Broad-based Contributions Drive Strong Revenue

and Profit Growth

Company Increases Quarterly Dividend by 17%

Charles River Associates (NASDAQ: CRAI), a worldwide leader in

providing economic, financial and management consulting services,

today announced financial results for the fiscal third quarter

ended September 28, 2024.

“Continued momentum in the business and demand for our services

drove CRA’s quarterly revenue to $167.7 million, representing 13.7%

year-over-year growth and the highest third-quarter revenue in the

Company’s history,” said Paul Maleh, CRA’s President and Chief

Executive Officer. “Our performance was broad based, with seven of

eleven practices growing revenue year over year. Five

practices—Antitrust & Competition Economics, Energy, Financial

Economics, Intellectual Property, and Risk, Investigations &

Analytics—each grew by more than 10% year over year. At the same

time, our North American operations continued its strong

performance by expanding revenue 16.4% year over year. We continue

to effectively manage the business, converting CRA’s top-line

performance into strong profitability that grew at rates faster

than revenue. In fact, this performance represents the highest

third-quarter profitability in the Company’s history as measured by

net income, earnings per share, and EBITDA.”

Highlights for Third Quarter Fiscal 2024

- Revenue grew 13.7% year over year to $167.7 million.

- Utilization was 76% and quarter-end headcount decreased 3.6%

year over year.

- Net income increased 33.1% year over year to $11.4 million, or

6.8% of revenue, compared with $8.6 million, or 5.8% of revenue, in

the third quarter of fiscal 2023; non-GAAP net income increased

51.0% year over year to $12.1 million, or 7.2% of revenue, compared

with $8.0 million, or 5.4% of revenue, in the third quarter of

fiscal 2023.

- Earnings per diluted share increased 38.0% year over year to

$1.67 from $1.21 in the third quarter of fiscal 2023; non-GAAP

earnings per diluted share increased 56.6% year over year to $1.77

from $1.13 in the third quarter of fiscal 2023.

- Non-GAAP EBITDA increased 54.8% to $21.3 million, or 12.7% of

revenue, compared with $13.8 million, or 9.3% of revenue, in the

third quarter of fiscal 2023.

- On a constant currency basis relative to the third quarter of

fiscal 2023, revenue, GAAP net income, and earnings per diluted

share would have been lower by $0.5 million, $0.1 million, and

$0.02 per diluted share, respectively. Non-GAAP net income,

earnings per diluted share, and non-GAAP EBITDA would have been

lower by $0.1 million, $0.02, per diluted share and $0.2 million,

respectively.

- CRA returned $2.9 million of capital to its shareholders via

quarterly dividend payments.

Management Commentary and Financial Guidance

“Through the first three quarters of fiscal 2024, on a constant

currency basis relative to fiscal 2023, CRA generated total revenue

of $509.4 million and non-GAAP EBITDA of $65.6 million, achieving a

margin of 12.9%,” continued Maleh. “Reflecting the continued

strength and quality of our business, we are reaffirming our

revenue and profit guidance. For full-year fiscal 2024, on a

constant currency basis relative to fiscal 2023, we expect revenue

in the range of $670.0 million to $685.0 million and non-GAAP

EBITDA margin in the range of 12.2% to 13.0%. We remain confident

in CRA’s overall competitive position, which is reflected in our

decision to raise our quarterly cash dividend by 17%, but we are

mindful that macroeconomic headwinds and geopolitical conditions

can affect our business.”

CRA does not provide reconciliations of its annual non-GAAP

EBITDA margin guidance to GAAP net income margin because the

Company is unable to estimate with reasonable certainty and without

unreasonable effort: (A) unusual gains or charges, foreign currency

exchange rates and the resulting effect of these items on CRA’s

taxes and (B) the impact of equity awards on CRA’s taxes. These

items are uncertain, depend on various factors, and may have a

material effect on CRA’s results computed in accordance with GAAP.

A reconciliation between the historical GAAP and non-GAAP financial

measures presented in this release is provided in the financial

tables at the end of this release.

Quarterly Dividend

On October 31, 2024, CRA announced that it increased its

quarterly cash dividend by 17% from $0.42 to $0.49 per common

share. The dividend will be payable on December 13, 2024 to

shareholders of record as of November 26, 2024. CRA expects to

continue paying quarterly dividends, the declaration, timing and

amounts of which remain subject to the discretion of CRA’s Board of

Directors.

Conference Call Information and Prepared CFO Remarks

CRA will host a conference call today at 10:00 a.m. ET to

discuss its third-quarter 2024 financial results. To listen to the

live call, please visit the “Investor Relations” section of CRA’s

website at www.crai.com, or dial (877) 709-8155 or (201) 689-8881.

An archived version of the webcast will be available on CRA’s

website for one year.

In combination with this press release, CRA has posted prepared

remarks by its CFO, Dan Mahoney, under “Quarterly Earnings” in the

“Investor Relations” section on CRA’s website at www.crai.com.

These remarks are offered to provide the investment community with

additional background on CRA’s financial results prior to the start

of the conference call.

About Charles River Associates (CRA)

Charles River Associates® is a leading global consulting firm

specializing in economic, financial, and management consulting

services. CRA advises clients on economic and financial matters

pertaining to litigation and regulatory proceedings, and guides

corporations through critical business strategy and

performance-related issues. Since 1965, clients have engaged CRA

for its unique combination of functional expertise and industry

knowledge, and for its objective solutions to complex problems.

Headquartered in Boston, CRA has offices throughout the world.

Detailed information about Charles River Associates, a registered

trade name of CRA International, Inc., is available at

www.crai.com. Follow us on LinkedIn, Instagram, and Facebook.

NON-GAAP FINANCIAL MEASURES

In this release, CRA has supplemented the presentation of its

financial results calculated in accordance with U.S. generally

accepted accounting principles or “GAAP” with the following

financial measures that are not calculated in accordance with GAAP:

non-GAAP net income, non-GAAP earnings per diluted share and

non-GAAP EBITDA. CRA believes that the non-GAAP financial measures

described in this press release are important to management and

investors because these measures supplement the understanding of

CRA’s ongoing operating results and financial condition. In

addition, these non-GAAP measures are used by CRA in its budgeting

process, and the non-GAAP adjustments are made to the performance

measures for some of CRA’s performance-based compensation.

As used herein, CRA defines non-GAAP EBITDA as net income before

interest expense (net), provision for income taxes, and

depreciation and amortization further adjusted for the impact of

certain items that we do not consider indicative of our core

operating performance, such as non-cash amounts relating to

valuation changes in contingent consideration, acquisition-related

costs, foreign currency (gains) losses, net, restructuring costs

and related tax effects. Non-GAAP net income and non-GAAP earnings

per diluted share also exclude non-cash amounts relating to

valuation changes in contingent consideration, acquisition-related

costs, foreign currency (gains) losses, net, restructuring costs

and related tax effects. This release also presents certain current

fiscal period financial measures on a “constant currency” basis in

order to isolate the effect that foreign currency exchange rate

fluctuations can have on CRA’s financial results. These constant

currency measures are determined by recalculating the current

fiscal period local currency financial measure using the specified

corresponding prior fiscal period’s foreign exchange rates. On a

constant currency basis for the fiscal year-to-date period ended

September 28, 2024 relative to the fiscal year-to-date period ended

September 30, 2023, revenue and non-GAAP EBITDA would have been

lower by $1.6 million and $0.4 million, respectively.

All of the non-GAAP financial measures referred to above should

be considered in conjunction with, and not as a substitute for, the

GAAP financial information presented in this release. EBITDA and

the financial measures identified in this release as “non-GAAP” are

reconciled to their GAAP comparable measures in the financial

tables appended to the end of this press release. In evaluating

these non-GAAP financial measures, note that the non-GAAP financial

measures used by CRA may be calculated differently from, and

therefore may not be comparable to, similarly titled measures used

by other companies.

SAFE HARBOR STATEMENT

Statements in this press release concerning our future business,

operating results and financial condition, including those

concerning guidance on future revenue and non-GAAP EBITDA margin,

the impact of exchange rate fluctuations on our financial results,

our expectations regarding continued growth, our expectations

regarding the payment of any future quarterly dividends and the

level and extent of any purchases under our expanded share

repurchase program, and statements using the terms “outlook,”

“expect,” or similar expressions, are “forward-looking” statements

as defined in Section 21 of the Exchange Act. These statements are

based upon our current expectations and various underlying

assumptions. Although we believe there is a reasonable basis for

these statements and assumptions, and these statements are

expressed in good faith, these statements are subject to a number

of additional factors and uncertainties. Our actual revenue and

non-GAAP EBITDA margin in fiscal 2024 on a constant currency basis

relative to fiscal 2023 could differ materially from the guidance

presented herein, and our actual performance and results may differ

materially from the performance and results contained in or implied

by the forward-looking statements made herein, due to many

important factors. These factors include, but are not limited to,

the possibility that the demand for our services may decline as a

result of changes in general and industry specific economic

conditions; the timing of engagements for our services; the effects

of competitive services and pricing; our ability to attract and

retain key employee or non-employee experts; the inability to

integrate and utilize existing consultants and personnel; the

decline or reduction in project work or activity; global economic

conditions including less stable political and economic

environments; foreign currency exchange rate fluctuations;

unanticipated expenses and liabilities; risks inherent in

international operations; changes in tax law or accounting

standards, rules, and regulations; our ability to collect on

forgivable loans should any become due; and professional and other

legal liability or settlements. Additional risks and uncertainties

are discussed in our periodic filings with the Securities and

Exchange Commission under the heading “Risk Factors.” The inclusion

of such forward-looking information should not be regarded as our

representation that the future events, plans, or expectations

contemplated will be achieved. Except as may be required by law, we

undertake no obligation to update any forward-looking statements

after the date of this press release, and we do not intend to do

so.

CRA INTERNATIONAL, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

FOR THE FISCAL QUARTERS AND

FISCAL YEAR-TO-DATE PERIODS ENDED

SEPTEMBER 28, 2024 COMPARED TO

SEPTEMBER 30, 2023

(IN THOUSANDS, EXCEPT PER

SHARE DATA)

Fiscal Quarter Ended Fiscal Year-to-Date Period

Ended September 28,2024 As a % ofRevenue

September 30,2023 As a % ofRevenue September

28,2024 As a % ofRevenue September 30,2023 As

a % ofRevenue Revenues

$

167,748

100.0

%

$

147,553

100.0

%

$

510,979

100.0

%

$

462,363

100.0

%

Costs of services (exclusive of depreciation and amortization)

115,188

68.7

%

105,894

71.8

%

359,394

70.3

%

327,064

70.7

%

Selling, general and administrative expenses

31,269

18.6

%

27,919

18.9

%

93,784

18.4

%

86,137

18.6

%

Depreciation and amortization

2,900

1.7

%

2,947

2.0

%

8,503

1.7

%

8,762

2.0

%

Income from operations

18,391

11.0

%

10,793

7.3

%

49,298

9.6

%

40,400

8.7

%

Interest expense, net

(1,457

)

-0.9

%

(1,025

)

-0.7

%

(3,405

)

-0.7

%

(3,212

)

-0.7

%

Foreign currency gains (losses), net

(904

)

-0.5

%

755

0.5

%

(1,236

)

-0.2

%

(459

)

-0.1

%

Income before provision for income taxes

16,030

9.6

%

10,523

7.1

%

44,657

8.7

%

36,729

7.9

%

Provision for income taxes

4,593

2.7

%

1,927

1.3

%

12,991

2.5

%

9,707

2.1

%

Net income

$

11,437

6.8

%

$

8,596

5.8

%

$

31,666

6.2

%

$

27,022

5.8

%

Net income per share: Basic

$

1.68

$

1.22

$

4.62

$

3.83

Diluted

$

1.67

$

1.21

$

4.57

$

3.78

Weighted average number of shares outstanding: Basic

6,760

6,977

6,840

7,026

Diluted

6,843

7,083

6,922

7,138

CRA INTERNATIONAL,

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

FOR THE FISCAL QUARTERS AND

FISCAL YEAR-TO-DATE PERIODS ENDED

SEPTEMBER 28, 2024 COMPARED TO

SEPTEMBER 30, 2023

(IN THOUSANDS, EXCEPT PER

SHARE DATA)

Fiscal Quarter Ended Fiscal Year-to-Date Period

Ended September 28,2024 As a % ofRevenue

September 30,2023 As a % ofRevenue September

28,2024 As a % ofRevenue September 30,2023 As

a % ofRevenue Revenues

$

167,748

100.0

%

$

147,553

100.0

%

$

510,979

100.0

%

$

462,363

100.0

%

Net income

$

11,437

6.8

%

$

8,596

5.8

%

$

31,666

6.2

%

$

27,022

5.8

%

Adjustments needed to reconcile GAAP net income to non-GAAP net

income: Non-cash valuation change in contingent consideration

-

-

%

16

-

%

-

-

%

52

-

%

Restructuring (1)

-

-

%

-

-

%

8,176

1.6

%

-

-

%

Acquisition-related costs

-

-

%

-

-

%

-

-

%

22

-

%

Foreign currency (gains) losses, net

904

0.5

%

(755

)

-0.5

%

1,236

0.2

%

459

0.1

%

Tax effect on adjustments

(227

)

-0.1

%

166

0.1

%

(2,467

)

-0.5

%

(138

)

-

%

Non-GAAP net income

$

12,114

7.2

%

$

8,023

5.4

%

$

38,611

7.6

%

$

27,417

5.9

%

Non-GAAP net income per share: Basic

$

1.78

$

1.14

$

5.63

$

3.89

Diluted

$

1.77

$

1.13

$

5.57

$

3.83

Weighted average number of shares outstanding: Basic

6,760

6,977

6,840

7,026

Diluted

6,843

7,083

6,922

7,138

(1) Includes cash severance of $2.5M and non-cash charges of

$5.7M associated with portfolio optimization actions.

CRA INTERNATIONAL,

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

FOR THE FISCAL QUARTERS AND

FISCAL YEAR-TO-DATE PERIODS ENDED

SEPTEMBER 28, 2024 COMPARED TO

SEPTEMBER 30, 2023

(IN THOUSANDS)

Fiscal Quarter Ended Fiscal Year-to-Date Period

Ended September 28,2024 As a % ofRevenue

September 30,2023 As a % ofRevenue September

28,2024 As a % ofRevenue September 30,2023 As

a % ofRevenue Revenues

$

167,748

100.0

%

$

147,553

100.0

%

$

510,979

100.0

%

$

462,363

100.0

%

Net income

$

11,437

6.8

%

$

8,596

5.8

%

$

31,666

6.2

%

$

27,022

5.8

%

Adjustments needed to reconcile GAAP net income to non-GAAP net

income: Non-cash valuation change in contingent consideration

-

-

%

16

-

%

-

-

%

52

-

%

Restructuring (1)

-

-

%

-

-

%

8,176

1.6

%

-

-

%

Acquisition-related costs

-

-

%

-

-

%

-

-

%

22

-

%

Foreign currency (gains) losses, net

904

0.5

%

(755

)

-0.5

%

1,236

0.2

%

459

0.1

%

Tax effect on adjustments

(227

)

-0.1

%

166

0.1

%

(2,467

)

-0.5

%

(138

)

-

%

Non-GAAP net income

$

12,114

7.2

%

$

8,023

5.4

%

$

38,611

7.6

%

$

27,417

5.9

%

Adjustments needed to reconcile non-GAAP net income to non-GAAP

EBITDA: Interest expense, net

1,457

0.9

%

1,025

0.7

%

3,405

0.7

%

3,212

0.7

%

Provision for income taxes

4,820

2.9

%

1,761

1.2

%

15,458

3.0

%

9,845

2.1

%

Depreciation and amortization

2,900

1.7

%

2,947

2.0

%

8,503

1.7

%

8,762

2.0

%

Non-GAAP EBITDA

$

21,291

12.7

%

$

13,756

9.3

%

$

65,977

12.9

%

$

49,236

10.6

%

(1) Includes cash severance of $2.5M and non-cash charges of

$5.7M associated with portfolio optimization actions.

CRA

INTERNATIONAL, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (IN THOUSANDS) September 28,2024

December 30,2023 Assets Cash and cash

equivalents

$

24,481

$

45,586

Accounts receivable and unbilled services, net

232,855

199,556

Other current assets

28,204

20,334

Total current assets

285,540

265,476

Property and equipment, net

38,496

38,176

Goodwill and intangible assets, net

102,176

101,185

Right-of-use assets

87,032

86,887

Other assets

69,099

61,487

Total assets

$

582,343

$

553,211

Liabilities and Shareholders’ Equity Accounts payable

$

28,430

$

28,701

Accrued expenses

146,284

171,040

Current portion of lease liabilities

18,626

16,475

Revolving line of credit

60,000

-

Other current liabilities

14,917

19,871

Total current liabilities

268,257

236,087

Non-current portion of lease liabilities

89,412

92,280

Other non-current liabilities

20,161

12,743

Total liabilities

377,830

341,110

Total shareholders’ equity

204,513

212,101

Total liabilities and shareholders’ equity

$

582,343

$

553,211

CRA INTERNATIONAL, INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (IN THOUSANDS) Fiscal

Year-to-Date Period Ended September 28,2024 September

30,2023 Operating activities: Net income

$

31,666

$

27,022

Adjustments to reconcile net income to net cash used in

operating activities: Non-cash items, net

24,425

21,542

Accounts receivable and unbilled services

(32,321

)

1,559

Working capital items, net

(53,459

)

(50,150

)

Net cash used in operating activities

(29,689

)

(27

)

Investing activities: Purchases of property and equipment,

net

(6,032

)

(2,008

)

Consideration paid for acquisition, net

(1,500

)

(577

)

Net cash used in investing activities

(7,532

)

(2,585

)

Financing activities: Borrowings under revolving line of

credit

95,000

105,000

Repayments under revolving line of credit

(35,000

)

(73,000

)

Tax withholding payments reimbursed by shares

(2,030

)

(2,040

)

Cash dividends paid

(8,850

)

(7,773

)

Repurchase of common stock

(33,348

)

(23,577

)

Net cash provided by (used in) financing activities

15,772

(1,390

)

Effect of foreign exchange rates on cash and cash

equivalents

344

159

Net decrease in cash and cash equivalents

(21,105

)

(3,843

)

Cash and cash equivalents at beginning of period

45,586

31,447

Cash and cash equivalents at end of period

$

24,481

$

27,604

Noncash investing and financing activities: Increase

(decrease) in accounts payable and accrued expenses for property

and equipment

$

1,228

$

(129

)

Asset retirement obligations

$

191

$

-

Excise tax on share repurchases

$

(284

)

$

(190

)

Right-of-use assets obtained in exchange for lease obligations

$

10,627

$

2,503

Supplemental cash flow information: Cash paid for taxes

$

17,085

$

9,953

Cash paid for interest

$

3,086

$

2,904

Cash paid for amounts included in operating lease liabilities

$

15,008

$

16,660

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031165212/en/

Dan Mahoney Chief Financial Officer Charles River Associates

617-425-3505

Nicholas Manganaro Sharon Merrill Advisors

crai@investorrelations.com 617-542-5300

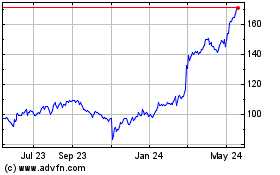

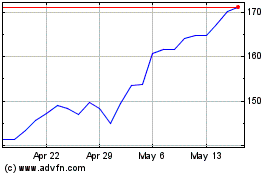

CRA (NASDAQ:CRAI)

Historical Stock Chart

From Nov 2024 to Dec 2024

CRA (NASDAQ:CRAI)

Historical Stock Chart

From Dec 2023 to Dec 2024