true000157642712/312024Q3falsehttp://fasb.org/us-gaap/2024#OperatingExpensesP3YP3YP2Yxbrli:sharesiso4217:USDiso4217:EURxbrli:sharesiso4217:USDxbrli:sharescrto:segmentxbrli:pureiso4217:EURcrto:daycrto:tranchecrto:market00015764272024-01-012024-09-300001576427crto:AmericanDepositarySharesMember2024-01-012024-09-300001576427us-gaap:CommonStockMember2024-01-012024-09-3000015764272024-10-2500015764272024-09-3000015764272023-12-3100015764272024-07-012024-09-3000015764272023-07-012023-09-3000015764272023-01-012023-09-300001576427us-gaap:CommonStockMember2022-12-310001576427us-gaap:TreasuryStockCommonMember2022-12-310001576427us-gaap:AdditionalPaidInCapitalMember2022-12-310001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001576427us-gaap:RetainedEarningsMember2022-12-310001576427us-gaap:ParentMember2022-12-310001576427us-gaap:NoncontrollingInterestMember2022-12-3100015764272022-12-310001576427us-gaap:RetainedEarningsMember2023-01-012023-03-310001576427us-gaap:ParentMember2023-01-012023-03-310001576427us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100015764272023-01-012023-03-310001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001576427us-gaap:CommonStockMember2023-01-012023-03-310001576427us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001576427us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001576427us-gaap:CommonStockMember2023-03-310001576427us-gaap:TreasuryStockCommonMember2023-03-310001576427us-gaap:AdditionalPaidInCapitalMember2023-03-310001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001576427us-gaap:RetainedEarningsMember2023-03-310001576427us-gaap:ParentMember2023-03-310001576427us-gaap:NoncontrollingInterestMember2023-03-3100015764272023-03-310001576427us-gaap:RetainedEarningsMember2023-04-012023-06-300001576427us-gaap:ParentMember2023-04-012023-06-300001576427us-gaap:NoncontrollingInterestMember2023-04-012023-06-3000015764272023-04-012023-06-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001576427us-gaap:CommonStockMember2023-04-012023-06-300001576427us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001576427us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001576427us-gaap:CommonStockMember2023-06-300001576427us-gaap:TreasuryStockCommonMember2023-06-300001576427us-gaap:AdditionalPaidInCapitalMember2023-06-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001576427us-gaap:RetainedEarningsMember2023-06-300001576427us-gaap:ParentMember2023-06-300001576427us-gaap:NoncontrollingInterestMember2023-06-3000015764272023-06-300001576427us-gaap:RetainedEarningsMember2023-07-012023-09-300001576427us-gaap:ParentMember2023-07-012023-09-300001576427us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001576427us-gaap:CommonStockMember2023-07-012023-09-300001576427us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001576427us-gaap:TreasuryStockCommonMember2023-07-012023-09-300001576427us-gaap:CommonStockMember2023-09-300001576427us-gaap:TreasuryStockCommonMember2023-09-300001576427us-gaap:AdditionalPaidInCapitalMember2023-09-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001576427us-gaap:RetainedEarningsMember2023-09-300001576427us-gaap:ParentMember2023-09-300001576427us-gaap:NoncontrollingInterestMember2023-09-3000015764272023-09-3000015764272022-12-0700015764272022-12-072022-12-070001576427us-gaap:CommonStockMember2023-12-310001576427us-gaap:TreasuryStockCommonMember2023-12-310001576427us-gaap:AdditionalPaidInCapitalMember2023-12-310001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001576427us-gaap:RetainedEarningsMember2023-12-310001576427us-gaap:ParentMember2023-12-310001576427us-gaap:NoncontrollingInterestMember2023-12-310001576427us-gaap:RetainedEarningsMember2024-01-012024-03-310001576427us-gaap:ParentMember2024-01-012024-03-310001576427us-gaap:NoncontrollingInterestMember2024-01-012024-03-3100015764272024-01-012024-03-310001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001576427us-gaap:CommonStockMember2024-01-012024-03-310001576427us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001576427us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001576427us-gaap:CommonStockMember2024-03-310001576427us-gaap:TreasuryStockCommonMember2024-03-310001576427us-gaap:AdditionalPaidInCapitalMember2024-03-310001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001576427us-gaap:RetainedEarningsMember2024-03-310001576427us-gaap:ParentMember2024-03-310001576427us-gaap:NoncontrollingInterestMember2024-03-3100015764272024-03-310001576427us-gaap:RetainedEarningsMember2024-04-012024-06-300001576427us-gaap:ParentMember2024-04-012024-06-300001576427us-gaap:NoncontrollingInterestMember2024-04-012024-06-3000015764272024-04-012024-06-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001576427us-gaap:CommonStockMember2024-04-012024-06-300001576427us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001576427us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001576427us-gaap:CommonStockMember2024-06-300001576427us-gaap:TreasuryStockCommonMember2024-06-300001576427us-gaap:AdditionalPaidInCapitalMember2024-06-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001576427us-gaap:RetainedEarningsMember2024-06-300001576427us-gaap:ParentMember2024-06-300001576427us-gaap:NoncontrollingInterestMember2024-06-3000015764272024-06-300001576427us-gaap:RetainedEarningsMember2024-07-012024-09-300001576427us-gaap:ParentMember2024-07-012024-09-300001576427us-gaap:NoncontrollingInterestMember2024-07-012024-09-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001576427us-gaap:CommonStockMember2024-07-012024-09-300001576427us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001576427us-gaap:TreasuryStockCommonMember2024-07-012024-09-300001576427us-gaap:CommonStockMember2024-09-300001576427us-gaap:TreasuryStockCommonMember2024-09-300001576427us-gaap:AdditionalPaidInCapitalMember2024-09-300001576427us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001576427us-gaap:RetainedEarningsMember2024-09-300001576427us-gaap:ParentMember2024-09-300001576427us-gaap:NoncontrollingInterestMember2024-09-3000015764272024-02-0100015764272024-02-012024-02-0100015764272023-01-012023-12-310001576427crto:RetailMediaMember2023-12-310001576427crto:PerformanceMediaMember2023-12-310001576427crto:RetailMediaMember2024-01-012024-09-300001576427crto:PerformanceMediaMember2024-01-012024-09-300001576427crto:RetailMediaMember2024-09-300001576427crto:PerformanceMediaMember2024-09-300001576427crto:RetailMediaMember2024-07-012024-09-300001576427crto:RetailMediaMember2023-07-012023-09-300001576427crto:RetailMediaMember2023-01-012023-09-300001576427crto:PerformanceMediaMember2024-07-012024-09-300001576427crto:PerformanceMediaMember2023-07-012023-09-300001576427crto:PerformanceMediaMember2023-01-012023-09-300001576427us-gaap:FairValueInputsLevel1Member2024-09-300001576427us-gaap:FairValueInputsLevel1Member2023-12-310001576427us-gaap:FairValueInputsLevel2Memberus-gaap:BankTimeDepositsMember2024-09-300001576427us-gaap:FairValueInputsLevel2Memberus-gaap:BankTimeDepositsMember2023-12-310001576427us-gaap:BankTimeDepositsMember2024-09-300001576427us-gaap:BankTimeDepositsMember2023-12-310001576427crto:IponwebMember2024-09-300001576427srt:OfficeBuildingMember2024-07-012024-09-300001576427crto:DataCenterMember2024-07-012024-09-300001576427srt:OfficeBuildingMember2023-07-012023-09-300001576427crto:DataCenterMember2023-07-012023-09-300001576427srt:OfficeBuildingMember2024-01-012024-09-300001576427crto:DataCenterMember2024-01-012024-09-300001576427srt:OfficeBuildingMember2023-01-012023-09-300001576427crto:DataCenterMember2023-01-012023-09-300001576427us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001576427us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001576427crto:SalesAndOperationsExpenseMember2024-01-012024-09-300001576427crto:SalesAndOperationsExpenseMember2023-01-012023-09-300001576427us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001576427us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001576427us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001576427us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001576427crto:LockUpSharesMember2024-01-012024-09-300001576427crto:LockUpSharesMember2023-01-012023-09-300001576427crto:RestrictedStockUnitPerformanceSharesMember2024-01-012024-09-300001576427crto:RestrictedStockUnitPerformanceSharesMember2023-01-012023-09-300001576427crto:NonEmployeeWarrantMember2024-01-012024-09-300001576427crto:NonEmployeeWarrantMember2023-01-012023-09-300001576427us-gaap:EmployeeStockOptionMember2024-09-300001576427crto:LockUpSharesMember2022-08-012022-08-010001576427crto:IponwebMember2022-08-0100015764272022-08-012022-08-010001576427crto:LockUpSharesMember2023-12-310001576427crto:LockUpSharesMember2024-09-300001576427crto:LockUpSharesMember2024-07-012024-09-300001576427us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001576427us-gaap:RestrictedStockUnitsRSUMember2023-12-310001576427us-gaap:RestrictedStockUnitsRSUMember2024-09-300001576427us-gaap:PerformanceSharesMember2024-01-012024-09-300001576427us-gaap:PerformanceSharesMember2024-07-012024-09-300001576427us-gaap:PerformanceSharesMember2023-12-310001576427us-gaap:PerformanceSharesMember2024-09-300001576427crto:TotalShareholderReturnTSRMember2024-01-012024-09-300001576427crto:TotalShareholderReturnTSRMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-09-300001576427crto:TotalShareholderReturnTSRMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-09-300001576427crto:TotalShareholderReturnTSRMember2024-07-012024-09-300001576427crto:TotalShareholderReturnTSRMember2023-12-310001576427crto:TotalShareholderReturnTSRMember2024-09-300001576427us-gaap:RestrictedStockMember2024-01-012024-09-300001576427us-gaap:RestrictedStockMember2023-01-012023-09-300001576427crto:ShareOptionsandBSPCEMember2024-01-012024-09-300001576427crto:ShareOptionsandBSPCEMember2023-01-012023-09-3000015764272022-08-0300015764272023-06-210001576427srt:AmericasMember2024-07-012024-09-300001576427us-gaap:EMEAMember2024-07-012024-09-300001576427srt:AsiaPacificMember2024-07-012024-09-300001576427srt:AmericasMember2023-07-012023-09-300001576427us-gaap:EMEAMember2023-07-012023-09-300001576427srt:AsiaPacificMember2023-07-012023-09-300001576427srt:AmericasMember2024-01-012024-09-300001576427us-gaap:EMEAMember2024-01-012024-09-300001576427srt:AsiaPacificMember2024-01-012024-09-300001576427srt:AmericasMember2023-01-012023-09-300001576427us-gaap:EMEAMember2023-01-012023-09-300001576427srt:AsiaPacificMember2023-01-012023-09-300001576427country:US2024-07-012024-09-300001576427country:US2023-07-012023-09-300001576427country:US2024-01-012024-09-300001576427country:US2023-01-012023-09-300001576427country:DE2024-07-012024-09-300001576427country:DE2023-07-012023-09-300001576427country:DE2024-01-012024-09-300001576427country:DE2023-01-012023-09-300001576427country:FR2024-07-012024-09-300001576427country:FR2023-07-012023-09-300001576427country:FR2024-01-012024-09-300001576427country:FR2023-01-012023-09-300001576427country:JP2024-07-012024-09-300001576427country:JP2023-07-012023-09-300001576427country:JP2024-01-012024-09-300001576427country:JP2023-01-012023-09-300001576427srt:AmericasMember2024-09-300001576427us-gaap:EMEAMember2024-09-300001576427srt:AsiaPacificMember2024-09-300001576427srt:AmericasMember2023-12-310001576427us-gaap:EMEAMember2023-12-310001576427srt:AsiaPacificMember2023-12-310001576427crto:RyanDamonMember2024-07-012024-09-300001576427crto:RyanDamonMember2024-09-300001576427crto:BrianGleesonMember2024-07-012024-09-300001576427crto:BrianGleesonMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the quarterly period ended September 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from _________ to _________

Commission file number: 001-36153

Criteo S.A.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| France | | | Not Applicable |

| (State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification Number) |

| | | |

| 32 Rue Blanche | Paris | France | 75009 |

| (Address of principal executive offices) | | | (Zip Code) |

+33 1 75 85 09 39

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | Name of each exchange on which registered | |

American Depositary Shares, each representing one Ordinary Share,

nominal value €0.025 per share | | CRTO | Nasdaq Global Select Market | |

| Ordinary Shares, nominal value €0.025 per share | * | | Nasdaq Global Select Market | * |

* Not for trading, but only in connection with the registration of the American Depositary Shares.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

As of October 25, 2024, the registrant had 55,182,166 ordinary shares, nominal value €0.025 per share, outstanding.

TABLE OF CONTENTS

General

Except where the context otherwise requires, all references in this Quarterly Report on Form 10-Q ("Form 10-Q") to the "Company," "Criteo," "we," "us," "our" or similar words or phrases are to Criteo S.A. and its subsidiaries, taken together. In this Form 10-Q, references to "$" and "US$" are to United States dollars. Our unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America, or "GAAP."

Trademarks

“Criteo,” the Criteo logo and other trademarks or service marks of Criteo appearing in this Form 10-Q are the property of Criteo. Trade names, trademarks and service marks of other companies appearing in this Form 10-Q are the property of their respective holders.

Special Note Regarding Forward-Looking Statements

This Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than present and historical facts and conditions contained in this Form 10-Q, including statements regarding our future results of operations and financial position, business strategy, plans and objectives for future operations, are forward-looking statements. When used in this Form 10-Q, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “is designed to,” “may,” “might,” "objective," “plan,” “potential,” “predict,” "project," "seek," “should,” "will," "would," or the negative of these and similar expressions identify forward-looking statements.

You should refer to Item 1A “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2023, and to our subsequent quarterly reports on Form 10-Q, for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Form 10-Q will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this Form 10-Q and the documents that we reference in this Form 10-Q and have filed as exhibits to this Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This Form 10-Q may contain market data and industry forecasts that were obtained from industry publications. These data and forecasts involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this Form 10-Q is generally reliable, such information is inherently imprecise.

PART I

Item 1. Financial Statements

CRITEO S.A.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED) | | | | | | | | | | | | | | |

| Notes | September 30, 2024 | | December 31, 2023 |

| | (in thousands) |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | 3 | $ | 208,740 | | | $ | 336,341 | |

Trade receivables, net of allowances of $35.1 million and $43.3 million at September 30, 2024 and December 31, 2023, respectively. | 4 | 646,283 | | | 775,589 | |

| Income taxes | 12 | 9,785 | | | 2,065 | |

| Other taxes | | 132,370 | | | 109,306 | |

| Other current assets | 5 | 44,879 | | | 48,291 | |

Restricted cash | 3 | 75,250 | | | 75,000 | |

| Marketable securities - current portion | 3 | 23,010 | | | 5,970 | |

| Total current assets | | 1,140,317 | | | 1,352,562 | |

| Property, plant and equipment, net | | 116,866 | | | 126,494 | |

| Intangible assets, net | | 170,359 | | | 180,888 | |

| Goodwill | | 526,569 | | | 524,197 | |

| Right of use assets - operating lease | 7 | 110,350 | | | 112,487 | |

| | | | |

| Marketable securities - non-current portion | 3 | 5,598 | | | 16,575 | |

| Non-current financial assets | | 4,957 | | | 5,294 | |

| Other non-current assets | 5 | 62,216 | | | 60,742 | |

| Deferred tax assets | | 71,128 | | | 52,680 | |

| Total non-current assets | | 1,068,043 | | | 1,079,357 | |

| Total assets | | $ | 2,208,360 | | | $ | 2,431,919 | |

| | | | |

| Liabilities and shareholders' equity | | | | |

| Current liabilities: | | | | |

| Trade payables | | $ | 629,997 | | | $ | 838,522 | |

| Contingencies - current portion | 14 | 1,604 | | | 1,467 | |

| Income taxes | 12 | 15,490 | | | 17,213 | |

| Financial liabilities - current portion | 3 | 4,753 | | | 3,389 | |

| Lease liability - operating - current portion | 7 | 26,159 | | | 35,398 | |

| Other taxes | | 83,401 | | | 66,659 | |

| Employee - related payables | | 104,095 | | | 113,287 | |

| Other current liabilities | 6 | 109,118 | | | 104,552 | |

| Total current liabilities | | 974,617 | | | 1,180,487 | |

| Deferred tax liabilities | | 3,182 | | | 1,083 | |

| Defined benefit plans | 8 | 4,938 | | | 4,123 | |

| Financial liabilities - non-current portion | 3 | 320 | | | 77 | |

| Lease liability - operating - non-current portion | 7 | 87,321 | | | 83,051 | |

| Contingencies - non-current portion | 14 | 31,939 | | | 32,625 | |

| Other non-current liabilities | 6 | 20,536 | | | 19,082 | |

| Total non-current liabilities | | 148,236 | | | 140,041 | |

| Total liabilities | | $ | 1,122,853 | | | $ | 1,320,528 | |

| Commitments and contingencies | | | | |

| Shareholders' equity: | | | | |

Common shares, €0.025 par value, 59,180,216 and 61,165,663 shares authorized, issued and outstanding at September 30, 2024 and December 31, 2023, respectively. | | $ | 1,970 | | | $ | 2,023 | |

Treasury stock, 4,399,179 and 5,400,572 shares at cost as of September 30, 2024 and December 31, 2023, respectively. | | (152,997) | | | (161,788) | |

| Additional paid-in capital | | 728,707 | | | 769,240 | |

| Accumulated other comprehensive loss | | (83,345) | | | (85,326) | |

| Retained earnings | | 557,072 | | | 555,456 | |

| Equity-attributable to shareholders of Criteo S.A. | | 1,051,407 | | | 1,079,605 | |

| Non-controlling interests | | 34,100 | | | 31,786 | |

| Total equity | | 1,085,507 | | | 1,111,391 | |

| Total equity and liabilities | | $ | 2,208,360 | | | $ | 2,431,919 | |

The accompanying notes form an integral part of these unaudited condensed consolidated financial statements.

CRITEO S.A.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| Notes | | September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| | (in thousands, except per share data) |

| | | | | | | | | |

| Revenue | 9 | | $ | 458,892 | | | $ | 469,193 | | | $ | 1,380,254 | | | $ | 1,383,143 | |

| | | | | | | | | |

| Cost of revenue: | | | | | | | | | |

| Traffic acquisition costs | | | (192,789) | | | (223,798) | | | (593,170) | | | (676,913) | |

| Other cost of revenue | | | (34,171) | | | (40,268) | | | (105,084) | | | (119,812) | |

| | | | | | | | | |

| Gross profit | | | 231,932 | | | 205,127 | | | 682,000 | | | 586,418 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Research and development expenses | | | (85,285) | | | (62,522) | | | (211,782) | | | (193,887) | |

| Sales and operations expenses | | | (90,823) | | | (94,572) | | | (278,734) | | | (308,325) | |

| General and administrative expenses | | | (46,222) | | | (36,599) | | | (134,590) | | | (95,306) | |

| Total operating expenses | | | (222,330) | | | (193,693) | | | (625,106) | | | (597,518) | |

| Income (loss) from operations | | | 9,602 | | | 11,434 | | | 56,894 | | | (11,100) | |

| Financial and Other income (loss) | 11 | | (8) | | | (2,967) | | | 889 | | | 2,008 | |

Income (loss) before taxes | | | 9,594 | | | 8,467 | | | 57,783 | | | (9,092) | |

| Provision for income tax (expense) benefit | 12 | | (3,450) | | | (1,832) | | | (15,014) | | | 1,685 | |

Net Income (loss) | | | $ | 6,144 | | | $ | 6,635 | | | $ | 42,769 | | | $ | (7,407) | |

| | | | | | | | | |

Net income (loss) available to shareholders of Criteo S.A. | | | $ | 6,245 | | | $ | 6,927 | | | $ | 40,476 | | | $ | (7,758) | |

| Net income (loss) available to non-controlling interests | | | $ | (101) | | | $ | (292) | | | $ | 2,293 | | | $ | 351 | |

| | | | | | | | | |

| Weighted average shares outstanding used in computing per share amounts: | | | | | | | | | |

| Basic | 13 | | 54,695,112 | | 56,297,666 | | 54,840,650 | | 56,173,218 |

| Diluted | 13 | | 58,430,133 | | 60,172,953 | | 58,909,952 | | 56,173,218 |

| | | | | | | | | |

Net income (loss) allocated to shareholders per share: | | | | | | | | | |

| Basic | 13 | | $ | 0.11 | | | $ | 0.12 | | | $ | 0.74 | | | $ | (0.14) | |

| Diluted | 13 | | $ | 0.11 | | | $ | 0.12 | | | $ | 0.69 | | | $ | (0.14) | |

The accompanying notes form an integral part of these unaudited condensed consolidated financial statements.

CRITEO S.A.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE OPERATIONS (UNAUDITED) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| (in thousands) |

| | | | | | | |

| Net income (loss) | $ | 6,144 | | | $ | 6,635 | | | $ | 42,769 | | | $ | (7,407) | |

Foreign currency translation adjustments, net of taxes | 24,531 | | | (10,458) | | | 1,953 | | | (12,593) | |

| Actuarial gains (losses) on employee benefits, net of taxes | (284) | | | 426 | | | (107) | | | 283 | |

| Other comprehensive income (loss) | $ | 24,247 | | | $ | (10,032) | | | $ | 1,846 | | | $ | (12,310) | |

Total comprehensive income (loss) | $ | 30,391 | | | $ | (3,397) | | | $ | 44,615 | | | $ | (19,717) | |

| Attributable to shareholders of Criteo S.A. | $ | 26,750 | | | $ | (2,198) | | | $ | 42,458 | | | $ | (16,295) | |

| Attributable to non-controlling interests | $ | 3,641 | | | $ | (1,199) | | | $ | 2,157 | | | $ | (3,422) | |

The accompanying notes form an integral part of these unaudited condensed consolidated financial statements.

CRITEO S.A.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share capital | Treasury

Stock | Additional paid-in capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Equity - attributable to shareholders of Criteo S.A. | Non controlling interest | Total equity | |

| Common shares | | Shares | | | |

| (in thousands, except share amounts ) | |

| Balance at December 31, 2022 | 63,248,728 | $2,079 | (5,985,104) | $(174,293) | $734,492 | $(91,890) | $577,653 | $1,048,041 | $33,065 | $1,081,106 | |

| Net income (loss) | — | — | — | — | — | — | (11,809) | (11,809) | (262) | (12,071) | |

| Other comprehensive income (loss) | — | — | — | — | — | 6,475 | — | 6,475 | (296) | 6,179 | |

| Issuance of ordinary shares | 67,968 | 2 | — | — | 1,295 | — | — | 1,297 | — | 1,297 | |

Change in treasury stocks(*) | — | — | (1,338,049) | (37,107) | — | — | (13,922) | (51,029) | — | (51,029) | |

| Share-Based Compensation | — | — | — | — | 24,610 | — | — | 24,610 | 97 | 24,707 | |

| Other changes in equity | — | — | — | — | — | — | — | — | — | — | |

| Balance at March 31, 2023 | 63,316,696 | $2,081 | (7,323,153) | $(211,400) | $760,397 | $(85,415) | $551,922 | $1,017,585 | $32,604 | $1,050,189 | |

| Net income (loss) | — | — | — | — | — | — | (2,876) | (2,876) | 905 | (1,971) | |

Other comprehensive loss | — | — | — | — | — | (5,887) | — | (5,887) | (2,570) | (8,457) | |

| Issuance of ordinary shares | 20,757 | — | — | — | 399 | — | — | 399 | — | 399 | |

Change in treasury stocks(*) | — | — | (89,425) | (2,646) | — | — | (21,189) | (23,835) | — | (23,835) | |

| Share-Based Compensation | — | — | — | — | 26,878 | — | — | 26,878 | (165) | 26,713 | |

| Other changes in equity | — | — | — | — | — | (26) | — | (26) | — | (26) | |

| Balance at June 30, 2023 | 63,337,453 | $2,081 | (7,412,578) | $(214,046) | $787,674 | $(91,328) | $527,857 | $1,012,238 | $30,774 | $1,043,012 | |

| Net income (loss) | — | — | — | — | — | — | 6,927 | 6,927 | (292) | 6,635 | |

Other comprehensive loss | — | — | — | — | — | (9,125) | — | (9,125) | (907) | (10,032) | |

| Issuance of ordinary shares | — | 1 | — | — | 251 | — | — | 252 | — | 252 | |

Change in treasury stocks(*) | 13,210 | — | 318,004 | 1,952 | — | — | (30,440) | (28,488) | — | (28,488) | |

| Share-Based Compensation | — | — | — | — | 23,461 | — | — | 23,461 | 44 | 23,505 | |

| Other changes in equity | — | — | — | — | (5) | (29) | — | (34) | — | (34) | |

| Balance at September 30, 2023 | 63,350,663 | $2,082 | (7,094,574) | $(212,094) | $811,381 | $(100,482) | $504,344 | $1,005,231 | $29,619 | $1,034,850 | |

(*) On December 7, 2022, Criteo's board of directors authorized an extension of the share repurchase program to up to $480.0 million of the Company's outstanding American Depositary Shares. The change in treasury stocks is comprised of 3,404,891 shares repurchased at a weighted average price of $30.4 offset by 1,288,939 treasury shares used for RSUs vesting and by 1,006,482 treasury shares used for LUSs vesting.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share capital | Treasury Stock | Additional paid-in capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Equity - attributable to shareholders of Criteo S.A. | Non controlling interest | Total equity | | |

| Common shares | | Shares | | | | |

| (in thousands, except share amounts ) | | |

| Balance at December 31, 2023 | 61,165,663 | $2,023 | (5,400,572) | $(161,788) | $769,240 | $(85,326) | $555,456 | $1,079,605 | $31,786 | $1,111,391 | | |

Net income | — | — | — | — | — | — | 7,244 | 7,244 | 1,322 | 8,566 | | |

Other comprehensive loss | — | — | — | — | — | (11,437) | — | (11,437) | (2,046) | (13,483) | | |

| Issuance of ordinary shares | 15,338 | 1 | — | — | 394 | — | — | 395 | — | 395 | | |

Change in treasury stocks(*) | — | — | (1,216,547) | (42,575) | — | — | (19,568) | (62,143) | — | (62,143) | | |

| Share-Based Compensation | — | — | — | — | 27,858 | — | — | 27,858 | 55 | 27,913 | | |

| Other changes in equity | — | — | — | — | — | — | (40) | (40) | — | (40) | | |

Balance at March 31, 2024 | 61,181,001 | $2,024 | (6,617,119) | $(204,363) | $797,492 | $(96,763) | $543,092 | $1,041,482 | $31,117 | $1,072,599 | | |

Net income | — | — | — | — | — | — | 26,987 | 26,987 | 1,072 | 28,059 | | |

Other comprehensive loss | — | — | — | — | — | (7,085) | — | (7,085) | (1,833) | (8,918) | | |

| Issuance of ordinary shares | 32,485 | — | — | — | 812 | — | — | 812 | — | 812 | | |

Change in treasury stocks(*) | (2,150,000) | (57) | 2,155,602 | 50,109 | (57,871) | — | (32,533) | (40,352) | — | (40,352) | | |

| Share-Based Compensation | — | — | — | — | 21,248 | — | — | 21,248 | 47 | 21,295 | | |

| Other changes in equity | — | — | — | — | — | — | (305) | (305) | — | (305) | | |

| Balance at June 30, 2024 | 59,063,486 | $1,967 | (4,461,517) | $(154,254) | $761,681 | $(103,848) | $537,241 | $1,042,787 | $30,403 | $1,073,190 | | |

| Net income (loss) | — | — | — | — | — | — | 6,245 | 6,245 | (101) | 6,144 | | |

Other comprehensive income | — | — | — | — | — | 20,503 | — | 20,503 | 3,744 | 24,247 | | |

| Issuance of ordinary shares | 116,730 | 3 | — | — | 3,223 | — | — | 3,226 | — | 3,226 | | |

Change in treasury stocks(*) | — | — | 62,338 | 1,257 | (70,774) | — | 14,521 | (54,996) | — | (54,996) | | |

| Share-Based Compensation | — | — | — | — | 34,577 | — | — | 34,577 | 57 | 34,634 | | |

| Other changes in equity | — | — | — | — | — | — | (935) | (935) | (3) | (938) | | |

| Balance at September 30, 2024 | 59,180,216 | $1,970 | (4,399,179) | $(152,997) | $728,707 | $(83,345) | $557,072 | $1,051,407 | $34,100 | $1,085,507 | | |

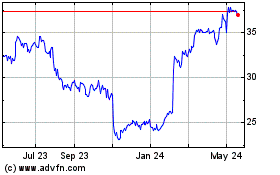

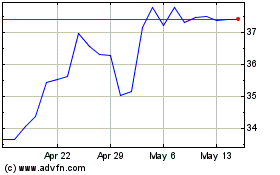

(*) On February 1, 2024, Criteo's board of directors authorized an extension of the share repurchase program to up to $630.0 million of the Company's outstanding American Depositary Shares. The change in treasury stocks is comprised of 4,297,334 shares repurchased at a weighted average price of $36.6 offset by 1,796,847 treasury shares used for RSUs vesting, by 1,351,880 treasury shares used for LUSs vesting and by 2,150,000 treasury shares cancelled.

The accompanying notes form an integral part of these unaudited condensed consolidated financial statements.

CRITEO S.A.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, 2024 | | September 30, 2023 |

| (in thousands) |

| Net income (loss) | | $ | 42,769 | | | $ | (7,407) | |

| Non-cash and non-operating items | | 136,013 | | | 42,706 | |

| - Amortization and provisions | | 67,134 | | | 56,288 | |

| - Payment for contingent liability on regulatory matters | | — | | | (43,334) | |

| | | | |

- Equity awards compensation expense | | 82,193 | | | 76,353 | |

| - Net (gain) or loss on disposal of non-current assets | | 924 | | | (8,903) | |

- Change in uncertain tax position | | 1,764 | | | (314) | |

- Net change in fair value of earn-out | | 3,202 | | | 1,499 | |

| - Change in deferred taxes | | (16,370) | | | (24,742) | |

| - Change in income taxes | | (9,321) | | | (18,007) | |

| | | | |

| - Other | | 6,487 | | | 3,866 | |

| Changes in working capital related to operating activities | | (90,075) | | | 27,607 | |

| - (Increase) / Decrease in trade receivables | | 138,595 | | | 78,890 | |

| - Increase / (Decrease) in trade payables | | (210,863) | | | (71,190) | |

| - (Increase) / Decrease in other current assets | | (16,430) | | | 1,968 | |

| - Increase/ (Decrease) in other current liabilities | | 1,452 | | | 17,926 | |

| - Change in operating lease liabilities and right of use assets | | (2,829) | | | 13 | |

| | | | |

| Cash from operating activities | | 88,707 | | | 62,906 | |

| Acquisition of intangible assets, property, plant and equipment | | (56,364) | | | (77,838) | |

| Change in accounts payable related to intangible assets, property, plant and equipment | | 3,122 | | | (16,749) | |

| Payment for business, net of cash acquired | | (527) | | | (6,957) | |

| Proceeds from disposition of investments | | — | | | 9,625 | |

| | | | |

| Change in other non-current financial assets | | (5,197) | | | (12,280) | |

Cash used for investing activities | | (58,966) | | | (104,199) | |

| | | | |

| | | | |

| Proceeds from exercise of stock options | | 4,433 | | | 1,948 | |

| Repurchase of treasury stocks | | (157,492) | | | (103,354) | |

| | | | |

| Cash payment for contingent consideration | | — | | | (22,025) | |

| Change in other financing activities | | (1,296) | | | (1,427) | |

| Cash used for financing activities | | (154,355) | | | (124,858) | |

| Effect of exchange rates changes on cash and cash equivalents | | (2,737) | | | (12,192) | |

Net decrease in cash and cash equivalents and restricted cash | | (127,351) | | | (178,343) | |

| Net cash and cash equivalents and restricted cash at beginning of period | | 411,341 | | | 448,200 | |

| Net cash and cash equivalents and restricted cash at end of period | | $ | 283,990 | | | $ | 269,857 | |

| | | | |

| Supplemental disclosures of cash flow information | | | | |

| Cash paid for taxes, net of refunds | | (36,099) | | | (41,377) | |

| Cash paid for interest | | (1,032) | | | (1,055) | |

The accompanying notes form an integral part of these unaudited condensed consolidated financial statements.

CRITEO S.A.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Criteo S.A. was initially incorporated as a société par actions simplifiée, or S.A.S., under the laws of the French Republic on November 3, 2005, for a period of 99 years and subsequently converted to a société anonyme, or S.A.

We are a global technology company that enables marketers and media owners to drive better commerce outcomes through the world’s leading Commerce Media Platform. We bring richer experiences to every consumer by supporting a fair and open internet that enables discovery, innovation, and choice — powered by trusted and impactful advertising from the world’s marketers and media owners.

We are leading the way in commerce media — a new approach to advertising that combines commerce data and machine learning to target consumers throughout their shopping journey and help marketers and media owners drive commerce outcomes (sales, leads, advertising revenue).

Our strategy is to help marketers and media owners activate 1st-party, privacy-safe data and drive better commerce outcomes through our Commerce Media Platform, which includes a suite of products:

•that offer marketers (brands, retailers, and agencies) the ability to easily reach consumers anywhere throughout their shopping journey and measure their advertising campaigns

•that offer media owners (publishers and retailers) the ability to monetize their advertising and promotions inventory for commerce anywhere where consumers spend their time

•that are underpinned by our advanced AI engine, analyzing large sets of commerce data in real-time to drive hyper personalization and budget efficiency.

In these notes, Criteo S.A. is referred to as the "Parent" company and together with its subsidiaries, collectively, as "Criteo," the "Company," the "Group," or "we".

Note 1. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements (the "Unaudited Condensed Consolidated Financial Statements") have been prepared by Criteo in accordance with generally accepted accounting principles in the United States of America ("GAAP") and pursuant to the applicable rules and regulations of the Securities and Exchange Commission ("SEC"), including regarding interim financial reporting. Certain information and disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. As such, these unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 23, 2024.

The unaudited condensed consolidated financial statements included herein reflect all normal recurring adjustments that are, in the opinion of management, necessary to state fairly the results for the interim periods presented. The results of operations for the interim periods presented are not necessarily indicative of the operating results to be expected for any subsequent interim period or for the fiscal year ending December 31, 2024.

Use of Estimates

The preparation of our Consolidated Financial Statements requires the use of estimates, assumptions and judgments that affect the reported amounts of assets, liabilities, and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amount of revenue and expenses during the period. We base our estimates and assumptions on historical experience and other factors that we believe to be reasonable under the circumstances. We evaluate our estimates and assumptions on an ongoing basis. Our actual results may differ from these estimates. Estimates in our financial statements include, but are not limited to, (1) gross versus net assessment in revenue recognition (2) income taxes, (3) assumptions used in the valuation of long-lived assets including intangible assets, and goodwill, (4) assumptions surrounding the recognition and valuation of contingent liabilities and losses.

Significant Accounting Policies

Reportable Segments

Beginning with the first quarter of 2024, the Company has changed its segment reporting structure to two reportable segments: Retail Media and Performance Media, which combines our former Marketing Solutions and Iponweb segments, to align with a change in how the Chief Operating Decision Maker (CODM), our Chief Executive Officer (CEO), allocates resources and assesses performance.

As such, prior period segment results and related disclosures have been conformed to reflect the Company’s current reportable segments. This change in accounting policy did not impact our results of operations, financial position, or cash flows. Refer to Note 2 for further discussion.

Goodwill Interim Impairment Evaluation

The Company's goodwill balance was $526.6 million and $524.2 million at September 30, 2024 and December 31, 2023, respectively. We assess goodwill for impairment at least annually during the fourth quarter and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. As noted above, during the first quarter 2024, the Company made a change to its operating and reportable segments from three to two segments: Retail Media and Performance Media. As a result of this change, we reassessed our reporting units for the evaluation of goodwill. Prior to this change, consistent with the determination that we had three operating/reportable segment, we determined that we had three reporting units for goodwill assessment purposes. Our reassessment during the first quarter of 2024 determined that, consistent with the determination that we had two operating/ reportable segments, we also have two reporting units for goodwill assessment purposes: Retail Media and Performance Media.

As a result of this change in reporting units, effective January 1, 2024, we estimated the fair value of our new reporting units and, based on an assessment of the relative fair values of our new reporting units after the change, we determined that the goodwill held by the Iponweb reportable unit was now allocated to the Performance Media reporting unit. This determination was largely based on the fact that the operations of the previous Iponweb operating segment/ reporting unit are significantly integrated with the Performance Media operating segment / reportable unit. The change in reporting units was also considered a triggering event indicating a test for goodwill impairment was required as of January 1, 2024 before and after the change in reporting units. The Company performed those impairment tests, which did not result in the identification of an impairment loss as of January 1, 2024.

Goodwill allocated to the two reportable segments and the changes in the carrying amount for the quarter-ended September 30, 2024 were as follows:

| | | | | | | | | | | |

| Retail Media | Performance Media | Total |

| |

Balance at January 1, 2024 | $ | 149,680 | | $ | 374,517 | | $ | 524,197 | |

| Acquisitions | — | | — | | — | |

| Disposals | — | | — | | — | |

| Currency translation adjustment | 429 | | 1,943 | | 2,372 | |

| Impairments | — | | — | | — | |

Balance at September 30, 2024 | $ | 150,109 | | $ | 376,460 | | $ | 526,569 | |

There have been no other significant changes to our accounting policies described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Recently Issued Accounting Pronouncements

There have been no recently issued accounting standards adopted during the period which had a material impact on the Company's financial statements.

There are no recently issued accounting standards that are expected to have a material impact on our results of operations, financial condition, or cash flows.

Note 2. Segment information

The Company reports segment information based on the management approach. The management approach designates the internal reporting used by management for making decisions and assessing performance as the source of the Company's reportable segments. Beginning with the first quarter of 2024, the Company changed its segment reporting structure and reports its results of operations through the following two segments: Retail Media and Performance Media.

–Retail Media: This segment encompasses revenue generated from brands, agencies and retailers for the purchase and sale of retail media digital advertising inventory and audiences, and services.

–Performance Media: This segment encompasses commerce activation, monetization, and services.

The Company's CODM allocates resources to and assesses the performance of each segment using information about Contribution excluding Traffic Acquisition Costs (Contribution ex-TAC), which is our segment profitability measure and reflects our gross profit plus other costs of revenue. The Company's CODM does not review any other financial information for our two segments, on a regular basis.

The following table shows revenue by reportable segment:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | September 30, 2023 | | September 30, 2024 | September 30, 2023 |

| (in thousands) |

| Retail Media | $ | 60,765 | | $ | 49,813 | | | $ | 166,414 | | $ | 132,424 | |

| Performance Media | 398,127 | | 419,380 | | | 1,213,840 | | 1,250,719 | |

| Total Revenue | $ | 458,892 | | $ | 469,193 | | | $ | 1,380,254 | | $ | 1,383,143 | |

The following table shows Contribution ex-TAC by reportable segment and its reconciliation to the Company’s Consolidated Statements of Operation:

| | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | |

| September 30, 2024 | September 30, 2023 | | September 30, 2024 | September 30, 2023 | |

| (in thousands) | |

| Contribution ex-TAC | | | | | | |

| Retail Media | $ | 59,583 | | $ | 48,436 | | | $ | 163,618 | | $ | 129,306 | | |

| Performance Media | 206,520 | | 196,959 | | | 623,466 | | 576,924 | | |

| $ | 266,103 | | $ | 245,395 | | | $ | 787,084 | | $ | 706,230 | | |

| | | | | | |

| Other costs of sales | (34,171) | | (40,268) | | | (105,084) | | (119,812) | | |

| Gross profit | $ | 231,932 | | $ | 205,127 | | | $ | 682,000 | | $ | 586,418 | | |

| Operating expenses | | | | | | |

| Research and development expenses | (85,285) | | (62,522) | | | (211,782) | | (193,887) | | |

| Sales and operations expenses | (90,823) | | (94,572) | | | (278,734) | | (308,325) | | |

| General and administrative expenses | (46,222) | | (36,599) | | | (134,590) | | (95,306) | | |

| Total Operating expenses | $ | (222,330) | | $ | (193,693) | | | $ | (625,106) | | $ | (597,518) | | |

| | | | | | |

| Income (loss) from operations | $ | 9,602 | | $ | 11,434 | | | $ | 56,894 | | $ | (11,100) | | |

| Financial and Other Income (Expense) | (8) | | (2,967) | | | 889 | | 2,008 | | |

| Income (loss) before tax | $ | 9,594 | | $ | 8,467 | | | $ | 57,783 | | $ | (9,092) | | |

Note 3. Financial Instruments

Fair Value Measurements

We classify our cash, cash equivalents and marketable debt securities within Level 1 or Level 2 because we use quoted market prices or pricing models with observable inputs to determine their fair value. Our term deposits are comprised primarily of interest-bearing term deposits and mutual funds. Interest-bearing and term bank deposits are considered Level 2 financial instruments as they are measured using valuation techniques based on observable market data. Term deposits are considered a level 2 financial instrument as they are measured using valuation techniques based on observable market data.

| | | | | | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Cash and Cash Equivalent | Marketable Securities | | Cash and Cash Equivalent | Marketable Securities |

| (in thousands) |

| Level 1 | | | | | |

| Cash and cash equivalents | $ | 180,321 | | $ | — | | | $ | 285,518 | | $ | — | |

| Level 2 | | | | | |

| Term deposits and notes | 28,419 | | 28,608 | | | 50,823 | | 22,545 | |

| Total | $ | 208,740 | | $ | 28,608 | | | $ | 336,341 | | $ | 22,545 | |

The fair value of term deposits approximates their carrying amount given the nature of the investments, its maturities and expected future cash flows.

Marketable Securities

The following table presents for each reporting period, the breakdown of the fair value of marketable securities:

| | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 | |

| | | | |

| (in thousands) | |

| | | | |

| | | | |

| Securities Held-to-maturity | | | | |

| Term Deposits | 28,608 | | | 22,545 | | |

| Total | $ | 28,608 | | | $ | 22,545 | | |

The gross unrealized gains on our marketable securities were not material as of September 30, 2024.

The following table classifies our marketable debt securities by contractual maturities:

| | | | | | | |

| Held-to-maturity | | |

| September 30, 2024 | | |

| | | |

| (in thousands) |

| Due in one year | $ | 23,010 | | | |

| Due in one to five years | 5,598 | | | |

| Total | $ | 28,608 | | | |

Restricted Cash

As of September 30, 2024, the Company has restricted cash of $75 million in an escrow account containing withdrawal conditions. The cash secures the Company's payment of Iponweb Acquisition contingent consideration to the Sellers, which is conditioned upon the achievement of certain revenue targets by the Iponweb business for the 2023 fiscal year, as discussed further in Note 6..

Note 4. Trade Receivables

The following table shows the breakdown in trade receivables net book value for the presented periods:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| (in thousands) |

| Trade accounts receivables | $ | 681,350 | | | $ | 818,937 | |

| (Less) Allowance for credit losses | (35,067) | | | (43,348) | |

| Net book value at end of period | $ | 646,283 | | | $ | 775,589 | |

As of September 30, 2024 no customer individually exceeded 10% of our gross accounts receivables.

Note 5. Other Current and Non-Current Assets

The following table shows the breakdown in other current assets net book value for the presented periods:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| (in thousands) |

| Prepayments to suppliers | $ | 5,828 | | | $ | 7,499 | |

| Other debtors | 9,439 | | | 7,279 | |

| Prepaid expenses | 29,612 | | | 32,858 | |

| Other current assets | — | | | 655 | |

| | | |

| Net book value at end of period | $ | 44,879 | | | $ | 48,291 | |

Prepaid expenses mainly consist of amounts related to SaaS arrangements largely for internal ERP systems

Other non-current assets of $62.2 million are primarily comprised of the indemnification asset of $49.1 million recorded against certain tax liabilities related to the purchase agreement for the Iponweb Acquisition.

Note 6. Other Current and Non-Current Liabilities

Other current liabilities are presented in the following table:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| (in thousands) |

| Earn out liability - current | $ | 54,640 | | | $ | 49,647 | |

| Rebates | 28,408 | | | 23,315 | |

| Deferred revenue and other customer prepayments | 15,981 | | | 25,925 | |

| Accounts payable relating to capital expenditures | 5,799 | | | 3,346 | |

| Other creditors | 4,290 | | | 2,319 | |

| Total current liabilities | $ | 109,118 | | | $ | 104,552 | |

The earn out liability is related to the Iponweb Acquisition, whereas the Sellers are entitled to contingent consideration, which is conditioned upon the achievement of certain revenue targets by the Iponweb business for the 2023 fiscal year. The related earn-out liability is valued and discounted using management's best estimate of the consideration that is expected to be paid in the fourth quarter of 2024.

Other non-current liabilities are presented in the following table:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| (in thousands) |

| | | |

| Uncertain tax positions | $ | 19,055 | | | $ | 16,785 | |

| Other | $ | 1,481 | | | $ | 2,297 | |

| Total non-current liabilities | $ | 20,536 | | | $ | 19,082 | |

The uncertain tax positions are primarily related to the Iponweb Acquisition.

Note 7. Leases

The components of lease expense are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | September 30, 2024 | | September 30, 2023 |

| Offices | | Data Centers | | Total | | Offices | | Data Centers | | Total |

| (in thousands) |

| Lease expense | $ | 3,624 | | | $ | 6,786 | | | $ | 10,410 | | | $ | 3,419 | | | $ | 5,644 | | | $ | 9,063 | |

| Short term lease expense | 287 | | | — | | | 287 | | | 200 | | | 13 | | | 213 | |

| Variable lease expense | 431 | | | 65 | | | 496 | | | 289 | | | 14 | | | 303 | |

| Sublease income | (343) | | | — | | | (343) | | | (277) | | | — | | | (277) | |

| Total operating lease expense | $ | 3,999 | | | $ | 6,851 | | | $ | 10,850 | | | $ | 3,631 | | | $ | 5,671 | | | $ | 9,302 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | September 30, 2024 | | September 30, 2023 |

| Offices | | Data Centers | | Total | | Offices | | Data Centers | | Total |

| (in thousands) |

| Lease expense | $ | 10,839 | | | $ | 19,642 | | | $ | 30,481 | | | $ | 10,548 | | | $ | 16,844 | | | $ | 27,392 | |

| Short term lease expense | 914 | | | — | | | 914 | | | 489 | | | 42 | | | 531 | |

| Variable lease expense | 1,102 | | | 122 | | | 1,224 | | | 493 | | | 75 | | | 568 | |

| Sublease income | (1,152) | | | — | | | (1,152) | | | (692) | | | — | | | (692) | |

| Total operating lease expense | $ | 11,703 | | | $ | 19,764 | | | $ | 31,467 | | | $ | 10,838 | | | $ | 16,961 | | | $ | 27,799 | |

Note 8. Employee Benefits

Defined Benefit Plans

According to French law and the Syntec Collective Agreement, French employees are entitled to compensation paid on retirement.

The following table summarizes the changes in the projected benefit obligation:

| | | | | |

| Projected benefit obligation |

| (in thousands) |

Projected benefit obligation present value at January 1, 2023 | $ | 3,708 | |

Service cost | 707 | |

Interest cost | 161 | |

| Curtailment | (306) | |

Actuarial losses (gains) | (290) | |

Currency translation adjustment | 143 | |

Projected benefit obligation present value at December 31, 2023 | $ | 4,123 | |

Service cost | 518 | |

Interest cost | 119 | |

| |

Actuarial losses (gains) | 101 | |

Currency translation adjustment | 77 | |

Projected benefit obligation present value at September 30, 2024 | $ | 4,938 | |

The Company does not hold any plan assets for any of the periods presented.

The main assumptions used for the purposes of the actuarial valuations are listed below:

| | | | | | | | | | | |

| Nine Months Ended | | Year Ended |

| September 30, 2024 | | December 31, 2023 |

Discount rate (Corp AA) | 3.8% | | 3.9% |

Expected rate of salary increase | 7.0% | | 7.0% |

Expected rate of social charges | 48.0% | | 48.0% |

Expected staff turnover | Company age-based table | | Company age-based table |

Estimated retirement age | 65 years old | | 65 years old |

Life table | TH-TF 2000-2002 shifted | | TH-TF 2000-2002 shifted |

Defined Contribution Plans

The total expense represents contributions payable to these plans by us at specified rates.

In some countries, the Group’s employees are eligible for pension payments and similar financial benefits. The Group provides these benefits via defined contribution plans. Under defined contribution plans, the Group has no obligation other than to pay the agreed contributions, with the corresponding expense charged to income for the year. The main contributions relate to France, the United States (for 401k plans), and the United Kingdom.

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | September 30, 2023 | | September 30, 2024 | September 30, 2023 |

| (in thousands) |

Defined contributions plans included in personnel expenses | $ | (4,684) | | $ | (4,694) | | | $ | (14,974) | | $ | (14,308) | |

Note 9. Revenue

The following table presents our disaggregated revenues by segment:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | Retail Media | | Performance Media | | Total |

| | | (in thousands) |

| September 30, 2024 | $ | 60,765 | | | $ | 398,127 | | | $ | 458,892 | |

| September 30, 2023 | $ | 49,813 | | | $ | 419,380 | | | $ | 469,193 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended | Retail Media | | Performance Media | | Total |

| | | (in thousands) |

| September 30, 2024 | $ | 166,414 | | | $ | 1,213,840 | | | $ | 1,380,254 | |

| September 30, 2023 | $ | 132,424 | | | $ | 1,250,719 | | | $ | 1,383,143 | |

Note 10. Share-Based Compensation

Equity awards Compensation Expense

Equity awards compensation expense recorded in the consolidated statements of operations was as follows:

| | | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | |

| (in thousands) |

Research and Development | $ | (44,461) | | | $ | (44,438) | | |

Sales and Operations | (15,703) | | | (15,240) | | |

General and Administrative | (22,029) | | | (16,675) | | |

Total equity awards compensation expense (1) | $ | (82,193) | | | $ | (76,353) | | |

| Tax benefit from equity awards compensation expense | 7,920 | | | 6,084 | | |

| Total equity awards compensation expense, net of tax effect | $ | (74,273) | | | $ | (70,269) | | |

(1) The nine months ended September 30, 2024 are presented net of $2.9 million capitalized stock-based compensation relating to internally developed software.

The breakdown of the equity award compensation expense by instrument type was as follows:

| | | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | |

| (in thousands) |

| Share options | $ | (46) | | | $ | (80) | | |

| Lock-up shares | (29,790) | | | (28,326) | | |

| Restricted stock units / Performance stock units | (51,058) | | | (46,519) | | |

| Non-employee warrants | (1,299) | | | (1,428) | | |

Total equity awards compensation expense (1) | $ | (82,193) | | | $ | (76,353) | | |

| Tax benefit from equity awards compensation expense | 7,920 | | | 6,084 | | |

| Total equity awards compensation expense, net of tax effect | $ | (74,273) | | | $ | (70,269) | | |

(1) Presented net of $2.9 million capitalized stock-based compensation relating to internally developed software.

A detailed description of each instrument type is provided below.

Share Options

Stock options granted under the Company’s stock incentive plans generally vest over four years, subject to the holder’s continued service through the vesting date and expire no later than 10 years from the date of grant.

In the following tables, exercise prices, grant date share fair values and fair value per equity instruments are provided in euros, as the Company is incorporated in France and the euro is the currency used for the grants.

| | | | | | | | | | | | | | | | | | | | | | | |

| Options Outstanding |

| Number of Shares Underlying Outstanding Options | | Weighted-Average Exercise Price | | Weighted-Average Remaining Contractual Term (Years) | | Aggregate Intrinsic Value |

| | |

Outstanding as of December 31, 2023 | 319,238 | | | | | | | |

| Options granted | — | | | | | | | |

| Options exercised | (79,993) | | | | | | | |

| Options forfeited | (9,439) | | | | | | | |

| Options canceled | — | | | | | | | |

| Options expired | (6,320) | | | | | | | |

Outstanding as of September 30, 2024 | 223,486 | | | | | | | |

| | | | | | | |

Vested and exercisable as of September 30, 2024 | 223,486 | | | € | 18.72 | | | 4.62 | | € | 17.94 | |

The aggregate intrinsic value represents the difference between the exercise price of the options and the fair market value of common stock on the date of exercise. No new stock options were granted in the period ending September 30, 2024. As of September 30, 2024, there was no remaining unrecognized stock-based compensation related to unvested stock options.

Lock up shares

On August 1, 2022, 2,960,243 treasury shares were transferred to the Founder (referred to as Lock Up Shares or "LUS"), as partial consideration for the Iponweb Acquisition. These shares are subject to a lock-up period that expires in three installments on each of the first three anniversaries of the Iponweb Acquisition, unless the vesting schedule changes or the Founder's employment agreement is terminated under certain circumstances during the duration of such lock-up period. These shares are considered as share-based compensation under ASC 718 and are accounted over the three-year lock-up period. The share based compensation expense is included in Research and Development expenses on the Consolidated Statement of Income. The shares were valued based on the volume weighted average price of one ADS traded on Nasdaq during the twenty (20) trading days immediately preceding July 28, 2022.

| | | | | | | | | | | |

| Shares | | Weighted-Average Grant date Fair Value Per Share |

|

|

Outstanding as of December 31, 2023 | 1,953,761 | | | — | |

| Granted | — | | | — | |

| Vested | (1,351,880) | | | — | |

| Forfeited | — | | | — | |

Outstanding as of September 30, 2024 | 601,881 | | | $ | 23.73 | |

During the three-month period ended September 30, 2024, the Company repurchased 640,000 shares, upon the expiration of the lock-up for approximately $30.0 million, as part of our share buy-back program. The shares were repurchased at fair market value based on the Nasdaq closing price. This resulted in additional share-based compensation expense of $13.3 million in the Consolidated Statement of Income.

As of September 30, 2024, the Company had unrecognized stock-based compensation relating to these lock up share awards of approximately $4.4 million, which is expected to be recognized over a period from October 1, 2024 to August 1, 2025.

Restricted Stock Units and Performance Stock Units

During the nine months ended September 30, 2024, the Company granted new equity under our current equity compensation plans, which was comprised of restricted stock units (“RSU”), and performance-based RSU awards consisting of total shareholder return (“TSR”) and performance vesting conditions (“PSU”) to the Company’s senior executives.

Restricted Stock Units

Restricted stock units generally vest over four years, subject to the holder’s continued service and/or certain performance conditions through the vesting date. In the following tables, exercise prices, grant date share fair values and fair value per equity instruments are in euros, as the Company is incorporated in France and the euro is the currency used for the grants.

| | | | | | | | | | | |

| Shares (RSU) | | Weighted-Average Grant date Fair Value Per Share |

|

|

Outstanding as of December 31, 2023 | 5,293,263 | | | — | |

| Granted | 1,492,022 | | | — | |

| Vested | (1,595,513) | | | — | |

| Forfeited | (294,566) | | | — | |

Outstanding as of September 30, 2024 | 4,895,206 | | | € | 30.86 | |

The RSUs are subject to a vesting period of four years, over which the expense is recognized on a straight-line basis. A total of 1,492,022 shares have been granted under this plan, with a weighted-average grant-date fair value of €30.86.

As of September 30, 2024, the Company had unrecognized stock-based compensation relating to restricted stock of approximately $89.6 million, which is expected to be recognized over a weighted-average period of 3.3 years.

Performance Stock Units

Performance stock units are subject to either a performance condition or a market condition.

Awards that are subject to a performance condition, are earned based on internal financial performance metrics measured by Contribution ex-TAC. A total of 568,081 shares have been granted at target under two plans with a vesting period of three years. The target shares are subject to a range of vesting from 0% to 200% based on the performance of internal financial metrics, for a maximum number of shares of 1,136,162. The grant-date fair value is determined based on the fair-value of the shares at the grant date. The weighted average grant-date fair value of those plans is €30.54 per share for a total fair value of approximately $18.9 million, to be expensed on a straight-line basis over the respective vesting period. The number of shares granted, vesting and outstanding subject to performance conditions is as follows:

| | | | | | | | | | | |

| Shares (PSU) | | Weighted-Average Grant date Fair Value Per Share |

|

|

Outstanding as of December 31, 2023 | 660,395 | | | — | |

| Granted | 568,081 | | | — | |

Performance share adjustment | 64,152 | | | |

| Vested | (202,637) | | | — | |

| Forfeited | — | | | — | |

Outstanding as of September 30, 2024 | 1,089,991 | | | € | 30.54 | |

As of September 30, 2024, the Company had unrecognized stock-based compensation related to performance stock units of approximately $19.5 million, which is expected to be recognized over a weighted-average period of 3.2 years.

Awards that are subject to a market condition are earned based on the Company’s total shareholder return relative to the Nasdaq Composite Index, and certain other vesting conditions. A total of 268,226 shares have been granted at target under this plan, to be earned in two equal tranches over a term of two and three years, respectively. The target shares are subject to a range of vesting from 0% to 200% for each tranche based on the TSR, for a maximum number of shares of 536,452. The grant-date fair value is approximately $13.7 million, to be expensed on a straight-line basis over the respective vesting period.

The grant-date fair value was determined based on a Monte-Carlo valuation model using the following key assumptions:

| | | | | |

| Expected volatility of the Company | 42.73 | % |

| Expected volatility of the benchmark | 71.18 | % |

| Risk-free rate | 4.27 | % |

| Expected dividend yield | — | % |

The number of shares granted, vested and outstanding subject to market conditions is as follows:

| | | | | | | | | | | |

| Shares (TSR) | | Weighted-Average Grant date Fair Value Per Share |

|

|

Outstanding as of December 31, 2023 | — | | | — | |

| Granted | 268,226 | | | — | |

| Vested | — | | | — | |

| Forfeited | — | | | — | |

Outstanding as of September 30, 2024 | 268,226 | | | € | 47.42 | |

As of September 30, 2024, a total of $3.4 million expense has been recognized and the Company had unrecognized stock-based compensation related to performance stock units based of market conditions of $10.5 million, which is expected to be recognized over a period from October 1, 2024 to March 1, 2027.

Non-employee warrants

Non-employee warrants generally vest over four years, subject to the holder’s continued service through the vesting date.

| | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | Weighted-Average Grant date Fair Value Per Share | | Weighted-Average Remaining Contractual Term (Years) | | Aggregate Intrinsic Value |

| | |

| | |

Outstanding as of December 31, 2023 | 244,457 | | | | | | | |

| Granted | — | | | | | | | |

| Exercised | (84,560) | | | | | | | |

| Canceled | — | | | | | | | |

| Expired | — | | | | | | | |

Outstanding as of September 30, 2024 | 159,897 | | | € | 16.59 | | | 3.80 | | € | 20.11 | |

| | | | | | | |

Vested and exercisable - September 30, 2024 | 159,897 | | | | | | | |

The aggregate intrinsic value represents the difference between the exercise price of the non-employee warrants and the fair market value of common stock on the date of exercise.

No new stock non-employee warrants were granted in the period ending September 30, 2024. As of September 30, 2024 all instruments have fully vested.

Note 11. Financial and Other Income and Expenses

The condensed consolidated statements of income line item “Financial and Other income (Loss)” can be broken down as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | September 30, 2023 | | September 30, 2024 | September 30, 2023 |

| (in thousands) |

| Financial income from cash equivalents | $ | 1,432 | | $ | 1,055 | | | $ | 5,261 | | $ | 3,190 | |

| Interest and fees | (505) | | (437) | | | (1,337) | | (1,500) | |

Foreign exchange losses | (901) | | (1,731) | | | (1,459) | | (4,683) | |

| Discounting impact | (8) | | (1,593) | | | (1,774) | | (3,692) | |

Other financial income | (26) | | (261) | | | 198 | | 8,693 | |

Total Financial and Other Income (Expense) | $ | (8) | | $ | (2,967) | | | $ | 889 | | $ | 2,008 | |

The $0.9 million in financial and other income for the nine months ended September 30, 2024, were mainly driven by financial income from cash equivalents, partially offset by a negative impact of foreign exchange losses and the change in the accretion of the earn-out liability related to the Iponweb Acquisition.

As of September 30, 2024, our exposure to foreign currency risk was centralized at Criteo S.A. and hedged using foreign currency swaps or forward purchases or sales of foreign currencies.

Note 12. Income Taxes

The tax provision for interim periods is determined using an estimate of our annual effective tax rate (“AETR”), adjusted for discrete items arising in the period. To calculate our estimated AETR, we estimate our income before taxes and the related tax expense or benefit for the full fiscal year (total of expected current and deferred tax provisions), excluding the effect of significant unusual or infrequently occurring items or comprehensive income items not recognized in the statement of income. Each quarter, we update our estimate of the annual effective tax rate, and if our estimated annual tax rate does change, we make a cumulative adjustment in that quarter. Our quarterly tax provision, and our quarterly estimate of our annual effective tax rate, are subject to significant volatility due to several factors, including our ability to accurately predict our income (loss) before provision for income taxes in multiple jurisdictions. Our effective tax rate in the future will depend on the portion of our profits earned within and outside of France.

In December 2021, the Organization for Economic Cooperation and Development (OECD) released Pillar Two Model Rules defining the global minimum tax, which calls for the taxation of a minimum rate of 15% for multinational companies with consolidated revenue above €750 million. Numerous jurisdictions have enacted or are in the process of enacting legislation to adopt a minimum effective tax rate. While the adoption of Pillar Two did not have a material impact on the nine months ended September 30, 2024, the Company will continue to assess the ongoing impact as additional guidance becomes available.

The following table presents provision for income taxes:

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 |

| (in thousands) |

| Provision for income tax (expense) benefit | $ | (15,014) | | | $ | 1,685 | |

For the nine months ended September 30, 2024, the provision for income taxes differs from the nominal standard French rate of 25.0% primarily due to the application the reduced income tax rate on the majority of the technology royalties income in France and nondeductible equity awards compensation expense.

Note 13. Earnings Per Share

Basic Earnings (Loss) Per Share

We calculate basic earnings (loss) per share ("EPS") by dividing the net income or loss for the period attributable to shareholders of the Parent by the weighted average number of shares outstanding.

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | September 30, 2023 | | September 30, 2024 | September 30, 2023 |

Net income (loss) attributable to shareholders of Criteo S.A. | $ | 6,245 | | $ | 6,927 | | | $ | 40,476 | | $ | (7,758) | |

| Weighted average number of shares outstanding | 54,695,112 | | 56,297,666 | | | 54,840,650 | | 56,173,218 | |

Basic earnings (loss) per share | $ | 0.11 | | $ | 0.12 | | | $ | 0.74 | | $ | (0.14) | |

Diluted Earnings (Loss) Per Share

We calculate diluted earnings (loss) per share by dividing the net income or loss attributable to shareholders of the Parent by the weighted average number of shares outstanding plus any potentially dilutive shares not yet issued from share-based compensation plans (refer to Note 10). For the nine months ended September 30, 2023, the Company reported a net loss hence basic net loss per share was the same as diluted net loss per share, as the inclusion of all potential shares of common stock outstanding would have been anti-dilutive.

For each period presented, a contract to issue a certain number of shares (i.e., share option, non-employee warrant, employee warrant ("BSPCE") was assessed as potentially dilutive if it was “in the money” (i.e., the exercise or settlement price is lower than the average market price).

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | September 30, 2023 | | September 30, 2024 | September 30, 2023 |

Net income (loss) attributable to shareholders of Criteo S.A. | $ | 6,245 | | $ | 6,927 | | | $ | 40,476 | | $ | (7,758) | |

| Basic shares : | | | | | |

| Weighted average number of shares outstanding of Criteo S.A. | 54,695,112 | | 56,297,666 | | | 54,840,650 | | 56,173,218 | |

| Dilutive effect of : | | | | | |

| Restricted share awards ("RSUs") | 3,080,895 | | 3,718,688 | | | 2,947,233 | | — | |

Lock-up shares ('LUSs") | 472,956 | | 967,941 | | | 949,255 | | — | |

| Share options and BSPCE | 121,177 | | 103,221 | | | 112,102 | | — | |

| Share warrants | 59,993 | | 53,378 | | | 60,712 | | — | |

| Diluted shares : | | | | | |

| Weighted average number of shares outstanding used to determine diluted earnings per share | 58,430,133 | | 60,172,953 | | | 58,909,952 | | 56,173,218 | |

Diluted earnings (loss) per share | $ | 0.11 | | $ | 0.12 | | | $ | 0.69 | | $ | (0.14) | |

The weighted average number of securities that were anti-dilutive for diluted EPS for the periods presented but which could potentially dilute EPS in the future are as follows:

| | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | September 30, 2023 |

| Restricted share awards | 303,261 | | 165,940 | |

| Share options and BSPCE | — | | — | |

| Weighted average number of anti-dilutive securities excluded from diluted earnings per share | 303,261 | | 165,940 | |

Note 14. Commitments and contingencies

From time to time we may become involved in legal proceedings or be subject to claims arising in the ordinary course of our business. We are not presently a party to any legal proceedings that, if determined adversely to us, would individually or taken together have a material adverse effect on our business, results of operations, financial condition or cash flows. Regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors.

The amount of the provisions represents management’s latest estimate of the expected impact.

Legal and Regulatory matters

Following a complaint from Privacy International against a number of advertising technology companies with certain data protection authorities, including in France, France's Commission Nationale de l'Informatique et des Libertés (the "CNIL") opened a formal investigation in January 2020 against Criteo. In June 2023, the CNIL issued its decision, which retained alleged European Union's General Data Protection Regulation ("GDPR") violations but reduced the financial sanction against Criteo from the original amount of €60 million ($64.2 million) to €40 million ($42.8 million). Criteo issued the required sanction payment during the third quarter of 2023. The decision relates to past matters and does not include any obligation for Criteo to change its current practices. Criteo has appealed this decision before the French Council of State (Conseil d’Etat).

We are party to a claim (Doe v. GoodRx Holdings, Inc. et al. in the U.S. District Court for the Northern District of California), alleging violations of various state and federal laws. We intend to vigorously defend our position, but we are unable to predict the potential outcome at this time.

Non-income tax risks