Form 425 - Prospectuses and communications, business combinations

10 December 2024 - 12:32AM

Edgar (US Regulatory)

Filed by Enterprise Bancorp, Inc.

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Enterprise Bancorp, Inc.

SEC File No.: 001-33912

Date: December 9, 2024

Enterprise Bank All-User from Enterprise Bank CEO

Dear Team Members,

I have some important news to share. This morning,

we issued the attached press release announcing that, subject to shareholder and regulatory approvals, Enterprise Bank will be merging

with, and into, Rockland Trust.

Joining Rockland Trust provides us with the scale

and resources necessary to compete effectively with the largest banks in our market, while continuing to deliver the exceptional customer

service that defines Enterprise Bank.

This decision was made with careful consideration for our team members,

customers and the communities we serve. Both institutions share many values, and Rockland Trust has demonstrated a strong commitment to

fostering relationships with the people and communities they serve – just as we do.

Rockland Trust recognizes what makes Enterprise

Bank unique. They understand that our dedication to strengthening local communities is at the heart of everything we do. Together, we

will continue our mission to support local individuals, families, businesses, and nonprofit organizations, as we always have.

Rockland Trust is a community-oriented commercial

bank that was founded in 1907 in Rockland, Massachusetts. They offer a wide variety of commercial, retail and wealth management products

and services for individuals, businesses, nonprofits, and municipalities. Rockland Trust has over $19 billion in assets and more than

$7.2 billion in assets under administration. The organization’s corporate headquarters is in Hanover, Massachusetts and they operate

123 branches, including one mobile branch, throughout Eastern Massachusetts.

Of Rockland Trust’s 123 branch offices and

Enterprise Bank’s 27 branch offices, there is no overlap, and there are no plans to close any branches (please see attached map

of branches). This meshing of physical branch locations and beneficial lack of redundancy also carries through to other customer contact

areas such as commercial lending, cash management, and wealth services, to name a few. With this increase in size, Rockland Trust will

also need to increase its operational staff, providing additional opportunities.

It is important to understand that the Board of

Directors, Senior Management, and I will remain in place until this transaction is completed, which we expect to occur sometime in the

second half of 2025.

I want to personally thank each of you for your

steadfast commitment to Enterprise Bank’s vision of strengthening the economic fabric in our communities. Since joining Enterprise

Bank 28 years ago, I have had the privilege to build relationships and friendships with so many of you.

I understand that you will have many questions

about how this news will affect you. To begin providing you with information regarding this merger, we will be conducting a Zoom call

at 8:45 AM this morning and will host an in-person meeting tomorrow night at the Westford Regency, at 5:30 PM. If you have any questions

that you would like to have addressed at the Westford Regency meeting, please https://app.smartsheet.com/b/form/9297f539155a46fc905227adce0d2c63.

Information regarding this morning’s Zoom call will be provided in a separate email. In the meantime, we will be posting customer

FAQs on our website for your reference. These will be live within the hour.

Thank you for your patience and support as we

navigate this journey.

I look forward to speaking with all of you.

Best,

Steven Larochelle

Chief Executive Officer

Important Additional Information:

In connection with the proposed transaction, Independent Bank Corp.

(“Independent”) will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement for a special

meeting of Enterprise Bancorp, Inc.’s (“Enterprise”) shareholders to approve the proposed transaction and that will

also constitute a prospectus for the Independent common stock that will be issued in the proposed transaction. BEFORE MAKING ANY INVESTMENT

DECISIONS, INVESTORS AND SHAREHOLDERS OF INDEPENDENT AND ENTERPRISE ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS

REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A copy of the proxy statement/prospectus, as well

as other filings containing information about Independent and Enterprise, can be obtained without charge, at the SEC’s website (https://www.sec.gov/)

or at the “Investor Relations” section of Independent’s website, www.rocklandtrust.com, under the heading “SEC

Filings” and in the “Investor Relations” section of Enterprise’s website, www.enterprisebanking.com, under the

heading “SEC Filings”. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by

reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Independent Investor Relations,

288 Union Street, Rockland, Massachusetts 02370, telephone (774) 363-9872 or to Enterprise Investor Relations, 222 Merrimack Street in

Lowell, Massachusetts 01852, Attention: Corporate Secretary, telephone (978) 656-5578. Information regarding the persons who may, under

the rules of the SEC, be considered participants in the solicitation of Enterprise shareholders in connection with the proposed transaction

will be set forth in the proxy statement/prospectus when it is filed with the SEC.

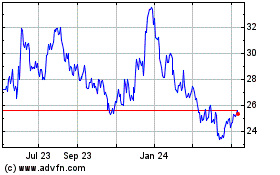

Enterprise Bancorp (NASDAQ:EBTC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Enterprise Bancorp (NASDAQ:EBTC)

Historical Stock Chart

From Mar 2024 to Mar 2025