As Filed with the Securities and Exchange Commission on September 19,

2023

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ESSA PHARMA INC.

(Exact name of Registrant as specified in its

charter)

| British

Columbia |

|

98-1250703 |

| (State

or other jurisdiction |

|

(I.R.S.

Employer |

| of

incorporation or organization) |

|

Identification

No.) |

Suite 720, 999 West Broadway

Vancouver, British Columbia V5Z 1K5

(778) 331-0962

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Copies to:

| Michael J.

Hong, Esq. |

|

Joseph A.

Garcia, Esq. |

| Skadden, Arps, Slate,

Meagher & Flom LLP |

|

Kyle Misewich, Esq. |

| 222 Bay Street |

|

Blake, Cassels &

Graydon LLP |

| Toronto, Ontario M5K

1J5 |

|

595 Burrard Street |

| (416) 777-4700 |

|

Vancouver, British Columbia

V7X 1L3 |

| |

|

(604) 631-3300 |

From time to time on or after the effective

date of this Registration Statement.

(Approximate date of commencement of proposed

sale to the public)

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. o

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. o

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. o

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer |

¨ |

|

Accelerated filer |

¨ |

| |

Non-accelerated filer |

x |

|

Smaller reporting company |

x |

| |

|

|

Emerging growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

The Registrant

hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant

shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission

acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission

is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

Subject to Completion, Dated September 19,

2023

PROSPECTUS

ESSA PHARMA INC.

US$200,000,000

Common Shares

Preferred Shares

Debt Securities

Subscription Receipts

Warrants

Units

We may offer and sell from time to time common shares, preferred shares,

debt securities, subscription receipts, warrants to purchase common shares and units or any combination thereof up to an aggregate initial

offering price of up to US$200,000,000 in one or more transactions under this shelf prospectus. In addition, certain selling securityholders

may offer and sell our securities from time to time. The securities may be offered separately or together, at times, in amounts, at prices

and on terms that will be determined based on market conditions at the time of sale and set forth in an accompanying shelf prospectus

supplement. We and/or any selling securityholders will provide specific terms of any offering in supplements to this prospectus. The

prospectus supplement will contain more specific information about the offering and the securities being offered, including the names

of any selling securityholders, if applicable. The supplements may add, update or change information contained in this prospectus. You

should read this prospectus and any prospectus supplement carefully before you invest. This prospectus may not be used to sell securities

unless accompanied by a prospectus supplement.

We and/or any selling securityholders, if applicable, may offer securities

for sale directly to purchasers or through underwriters, dealers or agents to be designated at a future date. These securities may also

be resold by selling securityholders. The supplements to this prospectus will provide the names of any underwriters, the specific terms

of the plan of distribution and the underwriter’s discounts and commissions.

This prospectus provides you with a general description of the securities

that we may offer. Each time we offer securities, we will provide you with a prospectus supplement that describes specific information

about the particular securities being offered and may add, update or change information contained or incorporated by reference in this

prospectus. You should read both this prospectus and the prospectus supplement, together with the additional information which is incorporated

by reference into this prospectus and the prospectus supplement.

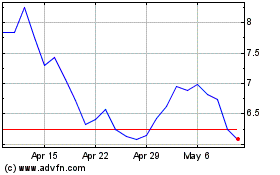

Our common shares are listed on the Nasdaq Capital Market (the “Nasdaq”)

under the symbol “EPIX.” On September 18, 2023, the closing price of our common shares was US$2.78 on the Nasdaq.

Unless otherwise specified in an applicable prospectus supplement, our preferred shares, debt securities, warrants, subscription receipts

and units will not be listed on any securities or stock exchange or on any automated dealer quotation system. There is currently no

market through which our securities, other than our common shares, may be sold and purchasers may not be able to resell such securities

purchased under this prospectus. This may affect the pricing of our securities, other than our common shares, in the secondary market,

the transparency and availability of trading prices, the liquidity of our securities and the extent of issuer regulation. See “Risk

Factors.”

An investment in our securities involves a high degree of risk.

Before purchasing any securities, you should carefully read the ‘‘Risk Factors’’ section beginning on page 4

of this prospectus and carefully consider the discussion of risks and uncertainties under the heading “Risk Factors” contained

in any applicable prospectus supplement and in the documents that are incorporated by reference.

Neither the U.S. Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any

representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

This prospectus is a part of a registration statement on Form S-3

that we have filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we and/or

certain selling securityholders, if applicable, may, from time to time offer and sell the securities described in this prospectus in

one or more offerings up to an aggregate initial offering price of US$200,000,000.

This prospectus provides you with a general description of our securities.

Each time we and/or any selling securityholders sell securities, we will provide a supplement to this prospectus that will contain specific

information about the securities being offered and the specific terms of that offering, including the names of any selling securityholders,

if applicable. When we refer to a “prospectus supplement,” we are also referring to any free writing prospectus or other

offering material authorized by us. The prospectus supplement may also add, update or change information contained in this prospectus.

If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on

the information in the prospectus supplement. You should read this prospectus and any prospectus supplement together with additional

information described under the headings “Where You Can Find More Information” and “Incorporation by Reference.”

We may offer and sell securities to or through underwriting syndicates

or dealers, through agents or directly to purchasers. The prospectus supplement for each offering of securities will describe in detail

the plan of distribution for that offering.

In connection with any offering of securities (unless otherwise specified

in a prospectus supplement), the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market

price of the securities offered at a higher level than that which might exist in the open market. Such transactions, if commenced, may

be interrupted or discontinued at any time. See “Plan of Distribution.”

Please carefully read both this prospectus and any prospectus supplement

together with the documents incorporated herein by reference under “Incorporation by Reference” and the additional information

described below under “Where You Can Find More Information.”

This prospectus and the documents incorporated by reference in this

prospectus contain forward-looking statements and forward-looking information within the meaning of the U.S. Private Securities Litigation

Reform Act of 1995. See “Cautionary Statement Regarding Forward-Looking Statements.”

Prospective investors should be aware that the ownership and disposition

of the securities described herein may have tax consequences. You should read the tax discussion contained in the applicable prospectus

supplement and consult your tax advisor with respect to your own particular circumstances.

You should rely only on the information contained or incorporated

by reference in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different

or additional information. If anyone provides you with different or additional information, you should not rely on it. The distribution

or possession of this prospectus in or from certain jurisdictions may be restricted by law. This prospectus is not an offer to sell these

securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted or where

the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale.

The information contained in this prospectus and any applicable prospectus supplement is accurate only as of the date of such document

and any information incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of

this prospectus or any applicable prospectus supplement or of any sale of our securities pursuant thereto. Our business, financial condition,

results of operations and prospects may have changed since those dates.

In this prospectus and in any prospectus supplement, unless the context

otherwise requires, references to:

| ● | “ESSA”,

the “Company”, “we”, “us” and “our” refer

to ESSA Pharma Inc., either alone or together with our subsidiaries as the context requires. |

| ● | “Exchange

Act” refers to the U.S. Securities Exchange Act of 1934, as amended. |

| ● | “Securities

Act” refers to the U.S. Securities Act of 1933, as amended. |

| ● | “FINRA”

refers to the Financial Industry Regulatory Authority. |

| ● | “Nasdaq”

refers to the Nasdaq Capital Market. |

| ● | “SEC”

or the “Commission” refers to the United States Securities and Exchange Commission. |

Unless stated otherwise or as the context otherwise requires, all

references to dollar amounts in this prospectus and any prospectus supplement are references to United States dollars. References to

“$” or “US$” are to United States dollars and references to “C$” are to Canadian dollars. See “Exchange

Rate Data.”

This prospectus and any applicable prospectus supplement include references

to trade names and trade-marks of other companies, which trade names and trade-marks are the property of their respective owners.

Market data and certain industry forecasts relating to the pharmaceutical

and biotechnology industries included in this prospectus, including any prospectus supplement or any document incorporated by reference

herein or therein, are derived from recognized industry reports published by industry analysts, industry associations and/or independent

consulting and data compilation organizations. Although we believe that these independent sources are generally reliable, the accuracy

and completeness of the information from such sources is not guaranteed and has not been independently verified by us, and we do not

make any representation as to the accuracy of such information.

THE

COMPANY

Overview of the Company

We are a clinical stage pharmaceutical company focused on developing

novel and proprietary therapies for the treatment of prostate cancer with an initial focus on patients whose disease is progressing despite

treatment with current standard of care therapies, including second-generation antiandrogen drugs such as abiraterone, enzalutamide,

apalutamide and darolutamide.

We believe

our latest series of investigational compounds, including our product candidate EPI-7386, have the potential to significantly expand

the interval of time in which patients with castration-resistant prostate cancer (“CRPC”) can benefit from anti-hormone-based

therapies. Specifically, the compounds are designed to disrupt the androgen receptor (“AR”) signaling pathway, the primary

pathway that drives prostate cancer growth, and prevent AR activation through selective binding to the N-terminal domain (“NTD”)

of the AR. In this respect, our compounds are designed to mechanistically differ from classical non-steroid antiandrogens. These antiandrogens

interfere either with androgen synthesis (i.e., abiraterone), or with the binding of androgens to the ligand-binding domain (“LBD”),

located at the opposite end of the receptor from the NTD (i.e. “lutamides”). A functional NTD is essential for the functionality

of the AR; blocking the NTD inhibits AR-driven transcription and therefore androgen-driven biology. We believe that the transcription

inhibition mechanism of our preclinical compounds is unique, and has the potential advantage of bypassing several of the identified mechanisms

of resistance to the antiandrogens currently used in the treatment of CRPC. We have been granted by the United States Adopted Names (“USAN”)

Council a unique USAN stem “Aniten” to recognize this new first-in-class mechanistic class. We refer to this series of proprietary

investigational compounds as the “Aniten” series. In preclinical studies, blocking the NTD has demonstrated the capability

to prevent AR-driven gene expression. A previously completed Phase 1 clinical trial of our first-generation agent, ralaniten acetate

(“EPI-506”) administered to patients with metastatic CRPC (“mCRPC”) refractory to current standard of care therapies

demonstrated prostate-specific antigen (“PSA”) declines, a sign of inhibition of AR-driven biology. This inhibition,

however, was neither deep nor sustained enough to confer clinical benefit and we have made the decision to develop a more potent next

generation drug which would also have a longer half-life. We have done so, and we are now in clinical trials with our next generation

Aniten, EPI-7386.

In developing possible therapeutics that involve binding to the NTD,

our strategic approach involves:

| ● | completing

the initial Phase 1 clinical development of EPI-7386 as a monotherapy treatment for patients

with mCRPC, who are resistant to the current standard of care, to demonstrate the

drug’s characteristics as a single agent as completely as possible, with regards to

safety, tolerability, and efficacy together with detailed pharmacological and biological

studies. The assessment of the clinical data will determine our clinical development of EPI-7386

as a single agent therapy and also as a combination therapy, whilst considering the impact

of such treatment against the size of the patient population whose tumours have progressed

and are prevalently driven by the AR pathway despite heavy pre-treatment of the latest

generation antiandrogens; |

| ● | combining

Aniten compounds with second-generation antiandrogens in earlier lines of therapy. We, with

industry partners, are conducting clinical trials of combinations of EPI-7386 and second-generation

antiandrogens in patients with nmCRPC, mCRPC, mHSPC and neo-adjuvant prostate cancer surgical

therapy in earlier lines of treatment; and |

| ● | continuing

preclinical studies including work on other Aniten molecules, NTD degraders and other potential

applications for AR NTD inhibitors. |

Further details concerning our business, including information with

respect to our assets, operations and development history, are provided in our Annual Report on Form 10-K for the year ended September 30, 2022 (our “Annual Report”), as revised or supplemented by our subsequent quarterly reports on Form 10-Q, or our current

reports on Form 8-K, which are incorporated herein by reference, and which may be amended, supplemented or superseded from time

to time by other reports we file with the SEC in the future. See “Documents Incorporated by Reference.” You are encouraged

to thoroughly review the documents incorporated by reference into this prospectus as they contain important information concerning our

business and our prospects.

Our registered and records office is located at Suite 3500, The Stack, 1133 Melville Street, Vancouver, British Columbia, Canada V6E 4E5. Our head office

is located at Suite 720 - 999 West Broadway, Vancouver, British Columbia, Canada V5Z 1K5.

We have one wholly-owned subsidiary, ESSA Pharmaceuticals Corp., existing

under the laws of the State of Texas.

RISK

FACTORS

Investing in our securities is speculative and involves a high degree

of risk. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under

the heading “Risk Factors” in the any applicable prospectus supplement and any free writing prospectus, together with all

the information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this

prospectus, including the risks, uncertainties and assumptions discussed under the heading “Risk Factors” in our Annual Report,

as revised or supplemented by our subsequent quarterly reports on Form 10-Q, or our current reports on Form 8-K, which are

incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with

the SEC in the future. These risks, as well as risks currently unknown to us, could materially adversely affect our future business,

operations and financial condition and could cause purchasers of securities to lose all or part of their investments. The risks and uncertainties

we have described are not the only risks we face; risks and uncertainties not currently known to us or that we currently deem to be immaterial

may also materially and adversely affect our business, financial condition, results of operations and prospects.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus (and any prospectus supplement), including the documents

incorporated by reference herein, contains forward-looking statements or forward-looking information within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. All statements in this prospectus, other

than statements of historical facts, are forward-looking statements. Forward-looking statements include statements that may relate to

the Company’s plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing

needs and other information that is not historical information. These statements appear in a number of different places in this prospectus

and can be identified by use of terminology such as “subject to”, “believe”, “anticipate”, “plan”,

“expect”, “intend”, “estimate”, “project”, “may”, “will”, “should”,

“would”, “could”, “hope”, “can”, or the negatives thereof, variations thereon and similar

expressions, or by discussions of strategy. Such forward-looking statements involve known and unknown risks, uncertainties and other

factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by such forward-looking statements. Examples of such forward looking statements

include, but are not limited to statements related to:

| ● | the

Company’s ability to maintain operations, development programs, preclinical studies,

clinical trials and raise capital as a result of global macroeconomic factors including inflation,

supply chain issues and any ongoing impact from the coronavirus disease 2019 outbreak (“COVID-19”); |

| ● | the

Company’s ability to advance its product candidate and potential future product candidates

through, and successfully complete, clinical trials; |

| ● | the

Company’s ability to recruit sufficient numbers of patients for future clinical trials,

and the benefits expected therefrom; |

| ● | the

Company’s ability to establish and maintain relationships with collaborators with acceptable

development, regulatory and commercialization expertise and the benefits to be derived from

such collaborative efforts; |

| ● | the

Company’s ability to obtain funding for operations, including research funding, and

the timing and potential sources of such funding; |

| ● | the

initiation, timing, cost, location, progress and success of, strategy and plans with respect

to ESSA’s research and development programs (including research programs and related

milestones with regards to next-generation drug candidates and compounds), preclinical studies

and clinical trials; |

| ● | the

therapeutic benefits, properties, effectiveness, pharmacokinetic profile and safety of the

Company’s product candidate and potential future product candidates, if any, including

the expected benefits, properties, effectiveness, pharmacokinetic profile and safety of the

Company’s next-generation Aniten compounds; |

| ● | the

Company’s ability to protect its intellectual property and operate its business without

infringing upon the intellectual property rights of others; |

| ● | developments

relating to the Company’s competitors and its industry, including the success of competing

therapies that are or may become available; |

| ● | the

Company’s ability to achieve profitability; |

| ● | the

grant (“CPRIT Grant”) under the Cancer Prevention and Research Institute of Texas

(“CPRIT”) and payments thereunder, including any residual obligations; |

| ● | the

Company’s intended use of proceeds from past and future offerings of the Company’s

securities; |

| ● | the

implementation of the Company’s business model and strategic plans, including strategic

plans with respect to patent applications and strategic collaborations and partnerships; |

| ● | the

Company’s ability to identify, develop and commercialize product candidates; |

| ● | the

Company’s commercialization, marketing and manufacturing capabilities and strategy; |

| ● | the

Company’s expectations regarding federal, state, provincial and foreign regulatory

requirements, including the Company’s plans with respect to anticipated regulatory

filings; |

| ● | whether

the Company will receive, and the timing and costs of obtaining, regulatory approvals in

the United States, Canada and other jurisdictions; |

| ● | the

accuracy of the Company’s estimates of the size and characteristics of the markets

that may be addressed by the Company’s product candidate and potential future product

candidates, if any; |

| ● | the

rate and degree of market acceptance and clinical utility of the Company’s potential

future product candidates, if any; |

| ● | the

timing of, and the Company’s ability and the Company’s collaborators’ ability,

if any, to obtain and maintain regulatory approvals for the Company’s product candidate

and potential future product candidates, if any; |

| ● | the

Company’s expectations regarding market risk, including inflation, interest rate changes

and foreign currency fluctuations; |

| ● | the

Company’s ability to engage and retain the employees required to grow its business; |

| ● | the

compensation that is expected to be paid to the Company’s employees; |

| ● | the

Company’s future financial performance and projected expenditures; and |

| ● | estimates

of the Company’s financial condition, expenses, future revenue, capital requirements

and its need for additional financing and potential sources of capital and funding. |

Such statements reflect the Company’s current views with respect

to future events, are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that are

inherently subject to significant medical, scientific, business, economic, competitive, political and social uncertainties and contingencies.

Many factors could cause the Company’s actual results, performance or achievements to be materially different from any future results,

performance, or achievements that may be expressed or implied by such forward-looking statements, including those described under “Risk

Factors” in the Company’s Annual Report. All the forward-looking statements included in this prospectus are based upon

our current expectations and various assumptions. Certain assumptions made in preparing the forward-looking statements include, but are

not limited to:

| ● | its

ability to maintain operations as a result of any ongoing impact from the COVID-19 outbreak; |

| ● | its

ability to conduct clinical studies involving its product candidate and to identify any future

product candidates; |

| ● | its

ability to obtain regulatory and other approvals to commence clinical trials involving any

future product candidates; |

| ● | its

ability to obtain positive results from research and development activities, including clinical

trials; |

| ● | the

availability of sufficient financing on reasonable terms; |

| ● | its

ability to obtain required regulatory approvals; |

| ● | its

ability to protect patents and proprietary rights; |

| ● | its

ability to successfully out-license or sell future products, if any, and in-license and develop

new products; |

| ● | the

absence of material adverse changes in its industry or the global economy; |

| ● | its

ability to attract and retain key personnel; |

| ● | its

continued compliance with third party license terms and non-infringement of third-party intellectual

property rights; |

| ● | its

ability to maintain good business relationships with its strategic partners; and |

| ● | its

ability to understand and predict market competition. |

The

Company believes there is a reasonable basis for its current expectations, views and assumptions, but they are inherently uncertain.

The Company may not realize its expectations, and its views and assumptions may not prove correct. Actual results could differ

materially from those described or implied by such forward-looking statements. In evaluating forward-looking statements, investors should

specifically consider the following uncertainties and factors, among others (including those set forth under the heading “Risk

Factors” in the Company’s Annual Report, as updated by the Company’s subsequent filings under the Exchange Act

and, if applicable, in any accompanying prospectus supplement filed relating to a specific offering or sale), that could affect future

performance and cause actual results to differ materially from those matters expressed in or implied by forward-looking statements.

Below is a summary of material factors that make

an investment in the Common Shares speculative or risky. Importantly, this summary does not address all of the risks and uncertainties

that the Company faces. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other

risks and uncertainties that the Company faces, can be found under the heading “Cautionary Note Regarding Forward-Looking Statements”

and “Risk Factors” in the Company’s Annual Report. The below summary is qualified in its entirety by those more

complete discussions of such risks and uncertainties. You should consider carefully the risks and uncertainties described under the heading

“Risk Factors” in the Company’s Annual Report, as updated by the Company’s subsequent filings under the

Exchange Act and, if applicable, in any accompany prospectus supplement filed relating to a specific offering or sale, as part of your

evaluation of an investment in the Company’s Common Shares. Important factors that could cause such differences include, among

other things, the following:

| ● | risks

related to the Company’s ability to maintain operations and execute on its business

plan as a result of the COVID-19 outbreak or other health epidemics; |

| ● | risks

related to clinical trial development and the Company’s ability to conduct the clinical

trial of its product candidate and the predictive value of its current or planned clinical

trials; |

| ● | risks

related to clinical trials being conducted by third parties under collaboration and clinical

supply agreements, including combination studies, using the Company's product candidate,

studies which the Company may not control, and ensuing reputational risk related to clinical

trial results; |

| ● | risks

related to the Company’s future success being dependent primarily on identification

through preclinical studies, clinical studies, regulatory approval for commercialization

of a single product candidate; |

| ● | risks

related to the Company’s license agreements with third parties; |

| ● | uncertainty

related to the Company’s ability to obtain required regulatory approvals for its proposed

products; |

| ● | risks

related to the Company's ability to conduct a clinical trial or submit a future New Drug

Application/New Drug Submission to the U.S. Food and Drug Administration (“FDA”)

or Investigational New Drug Application/Clinical Trial Application to Health Canada; |

| ● | risks

related to the Company's ability to successfully commercialize future product candidates; |

| ● | risks

related to the possibility that the Company’s product candidate and potential future

product candidates, if any, may have undesirable side effects when used alone or in combination

with other drugs; |

| ● | risks

related to the Company’s ability to enroll subjects in clinical trials; |

| ● | risks

that the FDA may not accept data from trials conducted in locations outside the United States; |

| ● | risks

related to the Company’s ongoing obligations and continued regulatory review; |

| ● | risks

related to potential administrative or judicial sanctions; |

| ● | the

risk of increased costs associated with prolonged, delayed or terminated clinical trials; |

| ● | the

risk that third parties may not carry out their contractual duties or terminate the relationship; |

| ● | risks

related to the Company’s lack of experience manufacturing product candidates on a large

clinical or commercial scale and the Company’s lack of manufacturing facility; |

| ● | risks

inherent in foreign operations, including related to foreign sourced raw materials, manufacturing

or clinical trials; |

| ● | risks

related to disruptions in domestic and foreign supply chains that the Company relies on for

the production and shipment of raw materials and clinical trial materials; |

| ● | risks

related to the Company’s failure to obtain regulatory approval in international jurisdictions; |

| ● | risks

related to recently enacted and future legislation in the United States and internationally

that may increase the difficulty and cost for the Company to obtain marketing approval of,

and commercialize, its product candidate and potential future products, if any, and affect

the prices the Company may obtain; |

| ● | risks

related to new legislation, new regulatory requirements, and the continuing efforts of governmental

and third-party payors to contain or reduce the costs of healthcare; |

| ● | uncertainty

as to the Company’s ability to raise additional funding; |

| ● | risks

related to the Company’s ability to raise additional capital on favorable terms and

the impact of dilution from incremental financing; |

| ● | risks

of a deemed default on any residual obligations of the agreement providing for the CPRIT

Grant and having to reimburse all of the CPRIT Grant, if such deemed default is not waived

by CPRIT; |

| ● | risks

related to the Company’s incurrence of significant losses in every quarter since inception

and its anticipation that it will continue to incur significant losses in the future; |

| ● | risks

related to the Company’s limited operating history; |

| ● | risks

related to the Company’s reliance on proprietary technology; |

| ● | risks

related to the Company’s ability to protect its intellectual property rights throughout

the world; |

| ● | risks

related to claims by third parties asserting that the Company, or its employees, contractors

or consultants have misappropriated their intellectual property, or claiming ownership of

what the Company regards as its intellectual property; |

| ● | risks

related to the Company’s ability to comply with governmental patent agency requirements

in order to maintain patent protection; |

| ● | risks

related to computer system failures or security breaches and increasing cyber threats; |

| ● | risks

related to business disruptions that could seriously harm the Company’s future revenues

and financial condition and increase its costs and expenses; |

| ● | risks

related to the Company’s ability to attract and maintain highly qualified personnel; |

| ● | risks

related to the possibility that third-party coverage and reimbursement and health care cost

containment initiatives and treatment guidelines may constrain the Company’s future

revenues; |

| ● | risks

related to potential conflicts of interest between the Company and its directors and officers; |

| ● | risks

related to competition from other biotechnology and pharmaceutical companies; |

| ● | risks

related to movements in foreign currency exchange rates, interest rates and the rate of inflation; |

| ● | risks

related to the Company’s ability to convince public payors and hospitals to include

the Company’s product candidate and potential future products, if any, on their approved

formulary lists; |

| ● | risks

related to the Company’s ability to establish an effective sales force and marketing

infrastructure, or enter into acceptable third-party sales and marketing or licensing arrangements; |

| ● | risks

related to the Company's ability to manage growth; |

| ● | risks

related to the Company’s ability to achieve or maintain expected levels of market acceptance

for its products; |

| ● | risks

related to the Company’s ability to realize benefits from acquired businesses or products

or form strategic alliances in the future; |

| ● | risks

related to collaborations with third parties; |

| ● | risks

that employees may engage in misconduct or other improper activities, including noncompliance

with regulatory standards and requirements, which could cause significant liability for the

Company and harm its reputation; |

| ● | risks

related to product liability lawsuits; |

| ● | risks

related to compulsory licensing and/or generic competition; |

| ● | risks

related to being a smaller reporting company; |

| ● | risks

related to share price volatility in the event there is low liquidity for the trading of

the Company's Common Shares; |

| ● | risks

related to the possibility that laws and regulations governing international operations may

preclude the Company from developing, manufacturing and selling certain product candidates

outside of the United States and Canada and require it to develop and implement costly compliance

programs; |

| ● | risks

related to laws that govern fraud and abuse and patients' rights; |

| ● | risks

related to the Company’s ability to comply with environmental, health and safety laws

and regulations; |

| ● | risks

related to the Company being a “passive foreign investment company”; |

| ● | risks

related to United States investors' ability to effect service of process or enforcement of

actions against the Company; |

| ● | risks

related to market price and trading volume volatility; |

| ● | risks

related to the Company's dividend policy; |

| ● | risks

associated with future sales of the Company’s securities; |

| ● | risks

related to the Company's ability to maintain an active trading market for the Company’s

common shares; |

| ● | risks

related to the Company’s ability to implement and maintain effective internal controls; |

| ● | risks

related to provisions in the Company’s charter documents and Canadian law affecting

corporate governance; and |

| ● | risks

related to analyst coverage. |

If one or more of these risks or uncertainties or a risk that is not

currently known to the Company, materialize, or if its underlying assumptions prove to be incorrect, actual results may vary materially

from those expressed or implied by forward-looking statements. The forward-looking statements represent the Company’s expectations,

plans, estimates and views as of the date of this document. The Company does not undertake and specifically declines any obligation to

update, republish or revise forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated

events, except as required by law. Investors are cautioned that we cannot guarantee future results, events, levels of activity, performance

or achievements and that forward-looking statements are inherently uncertain. Accordingly, investors are cautioned not to put undue reliance

on forward-looking statements. The Company advises you that these cautionary remarks expressly qualify in their entirely all forward-looking

statements attributable to the Company or persons acting on its behalf.

EXCHANGE

RATE INFORMATION

We use the United States dollar as our reporting currency. The following

table sets forth for each period indicated: (1) the low and high exchange rates during such period; (2) the exchange rates

in effect at the end of the period; and (3) the average exchange rates for such period, for one Canadian dollar, expressed in U.S.

dollars, as quoted by the Bank of Canada. The average exchange rate is calculated on the last business day of each month for the applicable

period.

| | | |

Year Ended September 30, | |

| | | |

2020 | | |

2021 | | |

2022 | |

| Low | | |

0.6898 | | |

0.7491 | | |

0.7285 | |

| High | | |

0.7710 | | |

0.8306 | | |

0.8111 | |

| Period End | | |

0.7497 | | |

0.7849 | | |

0.7296 | |

| Average | | |

0.7437 | | |

0.7915 | | |

0.7832 | |

The following table sets forth, for each of the last six months, the

low and high closing exchange rates and the closing exchange rate at the end of the month for Canadian dollars expressed in United States

dollars, as quoted by the Bank of Canada:

| | | |

Last Six Months | |

| | | |

March | | |

April | | |

May | | |

June | | |

July | | |

August | |

| Low | | |

0.7243 | | |

0.7339 | | |

0.7338 | | |

0.7417 | | |

0.7492 | | |

0.7350 | |

| High | | |

0.7389 | | |

0.7486 | | |

0.7488 | | |

0.7604 | | |

0.7617 | | |

0.7524 | |

| End of Month | | |

0.7389 | | |

0.7365 | | |

0.7351 | | |

0.7553 | | |

0.7589 | | |

0.7390 | |

On September 18, 2023, the closing exchange rate of Canadian

dollars expressed in United States dollars, as quoted by the Bank of Canada was C$1.00=US$0.7412.

USE

OF PROCEEDS

Unless we otherwise indicate in a prospectus supplement, we currently

intend to use the net proceeds from the sale of our securities for general corporate purposes, including funding research and development,

preclinical and clinical expenses, and corporate costs.

By the nature of our business as a clinical pharmaceutical company,

we had negative operating cash flow for our most recent interim financial period and financial year. To the extent we have negative cash

flows in future periods, we may use a portion of our general working capital to fund such negative cash flow. See “Risk Factors.”

More detailed information regarding the use of proceeds from the sale

of securities, including any determinable milestones at the applicable time, will be described in any applicable prospectus supplement.

We may also, from time to time, issue securities otherwise than pursuant to a prospectus supplement to this prospectus.

DIVIDEND

POLICY

Our dividend policy is set forth under the heading “Item 5.

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities” in our Annual

Report, which is incorporated in this prospectus by reference, as updated by our subsequent filings under the Exchange Act.

DESCRIPTION

OF SHARE CAPITAL

Common Shares

We are authorized to issue an unlimited number

of common shares, without par value. As of September 18, 2023, there were 44,100,838 common shares issued and outstanding, 8,150,274

common shares issuable upon exercise of outstanding stock options, and 2,927,477 common shares issuable upon exercise of warrants.

Of the outstanding warrants, 2,920,000 are pre-funded warrants, each exercisable at a nominal exercise price into one common

share.

Holders of our common shares are entitled to receive notice of any

meetings of our shareholders, and to attend and to cast one vote per common share at all such meetings. Holders of common shares are

entitled to receive on a pro rata basis such dividends on the common shares, if any, as and when declared by our board of directors at

its discretion, from funds legally available therefor, and, upon the liquidation, dissolution or winding up of the Company, are entitled

to receive on a pro rata basis the net assets of the Company after payment of debts and other liabilities, in each case subject to the

rights, privileges, restrictions and conditions attaching to any other series or class of shares ranking senior in priority to or on

a pro rata basis with, the holders of common shares with respect to dividends or liquidation. Our common shares do not carry any pre-emptive,

subscription, redemption or conversion rights, nor do they contain any sinking or purchase fund provisions.

Preferred Shares

We may issue our preferred shares from time to time in one or more

series. The terms of each series of preferred shares, including the number of shares, the designation, rights, preferences, privileges,

priorities, restrictions, conditions and limitations, will be determined at the time of creation of each such series by our board of

directors, without shareholder approval, provided that all preferred shares will rank equally within their class as to dividends and

distributions in the event of our dissolution, liquidation or winding-up.

DESCRIPTION

OF DEBT SECURITIES

In this description of debt securities section, “we,”

“us,” “our,” or “ESSA” refer to ESSA Pharma Inc. but not to its subsidiaries.

This section describes the general terms that will apply to any debt

securities issued pursuant to this prospectus. We may issue debt securities in one or more series under an indenture, or the indenture,

to be entered into between us and one or more trustees. The indenture will be subject to and governed by the United States Trust Indenture

Act of 1939, as amended (the “Trust Indenture Act”), and the British Columbia Business Corporations Act. A copy of the

form of the indenture will be filed with the SEC as an exhibit to the registration statement of which this prospectus forms a part. The

following description sets forth certain general terms and provisions of the debt securities and is not intended to be complete. For

a more complete description, prospective investors should refer to the indenture and the terms of the debt securities. If debt securities

are issued, we will describe in the applicable prospectus supplement the particular terms and provisions of any series of the debt securities

and a description of how the general terms and provisions described below may apply to that series of the debt securities. Prospective

investors should rely on information in the applicable prospectus supplement and not on the following information to the extent that

the information in such prospectus supplement is different from the following information.

We may issue debt securities and incur additional indebtedness other

than through the offering of debt securities pursuant to this prospectus.

General

The indenture will not limit the aggregate principal amount of debt

securities that we may issue under the indenture and will not limit the amount of other indebtedness that we may incur. The indenture

will provide that we may issue debt securities from time to time in one or more series and may be denominated and payable in U.S. dollars,

Canadian dollars or any foreign currency. Unless otherwise indicated in the applicable prospectus supplement, the debt securities will

be our unsecured obligations. The indenture will also permit us to increase the principal amount of any series of the debt securities

previously issued and to issue that increased principal amount.

The applicable prospectus supplement for any series of debt securities

that we offer will describe the specific terms of the debt securities and may include, but is not limited to, any of the following:

| ● | the

title of the debt securities; |

| ● | the

aggregate principal amount of the debt securities; |

| ● | the

percentage of principal amount at which the debt securities will be issued; |

| ● | whether

payment on the debt securities will be senior or subordinated to our other liabilities or

obligations; |

| ● | whether

the payment of the debt securities will be guaranteed by any other person; |

| ● | the

date or dates, or the methods by which such dates will be determined or extended, on which

we may issue the debt securities and the date or dates, or the methods by which such dates

will be determined or extended, on which we will pay the principal and any premium on the

debt securities and the portion (if less than the principal amount) of debt securities to

be payable upon a declaration of acceleration of maturity; |

| ● | whether

the debt securities will bear interest, the interest rate (whether fixed or variable) or

the method of determining the interest rate, the date from which interest will accrue, the

dates on which we will pay interest and the record dates for interest payments, or the methods

by which such dates will be determined or extended; |

| ● | the

place or places we will pay principal, premium, if any, and interest and the place or places

where debt securities can be presented for registration of transfer or exchange; |

| ● | whether

and under what circumstances we will be required to pay any additional amounts for withholding

or deduction for Canadian taxes with respect to the debt securities, and whether and on what

terms we will have the option to redeem the debt securities rather than pay the additional

amounts; |

| ● | whether

we will be obligated to redeem or repurchase the debt securities pursuant to any sinking

or purchase fund or other provisions, or at the option of a holder and the terms and conditions

of such redemption; |

| ● | whether

we may redeem the debt securities at our option and the terms and conditions of any such

redemption; |

| ● | the

denominations in which we will issue any registered debt securities, if other than denominations

of $1,000 and any multiple of $l,000 and, if other than denominations of $5,000, the denominations

in which any unregistered debt security shall be issuable; |

| ● | whether

we will make payments on the debt securities in a currency or currency unit other than U.S.

dollars or by delivery of our common shares or other property; |

| ● | whether

payments on the debt securities will be payable with reference to any index or formula; |

| ● | whether

we will issue the debt securities as global securities and, if so, the identity of the depositary

for the global securities; |

| ● | whether

we will issue the debt securities as unregistered securities (with or without coupons), registered

securities or both; |

| ● | the

periods within which and the terms and conditions, if any, upon which we may redeem the debt

securities prior to maturity and the price or prices of which and the currency or currency

units in which the debt securities are payable; |

| ● | any

changes or additions to events of default or covenants; |

| ● | the

applicability of, and any changes or additions to, the provisions for defeasance described

under “Defeasance” below; |

| ● | whether

the holders of any series of debt securities have special rights if specified events occur; |

| ● | any

mandatory or optional redemption or sinking fund or analogous provisions; |

| ● | the

terms, if any, for any conversion or exchange of the debt securities for any other securities; |

| ● | rights,

if any, on a change of control; |

| ● | provisions

as to modification, amendment or variation of any rights or terms attaching to the debt securities; and |

| ● | any

other terms, conditions, rights and preferences (or limitations on such rights and preferences)

including covenants and events of default which apply solely to a particular series of the

debt securities being offered which do not apply generally to other debt securities, or any

covenants or events of default generally applicable to the debt securities which do not apply

to a particular series of the debt securities. |

Unless stated otherwise in the applicable prospectus supplement, no

holder of debt securities will have the right to require us to repurchase the debt securities and there will be no increase in the interest

rate if we become involved in a highly leveraged transaction or we have a change of control.

We may issue debt securities bearing no interest or interest at a

rate below the prevailing market rate at the time of issuance, and offer and sell these securities at a discount below their stated principal

amount. We may also sell any of the debt securities for a foreign currency or currency unit, and payments on the debt securities may

be payable in a foreign currency or currency unit. In any of these cases, we will describe certain Canadian federal and U.S. federal

income tax consequences and other special considerations in the applicable prospectus supplement.

We may issue debt securities with terms different from those of debt

securities previously issued and, without the consent of the holders thereof, we may reopen a previous issue of a series of debt securities

and issue additional debt securities of such series (unless the reopening was restricted when such series was created).

Ranking and Other Indebtedness

Unless otherwise indicated in an applicable prospectus supplement,

our debt securities will be unsecured obligations and will rank equally with all of our other unsecured and unsubordinated debt from

time to time outstanding and equally with other securities issued under the indenture. The debt securities will be structurally subordinated

to all existing and future liabilities, including trade payables, of our subsidiaries.

Our board of directors may establish the extent and manner, if any,

to which payment on or in respect of a series of debt securities will be senior or will be subordinated to the prior payment of our other

liabilities and obligations and whether the payment of principal, premium, if any, and interest, if any, will be guaranteed by any other

person and the nature and priority of any security.

Debt Securities in Global Form

The Depositary and Book-Entry

Unless otherwise specified in the applicable prospectus supplement,

a series of the debt securities may be issued in whole or in part in global form as a “global security” and will be registered

in the name of and be deposited with a depositary, or its nominee, each of which will be identified in the applicable prospectus supplement

relating to that series. Unless and until exchanged, in whole or in part, for the debt securities in definitive registered form, a global

security may not be transferred except as a whole by the depositary for such global security to a nominee of the depositary, by a nominee

of the depositary to the depositary or another nominee of the depositary or by the depositary or any such nominee to a successor of the

depositary or a nominee of the successor.

The specific terms of the depositary arrangement with respect to any

portion of a particular series of the debt securities to be represented by a global security will be described in the applicable prospectus

supplement relating to such series. We anticipate that the provisions described in this section will apply to all depositary arrangements.

Upon the issuance of a global security, the depositary therefor or

its nominee will credit, on its book entry and registration system, the respective principal amounts of the debt securities represented

by the global security to the accounts of such persons, designated as “participants”, having accounts with such depositary

or its nominee. Such accounts shall be designated by the underwriters, dealers or agents participating in the distribution of the debt

securities or by us if such debt securities are offered and sold directly by us. Ownership of beneficial interests in a global security

will be limited to participants or persons that may hold beneficial interests through participants. Ownership of beneficial interests

in a global security will be shown on, and the transfer of that ownership will be effected only through, records maintained by the depositary

therefor or its nominee (with respect to interests of participants) or by participants or persons that hold through participants (with

respect to interests of persons other than participants). The laws of some states in the United States may require that certain

purchasers of securities take physical delivery of such securities in definitive form.

So long as the depositary for a global security or its nominee is

the registered owner of the global security, such depositary or such nominee, as the case may be, will be considered the sole owner or

holder of the debt securities represented by the global security for all purposes under the indenture. Except as provided below, owners

of beneficial interests in a global security will not be entitled to have a series of the debt securities represented by the global security

registered in their names, will not receive or be entitled to receive physical delivery of such series of the debt securities in definitive

form and will not be considered the owners or holders thereof under the indenture.

Any payments of principal, premium, if any, and interest, if any,

on global securities registered in the name of a depositary or its nominee will be made to the depositary or its nominee, as the case

may be, as the registered owner of the global security representing such debt securities. None of us, the trustee or any paying agent

for the debt securities represented by the global securities will have any responsibility or liability for any aspect of the records

relating to or payments made on account of beneficial ownership interests of the global security or for maintaining, supervising or reviewing

any records relating to such beneficial ownership interests.

We expect that the depositary for a global security or its nominee,

upon receipt of any payment of principal, premium, if any, or interest, if any, will credit participants’ accounts with payments

in amounts proportionate to their respective beneficial interests in the principal amount of the global security as shown on the records

of such depositary or its nominee. We also expect that payments by participants to owners of beneficial interests in a global security

held through such participants will be governed by standing instructions and customary practices, as is now the case with securities

held for the accounts of customers registered in “street name”, and will be the responsibility of such participants.

Discontinuance of Depositary’s Services

If a depositary for a global security representing a particular series

of the debt securities is at any time unwilling or unable to continue as depositary and a successor depositary is not appointed by us

within 90 days, we will issue such series of the debt securities in definitive form in exchange for a global security representing

such series of the debt securities. If an event of default under the indenture has occurred and is continuing, debt securities in definitive

form will be printed and delivered upon written request by the holder to the trustee. In addition, we may at any time and in our sole

discretion determine not to have a series of the debt securities represented by a global security and, in such event, will issue a series

of the debt securities in definitive form in exchange for all of the global securities representing that series of debt securities.

Debt Securities in Definitive Form

A series of the debt securities may be issued in definitive form,

solely as registered securities, solely as unregistered securities or as both registered securities and unregistered securities. Registered

securities will be issuable in denominations of $1,000 and integral multiples of $1,000 and unregistered securities will be issuable

in denominations of $5,000 and integral multiples of $5,000 or, in each case, in such other denominations as may be set out in the terms

of the debt securities of any particular series. Unless otherwise indicated in the applicable prospectus supplement, unregistered securities

will have interest coupons attached.

Unless otherwise indicated in the applicable prospectus supplement,

payment of principal, premium, if any, and interest, if any, on the debt securities (other than global securities) will be made at the

office or agency of the trustee, or at our option we can pay principal, interest, if any, and premium, if any, by check mailed or delivered

to the address of the person entitled at the address appearing in the security register of the trustee or electronic funds wire or other

transmission to an account of the person entitled to receive payments. Unless otherwise indicated in the applicable prospectus supplement,

payment of interest, if any, will be made to the persons in whose name the debt securities are registered at the close of business on

the day or days specified by us.

At the option of the holder of debt securities, registered securities

of any series will be exchangeable for other registered securities of the same series, of any authorized denomination and of a like aggregate

principal amount and tenor. If, but only if, provided in an applicable prospectus supplement, unregistered securities (with all unmatured

coupons, except as provided below, and all matured coupons in default) of any series may be exchanged for registered securities of the

same series, of any authorized denominations and of a like aggregate principal amount and tenor. In such event, unregistered securities

surrendered in a permitted exchange for registered securities between a regular record date or a special record date and the relevant

date for payment of interest shall be surrendered without the coupon relating to such date for payment of interest, and interest will

not be payable on such date for payment of interest in respect of the registered security issued in exchange for such unregistered security,

but will be payable only to the holder of such coupon when due in accordance with the terms of the indenture. Unless otherwise specified

in an applicable prospectus supplement, unregistered securities will not be issued in exchange for registered securities.

The applicable prospectus supplement may indicate the places to register

a transfer of the debt securities in definitive form. Except for certain restrictions set forth in the indenture, no service charge will

be payable by the holder for any registration of transfer or exchange of the debt securities in definitive form, but we may, in certain

instances, require a sum sufficient to cover any tax or other governmental charges payable in connection with these transactions.

We shall not be required to:

| ● | issue,

register the transfer of or exchange any series of the debt securities in definitive form

during a period beginning at the opening of business 15 days before any selection of securities

of that series of the debt securities to be redeemed and ending on the relevant redemption

date if the debt securities for which such issuance, registration or exchange is requested

may be among those selected for redemption; |

| ● | register

the transfer of or exchange any registered security in definitive form, or portion thereof,

called for redemption, except the unredeemed portion of any registered security being redeemed

in part; |

| ● | exchange

any unregistered security called for redemption except to the extent that such unregistered

security may be exchanged for a registered security of that series and like tenor; provided

that such registered security will be simultaneously surrendered for redemption with written

instructions for payment consistent with the provisions of the indenture; or |

| ● | issue,

register the transfer of or exchange any of the debt securities in definitive form which

have been surrendered for repayment at the option of the holder, except the portion, if any,

thereof not to be so repaid. |

Merger, Amalgamation or Consolidation

The indenture will provide that we may not consolidate with or amalgamate

or merge with or into any other person, enter into any statutory arrangement with any person or convey, transfer or lease our properties

and assets substantially as an entirety to another person, unless among other items:

| ● | we

are the surviving person, or the resulting, surviving or transferee person, if other than

us, is organized and existing under the laws of the United States, any state thereof or the

District of Columbia, Canada, or any province or territory thereof, or, if the amalgamation,

merger, consolidation, statutory arrangement or other transaction would not impair the rights

of holders, any other country; |

| ● | the

successor person (if not us) assumes all of our obligations under the debt securities and

the indenture; and |

| ● | we

or such successor person will not be in default under the indenture immediately after the

transaction. |

When such a person assumes our obligations in

such circumstances, subject to certain exceptions, we shall be discharged from all obligations under the debt securities and the indenture.

Additional Amounts

Unless otherwise specified in the applicable prospectus supplement,

all payments made by or on behalf of us under or with respect to the debt securities will be made free and clear of and without withholding

or deduction for or on account of any present or future tax, duty, levy, impost, assessment or other government charge (including penalties,

interest and other liabilities related thereto) imposed or levied by or on behalf of the Government of Canada or of any province or territory

thereof or by any authority or agency therein or thereof having power to tax, or Canadian Taxes, unless we are required to withhold or

deduct Canadian Taxes by law or by the interpretation or administration thereof by the relevant government authority or agency.

If we are so required to withhold or deduct any amount for or on account

of Canadian Taxes from any payment made under or with respect to the debt securities, we will pay as additional interest such additional

amounts, or the additional amounts, as may be necessary so that the net amount received by a holder of the debt securities after such

withholding or deduction will not be less than the amount such holder of the debt securities would have received if such Canadian Taxes

had not been withheld or deducted (a similar payment will also be made to holders of the debt securities, other than excluded holders

(as defined herein), that are exempt from withholding but required to pay tax under Part XIII of the Income Tax Act (Canada)

(the “ITA”), directly on amounts otherwise subject to withholding); provided, however, that no additional amounts will be

payable with respect to a payment made to a holder of the debt securities, or an excluded holder, in respect of the beneficial owner

thereof:

| ● | with

which we do not deal at arm’s length (for purposes of the ITA) at the time of the making

of such payment; |

| ● | which

is subject to such Canadian Taxes by reason of the debt securities holder’s failure

to comply with any certification, identification, information, documentation or other reporting

requirement if compliance is required by law, regulation, administrative practice or an applicable

treaty as a precondition to exemption from, or a reduction in the rate of deduction or withholding

of, such Canadian Taxes; |

| ● | which

is subject to such Canadian Taxes by reason of the debt securities holder being a resident,

domicile or national of, or engaged in business or maintaining a permanent establishment

or other physical presence in or otherwise having some connection with Canada or any province

or territory thereof otherwise than by the mere holding of the debt securities or the receipt

of payments thereunder; or |

| ● | which

is subject to such Canadian Taxes because it is not entitled to the benefit of an otherwise

applicable tax treaty by reason of the legal nature of such holder of the debt securities. |

We will make such withholding or deduction and remit the full amount

deducted or withheld to the relevant authority as and when required in accordance with applicable law. We will pay all taxes, interest

and other liabilities which arise by virtue of any failure of us to withhold, deduct and remit to the relevant authority on a timely

basis the full amounts required in accordance with applicable law. We will furnish to the holder of the debt securities, within 60 days

after the date the payment of any Canadian Taxes is due pursuant to applicable law, certified copies of tax receipts evidencing such

payment by us.

Whenever in the indenture there is mentioned, in any context, the

payment of principal, premium, if any, interest or any other payment under or with respect to a debt security, such mention shall be

deemed to include mention of the payment of additional amounts to the extent that, in such context, additional amounts are, were or could

be payable in respect thereof.

The foregoing obligations shall survive any termination, defeasance

or discharge of the indenture.

Tax Redemption

If and to the extent specified in the applicable prospectus supplement,

the debt securities of a series will be subject to redemption at any time, in whole but not in part, at a redemption price equal to the

principal amount thereof together with accrued and unpaid interest to the date fixed for redemption, upon the giving of a notice as described

below, if (1) we determine that (a) as a result of any change in or amendment to the laws (or any regulations or rulings promulgated

thereunder) of Canada or of any political subdivision or taxing authority thereof or therein affecting taxation, or any change in position

regarding application or interpretation of such laws, regulations or rulings (including a holding by a court of competent jurisdiction),

which change or amendment is announced or becomes effective on or after a date specified in the applicable prospectus supplement if any

date is so specified, we have or will become obligated to pay, on the next succeeding date on which interest is due, additional amounts

with respect to any debt security of such series as described under “Additional Amounts” or (b) on or after a date specified

in the applicable prospectus supplement, any action has been taken by any taxing authority of, or any decision has been rendered by a

court of competent jurisdiction in, Canada or any political subdivision or taxing authority thereof or therein, including any of those

actions specified in (a) above, whether or not such action was taken or decision was rendered with respect to us, or any change,

amendment, application or interpretation shall be proposed, which, in any such case, in the written opinion to us of legal counsel of

recognized standing, will result in our becoming obligated to pay, on the next succeeding date on which interest is due, additional amounts

with respect to any debt security of such series and (2) in any such case, we, in our business judgment, determine that such obligation

cannot be avoided by the use of reasonable measures available to us; provided however, that (i) no such notice of redemption may

be given earlier than 90 days prior to the earliest date on which we would be obligated to pay such additional amounts were a payment

in respect of the debt securities then due, and (ii) at the time such notice of redemption is given, such obligation to pay such

additional amounts remains in effect.

In the event that we elect to redeem the debt securities of such series

pursuant to the provisions set forth in the preceding paragraph, we shall deliver to the trustee a certificate, signed by an authorized

officer, stating that we are entitled to redeem the debt securities of such series pursuant to their terms.

Provision of Financial Information

We will file with the trustee, within 20 days after we file or

furnish them with the SEC, copies of our annual reports and of the information, documents and other reports (or copies of such portions

of any of the foregoing as the SEC may by rules and regulations prescribe) which we are required to file or furnish with the SEC

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act.

Notwithstanding that we may not remain subject to the reporting requirements

of Section 13 or 15(d) of the Exchange Act or otherwise report on an annual and quarterly basis on forms provided for such

annual and quarterly reporting pursuant to rules and regulations promulgated by the SEC, we will continue to provide the trustee

within 20 days after the time periods required for the filing or furnishing of such forms by the SEC, annual reports on Form 40-F,

Form 20-F or Form 10-K, as applicable, or any successor form; and reports on Form 8-K (or any successor form), as

applicable.

Events of Default

Unless otherwise specified in the applicable prospectus supplement

relating to a particular series of debt securities, the following is a summary of events which will, with respect to any series of the

debt securities, constitute an event of default under the indenture with respect to the debt securities of that series:

| ● | we

fail to pay principal of, or any premium on, any debt security of that series when it is

due and payable; |

| ● | we

fail to pay interest or any additional amounts payable on any debt security of that series

when it becomes due and payable, and such default continues for 30 days; |

| ● | we

fail to make any required sinking fund or analogous payment for that series of debt securities; |

| ● | we

fail to observe or perform any of the covenants described in the section “Merger, Amalgamation

or Consolidation” for a period of 30 days; |

| ● | we

fail to comply with any of our other agreements in the indenture that affect or are applicable

to the debt securities for 60 days after written notice by the trustee or to us and the trustee

by holders of at least 25% in aggregate principal amount of the outstanding debt securities

of any series affected thereby; |