0000029332False00000293322024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

THE DIXIE GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Tennessee | | 0-2585 | | 62-0183370 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 475 Reed Road | Dalton | Georgia | 30720 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| (706) | 876-5800 |

| (Registrant's telephone number, including area code) |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $3 Par Value | | DXYN | | NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, The Dixie Group, Inc. issued a press release reporting results for the second quarter ended June 29, 2024.

Item 9.01. Financial Statements and Exhibits.

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: August 8, 2024 | | THE DIXIE GROUP, INC. |

| | |

| | By: /s/ Allen L. Danzey |

| | Allen L. Danzey |

| | Chief Financial Officer |

CONTACT: Allen Danzey

Chief Financial Officer

706-876-5865

allen.danzey@dixiegroup.com

THE DIXIE GROUP REPORTS NET INCOME FOR THE SECOND QUARTER OF 2024

DALTON, GEORGIA (August 8, 2024) -- The Dixie Group, Inc. (NASDAQ: DXYN) today reported financial results for the quarter ended June 29, 2024.

•Net sales in the second quarter of 2024 were $70.5 million compared to $74.0 million in the same period of the prior year

•The gross profit margin for the three months of the second quarter of 2024 was 28.1% of net sales compared to 26.7% in the second quarter of 2024

•Operating income in the second quarter of 2024 was $2.3 million compared to $0.3 million in the second quarter of the prior year

•The Company had a net income from continuing operations of $0.7 million in the second quarter of 2024 compared to a net loss of $1.6 million in the same period of the prior year

•Subsequent to quarter end, the Company completed a 10 year sublease agreement to lease out all of the available warehouse space in its Saraland, Alabama facility. The Company will recognize an annual amount of approximately $1.8 million in other income over the term of the lease.

For the second quarter of 2024, the Company had net sales of $70,507,000 as compared to $74,009,000 in the same quarter of 2023. The Company had an operating income of $2,295,000 compared to an operating income of $253,000 in the second quarter of 2023. The net income from continuing operations in the second quarter of 2024 was $667,000 or $0.04 per diluted share. In 2023, the net loss from continuing operations for the second quarter was $1,620,000 or $0.11 per diluted share.

For the six months ended June 29, 2024, net sales were $135,761,000 or 3.8% below the net sales for the six-month period ended July 1, 2023 at $141,093,000. The operating income for the first six months of 2024 was $1,437,000 compared to an operating income of $560,000 in the same period of the prior year. The Company had a net loss from continuing operations of $1,743,000 or $0.12 per diluted share for the six months ended June 29, 2024 compared to a net loss form continuing operations of $3,171,000 or $0.22 per diluted share in the six month period ending July 1, 2023.

Commenting on the results, Daniel K. Frierson, Chairman and Chief Executive Officer, said, “High interest rates affecting the housing and home remodeling market and the impact on the economy from continued inflation continue to negatively impact our overall sales volume. Net sales from soft surfaces during the quarter were less than 1% below prior year while the industry, we believe, was down approximately 5.4%.We saw favorable margins in the second quarter as a result of the consolidation of our manufacturing operations on the East Coast and other cost savings initiatives, including the start of operations on our new extrusion line. The successful start up of our extrusion line provides us with raw materials at lower costs, as compared to our external purchasing, and also provides a continuity of supply, protecting us and our customers from potential supply disruptions.

The Dixie Group Reports Second Quarter 2024 Results

Page 2

August 8, 2024

During the quarter, we launched our Step Into Color campaign with in store marketing materials and a digital presence. This campaign connects our retail customers, designers, and consumers with a world of color options including custom color, which is now available in all brands. This is a great option for the customer who is looking for that perfect hue of a particular color. In a residential market which continues to move toward the sea of sameness that is solution dyed polyester, we are setting ourselves apart with piece dyed nylon.

In addition, we launched 18 new carpet styles in the second quarter, including 6 new DuraSilk™SD polyester styles in our DH Floors line and 11 new decorative styles in our 1866 and Décor lines. We also launched 6 new collections with 38 SKUs as updates to our hard surface programs. These included SPC Tile Looks, high end WPC, and high end engineered wood in our Fabrica program. These launches complete our new product launches for 2024 and these new products are already generating meaningful volume.

Our new product offerings will help us continue to maintain sales volume in a difficult market. We continue to be on track with our plan to reduce year over year costs by over $10 million in 2024 through cost savings related to our extrusion operations and the reduction of other controllable costs. We believe, once interest rates come down and consumer confidence returns, the housing market, along with remodeling activity, will rebound strongly, driven by pent up demand.” Frierson concluded.

The gross profit in the second quarter of 2024 was 28.1% of net sales compared to 26.7% of net sales in the second quarter of 2023. Our improved gross profit margins in 2024 were the result of efficiencies in our manufacturing operations, specifically related to our east coast plant consolidations, higher volumes and cost reductions including savings generated from our extrusion line operations. Selling and administrative costs in the second quarter of 2024 were below the prior year in expense dollars and as a percent of net sales, 24.6% in 2024 as compared to 25.7% in the same quarter of 2023.

On our balance sheet, receivables increased $4.3 million from the balance at fiscal year end 2023 due to higher sales in the last month of the second quarter 2024 as compared to the seasonally lower sales volume in the last month of the fiscal year 2023. The net inventory value of $76.1 million at the end of the second quarter of 2024 was slightly lower than the fiscal year end 2023 balance of $76.2 million. Combined accounts payable and accrued expenses were $6.2 million higher at the end of the second quarter of 2024 as compared to the December 2023 balance. This increase was primarily driven by higher payables and accruals for raw materials to replenish inventory and meet higher production needs in preparation for higher levels of demand in the third quarter as compared to the first quarter. In the second quarter of 2024, capital expenditures were $0.9 million. Capital expenditures for the full fiscal year 2024 are planned at $9.4 million, with $2.8 million being funded by cash investment within the year and the remaining $6.5 million from cash spent through deposits in prior years. Interest expense was $1.6 million in the second quarter of 2024 compared to $1.8 million in the second quarter of 2023. The lower interest expense in 2024 was the result of lower average debt balance within the quarter. Our debt increased by $3.4 million in the first six months of 2024 driven primarily by the planned cash investment in new product introductions in the first half of the year. Our availability under our line of credit with our senior lending facility was $13.6 million at the end of the second quarter of 2024.

Subsequent to the end of the second quarter, the Company signed a sublease agreement for 370,000 square feet of warehouse space in its leased facility in Saraland, Alabama. The lease is a ten year lease at a gross lease value of $23.3 million, excluding certain required landlord payments. This lease replaces the existing five year subleases of 200,000 total square feet in our Saraland, Alabama facility.

In the 2024 third quarter to date, sales are approximately 5.5% below the comparable period in the prior year.

This press release contains forward-looking statements. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management and the Company at the time of such statements and are not guarantees of performance. Forward-looking statements are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company's results include, but are not limited to, availability of raw material and transportation costs related to petroleum prices, the cost and availability of capital, integration of acquisitions, ability to attract, develop and retain qualified personnel and general economic and competitive conditions related to the Company's business. Issues related to the availability and price of energy may adversely affect the Company's operations. Additional information regarding these and other risk factors and uncertainties may be found in the Company's filings with the Securities and Exchange Commission. The Company disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise.

The Dixie Group Reports Second Quarter 2024 Results

Page 3

August 8, 2024

THE DIXIE GROUP, INC.

Consolidated Condensed Statements of Operations

(unaudited; in thousands, except earnings (loss) per share)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended | | |

| | June 29,

2024 | | July 1,

2023 | | June 29,

2024 | | July 1,

2023 | | | | |

| | | | | | | | | | | |

| NET SALES | $ | 70,507 | | | $ | 74,009 | | | $ | 135,761 | | | $ | 141,093 | | | | | |

| Cost of sales | 50,694 | | | 54,229 | | | 100,139 | | | 103,480 | | | | | |

| GROSS PROFIT | 19,813 | | | 19,780 | | | 35,622 | | | 37,613 | | | | | |

| Selling and administrative expenses | 17,376 | | | 19,042 | | | 33,748 | | | 35,451 | | | | | |

| Other operating income, net | (105) | | | (234) | | | (52) | | | (166) | | | | | |

| Facility consolidation and severance expenses, net | 247 | | | 719 | | | 489 | | | 1,768 | | | | | |

| | | | | | | | | | | |

| OPERATING INCOME | 2,295 | | | 253 | | | 1,437 | | | 560 | | | | | |

| Interest expense | 1,620 | | | 1,849 | | | 3,152 | | | 3,707 | | | | | |

| Other (income) expense, net | 4 | | | 3 | | | 8 | | | (10) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Income (loss) from continuing operations before taxes | 671 | | | (1,599) | | | (1,723) | | | (3,137) | | | | | |

| Income tax provision | 4 | | | 21 | | | 20 | | | 34 | | | | | |

| Income (loss) from continuing operations | 667 | | | (1,620) | | | (1,743) | | | (3,171) | | | | | |

| Loss from discontinued operations, net of tax | (64) | | | (106) | | | (148) | | | (313) | | | | | |

| NET INCOME (LOSS) | $ | 603 | | | $ | (1,726) | | | $ | (1,891) | | | $ | (3,484) | | | | | |

| | | | | | | | | | | |

| BASIC EARNINGS (LOSS) PER SHARE: | | | | | | | | | | | |

| Continuing operations | $ | 0.04 | | | $ | (0.11) | | | $ | (0.12) | | | $ | (0.22) | | | | | |

| Discontinued operations | (0.00) | | | (0.01) | | | (0.01) | | | (0.02) | | | | | |

| Net income (loss) | $ | 0.04 | | | $ | (0.12) | | | $ | (0.13) | | | $ | (0.24) | | | | | |

| | | | | | | | | | | |

| DILUTED EARNINGS (LOSS) PER SHARE: | | | | | | | | | | | |

| Continuing operations | $ | 0.04 | | | $ | (0.11) | | | $ | (0.12) | | | $ | (0.22) | | | | | |

| Discontinued operations | (0.00) | | | (0.01) | | | (0.01) | | | (0.02) | | | | | |

| Net income (loss) | $ | 0.04 | | | $ | (0.12) | | | $ | (0.13) | | | $ | (0.24) | | | | | |

| | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | |

| Basic | 14,894 | | | 14,808 | | | 14,872 | | | 14,742 | | | | | |

| Diluted | 14,987 | | | 14,808 | | | 14,872 | | | 14,742 | | | | | |

| | | | | | | | | | | |

The Dixie Group Reports Second Quarter 2024 Results

Page 4

August 8, 2024

THE DIXIE GROUP, INC.

Consolidated Condensed Balance Sheets

(in thousands)

| | | | | | | | | | | |

| | June 29,

2024 | | December 30,

2023 |

| ASSETS | (Unaudited) | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 83 | | | $ | 79 | |

| Receivables, net | 28,019 | | | 23,686 | |

| Inventories, net | 76,131 | | | 76,211 | |

| Prepaid and other current assets | 10,877 | | | 12,154 | |

| Current assets of discontinued operations | 219 | | | 265 | |

| Total Current Assets | 115,329 | | | 112,395 | |

| | | |

| Property, Plant and Equipment, Net | 36,077 | | | 31,368 | |

| Operating Lease Right-Of-Use Assets | 27,425 | | | 28,962 | |

| | | |

| Other Assets | 18,267 | | | 17,130 | |

| Long-Term Assets of Discontinued Operations | 1,394 | | | 1,314 | |

| TOTAL ASSETS | $ | 198,492 | | | $ | 191,169 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 19,371 | | | $ | 13,935 | |

| Accrued expenses | 17,407 | | | 16,598 | |

| Current portion of long-term debt | 3,184 | | | 4,230 | |

| Current portion of operating lease liabilities | 3,835 | | | 3,654 | |

| Current liabilities of discontinued operations | 1,016 | | | 1,137 | |

| Total Current Liabilities | 44,813 | | | 39,554 | |

| | | |

| Long-Term Debt, Net | 82,699 | | | 78,290 | |

| | | |

| Operating Lease Liabilities | 24,206 | | | 25,907 | |

| Other Long-Term Liabilities | 15,844 | | | 14,591 | |

| Long-Term Liabilities of Discontinued Operations | 3,626 | | | 3,536 | |

| Stockholders' Equity | 27,304 | | | 29,291 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 198,492 | | | $ | 191,169 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

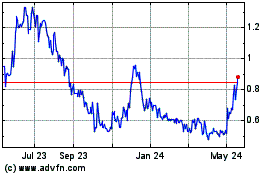

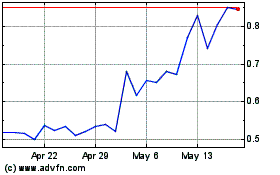

Dixie (NASDAQ:DXYN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dixie (NASDAQ:DXYN)

Historical Stock Chart

From Nov 2023 to Nov 2024