充

Section 11 Assignment, Modification,

Modification and Supplementation of this Agreement

| 11.1 | 未经另一方事先书面同意,任何一方均不得将本协议或其在本协议项下的任何权利和义务予以转让。 |

Despite otherwise agreed in this Agreement,

neither Party may assign this Agreement or any of its rights and obligations under this Agreement without the prior written consent of

the other Party.

| 11.2 | 本协议可根据本次交易方案的调整和变化作出变更、修改和补充。 |

This Agreement may be changed, modified

and supplemented according to the adjustment and changes of the Transaction.

| 11.3 | 本协议的变更、修改、补充应经双方协商一致并以书面形式作出,但变更、修改后的协议或补充协议应取得各自内部有权机构的同意并获得有权监管机构的必要同意(如需)。 |

Any changes, modifications and supplements

to this Agreement shall be made in writing by mutual agreement between the Parties, but the altered or modified agreements or supplemental

agreements shall be subject to the consent of the respective internal authorities and the necessary consents of the Competent Regulatory

Authorities (if necessary).

第12条

完整协议

Section 12 Entire Agreement

本协议系双方之间截至本协议签署之日关于本次交易相关事宜的完整的协议,任何在本协议成立之前双方达成的有关建议、陈述、保证、协议或承诺如与本协议存在矛盾,则双方均应以本协议约定为准。

This Agreement is the entire agreement

between the Parties on matters related to this Transaction as of the date of signing this Agreement, and any relevant suggestions, representations,

warranties, agreements or commitments reached by the Parties before the conclusion of this Agreement shall be subject to the provisions

of this Agreement in the event of any contradiction between the two Parties and this Agreement.

第13条

可分割性

Section 13 Severability

如果本协议中任何规定被判定为不合法、无效、或不具有可强制执行性,则双方同意该项规定应当在可行的最大限度内予以强制执行,以实现双方的意图,且本协议所有其他规定的有效性、合法性和可强制执行力均不受到任何损害。如为实现双方原有意图之必须,双方将以诚信协商修订本协议,以尽可能贴近前述原有意图且能够强制执行的文字来取代不可强制执行的文字。

If any provision of this Agreement

is held to be unlawful, void, or unenforceable, the Parties agree that such provision shall be enforced to the fullest extent practicable

to effect the intent of the Parties, and the validity, legality, and enforceability of all other provisions of this Agreement shall not

be impaired in any way. If it is necessary to achieve the original intent of the Parties, the Parties will negotiate in good faith to

amend this Agreement and replace the unenforceable language with the unenforceable language that is as close as possible to the aforesaid

original intent and enforceable.

第14条

不可抗力

Section 14 Force Majeure

| 14.1 | 不可抗力是指双方或者一方不可预见、不可避免并不可克服的客观事件,包括但不限于战争、地震、洪水、火灾、战争、罢工等。如果一方因不可抗力事件而不能履行其任何义务,因不可抗力事件而不能履行的本协议项下义务的履行时间应予延长,延长的时间等于不可抗力事件所导致的延误时间。声称遭遇不可抗力事件而不能履行义务的一方应采取适当措施减少或消除不可抗力事件的影响,并应努力在尽可能短的时间内恢复履行受不可抗力事件影响的义务。如有不可抗力事件发生,任何一方均无须对因不可抗力事件无法或延迟履行义务而使另一方遭受的任何损害、费用增加或损失承担责任。 |

Force majeure refers to unforeseeable,

unavoidable and insurmountable objective events of both Parties or either Party, including but not limited to war, earthquake, flood,

fire, war, strike, etc. (“Force Majeure Event”). If a Party is unable to perform any of its obligations due to a Force Majeure

Event, the time for performance of its obligations under this Agreement that is unable to be performed as a result of the Force Majeure

Event shall be extended for an extended period equal to the delay caused by the Force Majeure Event. The Party claiming to have encountered

Force Majeure Event and is unable to perform its obligations shall take appropriate measures to reduce or eliminate the effects of the

Force Majeure Event and shall endeavor to resume performance of its obligations affected by the Force Majeure Event in the shortest possible

time. In the event of a Force Majeure Event, neither Party shall be liable for any damages, increased expenses or losses suffered by the

other Party as a result of the inability or delay in performance of its obligations due to the Force Majeure Event.

| 14.2 | 受不可抗力事件影响的一方应在不可抗力事件发生后的5个工作日内通知另一方并提供其所能得到的证据。如因不可抗力事件导致本协议无法履行达10 日,则本协议任何一方有权以书面通知的方式终止本协议。 |

The Party affected by the Force Majeure

Event shall notify the other Party and provide the evidence available to it within 5 Business Days after the occurrence of the Force Majeure

Event. If the performance of this Agreement cannot be performed for 10 days due to a Force Majeure Event, either Party to this Agreement

shall have the right to terminate this Agreement by written notice.

| 14.3 | 在发生不可抗力事件期间,除因不可抗力事件导致不能履行的方面外,双方应在其他各个方面继续履行本协议。 |

During the occurrence of a Force Majeure

Event, the Parties shall continue to perform this Agreement in all respects, except for those aspects that cannot be performed due to

the Force Majeure Event.

第15条

法律适用及争议解决

Section 15 Governing Law and Dispute

Resolution

| 15.1 | 本协议的制定、解释及其在执行过程中出现的、或与本协议有关的纠纷之解决,受中华人民共和国现行有效的法律的约束。 |

The formulation and interpretation

of this Agreement and the resolution of disputes arising in the course of its implementation or in connection with this Agreement shall

be governed by the laws currently in force in the People’s Republic of China.

| 15.2 | 因本合同引起的或与本合同有关的任何争议,由合同各方协商解决,也可由有关部门调解。协商或调解不成的,可依法向本协议签订地有管辖权的人民法院起诉。 |

Any dispute arising out of or in connection

with this Agreement shall be settled by the Parties through negotiation or mediation by the relevant authorities. If the negotiation or

mediation fails, the lawsuit may be filed with the people’s court with jurisdiction in the place where this Agreement is signed in accordance

with the law.

第16条

通知

Section 16 Notifications

| 16.1 | 本协议规定任何一方向另一方发出的所有通知或书面通讯应以传真或速递服务公司递交,迅速传送或发送至另一方,同时以传真或电子邮件方式及电话通知方式送达和通告另一方。 |

This Agreement provides that all notices

or written communications given by either Party to the other Party shall be delivered by facsimile, E-mail or courier service and promptly

transmitted or sent to the other Party, and shall be served and notified to the other Party by facsimile or electronic mail and telephone

notice.

| 16.2 | 根据本协议发出的通知或通讯,除非另有证据证明其于更早日期送达,如以速递服务公司递交的信件发出,信件交给速递服务公司后5个工作日应视为送达日期;如以电子邮件或传真发出,则在电子邮件或传真发送后3个工作日 为送达日期。 |

Unless otherwise proved to have been

delivered on an earlier date, unless otherwise proved to have been delivered on an earlier date, 5 Business Days after the letter is delivered

to the courier service company, the date of delivery shall be deemed to be 5 Business Days after the letter is delivered to the courier

service company; If sent by E-mail or fax, the date of delivery shall be 3 Business Days after the E-mail or fax has been sent.

第17条

保密

Section 17 Confidentiality

| 17.1 | 除非本协议另有规定,双方应尽最大努力,对其因履行本协议取得的所有有关另一方的各种形式的商业信息、资料或文件内容等保密,包括本协议的任何内容及双方可能有的其他合作事项等。任何一方应限制其雇员、代理人等仅在为履行本协议义务所必需时方可获得上述信息。 |

Unless otherwise specified in this

Agreement, both Parties shall use their best efforts to keep confidential all forms of business information, materials or documents related

to the other Party obtained by them as a result of the performance of this Agreement, including any content of this Agreement and other

cooperation matters that the two Parties may have. Either Party shall restrict its employees, agents, etc. from having access to such

information only as necessary to perform its obligations under this Agreement.

The limitations in Section 17.1 shall

not apply to:

| 17.2.1 | 在接收方获得信息时已成为公众一般可取得的资料和信息 |

material and information that is generally

available to the public at the time the information is available to the recipient;

| 17.2.2 | 接收方可以证明在获得信息前其已经掌握,并且不是从另一方直接或间接取得的资料; |

the receiving party can demonstrate

that it was in possession of the information before it was obtained and that it did not obtain it directly or indirectly from the other

party;

| 17.2.3 | 任何一方依照法律、法规或规范性文件要求,有义务向有关政府部门或有关的证券交易所提供,或任何一方因其正常经营所需,向其聘请的中介机构提供上述保密信息; |

Either Party is obliged to provide

the above confidential information to the relevant government departments or relevant stock exchanges in accordance with the requirements

of laws, regulations or normative documents, or to the intermediaries hired by either Party for its normal business needs;

| 17.2.4 | 任何一方向其银行及/或其他提供融资的机构在进行正常业务的情况下所提供的相关信息。 |

Relevant information provided by either

Party to its banks and/or other institutions providing financing in the ordinary course of business.

| 17.3 | 双方应促使各自董事、高级管理人员和其他雇员以及其关联公司的董事、高级管理人员和其他雇员以及各自聘请的中介机构遵守本条所规定的保密义务。 |

The Parties shall procure that their

respective directors, officers and other employees, as well as the directors, officers and other employees of their affiliates and the

intermediaries engaged by them, comply with the confidentiality obligations set out in this Section.

| 17.4 | 本协议无论因何原因终止,本条约定均继续有效。 |

This Agreement shall survive any termination

for any reason.

第18条

其他

Section 18 Miscellaneous

| 18.1 | 放弃。如果任何一方放弃追究另一方对本协议项下任何责任或义务的违约,则应当由放弃追究的一方以书面方式做出并签署,且该项放弃不应被视为放弃追究另一方今后在本协议项下的其他违约行为。 |

Waiver. If either Party waives any

breach of any liability or obligation of the other Party under this Agreement, it shall be in writing and signed by the Party waiving

it, and such waiver shall not be deemed a waiver of the other Party’s other future breach under this Agreement.

| 18.2 | 本协议一式二份,协议各方各执一份。各份协议文本具有同等法律效力。 |

This Agreement shall be executed in

duplicate, one copy by each of the Parties. Each copy shall have the same legal effect.

| 18.3 | 本协议由中文和英文两个版本组成,中文版本和英文版本内容不一致的,以中文版本为准。 |

This Agreement is made in both Chinese

and English; in case of any conflicts between these two versions, the Chinese version shall prevail.

(以下无正文)

(No text below)

签署时间:2024年5月29日

Date of signing: 2024/5/29

签署地点:厦门市思明区

Place of signing: Siming District,

Xiamen City

甲方:

授权代表签字:/s/

Huang Zhuoqin

Party A:

Signature of the Authorized Representative:______________

乙方

签字:/s/

Zheng Shaorong

Party B:

Signature:

17

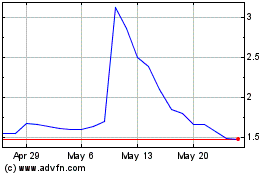

Pop Culture (NASDAQ:CPOP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pop Culture (NASDAQ:CPOP)

Historical Stock Chart

From Dec 2023 to Dec 2024