Capital Southwest Announces Capital Markets Activity for the Quarter Ended December 31, 2022

04 January 2023 - 8:01AM

Capital Southwest Corporation (“Capital Southwest”, “the Company”)

(Nasdaq: CSWC), an internally managed business development company

focused on providing flexible financing solutions to support the

acquisition and growth of middle market businesses, is pleased to

release an overview of its capital markets activity for the quarter

ended December 31, 2022.

During the quarter, Capital Southwest raised a

total of $104.3 million in gross equity proceeds at a weighted

average price of $17.99, or 109% of the prevailing NAV per Share.

The Company raised equity proceeds through both an underwritten

public offering and its “at-the-market” offering (“Equity ATM

Program”). Total gross proceeds raised in the underwritten offering

and through the Equity ATM Program were $46.0 million and $58.3

million, respectively. In total, the Company received net equity

proceeds of $101.6 million during the quarter, after deducting

commissions paid to the underwriters on shares sold.

In addition, during the quarter, the Company

received a commitment from the Small Business Administration

(“SBA”) to reserve $50 million of additional leverage in the form

of SBA-guaranteed debentures (“SBA Debentures”) to Capital

Southwest SBIC I, L.P, a wholly owned subsidiary of the Company

(“SBIC I”). This brings the total SBA leverage commitment to SBIC I

to $130 million. Each issuance of leverage continues to be

conditioned upon full compliance with SBA regulations. As of

September 30, 2022, SBIC I had $80 million in SBA Debentures

outstanding.

Finally, during the quarter, the Company

completed an increase to its senior secured revolving credit

facility (the “Credit Facility”). The Credit Facility was increased

under the existing accordion feature by $20 million, bringing the

total commitments from $380 million to $400 million. The $20

million increase was provided by one existing lender and one new

lender, bringing the total bank syndicate to 11 participants. As of

September 30, 2022, the Credit Facility had $240 million in total

debt outstanding.

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is

a Dallas, Texas-based, internally managed business development

company with approximately $1.1 billion in investments at fair

value as of September 30, 2022. Capital Southwest is a middle

market lending firm focused on supporting the acquisition and

growth of middle market businesses with $5 million to $35 million

investments across the capital structure, including first lien,

second lien and non-control equity co-investments. As a public

company with a permanent capital base, Capital Southwest has the

flexibility to be creative in its financing solutions and to invest

to support the growth of its portfolio companies over long periods

of time.

Disclaimers

This press release contains historical

information with respect to Capital Southwest’s equity capital

activities and capital resources. No assurance can be provided that

the Company can access equity capital in the future and at the same

pace. In addition, current statues and regulations permit SBIC I to

borrow up to $175 million in SBA Debentures with at least $87.5

million in regulatory capital (as defined in the SBA regulations).

The SBA also may limit the amount that may be drawn each year under

its leverage commitments. These statements are not guarantees of

future results and are subject to numerous risks, uncertainties and

assumptions that could cause future performance results to differ

materially from historical performance. These risks include risks

related to: the impact of market conditions on Capital Southwest’s

ability to access the equity capital in the future; changes in the

financial, capital, and lending markets; changes in the interest

rate environment; regulatory changes; tax treatment and general

economic and business conditions; Capital Southwest’s ability to

operate SBIC I, as an SBIC; and uncertainties associated with the

impact from the COVID-19 pandemic.

Readers are encouraged to review Capital

Southwest's Annual Report on Form 10-K for the year ended March 31,

2022 and subsequent filings, including the "Risk Factors" sections

therein, with the Securities and Exchange Commission for a more

complete discussion of the risks and other factors that could

affect our business. Except as required by the federal securities

laws, Capital Southwest does not undertake any obligation to

publicly update or revise any disclaimers, whether as a result of

new information, future events, changing circumstances or any other

reason after the date of this press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial Officer214-884-3829

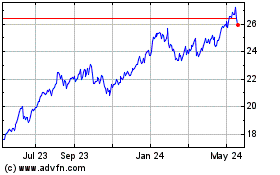

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

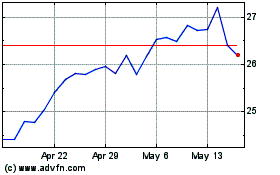

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Jan 2024 to Jan 2025