Form 8-K - Current report

08 August 2024 - 10:21PM

Edgar (US Regulatory)

0000029332False00000293322024-08-082024-08-0800000293322023-05-022023-05-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

THE DIXIE GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Tennessee | | 0-2585 | | 62-0183370 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 475 Reed Road | Dalton | Georgia | 30720 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| (706) | 876-5800 |

| (Registrant's telephone number, including area code) |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $3 Par Value | | DXYN | | NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

The information attached as Exhibit 99.1 hereto supersedes the investor presentation previously furnished on Form 8-K dated May 2, 2024 and is being furnished pursuant to Item 7.01; such information, including the information excerpted below in this Item 7.01, shall not be deemed to be "filed" for any purpose.

These updated investor presentation materials may be found on the Company's website at

https://investor.dixiegroup.com.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: August 8, 2024 | | THE DIXIE GROUP, INC. |

| | |

| | By: /s/ Allen L. Danzey |

| | Allen L. Danzey |

| | Chief Financial Officer |

August 2024 Investor Presentation Contact: Allen Danzey CFO The Dixie Group Phone: 706-876-5865 allen.danzey@dixiegroup.com Exhibit 99.1

Forward Looking Statements The Dixie Group, Inc. • Statements in this presentation which relate to the future, are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company’s results include, but are not limited to, raw material and transportation costs related to petroleum prices, the cost and availability of capital, and general economic and competitive conditions related to the Company’s business. Issues related to the availability and price of energy may adversely affect the Company’s operations. Additional information regarding these and other factors and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission. • General information set forth in this presentation concerning market conditions, sales data and trends in the U.S. carpet and rug markets are derived from various public and, in some cases, non-public sources. Although we believe such data and information to be accurate, we have not attempted to independently verify such information. 2

Dixie History • 1920 • 1990’s • 2003 • 2003 • 2005 • 2012 • 2013 • 2014 • 2014 • 2016 • 2017 • 2018 • 2018 • 2019 • 2021 • 2022 • 2024 Began as Dixie Mercerizing in Chattanooga, TN Transitioned from textiles to floorcovering Refined focus on upper- end floorcovering market Launched Dixie Home - upper end residential line Launched modular tile carpet line – new product category Purchased Colormaster dye house and Crown Rugs Purchased Robertex - wool carpet manufacturing Purchased Atlas Carpet Mills – high-end commercial business Purchased Burtco - computerized yarn placement for hospitality Launched Calibré luxury vinyl flooring in Masland Contract Launched Stainmaster® LVF in Masland and Dixie Home Launched engineered wood in our Fabrica brand Unified Atlas and Masland Contract into single business unit Launched TRUCOR and TRUCOR Prime LVF in Dixie Home and Masland Sale of AtlasMasland Commercial Business Launched 1866 by Masland and Décor by Fabrica Celebrating the 50th Anniversary of the Fabrica Brand 3

Dixie Today • Commitment to brands in the upper-end residential market with strong growth potential. • Diversified customer base – Top 10 customers • 6.6% of sales – Top 100 customers • 24% of sales 4

Net Sales of Residential Products ($ shown in millions) 5

Dixie Group Business Drivers 6 • The residential flooring market is driven by remodeling, existing home sales and new construction of single family and multifamily housing. • Our residential business plays primarily in the mid to high end residential replacement segment, dependent upon consumer confidence, the health of the stock market and the wealth effect.

Market Data Industry Sales in $ Industry Sales in Units US Existing Home Sales Mortgage Rates Comparative industry sales data for first quarter over the last three years show sales down 21.7% in dollars and 26.5% in units. Existing home sales, affected by rising mortgage rates, are down significantly from the strong activity in 2022. $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 2021 2022 2023 2024 Data is for First Six Months of Each Year 23.3% Decline 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 2021 2022 2023 2024 Data is for First Six Months of Each Year 26.0% Decline

Remodeling Activity 8

2023 U.S. Flooring Manufacturers Source: Floor Focus - Flooring includes sales of carpet, rugs, ceramic floor tile, wood, laminate, resilient and rubber 9 Flooring Manufacturers Flooring $ in millions Flooring Market % Shaw (Berkshire Hathaway) 5,487 21.6% Mohawk (MHK) 4,895 19.3% Engineered Floors 1,475 5.8% MSI 1,367 5.4% Mannington 852 3.4% Imports & All Others 11,229 44.4% Total 25,305 100.0%

Carpet Trends – Independent Floor Covering Retailers The Dixie Group as Compared to the Industry Independent Floor Covering Retailers excludes big box stores and business related to multi- family housing and new home construction. This most closely represents the area Dixie competes in. -25% -20% -15% -10% -5% 0% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Independent FC Retail The Dixie Group 10

GROWTH INITIATIVES Decorative/TDG Retail Soft/Industry (Residential Replacement) -25.0% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 2022.Q1 2022.Q2 2022.Q3 2022.Q4 2023.Q1 2023.Q2 2023.Q3 2023.Q4 2024.Q1 Decorative / TDG Retail Soft / Industry (Res Replacement) Decorative TDG Retail Soft Residential Replacement 11

GROWTH INITIATIVES PET/TDG Retail Soft/Industry (Residential Replacement) -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 2022.Q1 2022.Q2 2022.Q3 2022.Q4 2023.Q1 2023.Q2 2023.Q3 2023.Q4 2024.Q1 TDG Retail Soft Residential Replacement PET 12

Market Share 13Sales by The Dixie Group as a percent of the estimated total residential market

Industry Positioning The Dixie Group • Strategically our business is driven by our relationship to the upper-end consumer and the design community • This leads us to: – Have a sales force that is attuned to design and customer solutions – Be a “product driven company” with an emphasis on beautiful and trend setting styles, colors, and designs – Be quality focused with a reputation for building excellent products and standing behind what we make – And, unlike most of the industry, not manufacturing driven 14

Dixie Group High-End Residential Sales All Brands 15 Sales by Brand for Q2 2024 Trailing Twelve Months

Dixie Group High-End Residential Sales All Brands Sales by Channel for Q2 2024 Trailing Twelve Months The company believes that a significant portion of retail sales also involve a designer. 16 Retailer Designer Other Builder

• In 2023, we rebranded Dixie Home as DH Floors and celebrated 20 years in the market. • Affordable Fashion: DH Floors provides well styled carpet and hard surface designs in the mid to high end residential market. • With a broad range of price points, DH Floors meets the needs of a wide range of consumers through the specialty retail channel. • During 2023, our new collection of beautiful carpet styles made with DuraSilk SD Pet Solutions polyester was well received by the market and became a key growth category. • In 2024, we are expanding our line of DuraSilk SD carpet styles with unique aesthetics and colorations. We are also launching new EnVision® Nylon and EnVision®SD Nylon styles. • Growth initiatives – DuraSilk SD Pet Solutions Polyester – TRUCOR® SPC and MFC Hybrid flooring – DH engineered wood – EnVision® Nylon – EnVisionSD® Pet Solutions 17

• Inspired by Design: leading high-end brand with reputation for innovative styling, design and color • High-end retail / designer driven, approximately 16% of sales directly involve a designer • The most versatile offering in the industy • Growth initiatives – TRUCOR® Prime WPC flooring – TRUCOR® Energy SPC flooring – TRUCOR® Tymbr high performance laminate flooring – 1866 by Masland high end wool and decorative carpet and rugs – EnVision Nylon – EnVisionSD Pet Solutions 15

• Quality without Compromise: beautiful, high end residential products, manufactured with the finest raw materials and an unwavering commitment to quality and attention to detail. • Designer focused, approximately 22% of sales directly involve a designer • Custom construction, pattern, and color capabilities. • Celebrating the Fabrica brand’s 50th Anniversary in 2024 • Growth initiatives – Fabrica Fine Wood Floors, a sophisticated collection of refined wood flooring – EnVision Nylon – Décor by Fabrica – high end wool and decorative carpet and rugs 16

Business Challenges • Invista sold Stainmaster brand to Lowes • Ultimately led to the loss of our business with Lowes – our largest mass merchant customer • We sold our commercial division to Mannington • Began a restructuring plan to right size our operations to the new sales volume 2021 • Our primary raw material supplier exited the business in an abrupt and abusive manner • We endured exorbitant price increases coupled with significant internal costs, disruptions in operations and delayed introductions of new product • We lost our business with our largest mass merchant retailer as a result of the sale of the Stainmaster brand and cost increases • Exorbitant increase in the freight costs for imported goods • Cost and operational disruptions as a result of our ongoing restructuring plan 2022 • Higher rates on mortgages and inflated housing prices have caused a decline in sales within the flooring industry • Decline in the volume of sales of existing homes - a primary driver for our business • Persistent inflation and other economic conditions have delayed interest cuts expected in 2024 2023 - 2024

2023 Cost Reduction Plan $35.6 Million In iti at iv e Co st S av in gs Employee Headcount Reduction Number of employees was reduced by 27% (354 employees) Lower Costs on Nylon Fiber. Existing nylon broadloom styles were converted to new raw material fibers from multiple suppliers at lower cost Reduction in Sample Expense Prior year included non-recurring expense for displays related to decorative and hard surface businesses Reduction in the Cost of Freight for Imported Inventory Inflated costs incurred in 2022 returned to, and remained at, more normal levels in 2023 $13.4 Million $7.0 Million $5.0 Million $4.1 Million Other Cost Reductions Operational improvements, reductions in other raw materials, lease revenue from available warehouse space, increased freight surcharges and favorable adjustment to customer discount terms $6.1 Million 21

2024 Cost Reduction Plan $11.9 Million In iti at iv e Co st S av in gs Raw Material Cost Savings Savings from Partial Year of Internal Extrusion Operations and reductions in Costs of Nylon Fiber and Polyester Yarn Reductions in Expenses for Samples Costs maintained at a level to support new product introductions and sample replenishment Lower Expenses Related to Restructuring Change in Customer Terms for Discounts $3.6 Million $2.0 Million $2.0 Million $1.7 Million Other Cost Reductions Operational Improvements and Lease Revenue from Available Warehouse Space $2.6 Million 22

Looking Forward We anticipate strong sales driven by pent up demand when interest rates are reduced and the housing market recovers. Gross margins will continue to improve with full volume from extrusion operations and increased volume in the manufacturing plants. Selling expenses are expected to stay at normal levels for product introductions and sample replenishment. Other income will increase for revenue from leasing available warehouse space. 23

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

May 02, 2023 |

| Document Information [Line Items] |

|

|

| Document Type |

8-K

|

|

| Amendment Flag |

false

|

|

| Document Period End Date |

Aug. 08, 2024

|

|

| Entity Registrant Name |

THE DIXIE GROUP, INC.

|

|

| Entity Incorporation, State or Country Code |

TN

|

|

| Entity File Number |

0-2585

|

|

| Entity Tax Identification Number |

62-0183370

|

|

| Entity Address, Address Line One |

475 Reed Road

|

|

| Entity Address, City or Town |

Dalton

|

|

| Entity Address, State or Province |

GA

|

|

| Entity Address, Postal Zip Code |

30720

|

|

| City Area Code |

(706)

|

|

| Local Phone Number |

876-5800

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

Common Stock, $3 Par Value

|

|

| Trading Symbol |

DXYN

|

|

| Security Exchange Name |

NASDAQ

|

|

| Entity Emerging Growth Company |

|

false

|

| Entity Central Index Key |

0000029332

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

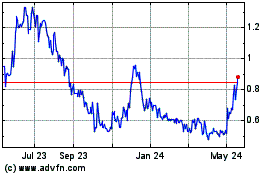

Dixie (NASDAQ:DXYN)

Historical Stock Chart

From Jan 2025 to Feb 2025

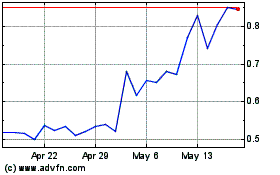

Dixie (NASDAQ:DXYN)

Historical Stock Chart

From Feb 2024 to Feb 2025