UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number 001-40375

E-Home Household Service Holdings Limited

(Translation of registrant’s name into English)

E-Home, 18/F, East Tower, Building B,

Dongbai Center, Yangqiao Road,

Gulou District, Fuzhou City 350001,

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F

☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Entry into a Material

Definitive Agreement

On January 11, 2024,

E-Home Household Service Holdings Limited (the “Company”) entered into a Securities Purchase Agreement (the “Agreement”)

with certain purchasers identified on the signature page thereto (the “Purchasers”), pursuant to which the Company agreed

to sell to the Purchasers in a private placement 20,000,000 ordinary shares (the “Shares”) of the Company, at a purchase price

of $0.68 per share for an aggregate price of $13,600,000 (the “Private Placement”). The Private Placement will be completed

pursuant to the exemption from registration provided by Regulation S promulgated under the Securities Act of 1933, as amended. The foregoing

summary of the terms of the Agreement are subject to, and qualified in its entirety by, the Agreement, a copy of which is attached hereto

as Exhibit 10.1 and is incorporated by reference herein.

Stock Award to Certain

Officer

On January 9, 2024 (the

“Grant Date”), the Compensation Committee of the Board of Directors (the “Board”) of the Company granted a stock

award of 340,000 ordinary shares of the Company (“Shares”) to Mr. Wenshan Xie, Chief Executive Officer of the Company (the

“Grantee”), pursuant to the Company’s 2023 Share Incentive Plans (the “Grant”). 50% of the Shares

vested immediately on the Grant Date and the remaining 50% of the Shares shall vest on six months anniversary of the Grant Date. The Grantee

also entered into a Stock Award Agreement with the Company on January 9, 2024. The form of Stock Award Agreement is filed as Exhibits

10.2 and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 16, 2024

| |

E-Home Household Service Holdings Limited |

| |

|

| |

By: |

/s/ Wenshan Xie |

| |

Name: |

Wenshan Xie |

| |

Title: |

Chief Executive Officer |

Exhibit Index

Exhibit 10.1

SECURITIES

PURCHASE AGREEMENT

This Securities Purchase Agreement

(this “Agreement”) is dated as of January 11, 2024 (the “Effective Date”) by and between E-Home

Household Service Holdings Limited, a Cayman Islands exempted company (the “Company”) and each purchaser identified

on the signature pages hereto (each, including its successors and assigns, a “Purchaser” and collectively the “Purchasers”).

RECITALS

WHEREAS, subject to

the terms and conditions set forth in this Agreement and pursuant to an exemption from the registration requirements of Section 5 of the

Securities Act contained in Section 4(a)(2) thereof and/or Regulations S thereunder, the Company desires to issue and sell to the Purchasers,

and the Purchasers desire to purchase from the Company, certain securities of the Company as more fully described in this Agreement.

NOW, THEREFORE, IN

CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration the receipt and adequacy

of which are hereby acknowledged, the Company and the Purchasers agree as follows:

ARTICLE I.

DEFINITIONS

1.1 Definitions.

In addition to the terms defined elsewhere in this Agreement, the following terms have the meanings set forth in this Section 1.1:

“Affiliate”

means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control

with a Person as such terms are used in, and construed, under Rule 405 under the Securities Act.

“Board

of Directors” means the board of directors of the Company.

“Business

Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day

on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

“Closing”

means the closing of the purchase and sale of the Shares pursuant to Section 2.1.

“Closing

Date” means the day on which all of the Transaction Documents have been executed and delivered by the applicable parties thereto,

and all conditions precedent to (i) the Purchasers’ obligations to pay the Subscription Amount and (ii) the Company’s obligations

to deliver the Shares, in each case, have been satisfied or waived.

“Commission”

means the United States Securities and Exchange Commission.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exchange

Rules” shall mean the listing rules of The Nasdaq Stock Market.

“Liens”

means a lien, charge, pledge, security interest, encumbrance, right of first refusal, preemptive right or other restriction.

“Ordinary Shares”

means the ordinary shares of the Company, par value $0.2 per share, and any other class of securities into which such securities may hereafter

be reclassified or changed.

“Per Share Purchase

Price” equals $0.68 per share of Ordinary Shares, subject to adjustment for reverse and forward stock splits, stock combinations

and other similar transactions of the Ordinary Shares that may occur after the date of this Agreement.

“Person”

means an individual, corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company,

joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Required

Approvals” shall have the meaning ascribed to such term in Section 3.1(c).

“Rule 144”

means Rule 144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time,

or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“SEC Reports”

shall have the meaning ascribed to such term in Section 3.1(f).

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Securities

Laws” means, collectively, the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley”), the Securities

Act, the Exchange Act, the Rules and Regulations, the auditing principles, rules, standards and practices applicable to auditors of “issuers”

(as defined in Sarbanes-Oxley) promulgated or approved by the Public Company Accounting Oversight Board, the Exchange Rules and applicable

state securities laws and regulations.

“Shares”

means the Ordinary Shares of issued or issuable to each Purchaser pursuant to this Agreement.

“Short

Sales” means all “short sales” as defined in Rule 200 of Regulation SHO under the Exchange Act (but shall not be

deemed to include the location and/or reservation of borrowable shares of Ordinary Shares).

“Subscription

Amount” means, as to each Purchaser, the aggregate amount to be paid for Shares purchased hereunder as specified below such

Purchaser’s name on the signature page of this Agreement and next to the heading “Subscription Amount,” in United States

dollars and in immediately available funds.

“Subsidiary”

means any subsidiary of the Company and shall, where applicable, also include any direct or indirect subsidiary of the Company formed

or acquired after the date hereof.

“Trading

Day” means a day on which the principal Trading Market is open for trading.

“Trading

Market” means any of the following markets or exchanges on which the Ordinary Shares are listed or quoted for trading on the

date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York

Stock Exchange (or any successors to any of the foregoing).

“Transaction

Documents” means this Agreement, and any other documents or agreements executed between the Company and the Purchasers in connection

with the transactions contemplated hereunder.

“Transfer

Agent” means VStock Transfer, LLC, the current transfer agent of the Company, with a mailing address of 18 Lafayette Place,

Woodmere, New York 11598, and any successor transfer agent of the Company.

ARTICLE II.

PURCHASE AND SALE

2.1 Closing.

On the Closing Date, upon the terms and subject to the conditions set forth herein, the Company agrees to sell, and the Purchasers, severally

and not jointly, agree to purchase, up to an aggregate of 20,000,000 Ordinary Shares of the Company at Per Share Purchase Price for a

total of $13,600,000. Each Purchaser’s Subscription Amount as set forth on the signature page hereto executed by such Purchaser

shall be made available for “Delivery Versus Payment” settlement with the Company or its designees. Upon receiving such

Purchaser’s Subscription Amount on the Closing Date and the delivery by such Purchaser of the other items set forth in Section 2.2

deliverable at the Closing, the Company shall deliver the Shares to such Purchaser as determined pursuant to Section 2.2(a).

2.2 Deliveries.

(a) On

or prior to the Closing Date, the Company shall deliver or cause to be delivered to each Purchaser each of the following:

(i) this

Agreement duly executed by the Company;

(ii) subject

to the last sentence of Section 2.1, a copy of the irrevocable instructions to the Transfer Agent instructing the Transfer Agent to deliver

the Shares equal to such Purchaser’s Subscription Amount divided by the Per Share Purchase Price, in the name of such Purchaser.

(b) On

or prior to the Closing Date, each of the Purchasers shall deliver or cause to be delivered to the Company, as applicable, the following:

(i) this

Agreement duly executed by such Purchaser; and

(ii) such

Purchaser’s Subscription Amount by wire transfer to the bank account directed by the Company.

2.3 Closing

Conditions.

(a) The

obligations of the Company hereunder in connection with the Closing are subject to the following conditions being met:

(i) the

accuracy when made and on the Closing Date of the representations and warranties of such Purchaser contained herein (unless as of a specific

date therein in which case they shall be accurate as of such date);

(ii) all

obligations, covenants and agreements of such Purchaser required to be performed at or prior to the Closing Date shall have been performed;

and

(iii) the

delivery by such Purchaser of the items set forth in Section 2.2(b) of this Agreement on or prior to the Closing Date.

(b) The

obligations of the Purchasers hereunder in connection with the Closing are subject to the following conditions being met:

(i) the

accuracy when made and on the Closing Date of the representations and warranties of the Company contained herein (unless as of a specific

date therein in which case they will be accurate as of such date);

(ii) all

obligations, covenants and agreements of the Company required to be performed at or prior to the Closing Date shall have been performed;

(iii) the

delivery by the Company of the items set forth in Section 2.2(a) of this Agreement on or prior to the Closing Date; and

(iv) there

shall have been no material adverse effect with respect to the Company since the date hereof.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES

3.1 Representations

and Warranties of the Company. Except as indicated in the SEC Reports, the Company hereby represents and warrants to the Purchasers

as of the date of this Agreement and as of the Closing Date as follows:

(a) Organization

and Qualification. The Company and each of the Subsidiaries, if any, is an entity duly incorporated or otherwise organized and validly

existing under the laws of each jurisdiction in which it owns or leases properties or conducts any business so as to require such qualification,

with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted.

(b) Authorization;

Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated

by this Agreement and each of the other Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. The

execution and delivery of this Agreement and each of the other Transaction Documents by the Company and the consummation by it of the

transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no further

action is required by the Company, the Board of Directors or the Company’s stockholders in connection herewith or therewith other

than in connection with the Required Approvals (as defined below).

(c) Filings,

Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any notice to,

or make any filing or registration with, any governmental authority or any court or other federal, state, local or other governmental

authority or other Person in connection with the execution, delivery and performance by the Company of the Transaction Documents or the

offer, issue and sale of the Shares, other than: (i) the disclosure filing required for this Agreement and (ii) application(s) to each

applicable Trading Market for the listing of the Shares for trading thereon in the time and manner required thereby (collectively, the

“Required Approvals”).

(d) Authorization

of the Shares. The Shares to be sold by the Company and their issue and sale are duly authorized and, when issued and paid for in

accordance with the applicable Transaction Documents, will be duly and validly issued, fully paid and free and clear of all Liens imposed

by the Company.

(e) Capitalization.

Except as may be described in the SEC Reports, all of the issued share capital of the Company has been duly and validly authorized and

issued, is fully paid and non-assessable.

(f) SEC

Reports. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by the Company under

the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the date hereof

(or such shorter period as the Company was required by law or regulation to file such material) (the foregoing materials, including the

exhibits thereto, documents incorporated by reference therein, being collectively referred to herein as the “SEC Reports”).

(g) Investment

Company. The Company is not, and is not an Affiliate of, and immediately after receipt of payment for the Shares, will not be or be

an Affiliate of, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

3.2 Representations

and Warranties of the Purchaser. Each Purchaser, for itself and for no other Purchasers, hereby represents and warrants as of the

date hereof and as of the Closing Date to the Company as follows (unless as made of a specific date stated therein, in which case they

shall be accurate as of such date):

(a) Organization;

Authority. Such Purchaser is either an individual or an entity duly incorporated or formed, validly existing and in good standing

under the laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability company

or similar power and authority to enter into and to consummate the transactions contemplated by the Transaction Documents and otherwise

to carry out its obligations hereunder and thereunder. The execution and delivery of the Transaction Documents and performance by such

Purchaser of the transactions contemplated by the Transaction Documents have been duly authorized by all necessary corporate, partnership,

limited liability company or similar action, as applicable, on the part of such Purchaser. Each Transaction Document to which it is a

party has been duly executed by such Purchaser, and when delivered by such Purchaser in accordance with the terms hereof, will constitute

the valid and legally binding obligation of such Purchaser, enforceable against it in accordance with its terms.

(b) Understandings

or Arrangements. Such Purchaser is acquiring the Shares for its own account and has no direct or indirect arrangement or understandings

with any other persons to distribute or regarding the distribution of the Shares (this representation and warranty not limiting such Purchaser’s

right to sell the Shares in compliance with applicable federal and state securities laws). Such Purchaser is acquiring the Shares as principal,

not as nominee or agent, and not with a view to or for distributing or reselling the Shares or any part thereof in violation of the Securities

Act or any applicable state securities law.

(c) Foreign

Investors. Such Purchaser hereby represents that it has satisfied itself as to the full observance by such Purchaser of the laws of

its jurisdiction applicable to such Purchaser in connection with the purchase of the Shares or the execution and delivery by such Purchaser

of this Agreement and the Transaction Documents, including (i) the legal requirements within its jurisdiction for the purchase of

the Shares, (ii) any foreign exchange restrictions applicable to the purchase, (iii) any governmental or other consents that

may need to be obtained, and (iv) the income tax and other tax consequences, if any, that may be relevant to such Purchaser’s

purchase, holding, redemption, sale, or transfer of the Shares. Such Purchaser’s subscription and payment for, and continued beneficial

ownership of, the Shares will not violate any securities or other laws of such Purchaser’s jurisdiction applicable to such Purchaser.

(d) Experience

of Purchaser. Such Purchaser, either alone or together with its representatives, has such knowledge, sophistication and experience

in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Shares,

and has so evaluated the merits and risks of such investment. Such Purchaser is able to bear the economic risk of an investment in the

Shares and, at the present time, is able to afford a complete loss of such investment.

(e) Access

to Information. Such Purchaser acknowledges that it has had the opportunity to review the Transaction Documents and the SEC Reports

and has been afforded (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives

of the Company concerning the terms and conditions of the offering of the Shares and the merits and risks of investing in the Shares;

(ii) access to information about the Company and its financial condition, results of operations, business, properties, management and

prospects sufficient to enable it to evaluate its investment; and (iii) the opportunity to obtain such additional information that the

Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with

respect to the investment.

(f) Regulation

S. Such Purchaser is a non-U.S. person (as such term is defined in Rule 902 of Regulation S under the Securities Act) and is not acquiring

the Shares for the account or benefit of a U.S. person. Such Purchaser will not, within six (6) months of the date of the transfer of

the Shares to such Purchaser, (i) make any offers or sales of the Shares in the United States or to, or for the benefit of, a U.S. person

(in each case, as defined in Regulation S) other than in accordance with Regulation S or another exemption from the registration requirements

of the Securities Act, or (ii) engage in hedging transactions with regard to the Shares unless in compliance with the Securities Act.

Neither such Purchaser nor any of such Purchaser’s Affiliates or any person acting on his/her or their behalf has engaged or will

engage in directed selling efforts (within the meaning of Regulation S) with respect to the Shares, and all such persons have complied

and will comply with the offering restriction requirements of Regulation S in connection with the offering of the Shares outside of the

United States. Such Purchaser further makes the representations and warranties to the Company set forth on Exhibit A.

(g) Certain

Transactions and Confidentiality. Other than consummating the transactions contemplated hereunder, such Purchaser has not, nor has

any Person acting on behalf of or pursuant to any understanding with such Purchaser, directly or indirectly executed any purchases or

sales, including Short Sales, of the securities of the Company during the period commencing as of the time that such Purchaser first

discussed the transaction with the Company or any other Person representing the Company setting forth the material terms of the transactions

contemplated hereunder and ending on the date when this Agreement is publicly disclosed by the Company. Such Purchaser has maintained

the confidentiality of all disclosures made to it in connection with this transaction (including the existence and terms of this transaction).

(h) Purchaser

Status. At the time such Purchaser was offered the Shares, it was, and as of the date hereof it is, an “accredited investor”

as defined in Rule 501(a) under the Securities Act.

(i) No

Registration. Such Purchaser understands that the Shares have not been, and will not be, registered under the Securities Act or applicable

securities laws of any state or country and therefore the Shares cannot be sold, pledged, assigned or otherwise disposed of unless they

are subsequently registered under the Securities Act and applicable state securities laws or exemptions from such registration requirements

are available. The Company shall be under no obligation to register the Shares under the Securities Act and applicable state securities

laws, and any such registration shall be in the Company’s sole discretion.

(j) No

General Solicitation. Such Purchaser is not purchasing the Shares as a result of any advertisement, article, notice or other communication

regarding the Shares published in any newspaper, magazine, website or similar media or broadcast over television or radio or presented

at any seminar or any other general solicitation or general advertisement.

ARTICLE IV.

OTHER AGREEMENTS OF THE PARTIES

4.1 Reservation

of Securities. As of the date hereof, the Company has reserved and the Company shall continue to reserve and keep available at all

times, free of preemptive rights, a sufficient number of shares of Ordinary Shares for issuance pursuant to the Transaction Documents

in such amount as may then be required to fulfill its obligations in full under the Transaction Documents.

4.2 Certain

Transactions and Confidentiality. Each Purchaser covenants that neither it nor any Affiliate acting on its behalf or pursuant to any

understanding with it will execute any purchases or sales, including Short Sales of any of the Company’s securities during the period

commencing with the execution of this Agreement and ending on the date when this Agreement is publicly disclosed by the Company.

Each Purchaser also covenants that until such time as the transactions contemplated by this Agreement are publicly disclosed by the Company,

such Purchaser will maintain the confidentiality of the existence and terms of this transaction.

4.3 Legends.

The Shares may only be disposed of in compliance with state and federal securities laws. In connection with any transfer of Shares other

than pursuant to an effective registration statement or Rule 144, , the Company may require the transferor thereof to provide to the Company

an opinion of counsel selected by the transferor and reasonably acceptable to the Company, the form and substance of which opinion shall

be reasonably satisfactory to the Company, to the effect that such transfer does not require registration of such transferred Shares under

the Securities Act. Each Purchaser agrees to the imprinting, so long as is required by this Section 4.3, of a legend on all of the certificates

evidencing the Shares in the following form:

THIS

SECURITY HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON

AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY

NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION

FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE

SECURITIES LAWS.

ARTICLE V.

MISCELLANEOUS

5.1 Termination.

This Agreement may be terminated by the Company or any Purchaser, as to such Purchaser’s obligations hereunder only and without

any effect whatsoever on the obligations between the Company and the other Purchasers, by written notice to the other party if the Closing

has not been consummated on or before January 31, 2024; provided, however, that no such termination will affect the right of any party

to sue for any breach by any other party (or parties).

5.2 Fees

and Expenses. Except as expressly set forth in the Transaction Documents to the contrary, each party shall pay the fees and expenses

of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation,

preparation, execution, delivery and performance of this Agreement.

5.3 Entire

Agreement. The Transaction Documents contain the entire understanding of the parties with respect to the subject matter hereof and

thereof and supersede all prior agreements and understandings, oral or written, with respect to such matters, which the parties acknowledge

have been merged into such documents, exhibits and schedules.

5.4 Notices.

Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in writing and shall

be deemed given and effective on the earliest of: (a) the date of transmission, if such notice or communication is delivered via facsimile

at or prior to 5:30 p.m. (New York City time) on a Trading Day, (b) the next Trading Day after the date of transmission, if such notice

or communication is delivered via facsimile on a day that is not a Trading Day or later than 5:30 p.m. (New York City time) on any Trading

Day, (c) the second (2nd) Trading Day following the date of mailing, if sent by U.S. nationally recognized overnight courier service or

(d) upon actual receipt by the party to whom such notice is required to be given. The address for such notices and communications shall

be as set forth on the signature pages attached hereto.

5.5 Amendments;

Waivers. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument signed, in

the case of an amendment, by the Company and a Purchaser as to such Purchaser’s obligations hereunder only and without any effect

whatsoever on the obligations between the Company and the other Purchasers, or, in the case of a waiver, by the party granting the waiver.

No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing

waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall

any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right.

5.6 Headings.

The headings herein are for convenience only, do not constitute a part of this Agreement and shall not be deemed to limit or affect any

of the provisions hereof.

5.7 Successors

and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and permitted assigns.

No party hereto may assign this Agreement or any rights or obligations hereunder without the prior written consent of the Company and

such Purchaser.

5.8 No

Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors and permitted

assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other Person, except as otherwise set forth in

this Section 5.8.

5.9 Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of the Transaction Documents shall be governed

by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts

of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of the transactions

contemplated by this Agreement and any other Transaction Documents (whether brought against a party hereto or its respective affiliates,

directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts

sitting in the New York City, New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts

sitting in New York City, for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated

hereby or discussed herein (including with respect to the enforcement of any of the Transaction Documents), and hereby irrevocably waives,

and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such

court, that such suit, action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably

waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof

via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices

to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing

contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law.

5.10 Survival.

The representations and warranties contained herein shall survive the Closing and the delivery of the Shares. The terms of this Article

V shall survive any termination of the Agreement pursuant to Section 5.1.

5.11 Execution.

This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to each other party, it being understood that

the parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission or by e-mail delivery

of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose

behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page were an original

thereof.

5.12 Severability.

If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, illegal,

void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full force

and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially reasonable efforts

to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term, provision,

covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would have executed the remaining

terms, provisions, covenants and restrictions without including any of such that may be hereafter declared invalid, illegal, void or unenforceable.

5.13 Saturdays,

Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted

herein shall not be a Business Day, then such action may be taken or such right may be exercised on the next succeeding Business Day.

5.14 Construction.

The parties agree that each of them and/or their respective counsel have reviewed and had an opportunity to revise the Transaction Documents

and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall

not be employed in the interpretation of the Transaction Documents or any amendments thereto. In addition, each and every reference to

share prices and shares of Ordinary Shares in any Transaction Document shall be subject to adjustment for reverse and forward stock splits,

stock combinations and other similar transactions of the Ordinary Shares that occur after the date of this Agreement. The English version

of this Agreement, regardless of whether a translation in any other language is or will be made, shall be the only authentic version.

5.15 WAIVER

OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES

EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY

AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

(Signature Pages Follow)

IN WITNESS WHEREOF,

the parties hereto have caused this Securities Purchase Agreement to be duly executed by their respective authorized signatories as of

the date first indicated above.

| E-Home Household Service Holdings Limited |

| |

|

| By: |

/s/Wenshan

Xie |

|

| |

Name: |

Wenshan Xie |

|

| |

Title: |

Chief Executive Officer |

|

Address for Notice:

E-Home Household Service Holdings Limited

18/F, East Tower, Building B, Dongbai Center

Yangqiao Road, Gulou District, Fuzhou City

Fujian Province, China 350001

E-Mail:

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE PAGE FOR PURCHASER FOLLOWS]

[PURCHASER SIGNATURE PAGES TO SECURITIES PURCHASE

AGREEMENT]

IN WITNESS WHEREOF, the undersigned

have caused this Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated

above.

Name of Purchaser:

Signature of Authorized Signatory of Purchaser:

Name of Authorized Signatory:

Title of Authorized Signatory:

Email Address of Authorized Signatory:

Address for Notice to Purchaser:

Subscription Amount: $

Number of Shares:

EXHIBIT A TO

THE SECURITIES PURCHASE AGREEMENT

NON U.S. PERSON REPRESENTATIONS

Purchaser indicates that it is not a U.S. person, further represents

and warrants to the Company as follows:

| 1. | At the time of (a) the offer by the Company and (b) the acceptance of the offer by the Purchaser, of the

Shares, Purchaser was outside the United States. |

| 2. | Purchaser is acquiring the Shares for Purchaser’s own account, for investment and not for distribution

or resale to others and is not purchasing the Shares for the account or benefit of any U.S. person, or with a view towards distribution

to any U.S. person, in violation of the registration requirements of the Securities Act. |

| 3. | Purchaser will make all subsequent offers and sales of the Shares either (x) outside of the United States

in compliance with Regulation S; (y) pursuant to a registration under the Securities Act; or (z) pursuant to an available exemption from

registration under the Securities Act. Specifically, Purchaser will not resell the Shares to any U.S. person or within the United States

prior to the expiration of a period commencing on the date of Closing and ending on the date that is six months thereafter (the “Distribution

Compliance Period”), except pursuant to registration under the Securities Act or an exemption from registration under the Securities

Act. |

| 4. | Purchaser has no present plan or intention to sell the Shares in the United States or to a U.S. person

at any predetermined time, has made no predetermined arrangements to sell the Shares and is not acting as a distributor of such securities. |

| 5. | Neither Purchaser, its affiliates nor any person acting on behalf of Purchaser, has entered into, has

the intention of entering into, or will enter into any put option, short position or other similar instrument or position in the U.S.

with respect to the Shares at any time after the date of Closing through the Distribution Compliance Period except in compliance with

the Securities Act. |

| 6. | Purchaser consents to the placement of a legend on any certificate or other document evidencing the Shares

substantially in the form set forth in Section 4.3. |

| 7. | Purchaser is not acquiring the Shares in a transaction (or an element of a series of transactions) that

is part of any plan or scheme to evade the registration provisions of the Securities Act. |

| 8. | Purchaser has sufficient knowledge and experience in finance, securities, investments and other business

matters to be able to protect Purchaser’s interests in connection with the transactions contemplated by this Agreement. |

| 9. | Purchaser has consulted, to the extent that it has deemed necessary, with its tax, legal, accounting and

financial advisors concerning its investment in the Shares. |

| 10. | Purchaser understands the various risks of an investment in the Shares and can afford to bear such risks

for an indefinite period of time, including, without limitation, the risk of losing its entire investment in the Shares. |

| 11. | Purchaser has had access to the Company’s information that the Purchaser has requested and all such

information is sufficient for Purchaser to evaluate the risks of investing in the Shares. |

| 12. | Purchaser has been afforded the opportunity to ask questions of and receive answers concerning the Company

and the terms and conditions of the issuance of the Shares. |

| 13. | Purchaser is not relying on any representations and warranties concerning the Company made by the Company

or any officer, employee or agent of the Company, other than those contained in this Agreement. |

| 14. | Purchaser will not sell or otherwise transfer the Shares unless either (A) the transfer of such securities

is registered under the Securities Act or (B) an exemption from registration of such securities is available. |

| 15. | Purchaser represents that the address furnished on its signature page to this Agreement is the principal

residence if he/she is an individual or its principal business address if it is a corporation or other entity. |

| 16. | Purchaser understands and acknowledges that the Shares have not been recommended by any federal or state

securities commission or regulatory authority, that the foregoing authorities have not confirmed the accuracy or determined the adequacy

of any information concerning the Company that has been supplied to Purchaser and that any representation to the contrary is a criminal

offense. |

Exhibit 10.2

E-Home

Household Service Holdings Limited

STOCK

AWARD aGREEMENT

THIS STOCK AWARD AGREEMENT

(“Agreement”) is entered into by and between E-Home Household Service Holdings Limited, a company incorporated

in the Cayman Islands (the “Company”) and the Grantee effective as of Grant Date. The Administrator

has authorized this grant of the ordinary shares of the Company (“Stock”) to the Grantee as set forth below. Unless

otherwise indicated, any capitalized term used but not defined herein shall have the meaning as described to such term in the Company’s

2023 Share Incentive Plan (the “2023 Plan”).

| Grantee: |

Wenshan Xie |

| Grant Date: |

January 9, 2024 |

| Number of Stock (“Shares”): |

340,000 |

| Purchase Price (per share): |

$0 |

The parties hereto agree as

follows:

1. Grant

of Stock. Subject in all respects to the 2023 Plan and the restrictions and conditions herein, the Grantee is hereby granted Shares

at the Purchase Price as set forth above.

2. Vesting

Period.

2.1 Vesting

Period. The vesting period for the Shares: fifty percent (50%) of Shares shall vest the on the Grant Date and the remaining fifty

percent (50%) of Shares shall vest on six months anniversary of the Grant Date, subject to the Grantee remaining in the continuous service

of the Company or its affiliates on such date.

2.2 Separation

from Service. Upon the Grantee’s separation from services to the Company or its subsidiaries, any unvested shares shall immediately

be deemed forfeited, and the Grantee shall have no further rights with respect to the unvested shares.

3. Settlement

of Shares. Shares subject to the vesting period shall be issued to the Grantee immediately following the lapse of the applicable

vesting period to which the Shares are subject, but in no event later than thirty (30) days following the lapse of the applicable vesting

date.

4. Stockholder

Rights. The Grantee shall not be entitled to any rights of a stockholder of the Company, including the right to vote or receive

dividends declared or paid with respect to the Shares, until the Shares are issued to the Grantee upon lapse of the vesting period. Shares

issued upon lapse of the vesting period is subject to the terms and conditions of the Memorandum and Articles of Association and other

governing documents of the Company, as they may be amended from time to time.

5. Securities

Law Compliance. Shares acquired applicable to this Stock Award are subject to the terms and conditions of the 2023 Plan (Securities

Law and Other Regulatory Compliance). The Grantee acknowledges and makes the representations and warranties as described below, and agrees

to provide such other representations and warranties and take such actions as otherwise may be requested by the Company for compliance

with applicable laws, and any issuance of Shares by the Company shall be made in reliance upon the express representations and warranties

of the Grantee that:

(a) the

Grantee is acquiring the Shares for his own account, for investment purposes and without any present intention of distributing or reselling

said Shares, except as permitted under the Securities Act; and

(b) the

Grantee is fully aware of the highly speculative nature of the investment in the Shares, the financial hazards involved in the investment,

and the lack of liquidity and restrictions on transferability of the Shares (e.g., that the Grantee may not be able to sell or

dispose of the Shares or use it as collateral for loans); and

(c) the

Grantee has received and had access to such information as the Grantee considers necessary and appropriate for deciding whether to invest

in the Shares and has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the

issuance.

6. Certificate(s)

Representing Shares. The Company shall issue Shares either in certificate form or in book entry form, registered in the name of

the Grantee.

7. Tax

Withholding. As a condition to the issuance of Shares applicable to this Stock Award, the Grantee must remit to the Company the

statutory minimum (but not more) amount necessary to satisfy any applicable Federal, state or local tax withholding requirements.

8. Provisions

of Plan Control. This Agreement is subject to all terms, conditions and provisions of the 2023 Plan, including, without limitation,

the amendment provisions thereof, and to such rules, regulations and interpretations relating to the 2023 Plan as may be adopted by the

Board and as may be in effect from time to time. The 2023 Plan is incorporated herein by reference. If and to the extent that this Agreement

conflicts or is inconsistent with the terms, conditions and provisions of the 2023 Plan, the 2023 Plan shall control and this Agreement

shall be deemed to be modified accordingly. This Agreement contains the entire agreement and understanding of the parties with respect

to the subject matter hereof and supersedes any prior agreements and understandings (whether written or oral) between the Company and

the Grantee with respect to the subject matter hereof.

9. Successors,

Assigns and Transferees. This Agreement shall be binding upon, and inure to the benefit of, the parties hereto and each of their

respective successors and permitted transferees (including, upon the death of the Grantee, the Grantee’s estate).

10. Not

an Employment Contract. This Agreement is not an agreement of employment or an agreement to engage Grantee as an officer, director

or an independent contractor. This Agreement does not guarantee that the Company or any affiliate will employ, retain, contract with or

continue to employ, retain or contract with the Grantee during the entire, or any portion of the term of this Agreement, nor does it modify

in any respect the Company’s or any affiliate’s right to terminate or modify the Grantee’s employment, engagement or

compensation.

10. Confidentiality.

The Grantee agrees that he will not disclose to any third party the grant of stock award, number of shares granted and the existence of

this agreement unless it is required by the laws, regulations or rules of SEC.

11. Governing

Law. This Agreement shall be governed by, and construed in accordance with, the laws of the Cayman Islands, without giving effect

to any choice of law or conflict of law provision or rule.

12. Counterparts.

This Agreement may be executed and delivered (including by facsimile or other electronic transmission) with counterpart signature pages

or in separate counterparts each of which shall be an original and all of which taken together shall constitute one and the same agreement.

IN WITNESS WHEREOF, the parties have executed this

Agreement on the date set forth above.

| |

E-Home Household Service Holdings Limited |

| |

|

| |

By: |

/s/Chunsheng Zhu |

| |

Name: |

Chunsheng Zhu |

| |

Title: |

CFO |

| |

GRANTEE |

| |

|

| |

By: |

/s/Wenshan Xie |

| |

Name: |

Wenshan Xie |

3

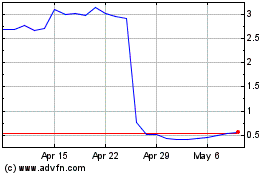

E Home Household Service (NASDAQ:EJH)

Historical Stock Chart

From Mar 2024 to Apr 2024

E Home Household Service (NASDAQ:EJH)

Historical Stock Chart

From Apr 2023 to Apr 2024